Military Analytics Market by Component (Services, Solutions), Deployment (On-premises, Cloud), Application, End-User (MROs, Airlines, Airports, OEMs), Business Function, Region (North America, Europe, APAC, RoW) - Global Forecast to 2030

The Military Analytics market is projected to grow from USD xx billion in 2024 to USD xx billion by 2030, at a CAGR of xx% from 2024 to 2030. The increasing requirement to procure advanced analytical software by the aviation industry has led software developers to enhance the capabilities of their predictive, prescriptive, and descriptive analytics solutions for several applications. Listed below are some of the new technologies observed in the Military Analytics market.

To know about the assumptions considered for the study, Request for Free Sample Report

Military Analytics Market Dynamics

Driver: Growing adoption of rugged and smart wearables to collect and analyze critical data during combat

Military Analytics helps batallions in analyzing various combat related situations. With modern electronic equipment, defense forces can collect multiple sets of data which can be automatically analysed to generate appropriate command. Thus, the demand for automated command functions is helping defense forces during effective decision making process.

Restraint: Lack of appropriate analytical skills

The integration between conventional and modern military devices is difficult, which requires huge amount of investments and expertise. In some cases, new devices have different protocols that make these difficult to adopt. Integration of legacy data systems with new technologies is time and effort-consuming and may distract an organization from its core business activities owing to lack of proper analytical skills .

Opportunity: Use of AI-based analytics solutions for critical functions in defense industry

The use of Military Analytics in defense operations requires skilled professionals and can be time-consuming. Artificial intelligence (AI) is a collection of technologies that excel at extracting insights and patterns from large sets of data, which are then employed to make predictions based on that information. Thus, AI is being used to automate the analytics process to make it more efficient and accessible, owing to the improved user interface through natural language processing. Companies such as SAP SE and Oracle Corporation offer several Military Analytics solutions that are based upon the use of AI platforms. For example, Oracle Analytics and Oracle cloud ERP are based on AI. Automation platforms, content management systems, and CRMs are some of the available AI-based analytics solutions in the market. Thus, the incorporation of AI into data analytics can act as an opportunity for the Military Analytics market to grow.

Challenge: Economic challenges faced by the aviation industry due to COVID-19

The COVID-19 outbreak has led to major economic problems and challenges for the defense industry. Since the beginning of the outbreak, the civil defense has been among the most severely hit sectors globally.

Military Analytics Market Ecosystem

Based on component, the solutions segment is projected to lead the market during the forecast period.

Based on component, the Military Analytics market is segmented into solutions and services. The solutions segment is expected to lead the market during the forecast period due to increased demand for customized Military Analytics solutions that can tackle uncertainties in the aviation business. The services segment offers on-demand functionalities of aviation analytics, such as weather reporting and navigation, to focus on specific targeted areas. The Military Analytics services segment is anticipated to grow at a CAGR of xx% during the forecast period.

Based on platform, the ground segment is projected to grow at the highest CAGR during forecast period.

Based on platform, the Military Analytics market is segmented into ground, airborne, and naval. The ground segment is expected to lead the market during the forecast period, owing to the development of sophisticated ground-based military equipment that can be automated to collect, process and generate useable datasets for military operations.

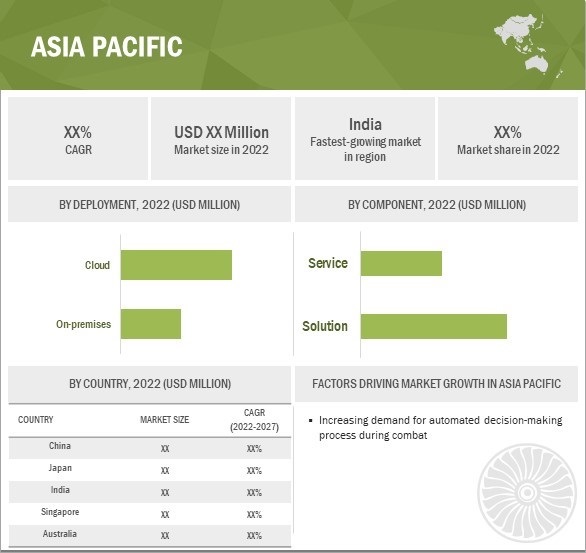

The Military Analytics market in Asia Pacific is projected to grow at the highest CAGR from 2022 to 2027.

The availability of technical expertise and workforce in countries such as China, Japan, and India is one of the major factors driving the Military Analytics market in the Asia Pacific region. The growing demand for improved functional efficiency and an effective supply chain has positively impacted the Military Analytics market. The presence of startups providing analytics solutions, such as IBS Software Services, is one of the key reasons that aircraft OEMs and MRO solution providers are attracted to the Asia Pacific region where they can procure specifically devised solutions.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players:

The global Military Analytics market is dominated by a few globally established players such as Oracle Corporation (US), General Electric (US), Lufthansa Technik (Germany), SAP (Germany), and IBM Corporation (US).

