Military Actuators Market by Application (Air, Land, Naval), System (Electrical, Hydraulic, Pneumatic, Mechanical), Component (Cylinders, Drives, Servo Valves, Manifolds), Type (Linear, Rotary), and Region (2025-2035)

The global military actuators market is entering a transformative phase as defense modernization, automation, and intelligent motion control redefine how military platforms operate. Across air, land, and naval applications, actuators play a crucial role in converting energy into motion, enabling precision control in combat vehicles, aircraft, missile systems, naval platforms, and unmanned systems. Between 2025 and 2035, this market is projected to expand significantly, driven by innovations in materials, electrification, miniaturization, and the integration of artificial intelligence (AI) into defense systems.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNewNew.asp?id=11960311

Understanding the Role of Military Actuators

Military actuators are essential components that convert electrical, hydraulic, pneumatic, or mechanical energy into motion for critical defense systems. They are responsible for controlling flight surfaces, turret movements, missile deployment, weapon stabilization, radar positioning, and many other dynamic functions. As defense systems evolve toward higher autonomy and efficiency, the demand for precise, durable, and intelligent actuators has intensified.

The market’s development is strongly influenced by global defense budgets, increasing military modernization programs, and the growing integration of advanced motion control systems into defense platforms. The shift toward smart, low maintenance, and energy efficient actuators marks a key technological transition that defines this market’s trajectory.

Market Segmentation Overview (2025–2035)

The military actuators market can be analyzed based on application, system, component, type, and region. Each segment plays a vital role in shaping the overall growth and competitive landscape.

Application Segmentation: Air, Land, and Naval Platforms

The air segment dominates due to extensive usage in aircraft flight control systems, engine control, landing gear mechanisms, and weapon release systems. In the land segment, actuators are deployed in armored vehicles, artillery systems, missile launchers, and autonomous ground systems. The naval domain utilizes actuators for ship control systems, radar stabilization, torpedo tubes, and sonar array alignment.

System Segmentation: Electrical, Hydraulic, Pneumatic, and Mechanical

Electrical actuators are gaining prominence due to their energy efficiency, precision, and ease of integration with digital systems. Hydraulic actuators remain essential for heavy duty applications requiring high force, while pneumatic and mechanical actuators find niche roles in specific defense platforms where rapid motion or simplicity is preferred.

Component Segmentation: Cylinders, Drives, Servo Valves, and Manifolds

Each component forms a critical building block of actuator assemblies. Cylinders and drives ensure controlled movement, servo valves manage pressure and flow in hydraulic systems, and manifolds provide structural integration for fluid or power control.

Type Segmentation: Linear and Rotary Actuators

Linear actuators facilitate straight line motion, crucial in weapon elevation systems, aircraft control surfaces, and naval hatches. Rotary actuators provide rotational motion for turret rotation, radar systems, and missile guidance platforms.

Air Domain Applications: The Rise of Electro Hydraulic Control Systems

In aviation, actuators have become the backbone of modern flight control systems. With next generation fighter jets, drones, and transport aircraft adopting fly by wire technology, actuator precision determines maneuverability and mission success. Electro hydraulic actuators (EHAs) are replacing traditional hydraulic lines, reducing weight and maintenance requirements while enhancing reliability.

Emerging aircraft such as the F-35 Lightning II integrate advanced electro mechanical actuators to manage flight control, stealth surfaces, and weapons deployment. In addition, unmanned aerial vehicles (UAVs) use compact actuators for control surfaces, camera stabilization, and payload management. These advancements highlight the air segment’s strong growth potential between 2025 and 2035.

Land Domain Applications: Modernizing Ground Combat Platforms

Military actuators in land systems have evolved beyond mechanical simplicity to embrace automation and robotics. In armored vehicles, actuators manage turret aiming, suspension control, and weapon stabilization, providing increased accuracy and crew safety. With the rise of autonomous and remotely operated vehicles, the integration of smart actuators capable of self diagnosis and condition monitoring has become critical.

Electrification trends are reshaping ground vehicle designs, and electric actuators are replacing hydraulic components to minimize noise, improve energy efficiency, and simplify maintenance. Hybrid and electric combat vehicles will heavily depend on compact actuators to control subsystems, power steering, and braking systems, reflecting a long term industry shift toward cleaner, smarter, and more efficient battlefield mobility.

Naval Domain Applications: Enhancing Precision and Survivability

Naval platforms require robust actuator systems capable of enduring harsh maritime environments. Applications range from weapon control systems and radar stabilization to ship steering and valve operation. Modern destroyers and submarines rely on actuators for periscope control, propulsion systems, and communication antenna alignment.

