Metaverse in Gaming Market by Component, Hardware (AR Devices, VR Devices, MR Devices, Displays), Software (Extended Reality Software, Gaming Engines, Metaverse Platforms, Financial Platforms), Game Genre and Region - Global Forecast to 2028

Metaverse in Gaming Market Overview

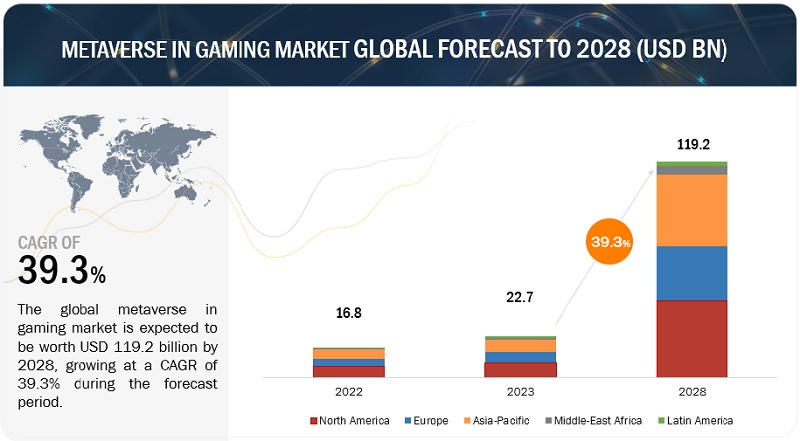

The global Metaverse in Gaming Market size was valued $22.7 billion in 2023 and is anticipated to reach $119.2 billion by 2028 with robust CAGR of 39.3% during the forecast period.

Surge in virtual world immersive interactive gameplay experience in the metaverse in gaming industry, upsurge in AR, VR, devices demand globally, emerging, and profitable opportunities from adjacent markets such as Extended Reality, Mixed Reality, brand promotions using gamification strategy and virtual world 3D simulators, are few factors which are expected to be the major driving forces in the growth of the Metaverse in gaming Market.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Recession Impact on the Global Metaverse in Gaming Market

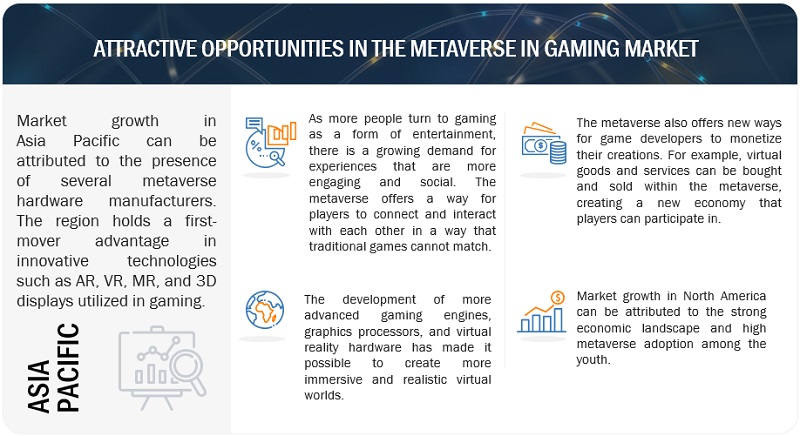

The virtual world gaming industry in North America is worth more than music and film combined (the entertainment industry) and shows no sign of stopping; and by 2026, it should reach USD 326 billion in value, according to a PwC survey. According to the EY Gaming Industry Survey report, considering the product side, half of the Nordics executives surveyed (precisely 53%) responded that they are prioritizing investments in VR, AR, and MR experiences. The survey conducted was also aimed at measuring the impact of a recession on the metaverse in gaming industry wherein respondents belonged to practices such as e-sports, gaming accessory manufacturers, gaming distribution, gaming hardware, gaming platform company, gaming publisher, gaming studio, and semiconductors/chip manufacturers. In July 2022, Dubai’s new metaverse (with a gaming focus) strategy was designed to add USD 4 billion to the economy which would result in 40,000 new jobs over the next five years. Overall, it is estimated that the gaming metaverse will inject USD 15 billion into GCC (Gulf Cooperation Council) economies by 2030. The metaverse in gaming industry is forecasted to contribute a whopping USD 2.4 billion to the economy by 2030; the contributors will be Bahrain, Qatar, Oman, the United Arab Emirates, Saudi Arabia, Dubai, and Kuwait (members of the GCC). Meta is investing more than USD 1 billion in programs that support creators (game developers) on metaverse platforms and help them succeed in the Middle East, North Africa, and Turkey. This region is profoundly working, with an eye on technical aspects, on long-term NFT projects to tackle a recession technically in the long run.

