Microbiome Sequencing Services Market by Service (Sample Preparation, Sequencing, Library Preparation), Type (Amplicon Sequencing, Whole Genome Sequencing), Technology (Sequencing by Synthesis, Nanopore Sequencing), End User - Global Forecast to 2028

Market Growth Outlook Summary

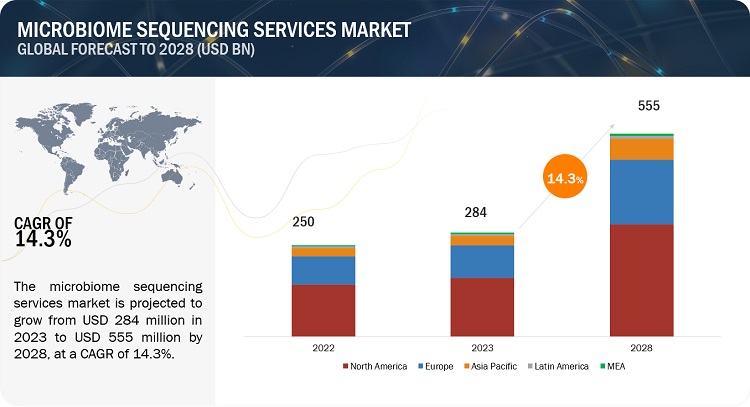

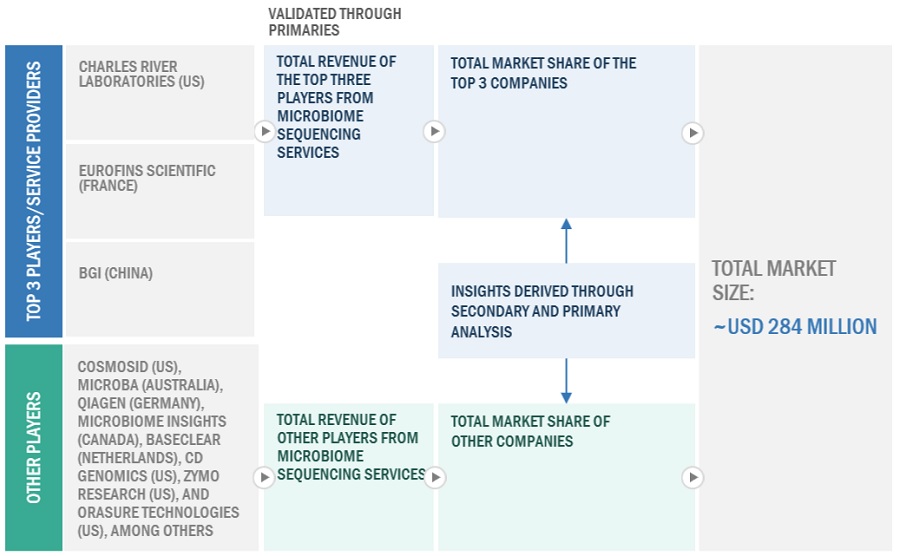

The global microbiome sequencing services market, valued at US$250 million in 2022, stood at US$284 million in 2023 and is projected to advance at a resilient CAGR of 14.3% from 2023 to 2028, culminating in a forecasted valuation of US$555 billion by the end of the period. Factors contributing to market growth include the high demand for metagenomic sequencing, the increasing use of sequencing technologies in developing human microbiome therapeutics, and the expenses associated with advanced sequencing equipment, which drive end users to outsource microbiome sequencing. However, the lack of skilled expertise in handling complex samples may hinder the market's growth during the forecast period.

Microbiome Sequencing Services Market – Global Forecast and Growth Insights to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Microbiome Sequencing Services Market – Global Forecast and Key Opportunities to 2028

Microbiome Sequencing Services Market Dynamics to 2028

DRIVER: High cost of advanced infrastructure for sequencing

The field of microbiome sequencing requires sophisticated and expensive equipment, such as next-generation sequencing (NGS) platforms, bioinformatics tools, and data storage and analysis capabilities. Setting up and maintaining such infrastructure can be cost-prohibitive for many research and academic institutes, pharmaceutical and biotechnology companies, and other end users. Outsourcing microbiome sequencing to specialized service providers allows professionals to access advanced infrastructure and expertise without the need for substantial upfront investments. These service providers typically have state-of-the-art facilities and experienced personnel who are skilled in performing microbiome sequencing using the latest technologies and methodologies. Through outsourcing, professionals can leverage the capabilities of these specialized facilities without the burden of capital expenditures, operational costs, and maintenance expenses associated with in-house infrastructure.

RESTRAINT: Dearth of skilled personnel

The shortage of skilled personnel with expertise in sequencing and data analysis is a significant challenge in the field of microbiome sequencing. Microbiome research involves complex methodologies, including sample collection, DNA extraction, library preparation, sequencing, and data analysis. The proper execution of these steps requires specialized knowledge and technical expertise. However, the field of microbiome sequencing is relatively new and evolving rapidly, with a shortage of skilled personnel with the necessary expertise. Training and developing skilled personnel in microbiome sequencing can be time-consuming and resource-intensive, and there may be a lag in keeping up with the latest advancements in sequencing technologies and data analysis methods.

OPPORTUNITY: Expanding applications of microbiome sequencing in therapeutics development

Oral microbiome sequencing can provide insights into the microbial etiology of oral health conditions, identify key pathogenic species or functional genes associated with oral diseases, and reveal potential therapeutic targets for intervention. This knowledge can be used to develop novel strategies for oral health management, including probiotics, antimicrobial treatments, and personalized oral care regimens tailored to an individual's oral microbiome.

CHALLENGE: Issues related to sample preparation/isolation of microbes for sequencing

Despite the success of using metagenomic sequence data to guide the isolation and cultivation of microbes, there are still challenges and limitations that need to be addressed for more widespread success. Anaerobic microbes may also pose technical challenges for some targeted isolation methods due to limitations with cell sorters. Determining suitable growth media and physicochemical conditions for target organisms based solely on genome sequences can be challenging, as natural environment compositions are often unknown. Contamination can also be a significant challenge in microbiome research, as it can introduce non-target microbial DNA from external sources during sample collection, processing, and sequencing. Contamination can arise from reagents, equipment, and environmental sources, leading to false-positive or false-negative results. Proper controls, including negative controls and rigorous contamination prevention measures, should be implemented to minimize contamination and ensure accurate and reliable sequencing results.

