Military Laser Systems Market by Application (Weapons and Non-weapons), Technology (Solid-state Laser, Fiber Laser, Semiconductor Laser, Gas Laser, Liquid Laser, Free-electron Laser), Platform, End Use, Output Power, and Region - Global Forecast to 2028

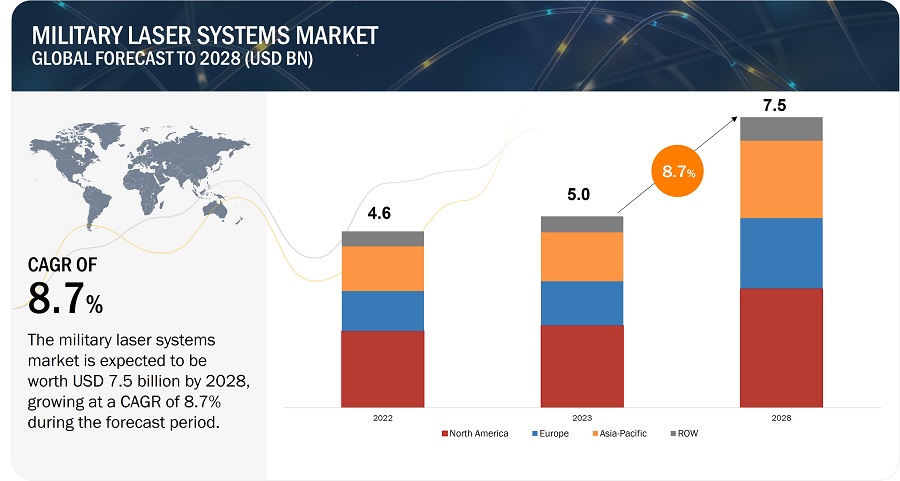

The Military Laser Systems Market is estimated to be USD 5.0 billion in 2023 and is projected to reach USD 7.5 billion by 2028, at a CAGR of 8.7% from 2023 to 2038. The market is driven by factors such as rising focus on development of high-precision military laser systems.

Military Laser Systems Industry Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Military laser systems Market Dynamics:

Drivers: Significant investment by the government on weapon modernization to drive growth

The rising nation security concern with increase in use of unmanned aerial vehicles attacks, warlike situations, and the constant disagreement with neighboring countries are expected to boost the demand and development of high energy laser weapons. These weapons are being increasingly integrated into military platforms such as naval ships, military aircraft, attack helicopters, armored vehicles, and space interceptors among others. In recent years, multiple defense manufacturers and integrators have been researching and developing laser weapons. Manufacturers involved in this market are adopting collaboration and acquisition strategies to successfully complete defense contracts. In December 2022, Lockheed Martin Corporation (US) collaborated with the Israel-based Rafael Advanced Defense Systems, Ltd. to jointly develop, test, and manufacture High Energy Laser Weapon Systems (HELWS) in the US and Israel.

Ongoing research, development, and demonstrations will boost the demand for high-energy laser weapons. The US military doubled its spending on directed energy weapons capability between 2017 and 2019, from USD 535.0 million to USD 1.1 billion. China, India, Israel, France, the UK, and Russia are investing in laser weapons to strengthen their military combat capabilities. Manufacturers, contractors, and integrators in the defense industry, such as Raytheon Technologies (US), Northrop Grumman Corporation (US), and Lockheed Martin Corporation (US), have developed weapon systems that employ high-energy laser systems to counter modern threats.

Drivers: Development of compact military laser systems for UAV platforms

Military systems like laser beams that are used to kill inanimate objects, bombs, and drones are the key reason why the governments are investing in the smart future of aerial protection. These laser systems are designed to make it easier for crowd control and securing buildings. They can help to reduce crime, such as the smuggling of drugs or people. Drones and military laser systems are among the primary tools in the modernization of the security of the world. However, a clear understanding of the subject is necessary for readers to be engaged effectively. Unmanned systems, such as military laser systems, digitally enhanced the defense mechanism. Unmanned aerial vehicles (UAVs) carrying military laser systems can be used for different missions. Fly unmanned aircraft needing the help of only one operator, which in turn, segue into fewer problems and accidents. Because of their many benefits, the US, India, and China have sanctioned heavy budgets to the procurers for their defense forces. The increased deployments of UAVs for defense missions in the sky have resulted in a growing need for lighter and smaller laser-based solutions that are able to be successfully integrated into the UAV platform without spoiling its overall effectiveness. Consequently, the world's most significant weapon suppliers, the Lasers systems market including the companies Leonardo S.p.A. (Italy) and Lockheed Martin Corporation (US)

emphasize the importance of miniaturization ed batteries for UAV battery systems.

Restraints: High development and platform integration costs

The initial cost involved in developing military laser systems is high due to the need for sufficient time for R&D, infrastructure to develop laser systems from scratch, field testing, demonstration, and installation. Moreover, the development and production of military laser systems are complex and require a high technical expertise to design and manufacture, leading to high production costs. In addition, the high level of sophistication and precision required in these systems means that they need to be regularly maintained and upgraded, further adding to the overall cost. For example, military systems based on fiber laser technology cost around USD 20 million per unit. The high-energy military lasers cost more than standard kinetic energy or legacy weapons such as rifles, guns, or bombs. The US Navy has spent USD 40 million in developing a military laser to shoot down drones. Though the cost per shot of the laser weapon system is low, the development cost is very high. These factors limit the entry of new players in the market, in turn restraining the market growth.

Restraints: Regulatory hurdles

The defense industry of the world is affected by a number of different regulations that have been established regarding the usage of weaponized and non-weaponized systems, the latter being especially laser technologies. These regulations not only focus on the production process but also cover the importation and exportation of the military laser systems which must respect certain legal requirements given by the government. For instance, in the US, military lasers must adhere to the Federal Laser Product Performance Standard (FLPPS). A proposal on this topic was made by the US Department of State back in July 2015, the name of which was International Traffic in Arms Regulations (ITAR), and the main thrust was on Category XVII of the US Munitions List (USML). This change was a means of specifying how directed energy weapons, including laser-based systems, should be regulated. Some of the points harping on their patterns of design, usage, and control were covered in the regulation too.

The laser weapons are not globally defined under any international law, and neither are they the subject of due attention during discussions within international legal frameworks. Still, there are several legal systems that could overlap in relation to these machineries. The concept of laser-based systems in the field raises legal questions, particularly international laws that regulate the use of armed forces. The weapons that use directed energy are classified as non-lethal most of the time or less lethal, which distinguishes them from the traditional lethal ones. This area of classification is one of the main sides of the ongoing damasking about their role in warfare.

Opportunities: Growing adoption of UAVs for military applications

Recently, the demand for unmanned aerial vehicles has increased due to their growing use by military forces of different countries for target tracking, battle management, ISR, and combat operations, among others. The new-generation UAVs are used for various combat and tactical missions. Some common examples of military drones or UAVs are MQ-4 Reaper, MQ-1B Predator, QF-4 Aerial Target, RQ-4 Global Hawk, AeroVironment Wasp AE, RQ-1 Predator, BQM-155 Hunter, and CL-289 Piver. UAVs, such as the Predator and the Heron, have been developed by the US and Israel, respectively. Military expenditure for UAV technology is anticipated to grow with increase in military budgets, offering growth opportunities to specialized drone manufacturers and software developers. Approximately 95 countries across the world already have some form of military drone. Various drones are being designed solely for surveillance operations. However, some drones have been designed for critical operations, such as carrying munitions. Countries such as China, India, Germany, and Azerbaijan use remotely piloted UAVs designed for carrying munitions for dense forces. Drones are also used as loitering munitions. Loitering munitions are defined as weapons or flying bombs that contain high-resolution cameras and infrared systems for conducting surveillance activities. They hover over the targets, search for the location of targets, and attack them when the targets are visible. With this increase in the use of UAVs, the concern for aerial threat also increases. Therefore, to destroy UAVs, the demand for laser technology-enabled military systems is increasing. The rise in UAV adoption will create significant growth opportunities for the Military Laser Systems Industry in the upcoming years.

