Middle East and Africa Power Rental Market by End-user (Utilities, Construction, Oil & gas, and Others (Industrial, Shipping, Quarrying & Mining, and Events)), by Fuel Type (Diesel & Gas) and by Region - Trends and Forecast to 2019

[184 Pages Report] Each region has been analyzed with respect to its market trends, growth, and future prospects in the Middle East and Africa power rental market. This report basically aims to estimate the power rental market for the Middle East and Africa from 2014 to 2019.

The Middle East and Africa power rental market size is estimated to reach $9,048.25 million by 2019 from $3,942.07 million in 2014. The major factors responsible for driving the growth of this market include the increasing demand of power in the respective regions.

The Middle East market remains the largest market for power rental. Widespread construction and developmental activities are driving growth of the power rental market. The permanent power producersí inability to meet the power demand especially during extremely hot weather conditions, are considered as opportunities for the Middle East and Africa power rental market. Rising imports of low cost Chinese generators and upcoming power generation projects through renewable sources such as solar, wind and biomass energy in the Middle East and Africa can limit the growth of power rental market in the region.

Wear and tear of the generators and decrease in global oil prices are major challenges for the power rental market in the Middle East and Africa.

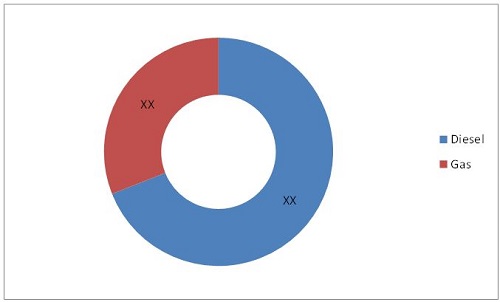

Middle East and Africa Power Rental Projected Market Size, by Type (2019)

Source: Related Research Publications and MarketsandMarkets Analysis

The report analyzes the power rental market for the regions of the Middle East and Africa. The report also provides a market overview of power rental market of the Middle East and Africa by different types. Among these types, diesel is the most preferred fuel for igniting the generators.

For this report, the major players in the market are identified through secondary and primary research, based on which their market shares are evaluated. This includes a study of the annual reports of top market players and interviews with key opinion leaders such as the CEOs, directors, and marketing executives. The market size for various types of oilfield service providers are determined and evaluated using primary and secondary research. The market data is available from 2012 to 2019 at a CAGR from 2014 to 2019.

Customer Interested in this report also can view

Temporary Power Market by Generator Rating (Less than 80 kW, 81-280kW, 281-600 kW), End Use (Events, Utilities, Oil & Gas, Construction, Mining, Manufacturing, & Shipping), Fuel Type (Diesel, Gas, & Others (Duel Fuel & HFO)) - Global Forecast to 2021

Power Rental Market by Fuel (Diesel, Gas, Duel Fuel & HFO), Power Rating, End User (Utilities, Oil & Gas, Events, Construction, Mining, Manufacturing, Shipping), Application (Peak Shaving, Base Load, Stand by), by Region - Global Trends & Forecast to 2021

To cater the increasing power demand across the Middle East and Africa, signing supply contracts is adopted by maximum industry players as a key strategy in order to achieve growth in the power rental market. Permanent power producersí inability to meet the power demand at regular periods and especially during extremely hot weather conditions, are considered as opportunities for the Middle East and Africa power rental market. This market is estimated to reach $9,048.25 million at a CAGR of 18.08% from 2014 to 2019.

The power rental market is defined as the revenue earned either through renting generators or from a temporary power plant. Earlier, power rental companies would rent out generators, the maintenance responsibility for which would have to borne by company itself, and the cost earned from renting such generators generated revenue for the power rental market. Now, power rental companies build and maintain temporary power plants and charge users on the basis of duration, capacity build, and electricity units supplied.

The power rental market in the Middle East and African region has a significant growth rate, as it is an economically sustainable option to rent out generators over installing an IPP for the same purpose.

Growing population, urbanization, and customized standards of living are seen improving in the Middle Eastern and African countries which are in turn likely to increase the demand for power in the coming years. Grid networks being poor or erratic in certain areas, power rentals would emerge as a feasible option to meet end-user requirements. This has created many opportunities for rental power service providers that can offer accelerated turnkey power solutions.

Saudi Arabia is the largest market for power rental in the Middle East and Africa, owing to the increased construction activities. UAE and South Africa are also one of the attractive markets for the power rental industry in the regions of the Middle East and Africa.