Microbiome Sequencing Services Market Map & Ecosystem Overview

Microbiome sequencing services start with outsourcing of study design, wherein the service provider helps in the implementation and validation of the hypothesis and the variables of interest in a sequencing project. Different variables in the aspect of study design include the number of samples required, apt sequencing technology to be used, and the requirement of follow-up studies. Service providers have expertise with respect to the collection, storage, and transport options optimized for this workflow. NGS instruments are predominantly used for the sequencing of DNA and RNA samples. Shotgun metagenomics sequencing is offered by a majority of sequencing service providers, even for deep-sequenced samples. DNA library preparation is verified for quality and yield. Genomic DNA is fragmented at specific sizes suitable for the purification/separation of desired proteins and nucleic acids.

Source: Annual Reports, SEC Filings, Investor Presentations, Expert Interviews, and MarketsandMarkets Analysis

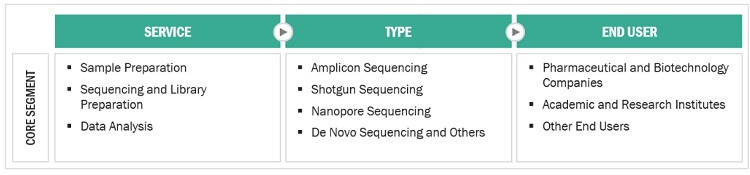

Based on service, sequencing and library preparation services segment accounted for the largest share of the Microbiome Sequencing Services Market in 2022

Based on service, the market is segmented into sample preparation services, sequencing and library preparation services, and data analysis services. The sequencing and library preparation services segment accounted for the largest share of the market whereas sample preparation services segment accounted for the second-largest share in 2022. Sample preparation segment includes services that are applied for the collection, storage, and processing of samples subjected to microbiome sequencing. It is imperative to ensure that microbiome analysis is reproducible. Reproducibility is affected by several factors, such as sample size, storage methods, and collection methods.

Based on type, amplicon sequencing segment accounted for the largest share of the Microbiome Sequencing Services Market in 2022

Based on type, the global market is segmented into amplicon sequencing, whole-genome sequencing, shotgun sequencing, and other types. Other types of sequencing include metagenomic sequencing, de novo sequencing, and metatranscriptomic sequencing. High accuracy of 16S amplicon sequencing is the key contributor to the dominance of amplicon sequencing segment. Additionally, the demand for targeted sequencing is anticipated to increase in metagenomic research activities. The targeted amplicon sequencing method involves sequencing a phylogenetically informative marker to identify organisms in community samples.

Based on technology, nanopore sequencing segment of the global Microbiome Sequencing Services Market is expected to grow with a highest CAGR throughout the forecast period

Based on technology, the global market is segmented into sequencing by synthesis (SBS), sequencing by ligation (SBL), nanopore sequencing, and other technologies. Introduced by Oxford Nanopore Technologies, nanopore sequencing technology (which is considered the fourth generation of sequencing) has emerged as a competitive, portable technology. The technology works through the detection of unique electrical signals of different molecules as they pass across the nanopore with a semiconductor-based electronic detection system. This technology makes for a high throughput, cost-effective sequencing solution.

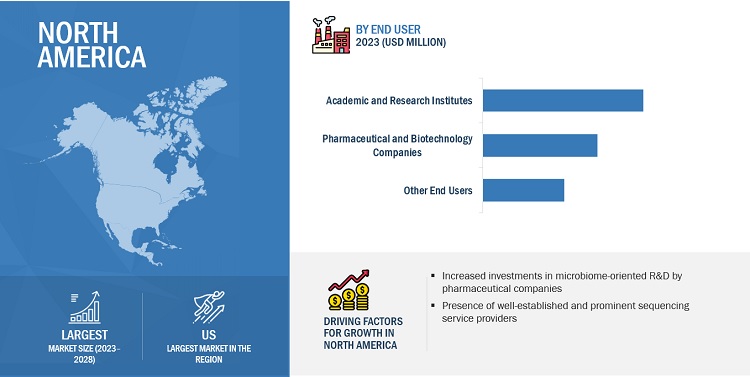

The North American market is projected to contribute the largest share for the microbiome sequencing services market.

The global market is segmented into five major regions—North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa. North America is the largest regional market for microbiome sequencing services. US has emerged as the key revenue contributor to this region. The US market is a rapidly growing and dynamic market that is driven by several factors. One of the key drivers for market growth in the US is the increasing awareness and understanding of the role of the microbiome in human health. Research has shown that microorganisms residing in and on the human body play a crucial role in various physiological processes, including digestion, immunity, and metabolism. The increasing focus on gaining a deep understanding of this has driven the demand for microbiome sequencing services to study the composition and function of the microbiome.

Microbiome Sequencing Services Market by Region – Forecast to 2028

To know about the assumptions considered for the study, download the pdf brochure

The global microbiome sequencing services market is highly fragmented, with Charles River Laboratories (US), Eurofins Scientific (France), and BGI (China) emerging as the top three players in the global market. Other prominent players include CosmosID (US), Microba (Australia), QIAGEN (Germany), Microbiome Insights (Canada), BaseClear (Netherlands), CD Genomics (US), Zymo Research (US), OraSure Technologies (US), MR DNA (US), Eremid Genomic Services (US), Clinical-Microbiomics A/S (Denmark), Novogene Co., Ltd. (China), EzBiome (US), Boster Biological Technology (US), Zifo (India), omics2view.consulting GbR (Germany), and Macrogen, Inc. (South Korea).

