Military Satellite Modem Market by Type (Single-Channel Modems, Multi-Channel Modems, Frequency Agile Modems, Software-Defined Modems), By Application (Communication Systems, Surveillance & Reconnaissance, Remote Sensing, Command & Control, Other Applications), By End User (Armed Forces, Defense Contractors, Military Agencies, Government Agencies, Other Sectors) and Region - Global Forecast to 2030

Exhaustive secondary research was done to collect information on military satellite modem market, its adjacent markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Demand-side analyses were carried out to estimate the overall size of the market. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as D&B Hoovers, Bloomberg, Business Week, and different magazines were referred to identify and collect information for this study. Secondary sources also included annual reports, press releases & investor presentations of companies, certified publications, articles by recognized authors, and research papers.

Primary Research

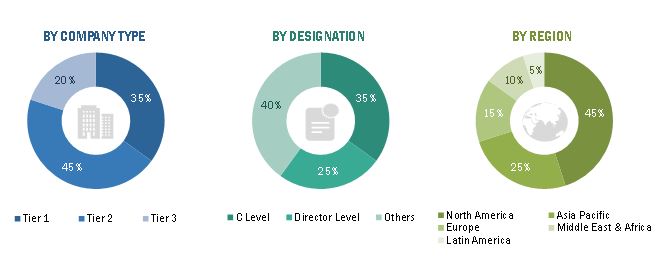

Extensive primary research was conducted after acquiring information regarding the military satellite modem market scenario through secondary research. The market for military satellite modem is being driven by a range of stakeholders, including satellite modem manufacturers, telecommunications equipment providers, and semiconductor manufacturers. The demand-side of this market is characterized by various end users, such as military forces, satellite service providers, and defense contractors. The supply side is characterized by technological advancements and the development in military satellite modems. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the military satellite modem market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size from the market size estimation process, the total market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for market segments and subsegments, the data triangulation procedure has been implemented, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated using both top-down and bottom-up approaches.

Report Objectives

- To define, describe, segment, and forecast the size of the military satellite modem market based on channel type, data rate, application, end user, technology, modulation type, and region.

- To forecast the size of different segments of the market with respect to five key regions, namely, North America, Europe, Asia Pacific, Middle East & Africa, and Latin America, along with their key countries

- To identify and analyze the key drivers, restraints, opportunities, and challenges influencing the growth of the market.

- To identify technology trends currently prevailing in the military satellite modem market

- To analyze micro markets with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders by identifying the key market trends

- To profile the leading market players and comprehensively analyze their market share and core competencies.

- To analyze the degree of competition in the market by identifying the key growth strategies, such as acquisitions, new product launches, contracts, and partnerships, adopted by the leading market players.

- To identify detailed financial positions, key products, and unique selling points of the leading companies in the market

- To provide a detailed competitive landscape of the market, along with a ranking analysis, market share analysis, and revenue analysis of the key players

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2023–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023-2028 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

By Channel Type, By Data Rate, By Application, By End User, By Technology, and By Modulation Type |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

|

Companies covered |

Viasat Inc. (US), COMTECH TELECOMMUNICATIONS CORP. (US), ST Engineering (Singapore), Teledyne Technologies Incorporated (US), Gilat Satellite Networks Ltd. (Israel), ORBCOMM (US), NOVELSAT (Israel), Datum Systems (US), L3Harris Technologies, Inc. (US), Thales Group (France), Raytheon Technologies Corporation (US), Airbus SAS (France), and Elbit System Ltd. (Israel) are some of the major players of Military Satellite Modem market. (25 Companies) |

Military Satellite Modem Market Highlights

The study categorizes the military satellite modem market based on Channel Type, Data Rate, Application, End User, Technology, Modulation Type, and Region.

|

Segment |

Subsegment |

|

By Channel Type |

|

|

By Data Rate |

|

|

By Application |

|

|

By End User |

|

|

By Technology |

|

|

By Modulation Type |

|

|

By Region |

|

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

Company Information

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the military satellite modem market.

Growth opportunities and latent adjacency in Military Satellite Modem Market