Micro Injection Molding Machine Market by Type (0-10 tons, 10-30 tons, and 30-40 tons), Application (Medical, Automotive, Fiber Optics, Electronics), Region (North America, Europe, Asia-Pacific, South America, MEA) - Global Forecast to 2028

Updated on : August 22, 2025

Micro Injection Molding Machine Market

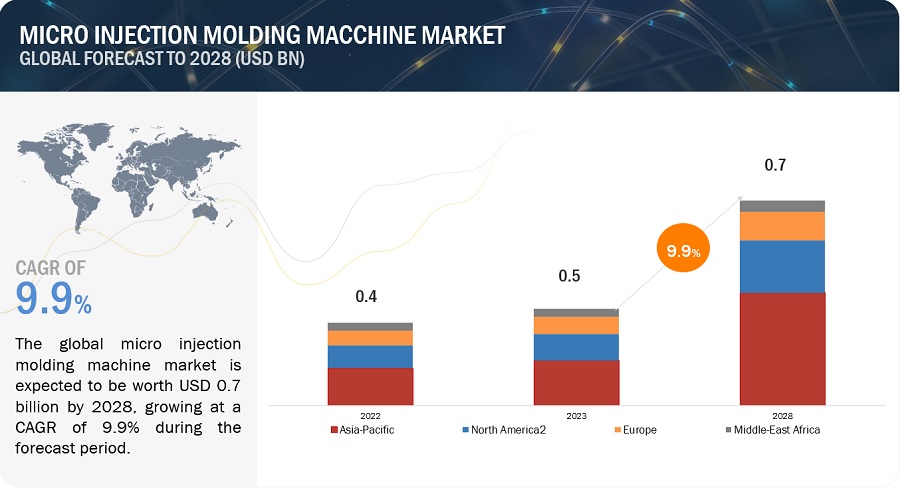

The global micro injection molding machine market was valued at USD 0.5 billion in 2023 and is projected to reach USD 0.7 billion by 2028, growing at 9.9% cagr from 2023 to 2028. The major drivers of this market are growth in the automotive sector and rising demand for medical applications. The demand for automobiles is significantly increasing in emerging countries due to rising populations and modernization. The number of medical procedures such as cosmetic, dental, and aesthetic has increased due to the rising aged population, increasing disposable income, accessibility of advanced technologies, and extending procedural safety. The prominence of these procedures across the world promotes the micro injection molding machines market. APAC is the key market for micro injection molding machines globally, followed by Europe, North America, South America, and the Middle East & Africa in terms of value.

Micro Injection Molding Machine Market Forecast & Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Attractive Opportunities in Micro Injection Molding Machine Market

Micro Injection Molding Machine Market Dynamics

Driver: Growth in the automotive sector fueling demand for micro injection molding machine

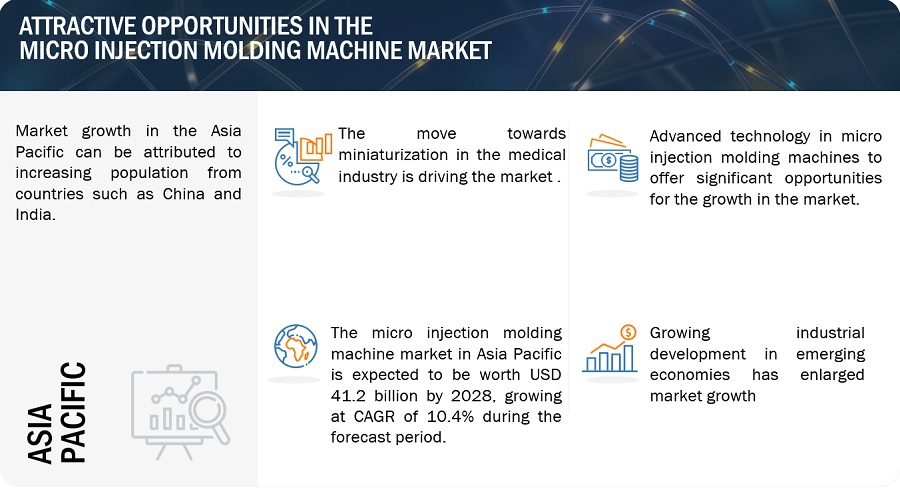

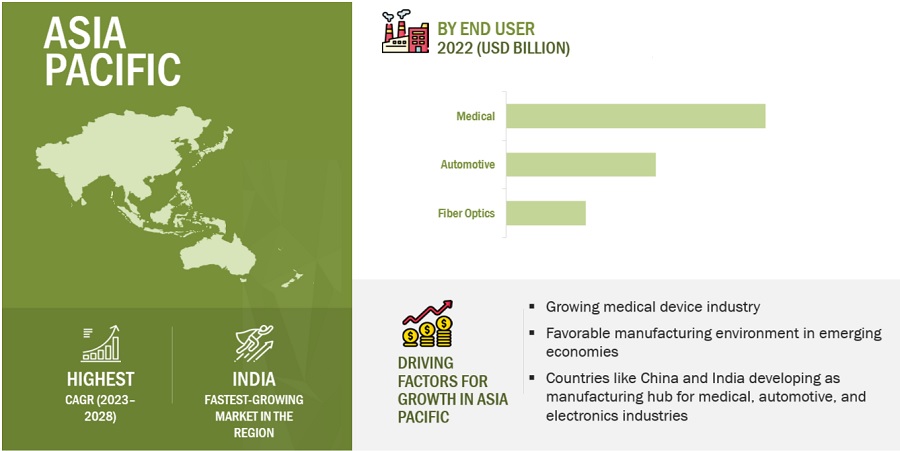

One of the key factors driving the market for micro injection molding machines, so the theory goes, is the expanding automobile industry. For numerous interior automobile parts, such as interior buttons and switches, various kinds of clip washers, door-lock components, gears, encoders for electronic modules, and so forth, micro injection molding is a common technique. Since these are the most crucial components in the automotive production sector, the market for micro-injection molding machines is anticipated to grow throughout the forecast period due to rising automobile demand. Automobile demand is rising significantly in China, India, South Korea, and Japan. This is propelling the growth of the micro injection molding machine market in the Asia Pacific.