Microbiome Sequencing Services Market Report Scope and Insights

| Report Metric | Details |

|---|---|

| Market Revenue in 2023 | USD 284 million |

| Projected Revenue by 2028 | USD 555 million |

| Revenue Rate | Poised to Grow at a CAGR of 14.3% |

| Market Driver | High cost of advanced infrastructure for sequencing |

| Market Opportunity | Expanding applications of microbiome sequencing in therapeutics development |

Microbiome Sequencing Services Market Segmentation and Analysis

By Service

- Sample Preparation

- Sequencing and Library Preparation

- Data Analysis

By Type

- Amplicon Sequencing

- Whole-genome Sequencing

- Shotgun Sequencing

- Other Types

By Technology

- Sequencing by Synthesis (SBS)

- Sequencing by Ligation (SBL)

- Nanopore Sequencing

- Other Technologies

By End User

- Pharmaceutical and Biotechnology Companies

- Academic and Research Institutes

- Other End Users

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Spain

- Italy

- RoE

-

Asia Pacific

- China

- India

- Japan

- RoAPAC

- Latin America

- Middle East & Africa

Microbiome Sequencing Services Market Recent Developments and Insights

- In March 2023, Microba launched a new human gut microbiome testing service for comprehensive gastrointestinal testing solutions. The solutions are accessible to healthcare professionals in Australia through a different brand name, Co-Biome.

- In February 2023, Locus Biosciences announced a long-term partnership with CosmosID to gain the support of the latter for clinical trial studies. CosmosID’s support for microbiome analysis is expected to assist Locus Biosciences in strengthening its precision therapeutics platform.

- In March 2022, Diversigen announced the launch of a new service, metatranscriptomic sequencing and analysis of the gut microbiome. This service will assist research professionals in understanding gene expression while gaining insights into both function and mechanism of microbiomes in samples.

Frequently Asked Questions (FAQ):

What is the projected growth and market value of the global microbiome sequencing services market?

The global microbiome sequencing services market is projected to grow from USD 284 million in 2023 to USD 555 million by 2028, demonstrating a robust CAGR of 14.3%.

What factors are driving the growth of the microbiome sequencing services market?

Key drivers include the growing focus on human microbiome therapeutics, high demand for metagenomic sequencing, and the outsourcing of sequencing services due to the high costs of advanced infrastructure.

What challenges are hindering the growth of the microbiome sequencing services market?

The market faces challenges such as a lack of skilled personnel to handle complex samples and high costs associated with sequencing equipment and services.

Which technologies dominate the microbiome sequencing services market?

Sequencing by Synthesis (SBS) accounted for the largest market share in 2022, while nanopore sequencing is expected to grow at the highest CAGR during the forecast period.

Which regions are expected to experience significant growth in the microbiome sequencing services market?

North America leads the market due to advanced infrastructure and funding, while the Asia Pacific region is expected to grow the fastest owing to increased awareness, government support, and emerging biotechnology industries.

What are the major services offered in the microbiome sequencing market?

The market is segmented into sample preparation, sequencing and library preparation, and data analysis services. Sequencing and library preparation accounted for the largest share and are projected to grow the fastest.

What role do academic and research institutes play in the microbiome sequencing services market?

Academic and research institutes accounted for the largest market share in 2022 due to their extensive adoption of microbiome sequencing for clinical research and therapeutic development.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing demand for metagenomic sequencing- Growing focus on human microbiome therapeutics development- High cost of advanced infrastructure for sequencingRESTRAINTS- Dearth of skilled personnelOPPORTUNITIES- Expanding applications of microbiome sequencing in therapeutics developmentCHALLENGES- Issues related to sample preparation/isolation of microbes for sequencing

- 5.3 TECHNOLOGY ANALYSIS

- 5.4 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

- 5.5 VALUE CHAIN ANALYSIS

-

5.6 ECOSYSTEM MARKET MAP

-

5.7 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.8 REGULATORY ANALYSISNORTH AMERICA- US- CanadaEUROPEASIA PACIFIC- China- Japan- IndiaLATIN AMERICAMIDDLE EASTREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

-

5.9 PRICING ANALYSISAVERAGE SELLING PRICE TREND ANALYSIS

- 5.10 KEY CONFERENCES AND EVENTS IN 2023–2024

- 5.11 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.1 INTRODUCTION

-

6.2 SAMPLE PREPARATIONNEED FOR SPECIFIC SAMPLE PREPARATION PROTOCOLS BASED ON SAMPLE TYPE TO DRIVE GROWTH

-

6.3 SEQUENCING AND LIBRARY PREPARATIONSEQUENCING AND LIBRARY PREPARATION SERVICES TO DOMINATE MARKET DURING FORECAST PERIOD

-

6.4 DATA ANALYSISDEVELOPMENT OF ADVANCED BIOINFORMATICS SOLUTIONS TO DRIVE GROWTH

- 7.1 INTRODUCTION

-

7.2 AMPLICON SEQUENCINGHIGH ACCURACY OF 16S AMPLICON SEQUENCING TO DRIVE ADOPTION

-

7.3 WHOLE-GENOME SEQUENCINGACCURATE REFERENCE GENOMES GENERATED FOR MICROBIAL IDENTIFICATION TO BOOST MARKET

-

7.4 SHOTGUN SEQUENCINGADVANCEMENTS IN DATA ANALYSIS SOLUTIONS TO SUPPORT ADOPTION

- 7.5 OTHER TYPES

- 8.1 INTRODUCTION

-

8.2 SEQUENCING BY SYNTHESIS (SBS)SBS TECHNOLOGY ENABLES HIGHEST PRODUCTION OF BASE PAIRS IN SHORT TIME

-

8.3 SEQUENCING BY LIGATION (SBL)INCREASING DEMAND FOR SBL IN FOOD MICROBIOME RESEARCH TO BOOST GROWTH

-

8.4 NANOPORE SEQUENCINGONLY SEQUENCING TECHNOLOGY WITH DIRECT RNA SEQUENCING CAPABILITIES

- 8.5 OTHER TECHNOLOGIES

- 9.1 INTRODUCTION

-

9.2 PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIESROBUST FUNDING FOR MICROBIOME-BASED THERAPEUTICS TO DRIVE MARKET