Opportunities: Increasing investment in R&D to design next-generation military laser systems

The aerospace and defense industry is a major user of laser systems for various applications, such as laser communication systems, laser-based weapon systems, laser rangefinders, laser-guided missiles, and laser sensors. The industry is expected to witness significant growth opportunities for laser systems in the coming years. The defense industry is constantly looking for high-end systems to enhance the capabilities of military aircraft and defense systems. Laser systems offer high precision, speed, and reliability, making them an ideal choice for a wide range of applications. Many governments around the world are increasing their investment in military research and development to enhance their defense capabilities. Laser systems are likely to play a key role in these efforts, leading to further growth opportunities for the industry.

Improved system reliability is a crucial factor in selecting a military laser system by any country. The defense systems are deployed in harsh environments. Hence, such systems require the incorporation of advanced hardware units to help gather critical data. Military laser systems are deployed in strategic locations to increase detection rates. The development of state-of-the-art military laser systems with high accuracy has led countries with border disputes and regional threats to rely on these advanced military laser systems for their border protection. Overall, the rising investment in R&D will provide opportunities for market players to design advanced laser systems for military applications.

Challenges: Integration of military laser systems with various platforms

The integration between conventional and modern devices is difficult, which adversely affects the efficiency of military laser systems. In some cases, new devices have different protocols that make military systems difficult to adopt. Integration of legacy systems with new technologies is time and effort-consuming and may distract an organization from its core business activities.

Integrating a laser system with standalone solutions to the desired level has always been a complex task. Integrating laser-based systems with other platform-based systems, such as communications systems, target tracking systems, and navigation, guidance, and control systems, requires deep R&D, prototype designing, compatibility testing, and field testing. The level of complexity increases with the decrease in the amount of space available on platforms. Thus, combat helicopters have the highest complications in integration, followed by armored vehicles and ships. This integration can be challenging and may require significant customization and testing to ensure compatibility and optimal performance.

Challenges: Increased barriers to designing high-energy military laser systems

High-energy military lasers require a large amount of energy to power them, presenting a major challenge in their development. Due to atmospheric absorption, scattering, and other losses that occur, a laser requires as much as 100 mW to ultimately deliver 1 mW to a target. The development of high-energy lasers poses a challenge considering the total size, weight, and power requirements of these systems.

In addition to the above, the complexity in the design of military laser systems used by the defense industry has increased, resulting in increased complications of the weapon systems. The need for laser system components offering parallel operations with lower power consumption, as well as the size and weight reduction, in the defense industry has resulted in increased complexity of the design of military laser systems. Continuous upgrades in laser systems, such as the development of 300 kW and above high-energy lasers, require other compatible laser sources and associated high-end components to match the design requirements of military electronic equipment and systems. Vendors need to keep pace with the changing processes and technological developments and be on par with technological breakthroughs to design advanced and complex architectures suitable for military systems and associated equipment. Failure to do so might reduce the number of contracts, agreements, and licenses and affect the overall performance of military laser systems in terms of efficiency and reliability.

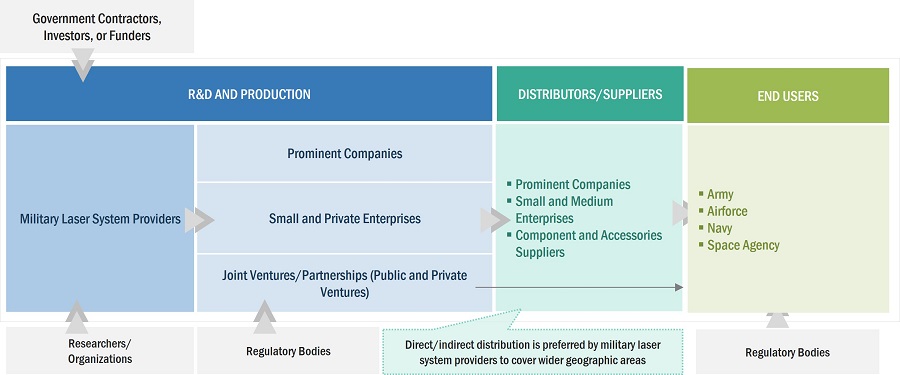

Military Laser Systems Market Ecosystem

Prominent companies in this market include well-established, financially stable providers of laser systems for military purpose. Major players operating in the military laser systems companies include Northrop Grumman(US), Raytheon Technologies Corporation(US), BAE Systems plc (US), Lockheed Martin Corporation (US), Thales Group(France), and Coherent Corp. (US).

Based on application, the weapons segment is projected to grow at the highest CAGR in the military laser systems market during the forecast period

Based on application, the military laser systems market has been segmented into weapons and non-weapons. Growing concern over nation security to boost the procurement of modern weapon systems.

Based on platform, the naval segment is projected to grow at the highest CAGR in the military laser systems during the forecast period

Based on platform, the military laser systems have been segmented into land, airborne, naval, and space. The naval segment is expected to grow at a higher CAGR during the forecast period. The increasing development of shipboard laser weapons is driving this segment of the market.

Based on technology, the fiber laser technology is expected to grow at the highest CAGR during the forecast period

The technology segment has been segmented into solid-state laser, fiber laser, semiconductor laser, gas laser, liquid laser, and free-electron laser. Among these, fiber laser witness strong growth during the forecast period. Fiber lasers are highly compact, robust, efficient, low maintenance, reliable, and long-lasting high-energy lasers. It is widely used in directed energy weapons. The applications of fiber lasers typically include tactical directed energy and power beaming. Electrical fiber lasers can be spectrally combined to produce a high-power, weapon-grade beam, as demonstrated by Lockheed Martin Corporation (US).

Based on end use, the directed energy weapons (DEWs) segment is estimated to lead the market during the forecast period

The End use segment has been classified into target designation and ranging; navigation, guidance, & control; defensive countermeasures; communication systems; and directed energy weapons. Among these, the directed energy weapons (DEWs) segment is estimated to lead the market during the forecast period. The growth of this segment can be attributed to the easy installation and low power consumption of high-energy laser weapons. Compared to conventional ordnance, DEWs have next to zero time of flight, which allows for a longer decision time and a quicker reaction time.