Restraints: Extreme initial and maintenance costs of machines

An all-electric micro injection molding machine has the best acceleration performance, improved repeatability, and shorter injection times because of dynamic servo motors. The high investment costs of all-electric equipment are caused by their advanced technology. The costly maintenance is yet another drawback. As the entire system must be replaced in the issue of motor failure, maintenance costs can be extremely expensive.

Despite being less expensive than electric equipment, hydraulic injection machines still use a lot of electricity. Every stage of the molding process involves the hydraulic motor operating at maximum power, which results in high electric energy expenditures. The hydraulic motor is connected to an electric power unit. Typically, a hydraulic micro-injection molding machine uses 0,4 kWh of energy. The motor oil is another drawback because it needs to be updated because it loses its viscosity after a few hours of use. The use of motor oil has high maintenance expenses since it needs to be replaced, and its disposal has a detrimental environmental impact. The price of preventative maintenance has a big impact on the price of manufacturing.

Opportunities: Rising trend of electric vehicles increases demand for microinjection molds

One of the main factors propelling the market for micro injection molding machines is the strong position of the automobile industry. Electric vehicles are made up of a variety of electronic components, including a DC converter, all-electric auxiliary, electric traction motor, traction battery pack, electric gearbox, and others. These electronic components are made up of different microcomponents. During the creation of an electric car, these tiny parts are crucial. Micro injection molding equipment is used to produce these intricate, tiny components. The rising demand for electric vehicles is anticipated to have a favorable impact on the growth of the micro injection molding machine market since they require more tiny injection molded items than ICE vehicles.

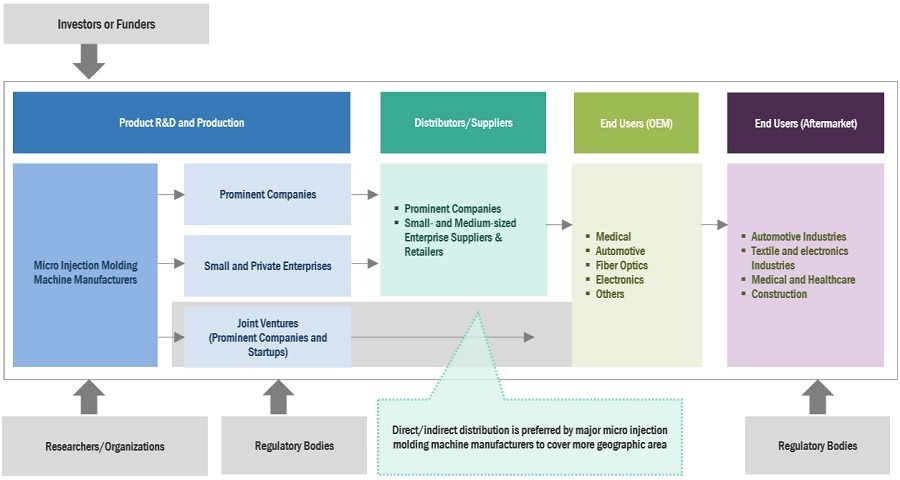

Micro Injection Molding Machine Market Ecosystem

Prominent companies in this market include well-established, financially stable micro injection molding machines. These businesses have been in business for a while and have an extensive range of products, pioneering technologies, and strong international sales and marketing networks. Top companies in this market include Sumitomo Heavy Industries Ltd. (Japan), Engel Austria GmbH (Austria), Nissei Plastic Industrial Co., Ltd. (Japan), Sodick Co., Ltd. (Japan), and Hillenbrand Inc. (US).

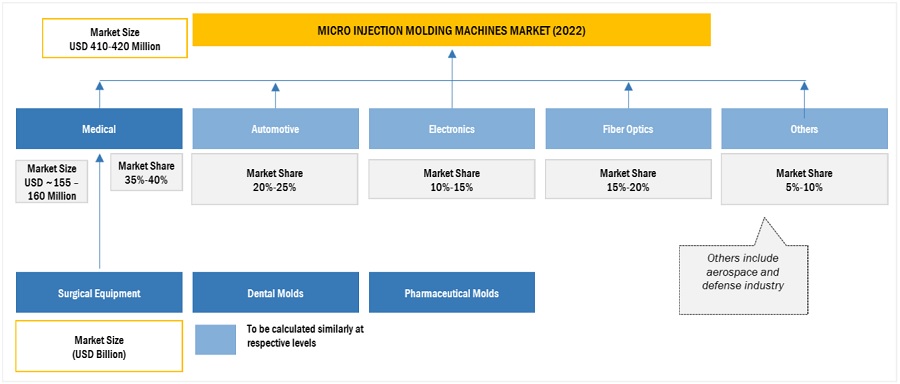

Based on application, Medical is estimated to be the largest application of micro injection molding machine market forecast period.

Micro components are increasingly being used in medical procedures as a result of technical advancements in the field of medicine, which improve patient outcomes overall. Intensified R&D is driving up demand for micro injection molding equipment in the medical industry as well as for medical micro parts. Rising chronic diseases across the world have led to the development of nanotechnology and miniaturization in the medical sector. Growing miniaturization in medical equipment tends to rely on the micro-injection molded components for the care of critical patients within and outside of the body. This developed miniaturization propelled the demand for micro-injection molding machines.

Based on type, the 30 to 40 tons clamping force segment is the largest type of micro injection molding machine for the micro injection molding machine market in 2022.

As the demand for small precision parts is increasing in automotive, electronics, and medical applications due to the increasing trend of miniaturization, the requirement for micro-injection molding machines is also expected to increase. These factors are driving the demand for micro-injection molding machines with a clamping force of 30 to 40 tons.

“Asia Pacific is expected to be the largest micro injection molding machine market during the forecast period, in terms of value.

