Military Lubricants Market by Type (Engine Oil, Special Lubricants & Additives, Grease), Technology (Synthetic, Mineral-based), End User (Army, Navy, Air Force), Fit, Application and Region - Global Forecast to 2030

The military lubricants market is estimated at USD XX million in 2024 and is projected to reach USD XX million by 2030, at a CAGR of XX% from 2024 to 2030. The increase in global defense spending is fostering the growth of the demand for new defense platforms across all domains, which is creating a parallel demand for lubricants to ensure the optimal performance of associated components and subsystems. Moreover, the need to keep the fleet of military assets in operation has also encouraged MRO activities being conducted on them, thereby boosting the demand for lubricants from the MRO sector as well.

To know about the assumptions considered for the study, Request for Free Sample Report

Military Lubricants Market Dynamics:

Driver: Growing active fleet driving demand from both OEM and MRO sectors

An increase in defense expenditure by the leading countries such as the US, UK, Russia, and China is expected to drive the supply chain of military aviation, as the funds would be directed to drive both the development and adoption of new aircraft but also drive the MRO activities required to maintain the airworthiness of the existing fleet. Besides, as more sophisticated aircraft are being developed and inducted, several sophisticated subsystems are being integrated into them that require efficient lubrication to prevent system failures and increase the reliability and component life of the integrated systems. This has encouraged the development of advanced lubricants to support the operational parameters of the different types of aircraft. NYCO (France), 3M (US), Exxon Mobil Corporation (US), Nye Lubricants, Inc. (US), Eastman Chemical Company (US), and The Chemours Company (US) are the leading players in the military lubricants market.

Restraint: High susceptibility to contamination of lubricants

Lubricants are susceptible to contamination through improper storage and faulty maintenance practices. The use of contaminated lubrication can be disastrous for any military platform as they may drastically deteriorate performance in demanding conditions. For instance, the carbon that is formed in the bearing compartments near hot turbine sections breaks off and circulates through the lubricating systems when oil evaporates under high heat conditions. Though, the pieces of carbon are usually not hard enough or large enough to cause failure of the pumps, they may be large enough to clog small filters or nozzles. Furthermore, the presence of sand, dirt, and metallic particles in the lube system is another source of operational contamination.

Improper oil mixing and servicing are some of the prominent faulty maintenance practices that can result in the contamination of lubricating fluid. Other sources of contamination include but are not limited to rust, improper sealing of storage container, which may either induce impurities in the military lubricant or deteriorate its mechanical properties, such as viscosity and density.

Opportunity: Green aviation initiatives driving the adoption of environmentally safe lubricants

The global community is committed to ambitious emissions reduction goals. Hence, Sustainable Aviation Fuel has been identified as one of the key elements in helping achieve these goals. Since, traditional lubricants are toxic, non-biodegradable, and contaminate air and water resources, the demand for sustainable alternatives is increasing due to the adoption of environment-friendly initiatives by the aerospace and defense sector. For instance, vegetable-based lubricants are gaining preference in the aviation industry. However, these lubricants are not very stable at high temperatures and pressures and, thus, are used as specialty lubricants or additives. MIL-G-6032 is a vegetable oil-based grease used for the lubrication of specific pump bearings, valves, and fittings in military aircraft. Such lubricants are beneficial for more than just the environment as they can not only save energy, but also enhance operational parameters such as higher operational life and lower consumption.

Challenge: Adherence to stringent regulations

Military lubricants are required to possess significantly higher performance parameters than the general lubricants used in other industries. Hence, to target their product offering to a wider customer base, military lubricant manufacturers and users need to consult the applicable technical specifications for the grade of oil recommended for use in an engine. In general, the Society of Automotive Engineers (SAE) classifies engine oils by viscosity grades. Oils are classified based on their measured viscosity at high temperatures for single grade oils and at low and high temperatures for multigrade oils. However, the multigrades have a high viscosity index (VI) and may fall into more than one SAE grade classification. For instance, the SAE standard J1966 establishes the requirements for non-dispersant, (straight grade) mineral lubricating oils used in four-stroke cycle piston aircraft engines. It covers the same requirements as the former military specification MIL-L-6082. J1899 establishes the requirements for lubricating oils containing ashless dispersant additives, the same as MIL-L-22851. Stringent emission norms are expected to affect the current product portfolio of the market players, forcing them to spend extensive financial and technical resources to develop high performance military lubricants that not only comply with operational standards but also with the emerging emission norms.