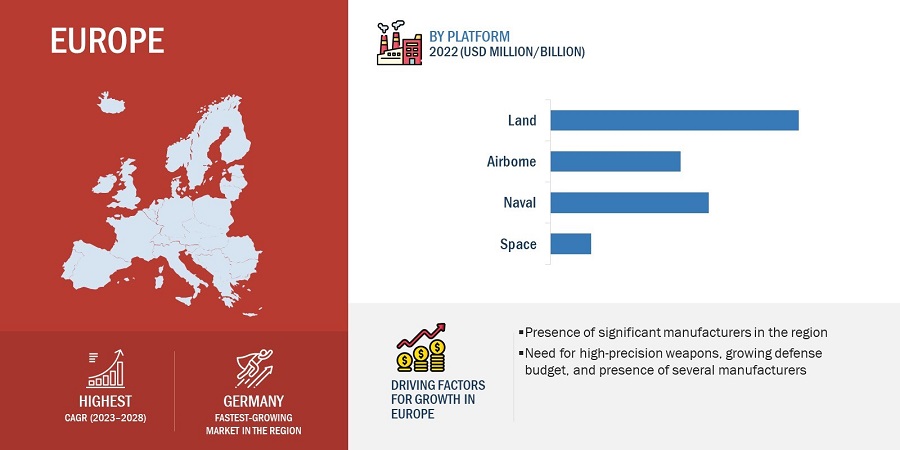

Europe is anticipated to grow at highest CAGR during 2023-2028

The fastest growth of Europe is due to the growing demand and development of military laser weapons in European countries such as UK, Russia, Germany, and France. Investment in R&D activities, and the increasing defense budget by the Germany and France government for the development of modern weapons is driving the growth of this region.

Military Laser Systems Market by Region

To know about the assumptions considered for the study, download the pdf brochure

North America accounted for the largest market share, followed by Asia Pacific in 2022. This market's growth is primarily driven by cross-border disputes and terrorist attacks in different parts of the world, along with advancements in technologies such as high-energy lasers. Rising investment in developing, testing, and demonstrating 300+ kW high-energy laser systems will boost the military laser systems market during the forecast period.

Key Market Players

Major players operating in the military laser systems market include Northrop Grumman Corporation (US), Raytheon Technologies Corporation (US), Lockheed Martin Corporation (US), Thales Group (France), Elbit System Ltd. (Israel), and BAE System plc (UK).

Scope of the Report

|

Segment |

Subsegment |

|

Estimated Market Size

|

USD 5.0 Billion in 2023

|

|

Projected Market Size

|

USD 7.5 Billion by 2028

|

|

Growth Rate

|

CAGR of 8.7%

|

|

Market Size Available for Years |

2019–2028 |

|

Base Year Considered |

2022 |

|

Forecast Period |

2023–2028 |

|

Forecast Units |

Value (USD Million/Billion) |

|

Segments Covered |

Application, Platform, Technology, End Use, Output Power, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, Rest of the World |

|

Companies Covered |

Northrop Grumman Corporation (US), Raytheon Technologies Corporation (US), Lockheed Martin Corporation (US), Thales Group (France), L3Harris Technologies Inc. (US), BAE System (UK), Elbit System (Israel), and Rheinmetall AG (Germany) |

Military Laser Systems Market Highlights

This research report categorizes the military laser systems market based on application, platform, technology, end use, output power, and region.

|

Segment |

Subsegment |

|

By Application: |

|

|

By Technology: |

|

|

By End Use: |

|

|

By Platform: |

|

|

By Output Power: |

|

|

By Region: |

|

Recent Developments

- In March 2023, Raytheon Technologies Corporation received a USD 230 million contract from the US Air Force to produce and deliver 1500 StormBreaker smart weapons. The Stormbreaker is a network-enabled weapon system that provides unprecedented capability against moving targets, regardless of all weather conditions, using its tri-mode seeker and multi-effects warhead.

- In March 2023, Northrop Grumman Corporation received an initial production and operations contract from the US Marine Corps to develop a laser-based Next Generation Handheld Targeting System (NGHTS). NGHTS is a device that would help Marines to improve their target identification and designation capabilities.

- In February 2023, Bharat Dynamics Limited (BDL) (India) signed a Memorandum of Understanding with Thales Group to provide support in establishing a manufacturing facility in India. This facility will boost the development of precision-strike 70mm laser-guided rockets (FZ275 LGR).

- In September 2022, BAE Systems plc introduced a cost-effective, compact laser weapon system that provides precise and advanced air defense capabilities for war fighters against unmanned aerial systems.

- In July 2022, Northrop Grumman Corporation completed the preliminary design review of a high-energy laser using coherent beam-combining technology. This technology allows the combination of high-power laser beams into a single beam that can be scaled for maximum power.

Frequently Asked Questions (FAQ):

What is the Current Size of the Military Laser Systems Market?

The Military Laser Systems Market is projected to grow from an estimated USD 5.0 Billion in 2023 to USD 7.5 Billion by 2028, at a Compound Annual Growth Rate (CAGR) of 8.7% from 2023 to 2028.

What Are the Key Sustainability Strategies Adopted by Leading Players Operating in the Military Laser Systems Market?

The organic and inorganic strategies adopted by key players to strengthen their position in the military laser systems market are high R&D investment, new product launches, collaborations & expansions, contracts, partnerships, and agreements, to expand their presence in the market further.

What Factors Support the Military Laser Systems Market Growth During Forecast Period?

Increase in defense budgets owing to growing concerns over national security is the key factor supporting the military laser systems market growth during forecast period.

Which Region is Expected to Hold the Highest Market Share in the Military Laser Systems Market?

North America accounted for the largest share of 43.51% of the market in 2022.

Who Are the Leading Players in Military Laser Systems Market?

Northrop Grumman Corporation (US), Raytheon Technologies Corporation (US), Lockheed Martin Corporation (US), Thales Group (France), Elbit System Ltd. (Israel), and BAE System plc (UK) are the leading players in the military laser systems market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Rising focus on development of high-precision military laser systems- Significant investments in modern weapon systems by governments- Increase in defense budgets owing to growing concerns over national security- Development of compact military laser systems for UAV platformsRESTRAINTS- Regulatory hurdles- High development and platform integration costsOPPORTUNITIES- Increasing investment in R&D to design next-generation military systems- Growing adoption of UAVs for military applicationsCHALLENGES- Increased barriers to designing high-energy military laser systems- Integration of military laser systems with various platforms

- 5.3 VALUE CHAIN ANALYSIS

-

5.4 TRENDS/DISRUPTION IMPACTING CUSTOMER BUSINESSREVENUE SHIFT AND NEW REVENUE POCKETS FOR MILITARY LASER SYSTEM MANUFACTURERS

-

5.5 MILITARY LASER SYSTEMS MARKET ECOSYSTEMPROMINENT COMPANIESPRIVATE AND SMALL ENTERPRISESEND USERS

-

5.6 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.7 RECESSION IMPACT ANALYSISRECESSION IMPACT ON MILITARY LASER SYSTEMS MARKET

-

5.8 REGULATORY LANDSCAPENORTH AMERICAEUROPEASIA PACIFICREST OF THE WORLD

-

5.9 TRADE ANALYSISIMPORT DATA OF MILITARY VEHICLES, BY REGION, 2017−2020

- 5.10 AVERAGE SELLING PRICE TREND

-

5.11 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 5.12 KEY CONFERENCES AND EVENTS IN 2023–2024

- 6.1 INTRODUCTION

-

6.2 TECHNOLOGY TRENDSQUANTUM CASCADE LASERS (QCLS)LASER BEAM ENERGYAI AND ML IN MILITARY LASER SYSTEMS3D PRINTINGCOUNTER-UAVS AND DIRECTED ENERGY WEAPON SYSTEMSHETEROGENEOUS INTEGRATION

- 6.3 TECHNOLOGY ANALYSIS

-

6.4 IMPACT OF MEGATRENDSMILITARY LASER SYSTEMS FOR ARMED FORCESSOLID-STATE LASERS TO COUNTER UNMANNED AERIAL VEHICLESMILITARY LASER SOLUTIONS FOR SPACE AND SATELLITE SECURITYOPERATIONS ON INTEGRATED BATTLEFIELDS WITH COLLABORATIVE COMBAT