In terms of value, In Asia Pacific, China is the largest micro injection molding machine market. Due to extreme growth in manufacturing industries and other commercial units, there is an increase in domestic demand which is expected to propel the demand for micro-injection molding machines in Asia Pacific. The expanding population will have a considerable impact on the automotive and electronics industry in the region. The development in the number of on-road commercial vehicles influences the growth of the micro injection molding machines market in the automotive industry. The increase in production facilities in the region is a major contributor to the market. Because of rapid development in the healthcare industry and the move towards nanotechnology, the Medical sector is rising, which can favorably impact the micro injection molding machines market.

To know about the assumptions considered for the study, download the pdf brochure

Micro Injection Molding Machine Market Players

The key players profiled in the report include Sumitomo Heavy Industries Ltd. (Japan), Engel Austria GmbH (Austria), Nissei Plastic Industrial Co., Ltd. (Japan), Sodick Co., Ltd. (Japan), and Hillenbrand Inc. (US). and among others, are the key manufacturers that have held major market share in the last few years. The major focus was given to acquisition, innovation, and new product development due to the changing requirements of users across the world.

Read More: Micro Injection Molding Machine Companies

Micro Injection Molding Machine Market Report Scope

|

Report Metric |

Details |

|

Years considered for the study |

2016–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Units Considered |

Volume (Kiloton) and Value (USD Billion) |

|

Segments Covered |

Type, Application, and Region |

|

Regions Covered |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies profiled |

Sumitomo Heavy Industries Ltd. (Japan), Engel Austria GmbH (Austria), Nissei Plastic Industrial Co., Ltd. (Japan), Sodick Co., Ltd. (Japan), and Hillenbrand Inc. (US). |

This report categorizes the global micro injection molding machines market based on product type, application, and region.

On the basis of Type, the micro injection molding machine market has been segmented as follows:

- 0-10 tons,

- 10-30 tons

- 30-40 tons

On the basis of application, the micro injection molding machine market has been segmented as follows:

- Medical

- Automotive

- Fiber Optics

- Electronics

- Others

On the basis of region, the micro injection molding machines market has been segmented as follows:

- Asia Pacific

- North America

- Europe

- Middle East & Arica

- South America

Recent Developments

- In 2022, Engel Austria GmbH invested 11 million euros in building its robot production plant in Dietach, Austria. This expansion will provide about 3000 m² of floor space in the existing plant area.

- In 2020, for the market launch of its new micro-injection unit for liquid silicone rubber, Engel Austria GmbH produced the tiniest precision parts with a weight of 0.0013 grams for the field of ophthalmology. This is accomplished using an all-electric, tie-bar-free ENGEL emotion 50/30 TL injection molding machine. The new LSR micro-injection device combines the highest level of accuracy with the greatest degree of flexibility and affordability.

- In 2023, Sumitomo Heavy Industries, Ltd. pioneered the sale of the all-new -small-sized iM 18E hybrid injection molding machine, which has the smallest footprint and offers accurate and high-speed molding technology.

- In 2021, Nissei Plastic Industrial Co., Ltd. merged its US sales subsidiary Nissei America Inc. (California), and production subsidiary Nissei Plastic Machinery Inc. (Texas) to enhance their global production and sales structures.

Frequently Asked Questions (FAQ):

What are the factors influencing the growth of micro-injection molding machines?

One of the main factors propelling the market for micro injection molding machines is the strong position of the automobile industry. Electric vehicles are made up of a variety of electronic components, including a DC converter, all-electric auxiliary, electric traction motor, traction battery pack, electric gearbox, and others. These electronic components are made up of different micro components. These tiny parts play a crucial role in the creation of electric vehicle manufacturing. These are incredibly tiny and intricate parts that are produced using a micro injection molding machine. The rising demand for electric vehicles is anticipated to positively affect the growth of the micro injection molding machine market since they require more micro injection molded items than ICE vehicles.

What are the different applications of micro injection molding machines?

The medical, automotive, electronics, fiber optics, and other segments make up the global market for micro injection molding machines. The drive towards miniaturization has significantly accelerated in recent years. Many items and the components that go into them are getting smaller, more intricate, and more compact. An extensive number of these delicate, complicated components are produced by micro-injection molding technology. Examples in the field of medical technology include the increase in minimally invasive procedures and the creation of novel analytical techniques. Another market for micro-molding is consumer electronics, which includes incredibly tiny electrical and optical precision parts for cell phones.

What is the biggest restraint for micro injection molding machines?

Production efficiency, quick injection times due to dynamic servo motors, improved repeatability, decreased noise, and superior acceleration performance are all features of all-electric micro injection molding machines. The high investment costs of all-electric equipment are caused by their advanced technology. The pricey maintenance is yet another drawback. The entire system must be replaced in the event of a motor failure, which comes at a hefty maintenance expense.

What are the various strategies key players are focusing on within the micro injection molding machine market?

Key players are majorly focused on acquisitions, new product launches, and Innovation with local or regional players within the market in order to attract a larger market share globally.

Who are the major players in the chromatography resins market?

The major player involved in the chromatography resins market are Sumitomo Heavy Industries Ltd. (Japan), Engel Austria GmbH (Austria), Nissei Plastic Industrial Co., Ltd. (Japan), Sodick Co., Ltd. (Japan), and Hillenbrand Inc. (US). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing demand for miniaturized products- Advancements in manufacturing technologies- Growing trend of miniaturization in consumer electronicsRESTRAINTS- High initial investment- Limited market awarenessOPPORTUNITIES- Growing demand in healthcare and automotive industries- Expansion into emerging economiesCHALLENGES- Complex design and tooling requirements- Competition from alternative technologies

-

5.3 PORTER’S FIVE FORCES ANALYSISTHREAT OF SUBSTITUTESTHREAT OF NEW ENTRANTSBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.4 MACROECONOMIC INDICATORSGDP TRENDS AND FORECASTS FOR MAJOR ECONOMIES