Electro mechanical and hydraulic actuators have found particular favor in naval automation systems, as they offer reliability and low latency in mission critical operations. Integration with condition based monitoring systems ensures long term reliability and minimizes downtime. The focus on autonomous underwater vehicles (AUVs) and unmanned surface vehicles (USVs) has further expanded demand for compact, energy efficient actuators capable of operating in subsea conditions.

Technological Evolution: Electrical and Hybrid Actuation Systems

The shift from hydraulic and pneumatic systems toward electric actuation is a defining trend in modern defense technology. Electrical actuators offer superior control, lower maintenance, and faster response times, making them ideal for advanced military applications. Hybrid electro hydraulic systems combine the best of both technologies, delivering high power density with precise digital control.

The use of smart sensors and embedded microprocessors has led to the emergence of intelligent actuators capable of predictive diagnostics and performance optimization. Such systems enhance mission reliability and reduce operational downtime, critical for mission success in modern warfare environments.

Key Components: The Core of Precision Control

Cylinders, drives, servo valves, and manifolds form the essential substructure of actuator assemblies. Cylinders ensure controlled linear motion, while drives translate command signals into precise mechanical movement. Servo valves play a pivotal role in hydraulic systems by managing pressure and flow rate, ensuring stable response under varying loads. Manifolds integrate these elements into compact, efficient systems.

Manufacturers are adopting lightweight materials such as titanium and carbon composites to enhance durability and performance without adding excessive weight. Additionally, additive manufacturing is emerging as a key technique in actuator component production, reducing lead times and enabling complex geometries.

Linear vs. Rotary Actuators: Applications Across Platforms

Linear actuators remain the preferred choice for flight surfaces, landing gear systems, and weapon positioning mechanisms. They deliver accurate, high force motion control vital to the functionality of aircraft and armored platforms. Rotary actuators, on the other hand, dominate applications requiring rotational motion, such as turret control, radar tracking, and missile deployment.

Future systems will increasingly use smart actuators capable of switching between linear and rotary modes based on operational requirements, optimizing versatility and reducing system complexity.

Regional Insights: The Global Expansion Outlook

North America leads the global military actuators market, driven by robust defense modernization programs, particularly in the United States. Companies such as Moog Inc., Parker Hannifin Corporation, Curtiss-Wright, and Honeywell International play significant roles in advancing actuator technologies. Europe follows closely with initiatives under NATO for standardization and modernization, emphasizing energy efficient and lightweight systems.

Asia-Pacific is expected to witness rapid growth due to rising defense budgets in China, India, Japan, and South Korea. These nations are investing in domestic actuator production to support indigenous defense manufacturing initiatives. The Middle East and Africa continue to modernize armored and air defense fleets, while Latin America is emerging as a niche market driven by surveillance and naval modernization efforts.

Technological Disruption: AI and Predictive Maintenance in Actuators

Artificial intelligence is reshaping actuator maintenance and performance monitoring. Predictive algorithms can analyze data from sensors embedded in actuators, forecasting failures before they occur. This capability is particularly valuable for critical systems where downtime can impact mission outcomes.

Machine learning based calibration systems ensure that actuators maintain optimal performance across varying conditions, while adaptive control algorithms enhance precision in autonomous vehicles and unmanned systems. By 2035, AI integration is expected to become standard in all new generation military actuator platforms.

Sustainability and Energy Efficiency in Defense Systems

The global focus on sustainability has influenced the design and production of defense equipment. Electrical actuators produce fewer emissions compared to hydraulic systems, reducing the environmental footprint of military operations. As nations move toward greener defense infrastructure, the shift toward fully electric actuation will accelerate.

Energy efficient actuator systems also contribute to extended operational endurance for unmanned platforms and reduce dependency on logistics chains. The combination of electrification and AI driven efficiency optimization represents the future direction of sustainable military technology.

Market Forecast and Future Opportunities (2025–2035)

The military actuators market is poised for substantial growth between 2025 and 2035, fueled by automation, miniaturization, and digital control trends. Global market revenues are projected to increase as defense agencies upgrade legacy systems and integrate smart actuators across all domains.

The increasing use of unmanned platforms, space defense applications, and high speed missile systems will create new opportunities for actuator manufacturers. Companies investing in lightweight materials, AI integration, and energy efficient designs will maintain a competitive advantage. Strategic partnerships between defense primes and actuator manufacturers will also play a crucial role in advancing the technological frontier.

The Future of Military Motion Control

The next decade will define the evolution of military actuators from purely mechanical devices to intelligent, adaptive systems forming the core of modern defense architectures. From enhancing precision in aircraft control to enabling unmanned ground and naval platforms, actuators represent the silent force driving mission success.

