Microarray Analysis Market by Product & Service (Consumables, Instrument, Software, Services), Type (DNA, Protein Microarray), Application (Research), End User (Diagnostic Laboratories, Pharmaceutical & Biotechnology Companies) - Global Forecasts to 2023

The global microarray analysis market is projected to reach USD 5.52 billion by 2023, at a CAGR of 7.6%. The major factors driving the growth of this market are the increasing incidence of cancer, increasing funding for genomic and proteomic research, and growing application areas of microarrays.

The objectives of this study are as follows:

- To define, describe, segment, and forecast the microarray analysis market by product and service, type, application, end user, and region

- To forecast the size of the market with respect to four main regional segments, namely, North America, Europe, Asia Pacific, and the Rest of the World (RoW)

- To provide detailed information about factors influencing the growth of the market (drivers, opportunities, and challenges)

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To profile key players and comprehensively analyze their market shares and core competencies in terms of market developments and growth strategies

- To track and analyze competitive developments such as product approval, agreements, acquisitions, and product launches in the market

Drivers

Increasing incidence of cancer

DNA microarrays are used for the diagnosis of various types of cancers. As a result, the rising incidence of cancer across the globe is expected to support the growth of the microarray analysis market during the forecast period. According to the WHO, cancer is the second-leading cause of death globally and accounted for 8.8 million deaths in 2015. Also, globally, the incidence of cancer is expected to increase from 14.1 million in 2012 to 21.7 million by 2030. As of 2015, 15.2 million cancer cases were diagnosed globally, with 57.0% of them being reported across developing countries in Africa, Latin America, and Asia (Source: GLOBOCAN, 2012).

Growing application areas of microarrays

The microarray technology is primarily used in genome mapping and sequencing applications. However, over the last few years, this technology is increasingly being used in the diagnosis of infectious and genetic diseases, drug discovery, pharmacogenomic research, cancer diagnostics, and forensic applications. Additionally, the microarray technology is also used in immunology research such as the study of the relation between phenotype and gene expression, activation and differentiation of immune cells, regulation of immune responses, analysis of the molecular mechanisms of allergy, and immunological pharmacology.

Research Methodology

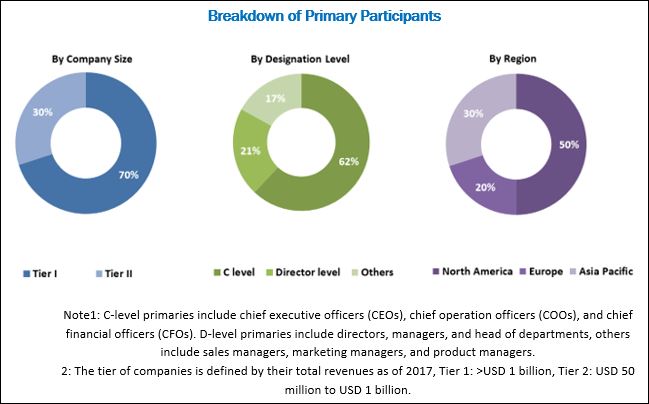

Top-down and bottom-up approaches were used to estimate and validate the size of the market and to estimate the size of various other dependent submarkets. The overall market size was used in the top-down approach to estimate the sizes of other individual submarkets (mentioned in the market segmentation by product and service, type, application, and end user) through percentage splits from secondary and primary research. The bottom-up approach was also implemented (wherever applicable) for data extracted from secondary research to validate the market segment revenues obtained. Various secondary sources such as Bloomberg Business, Factiva, and Avention; white papers; annual reports; company house documents; and SEC filings of companies. Societies and organizations such as the Human Genome Organisation, World Health Organization (WHO) and the Centers for Disease Control and Prevention (CDC) have been used to identify and collect information useful for this extensive commercial study of the market. Primary sources such as experts from related industries and suppliers have been interviewed to obtain and verify critical information as well as to assess prospects of the microarray analysis market. The breakdown of profiles of primaries is shown in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

The key players in the microarray analysis market include are Thermo Fisher Scientific, Inc. (US), Agilent Technologies, Inc. (US), Molecular Devices (US), PerkinElmer Inc. (US), Illumina, Inc. (US), GE Healthcare (US), and Bio-Rad Laboratories Inc. (US).