-

6.1 SUPPLY CHAIN ANALYSISRAW MATERIALMANUFACTURINGDISTRIBUTION TO END USERS

-

6.2 TRENDS/DISRUPTIONS IMPACTING CUSTOMER’S BUSINESS

-

6.3 ECOSYSTEM ANALYSIS/MARKET MAP

-

6.4 CASE STUDIESSUMITOMO MICRO INJECTION MOLDING MACHINEARBURG MICRO INJECTION MOLDING MACHINE

-

6.5 TECHNOLOGY ANALYSISADVANCING INDUSTRY 4.0: AUTOMATION AND IOT TO REVOLUTIONIZE MICRO INJECTION MOLDING MACHINESSUMITOMO (SHI) DEMAG INTRODUCES SK-II CONTROL OPTION, ADVANCING PRECISION IN MICRO INJECTION MOLDING MACHINES

-

6.6 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

6.7 TRADE DATAIMPORT SCENARIO OF MICRO INJECTION MOLDING MACHINESEXPORT SCENARIO OF MICRO INJECTION MOLDING MACHINES

-

6.8 GLOBAL REGULATORY FRAMEWORK AND ITS IMPACT ON MICRO INJECTION MOLDING MACHINES MARKETREGULATIONS RELATED TO MICRO INJECTION MOLDING MACHINES MARKETREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.9 KEY CONFERENCES & EVENTS IN 2023

-

6.10 PATENT ANALYSISAPPROACHDOCUMENT TYPEJURISDICTION ANALYSIS

- 7.1 INTRODUCTION

- 7.2 0–10 TON-FORCE

- 7.3 10–30 TON-FORCE

- 7.4 30–40 TON-FORCE

- 8.1 INTRODUCTION

-

8.2 MEDICALGROWING TREND OF MINIATURIZATION AND NANOTECHNOLOGY IN MEDICAL SECTOR TO DRIVE DEMAND

-

8.3 AUTOMOTIVEGROWING ADVANCED TECHNOLOGY IN AUTOMOTIVE INDUSTRY TO DRIVE DEMAND

-

8.4 FIBER OPTICSHIGH DEMAND FOR MOLDED COMPONENTS IN FIBER OPTICS TO DRIVE MARKET

-

8.5 ELECTRONICSRAPID TECHNOLOGICAL ADVANCEMENTS TO DRIVE NEED FOR PRECISION PARTS IN ELECTRONICS INDUSTRY

- 8.6 OTHERS

- 9.1 INTRODUCTION

-

9.2 NORTH AMERICARECESSION IMPACTNORTH AMERICA: MICRO INJECTION MOLDING MACHINES MARKET, BY APPLICATIONNORTH AMERICA: MICRO INJECTION MOLDING MACHINES MARKET, BY COUNTRY- US- Canada- Mexico

-

9.3 ASIA PACIFICRECESSION IMPACTASIA PACIFIC: MICRO INJECTION MOLDING MACHINES MARKET, BY APPLICATIONASIA PACIFIC: MICRO INJECTION MOLDING MACHINES MARKET, BY COUNTRY- China- Japan- India

-

9.4 EUROPERECESSION IMPACTEUROPE: MICRO INJECTION MOLDING MACHINES MARKET, BY APPLICATIONEUROPE: MICRO INJECTION MOLDING MACHINES MARKET, BY COUNTRY- Germany- France- UK

-

9.5 MIDDLE EAST & AFRICARECESSION IMPACTMIDDLE EAST & AFRICA: MICRO INJECTION MOLDING MACHINES MARKET, BY APPLICATIONMIDDLE EAST & AFRICA: MICRO INJECTION MOLDING MACHINES MARKET, BY COUNTRY- Saudi Arabia- South Africa

-

9.6 SOUTH AMERICARECESSION IMPACTSOUTH AMERICA: MICRO INJECTION MOLDING MACHINES MARKET, BY APPLICATIONSOUTH AMERICA: MICRO INJECTION MOLDING MACHINES MARKET, BY COUNTRY- Brazil- Argentina

- 10.1 INTRODUCTION

- 10.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 10.3 RANKING OF KEY MARKET PLAYERS

- 10.4 MARKET SHARE ANALYSIS

- 10.5 COMPANY PRODUCT FOOTPRINT ANALYSIS

-

10.6 COMPANY EVALUATION MATRIX (TIER 1), 2022STARSEMERGING LEADERSPARTICIPANTSPERVASIVE PLAYERS

- 10.7 COMPETITIVE BENCHMARKING

-

10.8 START-UPS/SMES EVALUATION MATRIX, 2022PROGRESSIVE COMPANIESRESPONSIVE COMPANIESSTARTING BLOCKSDYNAMIC COMPANIES

-

10.9 COMPETITIVE SITUATIONS AND TRENDSPRODUCT LAUNCHESDEALSOTHER DEVELOPMENTS

-

11.1 MAJOR PLAYERSARBURG GMBH & CO. KG- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewENGEL AUSTRIA GMBH- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewHILLENBRAND, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewNISSEI PLASTIC INDUSTRIAL CO., LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewTHE JAPAN STEEL WORKS LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSODICK CO., LTD.- Business overview- Products/Solutions/Services offered- MnM viewSUMITOMO HEAVY INDUSTRIES, LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewBOY MACHINES, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewWITTMANN BATTENFELD GMBH- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewBABYPLAST (RAMBALDI GROUP)- Business overview- Products/Solutions/Services offered- MnM view

-

11.2 OTHER KEY PLAYERSNINGBO SHUANGSHENG PLASTIC MACHINERY CO., LTD.ANNTONG IND. CO., LTD.KRAUSS-MAFFEI CORPORATIONSHIBAURA MACHINE CO., LTD.NINGBO CHUANGJI MACHINERY CO., LTD.