Metaverse in Gaming Market Growth Dynamics

Driver: Brand promotions using gamification and virtual world simulators

Many companies, especially from the retail and gaming (entertainment) industry, are taking advantage of the gaming part of the metaverse. They are strategically using metaverse in gaming to engage in metaverse-based promotions and sponsorships. These companies capitalize by gamifying their brands through immersive online experiences and virtual world simulators. Some of the metaverse in gaming projects that gamify brand awareness include Reactland by Nike, Inc. (US), MagicBand+ by Disney (US), Mobility Adventure by Hyundai Motor Company (South Korea), and Gucci Garden by Gucci (Italy). People engage in these 3D worlds to play mini-games, connect with other gamers, socialize, make friends, and get product information through salespeople, chatbots, or virtual AI agents. Metaverse in gaming makes brand promotion interesting and engaging for young customers. Therefore, it is expected to drive the market during the forecast period.

Restraint: Regulating metaverse in gaming with respect to cybersecurity, privacy, and usage standards

Security and privacy issues are the major challenges the VR, AR, and MR industries face. These issues have emerged due to inconsistencies in programming and negligence and oversight of the developers and end users of apps and devices. With the increased amount of sensitive data being collected from players, data breaches, unauthorized data access, and data misuse become significant threats/obstructions. For instance, with whom a user speaks, what someone chooses to play and indulge in which virtual world game live-streaming, how much attention each user pays to an advertisement, or a specific immersive game basis genre, and few more. Additionally, it can even obtain extremely personal details, such as the way an individual virtually with its digital character or Avatar walks, talks, breathes and, perhaps, brainwave patterns could be collected in order to have a far better grasp on people's mental processes and behaviors. Gaming metaverse users ought to be logged in for long time periods, which means that their behavioral patterns will be continuously tracked and collected.

With reference to the applicability of the General Data Protection Regulation (GDPR), an obvious question arises, if the current data protection framework is adequate and sufficient to regulate how personal data is processed in the gaming metaverse. Moreover, determining the GDPR's territorial application is an issue in itself (when the entities are not based in the European Union [EU]), since it depends on the location of the end-user/gamer when personal data is processed.

Opportunity: Significant growth opportunities despite possible economic slowdown

The pandemic outbreak has hastened the evolution of the internet, resulting in the metaverse, where cyberspace has become more of an interactive 3D space with business and networking, as well as content that corresponds to the worlds in popular games such as Roblox. Playing in the metaverse allows gamers to meet new people and expand their social circle as well as have portable live-handling-virtual-play gaming assets, such as avatars and weapons, that are associated with players and have value in virtual settings. The increased popularity that the gaming category is witnessing in different virtual worlds such as Sandbox and Decentraland, is likely to grow with the advancement in technology and the fast-expanding user base in the 3D gaming sector. Moreover, the live streaming of games in the metaverse with more users jumping on the bandwagon will also help gaming companies to intensify their penetration to set new benchmarks for growth and profitability in the virtual worlds.

Challenge: Regional government regulations coupled with environmental impact

Metaverse in gaming is supported by adjacent technologies, primarily cloud computing (cloud gaming), blockchain, and XR. These technologies require high computing powers and storage, which has resulted in the ever-increasing need for data centers and computing equipment, such as storage hardware, cooling components, networking cables, GPU, CPU, and bandwidth. Further, the blockchain plays an important role in the functioning of the metaverse, which is backed by cryptocurrency mining and the heat generated by crypto mines housed by thousands of graphics cards. VR technology and data centers use AI and cloud services, which require quite a bit of energy. Running and maintaining such an infrastructure requires a lot of energy and power. All this collectively impacts the environment directly or indirectly. According to Data Quest, metaverse in gaming could lead to an influx of greenhouse gas emissions. Cloud gaming, a primary part of metaverse in gaming and XR, could also raise carbon emissions significantly over the next decade if not controlled. The evolution of technologies, such as 4K and 8K, is also witnessing the rise in the streaming of hi-resolution videos and images, which only increases the need for more energy. Such factors are expected to hinder market growth. However, mass recycling of e-waste, emphasis on buying second-hand electronics, and streaming in standard definition are possible ways to reduce greenhouse emissions caused by metaverse in gaming.