Target Audience for this Report:

- Pharmaceutical companies

- Biotechnology companies

- Research institutes

- Contract research organizations

- Research and consulting companies

- Microarray manufacturers & distributors

- DNA & gene chip manufacturers & distributors

Expansions

|

Year |

Company |

Location |

Description |

|

2017 |

Agilent Technologies |

Germany |

Opened its new customer & technology center in Waldbronn |

|

2017 |

Illumina |

France |

Opened its Solutions Center on the Genopole Campus in Évry, Paris |

Acquisitions

|

Year |

Company 1 |

Company 2 |

Description |

|

2017 |

PerkinElmer |

EUROIMMUN (Germany) |

This acquisition strengthened Perkin Elmer’s microarray analysis portfolio |

|

2016 |

Thermo Fisher Scientific |

Affymetrix, Inc. (US) |

The acquisition provided Thermo Fisher access to Affymetrix’s antibody portfolio and new genetic analysis capabilities for clinical purposes. |

Agreements

|

Month/Year |

Company 1 |

Company 2 |

Description |

|

2018 |

Merck |

HistoCyte Laboratories (UK) |

For the distribution HistoCyte’s portfolio of cell line reference products for immunohistochemistry and in situ hybridization in the US and other select geographies |

|

2017 |

Agilent Technologies |

Agendia (Netherlands) |

To expand their relationship to include the development of an RNA-Seq kit version of Agendia's currently marketed MammaPrint and BluePrint tests |

Product Launches and Approvals

|

Year |

Company |

Segment |

Product |

|

2018 |

Agilent Technologies |

Instrument |

The China Food and Drug Administration approved the SureScan Dx microarray scanner |

|

2017 |

Thermo Fisher Scientific |

Probes |

Axiom Africa array for medical and population genomics |

Scope of the Report:

This report categorizes the microarray analysis market into the following segments:

Microarray Analysis Market, By Product and Service

- Consumables

- Instruments

- Software and Services

Microarray Analysis Market, By Type

- DNA Microarrays

- Protein Microarrays

- Other Microarrays

Microarray Analysis Market, By Application

- Research Applications

- Drug Discovery

- Disease Diagnostics

- Other Applications

Microarray Analysis Market, By End User

- Research and Academic Institutes

- Pharmaceutical and Biotechnology Companies

- Diagnostic Laboratories

- Other End Users

Microarray Analysis Market, By Region

-

North America

- US

- Canada

- Europe

-

Asia Pacific

- China

- India

- Japan

- RoAPAC (Rest of Asia Pacific)

- Rest of the World

Customization Options:

- Company Information: Detailed company profiles of five or more market players

- Opportunities Assessment: A detailed report underlining the various growth opportunities presented in the market

By product and service, the market is segmented into consumables, software & services, instruments. In 2018, the consumables segment is estimated to command the largest share of the microarray analysis market. The large share of this segment can be attributed to the growing applications of microarray in various fields and the regular, repeated, & bulk purchases of consumables.

On the basis of type, the market has been segmented into DNA microarrays, protein microarrays, and other microarrays. DNA microarrays are expected to account for the largest share of the microarray analysis market. The large share of this segment can be attributed to the use of DNA microarrays in various applications such as drug discovery, genomic and cancer research, personalized medicine, and genetic disease diagnosis.

Based on application, the market has been segmented into research applications, disease diagnostics, drug discovery, and other applications. The research applications segment is projected to account for the largest share of the market. Increasing private and government funding for genomic and proteomic research is the major driving factor for this market.

The end user segment categorized into research and academic institutes, pharmaceutical and biotechnology companies, diagnostic laboratories, and other end users. Research and academic institutes are expected to command the largest market share of this market. Increasing funding and growing initiatives by governments to support Genomics and Proteomics research projects is a key factor driving the growth of the research and academic institutes segment.

