Methyl Tertiary Butyl Ether Market by Manufacturing Process, (Steam Cracker, Fluid Liquid Cracker), Application (Gasoline), and Region (North America, Europe, APAC, Latin America, Middle East & Africa) - Global Forecast to 2022

[107 Pages Report] global methyl tertiary butyl ether (MTBE) market was valued at USD 14.33 Billion in 2016 and projected to reach USD 18.99 Billion by 2022, at a CAGR of 4.8% during the forecast period. The use of MTBE as oxygenate is rising rapidly in Asian and Middle Eastern & African countries due to environmental restrictions to curb air pollution. Furthermore, MTBE producers are extensively involved in expansions and acquisitions to secure their positions in the methyl tertiary butyl ether market. In this study, the years considered to estimate the market size of MTBE have been mentioned below:

- Base Year 2016

- Estimated Year 2017

- Projected Year 2022

- Forecast Period 2017 to 2022

2016 has been considered the base year for company profiles. Whenever information was unavailable for the base year, the prior year has been considered.

Objectives of the Study

- To analyze and forecast the market size of MTBE, in terms of volume (kilotons) and value (USD million)

- To provide detailed information regarding the key factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To define, describe, and forecast the methyl tertiary butyl ether market on the basis of manufacturing process and application

- To analyze and forecast the methyl tertiary butyl ether market for regions, namely, North America, Europe, APAC, the Middle East & Africa (ME&A), Latin America, and their major countries

- To analyze and forecast the market size on the basis of manufacturing process and application, in terms of volume and value, for five main regions

- To strategically analyze the market with respect to individual growth trends, future prospects, and contribution of submarkets1 to the overall market

- To analyze market opportunities, and competitive landscape for stakeholders and market leaders

- To strategically profile key players and analyze their core competencies2

- Submarkets refer to the regional subdivisions of the methyl tertiary butyl ether market.

- Core competencies of the companies are determined in terms of key strategies adopted by them to sustain their positions in the market.

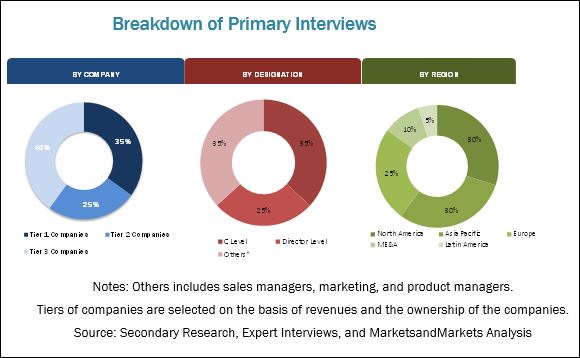

Various secondary sources, such as such as Factiva, Hoovers, and Manta, among others have been used to understand and gain insights into the global methyl tertiary butyl ether market. Experts from top MTBE companies have been interviewed to verify and collect critical information and to assess the trends in the methyl tertiary butyl ether market during the forecast period. Top-down, bottom-up, and data triangulation approaches have been implemented to calculate the exact values of the overall parent and individual market sizes.

To know about the assumptions considered for the study, download the pdf brochure

The market for MTBE has a diversified and established ecosystem of its upstream players, such as raw material suppliers and downstream stakeholders, such as manufacturers, vendors, end users, and government organizations. Most of the major players in the methyl tertiary butyl ether market have undertaken backward and forward integration to strengthen their positions in the market. Some of the MTBE manufacturers include SABIC (Saudi Arabia), Evonik (Germany), China National Petroleum Corporation (China), Huntsman International (US), Eni S.p.A (Italy), Sinopec (China), LyondellBasell (Netherlands), Shell (Netherlands), Emirates National Oil Company (UAE), and Qafac (QATAR).

Target audience

- MTBE Manufacturers

- Raw Material Suppliers

- Distributors and Suppliers

- End-use Industries

- Industry Associations

This study answers several questions for the stakeholders, primarily, which market segments they need to focus upon during the next two to five years to prioritize their efforts and investments.

Scope of the Report:

This research report categorizes the methyl tertiary butyl ether market based on manufacturing process, application, and region, and forecasts revenue growth and analysis of trends in each of the submarkets.