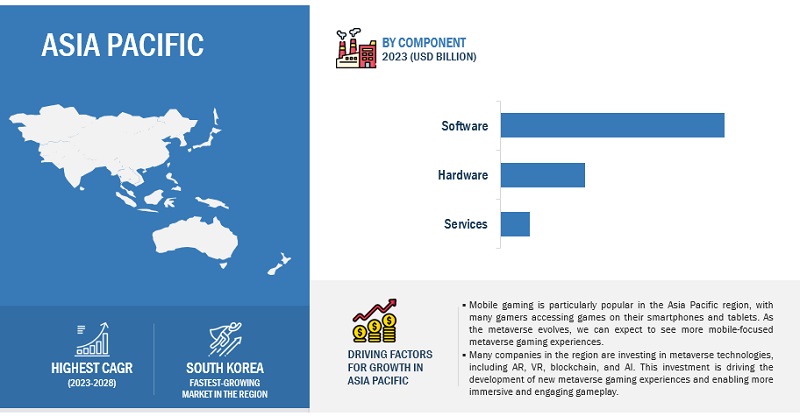

By component, the software segment to hold the largest market share during the forecast period

The software includes gaming engines, 3D modeling and reconstruction tools, volumetric video tools, geospatial mapping software, metaverse platforms, and financial platforms. A game engine is a software development program or environment used originally to develop video games. Now, a game engine can also be used for visualization (as with the development of digital twins), collaboration, and more. The features of a game engine may include animation tools, artificial intelligence, physics and collision engines, audio engines, and more.

Social media and video game companies are at the center of the metaverse's capability that leverages their vast user bases, interactive digital events, creation platforms, and hardware to build the foundation. NFTs facilitate the concept of play-to-earn (P2E) in the metaverse. Metaverse-ready gaming applications can use NFTs to build in-game assets with real-world value. Players who earn these NFTs through gameplay can later cash them out for real money. The value of the NFT would increase with time as more people start playing the game and want to own a piece of it. You can then trade or sell your NFTs to gain more money.

By software, Extended reality software segment to hold the largest market share during the forecast period

Several extended reality software includes AR and VR web app development tools, AR and VR mobile app development tools, AR and VR studios, Software Development Kits (SDK), and cloud-based tools. The extended reality software market has witnessed high growth in recent years and is set to witness significant growth during the next five years. Mass consumerization is anticipated to help achieve widespread adoption of extended reality software globally. Software Development Kits (SDK) are sets of software development tools that allow the creation of applications for specific software packages, software frameworks, hardware platforms, and operating systems. Several AR, VR, and MR applications are available in the market for Android and iOS, while a few of them are iOS specific.

SDK provides tools to design, create, and test AR, VR, and MR experiences. They act as building blocks to create training simulations, marketing experiences, and mobile apps. These kits offer tools to carry out cloning functions and add and move 3D objects. SDK also offers flexibility to non-developers by providing them with dragging and dropping tools to customize users' experiences. These kits can be integrated with operating systems and hardware to display VR. The key SDKs available in the market are Apple’s ARKit, ARCore, Vuforia, AR Foundation, OpenVR SDK, Valve’s SteamVR SDK, Virtual Reality Tool Kit (VRTK), Sony’s PlayStation VR (PSVR) Dev Kit, Meta’s Oculus SDK, and Google VR SDK.

By game genre, Strategy segment to record the highest CAGR during the forecast period

These games let players explore a vast, open world filled with cooperative gameplay and social features. One can create and customize weapons using primal energy, and challenge themselves by facing off against formidable bosses. This gaming genre tests players’ decision-making skills. It is a high-revenue game type; however, game-makers must be strategic in creating strategy games. Players are likely to get easily bored, especially if they feel a lack of progress while playing and brainstorming strategy(ies). Developers should include exclusive live event rewards, collectible mechanics, and special player vs. environment modes to incentivize players and reduce uninstalls.

By Region, Asia Pacific to record the highest CAGR during the forecast period

The Asia Pacific Metaverse in gaming Market is estimated and forecasted to have robust growth in the future. Metaverse in gaming solution vendors need to continuously innovate and upscale to meet the diversified demands from gamers across various countries, such as Australia and New Zealand (ANZ), Japan, China, Singapore, South Korea, India, Indonesia, Hong Kong. Gaming companies have been quick to jump on the bandwagon. Local tech and gaming giant Alibaba (China) is rewarding players with NFTs on its first blockchain game, Ant Adventure, which can be played through the Alipay app. IT services giant Fujitsu (Japan) and automobile manufacturer Mitsubishi have embarked on a collaboration to create an advertiser-friendly immersive gaming environment which has been grandly named the ‘Japan Metaverse Economic Zone’. Asia Pacific is the world’s largest hardware manufacturer. Metaverse in gaming vendors are sincerely upgrading the region’s connectivity technologies to be reliable, exhibit high bandwidth and upstream connections to be emerged for enjoying gaming metaverse experiences. Asia Pacific houses 55% of global gamers, totaling 1.7 billion, and contributes over USD 72 billion in annual gaming revenue. Role-playing games [RPG], popularized by titles like Final Fantasy and Dragon Quest, have been the dominant genre in Asia Pacific’s gaming market since the late 1980s and early 1990s.