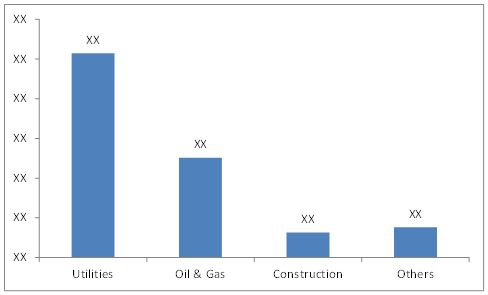

Middle East And Africa Market Share, by End-Users, 2019, ($Million)

Note: Other end users include Industrial, Shipping, Mining, Events, universities, government, hospitals

Source: Related research publications, and MarketsandMarkets Analysis

Currently, utilities sector dominate the power rental market of the Middle East and Africa in the end-user segment. Oil & gas market occupy the second largest market share in the oil rich regions of the Middle East and Africa. Construction segment is also one of the largest growing segments in the power rental industry.

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency & Pricing

1.5 Package Size

1.6 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Introduction

2.2 Market Size Estimation

2.3 Market-Breakdown Using Primary and Secondary Sources

2.3.1 Market Breakdown and Data Triangulation

2.4 Market Size Estimation

2.4.1 Key Data Taken From Secondary Sources

2.4.2 Key Data Taken From Primary Sources

2.4.3 Assumptions

3 Executive Summary (Page No. - 24)

4 Premium Insights (Page No. - 29)

4.1 Market Opportunities

4.2 Middle East & Africa Power Rental Market Ė Top Three End-User Segment

4.3 Power Rental Market in the Middle East & Africa, 2014

4.4 Diesel & Gas Gensets Market Share (Value), by Fuel Type: 2014 vs. 2019

5 Market Overview (Page No. - 32)

5.1 Introduction

5.2 Middle East & Africa Power Rental Market, by End-User

5.3 Middle East & Africa Power Rental Market, by Type

5.4 Middle East & Africa Power Rental Market, by Region

5.5 Market Dynamics

5.5.1 Drivers

5.5.1.1 Increase in Demand of Power

5.5.1.2 Major Upcoming Events

5.5.1.3 Lack of Infrastructure

5.5.2 Restraints

5.5.2.1 Increased in Number of Ipps and Permanent Power Plants

5.5.2.2 Low-Priced Generator Are Imported From China

5.5.2.3 Energy Efficiency and Energy Conservation

5.5.3 Opportunities

5.5.3.1 Investment in the Power Rental Industry

5.5.3.2 New Technology for Temporary Power Equipment

5.5.4 Challenges

5.5.4.1 Wear and Tear of Generators

5.5.4.2 Decrease in Global Oil Prices

5.5.5 Winning Imperatives

5.5.5.1 Inability of Permanent Power Producers to Meet the Demand

6 Industry Trends (Page No. - 40)

6.1introduction

6.2 Value Chain Analysis

6.3 Supply Chain Analysis

6.4 Porterís Five Forces Analysis

6.4.1 Threat of Substitutes

6.4.2 Threat of New Entrants

6.4.3 Bargaining Power of Buyers

6.4.4 Bargaining Power of Suppliers

6.4.5 Industry Competition

7 Middle East & Africa Power Rental Market, by Fuel Type (Page No. - 46)

7.1 Introduction

7.2 Middle East & Africa Power Rental Market, by Fuel Type

7.3 Diesel Generator Rental Market

7.3.1 Middle East Diesel Generator Rental Market

7.3.2 Africa Diesel Generator Rental Market

7.4 Gas Generator Rental Market

7.4.1 Middle East Gas Generator Rental Market

7.4.2 Africa Gas Generator Rental Market

8 Middle East & Africa Power Rental Market, by End-User (Page No. - 57)

8.1 Introduction

8.2 Middle East and Africa Power Rental Market, by End-User

8.3 Utilities

8.4 Oil & Gas

8.5 Construction

8.6 Other End-Users

8.7 Industrial

8.8 Mining

8.9 Shipping

8.10 Events

8.11 Others

9 Middle East & Africa Power Rental Market, by Region (Page No. - 91)

9.1 Introduction

9.2 Middle East & Africa Power Rental Market, by Region

9.3 Middle East Power Rental Market, by Fuel Type

9.3.1 Middle East Power Rental Market, by Region

9.3.2 Iran Power Rental Market, by Fuel Type

9.3.3 Oman Power Rental Market, by Fuel Type