By Manufacturing Process:

- Steam Cracker

- Fluid Liquid Cracker

- Others

By Application:

- Gasoline

- Others

By Region

- North America

- Europe

- APAC

- Middle East & Africa (ME&A)

- Latin America

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the companys specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the North America methyl tertiary butyl ether market

- Further breakdown of the Europe MTBE market

- Further breakdown of the APAC methyl tertiary butyl ether market

- Further breakdown of the Middle East & Africa MTBE market

- Further breakdown of the Latin America methyl tertiary butyl ether market

Company Information

- Detailed analysis and profiles of additional market players

The global size of the Methyl Tertiary Butyl Ether (MTBE) market, in terms of value, is projected to reach USD 18.99 Billion by 2022 from an estimated USD 14.99 Billion in 2017, at a CAGR of 4.8% between 2017 and 2022. The market is growing because of the increasing demand from different applications. The gasoline segment is expected to be the fastest-growing segment during the forecast period as the use of MTBE as oxygenate reduces air pollution due to which its demand is increasing for gasoline blending. The major opportunity for the market is the expanding petrochemical application of MTBE, such as the manufacture of high purity isobutylene, highly reactive polyisobutylene, Methyl Methacrylate (MMA), and some smaller derivatives. These products are growing at rates above the global GDP. Replacement of MTBE with ethanol and ETBE is a major restraint for the growth of the market.

The global methyl tertiary butyl ether market is segmented on the basis of manufacturing process, application, and region. Based on the manufacturing process, the MTBE market has been further segmented into steam cracker, fluid liquid cracker, and others. Others include dehydrogenation and dehydration. Fluid liquid cracker and steam cracker are the most commonly used manufacturing processes as these are refinery based processes and are much simpler than other two processes, which are dehydration and dehydrogenation.

Major applications in the MTBE market are gasoline and others. Others include high purity isobutene and medical intermediates. Gasoline is the largest application of MTBE, in terms of value. MTBE has been used in gasoline since 1979 due to environmental and health concerns. The use of MTBE as gasoline additive mainly started with the replacement of metallic additives, such as lead and Methylcyclopentadienyl Manganese Tricarbonyl (MMT). The significant volume of MTBE consumption in gasoline is driving the demand for MTBE in the gasoline application. Rapidly increasing vehicle fleets especially in emerging economies and increasing urbanization is driving the demand for MTBE in the gasoline segment.

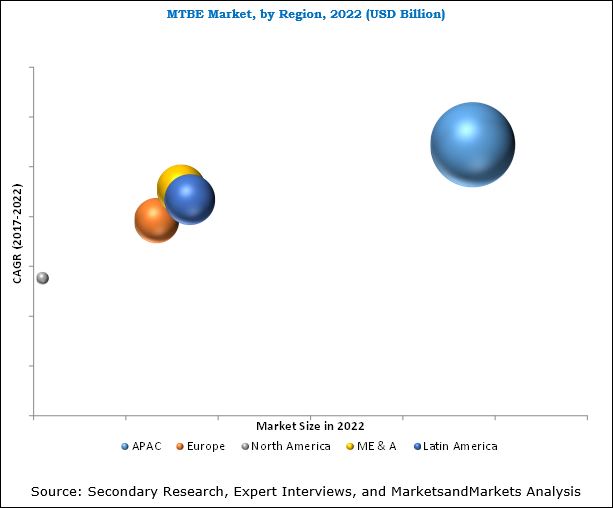

APAC is the largest market for MTBE, majorly driven by the growing demand for gasoline blending as it enables reduction in harmful carbon emissions caused by the burning of gasoline. Middle East & Africa and Latin America also have significant demand for MTBE for gasoline blending due to growing urbanization in the regions. China is the largest and the fastest-growing country in terms of demand for MTBE for gasoline blending because of its large population and high growth economy. Fluid liquid cracker is the leading manufacturing process in the methyl tertiary butyl ether market. This is because this process is much simpler than other processes, as, in this process, isobutene is extracted as a byproduct from Fluid Catalytic Cracker (FCC) overheads.

Significant capital is required to set up MTBE producing plants. MTBE is mostly produced at refinery-based plants due to which it is difficult to set up new plants as the cost of setting up a new refinery is very high. In addition, there are legal and regulatory barriers in many countries due to environmental and health issues related to the use of MTBE as an oxygenate. Due to this, the threat of new entrants in the methyl tertiary butyl ether market is low. The intensity of competitive rivalry is moderate because MTBE used for gasoline blending is undifferentiated due to which there is high competition in the market. However, the presence of a few large MTBE producers in the market is leading to low competition in the market.