- 12.1 INTRODUCTION

- 12.2 LIMITATION

-

12.3 INJECTION MOLDING MACHINES MARKETMARKET DEFINITIONMARKET OVERVIEWINJECTION MOLDING MACHINES MARKET, BY REGION- Asia Pacific- Europe- North America- Middle East & Africa- South America

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 MICRO INJECTION MOLDING MACHINES MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 2 GDP TRENDS AND FORECASTS, BY MAJOR ECONOMY, 2021–2028 (USD BILLION)

- TABLE 3 MICRO INJECTION MOLDING MACHINES MARKET: ECOSYSTEM

- TABLE 4 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS (%)

- TABLE 5 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 6 MICRO INJECTION MOLDING MACHINE IMPORTS, BY REGION, 2013–2022 (USD MILLION)

- TABLE 7 MICRO INJECTION MOLDING MACHINE EXPORTS, BY REGION, 2013–2022 (USD MILLION)

- TABLE 8 MICRO INJECTION MOLDING MACHINES MARKET: DETAILED LIST OF CONFERENCES & EVENTS, 2023

- TABLE 9 PATENT STATUS AND COUNT, 2013–2023

- TABLE 10 MICRO INJECTION MOLDING MACHINES MARKET, BY CLAMPING FORCE, 2016–2021 (USD MILLION)

- TABLE 11 MICRO INJECTION MOLDING MACHINE MARKET, BY CLAMPING FORCE, 2022–2028 (USD MILLION)

- TABLE 12 MICRO INJECTION MOLDING MACHINES MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

- TABLE 13 MICRO INJECTION MOLDING MACHINE MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 14 MEDICAL: MICRO INJECTION MOLDING MACHINES MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 15 MEDICAL: MICRO INJECTION MOLDING MACHINE MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 16 AUTOMOTIVE: MICRO INJECTION MOLDING MACHINES MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 17 AUTOMOTIVE: MICRO INJECTION MOLDING MACHINE MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 18 FIBER OPTICS: MICRO INJECTION MOLDING MACHINES MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 19 FIBER OPTICS: MICRO INJECTION MOLDING MACHINE MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 20 ELECTRONICS: MICRO INJECTION MOLDING MACHINES MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 21 ELECTRONICS: MICRO INJECTION MOLDING MACHINE MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 22 OTHERS: MICRO INJECTION MOLDING MACHINES MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 23 OTHERS: MICRO INJECTION MOLDING MACHINE MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 24 MICRO INJECTION MOLDING MACHINES MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 25 MICRO INJECTION MOLDING MACHINE MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 26 NORTH AMERICA: MICRO INJECTION MOLDING MACHINES MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

- TABLE 27 NORTH AMERICA: MICRO INJECTION MOLDING MACHINE MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 28 NORTH AMERICA: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

- TABLE 29 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 30 US: MICRO INJECTION MOLDING MACHINES MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

- TABLE 31 US: MICRO INJECTION MOLDING MACHINE MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 32 CANADA: MICRO INJECTION MOLDING MACHINES MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

- TABLE 33 CANADA: MICRO INJECTION MOLDING MACHINE MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 34 MEXICO: MICRO INJECTION MOLDING MACHINES MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

- TABLE 35 MEXICO: MICRO INJECTION MOLDING MACHINE MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 36 ASIA PACIFIC: MICRO INJECTION MOLDING MACHINES MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

- TABLE 37 ASIA PACIFIC: MICRO INJECTION MOLDING MACHINE MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 38 ASIA PACIFIC: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

- TABLE 39 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 40 CHINA: MICRO INJECTION MOLDING MACHINES MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

- TABLE 41 CHINA: MICRO INJECTION MOLDING MACHINE MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 42 JAPAN: MICRO INJECTION MOLDING MACHINES MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

- TABLE 43 JAPAN: MICRO INJECTION MOLDING MACHINE MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 44 INDIA: MICRO INJECTION MOLDING MACHINES MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

- TABLE 45 INDIA: MICRO INJECTION MOLDING MACHINE MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 46 EUROPE: MICRO INJECTION MOLDING MACHINES MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

- TABLE 47 EUROPE: MICRO INJECTION MOLDING MACHINE MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 48 EUROPE: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

- TABLE 49 EUROPE: MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 50 GERMANY: MICRO INJECTION MOLDING MACHINES MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

- TABLE 51 GERMANY: MICRO INJECTION MOLDING MACHINE MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 52 FRANCE: MICRO INJECTION MOLDING MACHINES MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

- TABLE 53 FRANCE: MICRO INJECTION MOLDING MACHINE MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 54 UK: MICRO INJECTION MOLDING MACHINES MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

- TABLE 55 UK: MICRO INJECTION MOLDING MACHINE MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 56 MIDDLE EAST & AFRICA: MICRO INJECTION MOLDING MACHINES MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

- TABLE 57 MIDDLE EAST & AFRICA: MICRO INJECTION MOLDING MACHINE MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 58 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

- TABLE 59 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 60 SAUDI ARABIA: MICRO INJECTION MOLDING MACHINES MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

- TABLE 61 SAUDI ARABIA: MICRO INJECTION MOLDING MACHINE MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 62 SOUTH AFRICA: MICRO INJECTION MOLDING MACHINES MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

- TABLE 63 SOUTH AFRICA: MICRO INJECTION MOLDING MACHINE MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 64 SOUTH AMERICA: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

- TABLE 65 SOUTH AMERICA: MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 66 SOUTH AMERICA: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

- TABLE 67 SOUTH AMERICA: MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 68 BRAZIL: MICRO INJECTION MOLDING MACHINES MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

- TABLE 69 BRAZIL: MICRO INJECTION MOLDING MACHINE MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 70 ARGENTINA: MICRO INJECTION MOLDING MACHINES MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

- TABLE 71 ARGENTINA: MICRO INJECTION MOLDING MACHINE MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 72 OVERVIEW OF STRATEGIES ADOPTED BY KEY MICRO INJECTION MOLDING MACHINE MANUFACTURERS