9.3.4 Qatar Power Rental Market, by Fuel Type

9.3.5 Saudi Arabia Power Rental Market, by Fuel Type

9.3.6 UAE Power Rental Market, by Fuel Type

9.3.7 Other Middle East, Power Rental Market, by Fuel Type

9.3.8 Africa Power Rental Market, by Fuel Type

9.4 Africa Power Rental Market, by Region

9.4.1 Algeria Power Rental Market, by Fuel Type

9.4.2 Egypt Power Rental Market, by Fuel Type

9.4.3 Libya Power Rental Market, by Fuel Type

9.4.4 Nigeria Power Rental Market, by Fuel Type

9.4.5 Other Africa Power Rental, by Fuel Type

9.4.6 Middle East & Africa Power Rental Market, by End-User

9.5 Middle East Power Rental Market, by End-User

9.6 Middle East Power Rental Market, by Other End-User

9.6.1 Iran Power Rental Market, by End-User

9.6.2 Oman Power Rental Market, by End-User

9.6.3 Qatar Power Rental Market, by End-User

9.6.4 Saudi Arabia Power Rental Market, by End-User

9.6.5 UAE Power Rental Market, by End-User

9.6.6 Other Middle East Countries, Power Rental Market, by End-User

9.6.7 Africa Power Rental Market, by End-Users

9.7 Africa Power Rental Market, by Other End-User

9.7.1 Algeria Power Rental Market, by End-User

9.7.2 Angola Power Rental Market, by End-User

9.7.3 Egypt Power Rental Market, by End-User

9.7.4 Libya Power Rental Market, by End-User

9.7.5 Nigeria Power Rental Market, by End-User

9.7.6 South Africa Power Rental Market, by End-User

9.7.7 Other African Countries Power Rental Market, by End-User

10 Competitive Landscape (Page No. - 117)

10.1 Overview

10.2 Market Share Analysis, 2013

10.3 Competitive Situation & Trends

10.3.1 Supply Contracts

10.3.2 Expansions

10.3.3 Agreements

10.3.4 Awards & Recognition

10.3.5 New Product Launch

10.3.6 Joint Venture

10.3.7 Partnership

10.3.8 Other Developments

11 Company Profiles (Page No. - 146)

11.1 Introduction

11.2 Aggreko Plc

11.2.1 Business Overview

11.2.2 Products

11.2.3 Recent Developments

11.2.4 Key Strategy

11.2.5 SWOT Analysis

11.2.6 MNM View

11.3 Altaaqa Global

11.3.1 Business Overview

11.3.2 Products & Services

11.3.3 Recent Developments

11.3.4 Key Strategy

11.3.5 SWOT Analysis

11.3.6 MNM View

11.4 Apr Energy Plc.

11.4.1 Business Overview

11.4.2 Products

11.4.3 Recent Developments

11.4.4 Key Strategy

11.4.5 SWOT Analysis

11.4.6 MNM View

11.5 Bryne Equipment Rental LLC.

11.5.1 Business Overview

11.5.2 Products

11.5.3 Developments

11.5.4 Key Strategy

11.6 Cummins Inc.

11.6.1 Business Overview

11.6.2 Products

11.6.3 Recent Developments

11.6.4 Key Strategy

11.6.5 SWOT Analysis

11.6.6 MNM View

11.7 Hertz Equipment Rental

11.7.1 Business Overview

11.7.2 Products

11.7.3 Recent Developments

11.7.4 Key Strategy

11.8 Jubaili Bros. LLC

11.8.1 Business Overview

11.8.2 Products

11.8.3 Developments

11.8.4 Key Strategy

11.9 Rental Solutions & Services LLC

11.9.1 Business Overview

11.9.2 Products

11.9.3 Developments

11.9.4 Key Strategy

11.9.5 SWOT Analysis

11.9.6 MNM View

11.10 Sakr Power Group

11.10.1 Business Overview

11.10.2 Products

11.10.3 Developments

11.10.4 Key Strategy

11.11 Speedy Hire Plc.

11.11.1 Business Overview

11.11.2 Products

11.11.3 Developments

11.11.4 Key Strategy

12 Appendix (Page No. - 179)

12.1 Insights of Industry Experts

12.2 Discussion Guide

12.3 Introducing RT: Real Time Market Intelligence

12.4 Available Customizations

12.5 Related Reports

List of Tables

Table 1 Lack of Infrastructure and Major Upcoming Events Is Driving Growth of the Middle East & Africa Power Rental Market