Recent Developments

- In July 2022, General Electric signed an MoU with Microsoft and Teradata to work on a solution to lower carbon emissions. The three businesses plan to start collaborating to create a product that will give airplane operators the tools they need to monitor, report, and reduce emissions right away. To tackle the problem of cutting aircraft emissions, the collaboration combines the software solutions of three top companies.

- In July 2022, Askdata, a start-up with a focus on search-driven analytics, was acquired by SAP SE to improve its capacity to support businesses in making more informed decisions. Users can search, engage with, and work together on real-time data to maximize business insights. Askdata's customized experience, which is available in many different languages, connects live to source apps without moving data and keeps the entire business context to deliver insightful responses and proactive insights.

- In July 2022, IFS AB finalized a deal to acquire Ultimo Software Solutions, a Dutch company that offers cloud Enterprise Asset Management (EAM) software. Ultimo Software Solutions has established a solid reputation for the comprehensiveness, adaptability, and customizability of its SaaS EAM solutions. As the only vendor now able to provide Cloud native EAM solutions that cater to every firm with either sophisticated end-to-end business demands or as a standalone point solution, IFS AB stands out from competitors thanks to its partnership with Ultimo Software Solutions.

- In July 2022, Malaysia Airlines extended its relationship with SITA to complete a significant upgrade that will provide quick, secure, and dependable network connectivity between its hub in Kuala Lumpur and its international operations. Malaysia Airlines will use SITA Connect, which was created especially for the aviation sector, to satisfy its demands within and outside of airports. SITA's global presence at over 650 airports in 220 countries and territories will provide easy access to new features and apps, cut connectivity costs, improve service quality as well as simplify the check-in process for passengers.

- In May 2022, Oracle Corporation signed a contract to buy Adi Insights, a leading supplier of workforce management systems. The acquisition will enable SuitePeople, NetSuite's human resource management platform, to manage overtime, capture time, estimate demand, and schedule shifts.

Frequently Asked Questions (FAQ):

What are your views on the growth prospect of the Military Analytics market?

Response: The Military Analytics market is expected to grow substantially owing to the growing trend of digitization and expected increasing demand for aircraft fleet, globally.

What are the key sustainability strategies adopted by leading players operating in the Military Analytics market?

Response: Key players have adopted various organic and inorganic strategies to strengthen their position in the aircraft actuators market. The major players include IBM Corporation (US), SAP (Germany), Lufthansa Technik (Germany), General Electric (US), and Oracle Corporation (US). and others, these players have adopted various strategies, such as acquisitions, contracts, expansions, new product launches, and partnerships & agreements, to expand their presence in the market.

What are the new emerging technologies and use cases disrupting the Military Analytics market?

Response: Some of the major emerging technologies and use cases disrupting the market include demand for Software as a Service (SaaS), predictive analytics, and integration of big data technology in Military Analytics applications.

Who are the key players and innovators in the ecosystem of the Military Analytics market?

Response: The key players in the Military Analytics market include IBM Corporation (US), IFS (Sweden), Ramco Systems (India), SAP (Germany), Swiss AviationSoftware (Switzerland), Lufthansa Technik (Germany), General Electric (US), and Honeywell International (US) and others.

Which region is expected to hold the highest market share in the Military Analytics market?

Response: Military Analytics market in North America is projected to hold the highest market share during the forecast period due to the presence of several Military Analytics service providers in the region.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

1.3.2 REGIONAL SCOPE

1.3.3 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY & PRICING

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 Secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Primary sources