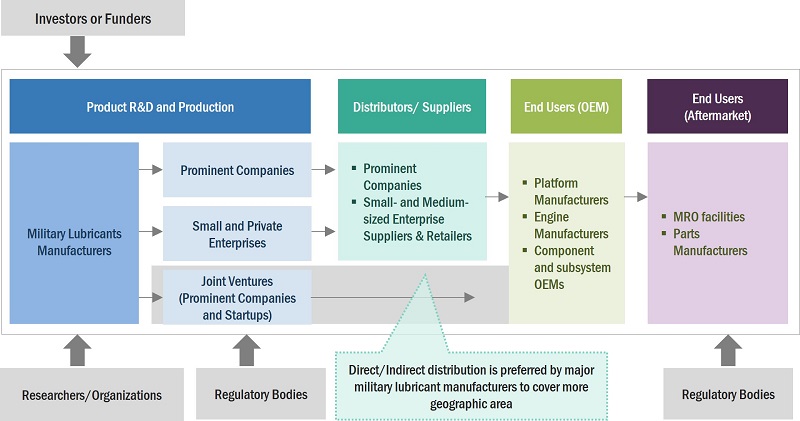

Military Lubricants Market Ecosystem

Prominent companies that provide military lubricants, private and small enterprises, distributors/suppliers/retailers, and end customers (OEMs and MROs) are the key stakeholders in the military lubricants market ecosystem. Investors, funders, academic researchers, distributors, service providers, and airport and aerodrome authorities serve as the major influencers in the military lubricants market.

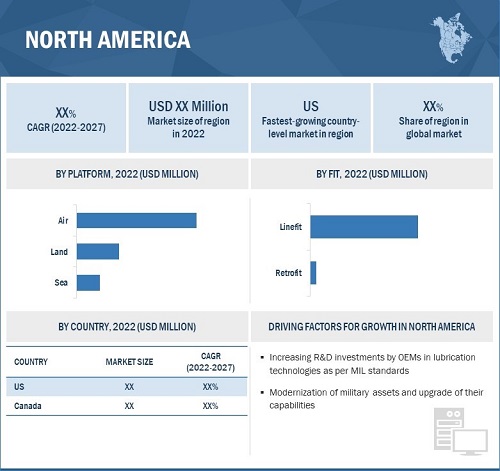

The aircraft segment of the military lubricants market is projected to dominate market share between 2022 and 2027

The military lubricants market has been segmented based on type, technology, end user, application, and region. Based on application, the military lubricants market has been segmented into aircraft, weapons, land vehicles, and marine platforms. The aircraft segment accounted for XX% of the global market in 2022 and is anticipated to occupy a dominant share of the market by the end of 2027 due to factors such as increasing investment towards the manufacturing of new generation military aircraft encouraging the OEM segment, and the scheduled maintenance activities to ensure operational capabilities of the existing fleet.

The aftermarket segment of the military lubricants market is estimated to have the highest CAGR during the forecast period

Based on fit, the military lubricants market is segmented into OEM (Original Equipment Manufacturer) and aftermarket. The aftermarket segment accounted for XX% of the overall military lubricants market in 2022 and is projected to grow at a CAGR of XX% during the forecast period on account of the gargantuan fleet of defense platforms operating by the global armed forces. Furthermore, the growing geopolitical rift in certain regions is also affecting the demand for maintenance of existing miliotay assets in pristine operating condition, thereby driving the demand for lubricants in the aftermarket segment.