- TABLE 73 MICRO INJECTION MOLDING MACHINES MARKET: DEGREE OF COMPETITION

- TABLE 74 MICRO INJECTION MOLDING MACHINE MARKET: CLAMPING FORCE FOOTPRINT

- TABLE 75 MICRO INJECTION MOLDING MACHINES MARKET: APPLICATION FOOTPRINT

- TABLE 76 MICRO INJECTION MOLDING MACHINE MARKET: REGION FOOTPRINT

- TABLE 77 MICRO INJECTION MOLDING MACHINES: DETAILED LIST OF KEY START-UPS/SMES

- TABLE 78 MICRO INJECTION MOLDING MACHINES MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

- TABLE 79 MICRO INJECTION MOLDING MACHINE MARKET: PRODUCT LAUNCHES (2019–2022)

- TABLE 80 MICRO INJECTION MOLDING MACHINES MARKET: DEALS (2019–2022)

- TABLE 81 MICRO INJECTION MOLDING MACHINE MARKET: OTHER DEVELOPMENTS (2019–2022)

- TABLE 82 ARBURG GMBH & CO. KG: COMPANY OVERVIEW

- TABLE 83 ARBURG GMBH & CO. KG: PRODUCTS OFFERED

- TABLE 84 ARBURG GMBH & CO. KG: PRODUCT LAUNCHES

- TABLE 85 ARBURG GMBH & CO. KG: DEALS

- TABLE 86 ARBURG GMBH & CO. KG: OTHER DEVELOPMENTS

- TABLE 87 ENGEL AUSTRIA GMBH: COMPANY OVERVIEW

- TABLE 88 ENGEL AUSTRIA GMBH: PRODUCTS OFFERED

- TABLE 89 ENGEL AUSTRIA GMBH: PRODUCT LAUNCHES

- TABLE 90 ENGEL AUSTRIA GMBH: OTHER DEVELOPMENTS

- TABLE 91 HILLENBRAND, INC: COMPANY OVERVIEW

- TABLE 92 HILLENBRAND, INC.: PRODUCTS OFFERED

- TABLE 93 HILLENBRAND, INC.: DEALS

- TABLE 94 NISSEI PLASTIC INDUSTRIAL CO., LTD.: COMPANY OVERVIEW

- TABLE 95 NISSEI PLASTIC INDUSTRIAL CO., LTD.: PRODUCTS OFFERED

- TABLE 96 NISSEI PLASTIC INDUSTRIAL CO., LTD.: DEALS

- TABLE 97 THE JAPAN STEEL WORKS LTD.: COMPANY OVERVIEW

- TABLE 98 THE JAPAN STEEL WORKS LTD.: PRODUCTS OFFERED

- TABLE 99 THE JAPAN STEEL WORKS LTD.: OTHER DEVELOPMENTS

- TABLE 100 SODICK CO., LTD.: COMPANY OVERVIEW

- TABLE 101 SODICK CO., LTD.: PRODUCTS OFFERED

- TABLE 102 SUMITOMO HEAVY INDUSTRIES, LTD.: COMPANY OVERVIEW

- TABLE 103 SUMITOMO HEAVY INDUSTRIES, LTD.: PRODUCTS OFFERED

- TABLE 104 SUMITOMO HEAVY INDUSTRIES, LTD.: PRODUCT LAUNCHES

- TABLE 105 BOY MACHINES, INC.: COMPANY OVERVIEW

- TABLE 106 BOY MACHINES, INC.: PRODUCTS OFFERED

- TABLE 107 BOY MACHINES, INC.: PRODUCT LAUNCHES

- TABLE 108 WITTMANN BATTENFELD GMBH: COMPANY OVERVIEW

- TABLE 109 WITTMANN BATTENFELD GMBH: PRODUCTS OFFERED

- TABLE 110 WITTMANN BATTENFELD GMBH: OTHER DEVELOPMENTS

- TABLE 111 BABYPLAST (RAMBALDI GROUP): COMPANY OVERVIEW

- TABLE 112 BABYPLAST (RAMBALDI GROUP): PRODUCTS OFFERED

- TABLE 113 NINGBO SHUANGSHENG PLASTIC MACHINERY CO., LTD.: COMPANY OVERVIEW

- TABLE 114 ANNTONG IND. CO., LTD.: COMPANY OVERVIEW

- TABLE 115 KRAUSS MAFFEI CORPORATION: COMPANY OVERVIEW

- TABLE 116 SHIBAURA MACHINE CO., LTD.: COMPANY OVERVIEW

- TABLE 117 NINGBO CHUANGJI MACHINERY CO., LTD.: COMPANY OVERVIEW

- TABLE 118 INJECTION MOLDING MACHINES MARKET, BY REGION, 2017–2020 (USD MILLION)

- TABLE 119 INJECTION MOLDING MACHINES MARKET, BY REGION, 2021–2027 (USD MILLION)

- TABLE 120 INJECTION MOLDING MACHINES MARKET, BY REGION, 2017–2020 (UNIT)

- TABLE 121 INJECTION MOLDING MACHINES MARKET, BY REGION, 2021–2027 (UNIT)

- TABLE 122 ASIA PACIFIC: INJECTION MOLDING MACHINES MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

- TABLE 123 ASIA PACIFIC: INJECTION MOLDING MACHINES MARKET, BY COUNTRY, 2021–2027 (USD MILLION)

- TABLE 124 ASIA PACIFIC: INJECTION MOLDING MACHINES MARKET, BY COUNTRY, 2017–2020 (UNIT)

- TABLE 125 ASIA PACIFIC: INJECTION MOLDING MACHINES MARKET, BY COUNTRY, 2021–2027 (UNIT)

- TABLE 126 EUROPE: INJECTION MOLDING MACHINES MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

- TABLE 127 EUROPE: INJECTION MOLDING MACHINES MARKET, BY COUNTRY, 2021–2027 (USD MILLION)

- TABLE 128 EUROPE: INJECTION MOLDING MACHINES MARKET, BY COUNTRY, 2017–2020 (UNIT)

- TABLE 129 EUROPE: INJECTION MOLDING MACHINES MARKET, BY COUNTRY, 2021–2027 (UNIT)