Table 2 Increased Installation of Ipps and Permanent Power Plants Are Restraining the Growth of the Middle East & Africa Power Rental Market

Table 3 Investment in Power Rental Industry and New Technology for Temporary Power Requirement

Table 4 Decrease in Global Oil Prices Can Be A Challenge for the Power Rental Industry

Table 5 Oil Production: Middle East (Thousand Barrels Daily)

Table 6 Oil Production: Africa (Thousand Barrels Daily)

Table 7 Middle East & Africa Power Rental Market Size, by Fuel Type, 2014-2019 ($Million)

Table 8 Middle East & Africa Power Rental Market Size, by Diesel Type, 2014-2019 ($Million)

Table 9 Middle East Power Rental Market Size, by Diesel Type, 2014-2019 ($Million)

Table 10 Africa Power Rental Market Size, by Diesel Type, 2014-2019 ($Million)

Table 11 Natural Gas Production: Middle East (Million Tonnes Oil Equivalent)

Table 12 Natural Gas Production: Africa (Million Tonnes Oil Equivalent)

Table 13 Middle East & Africa Power Rental Market Size, by Gas Type, 2014-2019 ($Million)

Table 14 Middle East Power Rental Market Size, by Gas Type, 2014-2019 ($Million)

Table 15 Africa Power Rental Market Size, by Gas Type, 2014-2019 ($Million)

Table 16 Middle East and Africa Power Rental Market, by End-User, 2014-2019 ($Million)

Table 17 Average Retail Price of Electricity, by End-User, 2010-2014, (Cents Per Kilowatt-Hour)

Table 18 The Middle East Set to Outpace Africa in Terms of Growth in the Utilities Segment of the Power Rental Market

Table 19 Middle East and Africa Power Rental Market for the Utilities Segment, 2014-2019 ($Million)

Table 20 Middle East: Net Electricity Consumption, by Country, 2010-2012, (Billion Kilowatt Hours)

Table 21 Middle East: Power Rental Market for the Utilities Segment, by Country, 2014-2019 ($Million)

Table 22 Africa: Net Electricity Consumption, by Country, 2010-2012, (Billion Kilowatt Hours)

Table 23 Africa: Power Rental Market for the Utilities Segment, by Country, 2014-2019 ($Million)

Table 24 Electricity Demand* in Africa in the New Policies Scenario (TWH)

Table 25 Africa: Power Rental Market for the Utilities Segment, by Region, 2014-2019 ($Million)

Table 26 Middle East and Africa Power Rental Market for the Oil & Gas Segment, 2014-2019 ($Million)

Table 27 Middle East: Power Rental Market for the Oil & Gas Segment, by Country, 2014-2019 ($Million)

Table 28 Africa: Power Rental Market for the Oil & Gas Segment, by Country, 2014-2019 ($Million)

Table 29 Middle East and Africa Power Rental Market for the Construction Segment, 2014-2019 ($Million)

Table 30 Middle East: Power Rental Market for the Construction Segment, by Country, 2014-2019 ($Million)

Table 31 Africa: Power Rental Market for the Construction Segment, by Country, 2014-2019 ($Million)

Table 32 Africa: Power Rental Market for the Construction Segment, by Region, 2014-2019 ($Million)

Table 33 Middle East and Africa Power Rental Market for the Other End-User Segment, 2014-2019 ($Million)

Table 34 Middle East: Power Rental Market for the Other End-User Segment, by Country, 2014-2019 ($Million)

Table 35 Africa: Power Rental Market for the Other End-User Segment, by Country, 2014-2019 ($Million)

Table 36 Other Middle East and Africa Power Rental Market, by End-User, 2014-2019 ($Million)

Table 37 Middle East and Africa Power Rental Market for the Industrial Segment, 2014-2019 ($Million)

Table 38 Middle East: Gdp of Top Ten Countries, 2013-2014 ($Million)

Table 39 Middle East: Power Rental Market for the Industrial Segment, by Country, 2014-2019 ($Million)

Table 40 Africa: Gdp of Top Ten Countries, 2013-2014 ($Million)

Table 41 Africa: Power Rental Market for Industrial Segment, by Country, 2014-2019 ($Million)

Table 42 Middle East and Africa Power Rental Market for the Mining Segment, 2014-2019 ($Million)