Metaverse in Gaming Companies

The report includes the study of Metaverse in gaming companies, products, solutions and services. It profiles major vendors in the global Metaverse in gaming Market. The major vendors in the Metaverse in gaming industry include Meta (US), Activision Blizzard (US), Netease (China), Electronic Arts (US), Take-Two (US), Tencent (China), Nexon (Japan), Epic games (US), Unity (US), Valve (US), Accenture (Ireland), Adobe (US), HPE (US), Deloitte (UK), Ansys (US), Autodesk Inc. (US), Intel (US), Tech Mahindra (India), ByteDance (China), Nvidia (US), Microsoft (US), Samsung (South Korea), Google (US), Sony (Japan), HTC (Taiwan), Seiko Epson (Japan), Apple (US), Qualcomm (US), Panasonic (Japan), EON Reality (US), Roblox (US), Lenovo (Hong Kong), Razer (US), Nextech AR Solutions (Canada), ZQGame (China), TaleCraft (Marshall islands), VRChat (US), Decentraland (Argentina), Somnium Space (UK), Sandbox (US). These players have adopted various strategies to grow in the global Metaverse in gaming Market.

The study includes an in-depth competitive analysis of these key players in the Metaverse in gaming Market with their company profiles, recent developments, and key market strategies.

Scope of the Report

|

Report Metrics |

Details |

|

Market Size in 2023 |

$22.7 billion |

|

Revenue Forecast for 2028 |

$119.2 billion |

|

CAGR (2023-2028) |

39.3% |

|

Growth Drivers |

Brand promotions using gamification and virtual world simulators |

|

Key Opportunities |

Significant growth opportunities despite possible economic slowdown |

|

Market size available for years |

2019–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD Million/Billion) |

|

Segments covered |

Component, Hadware, Software, Service, Game Genre, and Region |

|

Geographies covered |

North America, Asia Pacific, Europe, Middle East and Africa, and Latin America |

|

List of Metaverse in Gaming Companies |

Meta(US), Microsoft(US), NetEase(China), Electronic Arts(US), Take-Two (US), Tencent (China), Nexon (Japan), Epic Games (US), Unity (US), Valve (US), Accenture (Ireland), Adobe (US), HPE (US), Deloitte (UK), Ansys (US), Autodesk (US), Intel (US), Tech Mahindra (India), ByteDance (China), Nvidia (US), Activision Blizzard (US), Samsung (South Korea), Google (US), Sony (Japan), HTC (Taiwan), Seiko Epson (Japan), Apple (US), Qualcomm (US), Panasonic (Japan), Eon Reality (US), Roblox (US), Lenovo (Hong Kong), Razer (US), Nextech AR Solutions (Canada), ZQGame (China), Talecraft (Marshall islands), VR Chat (US), Decentraland (Argentina), Somnium Space (UK), and Sandbox VR (US) |

The research report categorizes the Metaverse Gaming Market to forecast revenues and analyze trends in each of the following submarkets:

By component:

- Hardware

- Software

- Services

By hardware:

- AR Devices

- VR Devices

- MR Devices

- Displays

By software:

- Extended Reality Software

- Gaming Engines

- 3D Mapping, Modeling, and Reconstruction

- Financial Platforms

- Metaverse Platforms

By game genre:

- Action

- Adventure

- Casual

- Role-playing

- Simulation

- Sports & Racing

- Strategy

By region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

Asia Pacific

- China

- Japan

- South Korea

- Rest of Asia Pacific

-

Middle East & Africa

- United Arab Emirates

- Rest of Middle East & Africa

-

Latin America

- Brazil

- Rest of Latin America

Recent Developments:

- In April 2023, Electronic Arts launched EA SPORTS FC which unveiled its new brand identity, vision, and logo. FC will become an EA SPORTS platform for creating, innovating, and expanding new football experiences, connecting hundreds of millions of fans via console, mobile, online, and esports products.

- In March 2023, Unreal Editor for Fortnite (UEFN), a version of the Unreal Editor that has the ability to create and publish experiences directly to Fortnite. With many of Unreal Engine 5’s powerful features at users’ fingertips, creators and developers have access to an entire world of new creative options for game production and experiences that can be enjoyed by millions of Fortnite players. UEFN will also permit the use of ‘Verse,’ which the company claims come(s) with powerful customization capabilities such as chaining devices together, and the ability to conveniently create new game logic hassle-free.