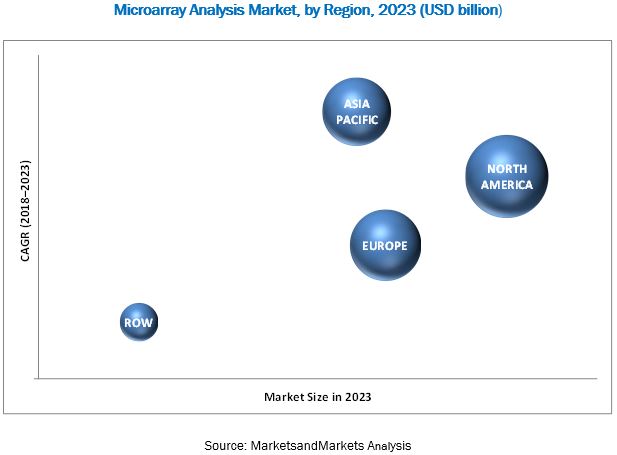

The market is dominated by North America, followed by Europe. North America will continue to dominate the market during the forecast period. The increasing incidence of various diseases such as cancer and genetic diseases in this region and increasing funding for genomics and proteomics research in this region are the major factors supporting the growth of the microarray analysis market in North America.

The emergence of NGS as an effective alternative to the microarray technology may hinder the growth of the market to a certain extent.

The major players in the microarray analysis market include Thermo Fisher Scientific, Inc. (US), Agilent Technologies, Inc. (US), Molecular Devices (US), PerkinElmer Inc. (US), Illumina, Inc. (US), GE Healthcare (US), and Bio-Rad Laboratories Inc. (US).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 12)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Market Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 15)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Assumptions for the Study

3 Executive Summary (Page No. - 23)

4 Premium Insights (Page No. - 27)

4.1 Microarray Analysis Market Overview

4.2 Asia Pacific: Market, By Product & Service (2018)

4.3 Market, By Region (2018)

4.4 Geographical Snapshot of the Market

5 Market Overview (Page No. - 31)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Incidence of Cancer

5.2.1.2 Growth in Funding for Genomic and Proteomic Research

5.2.1.3 Growing Application Areas of Microarrays

5.2.2 Opportunities

5.2.2.1 Use of Microarrays in Personalized Medicine

5.2.3 Challenges

5.2.3.1 Growing Adoption of Next-Generation Sequencing

6 Microarray Analysis Market, By Product and Service (Page No. - 35)

6.1 Introduction

6.2 Consumables

6.3 Software and Services

6.4 Instruments

7 Microarray Analysis Market, By Type (Page No. - 40)

7.1 Introduction

7.2 Dna Microarrays

7.3 Protein Microarrays

7.4 Other Microarrays

8 Microarray Analysis Market, By Application (Page No. - 44)

8.1 Introduction

8.2 Research Applications

8.3 Drug Discovery

8.4 Disease Diagnostics

8.5 Other Applications

9 Microarray Analysis Market, By End User (Page No. - 50)

9.1 Introduction

9.2 Research & Academic Institutes

9.3 Pharmaceutical & Biotechnology Companies

9.4 Diagnostic Laboratories

9.5 Other End Users

10 Microarray Analysis Market, By Region (Page No. - 56)

10.1 Introduction

10.2 North America

10.2.1 US

10.2.2 Canada

10.3 Europe

10.4 Asia Pacific

10.4.1 China

10.4.2 India

10.4.3 Japan

10.4.4 Rest of Asia Pacific

10.5 Rest of the World

11 Competitive Landscape (Page No. - 80)

11.1 Overview

11.2 Market Ranking Analysis, 2017

11.3 Competitive Scenario

11.3.1 Expansions

11.3.2 Acquisitions

11.3.3 Agreements

11.3.4 Product Launches and Approvals

12 Company Profiles (Page No. - 84)

(Introduction, Products & Services, Strategy, & Analyst Insights, Developments, MnM View)*