Table 43 Africa: Power Rental Market for Mining Segment, by Region, 2014-2019 ($Million)

Table 44 Middle East and Africa Power Rental Market for the Shipping Segment, 2014-2019 ($Million)

Table 45 Middle East: List of Major Events Using Power Rental, 2013-2022

Table 46 Middle East and Africa Power Rental Market for the Events Segment, 2014-2019 ($Million)

Table 47 Middle East: Power Rental Market for the Events Segment, by Country, 2014-2019 ($Million)

Table 48 Middle East and Africa Power Rental Market for the Others Segment, 2014-2019 ($Million)

Table 49 Middle East & Africa Power Rental Market Size, by Region, 2014-2019 ($Million)

Table 50 Middle East Power Rental Market Size, by Fuel Type, 2014-2019 ($Million)

Table 51 Middle East Power Rental Market Size, by Region, 2014-2019 ($Million)

Table 52 Iran Power Rental Market Size, by Fuel Type, 2014-2019 ($Million)

Table 53 Oman Power Rental Market Size, by Fuel Type, 2014-2019 ($Million)

Table 54 Qatar Power Rental Market Size, by Fuel Type, 2014-2019 ($Million)

Table 55 Saudi Arabia Power Rental Market Size, by Fuel Type, 2014-2019 ($Million)

Table 56 UAE Power Rental Market Size, by Fuel Type, 2014-2019 ($Million)

Table 57 Other Middle East, Power Rental Market Size, by Fuel Type, 2014-2019 ($Million)

Table 58 Africa Power Rental Market, by Fuel Type, 2014-2019 ($Million)

Table 59 Africa Power Rental Market Size, by Region, 2014-2019 ($Million)

Table 60 Algeria Power Rental Market Size, by Fuel Type, 2014-2019 ($Million)

Table 61 Egypt Power Rental Market Size, by Fuel Type, 2014-2019 ($Million)

Table 62 Libya Power Rental Market Size, by Fuel Type, 2014-2019 ($Million)

Table 63 Nigeria Power Rental Market Size, by Fuel Type, 2014-2019 ($Million)

Table 64 Other Africa Power Rental Market Size, by Fuel Type, 2014-2019 ($Million)

Table 65 Middle East & Africa Power Rental Market Size, by End-User, 2014-2019 ($Million)

Table 66 Middle East Power Rental Market Size, by End-User, 2014-2019 ($Million)

Table 67 Middle East Power Rental Market Size, by Other End-User, 2014-2019 ($Million)

Table 68 Iran Power Rental Market Size, by End-User, 2014-2019 ($Million)

Table 69 Oman Power Rental Market, by End-User, 2014-2019 ($Million)

Table 70 Qatar Power Rental Market Size, by End-User, 2014-2019 ($Million)

Table 71 Saudi Arabia Power Rental Market Size, by End-User, 2014-2019 ($Million)

Table 72 UAE Power Rental Market Size, by End-User, 2014-2019 ($Million)

Table 73 Other Middle East Countries: Power Rental Market Size, by End-User, 2014-2019 ($Million)

Table 74 Africa: Power Rental Market Size, by End-User, 2014-2019 ($Million)

Table 75 Africa Power Rental Market Size, by Other End-User, 2014-2019 ($Million)

Table 76 Algeria Power Rental Market Size, by End-User, 2014-2019 ($Million)

Table 77 Angola Power Rental Market Size, by End-User, 2014-2019 ($Million)

Table 78 Egypt Power Rental Market Size, by End-User, 2014-2019 ($Million)

Table 79 Libya Power Rental Market Size, by End-User, 2014-2019 ($Million)

Table 80 Nigeria Power Rental Market Size, by End-User, 2014-2019 ($Million)

Table 81 South Africa Power Rental Market Size, by End-User, 2014-2019 ($Million)

Table 82 Other African Countries Power Rental Market, by End-User, 2014-2019 ($Million)

Table 83 Supply Contract, 2008-2014

Table 84 Expansions, 2010-2014

Table 85 Agreements, 2010-2013

Table 86 Awards & Recognition, 2009-2014

Table 87 New Product Launch, 2012-2013

Table 88 Joint Ventures, 2008-2013

Table 89 Partnership, 2011-2013

Table 90 Other Developments, 2010-2014

List of Figures

Figure 1 Middle East & Africa Power Rental Market: Research Design

Figure 2 Market Size Estimation Methodology: Bottom-Up Approach

Figure 3 Market Size Estimation Methodology: Top-Down Approach

Figure 4 Breakdown of Primary Interviews: by Company Type, Designation, & Region

Figure 5 Data Triangulation

Figure 6 Middle East & Africa Power Rental End-User Market Snapshot (2014 vs 2019): Market for Utilities Is Dominating in the End-User Industry

