Micro-Perforated Films Market by Material(PE, PP, and PET), Application (Fresh Fruits & Vegetables, Bakery & Confectionery, and Ready-to-eat Food), and Region (North America, Europe, APAC, Middle East & Africa, and South America)-Global Forecast to 2022

[113 Pages Report] global micro-perforated films market was USD 1.19 Billion in 2016 and is projected to reach USD 1.50 Billion by 2022, at a CAGR of 4.0% between 2017 and 2022. In this study, 2016 has been considered the base year and 2022 the forecast year to estimate the micro-perforated films market size.

The objectives of the study are:

- To analyze and forecast the global micro-perforated films market, in terms of value

- To provide detailed information about the key growth factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze and forecast the size of the market on the basis of material and application

- To estimate and forecast the market size on the basis of five regions, namely, Europe, APAC, North America, Middle East & Africa, and South America

- To estimate and forecast the micro-perforated films market at country-level in each of the regions

- To analyze the market opportunities and present a competitive landscape of the market

- To analyze competitive developments, such as new product developments, expansions, acquisitions, and agreements & partnerships in the micro-perforated films market

- To strategically identify and profile key market players and analyze their core competencies*

Note: Core competencies* of the companies are determined in terms of their key developments and key strategies adopted by them to sustain their positions in the market.

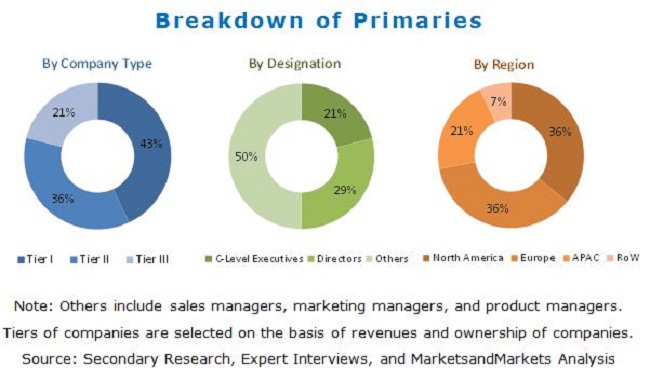

Different secondary sources, such as company websites, encyclopedia, directories, and databases, such as Hoovers, Bloomberg, Businessweek, Factiva, and OneSource have been used to identify and collect information useful for this extensive, commercial study of the global micro-perforated films market. Primary sources, including experts from related industries, have been interviewed to verify and collect critical information and assess prospects of the market. The top-down approach has been implemented to validate the market size in terms of value. Along with the data triangulation procedures and validation of data through primaries, the exact values of the overall parent market size and individual market sizes have been determined and confirmed in this study.

To know about the assumptions considered for the study, download the pdf brochure

The micro-perforated films market has a diversified and established ecosystem of upstream players, such as raw material suppliers, and downstream stakeholders, such as manufacturers, vendors, end users, and government organizations.

This study answers several questions for stakeholders, primarily, which market segments they should focus upon during the next two to five years to prioritize their efforts and investments. These stakeholders include micro-perforated film manufacturers, such as Mondi (Austria), Amcor Limited (Australia), Sealed Air Corporation (US), Bollore Group (France), Uflex Ltd. (India), TCL Packaging (UK), Coveris Holdings S.A. (US), Amerplast (Finland), Aera (France), and Now Plastics (US), among others.

Key Target Audience:

- Manufacturers of Micro-Perforated Films

- Manufacturers in Applications, such as Fresh Vegetables and Fruits, Bakery & Confectionary, Ready-To-Eat Food, Meat, Poultry, and Seafood

- Traders, Distributors, and Suppliers of Micro-Perforated Films

- Regional Manufacturer Associations and General Plastic Film Associations

- Government and Regional Agencies and Research Organizations

Scope of the Report:

This research report categorizes the global micro-perforated films market based on material, application, and region, forecasts revenue growth, and provides an analysis of trends in each of the submarkets.

Based on Material:

- Polyethylene (PE)

- Polypropylene (PP)

- Polyethylene Terephthalate (PET)

- Others

Each material is further described in detail in the report with value forecasts until 2022.