- In January 2023, Unity, which is a global platform for creating and growing real-time 3D (RT3D) content, and Google together simplified ways for developers to create multiplayer experiences by offering two solutions from Unity Gaming Services (UGS), Game Server Hosting (Multiplay) and Voice and Text Chat (Vivox), on the Google Cloud Marketplace.

Frequently Asked Questions (FAQ):

How big is the Metaverse in Gaming Market?

What is the Metaverse in Gaming Market Growth?

What are the challenges in the Metaverse in Gaming Market?

Which are the top Metaverse in Gaming companies?

Who will be the leading hub for Metaverse in Gaming Market?

What is the Metaverse in Gaming Market Segmentation?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increase in industrial training and deployment in education sector- Rapid adoption of virtual technologies- Decrease in price of VR headsetsRESTRAINTS- Requirement of reliable and scalable technology infrastructure- Health and mental issues from excessive use- High installation and maintenance costs of high-end metaverse componentsOPPORTUNITIES- Immersive experience offered to students- Major infusion of educational technology prompted by COVID-19 pandemic- Constantly evolving 5G technologyCHALLENGES- Fear of content development, digital inequality, and access issues- Innovation in transforming education ecosystem

-

5.3 CASE STUDY ANALYSISSTEVENS INSTITUTE OF TECHNOLOGY UTILIZED SAMSUNG INTERACTIVE BOARDS FOR DISTANT CLASSROOMSECNU XIPING BILINGUAL SCHOOL SUPPORTED SUPERIOR EDUCATIONAL EXPERIENCES WITH LENOVO THINKAGILE VX SERIESONTARIO COLLEGE TURNED TO MICROSOFT’S MIXED REALITY FOR FUTURE OF TRAININGKATHERINE WARINGTON SCHOOL ENHANCED CLASSROOM ENGAGEMENT WITH CLASSVRUNITY PREPARES TAFE QUEENSLAND STUDENTS FOR IN-DEMAND CAREERS WITH UAA

-

5.4 ECOSYSTEM

- 5.5 VALUE CHAIN ANALYSIS

-

5.6 PRICING ANALYSISINTRODUCTIONAVERAGE SELLING PRICE TRENDSAVERAGE SELLING PRICE TRENDS OF KEY PLAYERS, BY TYPE

-

5.7 PATENT ANALYSIS

-

5.8 TECHNOLOGY ANALYSISAI AND ML5G NETWORKINTERNET OF THINGSVIRTUAL REALITYAUGMENTED REALITY

-

5.9 REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSREGULATIONS, BY REGION- North America- Europe- Asia Pacific- Middle East & South Africa- Latin AmericaREGULATORY IMPLICATIONS AND INDUSTRY STANDARDS- General Data Protection Regulation- SEC Rule 17a-4- ISO/IEC 27001- System and Organization Controls 2 Type II Compliance- Financial Industry Regulatory Authority- Freedom of Information Act- Health Insurance Portability and Accountability Act

-

5.10 PORTER’S FIVE FORCES MODELINTENSITY OF COMPETITIVE RIVALRYBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTES

- 5.11 KEY CONFERENCES AND EVENTS

-

5.12 TRENDS/DISRUPTIONS IMPACTING BUYERS

-

5.13 KEY STAKEHOLDERS & BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

6.1 INTRODUCTIONCOMPONENT: METAVERSE IN EDUCATION MARKET DRIVERS

-

6.2 HARDWAREAR DEVICES- Facilitating more efficient and interactive engagement with subjectsVR DEVICES- Allowing students to manipulate virtual objects using natural hand gesturesMR DEVICES- High-performance graphics to experience enhanced learningINTERACTIVE DISPLAYS & PROJECTORS- Enhanced students’ cognitive learning capabilities

-

6.3 SOFTWAREEXTENDED REALITY SOFTWARE- Improved learning capabilities and reduction in learning timeGAMING ENGINES- Creating fun and engaging ways for studentsMETAVERSE PLATFORM- More engaging experience than traditional classroom lectures or online courses3D MAPPING, MODELING, AND RECONSTRUCTION- Creating natural-looking spaces to enhance student engagement

-

6.4 PROFESSIONAL SERVICESAPPLICATION DEVELOPMENT & SYSTEM INTEGRATION- Deep understanding of various components involved and ability to implement interfacesSTRATEGY & BUSINESS CONSULTING SERVICES- Helping clients identify and solve problems, achieve their goals, and improve their overall performance