The synthetic segment of the military lubricants market is estimated to dominate market share during the forecast period

Based on technology, the military lubricants market is segmented into synthetic and mineral-based lubricants. Owing to their superior performance parameters, as compared to their mineral-based counterparts, the synthetic lubricant segmented accounted for XX% of the total market in 2022 and is projected to hold its dominance in terms of market share during the forecast period.

The engine oil segment of the military lubricants market is estimated to dominate market share during the forecast period

Based on type, the military lubricants market is segmented into engine oil, hydraulic fluid, special lubricants & additives and grease. Engine oil is projected to dominate market share during the forecast period due to their application in the engines to keep them lubricated, cool, and free from external contaminants. Furthermore, the constant replenishment of engine oils as and when required after a flight (in case of military aircraft) or also after a certain period (in case of other platforms) also boosts their demand as they are required to strictly operate under certain parameters to avoid catastrophic failure.

North America is estimated to have the largest market in 2022 for military lubricants

North America is estimated to be the largest market for military lubricants in 2022, followed by Asia Pacific and Europe. This is attributed to the low oil prices and improved efficiency of military platform operations that are fueling the growth of the defense industry in the North American region. The increase in operating hours of existing fleet of global defense forces and the expansion of the fleet of defense forces of different countries in the region are also driving the growth of the North America military lubricants market.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

NYCO (France), 3M (US), Exxon Mobil Corporation (US), Nye Lubricants, Inc. (US), Eastman Chemical Company (US), and The Chemours Company (US) are the leading players in the military lubricants market.

Exxon Mobil Corporation (US) is the leading player in the military lubricants market. The company’s well-established distribution network and brand value serve as an essential factor for its growth. It manufactures products that offer benefits such as low maintenance costs, long equipment life, and reduced energy consumption. The company focuses on inorganic and organic strategies. The company’s strategy for sustainable long-term growth involves expansion in the member countries of the Association of Southeast Asian Nations (ASEAN).

Recent Developments

- In April 2021, LANXESS launched an organic lubricant additive for high-performance engine oils. The new Addition RC 3502 has been specifically developed to reduce friction and deliver sustained performance and anti-wear protection.

- In April 2021, NYCO introduced the NYCO Grease GN 3058, which delivers outstanding performances in four key properties for applications such as wheel bearings, propeller bearings and highly loaded landing gear areas: the base oil viscosity, the load wear index, the resistance to water washout and the oil separation.

Frequently Asked Questions (FAQs):

How will the drivers, challenges, and future opportunities for the military lubricants market affect its dynamics and the subsequent market analysis of the associated trends?

Military lubricants are highly sophisticated fluids that are used to lubricate the different parts of an aircraft, thereby prolonging their service life. Synthetic lubricants are highly effective for the job as they possess superior lubricating capabilities than their mineral-based counterparts and hence are extensively used by commercial, military, and business aviation platforms. The rise in operational fleet is anticipated to drive the demand for military lubricants during the forecast period.

What are the key sustainability strategies adopted by leading players operating in the military lubricants market?

A benchmarking of the growth strategies adopted by key players were undertaken which offers a comprehensive analysis of new product launches, contracts, partnerships, collaborations, expansions, agreements, new product developments, and acquisitions.

What are the new emerging technologies and use cases disrupting the industry?

The development of Standard Performance Capable (SPC) oils and High-Performance Capable (HPC) oils are anticipated to be widely adopted by different platforms as per their operational scenario during the forecast period. Besides, the introduction and adoption of sustainable aviation fuel and other green initiatives in the defense aviation sector is envisioned to have a profound disruptive effect on the existing market.

Who are the key players and innovators in the partnership ecosystem?

NYCO (France), 3M (US), Exxon Mobil Corporation (US), Nye Lubricants, Inc. (US), Eastman Chemical Company (US), and The Chemours Company (US) are some of the key players in the military lubricants market. These key companies are all strong in their home regions and are exploring geographic diversification alternatives to grow their businesses.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Growth opportunities and latent adjacency in Military Lubricants Market