Based on Application:

- Fresh Fruits & Vegetables

- Bakery & Confectionary

- Ready-To-Eat Food

- Others

Each application is further described in detail in the report with value forecasts until 2022.

Based on Region:

- APAC

- North America

- Europe

- Middle East & Africa

- South America

Each region is further segmented by key countries, such as China, India, Australia, Japan, South Korea, the US, Mexico, Canada, Germany, the UK, Italy, France, The Netherlands, Saudi Arabia, the UAE, South Africa, Argentina, and Brazil.

Available Customizations:

he following customization options are available for the report:

Company Information- Analysis and profiles of additional global as well as regional market players (up to 3)

- Further breakdown of the Rest of APAC micro-perforated films market into Singapore, Malaysia, the Philippines, Thailand, and others

- Further breakdown of the Rest of European micro-perforated films market into Poland, Austria, Belgium, and others

The global micro-perforated films market is estimated at USD 1.23 Billion in 2017 and is projected to reach USD 1.50 Billion by 2022, at a CAGR of 4.0% between 2017 and 2022. The market is witnessing growth due to the increasing use of micro-perforated films for food packaging applications, such as fresh fruits & vegetables, bakery & confectionary, ready-to-eat food, and others which include meat, seafood, and poultry.

Based on material, the micro-perforated films market is segmented into PE, PP, PET, and others. PE is estimated to lead the segment in 2017 owing to the wide usage in food packaging applications. However, the PP segment is projected to register the highest CAGR during the forecast period owing to its low price, recyclability, excellent transparency, as well as increasing demand for Biaxially-oriented Polypropylene (BOPP).

Based on application, the micro-perforated films market is segmented into fresh fruits & vegetables, bakery & confectionary, ready-to-eat food products, and others. The fresh fruits & vegetables segment is estimated to be the largest segment of the global micro-perforated films market in 2017, and is further projected to be the fastest-growing during the forecast period. This is due to the increasing demand for use in packing fresh fruits & vegetables to enable to keep them fresh and extend their shelf life. Convenient handling, changing lifestyles, increasing retail chains, and growing disposable incomes are further expected to drive the market in the fresh fruits & vegetables segment.

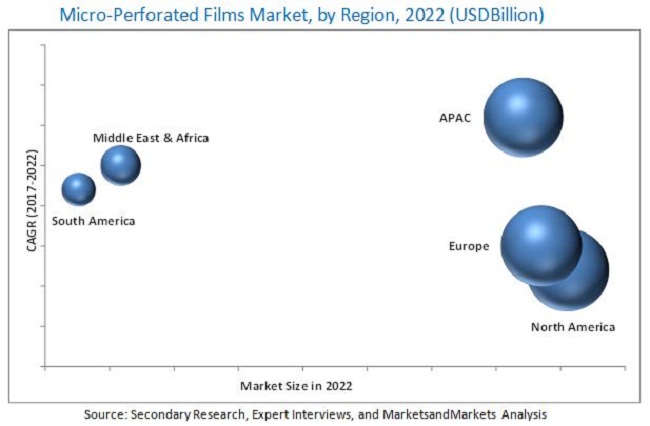

North America is estimated to be the largest market for micro-perforated films in 2017. Increasing awareness towards the consumption of healthier and convenience food products, presence of major manufacturers, along with the higher penetration of retail formats is expected to boost the demand for micro-perforated films in the region during the forecast period. APAC is projected to be the fastest-growing micro-perforated films market between 2017 and 2022. The growth of the market in APAC can be attributed to the rapidly increasing consumption of micro-perforated films to pack fresh fruits & vegetables, bakery & confectionary, and ready-to-eat food applications, in countries, such as China, India, and Japan. Apart from this, expansion of retail channels, increasing urbanization, large consumer base, and increasing disposable incomes are expected to drive the market in the region.

The global micro-perforated films market is witnessing moderate growth. Factors restraining and challenging the growth of the micro-perforated films market are the limitations pertaining to film thickness and susceptibility to contamination.