- 6.5 INNOVATION AND PATENT REGISTRATIONS

-

6.6 USE CASE ANALYSIS: MILITARY LASER SYSTEMS MARKETHIGH-PRECISION LASER RANGEFINDERS FOR TARGET TRACKINGTACTICAL HIGH-ENERGY LASER BY NORTHROP GRUMMAN OFFERS VIABLE DEFENSE AGAINST THREATSTURKEY BECAME FIRST NATION TO USE MILITARY LASER SYSTEMS IN COMBATGERMAN NAVY INTEGRATES HIGH-ENERGY LASER ON FRIGATE TO COUNTER DRONES

- 7.1 INTRODUCTION

-

7.2 WEAPONSINCREASED SAFETY CONCERNS AND EXACTITUDE OF OPERATIONS TO DRIVE SEGMENTLETHAL WEAPONS- Growing adoption of lethal weapons to strengthen defense capabilitiesNON-LETHAL WEAPONS- Rising development of new varieties of non-lethal weapons

-

7.3 NON-WEAPONSNEED FOR ACCURATE AND REAL-TIME TARGET INFORMATION IN MILITARY MISSIONS TO DRIVE SEGMENTLASER RANGEFINDERS- Need to determine accurate location of targets to drive segmentLASER DESIGNATORS- Rising adoption of laser-guided munition to drive segmentLASER POINTERS/ILLUMINATORS- Demand for improved night visibility to drive segmentLIDAR- Increased use of LiDAR in mapping, surveying, and remote sensing applications to drive segmentRING LASER GYROSCOPES- Increased integration of ring laser gyroscopes in INS to improve navigation capabilities to drive segmentLASER TERMINALS- Growing focus on improving military communication to drive segmentLASER ALTIMETERS- Increased integration of laser altimeters with satellites due to their small size, low weight, and low power consumption to drive segment

- 8.1 INTRODUCTION

-

8.2 SOLID-STATE LASERINCREASED DEVELOPMENT OF SOLID-STATE LASER SOLUTIONS

-

8.3 FIBER LASERLOW MAINTENANCE, HIGH RELIABILITY, AND HIGH EFFICIENCY

-

8.4 SEMICONDUCTOR LASERGROWING EMPLOYMENT OF DIODE LASERS TO PUMP OTHER TYPES OF LASERS AND IMPROVE OUTPUT ENERGY

-

8.5 GAS LASERPROVIDES PRECISION WITH DESTRUCTIVE CAPABILITY AT SPEED OF LIGHT

-

8.6 LIQUID LASERBETTER PERFORMANCE DUE TO CONTINUOUS COOLING BY LIQUID CIRCULATION

-

8.7 FREE-ELECTRON LASERUSED TO DEVELOP LASER SYSTEMS TO ACHIEVE MEGAWATT-LEVEL OUTPUT

- 9.1 INTRODUCTION

-

9.2 TARGET DESIGNATION AND RANGINGGROWING ADOPTION OF ADVANCED LASER DESIGNATORS AND RANGEFINDERS TO ENHANCE TARGET SENSING

-

9.3 NAVIGATION, GUIDANCE, & CONTROLNEED FOR EXACT LOCATION DETAILS WITH ALTITUDE AND ORIENTATION FOR EFFECTIVE PLANNING AND EXECUTION OF MILITARY MISSIONS

-

9.4 DEFENSIVE COUNTERMEASURESINCREASED SAFETY CONCERNS OVER CHANGING WARFARE NATURE

-

9.5 COMMUNICATION SYSTEMSFOCUS ON IMPROVING MILITARY COMMUNICATIONS

-

9.6 DIRECTED ENERGY WEAPONSINCREASED DEMAND IN COMBAT OPERATIONS

- 10.1 INTRODUCTION

-

10.2 LANDGROWING PROCUREMENT OF ARMORED VEHICLES IN DEVELOPING COUNTRIESARMORED VEHICLES- Easy installation of directed energy weaponsDISMOUNTED SOLDIER SYSTEMS- Compact, lightweight, and energy-efficient weaponsARTILLERY SYSTEMS- Demand for precision targeting and attack

-

10.3 AIRBORNEGROWING ADOPTION OF AIRBORNE LASER WEAPONSATTACK HELICOPTERS- Low cost of engagement and easy installationFIGHTER AIRCRAFT- Demand for compact solid-state lasers for integration in advanced fighter aircraftTACTICAL UAVS- Low equipment weight, size, and power consumption

-

10.4 NAVALGROWING PROCUREMENT OF MODERN WARSHIPS TO STRENGTHEN NAVAL CAPABILITIESCOMBAT SHIPS- Fast, maneuverable, and long enduranceSUBMARINES- Surge in development of modern submarines to improve maritime boundary securityUNMANNED SURFACE VEHICLES- Used for ISR, ASW, and MCM

-

10.5 SPACEDEPLOYMENT OF HIGH-ENERGY LASERS IN SPACE TO DRIVE SEGMENTSATELLITES- Assist in strategic and tactical missionsSPACE-BASED INTERCEPTORS- Low reaction time and high attack speedEARTH-TO-SPACE WEAPONS- Suitable for space security and preparedness

- 11.1 INTRODUCTION

- 11.2 <10 KW

- 11.3 10–100 KW

- 11.4 >100 KW

- 12.1 INTRODUCTION

- 12.2 REGIONAL RECESSION IMPACT ANALYSIS

-

12.3 NORTH AMERICAPESTLE ANALYSIS: NORTH AMERICAUS- Growing development and demonstration of high-energy lasers to drive marketCANADA- Increased R&D investments in defense systems to drive market

-

12.4 EUROPEPESTLE ANALYSIS: EUROPEUK- Significant investment in laser technology-enabled military systems to drive marketGERMANY- High demand for weapons and non-weapons for improved military platform capabilities to drive marketFRANCE- Procurement and development of integrated military systems to enhance defense platform capabilities to drive marketITALY- Significant investment in defense R&D activities to drive marketRUSSIA- Strong focus on adopting modern weapon systems for enhanced military power to drive marketREST OF EUROPE

-

12.5 ASIA PACIFICPESTLE ANALYSIS: ASIA PACIFICCHINA- Growing defense budget and development of modern warfare solutions to drive marketINDIA- Increasing procurement of combat vehicles to drive marketJAPAN- Rising focus on innovating high-end indigenous military technologies to drive marketAUSTRALIA- Government-funded programs to design advanced military solutions to drive marketSOUTH KOREA- Rising tensions with neighboring countries to boost procurement of military systemsREST OF ASIA PACIFIC

-

12.6 REST OF THE WORLDPESTLE ANALYSIS: REST OF THE WORLDMIDDLE EAST & AFRICA- Presence of key market players to contribute to market growthLATIN AMERICA- Rising concern over increasing UAV threats to drive market