As nations invest heavily in modernization, automation, and electrification, the demand for reliable, energy efficient, and AI integrated actuators will grow exponentially. The global military actuators market between 2025 and 2035 will not only shape the dynamics of defense motion control but also redefine operational efficiency, sustainability, and technological superiority across every domain of modern warfare.

Table of Contents

1 Introduction (Page No. - 21)

1.1 Objectives of the Study

1.2 Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 24)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Breakdown of Primaries

2.1.3 Market Definition & Scope

2.1.4 By Segment and Subsegment

2.1.5 Segment Definitions

2.1.5.1 Military Actuators Market, By Type

2.1.5.2 Military Actuators Market, By System

2.1.5.3 Military Actuators Market, By Application

2.1.5.4 Military Actuators Market, By Component

2.2 Research Approach & Methodology

2.2.1 Bottom-Up Approach

2.2.1.1 Regional Military Actuators Market

2.2.1.2 General Approach for the Military Actuators Market

2.2.1.3 Military Actuators Market Approach, By Type, Application, Component, and System

2.2.2 Top-Down Approach

2.2.3 Pricing Analysis

2.3 Triangulation & Validation

2.3.1 Triangulation Through Secondary

2.3.2 Triangulation Through Primaries

2.4 Market Breakdown and Data Triangulation

2.5 Research Assumptions

2.5.1 Market Sizing

2.5.2 Market Forecasting

2.6 Risks

2.7 Others

2.7.1 Grey Areas

2.7.2 Limitations

3 Executive Summary (Page No. - 38)

4 Premium Insights (Page No. - 41)

4.1 Attractive Opportunities in Military Actuators Market From 2019 to 2024

4.2 Military Actuators Market, By Component

4.3 Military Actuators Market, By System

4.4 Military Actuators Market, By Country

5 Market Overview (Page No. - 43)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Ongoing Military Automation Across the Globe

5.2.1.2 Increasing Demand for Electrical Actuators From the Aerospace & Defense Industry

5.2.2 Opportunities

5.2.2.1 Development of Miniaturized Military Actuators

5.2.2.2 Use of Advanced Military Actuators in Different Applications

5.2.3 Challenges

5.2.3.1 Formulation and Stringent Implementation of Various Regulatory Norms

5.2.3.2 Issues Related to Power Consumption, Noise, and Leakage

5.2.3.3 High Overhaul and Maintenance Cost of Military Actuators

6 Industry Trends (Page No. - 47)

6.1 Introduction

6.2 Technology Trends

6.2.1 Amplified Piezoelectric Actuators

6.2.2 Electrical Actuators

6.2.3 Electrohydrostatic Actuation Systems

6.3 Regulatory Landscape

6.3.1 Component Designing

6.3.1.1 Weight

6.3.1.2 Strength

6.3.2 Airline Operations

6.3.2.1 Durability

6.3.2.2 Reparability

6.3.3 Manufacturing

6.3.3.1 Raw Materials

6.3.3.2 Reproducibility

6.4 Patent Listings, 2014–2015

7 Military Actuators Market, By Application (Page No. - 50)

7.1 Introduction

7.2 Land

7.2.1 Land Application By Platform

7.2.1.1 Main Battle Tanks

7.2.1.1.1 Increasing Defense Expenditures and Ongoing Military Modernization Programs are Driving the Demand for Main Battle Tanks Across the Globe.

7.2.1.2 Armored Fighting Vehicles

7.2.1.2.1 Increasing Incidences of Political Violence, Terrorism, and Civil Unrest, Among Others, Leading to Rise in Demand for Armored Fighting Vehicles

7.2.1.3 Light Tactical Vehicles

7.2.1.3.1 Increase in the Use of Light Vehicles for Patrolling and Reconnaissance Activities Fueling the Demand for Light Tactical Vehicles, Worldwide

7.2.1.4 Mine-Resistant Ambush Protected Vehicles(Mrapvs)

7.2.1.4.1 Rise in Use of Mrap Vehicles for Patrolling, Isr, Or Combat Operations Across the Globe

7.2.1.5 Amphibious Armored Vehicles

7.2.1.5.1 Launch of Maritime Surveillance, Coast/Beach Reconnaissance, and Combat Operations By Naval Forces Driving the Demand for Amphibious Armored Vehicles Market, Globally

7.2.1.6 Land-Based Missiles

7.2.1.6.1 Increase Use of Anti-Tank Missiles for Land-Based Defense Applications Leading to Growth of Land-Based Missiles Segment

7.2.1.7 Others

7.2.2 Land Application By Type

7.2.2.1 Military Ground Vehicle Actuators

7.2.2.1.1 Increased Use of Armored Vehicles for Electromechanical Turret Control Systems is Driving the Market for Military Ground Vehicle Actuators