Mondi (Austria), Amcor Limited (Australia), Sealed Air Corporation (US), Bollore Group (France), and Uflex Ltd. (India), lead the global micro-perforated films market. These players are the major manufacturers of micro-perforated films and are gaining a strong foothold in the market due to their robust business strategies.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 12)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market ScoPe

1.4 Years Considered for the Study

1.5 Currency

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 15)

2.1 Research Data

2.2 Secondary Data

2.2.1 Key Data From Secondary Sources

2.3 Primary Data

2.4 Market Size Estimation

2.4.1 Bottom-Up Approach

2.4.2 Top-Down Approach

2.5 Data Triangulation

2.6 Assumptions

3 Executive Summary (Page No. - 22)

4 Premium Insights (Page No. - 26)

4.1 Attractive Opportunities In the Micro-Perforated Films Market

4.2 Micro-Perforated Films Market, By Region

4.3 North America: Micro-Perforated Films Market

4.4 Micro-Perforated Films Market, By Country

5 Market Overview (Page No. - 29)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Demand for Longer Shelf Life of Food Products

5.2.1.2 Increasing Number of Retail Chains In Developing Countries

5.2.2 Restraints

5.2.2.1 Susceptibility to Contamination

5.2.3 Opportunities

5.2.3.1 Increasing Use of Micro-Perforated Films In Personal Care and Agricultural Industries

5.2.4 Challenges

5.2.4.1 Limitations Pertaining to Film Thickness

5.3 Porters Five Forces Analysis

5.3.1 Threat of New Entrants

5.3.2 Threat of Substitutes

5.3.3 Bargaining Power of Suppliers

5.3.4 Bargaining Power of Buyers

5.3.5 Intensity of ComPetitive Rivalry

5.4 Macroeconomic Indicators

5.4.1 Trends and Forecast of Gdp

5.4.2 Food Losses and Waste

6 Micro-Perforated Films Market, By Material (Page No. - 36)

6.1 Introduction

6.2 PE

6.3 PP

6.4 PET

6.5 Others

7 Micro-Perforated Films Market, By Application (Page No. - 41)

7.1 Introduction

7.2 Fresh Fruits & Vegetables

7.3 Bakery & Confectionary

7.4 Ready-To-Eat Food

7.5 Others

8 Micro-Perforated Films Market, By Region (Page No. - 46)

8.1 Introduction

8.2 North America

8.2.1 US

8.2.2 Mexico

8.2.3 Canada

8.3 EuroPe

8.3.1 Germany

8.3.2 France

8.3.3 UK

8.3.4 Italy

8.3.5 Netherlands

8.3.6 Rest of EuroPe

8.4 APAC

8.4.1 China

8.4.2 India

8.4.3 Japan

8.4.4 South Korea

8.4.5 Australia

8.4.6 Rest of APAC

8.5 Middle East & Africa

8.5.1 Saudi Arabia

8.5.2 UAE

8.5.3 South Africa

8.5.4 Rest of Middle East & Africa

8.6 South America

8.6.1 Brazil

8.6.2 Argentina

8.6.3 Rest of South America

9 ComPetitive LandscaPe (Page No. - 81)

9.1 Introduction

9.2 Market Ranking Analysis

9.3 ComPetitive Scenario

9.4 New Product Development

9.4.1 Expansion

9.4.2 Agreement/Patnership

9.4.3 Acquisition

10 Company Profiles (Page No. - 85)

10.1 Mondi

10.2 Amcor

10.3 Sealed Air

10.4 Bollore

10.5 Uflex

10.6 Tcl Packaging

10.7 Coveris Holdings

10.8 Now Plastics

10.9 Aera

10.10 Amerplast

10.11 Other Company Profiles

10.11.1 Korozo Ambalaj San.Ve Tic A.S.

10.11.2 Helion Industries

10.11.3 Darnel Inc.

10.11.4 Nordfolien

10.11.5 A-Roo Company LLC

10.11.6 Lasersharp Flexpak Services

10.11.7 NG Plastics Limited

10.11.8 SPecialty Polyfilms Pvt. Ltd.

10.11.9 Thermo-Pack Plastic Films Gmbh

10.11.10 Pioneer Hygiene Products

10.11.11 UltraPerf Technologies Inc.

10.11.12 Ervisa

10.11.13 Multivac Group

10.11.14 Pathway Solutions Inc.

10.11.15 Satyam Industries

11 ApPendix (Page No. - 105)

11.1 Insights From Industry ExPerts

11.2 Discussion Guide

11.3 Knowledge Store: Marketsandmarkets Subscription Portal

11.4 Introducing RT: Real-Time Market Intelligence

11.5 Available Customizations

11.6 Related Reports

11.7 Author Details

List of Tables (76 Tables)