12.1 Thermo Fisher Scientific

12.2 Agilent Technologies

12.3 Illumina

12.4 Perkinelmer, Inc.

12.5 Merck KGaA

12.6 GE Healthcare

12.7 Molecular Devices (A Subsidiary of Danaher)

12.8 Arrayit Corporation

12.9 Bio-Rad Laboratories

12.10 Microarrays, Inc.

*Details on Marketsandmarkets View, Introduction, Product & Services, Strategy, & Analyst Insights, New Developments Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 107)

13.1 Insights of Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.4 Available Customizations

13.5 Related Reports

13.6 Author Details

List of Tables (63 Tables)

Table 1 Growth in the Number of Personalized Medications, 2008–2016

Table 2 Microarray Analysis Market, By Product & Service, 2016–2023 (USD Million)

Table 3 Microarray Analysis Consumables Market, By Region, 2016–2023 (USD Million)

Table 4 Microarray Analysis Software and Services Market, By Region, 2016–2023 (USD Million)

Table 5 Microarray Analysis Instruments Market, By Region, 2016–2023 (USD Million)

Table 6 Market, By Type, 2016–2023 (USD Million)

Table 7 Microarray Analysis Market for Dna Microarrays, By Region, 2016–2023 (USD Million)

Table 8 Market for Protein Microarrays, By Region, 2016–2023 (USD Million)

Table 9 Market for Other Microarrays, By Region, 2016–2023 (USD Million)

Table 10 Microarray Analysis Market, By Application, 2016–2023 (USD Million)

Table 11 Microarray Analysis Market for Research Applications, By Region, 2016–2023 (USD Million)

Table 12 Market for Drug Discovery, By Region, 2016–2023 (USD Million)

Table 13 Microarray Analysis Market for Disease Diagnostics, By Region, 2016–2023 (USD Million)

Table 14 Market for Other Applications, By Region, 2016–2023 (USD Million)

Table 15 Microarray Analysis Market, By End User, 2016–2023 (USD Million)

Table 16 Market for Research & Academic Institutes, By Region, 2016–2023 (USD Million)

Table 17 Microarray Analysis Market for Pharmaceutical & Biotechnology Companies, By Region, 2016–2023 (USD Million)

Table 18 Microarray Analysis Market for Diagnostics Laboratories, By Region, 2016–2023 (USD Million)

Table 19 Market for Other End Users, By Region, 2016–2023 (USD Million)

Table 20 Microarray Analysis Market, By Region, 2016–2023 (USD Million)

Table 21 North America: Market, By Country, 2016–2023 (USD Million)

Table 22 North America: Microarray Analysis Market, By Product & Service, 2016–2023 (USD Million)

Table 23 North America: Microarray Analysis Market, By Type, 2016–2023 (USD Million)

Table 24 North America: Market, By Application, 2016–2023 (USD Million)

Table 25 North America: Microarray Analysis Market, By End User, 2016–2023 (USD Million)

Table 26 US: Market, By Product & Service, 2016–2023 (USD Million)

Table 27 US: Microarray Analysis Market, By Type, 2016–2023 (USD Million)

Table 28 US: Market, By Application, 2016–2023 (USD Million)

Table 29 US: Microarray Analysis Market, By End User, 2016–2023 (USD Million)

Table 30 Canada: Market, By Product & Service, 2016–2023 (USD Million)

Table 31 Canada: Microarray Analysis Market, By Type, 2016–2023 (USD Million)

Table 32 Canada: Market, By Application, 2016–2023 (USD Million)

Table 33 Canada: Microarray Analysis Market, By End User, 2016–2023 (USD Million)

Table 34 Europe: Market, By Product & Service, 2016–2023 (USD Million)

Table 35 Europe: Microarray Analysis Market, By Type, 2016–2023 (USD Million)

Table 36 Europe: Market, By Application, 2016–2023 (USD Million)

Table 37 Europe: Microarray Analysis Market, By End User, 2016–2023 (USD Million)

Table 38 Asia Pacific: Market, By Country, 2016–2023 (USD Million)

Table 39 Asia Pacific: Market, By Product & Service, 2016–2023 (USD Million)

Table 40 Asia Pacific: Microarray Analysis Market, By Type, 2016–2023 (USD Million)

Table 41 Asia Pacific: Market, By Application, 2016–2023 (USD Million)