7.2.2.2 Electromechanical Gun Elevation Actuators

7.2.2.2.1 Increased Use of Main Battle Tanks and Howitzer Gun Laying Systems is Driving the Demand for Electromechanical Gun Elevation Actuators, Worldwide

7.2.2.3 Elevation Actuators

7.2.2.3.1 Increased Use of Turret Controls in Combat Vehicles is Leading to Demand for Elevation Actuators Across the Globe

7.2.2.4 Gun and Turret Drive Actuator

7.2.2.4.1 Increased Demand for Gun and Turret Drive Actuators for Use in Naval Warships, Armored Platforms, and Airborne Combat Platforms Leading to the Growth of the Gun and Turret Drive Actuators

7.2.2.5 Traverse Actuators

7.2.2.5.1 Use of Traverse Actuators for the Movement and Positioning of Turret Systems is Leading to the Growth of This Segment of the Market.

7.2.2.6 Electromechanical Gun/Turret Drive Actuators

7.2.2.6.1 Increased Use of High Torque Brushless Motor in Combat Vehicles is Driving the Growth of the Electromechanical Gun/Turret Drive Actuators

7.3 Air

7.3.1 Air Application By Platform

7.3.1.1 Fighter Aircraft

7.3.1.1.1 Increased Demand for Fighter Aircraft for Air-To-Air Combat Operations

7.3.1.2 Helicopters

7.3.1.2.1 Increased Use of Helicopters for Surveillance, Observation, and Search & Rescue Operations

7.3.2 Air Application By Type

7.3.2.1 Flight Controls

7.3.2.1.1 Increased Use of Actuators in Aircraft Control Surfaces Such as Ailerons, Elevators, and

Rudders

7.3.2.2 Engine Controls

7.3.2.2.1 Increased Use of Actuators in Aircraft Engines and Auxiliary Power Units are Driving the Growth of the Engine Controls Segment

7.3.2.3 Active Vibration Controls

7.3.2.3.1 Use of Actuators in Active Vibration Controls to Curb the Rotor-Induced Vibrations in Aircraft

7.3.2.4 Weapon Bay Door Drives

7.3.2.4.1 Increased Use of Weapon Bay Door Drives in Air Inlet and Steering & Braking of Aircraft

7.3.2.5 Utility Actuation

7.3.2.5.1 Increased Use of Utility Actuation in Cargo Doors and Landing Gears

7.4 Naval

7.4.1 Naval Application By Platform

7.4.1.1 Frigates

7.4.1.1.1 Increased Use of Frigates in Long-Range Missions and Anti-Submarine Warfare & Anti-Piracy Missions

7.4.1.2 Destroyers

7.4.1.2.1 Increased Demand for Multi-Mission Naval Platforms to Fuel Demand for Destroyers Across the Globe

7.4.1.3 Corvettes

7.4.1.3.1 Increased Use of Medium Or Small Caliber Turret Guns in Anti-Submarine Warfare Leading to Demand for Corvettes, Worldwide

7.4.1.4 Offshore Patrol Vehicles

7.4.1.4.1 Rise in Use of Offshore Patrol Vehicles for Coastal Defense

7.4.2 Naval Application By Type

7.4.2.1 Linear Actuators for Weapon Robots

7.4.2.1.1 Increased Use of Undersea Control Surfaces for Naval Applications Fueling the Demand for Linear Actuators for Weapon Robots

7.4.2.2 Naval Rotary Hinge Actuators

7.4.2.2.1 Increased Deployment of Digital Servo Motor Controllers in Naval Applications is Driving the Growth of the Naval Rotary Hinge Actuators Segment

7.4.2.3 Others

8 Military Actuators Market, By Component (Page No. - 61)

8.1 Introduction

8.2 Cylinders

8.2.1 Increased Use of Cylinders for Transporting, Storing, and Dispensing Gases in Military Vehicles

8.3 Drives

8.3.1 Increased Use of Drives to Control the Speed of Motors to Reduce Shock Hazards

8.4 Servo Valves

8.4.1 Rise in Use of Electrically Modulated and Direction Control Valves Leading Growth of the Servo Valves Segment

8.5 Manifolds

8.5.1 Increase in Use the of Manifolds in Submarines and Surface Warships

8.6 Others

9 Military Actuators Market, By System (Page No. - 65)

9.1 Introduction

9.2 Hydraulic Actuators

9.2.1 Increased Use of Hydraulic Actuators in Gun Positioning and Armored Plate Positioning Applications

9.3 Electrical Actuators

9.3.1 Increasing Use of Electrical Actuators in Flight Control Systems Leading to Rise in Their Demand in the Aviation Sector