-

9.3 ACADEMIC AND RESEARCH INSTITUTESEXPANDING APPLICATIONS OF MICROBIOME RESEARCH TO DRIVE GROWTH

- 9.4 OTHER END USERS

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICAUS- Increasing awareness of microbiome research to drive growthCANADA- Increasing prevalence of chronic diseases to boost microbiome researchNORTH AMERICA: IMPACT OF RECESSION

-

10.3 EUROPEGERMANY- Rapidly increasing government funding to support growthUK- Significant government investments in genomics research to propel growthFRANCE- Growing number of microbiome sequencing startups to propel growthITALY- Increasing use of microbiome services in clinical research to drive growthSPAIN- Increasing prevalence of chronic diseases to drive marketREST OF EUROPEEUROPE: IMPACT OF RECESSION

-

10.4 ASIA PACIFICCHINA- Increasing investments in R&D to drive growthJAPAN- Significant growth in geriatric population to present opportunities for market growthINDIA- Increasing prevalence of chronic diseases to support growthREST OF ASIA PACIFICASIA PACIFIC: IMPACT OF RECESSION

-

10.5 LATIN AMERICABRAZIL- Growing adoption of next-generation sequencing technologies to propel growthREST OF LATIN AMERICALATIN AMERICA: IMPACT OF RECESSION

-

10.6 MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA: IMPACT OF RECESSION

- 11.1 OVERVIEW

- 11.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 11.3 MARKET SHARE ANALYSIS

- 11.4 REVENUE SHARE ANALYSIS OF TOP MARKET PLAYERS

-

11.5 COMPANY EVALUATION QUADRANTSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

- 11.6 COMPETITIVE SCENARIO

-

12.1 KEY PLAYERSCHARLES RIVER LABORATORIES- Business overview- Services offered- Recent developments- MnM viewEUROFINS SCIENTIFIC- Business overview- Services offered- MnM viewBGI GROUP- Business overview- Services offeredCOSMOSID- Business overview- Services offered- Recent developmentsMICROBA- Business overview- Services offered- Recent developmentsQIAGEN N.V.- Business overview- Services offered- Recent developmentsMICROBIOME INSIGHTS- Business overview- Services offered- Recent developmentsBASECLEAR- Business overview- Services offeredCD GENOMICS- Business overview- Services offeredZYMO RESEARCH CORPORATION- Business overview- Services offeredORASURE TECHNOLOGIES- Business overview- Services offered- Recent developmentsMR DNA- Business overview- Services offeredEREMID GENOMIC SERVICES- Business overview- Services offeredCLINICAL-MICROBIOMICS A/S- Business overview- Services offered- Recent developmentsNOVOGENE CO., LTD.- Business overview- Services offered

-

12.2 OTHER PLAYERSEZBIOMEBOSTER BIOLOGICAL TECHNOLOGYZIFOOMICS2VIEW.CONSULTING GBRMACROGEN, INC.

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 GLOBAL INFLATION RATE PROJECTIONS, 2021–2027 (% GROWTH)

- TABLE 2 US HEALTH EXPENDITURE, 2019–2022 (USD MILLION)

- TABLE 3 US HEALTH EXPENDITURE, 2023–2027 (USD MILLION)

- TABLE 4 MICROBIOME SEQUENCING SERVICES MARKET: IMPACT ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- TABLE 5 AVERAGE SELLING PRICE OF NGS SYSTEMS, BY KEY PLAYER (2021)

- TABLE 6 MICROBIOME SEQUENCING SERVICES MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 7 US FDA: MEDICAL DEVICE CLASSIFICATION

- TABLE 8 US: MEDICAL DEVICE REGULATORY APPROVAL PROCESS

- TABLE 9 CHINA: CLASSIFICATION OF MEDICAL DEVICES

- TABLE 10 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS: GENOMICS, MICROBIOME RESEARCH, AND METAGENOMICS

- TABLE 11 AVERAGE SELLING PRICE, BY SERVICE AND TYPE

- TABLE 12 MICROBIOME SEQUENCING/METAGENOMIC SEQUENCING/NGS CONFERENCES, 2023–2024

- TABLE 13 MICROBIOME SEQUENCING SERVICES MARKET, BY SERVICE, 2021–2028 (USD MILLION)

- TABLE 14 MICROBIOME SEQUENCING SERVICES MARKET FOR SAMPLE PREPARATION, BY REGION, 2021–2028 (USD MILLION)

- TABLE 15 NORTH AMERICA: MICROBIOME SEQUENCING SERVICES MARKET FOR SAMPLE PREPARATION, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 16 EUROPE: MICROBIOME SEQUENCING SERVICES MARKET FOR SAMPLE PREPARATION, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 17 ASIA PACIFIC: MICROBIOME SEQUENCING SERVICES MARKET FOR SAMPLE PREPARATION, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 18 LATIN AMERICA: MICROBIOME SEQUENCING SERVICES MARKET FOR SAMPLE PREPARATION, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 19 MICROBIOME SEQUENCING SERVICES MARKET FOR SEQUENCING AND LIBRARY PREPARATION, BY REGION, 2021–2028 (USD MILLION)