-

7.1 INTRODUCTIONEND USER: METAVERSE IN EDUCATION MARKET DRIVERS

-

7.2 ACADEMICINCREASED USAGE OF HANDHELD DEVICES FOR LEARNINGK–12- Multiple innovative resources to access metaverse in schoolsHIGHER EDUCATION- Students offered benefits of learning from anywhere

-

7.3 CORPORATECOLLABORATION AND SOCIAL LEARNING FOR EMPLOYEES WITHIN VIRTUAL ENVIRONMENT

- 8.1 INTRODUCTION

-

8.2 NORTH AMERICANORTH AMERICA: METAVERSE IN EDUCATION MARKET DRIVERSNORTH AMERICA: RECESSION IMPACTUS- Adoption of advanced technologies such as AR and VRCANADA- Combination of games and education offered in institutions

-

8.3 EUROPEEUROPE: METAVERSE IN EDUCATION MARKET DRIVERSEUROPE: RECESSION IMPACTUK- Growth in use of VR headsetsGERMANY- Increase in digitalization and effective management of metaverse in education through various stagesFRANCE- Strong support from French government for adoption of metaverse in education sectorREST OF EUROPE

-

8.4 ASIA PACIFICASIA PACIFIC: METAVERSE IN EDUCATION MARKET DRIVERSASIA PACIFIC: RECESSION IMPACTCHINA- Presence of innovative technologiesJAPAN- Increased R&D investments and skilled professionalsINDIA- Continuous upgrades to metaverse IT infrastructure and applicationsREST OF ASIA PACIFIC

-

8.5 MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA: METAVERSE IN EDUCATION MARKET DRIVERSMIDDLE EAST & AFRICA: RECESSION IMPACTKINGDOM OF SAUDI ARABIA- Commitment to collaborating with educational institutions and policymakersUAE- Rise in government investments and economic developmentREST OF THE MIDDLE EAST & AFRICA

-

8.6 LATIN AMERICALATIN AMERICA: METAVERSE IN EDUCATION MARKET DRIVERSLATIN AMERICA: RECESSION IMPACTBRAZIL- Promotion of creativity and innovation among students through latest softwareMEXICO- Major digital transformation in education sectorREST OF LATIN AMERICA

- 9.1 INTRODUCTION

- 9.2 RIGHT TO WIN

- 9.3 MARKET SHARE ANALYSIS

- 9.4 HISTORICAL REVENUE ANALYSIS OF TOP VENDORS

-

9.5 KEY COMPANY EVALUATION QUADRANTSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

9.6 OTHER PLAYER AND STARTUP/SME EVALUATION QUADRANTRESPONSIVE COMPANIESPROGRESSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING OF STARTUPS/SMES

- 9.7 COMPANY FINANCIAL METRICS

- 9.8 BAL SNAPSHOT OF KEY MARKET PARTICIPANTS

- 9.9 KEY MARKET DEVELOPMENTS

- 10.1 INTRODUCTION

-

10.2 KEY PLAYERSMETA PLATFORMS, INC.- Business overview- Products/Services offered- Recent developments- MnM viewMICROSOFT CORPORATION- Business overview- Products/Services offered- Recent developments- MnM viewADOBE INC.- Business overview- Product/Services offered- Recent developments- MnM viewHP INC.- Business overview- Products/Services offered- Recent developments- MnM viewUNITY SOFTWARE INC.- Business overview- Products/Services offered- Recent developments- MnM viewSAMSUNG ELECTRONICS- Business overview- Products/Services offered- Recent developmentsLENOVO- Business overview- Products/Services offered- Recent developmentsROBLOX CORPORATION- Business overview- Products/Services offered- Recent developmentsEPIC GAMES- Business overview- Products/Services offered- Recent developmentsBAIDU, INC.- Business overview- Products/Services offered- Recent developments

-

10.3 OTHER PLAYERSAVANTIS SYSTEMS LTD.AXON PARKTOMORROW’S EDUCATIONNEXTMEETCLASSVRMETABLE GMBHVIRBELALABSTERVICTORYXRENGAGE PLCVEDX SOLUTIONSSTEMULINETEASEHTCSANDBOX

-

10.4 STARTUPS/SMESMEDROOMMARVRUSFOTONVRIBENTOSLEGEND OF LEARNINGSOPHIADEVDENIMMERSEKWARK EDUCATIONHATCHXRMETAVERSE LEARNING LIMITED