Table 1 Forecast of Gdp, 20162022 (USD Billion)

Table 2 Food Losses and Waste Across the Supply Chain, By Region

Table 3 Micro-Perforated Films Market Size, By Material,20152022 (USD Million)

Table 4 Market of PE-Based Micro-Perforated Films Size, By Region,20152022 (USD Million)

Table 5 Market of PP-Based Micro-Perforated Films Size, By Region,20152022 (USD Million)

Table 6 Market of PET-Based Micro-Perforated Films Size, By Material,20152022 (USD Million)

Table 7 Market of Other Micro-Perforated Films Size, By Region,20152022 (USD Million)

Table 8 Market Size, By Application,20152022 (USD Million)

Table 9 Market In Fresh Fruits & Vegetables,By Region, 20152022 (USD Million)

Table 10 Market In Bakery & Confectionary, By Region, 20152022 (USD Million)

Table 11 Market In Ready-To-Eat Food, By Region,20152022 (USD Million)

Table 12 Market In Other Applications, By Region,20152022 (USD Million)

Table 13 Market Size, By Region, 20152022 (USD Million)

Table 14 North America: Micro-Perforated Films Market Size, By Country,20152022 (USD Million)

Table 15 North America: Market Size, By Application, 20152022 (USD Million)

Table 16 North America: Market Size, By Material,20152022 (USD Million)

Table 17 US: Market Size, By Application,20152022 (USD Million)

Table 18 US: Market Size, By Material,20152022 (USD Million)

Table 19 Mexico: Market Size, By Application,20152022 (USD Million)

Table 20 Mexico: Market Size, By Material,20152022 (USD Million)

Table 21 Canada: Market Size, By Application,20152022 (USD Million)

Table 22 Canada: Market Size, By Material,20152022 (USD Million)

Table 23 Europe: Micro-Perforated Films Market Size, By Country,20152022 (USD Million)

Table 24 Europe: Market Size, By Application,20152022 (USD Million)

Table 25 Europe: Market Size, By Material,20152022 (USD Million)

Table 26 Germany: Market Size, By Application,20152022 (USD Million)

Table 27 Germany: Market Size, By Material,20152022 (USD Million)

Table 28 France: Market Size, By Application,20152022 (USD Million)

Table 29 France: Market Size, By Material,20152022 (USD Million)

Table 30 UK: Market Size, By Application,20152022 (USD Million)

Table 31 UK: Market Size, By Material,20152022 (USD Million)

Table 32 Italy: Market Size, By Application,20152022 (USD Million)

Table 33 Italy: Market Size, By Material,20152022 (USD Million)

Table 34 Netherlands: Market Size, By Application, 20152022 (USD Million)

Table 35 Netherlands: Market Size, By Material,20152022 (USD Million)

Table 36 Rest of Europe: Market Size, By Application, 20152022 (USD Million)

Table 37 Rest of Europe: Market Size, By Material, 20152022 (USD Million)

Table 38 APAC: Micro-Perforated Films Market Size, By Country,20152022 (USD Million)

Table 39 APAC: Market Size, By Application,20152022 (USD Million)

Table 40 APAC: Market Size, By Material,20152022 (USD Million)

Table 41 China: Market Size, By Application,20152022 (USD Million)

Table 42 China: Market Size, By Material,20152022 (USD Million)

Table 43 India: Market Size, By Application,20152022 (USD Million)

Table 44 India: Market Size, By Material,20152022 (USD Million)

Table 45 Japan: Market Size, By Application, 20152022 (USD Million)

Table 46 Japan: Market Size, By Material,20152022 (USD Million)

Table 47 South Korea: Market Size, By Application, 20152022 (USD Million)

Table 48 South Korea: Market Size, By Material,20152022 (USD Million)