- TABLE 20 NORTH AMERICA: MICROBIOME SEQUENCING SERVICES MARKET FOR SEQUENCING AND LIBRARY PREPARATION, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 21 EUROPE: MICROBIOME SEQUENCING SERVICES MARKET FOR SEQUENCING AND LIBRARY PREPARATION, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 22 ASIA PACIFIC: MICROBIOME SEQUENCING SERVICES MARKET FOR SEQUENCING AND LIBRARY PREPARATION, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 23 LATIN AMERICA: MICROBIOME SEQUENCING SERVICES MARKET FOR SEQUENCING AND LIBRARY PREPARATION, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 24 MICROBIOME SEQUENCING SERVICES MARKET FOR DATA ANALYSIS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 25 NORTH AMERICA: MICROBIOME SEQUENCING SERVICES MARKET FOR DATA ANALYSIS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 26 EUROPE: MICROBIOME SEQUENCING SERVICES MARKET FOR DATA ANALYSIS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 27 ASIA PACIFIC: MICROBIOME SEQUENCING SERVICES MARKET FOR DATA ANALYSIS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 28 LATIN AMERICA: MICROBIOME SEQUENCING SERVICES MARKET FOR DATA ANALYSIS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 29 MICROBIOME SEQUENCING SERVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 30 AMPLICON SEQUENCING SERVICES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 31 NORTH AMERICA: AMPLICON SEQUENCING SERVICES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 32 EUROPE: AMPLICON SEQUENCING SERVICES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 33 ASIA PACIFIC: AMPLICON SEQUENCING SERVICES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 34 LATIN AMERICA: AMPLICON SEQUENCING SERVICES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 35 WHOLE-GENOME SEQUENCING SERVICES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 36 NORTH AMERICA: WHOLE-GENOME SEQUENCING SERVICES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 37 EUROPE: WHOLE-GENOME SEQUENCING SERVICES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 38 ASIA PACIFIC: WHOLE-GENOME SEQUENCING SERVICES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 39 LATIN AMERICA: WHOLE-GENOME SEQUENCING SERVICES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 40 SHOTGUN SEQUENCING SERVICES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 41 NORTH AMERICA: SHOTGUN SEQUENCING SERVICES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 42 EUROPE: SHOTGUN SEQUENCING SERVICES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 43 ASIA PACIFIC: SHOTGUN SEQUENCING SERVICES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 44 LATIN AMERICA: SHOTGUN SEQUENCING SERVICES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 45 OTHER MICROBIOME SEQUENCING SERVICES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 46 NORTH AMERICA: OTHER MICROBIOME SEQUENCING SERVICES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 47 EUROPE: OTHER MICROBIOME SEQUENCING SERVICES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 48 ASIA PACIFIC: OTHER MICROBIOME SEQUENCING SERVICES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 49 LATIN AMERICA: OTHER MICROBIOME SEQUENCING SERVICES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 50 MICROBIOME SEQUENCING SERVICES MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 51 MICROBIOME SEQUENCING SERVICES MARKET FOR SBS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 52 NORTH AMERICA: MICROBIOME SEQUENCING SERVICES MARKET FOR SBS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 53 EUROPE: MICROBIOME SEQUENCING SERVICES MARKET FOR SBS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 54 ASIA PACIFIC: MICROBIOME SEQUENCING SERVICES MARKET FOR SBS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 55 LATIN AMERICA: MICROBIOME SEQUENCING SERVICES MARKET FOR SBS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 56 MICROBIOME SEQUENCING SERVICES MARKET FOR SBL, BY REGION, 2021–2028 (USD MILLION)

- TABLE 57 NORTH AMERICA: MICROBIOME SEQUENCING SERVICES MARKET FOR SBL, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 58 EUROPE: MICROBIOME SEQUENCING SERVICES MARKET FOR SBL, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 59 ASIA PACIFIC: MICROBIOME SEQUENCING SERVICES MARKET FOR SBL, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 60 LATIN AMERICA: MICROBIOME SEQUENCING SERVICES MARKET FOR SBL, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 61 MICROBIOME SEQUENCING SERVICES MARKET FOR NANOPORE SEQUENCING, BY REGION, 2021–2028 (USD MILLION)

- TABLE 62 NORTH AMERICA: MICROBIOME SEQUENCING SERVICES MARKET FOR NANOPORE SEQUENCING, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 63 EUROPE: MICROBIOME SEQUENCING SERVICES MARKET FOR NANOPORE SEQUENCING, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 64 ASIA PACIFIC: MICROBIOME SEQUENCING SERVICES MARKET FOR NANOPORE SEQUENCING, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 65 LATIN AMERICA: MICROBIOME SEQUENCING SERVICES MARKET FOR NANOPORE SEQUENCING, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 66 MICROBIOME SEQUENCING SERVICES MARKET FOR OTHER TECHNOLOGIES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 67 NORTH AMERICA: MICROBIOME SEQUENCING SERVICES MARKET FOR OTHER TECHNOLOGIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 68 EUROPE: MICROBIOME SEQUENCING SERVICES MARKET FOR OTHER TECHNOLOGIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 69 ASIA PACIFIC: MICROBIOME SEQUENCING SERVICES MARKET FOR OTHER TECHNOLOGIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 70 LATIN AMERICA: MICROBIOME SEQUENCING SERVICES MARKET FOR OTHER TECHNOLOGIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 71 MICROBIOME SEQUENCING SERVICES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 72 MICROBIOME SEQUENCING SERVICES MARKET FOR PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 73 NORTH AMERICA: MICROBIOME SEQUENCING SERVICES MARKET FOR PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 74 EUROPE: MICROBIOME SEQUENCING SERVICES MARKET FOR PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 75 ASIA PACIFIC: MICROBIOME SEQUENCING SERVICES MARKET FOR PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 76 LATIN AMERICA: MICROBIOME SEQUENCING SERVICES MARKET FOR PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 77 MICROBIOME SEQUENCING SERVICES MARKET FOR ACADEMIC AND RESEARCH INSTITUTES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 78 NORTH AMERICA: MICROBIOME SEQUENCING SERVICES MARKET FOR ACADEMIC AND RESEARCH INSTITUTES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 79 EUROPE: MICROBIOME SEQUENCING SERVICES MARKET FOR ACADEMIC AND RESEARCH INSTITUTES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 80 ASIA PACIFIC: MICROBIOME SEQUENCING SERVICES MARKET FOR ACADEMIC AND RESEARCH INSTITUTES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 81 LATIN AMERICA: MICROBIOME SEQUENCING SERVICES MARKET FOR ACADEMIC AND RESEARCH INSTITUTES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 82 MICROBIOME SEQUENCING SERVICES MARKET FOR OTHER END USERS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 83 NORTH AMERICA: MICROBIOME SEQUENCING SERVICES MARKET FOR OTHER END USERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 84 EUROPE: MICROBIOME SEQUENCING SERVICES MARKET FOR OTHER END USERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 85 ASIA PACIFIC: MICROBIOME SEQUENCING SERVICES MARKET FOR OTHER END USERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 86 LATIN AMERICA: MICROBIOME SEQUENCING SERVICES MARKET FOR OTHER END USERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 87 MICROBIOME SEQUENCING SERVICES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 88 NORTH AMERICA: MICROBIOME SEQUENCING SERVICES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 89 NORTH AMERICA: MICROBIOME SEQUENCING SERVICES MARKET, BY SERVICE, 2021–2028 (USD MILLION)