- 13.1 INTRODUCTION

- 13.2 COMPANY OVERVIEW

- 13.3 RANKING ANALYSIS OF KEY PLAYERS IN MILITARY LASER SYSTEMS MARKET, 2022

- 13.4 REVENUE ANALYSIS, 2022

- 13.5 MARKET SHARE ANALYSIS, 2022

-

13.6 COMPETITIVE EVALUATION QUADRANTSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

13.7 STARTUP/SME EVALUATION QUADRANTPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 13.8 COMPETITIVE BENCHMARKING

-

13.9 COMPETITIVE SCENARIOMARKET EVALUATION FRAMEWORKPRODUCT LAUNCHESDEALSOTHERS

- 14.1 INTRODUCTION

-

14.2 KEY PLAYERSLOCKHEED MARTIN CORPORATION- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewRAYTHEON TECHNOLOGIES CORPORATION- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewNORTHROP GRUMMAN CORPORATION- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewTHALES GROUP- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewBAE SYSTEMS PLC- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewTHE BOEING COMPANY- Business overview- Products/Services/Solutions offered- Recent developmentsTEXTRON, INC.- Business overview- Products/Services/Solutions offeredRHEINMETALL AG- Business overview- Products/Services/Solutions offered- Recent developmentsL3HARRIS TECHNOLOGIES, INC.- Business overview- Products/Services/Solutions offered- Recent developmentsELBIT SYSTEMS LTD.- Business overview- Products/Services/Solutions offered- Recent developmentsLEONARDO S.P.A.- Business overview- Products/Services/Solutions offered- Recent developmentsSAFRAN SA- Business overview- Products/Services/Solutions offeredMBDA- Business overview- Products/Services/Solutions offeredCOHERENT CORP.- Business overview- Products/Services/Solutions offeredNEWPORT CORPORATION- Business overview- Products/Services/Solutions offered

-

14.3 OTHER PLAYERSDYNETICS, INC.LUMIBIRD SAAQWEST LLCBLUEHALOHENSOLDT AGFRANKFURT LASER COMPANYROKETSAN ASKORD TECHNOLOGIESMYNARIC AGALPHA DESIGN TECHNOLOGIES

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

- TABLE 1 MILITARY LASER SYSTEMS MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 USD EXCHANGE RATES

- TABLE 3 DEFENSE EXPENDITURE OF MAJOR COUNTRIES (USD BILLION)

- TABLE 4 MILITARY LASER SYSTEMS MARKET ECOSYSTEM

- TABLE 5 MILITARY LASER SYSTEMS: PORTER’S FIVE FORCES ANALYSIS

- TABLE 6 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER AGENCIES

- TABLE 7 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER AGENCIES

- TABLE 8 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER AGENCIES

- TABLE 9 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER AGENCIES

- TABLE 10 ARMORED VEHICLES: REGION-WISE IMPORT DATA, 2017−2020 (USD)

- TABLE 11 MOTORIZED TANKS AND OTHER ARMORED FIGHTING VEHICLES FITTED WITH WEAPONS: COUNTRY-WISE EXPORTS, 2020−2021 (USD THOUSAND)

- TABLE 12 MOTORIZED TANKS AND OTHER ARMORED FIGHTING VEHICLES FITTED WITH WEAPONS: COUNTRY-WISE IMPORTS, 2020−2021 (USD THOUSAND)

- TABLE 13 MILITARY LASER SYSTEMS MARKET: AVERAGE SELLING PRICE TREND

- TABLE 14 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP APPLICATIONS (%)

- TABLE 15 KEY BUYING CRITERIA FOR TOP THREE PLATFORMS

- TABLE 16 MILITARY LASER SYSTEMS MARKET: KEY CONFERENCES AND EVENTS

- TABLE 17 MIITARY LASER SYSTEM TECHNOLOGY ANALYSIS

- TABLE 18 IMPORTANT INNOVATION AND PATENT REGISTRATIONS, 2009–2023

- TABLE 19 MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 20 MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 21 MARKET FOR WEAPONS, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 22 MARKET FOR WEAPONS, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 23 MARKET FOR NON-WEAPONS, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 24 MARKET FOR NON-WEAPONS, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 25 MARKET, BY TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 26 MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 27 MARKET, BY END USE, 2020–2022 (USD MILLION)

- TABLE 28 MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 29 MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 30 MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 31 MARKET, BY OUTPUT POWER, 2020–2022 (USD MILLION)

- TABLE 32 MARKET, BY OUTPUT POWER, 2023–2028 (USD MILLION)

- TABLE 33 MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 34 MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 35 NORTH AMERICA: MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 36 NORTH AMERICA: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 37 NORTH AMERICA: MARKET, BY TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 38 NORTH AMERICA: MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 39 NORTH AMERICA: MARKET, BY END USE, 2020–2022 (USD MILLION)

- TABLE 40 NORTH AMERICA: MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 41 NORTH AMERICA: MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 42 NORTH AMERICA: MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 43 NORTH AMERICA: MARKET, BY OUTPUT POWER, 2020–2022 (USD MILLION)

- TABLE 44 NORTH AMERICA: MARKET, BY OUTPUT POWER, 2023–2028 (USD MILLION)

- TABLE 45 NORTH AMERICA: MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 46 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 47 US: MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 48 US: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 49 US: MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 50 US: MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 51 US: MARKET, BY TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 52 US: MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 53 CANADA: MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 54 CANADA: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 55 CANADA: MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 56 CANADA: MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 57 CANADA: MARKET, BY TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 58 CANADA: MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 59 EUROPE: MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 60 EUROPE: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 61 EUROPE: MARKET, BY TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 62 EUROPE: MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 63 EUROPE: MARKET, BY END USE, 2020–2022 (USD MILLION)

- TABLE 64 EUROPE: MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 65 EUROPE: MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 66 EUROPE: MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 67 EUROPE: MARKET, BY OUTPUT POWER, 2020–2022 (USD MILLION)

- TABLE 68 EUROPE: MARKET, BY OUTPUT POWER, 2023–2028 (USD MILLION)

- TABLE 69 EUROPE: MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 70 EUROPE: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 71 UK: MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 72 UK: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 73 UK: MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 74 UK: MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 75 UK: MARKET, BY TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 76 UK: MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 77 GERMANY: MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 78 GERMANY: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 79 GERMANY: MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 80 GERMANY: MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 81 GERMANY: MARKET, BY TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 82 GERMANY: MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 83 FRANCE: MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 84 FRANCE: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 85 FRANCE: MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 86 FRANCE: MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 87 FRANCE: MARKET, BY TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 88 FRANCE: MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 89 ITALY: MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 90 ITALY: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 91 ITALY: MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 92 ITALY: MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 93 ITALY: MARKET, BY TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 94 ITALY: MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 95 RUSSIA: MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 96 RUSSIA: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 97 RUSSIA: MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 98 RUSSIA: MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 99 RUSSIA: MARKET, BY TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 100 RUSSIA: MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 101 REST OF EUROPE: MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 102 REST OF EUROPE: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 103 REST OF EUROPE: MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 104 REST OF EUROPE: MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 105 REST OF EUROPE: MARKET, BY TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 106 REST OF EUROPE: MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 107 ASIA PACIFIC: MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 108 ASIA PACIFIC: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 109 ASIA PACIFIC: MARKET, BY TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 110 ASIA PACIFIC: MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 111 ASIA PACIFIC: MARKET, BY END USE, 2020–2022 (USD MILLION)

- TABLE 112 ASIA PACIFIC: MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 113 ASIA PACIFIC: MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 114 ASIA PACIFIC: MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 115 ASIA PACIFIC: MARKET, BY OUTPUT POWER, 2020–2022 (USD MILLION)

- TABLE 116 ASIA PACIFIC: MARKET, BY OUTPUT POWER, 2023–2028 (USD MILLION)