SABIC is the worlds largest producer of MTBE, and has a production capacity of 3200 KT per annum. In the fiscal year 2016, the company generated total sales of USD 35.40 billion. The company has been producing MTBE since 1987 and has been producing MTBE through the TBA and fluid liquid cracker processes. The MTBE produced by the company is mainly used for gasoline blending. The company has adopted the acquisitions strategy to increase its market share around the globe. It supplies MTBE to various regions, such as Europe, Americas, Asia, and MEA.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.4 Years Considered for the Study

1.5 Currency

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Assumptions

3 Executive Summary (Page No. - 24)

4 Premium Insights (Page No. - 27)

4.1 Attractive Opportunities in the MTBE Market

4.2 Methyl Tertiary Butyl Ether Market, By Manufacturing Process

4.3 MTBE Market, By Application

4.4 Methyl Tertiary Butyl Ether Market, By Manufacturing Process and Region

4.5 MTBE Market, By Country

5 Market Overview (Page No. - 30)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growing Demand From APAC Countries

5.2.2 Restraints

5.2.2.1 Replacement of MTBE By Ethanol and Etbe

5.2.2.2 Replacement of Gasoline Cars By Electric and Hybrid Cars

5.2.2.3 Health and Environmental Issues Related to MTBE Usage

5.2.3 Opportunities

5.2.3.1 Increasing Use in Petrochemical Applications

5.2.4 Challenges

5.2.4.1 Volatility of Crude Oil Prices

5.3 Porters Five Forces Analysis

5.3.1 Threat of New Entrants

5.3.2 Threat of Substitutes

5.3.3 Bargaining Power of Suppliers

5.3.4 Bargaining Power of Buyers

5.3.5 Intensity of Competitive Rivalry

6 Methyl Tertiary Butyl Ether Market, By Manufacturing Process (Page No. - 36)

6.1 Introduction

6.2 Steam Cracker

6.3 Fluid Liquid Cracker

6.4 Others

7 MTBE Market, By Application (Page No. - 42)

7.1 Introduction

7.2 Gasoline

7.3 Others

7.3.1 High Purity Isobutene

7.3.2 Medical Intermediates

8 Regional Analysis (Page No. - 48)

8.1 Introduction

8.2 North America

8.2.1 By Country

8.2.2 By Application

8.2.3 By Manufacturing Process

8.2.3.1 US

8.2.3.1.1 By Application

8.2.3.2 Canada

8.2.3.2.1 By Application

8.3 Europe

8.3.1 By Country

8.3.2 By Application

8.3.3 By Manufacturing Process

8.3.3.1 Russia

8.3.3.1.1 By Application

8.3.3.2 Italy

8.3.3.2.1 By Application

8.3.3.3 SAPin

8.3.3.4 UK

8.3.3.5 Netherlands

8.3.3.6 Greece

8.4 APAC

8.4.1 By Country

8.4.2 By Application

8.4.3 By Manufacturing Process

8.4.3.1 China

8.4.3.1.1 By Application

8.4.3.2 Singapore

8.4.3.2.1 By Application

8.4.3.3 South Korea

8.4.3.4 Malaysia

8.4.3.5 Taiwan

8.4.3.6 Indonesia

8.5 Middle East & Africa

8.5.1 By Country

8.5.2 By Application

8.5.3 By Manufacturing Process

8.5.3.1 Saudi Arabia

8.5.3.1.1 By Application

8.5.3.2 Iran

8.5.3.2.1 By Application

8.5.3.3 South Africa

8.5.3.4 Iraq

8.6 Latin America

8.6.1 By Country

8.6.2 By Application

8.6.3 By Manufacturing Process

8.6.3.1 Mexico

8.6.3.1.1 By Application

8.6.3.2 Venezuela

8.6.3.2.1 By Application

8.6.3.3 Chile

8.6.3.4 Argentina

9 Competitive Landscape (Page No. - 77)

9.1 Overview

9.2 Market Ranking

9.3 Recent Developments

9.3.1 Expansions

9.3.2 Acquisitions

10 Company Profiles (Page No. - 80)

Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View

10.1 Sabic

10.2 Evonik Industries

10.3 China National Petroleum Corporation

10.4 Huntsman International

10.5 ENI SAP

10.6 Sinopec

10.7 Lyondellbasell

10.8 Royal Dutch Shell

10.9 Emirates National Oil Company

10.10 QAFAC

10.11 Other Key Players

10.11.1 Gazprom

10.11.2 Enterprise Product Partners L.P.

10.11.3 National Iranian Oil Company (NIOC)

10.11.4 Petronas

10.11.5 Formosa Plastics Corporation

10.11.6 Exxon Mobil Corporation

10.11.7 Yussen Chemical

10.11.8 Reliance Industries Limited

10.11.9 Shandong Dongming Petrochemical Group

10.11.10 Panjin Heyun Industrial Group

*Details Might Not Be Captured in Case of Unlisted Companies.