2.1.2.2 Breakdown of primaries

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.2 RESTRAINTS

5.2.3 OPPORTUNITIES

5.2.4 CHALLENGES

5.3 PRICING ANALYSIS

5.4 VALUE CHAIN ANALYSIS

5.5 MARKET ECOSYSTEM MAP

5.6 TECHNOLOGY ANALYSIS

5.7 PATENT ANALYSIS

5.8 VOLUME DATA

5.9 CASE STUDY ANALYSIS

5.10 TRADE DATA STATISTICS

5.11 PORTER’S FIVE FORCES ANALYSIS

5.12 KEY CONFERENCES & EVENTS IN 2022-2023

5.13 TARIFF AND REGULATORY LANDSCAPE

5.14 KEY STAKEHOLDERS & BUYING CRITERIA

6 INDUSTRY TRENDS

6.1 INTRODUCTION

6.2 SUPPLY-CHAIN ANALYSIS

6.3 EMERGING INDUSTRY TRENDS

6.4 INNOVATION & PATENT REGISTRATION

6.5 IMPACT OF MEGA TREND

7 MILITARY ANALYTICS MARKET, BY COMPONENT

7.1 INTRODUCTION

7.2 SERVICE

7.2.1 PROFESSIONAL SERVICES

7.2.1.1 Training and consulting services

7.2.1.2 System integration and implementation services

7.2.1.3 Support and maintenance services

7.2.2 MANAGED SERVICES

7.2.3 SAAS

7.3 SOLUTION

8 MILITARY ANALYTICS MARKET, BY DEPLOYMENT

8.1 INTRODUCTION

8.2 CLOUD

8.3 ON-PREMISE

9 MILITARY ANALYTICS MARKET, BY APPLICATION

9.1 INTRODUCTION

9.2 WARFARE PLATFORM

9.3 CYBER SECURITY

9.4 LOGISTICS & TRANSPORTATION

9.5 TARGET RECOGNITION

9.6 BATTLEFIELD HEALTHCARE

9.7 SIMULATION & TRAINING

9.8 PLANNING & ALLOCATION

9.9 THREAT MONITORING & SITUATIONAL AWARENESS

9.10 INFORMATION PROCESSING

10 MILITARY ANALYTICS MARKET, BY TECHNOLOGY

10.1 INTRODUCTION

10.2 LEARNING & INTELLIGENCE

10.3 ADVANCED COMPUTING

10.4 AI SYSTEMS

11 MILITARY ANALYTICS MARKET, BY PLATFORM

11.1 INTRODUCTION

11.2 LAND

11.3 NAVAL

11.4 AIRBORNE

11.5 SPACE

12 MILITARY ANALYTICS MARKET, BY REGION

12.1 INTRODUCTION

12.3 NORTH AMERICA

12.3.1 US

12.3.2 CANADA

12.4 EUROPE

12.4.1 RUSSIA

12.4.2 FRANCE

12.4.3 UK

12.4.4 GERMANY

12.4.5 ITALY

12.4.6 REST OF EUROPE

12.5 ASIA PACIFIC

12.5.1 CHINA

12.5.2 INDIA

12.5.3 JAPAN

12.5.4 SOUTH KOREA

12.5.5 AUSTRALIA

12.5.6 REST OF APAC

12.6 MIDDLE EAST

12.6.1 SAUDI ARABIA

12.6.2 UAE

12.6.3 ISRAEL

12.6.4 QATAR

12.6.5 REST OF MIDDLE EAST

12.7 REST OF THE WORLD

12.7.1 LATIN AMERIC

12.7.2 AFRICA

13 COMPETITIVE LANDSCAPE

13.1 INTRODUCTION

13.1.1 MARKET EVALUATION FRAMEWORK

13.2 MARKET SHARE AND RANKING ANALYSIS, 2021

13.3 REVENUE ANALYSIS OF TOP 5 MARKET PLAYERS

13.4 COMPETITIVE LEADERSHIP MAPPING

13.5 START UP/SME MATRIX

13.6 COMPETITIVE SCENARIO

13.6.1 PRODUCT LAUNCHES

13.6.2 DEALS

13.6.3 OTHERS

14 COMPANY EVALUATION MATRIX AND COMPANY PROFILES

(BUSINESS OVERVIEW, PRODUCTS OFFERED, RECENT DEVELOPMENTS, SWOT ANALYSIS, MNM VIEW)*

14.1 KEY COMPANIES

14.1.1 MILITARY ANALYTICS LTD

14.1.2 BOOZ ALLEN HAMILTON INC.

14.1.3 GENERAL ELECTRIC

14.1.4. IBM CORPORATION

14.1.5. MERCATOR

14.1.6. MU SIGMA

14.1.7. ORACLE CORPORATION

14.1.8. RAMCO SYSTEMS

14.1.9. SAP SE

14.1.10. SAS INSTITUTE INC.

14.1.11 AIRPORT ANALYTICS (AA+)

14.1.12 HONEYWELL

14.1.13 IFS

14.1.14 CAPGEMINI

14.1.15 LUFTHANSA TECHNIK

14.1.16 SWISS AVIATION SOFTWARE

14.1.17 WINAIR

14.1.18 SITA

14.1.19 ATHEER AIR

14.1.20 HEXAWARE

14.2 STARTUP/SME PROFILES

14.2.1 JASOREN

14.2.2 FUTURE VISUAL

14.2.3 FOUNTX

14.2.4 MAGIC LEAP

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View might not be captured in case of unlisted companies.

** Only few key players are mentioned above, however top 20 to 25 key players will be profiled during the course of research study

**** All segments above will be further assessed & considered to be a part of market breakdown. The breakdown of segments will be finalized during the course of research.

***** Request for addition of company profiles or countries in the scope can be considered and included post feasibility

15 APPENDIX

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 AVAILABLE CUSTOMIZATION

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

Growth opportunities and latent adjacency in Military Analytics Market