-

11.1 INTRODUCTIONRELATED MARKETSLIMITATIONS

- 11.2 EXTENDED REALITY MARKET

- 11.3 AUGMENTED REALITY AND VIRTUAL REALITY MARKET

- 11.4 METAVERSE MARKET

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES, 2019–2022

- TABLE 2 LIST OF KEY SECONDARY SOURCES

- TABLE 3 METAVERSE IN EDUCATION MARKET: PRIMARY RESPONDENTS

- TABLE 4 FACTOR ANALYSIS

- TABLE 5 ASSUMPTIONS

- TABLE 6 METAVERSE IN EDUCATION MARKET: PRICING ANALYSIS, BY VENDOR

- TABLE 7 TOP PATENT OWNERS

- TABLE 8 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 METAVERSE IN EDUCATION MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 13 METAVERSE IN EDUCATION MARKET: KEY CONFERENCES AND EVENTS, 2023–2024

- TABLE 14 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP HARDWARE

- TABLE 15 KEY BUYING CRITERIA FOR TOP THREE HARDWARE

- TABLE 16 METAVERSE IN EDUCATION MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 17 METAVERSE IN EDUCATION MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 18 HARDWARE: METAVERSE IN EDUCATION MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 19 HARDWARE: METAVERSE IN EDUCATION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 20 METAVERSE IN EDUCATION MARKET, BY HARDWARE, 2018–2022 (USD MILLION)

- TABLE 21 METAVERSE IN EDUCATION MARKET, BY HARDWARE, 2023–2028 (USD MILLION)

- TABLE 22 AR DEVICES: METAVERSE IN EDUCATION MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 23 AR DEVICES: METAVERSE IN EDUCATION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 24 VR DEVICES: METAVERSE IN EDUCATION MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 25 VR DEVICES: METAVERSE IN EDUCATION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 26 MR DEVICES: METAVERSE IN EDUCATION MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 27 MR DEVICES: METAVERSE IN EDUCATION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 28 INTERACTIVE DISPLAYS & PROJECTORS: METAVERSE IN EDUCATION MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 29 INTERACTIVE DISPLAYS & PROJECTORS: METAVERSE IN EDUCATION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 30 SOFTWARE: METAVERSE IN EDUCATION MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 31 SOFTWARE: METAVERSE IN EDUCATION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 32 PROFESSIONAL SERVICES: METAVERSE IN EDUCATION MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 33 PROFESSIONAL SERVICES: METAVERSE IN EDUCATION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 34 METAVERSE IN EDUCATION MARKET, BY PROFESSIONAL SERVICE, 2018–2022 (USD MILLION)

- TABLE 35 METAVERSE IN EDUCATION MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 36 APPLICATION DEVELOPMENT & SYSTEM INTEGRATION: METAVERSE IN EDUCATION MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 37 APPLICATION DEVELOPMENT & SYSTEM INTEGRATION: METAVERSE IN EDUCATION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 38 STRATEGY & BUSINESS CONSULTING SERVICES: METAVERSE IN EDUCATION MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 39 STRATEGY & BUSINESS CONSULTING SERVICES: METAVERSE IN EDUCATION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 40 METAVERSE IN EDUCATION MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 41 METAVERSE IN EDUCATION MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 42 ACADEMIC: METAVERSE IN EDUCATION MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 43 ACADEMIC: METAVERSE IN EDUCATION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 44 METAVERSE IN EDUCATION MARKET, BY ACADEMIC END USER, 2018–2022 (USD MILLION)

- TABLE 45 METAVERSE IN EDUCATION MARKET, BY ACADEMIC END USER, 2023–2028 (USD MILLION)

- TABLE 46 K–12: METAVERSE IN EDUCATION MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 47 K–12: METAVERSE IN EDUCATION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 48 HIGHER EDUCATION: METAVERSE IN EDUCATION MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 49 HIGHER EDUCATION: METAVERSE IN EDUCATION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 50 CORPORATE: METAVERSE IN EDUCATION MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 51 CORPORATE: METAVERSE IN EDUCATION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 52 METAVERSE IN EDUCATION MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 53 METAVERSE IN EDUCATION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 54 NORTH AMERICA: METAVERSE IN EDUCATION MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 55 NORTH AMERICA: METAVERSE IN EDUCATION MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 56 NORTH AMERICA: METAVERSE IN EDUCATION MARKET, BY HARDWARE, 2018–2022 (USD MILLION)

- TABLE 57 NORTH AMERICA: METAVERSE IN EDUCATION MARKET, BY HARDWARE, 2023–2028 (USD MILLION)

- TABLE 58 NORTH AMERICA: METAVERSE IN EDUCATION MARKET, BY PROFESSIONAL SERVICE, 2018–2022 (USD MILLION)

- TABLE 59 NORTH AMERICA: METAVERSE IN EDUCATION MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 60 NORTH AMERICA: METAVERSE IN EDUCATION MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 61 NORTH AMERICA: METAVERSE IN EDUCATION MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 62 NORTH AMERICA: METAVERSE IN EDUCATION MARKET, BY ACADEMIC END USER, 2018–2022 (USD MILLION)