9.4 Pneumatic Actuators

9.4.1 Increasing Use of Pneumatic Actuators in Conveyors and Automated Storage Systems

9.5 Mechanical Actuators

9.5.1 Growing Use of Mechanical Actuators in Aircraft Gears and Other Components

9.6 Other Actuators

10 Military Actuators Market, By Type (Page No. - 69)

10.1 Introduction

10.2 Linear Actuators

10.2.1 Screw Driven Actuators

10.2.1.1 Increasing Use of Screw Driven Actuators in Servo Motors, Drive and Control Hardware, and Sensors

10.2.2 Belt Driven Actuators

10.2.2.1 Rising Use of Belt Driven Actuators in Increasing and Enhancing Operational Efficiency of Defense Weapons

10.2.3 Rod Driven Actuators

10.2.3.1 Increasing Demand for Rod Driven Actuators in the Aerospace & Defense Industry

10.3 Rotary Actuators

10.3.1 Bladder & Vane Actuators

10.3.1.1 Increasing Use of Rotary Actuators in Gates and Valves Used in the Aerospace & Defense Industry

10.3.2 Piston Actuators (Rack-and-Pinion and Scotch Yoke)

10.3.2.1 Increased Use of Piston Actuators for Precision Control Applications in the Defense Industry

10.4 Multi-Axis Positioning Actuators

10.5 Semi-Rotary Actuators

11 Regional Analysis (Page No. - 73)

11.1 Introduction

11.2 North America

11.2.1 US

11.2.2 Canada

11.3 Europe

11.3.1 Germany

11.3.2 UK

11.3.3 France

11.3.4 Russia

11.3.5 Rest of Europe

11.4 Asia Pacific

11.4.1 China

11.4.2 India

11.4.3 Japan

11.4.4 South Korea

11.4.5 Rest of Asia Pacific

11.5 Rest of the World

11.5.1 Latin America

11.5.2 Africa

12 Competitive Landscape (Page No. - 117)

12.1 Introduction

12.2 OEM Competitive Leadership Mapping

12.2.1 Visionary Leaders

12.2.2 Innovators

12.2.3 Dynamic Differentiators

12.2.4 Emerging Companies

12.3 Start-Ups Competitive Leadership Mapping

12.3.1 Visionary Leaders

12.3.2 Innovators

12.3.3 Dynamic Differentiators

12.3.4 Emerging Companies

12.4 Ranking of Key Players, 2018

12.5 Competitive Scenario

12.5.1 New Product Launches

12.5.2 Acquisitions

12.5.3 Contracts

12.5.4 Agreement/Collaborations

13 Company Profiles (Page No. - 125)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

13.1 Curtiss-Wright

13.2 Triumph Group

13.3 Moog

13.4 Meggitt

13.5 Venture Mfg. Co.

13.6 Parker Hannifin

13.7 Kyntronics

13.8 Nook Industries

13.9 AMETEK

13.10 Ultra Motion

13.11 EME EleKTro-Metall

13.12 Whippany Actuation Systems

13.13 Beaver Aerospace & Defense

13.14 Arkwin Industries

13.15 Hunt Valve

13.16 Temis SRL

13.17 Honeywell

13.18 Safran

13.19 Woodward

13.20 Innovators

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 159)

14.1 Discussion Guide

14.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.3 Available Customization

14.4 Related Reports

14.5 Author Details

List of Tables (117 Tables)

Table 1 Leading Global Manufacturers of Military Actuators

Table 2 Innovations & Patent Registrations, 2014–2015

Table 3 Military Actuators Size, By Application, 2017–2024 (USD Million)

Table 4 Military Actuators in Land, By Platform, 2017–2024 (USD Million)

Table 5 Military Actuators in Land, By Type, 2017–2024 (USD Million)

Table 6 Military Actuators in Air, By Platform, 2017–2024 (USD Million)

Table 7 Military Actuators Market in Air, By Type, 2017–2024 (USD Million)

Table 8 Military Actuators in Naval, By Platform, 2017–2024 (USD Million)

Table 9 Military Actuators Market in Naval, By Type, 2017–2024 (USD Million)

Table 10 Military Actuators Size, By Component, 2017–2024 (USD Million)

Table 11 Military Actuators Size, By System, 2017–2024 (USD Million)

Table 12 Military Actuators Size, By Type, 2017–2024 (USD Million)

Table 13 Military Actuators Size, By Region, 2017–2024 (USD Million)

Table 14 North America Military Actuators Size, By Type, 2017–2024 (USD Million)

Table 15 North America Military Actuators Size, By System, 2017–2024 (USD Million)

Table 16 North America Military Actuators Size, By Application, 2017–2024 (USD Million)

Table 17 North America Military Actuators in Land, By Platform, 2017–2024 (USD Million)