- TABLE 90 NORTH AMERICA: MICROBIOME SEQUENCING SERVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 91 NORTH AMERICA: MICROBIOME SEQUENCING SERVICES MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 92 NORTH AMERICA: MICROBIOME SEQUENCING SERVICES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 93 US: MICROBIOME SEQUENCING SERVICES MARKET, BY SERVICE, 2021–2028 (USD MILLION)

- TABLE 94 US: MICROBIOME SEQUENCING SERVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 95 US: MICROBIOME SEQUENCING SERVICES MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 96 US: MICROBIOME SEQUENCING SERVICES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 97 CANADA: MICROBIOME SEQUENCING SERVICES MARKET, BY SERVICE, 2021–2028 (USD MILLION)

- TABLE 98 CANADA: MICROBIOME SEQUENCING SERVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 99 CANADA: MICROBIOME SEQUENCING SERVICES MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 100 CANADA: MICROBIOME SEQUENCING SERVICES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 101 EUROPE: MICROBIOME SEQUENCING SERVICES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 102 EUROPE: MICROBIOME SEQUENCING SERVICES MARKET, BY SERVICE, 2021–2028 (USD MILLION)

- TABLE 103 EUROPE: MICROBIOME SEQUENCING SERVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 104 EUROPE: MICROBIOME SEQUENCING SERVICES MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 105 EUROPE: MICROBIOME SEQUENCING SERVICES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 106 GERMANY: MICROBIOME SEQUENCING SERVICES MARKET, BY SERVICE, 2021–2028 (USD MILLION)

- TABLE 107 GERMANY: MICROBIOME SEQUENCING SERVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 108 GERMANY: MICROBIOME SEQUENCING SERVICES MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 109 GERMANY: MICROBIOME SEQUENCING SERVICES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 110 UK: MICROBIOME SEQUENCING SERVICES MARKET, BY SERVICE, 2021–2028 (USD MILLION)

- TABLE 111 UK: MICROBIOME SEQUENCING SERVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 112 UK: MICROBIOME SEQUENCING SERVICES MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 113 UK: MICROBIOME SEQUENCING SERVICES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 114 HUMAN MICROBIOME STARTUPS IN FRANCE

- TABLE 115 FRANCE: MICROBIOME SEQUENCING SERVICES MARKET, BY SERVICE, 2021–2028 (USD MILLION)

- TABLE 116 FRANCE: MICROBIOME SEQUENCING SERVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 117 FRANCE: MICROBIOME SEQUENCING SERVICES MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 118 FRANCE: MICROBIOME SEQUENCING SERVICES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 119 ITALY: MICROBIOME SEQUENCING SERVICES MARKET, BY SERVICE, 2021–2028 (USD MILLION)

- TABLE 120 ITALY: MICROBIOME SEQUENCING SERVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 121 ITALY: MICROBIOME SEQUENCING SERVICES MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 122 ITALY: MICROBIOME SEQUENCING SERVICES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 123 SPAIN: MICROBIOME SEQUENCING SERVICES MARKET, BY SERVICE, 2021–2028 (USD MILLION)

- TABLE 124 SPAIN: MICROBIOME SEQUENCING SERVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 125 SPAIN: MICROBIOME SEQUENCING SERVICES MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 126 SPAIN: MICROBIOME SEQUENCING SERVICES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 127 REST OF EUROPE: MICROBIOME SEQUENCING SERVICES MARKET, BY SERVICE, 2021–2028 (USD MILLION)

- TABLE 128 REST OF EUROPE: MICROBIOME SEQUENCING SERVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 129 REST OF EUROPE: MICROBIOME SEQUENCING SERVICES MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 130 REST OF EUROPE: MICROBIOME SEQUENCING SERVICES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 131 ASIA PACIFIC: MICROBIOME SEQUENCING SERVICES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 132 ASIA PACIFIC: MICROBIOME SEQUENCING SERVICES MARKET, BY SERVICE, 2021–2028 (USD MILLION)

- TABLE 133 ASIA PACIFIC: MICROBIOME SEQUENCING SERVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 134 ASIA PACIFIC: MICROBIOME SEQUENCING SERVICES MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 135 ASIA PACIFIC: MICROBIOME SEQUENCING SERVICES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 136 CHINA: MICROBIOME SEQUENCING SERVICES MARKET, BY SERVICE, 2021–2028 (USD MILLION)

- TABLE 137 CHINA: MICROBIOME SEQUENCING SERVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 138 CHINA: MICROBIOME SEQUENCING SERVICES MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 139 CHINA: MICROBIOME SEQUENCING SERVICES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 140 JAPAN: MICROBIOME SEQUENCING SERVICES MARKET, BY SERVICE, 2021–2028 (USD MILLION)

- TABLE 141 JAPAN: MICROBIOME SEQUENCING SERVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 142 JAPAN: MICROBIOME SEQUENCING SERVICES MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 143 JAPAN: MICROBIOME SEQUENCING SERVICES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 144 INDIA: MICROBIOME SEQUENCING SERVICES MARKET, BY SERVICE, 2021–2028 (USD MILLION)

- TABLE 145 INDIA: MICROBIOME SEQUENCING SERVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 146 INDIA: MICROBIOME SEQUENCING SERVICES MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 147 INDIA: MICROBIOME SEQUENCING SERVICES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 148 REST OF ASIA PACIFIC: MICROBIOME SEQUENCING SERVICES MARKET, BY SERVICE, 2021–2028 (USD MILLION)

- TABLE 149 REST OF ASIA PACIFIC: MICROBIOME SEQUENCING SERVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 150 REST OF ASIA PACIFIC: MICROBIOME SEQUENCING SERVICES MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 151 REST OF ASIA PACIFIC: MICROBIOME SEQUENCING SERVICES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 152 LATIN AMERICA: MICROBIOME SEQUENCING SERVICES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 153 LATIN AMERICA: MICROBIOME SEQUENCING SERVICES MARKET, BY SERVICE, 2021–2028 (USD MILLION)