- TABLE 130 NORTH AMERICA: INJECTION MOLDING MACHINES MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

- TABLE 131 NORTH AMERICA: INJECTION MOLDING MACHINES MARKET, BY COUNTRY, 2021–2027 (USD MILLION)

- TABLE 132 NORTH AMERICA: INJECTION MOLDING MACHINES MARKET, BY COUNTRY, 2017–2020 (UNIT)

- TABLE 133 NORTH AMERICA: INJECTION MOLDING MACHINES MARKET, BY COUNTRY, 2021–2027 (UNIT)

- TABLE 134 MIDDLE EAST & AFRICA: INJECTION MOLDING MACHINES MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

- TABLE 135 MIDDLE EAST & AFRICA: INJECTION MOLDING MACHINES MARKET, BY COUNTRY, 2021–2027 (USD MILLION)

- TABLE 136 MIDDLE EAST & AFRICA: INJECTION MOLDING MACHINES MARKET, BY COUNTRY, 2017–2020 (UNIT)

- TABLE 137 MIDDLE EAST & AFRICA: INJECTION MOLDING MACHINES MARKET, BY COUNTRY, 2021–2027 (UNIT)

- TABLE 138 SOUTH AMERICA: INJECTION MOLDING MACHINES MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

- TABLE 139 SOUTH AMERICA: INJECTION MOLDING MACHINES MARKET, BY COUNTRY, 2021–2027 (USD MILLION)

- TABLE 140 SOUTH AMERICA: INJECTION MOLDING MACHINES MARKET, BY COUNTRY, 2017–2020 (UNIT)

- TABLE 141 SOUTH AMERICA: INJECTION MOLDING MACHINES MARKET, BY COUNTRY, 2021–2027 (UNIT)

- FIGURE 1 MICRO INJECTION MOLDING MACHINES MARKET SEGMENTATION

- FIGURE 2 MICRO INJECTION MOLDING MACHINES MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY APPROACH 1 (SUPPLY-SIDE): REVENUE OF PRODUCTS

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY APPROACH 1 BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE OF ALL PRODUCTS

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY APPROACH 2 – BOTTOM-UP (DEMAND-SIDE): APPLICATIONS SERVED

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 3 – TOP-DOWN

- FIGURE 7 MICRO INJECTION MOLDING MACHINES MARKET: DATA TRIANGULATION

- FIGURE 8 MARKET CAGR PROJECTIONS FROM SUPPLY-SIDE

- FIGURE 9 MARKET GROWTH PROJECTIONS FROM DEMAND-SIDE: DRIVERS AND OPPORTUNITIES

- FIGURE 10 30 TO 40 TONS CLAMPING FORCE SEGMENT TO DOMINATE MICRO INJECTION MOLDING MACHINES MARKET DURING FORECAST PERIOD

- FIGURE 11 MEDICAL TO BE LARGEST APPLICATION OF MICRO INJECTION MOLDING MACHINES MARKET DURING FORECAST PERIOD

- FIGURE 12 ASIA PACIFIC ACCOUNTED FOR LARGEST SHARE OF MICRO INJECTION MOLDING MACHINES MARKET IN 2022

- FIGURE 13 SHIFT TOWARD ELECTRIC VEHICLES TO DRIVE DEMAND FOR MICRO INJECTION MOLDING MACHINES

- FIGURE 14 ASIA PACIFIC TO BE LARGEST MICRO INJECTION MOLDING MACHINES MARKET BETWEEN 2023 AND 2028

- FIGURE 15 MEDICAL APPLICATION TO BE LARGEST CONSUMER OF MICRO INJECTION MOLDING MACHINES ACROSS REGIONS

- FIGURE 16 CHINA ACCOUNTED FOR LARGEST SHARE OF MICRO INJECTION MOLDING MACHINES MARKET IN 2022

- FIGURE 17 INDIA TO WITNESS HIGH DEMAND FOR MICRO INJECTION MOLDING MACHINES BETWEEN 2023 AND 2028

- FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN MICRO INJECTION MOLDING MACHINES MARKET

- FIGURE 19 PORTER’S FIVE FORCES ANALYSIS OF MICRO INJECTION MOLDING MACHINES MARKET

- FIGURE 20 MICRO INJECTION MOLDING MACHINES MARKET: SUPPLY CHAIN

- FIGURE 21 REVENUE SHIFT FOR MICRO INJECTION MOLDING MACHINES MARKET

- FIGURE 22 MICRO INJECTION MOLDING MACHINES MARKET: ECOSYSTEM

- FIGURE 23 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- FIGURE 24 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- FIGURE 25 MICRO INJECTION MOLDING MACHINE IMPORTS, BY KEY COUNTRY, 2013–2022

- FIGURE 26 MICRO INJECTION MOLDING MACHINE EXPORTS, BY KEY COUNTRY, 2013–2022

- FIGURE 27 PATENTS REGISTERED IN MICRO INJECTION MOLDING MACHINES MARKET, 2013–2023

- FIGURE 28 PATENT PUBLICATION TRENDS, 2013–2022

- FIGURE 29 LEGAL STATUS OF PATENTS FILED IN MICRO INJECTION MOLDING MACHINES MARKET

- FIGURE 30 MAXIMUM PATENTS FILED IN JURISDICTION OF US, 2013–2023

- FIGURE 31 0–10 TON-FORCE TO BE FASTEST-GROWING CLAMPING FORCE SEGMENT DURING FORECAST PERIOD

- FIGURE 32 MEDICAL SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 33 ASIA PACIFIC TO BE FASTEST-GROWING MARKET FOR MICRO INJECTION MOLDING MACHINES