Table 18 North America Military Actuators in Land, By Type, 2017–2024 (USD Million)

Table 19 North America Military Actuators in Air, By Platform, 2017–2024 (USD Million)

Table 20 North America Military Actuators in Air, By Type, 2017–2024 (USD Million)

Table 21 North America Military Actuators in Naval, By Platform, 2017–2024 (USD Million)

Table 22 North America Military Actuators in Naval, By Type, 2017–2024 (USD Million)

Table 23 North America Military Actuators Size, By Component, 2017–2024 (USD Million)

Table 24 North America Military Actuators Size, By Country, 2017–2024 (USD Million)

Table 25 US Military Actuators Size, By Type, 2017–2024 (USD Million)

Table 26 US Military Actuators Size, By System, 2017–2024 (USD Million)

Table 27 US Military Actuators Size, By Application, 2017–2024 (USD Million)

Table 28 US Military Actuators Size, By Component, 2017–2024 (USD Million)

Table 29 Canada Military Actuators Size, By Type, 2017–2024 (USD Million)

Table 30 Canada Military Actuators Size, By System, 2017–2024 (USD Million)

Table 31 Canada Military Actuators Size, By Application, 2017–2024 (USD Million)

Table 32 Canada Military Actuators Size, By Component, 2017–2024 (USD Million)

Table 33 Europe Military Actuators Size, By Type, 2017–2024 (USD Million)

Table 34 Europe Military Actuators Size, By System, 2017–2024 (USD Million)

Table 35 Europe Military Actuators Size, By Application, 2017–2024 (USD Million)

Table 36 Europe Military Actuators in Land, By Platform, 2017–2024 (USD Million)

Table 37 Europe Military Actuators in Land, By Type, 2017–2024 (USD Million)

Table 38 Europe Military Actuators in Air, By Platform, 2017–2024 (USD Million)

Table 39 Europe Military Actuators in Air, By Type, 2017–2024 (USD Million)

Table 40 Europe Military Actuators in Naval, By Platform, 2017–2024 (USD Million)

Table 41 Europe Military Actuators in Naval, By Type, 2017–2024 (USD Million)

Table 42 Europe Military Actuators Size, By Component, 2017–2024 (USD Million)

Table 43 Europe Military Actuators Size, By Country, 2017–2024 (USD Million)

Table 44 Germany Military Actuators, By Type, 2017–2024 (USD Million)

Table 45 Germany Military Actuators Size, By System, 2017–2024 (USD Million)

Table 46 Germany Military Actuators Size, By Application, 2017–2024 (USD Million)

Table 47 Germany Military Actuators Size, By Component, 2017–2024 (USD Million)

Table 48 UK Military Actuators Size, By Type, 2017–2024 (USD Million)

Table 49 UK Military Actuators Size, By System, 2017–2024 (USD Million)

Table 50 UK Military Actuators Size, By Application, 2017–2024 (USD Million)

Table 51 UK Military Actuators Size, By Component, 2017–2024 (USD Million)

Table 52 France Military Actuators Size, By Type, 2017–2024 (USD Million)

Table 53 France Military Actuators Size, By System, 2017–2024 (USD Million)

Table 54 France Military Actuators Size, By Application, 2017–2024 (USD Million)

Table 55 France Military Actuators Size, By Component, 2017–2024 (USD Million)

Table 56 Russia Military Actuators Size, By Type, 2017–2024 (USD Million)

Table 57 Russia Military Actuators Size, By System, 2017–2024 (USD Million)

Table 58 Russia Military Actuators Size, By Application, 2017–2024 (USD Million)

Table 59 Russia Military Actuators Size, By Component, 2017–2024 (USD Million)

Table 60 Rest of Europe Military Actuators Size, By Type, 2017–2024 (USD Million)

Table 61 Rest of Europe Military Actuators Size, By System, 2017–2024 (USD Million)

Table 62 Rest of Europe Military Actuators Size, By Application, 2017–2024 (USD Million)

Table 63 Rest of Europe Military Actuators Size, By Component, 2017–2024 (USD Million)

Table 64 Asia Pacific Military Actuators Size, By Type, 2017–2024 (USD Million)

Table 65 Asia Pacific Military Actuators Size, By System, 2017–2024 (USD Million)

Table 66 Asia Pacific Military Actuators Size, By Application, 2017–2024 (USD Million)

Table 67 Asia Pacific Military Actuators in Land, By Platform, 2017–2024 (USD Million)

Table 68 Asia Pacific Military Actuators in Land, By Type, 2017–2024 (USD Million)

Table 69 Asia Pacific Military Actuators in Air, By Platform, 2017–2024 (USD Million)