Figure 7 Diesel Gensets Market to Capture Lionís Share by 2019

Figure 8 Saudi Arabia Is the Largest Market for Power Rental in the Middle East

Figure 9 Africa Has Majority of Matured Markets in the Region

Figure 10 Market Opportunities in the Middle East & Africa Power Rental Market

Figure 11 Utilities to Grow At the Fastest Pace in the Middle East & Africa Power Rental Market

Figure 12 Utilities Segment to Capture the Lionís Share

Figure 13 Diesel Genset to Lead the Power Rental Market of Middle East & Africa In2019

Figure 14 Market Segmentation by End-User, Type, & Region

Figure 15 Increasing Power Demand Drive the Market in the Middle East and Africa

Figure 16 Value Chain Analysis

Figure 17 Supply Chain Analysis

Figure 18 Porterís Five Forces Analysis

Figure 19 Large End-User Base for the Power Rental Market in the Middle East and Africa

Figure 20 Utilities Are the Key Driving Force of the Middle East and Africa Power Rental Market

Figure 21 Increased Oil & Gas Production in Saudi Arabia and Nigeria to Drive the Growth of the Middle East and Africa Power Rental Market

Figure 22 Middle East Will Continue to Lead the Power Rental Market in the Construction Sector

Figure 23 Africa: Construction Projects, by Region, 2014

Figure 24 Industrial: the Power Rental Market in Turkey Is Expected to Grow More Than Double by 2019 Due to the Increase in Economic Activities

Figure 25 Middle East and Africa Mining Projects, by Region, 2014

Figure 26 Africa Mining Projects, by Region, 2014

Figure 27 Power Rental Market for Shipping Snapshot (2014 vs. 2019): Market Size by Value for Middle East and Africa Is Expected to Double in the Next Five Years

Figure 28 The Increasing Number of International Sports Events Is Driving the Power Rental Market in the Middle East

Figure 29 Increasing Number International Sports Events Is Driving the Power Rental Market in the Middle East

Figure 30 Diesel Generator Will Capture Lionís Share in the Middle East & Africa Power Rental Industry in 2019

Figure 31 The Middle East to Dominate the Power Rental Market in Diesel Generators

Figure 32Growth in Construction & Utilities Sector Is Enhancing the Power Rental Market in the Middle East

Figure 33 Qatar Exhibits Highest Growth among All the End-Users in the Middle East Region

Figure 34 UAE Is Expected to Lead the Top Three End-User Segment With Highest Growth Rate

Figure 35 Africa Is Projected to Have Matured Markets for the End-User Segment

Figure 36 Nigeria Is Projected to Have the Largest Market in Africa ($Million)

Figure 37 Companies Adopted Supply Contracts & Agreements to Capture the Markets

Figure 38 Middle East & Africa Power Rental Market Share: Top 5 Companies vs Others, 2013

Figure 39 Market Evaluation Framework: Significant Supply Contracts, Expansions, & Agreements Have Fueled Growth & Innovation from 2011-2014

Figure 40 Geographic Revenue Mix of Top 3 Market Players

Figure 41 Aggreko Plc. : Company Snapshot

Figure 42 Aggreko Plc. : SWOT Analysis

Figure 43 Altaaqa Global: Business Overview

Figure 44 Altaaqa Global : SWOT Analysis

Figure 45 Apr Energy Plc.: Business Overview

Figure 46 Apr Energy Plc.: SWOT Analysis

Figure 47 Bryne Equipment Rental LLC.: Business Overview

Figure 48 Cummins Inc.: Business Overview

Figure 49 Cummins Inc.: SWOT Analysis

Figure 50 Hertz Equipment Rental: Business Overview

Figure 51 Jubaili Bros. LLC: Business Overview

Figure 52 Rental Solutions and Services LLC: Business Overview

Figure 53 Rental Solutions and Services LLC: SWOT Analysis

Figure 54 Sakr Power Group: Business Overview

Figure 55 Speedy Hire Plc: Business Overview

Growth opportunities and latent adjacency in Middle East and Africa Power Rental Market