- TABLE 154 LATIN AMERICA: MICROBIOME SEQUENCING SERVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 155 LATIN AMERICA: MICROBIOME SEQUENCING SERVICES MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 156 LATIN AMERICA: MICROBIOME SEQUENCING SERVICES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 157 BRAZIL: MICROBIOME SEQUENCING SERVICES MARKET, BY SERVICE, 2021–2028 (USD MILLION)

- TABLE 158 BRAZIL: MICROBIOME SEQUENCING SERVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 159 BRAZIL: MICROBIOME SEQUENCING SERVICES MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 160 BRAZIL: MICROBIOME SEQUENCING SERVICES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 161 REST OF LATIN AMERICA: MICROBIOME SEQUENCING SERVICES MARKET, BY SERVICE, 2021–2028 (USD MILLION)

- TABLE 162 REST OF LATIN AMERICA: MICROBIOME SEQUENCING SERVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 163 REST OF LATIN AMERICA: MICROBIOME SEQUENCING SERVICES MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 164 REST OF LATIN AMERICA: MICROBIOME SEQUENCING SERVICES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 165 MIDDLE EAST & AFRICA: MICROBIOME SEQUENCING SERVICES MARKET, BY SERVICE, 2021–2028 (USD MILLION)

- TABLE 166 MIDDLE EAST & AFRICA: MICROBIOME SEQUENCING SERVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 167 MIDDLE EAST & AFRICA: MICROBIOME SEQUENCING SERVICES MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 168 MIDDLE EAST & AFRICA: MICROBIOME SEQUENCING SERVICES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 169 MICROBIOME SEQUENCING SERVICES MARKET: DEGREE OF COMPETITION

- TABLE 170 SERVICE LAUNCHES

- TABLE 171 DEALS

- TABLE 172 CHARLES RIVER LABORATORIES: BUSINESS OVERVIEW

- TABLE 173 EUROFINS SCIENTIFIC: BUSINESS OVERVIEW

- TABLE 174 BGI GROUP: BUSINESS OVERVIEW

- TABLE 175 COSMOSID: BUSINESS OVERVIEW

- TABLE 176 MICROBA: BUSINESS OVERVIEW

- TABLE 177 QIAGEN N.V.: BUSINESS OVERVIEW

- TABLE 178 MICROBIOME INSIGHTS: BUSINESS OVERVIEW

- TABLE 179 BASECLEAR: BUSINESS OVERVIEW

- TABLE 180 CD GENOMICS: COMPANY OVERVIEW

- TABLE 181 ZYMO RESEARCH CORPORATION: COMPANY OVERVIEW

- TABLE 182 ORASURE TECHNOLOGIES: BUSINESS OVERVIEW

- TABLE 183 MR DNA: BUSINESS OVERVIEW

- TABLE 184 EREMID GENOMIC SERVICES: BUSINESS OVERVIEW

- TABLE 185 CLINICAL-MICROBIOMICS A/S: BUSINESS OVERVIEW

- TABLE 186 NOVOGENE CO., LTD.: BUSINESS OVERVIEW

- FIGURE 1 RESEARCH DESIGN

- FIGURE 2 MICROBIOME SEQUENCING SERVICES MARKET: BREAKDOWN OF PRIMARIES

- FIGURE 3 MICROBIOME SEQUENCING SERVICES MARKET SIZE ESTIMATION (SUPPLY-SIDE ANALYSIS), 2022

- FIGURE 4 MARKET SIZE ESTIMATION: APPROACH 1 (COMPANY REVENUE ANALYSIS-BASED ESTIMATION), 2022

- FIGURE 5 ILLUSTRATIVE EXAMPLE OF COMPANY REVENUE ANALYSIS, 2022

- FIGURE 6 MARKET SIZE VALIDATION FROM PRIMARY SOURCES

- FIGURE 7 MICROBIOME SEQUENCING SERVICES MARKET (SUPPLY-SIDE): CAGR PROJECTIONS

- FIGURE 8 MICROBIOME SEQUENCING SERVICES MARKET: GROWTH ANALYSIS OF DEMAND-SIDE DRIVERS

- FIGURE 9 DATA TRIANGULATION METHODOLOGY

- FIGURE 10 MICROBIOME SEQUENCING SERVICES MARKET, BY SERVICE, 2023 VS. 2028 (USD MILLION)

- FIGURE 11 MICROBIOME SEQUENCING SERVICES MARKET, BY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 12 MICROBIOME SEQUENCING SERVICES MARKET, BY TECHNOLOGY, 2023 VS. 2028 (USD MILLION)

- FIGURE 13 MICROBIOME SEQUENCING SERVICES MARKET, BY END USER, 2023 VS. 2028 (USD MILLION)

- FIGURE 14 GEOGRAPHICAL SNAPSHOT OF MICROBIOME SEQUENCING SERVICES MARKET

- FIGURE 15 GROWING FOCUS ON HUMAN MICROBIOME THERAPEUTICS DEVELOPMENT TO DRIVE MARKET

- FIGURE 16 SEQUENCING AND LIBRARY PREPARATION SERVICES TO ACCOUNT FOR LARGEST SHARE OF NORTH AMERICAN MICROBIOME SEQUENCING SERVICES MARKET IN 2023

- FIGURE 17 SHOTGUN SEQUENCING SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 18 MICROBIOME SEQUENCING SERVICES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 19 ROLE OF MICROBIOME SEQUENCING IN THERAPEUTICS DEVELOPMENT

- FIGURE 20 REVENUE SHIFT AND NEW REVENUE POCKETS FOR MICROBIOME SEQUENCING SERVICE PROVIDERS

- FIGURE 21 VALUE CHAIN ANALYSIS OF MICROBIOME SEQUENCING SERVICES MARKET

- FIGURE 22 ECOSYSTEM OF MICROBIOME SEQUENCING SERVICES MARKET

- FIGURE 23 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF SEQUENCING SERVICES

- FIGURE 24 CRITERIA FOR OUTSOURCING SEQUENCING SERVICES

- FIGURE 25 MICROBIOME SEQUENCING SERVICES MARKET, BY REGION, 2023 VS. 2028 (USD MILLION)