Table 70 Asia Pacific Military Actuators in Air, By Type, 2017–2024 (USD Million)

Table 71 Asia Pacific Military Actuators in Naval, By Platform, 2017–2024 (USD Million)

Table 72 Asia Pacific Military Actuators in Naval, By Type, 2017–2024 (USD Million)

Table 73 Asia Pacific Military Actuators Size, By Component, 2017–2024 (USD Million)

Table 74 Asia Pacific Military Actuators Size, By Country, 2017–2024 (USD Million)

Table 75 China Military Actuators Size, By Type, 2017–2024 (USD Million)

Table 76 China Military Actuators Size, By System, 2017–2024 (USD Million)

Table 77 China Military Actuators Size, By Application, 2017–2024 (USD Million)

Table 78 China Military Actuators Size, By Component, 2017–2024 (USD Million)

Table 79 India Military Actuators Market Size, By Type, 2017–2024 (USD Million)

Table 80 India Military Actuators Market Size, By System, 2017–2024 (USD Million)

Table 81 India Military Actuators Market Size, By Application, 2017–2024 (USD Million)

Table 82 India Military Actuators Market Size, By Component, 2017–2024 (USD Million)

Table 83 Japan Military Actuators Market Size, By Type, 2017–2024 (USD Million)

Table 84 Japan Military Actuators Market Size, By System, 2017–2024 (USD Million)

Table 85 Japan Military Actuators Market Size, By Application, 2017–2024 (USD Million)

Table 86 Japan Military Actuators Market Size, By Component, 2017–2024 (USD Million)

Table 87 South Korea Military Actuators Market Size, By Type, 2017–2024 (USD Million)

Table 88 South Korea Military Actuators Market Size, By System, 2017–2024 (USD Million)

Table 89 South Korea Military Actuators Market Size, By Application, 2017–2024 (USD Million)

Table 90 South Korea Military Actuators Market Size, By Component, 2017–2024 (USD Million)

Table 91 Rest of Asia Pacific Military Actuators Market Size, By Type, 2017–2024 (USD Million)

Table 92 Rest of Asia Pacific Military Actuators Market Size, By System, 2017–2024 (USD Million)

Table 93 Rest of Asia Pacific Military Actuators Market Size, By Application, 2017–2024 (USD Million)

Table 94 Rest of Asia Pacific Military Actuators Market Size, By Component, 2017–2024 (USD Million)

Table 95 Rest of the World Military Actuators Market Size, By Type, 2017–2024 (USD Million)

Table 96 Rest of the World Military Actuators Market Size, By System, 2017–2024 (USD Million)

Table 97 Rest of the World Military Actuators Market Size, By Application, 2017–2024 (USD Million)

Table 98 Rest of the World Military Actuators Market in Land, By Platform, 2017–2024 (USD Million)

Table 99 Rest of the World Military Actuators Market in Land, By Type, 2017–2024 (USD Million)

Table 100 Rest of the World Military Actuators Market in Air, By Platform, 2017–2024 (USD Million)

Table 101 Rest of the World Military Actuators Market in Air, By Type, 2017–2024 (USD Million)

Table 102 Rest of the World Military Actuators Market in Naval, By Platform, 2017–2024 (USD Million)

Table 103 Rest of the World Military Actuators Market in Naval, By Type, 2017–2024 (USD Million)

Table 104 Rest of the World Military Actuators Market Size, By Component, 2017–2024 (USD Million)

Table 105 Rest of the World Military Actuators Market Size, By Region, 2017–2024 (USD Million)

Table 106 Latin America Military Actuators Market Size, By Type, 2017–2024 (USD Million)

Table 107 Latin America Military Actuators Market Size, By System, 2017–2024 (USD Million)

Table 108 Latin America Military Actuators Market Size, By Application, 2017–2024 (USD Million)

Table 109 Latin America Military Actuators Market Size, By Component, 2017–2024 (USD Million)

Table 110 Africa Military Actuators Market Size, By Type, 2017–2024 (USD Million)

Table 111 Africa Military Actuators Market Size, By System, 2017–2024 (USD Million)

Table 112 Africa Military Actuators Market Size, By Application, 2017–2024 (USD Million)

Table 113 Africa Military Actuators Market Size, By Component, 2017–2024 (USD Million)

Table 114 New Product Launches, 2012–2018

Table 115 Acquisitions, 2012–2018

Table 116 Contracts, 2012–2018

Table 117 Agreements/Collaborations, 2012–2018

List of Figures (43 Figures)