- TABLE 117 ASIA PACIFIC: MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 118 ASIA PACIFIC: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 119 CHINA: MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 120 CHINA: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 121 CHINA: MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 122 CHINA: MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 123 CHINA: MARKET, BY TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 124 CHINA: MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 125 INDIA: MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 126 INDIA: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 127 INDIA: MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 128 INDIA: MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 129 INDIA: MARKET, BY TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 130 INDIA: MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 131 JAPAN: MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 132 JAPAN: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 133 JAPAN: MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 134 JAPAN: MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 135 JAPAN: MARKET, BY TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 136 JAPAN: MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 137 AUSTRALIA: MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 138 AUSTRALIA: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 139 AUSTRALIA: MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 140 AUSTRALIA: MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 141 AUSTRALIA: MARKET, BY TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 142 AUSTRALIA: MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 143 SOUTH KOREA: MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 144 SOUTH KOREA: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 145 SOUTH KOREA: MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 146 SOUTH KOREA: MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 147 SOUTH KOREA: MARKET, BY TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 148 SOUTH KOREA: MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 149 REST OF ASIA PACIFIC: MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 150 REST OF ASIA PACIFIC: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 151 REST OF ASIA PACIFIC: MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 152 REST OF ASIA PACIFIC: MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 153 REST OF ASIA PACIFIC: MARKET, BY TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 154 REST OF ASIA PACIFIC: MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 155 REST OF THE WORLD: MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 156 REST OF THE WORLD: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 157 REST OF THE WORLD: MARKET, BY TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 158 REST OF THE WORLD: MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 159 REST OF THE WORLD: MARKET, BY END USE, 2020–2022 (USD MILLION)

- TABLE 160 REST OF THE WORLD: MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 161 REST OF THE WORLD: MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 162 REST OF THE WORLD: MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 163 REST OF THE WORLD: MARKET, BY OUTPUT POWER, 2020–2022 (USD MILLION)

- TABLE 164 REST OF THE WORLD: MARKET, BY OUTPUT POWER, 2023–2028 (USD MILLION)

- TABLE 165 REST OF THE WORLD: MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 166 REST OF THE WORLD: SYSTEMS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 167 MIDDLE EAST & AFRICA: MILITARY LASER SYSTEMS MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 168 MIDDLE EAST & AFRICA: MILITARY LASER SYSTEMS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 169 MIDDLE EAST & AFRICA: MILITARY LASER SYSTEMS MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 170 MIDDLE EAST & AFRICA: MILITARY LASER SYSTEMS MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 171 MIDDLE EAST & AFRICA: MILITARY LASER SYSTEMS MARKET, BY TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 172 MIDDLE EAST & AFRICA: MILITARY LASER SYSTEMS MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 173 LATIN AMERICA: MILITARY LASER SYSTEMS MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 174 LATIN AMERICA: MILITARY LASER SYSTEMS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 175 LATIN AMERICA: MILITARY LASER SYSTEMS MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 176 LATIN AMERICA: MILITARY LASER SYSTEMS MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 177 LATIN AMERICA: MILITARY LASER SYSTEMS MARKET, BY TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 178 LATIN AMERICA: MILITARY LASER SYSTEMS MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 179 KEY DEVELOPMENTS/STRATEGIES OF LEADING PLAYERS IN MILITARY LASER SYSTEMS MARKET

- TABLE 180 MILITARY LASER SYSTEMS MARKET: DEGREE OF COMPETITION

- TABLE 181 COMPANY FOOTPRINT (15 COMPANIES)

- TABLE 182 COMPANY APPLICATION FOOTPRINT

- TABLE 183 COMPANY PLATFORM FOOTPRINT

- TABLE 184 COMPANY REGION FOOTPRINT

- TABLE 185 MILITARY LASER SYSTEMS MARKET: PRODUCT LAUNCHES, FEBRUARY 2019–SEPTEMBER 2022

- TABLE 186 MILITARY LASER SYSTEMS MARKET: DEALS, JANUARY 2018– MARCH 2023

- TABLE 187 MILITARY LASER SYSTEMS MARKET: OTHERS, SEPTEMBER 2018–NOVEMBER 2022

- TABLE 188 LOCKHEED MARTIN CORPORATION: COMPANY OVERVIEW

- TABLE 189 LOCKHEED MARTIN CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 190 LOCKHEED MARTIN CORPORATION: DEALS

- TABLE 191 RAYTHEON TECHNOLOGIES CORPORATION: COMPANY OVERVIEW

- TABLE 192 RAYTHEON TECHNOLOGIES CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 193 RAYTHEON TECHNOLOGIES CORPORATION: PRODUCT LAUNCHES

- TABLE 194 RAYTHEON TECHNOLOGIES CORPORATION: DEALS

- TABLE 195 RAYTHEON TECHNOLOGIES CORPORATION: OTHERS

- TABLE 196 NORTHROP GRUMMAN CORPORATION: COMPANY OVERVIEW

- TABLE 197 NORTHROP GRUMMAN CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 198 NORTHROP GRUMMAN CORPORATION: PRODUCT LAUNCHES

- TABLE 199 NORTHROP GRUMMAN CORPORATION: DEALS

- TABLE 200 NORTHROP GRUMMAN CORPORATION: OTHERS

- TABLE 201 THALES GROUP: COMPANY OVERVIEW

- TABLE 202 THALES GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 203 THALES GROUP: DEALS

- TABLE 204 BAE SYSTEMS PLC: COMPANY OVERVIEW

- TABLE 205 BAE SYSTEMS PLC: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 206 BAE SYSTEMS PLC: PRODUCT LAUNCHES

- TABLE 207 BAE SYSTEMS PLC: DEALS

- TABLE 208 BAE SYSTEMS PLC: OTHERS

- TABLE 209 THE BOEING COMPANY: COMPANY OVERVIEW

- TABLE 210 THE BOEING COMPANY: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 211 THE BOEING COMPANY: PRODUCT LAUNCHES

- TABLE 212 THE BOEING COMPANY: DEALS

- TABLE 213 TEXTRON, INC.: COMPANY OVERVIEW

- TABLE 214 TEXTRON, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 215 RHEINMETALL AG: COMPANY OVERVIEW

- TABLE 216 RHEINMETALL AG: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 217 RHEINMETALL AG: PRODUCT LAUNCHES

- TABLE 218 RHEINMETALL AG: DEALS

- TABLE 219 L3HARRIS TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 220 L3HARRIS TECHNOLOGIES, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 221 L3HARRIS TECHNOLOGIES, INC.: DEALS

- TABLE 222 ELBIT SYSTEMS LTD.: COMPANY OVERVIEW

- TABLE 223 ELBIT SYSTEMS LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 224 ELBIT SYSTEMS LTD.: DEALS

- TABLE 225 LEONARDO S.P.A.: COMPANY OVERVIEW

- TABLE 226 LEONARDO S.P.A.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 227 LEONARDO S.P.A.: DEALS

- TABLE 228 SAFRAN SA: COMPANY OVERVIEW

- TABLE 229 SAFRAN SA: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 230 SAFRAN SA: DEALS

- TABLE 231 MBDA: COMPANY OVERVIEW

- TABLE 232 MBDA: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 233 MBDA: DEALS

- TABLE 234 MBDA: OTHERS

- TABLE 235 COHERENT CORP.: COMPANY OVERVIEW

- TABLE 236 COHERENT CORP.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 237 COHERENT CORP.: DEALS

- TABLE 238 NEWPORT CORPORATION: COMPANY OVERVIEW

- TABLE 239 NEWPORT CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 240 NEWPORT CORPORATION: OTHERS

- TABLE 241 DYNETICS, INC.: COMPANY OVERVIEW

- TABLE 242 LUMIBIRD SA: COMPANY OVERVIEW

- TABLE 243 AQWEST LLC: COMPANY OVERVIEW

- TABLE 244 BLUEHALO: COMPANY OVERVIEW

- TABLE 245 HENSOLDT AG: COMPANY OVERVIEW

- TABLE 246 FRANKFURT LASER COMPANY: COMPANY OVERVIEW

- TABLE 247 ROKETSAN AS: COMPANY OVERVIEW

- TABLE 248 KORD TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 249 MYNARIC AG: COMPANY OVERVIEW