Table 42 Asia Pacific: Market, By End User, 2016–2023 (USD Million)

Table 43 China: Market, By Product & Service, 2016–2023 (USD Million)

Table 44 China: Market, By Type, 2016–2023 (USD Million)

Table 45 China: Market, By Application, 2016–2023 (USD Million)

Table 46 China: Microarray Analysis Market, By End User, 2016–2023 (USD Million)

Table 47 India: Market, By Product & Service, 2016–2023 (USD Million)

Table 48 India: Market, By Type, 2016–2023 (USD Million)

Table 49 India: Market, By Application, 2016–2023 (USD Million)

Table 50 India: Microarray Analysis Market, By End User, 2016–2023 (USD Million)

Table 51 Japan: Market, By Product & Service, 2016–2023 (USD Million)

Table 52 Japan: Market, By Type, 2016–2023 (USD Million)

Table 53 Japan: Microarray Analysis Market, By Application, 2016–2023 (USD Million)

Table 54 Japan: Market, By End User, 2016–2023 (USD Million)

Table 55 RoAPAC: Microarray Analysis Market, By Product & Service, 2016–2023 (USD Million)

Table 56 RoAPAC: Market, By Type, 2016–2023 (USD Million)

Table 57 RoAPAC: Market, By Application, 2016–2023 (USD Million)

Table 58 RoAPAC: alysis Market, By End User, 2016–2023 (USD Million)

Table 59 RoW: Microarray Analysis Market, By Product & Service, 2016–2023 (USD Million)

Table 60 RoW: Market, By Type, 2016–2023 (USD Million)

Table 61 RoW: Market, By Application, 2016–2023 (USD Million)

Table 62 RoW: Market, By End User, 2016–2023 (USD Million)

Table 63 Top Five Companies in the Microarray Analysis Market, 2017

List of Figures (31 Figures)

Figure 1 Research Methodology

Figure 2 Breakdown of Primary Interviews

Figure 3 Bottom-Up Approach

Figure 4 Top-Down Approach

Figure 5 Data Triangulation Methodology

Figure 6 Microarray Analysis Market, By Product and Service, 2018 vs 2023 (USD Billion)

Figure 7 Market, By Type, 2018 vs 2023 (USD Billion)

Figure 8 Market, By Application, 2018 vs 2023 (USD Million)

Figure 9 Market, By End User, 2018 vs 2023 (USD Million)

Figure 10 Microarray Analysis Market, By Region, 2018 vs 2023 (USD Billion)

Figure 11 Increasing Incidence of Cancer is Expected to Drive Market Growth

Figure 12 Consumables are Expected to Command the Largest Market Share in 2018

Figure 13 North America is Expected to Hold the Largest Share of the Microarray Analysis Market in 2018

Figure 14 China to Register the Highest CAGR During the Forecast Period

Figure 15 Market: Drivers, Opportunities, and Challenges

Figure 16 Consumables Segment to Register the Highest CAGR During the Forecast Period

Figure 17 DNA Microarrays Segment to Register the Highest CAGR During the Forecast Period

Figure 18 Drug Discovery to Be the Fastest-Growing Application Segment of the Microarray Analysis Market During the Forecast Period

Figure 19 Pharmaceutical & Biotechnology Companies to Register the Highest Growth Rate in the Market During 2018–2023

Figure 20 Microarray Analysis Market in the Asia Pacific to Register the Highest Growth Rate During the Forecast Period

Figure 21 North America: Market Snapshot

Figure 22 Asia Pacific: Microarray Analysis Market Snapshot

Figure 23 Key Developments of Major Players From 2015 to 2018

Figure 24 Thermo Fisher Scientific: Company Snapshot

Figure 25 Agilent Technologies: Company Snapshot

Figure 26 Illumina: Company Snapshot

Figure 27 Perkinelmer, Inc.: Company Snapshot

Figure 28 Merck KGaA: Company Snapshot

Figure 29 GE Company: Company Snapshot

Figure 30 Danaher Corporation: Company Snapshot

Figure 31 Bio-Rad: Company Snapshot

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Microarray Analysis Market