Figure 1 Research Flow

Figure 2 Research Design: Military Actuators Market

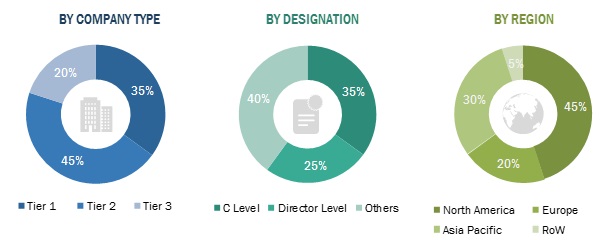

Figure 3 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Data Triangulation

Figure 7 Assumptions for the Research Study

Figure 8 Land Segment is Projected to Lead Military Actuators Market From 2019 to 2024

Figure 9 Linear Actuators Segment is Projected to Lead Military Actuators Market From 2019 to 2024

Figure 10 Fighter Aircraft Segment is Expected to Lead Military Actuators Market in Air From 2019 T0 2024

Figure 11 North America Estimated to Account for the Largest Share of Military Actuators Market in 2019

Figure 12 Emerging Demand for Electrical Actuators is Fueling the Growth of Military Actuators Market

Figure 13 Cylinders Segment is Projected to Lead Military Actuators Market From 2019 to 2024

Figure 14 Hydraulic Actuators Segment is Projected to Lead Military Actuators Market From 2019 to 2024

Figure 15 India Military Actuators Market is Projected to Grow at the Highest CAGR From 2019 to 2024

Figure 16 Military Actuators Market Dynamics

Figure 17 Air Segment of Military Actuators Market is Projected to Grow at the Highest CAGR From 2019 to 2024

Figure 18 Cylinders Segment of Military Actuators Market is Projected to Grow at the Highest CAGR From 2019 to 2024

Figure 19 Hydraulic Actuators Segment of Military Actuators Market is Projected to Grow at the Highest CAGR From 2019 to 2024

Figure 20 Multi-Axis Positioning Actuators Segment of Military Actuators Market is Projected to Grow at the Highest CAGR From 2019 to 2024

Figure 21 North America Region is Estimated to Account for the Largest Share of Military Actuators Market in 2019

Figure 22 North America Military Actuators Market Snapshot

Figure 23 Europe Military Actuators Market Snapshot

Figure 24 Asia Pacific Military Actuators Market Snapshot

Figure 25 Rest of the World Military Actuators Market Snapshot

Figure 26 Key Developments Undertaken By Leading Players in Military Actuators Market From 2012 to 2018

Figure 27 OEM: Military Actuators Market Competitive Leadership Mapping, 2018

Figure 28 Start-Ups: Military Actuators Market Competitive Landscape Mapping, 2018

Figure 29 Market Share of Top Players in Military Actuators Market, 2018 (%)

Figure 30 Curtiss-Wright: Company Snapshot

Figure 31 Curtiss-Wright: SWOT Analysis

Figure 32 Triumph Group: Company Snapshot

Figure 33 Moog: Company Snapshot

Figure 34 Moog: SWOT Analysis

Figure 35 Meggitt: Company Snapshot

Figure 36 Parker Hannifin: Company Snapshot

Figure 37 Parker Hannifin : SWOT Analysis

Figure 38 AMETEK : Company Snapshot

Figure 39 AMETEK : SWOT Analysis

Figure 40 Honeywell: Company Snapshot

Figure 41 Honeywell: SWOT Analysis

Figure 42 Safran: Company Snapshot

Figure 43 Woodward: Company Snapshot

The study involved four major activities to estimate the current market size for military actuators. Exhaustive secondary research was done to collect information on the market, peer markets, and the parent market. The next step was to validate these findings, assumptions, and market size with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Bloomberg BusinessWeek, and have been referred to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, regulatory bodies, trade directories, and databases.

Primary Research

The military actuators market comprises several stakeholders such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by the development of components, applications, systems, and types. The supply side is characterized by advancements in technologies and diverse application industries. Various primary sources from both, the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the military actuators market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- Key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both, the demand and supply sides, in the component, and application.

Report Objectives

- To define, segment, and project the global market size for military actuators

- To understand the structure of the military actuators market by identifying its various subsegments

- To provide detailed information about the key factors influencing the growth of the market (drivers, opportunities, and challenges)

- To analyze the micromarkets with respect to individual growth trends, prospects, and their contribution to the total market

- To project the size of the market and its submarkets, in terms of value, with respect to North America, Asia Pacific, Europe, and RoW (along with their respective key countries)

- To profile key players and comprehensively analyze their core competencies

- To understand the competitive landscape and identify major growth strategies adopted by players across key regions

- To analyze the competitive developments such as contracts, new product launches, acquisitions, collaborations, and agreements in the military actuators market

Available Customizations

Along with the market data, MarketsandMarkets offers customizations according to the company’s specific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Growth opportunities and latent adjacency in Military Actuators Market