11 Appendix (Page No. - 100)

11.1 Insights From Industry Experts

11.2 Discussion Guide

11.3 Knowledge Store: Marketsandmarkets Subscription Portal

11.4 Introducing RT: Real-Time Market Intelligence

11.5 Available Customizations

11.6 Related Reports

11.7 Author Details

List of Tables (70 Tables)

Table 1 MTBE Market Size, 20152022 (USD Million and Kiloton)

Table 2 Methyl Tertiary Butyl Ether Market Size, By Manufacturing Process, 20152022 (USD Million)

Table 3 MTBE Market Size, By Manufacturing Process, 20152022 (Kiloton)

Table 4 Steam Cracker Process Market Size, By Region, 20152022 (USD Million)

Table 5 Steam Cracker Process Market Size, By Region, 20152022 (Kiloton)

Table 6 Fluid Liquid Cracker Process Market Size, By Region, 20152022 (USD Million)

Table 7 Fluid Liquid Cracker Process Market Size, By Region, 20152022 (Kiloton)

Table 8 Other Processes Market Size, By Region, 20152022 (USD Million)

Table 9 Other Processes Market Size, By Region, 20152022 (Kiloton)

Table 10 MTBE Market Size, By Application, 20152022 (USD Million)

Table 11 Market Size, By Application, 20152022 (Kiloton)

Table 12 Methyl Tertiary Butyl Ether Market Size in Gasoline Application, By Region, 20152022 (USD Million)

Table 13 MTBE Market Size in Gasoline Application, By Region, 20152022 (Kiloton)

Table 14 MTBE Market Size in Other Applications, By Region, 20152022 (USD Million)

Table 15 MTBE Market Size in Other Applications, By Region, 20152022 (Kiloton)

Table 16 MTBE Market Size, By Region, 20152022 (Kiloton)

Table 17 Methyl Tertiary Butyl Ether Market Size, By Region, 20152022 (USD Million)

Table 18 North America: MTBE Market Size, By Country, 20152022 (Kiloton)

Table 19 North America: Methyl Tertiary Butyl Ether Market Size, By Country, 20152022 (USD Million)

Table 20 North America: Market Size, By Application, 20152022 (Kiloton)

Table 21 North America: MTBE Market Size, By Application, 20152022 (USD Million)

Table 22 North America: Market Size, By Manufacturing Process, 20152022 (Kiloton)

Table 23 North America: MTBE Market Size, By Manufacturing Process, 20152022 (USD Million)

Table 24 US: MTBE Market Size, By Application, 20152022 (Kiloton)

Table 25 US: Methyl Tertiary Butyl Ether Market Size, By Application, 20152022 (USD Million)

Table 26 Canada: MTBE Market Size, By Application, 20152022 (Kiloton)

Table 27 Canada: Methyl Tertiary Butyl Ether Market Size, By Application, 20152022 (USD Million)

Table 28 Europe: MTBE Market Size, By Country, 20152022 (Kiloton)

Table 29 Europe: Market Size, By Country, 20152022 (USD Million)

Table 30 Europe: MTBE Market Size, By Application, 20152022 (Kiloton)

Table 31 Europe: Market Size, By Application, 20152022 (USD Million)

Table 32 Europe: MTBE Market Size, By Manufacturing Process, 20152022 (Kiloton)

Table 33 Europe: Market Size, By Manufacturing Process, 20152022 (USD Million)

Table 34 Russia: MTBE Market Size, By Application, 20152022 (Kiloton)

Table 35 Russia: Methyl Tertiary Butyl Ether Market Size, By Application, 20152022 (USD Million)

Table 36 Italy: MTBE Market Size, By Application, 20152022 (Kiloton)

Table 37 Italy: Methyl Tertiary Butyl Ether Market Size, By Application, 20152022 (USD Million)

Table 38 APAC: MTBE Market Size, By Country, 20152022 (Kiloton)

Table 39 APAC: Market Size, By Country, 20152022 (USD Million)

Table 40 APAC : Market Size, By Application, 20152022 (Kiloton)

Table 41 APAC: MTBE Market Size, By Application, 20152022 (USD Million)

Table 42 APAC : Market Size, By Manufacturing Process, 20152022 (Kiloton)

Table 43 APAC: Market Size, By Manufacturing Process, 20152022 (USD Million)

Table 44 China: MTBE Market Size, By Application, 20152022 (Kiloton)

Table 45 China: Methyl Tertiary Butyl Ether Market Size, By Application, 20152022 (USD Million)

Table 46 Singapore: MTBE Market Size, By Application, 20152022 (Kiloton)

Table 47 Singapore: Methyl Tertiary Butyl Ether Market Size, By Application, 20152022 (USD Million)