- FIGURE 34 NORTH AMERICA: MICRO INJECTION MOLDING MACHINES MARKET SNAPSHOT

- FIGURE 35 ASIA PACIFIC: MICRO INJECTION MOLDING MACHINES MARKET SNAPSHOT

- FIGURE 36 EUROPE: MICRO INJECTION MOLDING MACHINES MARKET SNAPSHOT

- FIGURE 37 RANKING OF TOP FIVE PLAYERS IN MICRO INJECTION MOLDING MACHINES MARKET, 2022

- FIGURE 38 SUMITOMO HEAVY INDUSTRIES LIMITED LED MICRO INJECTION MOLDING MACHINES MARKET IN 2022

- FIGURE 39 REVENUE ANALYSIS OF KEY COMPANIES DURING PAST FIVE YEARS

- FIGURE 40 MICRO INJECTION MOLDING MACHINES MARKET: COMPANY FOOTPRINT

- FIGURE 41 COMPANY EVALUATION MATRIX FOR MICRO INJECTION MOLDING MACHINES MARKET (TIER 1)

- FIGURE 42 START-UP/SMES EVALUATION MATRIX FOR MICRO INJECTION MOLDING MACHINES MARKET, 2022

- FIGURE 43 NISSEI PLASTIC INDUSTRIAL CO., LTD.: COMPANY SNAPSHOT

- FIGURE 44 THE JAPAN STEEL WORKS LTD.: COMPANY SNAPSHOT

- FIGURE 45 SODICK CO., LTD.: COMPANY SNAPSHOT

- FIGURE 46 SUMITOMO HEAVY INDUSTRIES, LTD.: COMPANY SNAPSHOT

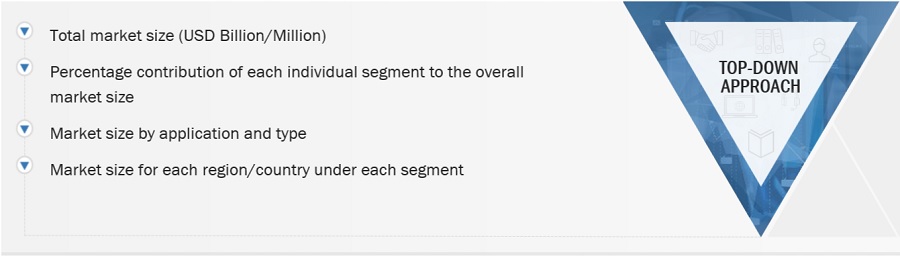

The study involved four major activities in estimating the market size for micro injection molding machines. Intensive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Post that, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

Secondary sources used in this study included annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles from recognized authors; and gold standard & silver standard websites such as Factiva, ICIS, Bloomberg, and others. The findings of this study were verified through primary research by conducting extensive interviews with key officials such as CEOs, VPs, directors, and other executives.

Primary Research:

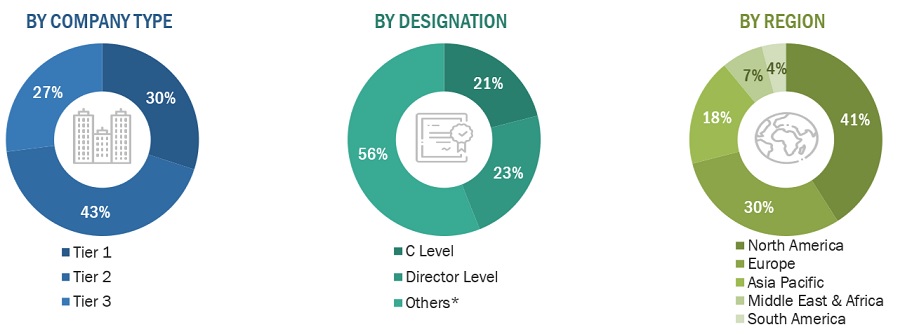

The micro injection molding machines market comprises several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by key opinion leaders in various applications for the micro injection molding machines market. The supply side is characterized by advancements in technology and diverse application industries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Breakdown of Primary Participants

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2022, available in the public domain, product portfolios, and geographical presence.

Other designations include consultants and sales, marketing, and procurement managers.

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY NAME |

DESIGNATION |

|

Sumitomo Heavy Industries, Ltd. |

Global Strategy & Innovation Manager |

|

Engel Austria Gmbh |

Technical Sales Manager |

|

Nissei Plastic Industrial Co., Ltd. |

Senior Supervisor |

|

Sodick Co., Ltd. |

Production Supervisor |

|

Hillenbrand Inc. |

Vice-President |

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the micro injection molding machines market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry have been identified through extensive secondary research.

- The supply chain of the industry has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

Micro Injection Molding Machine Market: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Micro Injection Molding Machine Market: Top-Down Approach

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into respective segments and subsegments. To realize the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying several factors and trends from both the demand and supply sides in the micro injection molding machines industry.

Market Definition

The micro injection molding machines market refers to the key industries involved in the production, distribution, and sale of micro injection molding machines. These are machines for microinjection molding with precision ranging from 10 to 100 microns; these machines are utilized to produce plastic parts for shot weights of 1 to 0.1 grams. This molding technique enables the most accurate and precise fabrication of intricate tiny geometries. The obvious determining element for micro molding is part size. A component or part created using micro molding has micro-scale dimensions, micro-scale features, and micro-scale tolerances. The fundamental idea behind the micro injection molding procedure is very similar to that of the conventional injection molding procedure. The injection molding machine incorporates the microinjection unit.

Key Stakeholders

- Micro injection molding machines manufacturers

- Raw material manufacturers

- Government planning commissions and research organizations

- Industry associations

- End-use industries

- R&D institutions

Report Objectives

- To analyze and forecast the size of the micro injection molding machines market in terms of volume and value

- To provide detailed information regarding key factors, such as drivers, restraints, challenges, and opportunities influencing the growth of the market

- To define, describe, and segment the micro injection molding machines market based on clamping force and application

- To forecast the size of the market segments for regions such as Asia Pacific, North America, Europe, South America, and the Middle East & Africa

- To strategically analyze the segmented markets with respect to individual growth trends, prospects, and contributions to the overall market

- To identify and analyze opportunities for stakeholders in the market

- To strategically profile key players and comprehensively analyze their core competencies

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country or additional application type

Company Information

- Detailed analysis and profiles of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Micro Injection Molding Machine Market