- TABLE 250 ALPHA DESIGN TECHNOLOGIES: COMPANY OVERVIEW

- FIGURE 1 MILITARY LASER SYSTEMS MARKET SEGMENTATION

- FIGURE 2 RESEARCH PROCESS FLOW

- FIGURE 3 MILITARY LASER SYSTEMS MARKET: RESEARCH DESIGN

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 5 RECESSION IMPACT ON REVENUE OF KEY PLAYERS

- FIGURE 6 MILITARY EXPENDITURE FROM 2019 TO 2021 (USD BILLION)

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 9 DATA TRIANGULATION

- FIGURE 10 ASSUMPTIONS FOR RESEARCH STUDY

- FIGURE 11 BY APPLICATION, WEAPONS SEGMENT ESTIMATED TO HOLD LARGER MARKET SHARE IN 2023

- FIGURE 12 BY PLATFORM, LAND SEGMENT TO LEAD MARKET FROM 2023 TO 2028

- FIGURE 13 BY TECHNOLOGY, SOLID-STATE LASER SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 14 INCREASING INVESTMENT IN DEVELOPMENT OF HIGH-ENERGY LASERS TO DRIVE MARKET

- FIGURE 15 SOLID-STATE LASER SEGMENT HELD LARGEST MARKET SHARE IN 2022

- FIGURE 16 LAND SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 17 NON-WEAPONS SEGMENT ACCOUNTED FOR LARGER MARKET SHARE IN 2022

- FIGURE 18 NORTH AMERICA ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

- FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN MILITARY LASER SYSTEMS MARKET

- FIGURE 20 US MILITARY SPENDING ON DIRECTED ENERGY WEAPONS (2017–2019)

- FIGURE 21 DEFENSE EXPENDITURE OF MAJOR COUNTRIES IN PERCENTAGE

- FIGURE 22 VALUE CHAIN ANALYSIS

- FIGURE 23 REVENUE SHIFT IN MILITARY LASER SYSTEMS MARKET

- FIGURE 24 MARKET ECOSYSTEM MAP: MILITARY LASER SYSTEMS MARKET

- FIGURE 25 PORTER’S FIVE FORCES ANALYSIS FOR MILITARY LASER SYSTEMS MARKET

- FIGURE 26 RECESSION IMPACT ANALYSIS ON MILITARY LASER SYSTEMS MARKET

- FIGURE 27 FACTORS IMPACTING MILITARY LASER SYSTEMS MARKET

- FIGURE 28 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP APPLICATIONS

- FIGURE 29 KEY BUYING CRITERIA FOR MILITARY LASER SYSTEMS, BY TOP THREE PLATFORMS

- FIGURE 30 HIGH-ENERGY LASER ROADMAP, 1960–2020

- FIGURE 31 TECHNOLOGICAL TRENDS IN MILITARY LASER SYSTEMS MARKET

- FIGURE 32 WEAPONS APPLICATION SEGMENT TO REGISTER HIGHER CAGR FROM 2023 TO 2028

- FIGURE 33 FIBER LASER SEGMENT TO REGISTER HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 34 DIRECTED ENERGY WEAPONS SEGMENT TO REGISTER HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 35 NAVAL SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 36 >100 KW SEGMENT TO REGISTER HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 37 REGIONAL SNAPSHOT: GROWTH RATE ANALYSIS, 2023-2028