Table 48 ME&A: MTBE Market Size, By Country, 20152022 (Kiloton)

Table 49 ME&A: Methyl Tertiary Butyl Ether Market Size, By Country, 20152022 (USD Million)

Table 50 ME&A: Market Size, By Application, 20152022 (Kiloton)

Table 51 Middle East & Africa: MTBE Market Size, By Application, 20152022 (USD Million)

Table 52 ME&A: MTBE Market Size, By Manufacturing Process, 20152022 (Kiloton)

Table 53 ME&A: Market Size, By Manufacturing Process, 20152022 (USD Million)

Table 54 Saudi Arabia: MTBE Market Size, By Application, 20152022 (Kiloton)

Table 55 Saudi Arabia: Methyl Tertiary Butyl Ether Market Size, By Application, 20152022 (USD Million)

Table 56 Iran: MTBE Market Size, By Application, 20152022 (Kiloton)

Table 57 Iran: Methyl Tertiary Butyl Ether Market Size, By Application, 20152022 (USD Million)

Table 58 Latin America: MTBE Market Size, By Country, 20152022 (Kiloton)

Table 59 Latin America: Market Size, By Country, 20152022 (USD Million)

Table 60 Latin America: Market Size, By Application, 20152022 (Kiloton)

Table 61 Latin America: Market Size, By Application, 20152022 (USD Million)

Table 62 Latin America: Market Size, By Manufacturing Process, 20152022 (Kiloton)

Table 63 Latin America: Market Size, By Manufacturing Process, 20152022 (USD Million)

Table 64 Mexico: MTBE Market Size, By Application, 20152022 (Kiloton)

Table 65 Mexico: Market Size, By Application, 20152022 (USD Million)

Table 66 Venezuela: MTBE Market Size, By Application, 20152022 (Kiloton)

Table 67 Venezuela: Methyl Tertiary Butyl Ether Market Size, By Application, 20152022 (USD Million)

Table 68 Sabic - the Largest Company in the MTBE Market

Table 69 Expansions, 20132017

Table 70 Acqusitions, 20132017

List of Figures (37 Figures)

Figure 1 MTBE: Market Segmentation

Figure 2 Methyl Tertiary Butyl Ether Market: Research Design

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Fluid Liquid Cracker to Register the Highest CAGR in the MTBE Market, in Terms of Value, 20172022

Figure 6 Gasoline to Be the Largest Application of MTBE Market, 20172022

Figure 7 APAC to Be the Fastest-Growing Market for MTBE

Figure 8 Rising Demand for Gasoline to Boost the MTBE Market Between 2017 and 2022

Figure 9 Fluid Liquid Cracker to Lead MTBE Market Between 2017 and 2022

Figure 10 Gasoline Dominated the MTBE Market in 2017

Figure 11 APAC LED MTBE Market in 2016

Figure 12 China to Register the Highest CAGR Between 2017 and 2022

Figure 13 Factors Governing the Methyl Tertiary Butyl Ether Market

Figure 14 MTBE Market: Porters Five Forces Analysis

Figure 15 Fluid Liquid Cracker Manufacturing Process to Lead MTBE Market, 20172022

Figure 16 APAC to Dominate MTBE Market in Steam Cracker Process Segment, 2017-2022

Figure 17 APAC to Dominate MTBE Market in Fluid Liquid Cracker Process Segment, 2017-2022

Figure 18 Gasoline to Be the Fastest-Growing Application of MTBE During the Forecast Period

Figure 19 APAC to Dominate the MTBE Market in Gasoline Application

Figure 20 APAC to Dominate the MTBE Market in Other Application

Figure 21 China LED the Global MTBE Market, 2016

Figure 22 US is A Lucrative Market

Figure 23 Russia is the Most Attractive Market

Figure 24 China is the Largest Market

Figure 25 Saudi Arabia to Be the Most Lucrative Market

Figure 26 Mexico to Be the Most Lucrative Market

Figure 27 Companies Adopted Expansions as the Key Growth Strategy Between 2013 and 2017

Figure 28 Sabic: Company Snapshot

Figure 29 Evonik Industries : Company Snapshot

Figure 30 China National Petroleum Corporation: Company Snapshot

Figure 31 Huntsman International LLC: Company Snapshot

Figure 32 ENI SAP: Company Snapshot

Figure 33 Sinopec: Company Snapshot

Figure 34 Lyondell Basell: Company Snapshot

Figure 35 Royal Dutch Shell: Company Snapshot

Figure 36 Emirates National Oil Company: Company Snapshot

Figure 37 QAFAC: Company Snapshot

Growth opportunities and latent adjacency in Methyl Tertiary Butyl Ether Market