Table 49 Australia: Market Size, By Application,20152022 (USD Million)

Table 50 Australia: Market Size, By Material,20152022 (USD Million)

Table 51 Rest of APAC: Market Size, By Application, 20152022 (USD Million)

Table 52 Rest of APAC: Market Size, By Material,20152022 (USD Million)

Table 53 Middle East & Africa: Micro-Perforated Films Market Size, By Country, 20152022 (USD Million)

Table 54 Middle East & Africa: Market, By Application, 20152022 (USD Million)

Table 55 Middle East & Africa: Market, By Material, 20152022 (USD Million)

Table 56 Saudi Arabia: Market Size, By Application,20152022 (USD Million)

Table 57 Saudi Arabia: Market Size, By Material,20152022 (USD Million)

Table 58 UAE: Market Size, By Application, 20152022 (USD Million)

Table 59 UAE: Market Size, By Material,20152022 (USD Million)

Table 60 South Africa: Market Size, By Application, 20152022 (USD Million)

Table 61 South Africa: Market Size, By Material, 20152022 (USD Million)

Table 62 Rest of Middle East & Africa: Market Size,By Application, 20152022 (USD Million)

Table 63 Rest of Middle East & Africa: Market Size,By Material, 20152022 (USD Million)

Table 64 South America: Micro-Perforated Films Market Size, By Country,20152022 (USD Million)

Table 65 South America: Market Size, By Application, 20152022 (USD Million)

Table 66 South America: Market Size, By Material,20152022 (USD Million)

Table 67 Brazil: Market Size, By Application,20152022 (USD Million)

Table 68 Brazil: Market Size, By Material,20152022 (USD Million)

Table 69 Argentina: Market Size, By Application,20152022 (USD Million)

Table 70 Argentina: Market Size, By Material,20152022 (USD Million)

Table 71 Rest of South America: Market Size, Application, 20152022 (USD Million)

Table 72 Rest of South America: Market Size,By Material, 20152022 (USD Million)

Table 73 New Product Developments, 20142017

Table 74 Expansions, 20142017

Table 75 Agreements/Partnerships, 20142017

Table 76 Acquisitions, 20142017

List of Figures (28 Figures)

Figure 1 Micro-Perforated Films Market Segmentation

Figure 2 Micro-Perforated Films Market: Research Design

Figure 3 Breakdown of Primary Interviews

Figure 4 Market Size Estimation: Bottom-Up Approach

Figure 5 Market Size Estimation: Top-Down Approach

Figure 6 Micro-Perforated Films Market: Data Triangulation

Figure 7 Pe to Dominate the Market of Micro-Perforated Films

Figure 8 Fresh Fruit & Vegetables to Dominate the Micro-PerforatedFilms Market

Figure 9 APAC to Be the Fastest-Growing Market of Micro-Perforated Films

Figure 10 China to Be the Fastest-Growing Market of Micro-Perforated Films

Figure 11 Growing Demand In Packaging of Fresh Fruits & Vegetables to Drive the Market of Micro-Perforated Films

Figure 12 APAC to Be the Fastest-Growing Market

Figure 13 North America Accounted for the Largest Share In 2016

Figure 14 China to Witness Significant Growth Between 2017 and 2022

Figure 15 Drivers, Restraints, Challenges, and Opportunities of the Micro-Perforated Films Market

Figure 16 PE to Dominate the Market of Micro-Perforated Films

Figure 17 Fresh Fruits & Vegetables Segment to Dominate the Market of Micro-Perforated Films

Figure 18 China to Be the Fastest-Growing Market of Micro-Perforated Films, 20172022

Figure 19 North American Market Snapshot

Figure 20 APAC Market Snapshot

Figure 21 Companies Mainly Adopted Inorganic Growth Strategies, 20142017

Figure 22 Market Ranking of Key Players, 2016

Figure 23 Mondi: Company Snapshot

Figure 24 Amcor: Company Snapshot

Figure 25 Sealed Air: Company Snapshot

Figure 26 Bollore: Company Snapshot

Figure 27 Uflex: Company Snapshot

Figure 28 Coveris Holdings: Company Snapshot

Growth opportunities and latent adjacency in Micro-Perforated Films Market