- FIGURE 38 REGIONAL RECESSION IMPACT ANALYSIS

- FIGURE 39 NORTH AMERICA: MILITARY LASER SYSTEMS MARKET SNAPSHOT

- FIGURE 40 EUROPE: MILITARY LASER SYSTEMS MARKET SNAPSHOT

- FIGURE 41 ASIA PACIFIC: MILITARY LASER SYSTEMS MARKET SNAPSHOT

- FIGURE 42 RANKING OF KEY PLAYERS IN MILITARY LASER SYSTEMS MARKET, 2022

- FIGURE 43 REVENUE ANALYSIS OF KEY COMPANIES IN MILITARY LASER SYSTEMS MARKET, 2019–2022

- FIGURE 44 MILITARY LASER SYSTEMS MARKET SHARE ANALYSIS OF KEY COMPANIES, 2022

- FIGURE 45 MARKET COMPETITIVE LEADERSHIP MAPPING, 2022

- FIGURE 46 MILITARY LASER SYSTEMS MARKET (STARTUP/SME) COMPETITIVE LEADERSHIP MAPPING, 2022

- FIGURE 47 LOCKHEED MARTIN CORPORATION: COMPANY SNAPSHOT

- FIGURE 48 RAYTHEON TECHNOLOGIES CORPORATION: COMPANY SNAPSHOT

- FIGURE 49 NORTHROP GRUMMAN CORPORATION: COMPANY SNAPSHOT

- FIGURE 50 THALES GROUP: COMPANY SNAPSHOT

- FIGURE 51 BAE SYSTEMS PLC: COMPANY SNAPSHOT

- FIGURE 52 THE BOEING COMPANY: COMPANY SNAPSHOT

- FIGURE 53 TEXTRON, INC.: COMPANY SNAPSHOT

- FIGURE 54 RHEINMETALL AG: COMPANY SNAPSHOT

- FIGURE 55 L3HARRIS TECHNOLOGIES, INC.: COMPANY SNAPSHOT

- FIGURE 56 ELBIT SYSTEMS LTD.: COMPANY SNAPSHOT

- FIGURE 57 LEONARDO S.P.A.: COMPANY SNAPSHOT

- FIGURE 58 SAFRAN SA: COMPANY SNAPSHOT

- FIGURE 59 MBDA: COMPANY SNAPSHOT

- FIGURE 60 COHERENT CORP.: COMPANY SNAPSHOT

- FIGURE 61 NEWPORT CORPORATION: COMPANY SNAPSHOT

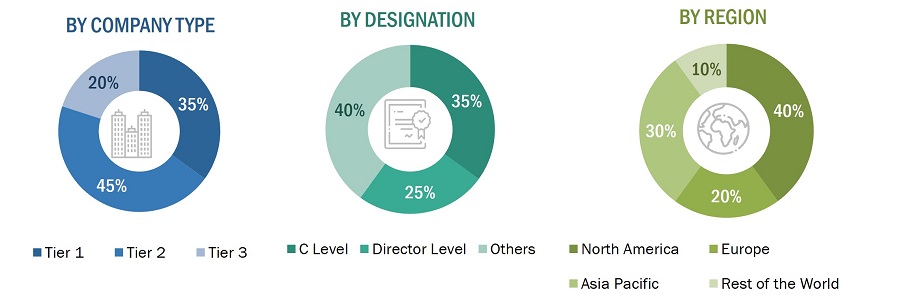

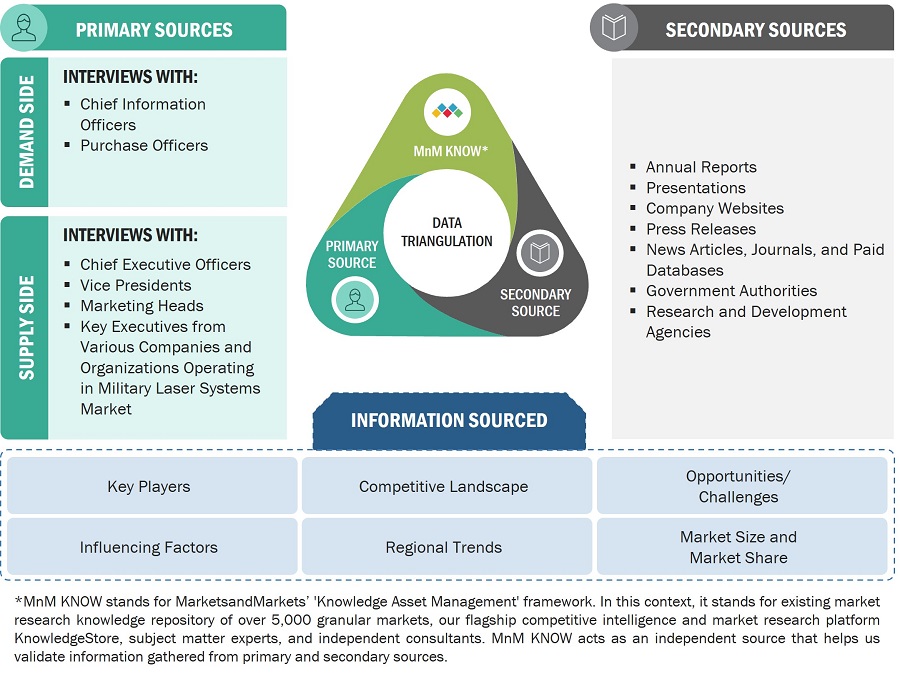

The research study conducted on the military laser systems market involved extensive use of secondary sources, including directories, databases of articles, journals on military laser systems, company newsletters, and information portals such as Hoover’s, Bloomberg, and Factiva to identify and collect information useful for this extensive, technical, market-oriented study of the military laser systems market. Primary sources are several industry experts from the core and related industries, alliances, organizations, Original Equipment Manufacturers (OEMs), vendors, suppliers, and technology developers. These sources relate to all segments of the value chain of the military laser systems market.

In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, among others, to obtain and verify critical qualitative and quantitative information and to assess future prospects of the market.

Secondary Research

In the secondary research process, various secondary sources were referred to identify and collect information for this study on the military laser systems market. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers and certified publications; articles from recognized authors; manufacturer's associations; directories; and databases. Secondary research was mainly used to obtain key information about the supply chain of the military laser systems industry, the monetary chain of the market, the total pool of key players, market classification and segmentation according to the industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

Extensive primary research was conducted to obtain qualitative and quantitative information for this report on the military laser systems market. Several primary interviews were conducted with the market experts from both demand- and supply-side across major regions, namely, North America, Europe, Asia Pacific, and Rest of the World. Primary sources from the supply-side included industry experts such as business development managers, sales heads, technology and innovation directors, and related key executives from various key companies and organizations operating in the military laser systems market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Extensive research into high-energy laser system sources and the concurrent advances in beam-directing technology have pushed technology to the level where fully configured military laser systems are now being designed and tested for imminent deployment. Advances in material technology, information technology, and space-based capabilities of the 21st century are also propelling the demand for military laser systems. The US Air Force project on airborne laser (ABL) is a classic example of how laser technology-based weapons are transforming into a formidable weapon system with hitherto unthinkable military capabilities.

The military laser systems market is an emerging one due to the growing demand for modern weapon solution and advanced target tracking and recognition systems. Both top-down and bottom-up approaches were used to estimate and validate the size of the military laser systems market. The research methodology used to estimate the market size also included the following details:

Key players were identified through secondary research, and their market ranking was determined through primary and secondary research. This included a study of annual and financial reports of the top market players and extensive interviews of leaders, including CEOs, directors, and marketing executives. All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

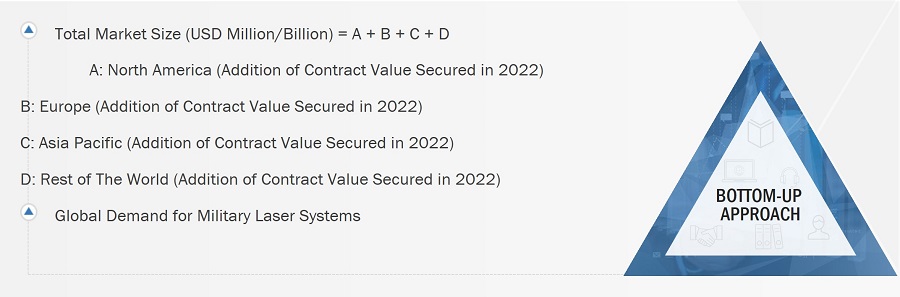

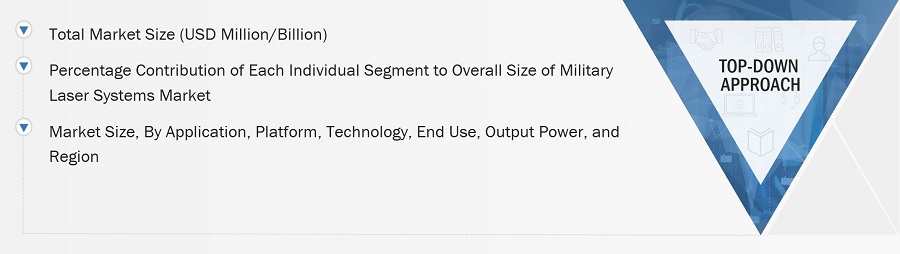

Market size estimation methodology: Bottom-up Approach

Market size estimation methodology: Top Down Approach

Data Triangulation

After arriving at the overall size of the military laser systems market from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the estimated sizes of different market segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Additionally, the market size was validated using both the top-down and bottom-up approaches

Market Definition

A laser technology-based weapon system is a future weapon system that emits highly focused energy for target destruction. The potential use of this advanced technology include anti-personnel weapon systems, missile defense systems, and disabling of lightly armored vehicles. Key factors driving the growth of the military laser systems market include a rising focus on the development of high-precision military laser systems, significant investments in modern weapon systems by governments, a rise in defense budgets owing to increasing concerns over national security, and the development of compact military laser systems for UAV platforms.

Key Stakeholders

- Senior Management

- End User

- Finance/Procurement Department

- R&D Department

Report Objectives

- To define, describe, segment, and forecast the size of the military laser systems market based on application, platform, technology, end use, and output power, along with a regional analysis.

- To forecast the size of different segments of the market with respect to four key regions, namely, North America, Europe, Asia Pacific, and the Rest of the World, along with their key countries

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the market.

- To identify technology trends currently prevailing in the market

- To provide an overview of the tariff and regulatory landscape with respect to military laser systems across different regions

- To analyze micromarkets1 with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders by identifying key market trends

- To analyze the impact of the recession on the market and its stakeholders

- To profile the leading market players and comprehensively analyze their market share and core competencies2

- To analyze the degree of competition in the market by identifying key growth strategies, such as constant innovation, high R&D investment, new product launches, collaborations & expansions, contracts, partnerships, and agreements, adopted by the leading market players.

- To identify detailed financial positions, key products, and unique selling points of leading companies in the market

- To provide a detailed competitive landscape of the military laser systems market, along with a ranking analysis, market share analysis, and revenue analysis of the key players

Micromarkets refer to further segments and subsegments of the military laser systems market included in the report.

Core competencies of companies were captured in terms of their key developments and key strategies adopted by them to sustain their position in the market.

Available customizations

Along with the market data, MarketsandMarkets offers customizations as per the specific needs of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the market segments at country-level

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Military Laser Systems Market