- FIGURE 26 NORTH AMERICA: MICROBIOME SEQUENCING SERVICES MARKET SNAPSHOT

- FIGURE 27 ASIA PACIFIC: MICROBIOME SEQUENCING SERVICES MARKET SNAPSHOT

- FIGURE 28 STRATEGIES ADOPTED BY KEY PLAYERS IN MICROBIOME SEQUENCING SERVICES MARKET, 2020–2023

- FIGURE 29 MICROBIOME SEQUENCING SERVICES MARKET SHARE ANALYSIS, BY KEY PLAYER, 2022

- FIGURE 30 REVENUE SHARE ANALYSIS OF TOP PLAYERS IN MICROBIOME SEQUENCING SERVICES MARKET, 2020–2022

- FIGURE 31 MICROBIOME SEQUENCING SERVICES MARKET: COMPANY EVALUATION QUADRANT, 2022

- FIGURE 32 CHARLES RIVER LABORATORIES: COMPANY SNAPSHOT (2022)

- FIGURE 33 EUROFINS SCIENTIFIC: COMPANY SNAPSHOT (2022)

- FIGURE 34 QIAGEN N.V.: COMPANY SNAPSHOT (2022)

- FIGURE 35 ORASURE TECHNOLOGIES: COMPANY SNAPSHOT (2022)

This study involved four major activities in estimating the current size of the microbiome sequencing services market. Exhaustive secondary research was carried out to collect information on the market, its peer markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation procedures were used to estimate the market size of segments.

Secondary Research

Secondary research was used mainly to identify and collect information for the extensive, technical, market-oriented, and commercial study of the microbiome sequencing services market. The secondary sources used for this study include publications from government sources National Human Genome Research Institute (NHGRI), the National Center for Biotechnology Information (NCBI), the Genomics Research and Development Initiative (GRDI), UK Research and Innovation (UKRI), Microbiome Foundation France, the Centre for Genomic Regulation (CRG) Spain, Human MetaGenome Consortium Japan (HMGJ), Microbiome Research Centre (MRC) Australia, Center of Innovation in Personalized Medicine (CIPM), Department of Biotechnology (GENOME India and Microbiome) India, South African Society for Human Genetics, Food and Drug Administration (FDA), Annual Reports, SEC Fillings, Press Releases, Investor Presentation, Expert Interviews, and MarketsandMarkets Analysis. These sources were also used to obtain key information about major players, market classification, and segmentation according to industry trends, regional/country-level markets, market developments, and technology perspectives.

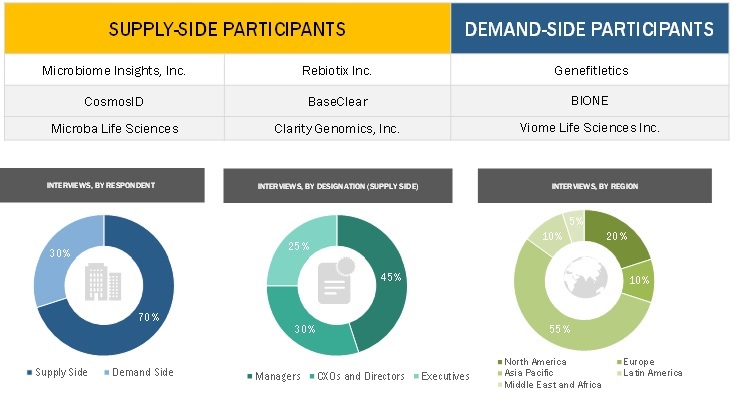

Primary Research

In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify the critical qualitative and quantitative information as well as assess prospects of the market. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the microbiome sequencing services market. These methods were also used extensively to estimate the size of various segments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes—the market was split into several segments. To complete the overall market engineering process and arrive at the exact statistics of each market segments, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the microbiome sequencing services industry.

Market Definition

Microbiome sequencing is applied to decode the genetic material of all the microorganisms in a given sample which may contain bacteria, viruses, or fungi. Whole-genome sequencing (WGS) and amplicon sequencing are the two key microbiome sequencing services. Sequencing-based detection of microorganisms exhibits different advantages over traditional approaches, some of which are mentioned below:

- Detection of anaerobic bacteria

- More cost-effective microbiome characterization of multiplex microbial samples

- Identification of non-cultivable bacteria

- Estimate the relative abundance of microbes in a sample

- Profile hundreds of microorganisms in a single analysis

- Examine complex microbiomes and microbiota communities

The microbiome sequencing services market comprises services employed for sample preparation, sequencing, library preparation, and data analysis suitable for different samples, including human microbiome samples and environmental samples.

Key Stakeholders

- Research Institutes

- Pharmaceutical and Biotechnology Companies

- Microbiome Sequencing Service Providers

- Metagenomic Sequencing Service Providers

- NGS Service Providers

- Venture Capitalists and Investors

- Contract Research Organizations

- Government Associations

- Healthcare Associations/Institutes

- Business Research and Consulting Service Providers

Report Objectives

- To define, describe, and forecast the global microbiome sequencing services market based on service, type, technology, end user, and region

- To provide detailed information regarding the major factors influencing the market growth (such as drivers, restraints, challenges, and opportunities)

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

-

To analyze the opportunities in the market for stakeholders and provide details of

the competitive landscape for market leaders operating in the market - To forecast the revenue of the market with respect to five regional segments—North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To profile the key market players and comprehensively analyze their service portfolios, market positions, and core competencies

- To track and analyze competitive developments such as services launches, expansions, agreements, collaborations, partnerships, and acquisitions in the market

- Micromarkets are the further segments and subsegments of the market.

- Core competencies of companies are captured in terms of the key developments, market shares, and key strategies adopted to sustain their positions in the market.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

- Company Information: Detailed analysis and profiling of additional market players (up to five)

- Geographic Analysis: Further breakdown of the RoE microbiome sequencing services market, by country. Further breakdown of the RoAPAC microbiome sequencing services market, by country. Further breakdown of the RoLATAM and MEA microbiome sequencing services markets, by country.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Microbiome Sequencing Services Market