- TABLE 63 NORTH AMERICA: METAVERSE IN EDUCATION MARKET, BY ACADEMIC END USER, 2023–2028 (USD MILLION)

- TABLE 64 NORTH AMERICA: METAVERSE IN EDUCATION MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 65 NORTH AMERICA: METAVERSE IN EDUCATION MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 66 US: METAVERSE IN EDUCATION MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 67 US: METAVERSE IN EDUCATION MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 68 CANADA: METAVERSE IN EDUCATION MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 69 CANADA: METAVERSE IN EDUCATION MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 70 EUROPE: METAVERSE IN EDUCATION MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 71 EUROPE: METAVERSE IN EDUCATION MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 72 EUROPE: METAVERSE IN EDUCATION MARKET, BY HARDWARE, 2018–2022 (USD MILLION)

- TABLE 73 EUROPE: METAVERSE IN EDUCATION MARKET, BY HARDWARE, 2023–2028 (USD MILLION)

- TABLE 74 NORTH AMERICA: METAVERSE IN EDUCATION MARKET, BY PROFESSIONAL SERVICE, 2018–2022 (USD MILLION)

- TABLE 75 NORTH AMERICA: METAVERSE IN EDUCATION MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 76 EUROPE: METAVERSE IN EDUCATION MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 77 EUROPE: METAVERSE IN EDUCATION MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 78 EUROPE: METAVERSE IN EDUCATION MARKET, BY ACADEMIC END USER, 2018–2022 (USD MILLION)

- TABLE 79 EUROPE: METAVERSE IN EDUCATION MARKET, BY ACADEMIC END USER, 2023–2028 (USD MILLION)

- TABLE 80 EUROPE: METAVERSE IN EDUCATION MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 81 EUROPE: METAVERSE IN EDUCATION MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 82 UK: METAVERSE IN EDUCATION MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 83 UK: METAVERSE IN EDUCATION MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 84 GERMANY: METAVERSE IN EDUCATION MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 85 GERMANY: METAVERSE IN EDUCATION MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 86 FRANCE: METAVERSE IN EDUCATION MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 87 FRANCE: METAVERSE IN EDUCATION MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 88 REST OF EUROPE: METAVERSE IN EDUCATION MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 89 REST OF EUROPE: METAVERSE IN EDUCATION MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 90 ASIA PACIFIC: METAVERSE IN EDUCATION MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 91 ASIA PACIFIC: METAVERSE IN EDUCATION MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 92 ASIA PACIFIC: METAVERSE IN EDUCATION MARKET, BY HARDWARE, 2018–2022 (USD MILLION)

- TABLE 93 ASIA PACIFIC: METAVERSE IN EDUCATION MARKET, BY HARDWARE, 2023–2028 (USD MILLION)

- TABLE 94 ASIA PACIFIC: METAVERSE IN EDUCATION MARKET, BY PROFESSIONAL SERVICE, 2018–2022 (USD MILLION)

- TABLE 95 ASIA PACIFIC: METAVERSE IN EDUCATION MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 96 ASIA PACIFIC: METAVERSE IN EDUCATION MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 97 ASIA PACIFIC: METAVERSE IN EDUCATION MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 98 ASIA PACIFIC: METAVERSE IN EDUCATION MARKET, BY ACADEMIC END USER, 2018–2022 (USD MILLION)

- TABLE 99 ASIA PACIFIC: METAVERSE IN EDUCATION MARKET, BY ACADEMIC END USER, 2023–2028 (USD MILLION)

- TABLE 100 ASIA PACIFIC: METAVERSE IN EDUCATION MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 101 ASIA PACIFIC: METAVERSE IN EDUCATION MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 102 CHINA: METAVERSE IN EDUCATION MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 103 CHINA: METAVERSE IN EDUCATION MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 104 JAPAN: METAVERSE IN EDUCATION MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 105 JAPAN: METAVERSE IN EDUCATION MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 106 INDIA: METAVERSE IN EDUCATION MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 107 INDIA: METAVERSE IN EDUCATION MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 108 REST OF ASIA PACIFIC: METAVERSE IN EDUCATION MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 109 REST OF ASIA PACIFIC: METAVERSE IN EDUCATION MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 110 MIDDLE EAST & AFRICA: METAVERSE IN EDUCATION MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 111 MIDDLE EAST & AFRICA: METAVERSE IN EDUCATION MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 112 MIDDLE EAST & AFRICA: METAVERSE IN EDUCATION MARKET, BY HARDWARE, 2018–2022 (USD MILLION)

- TABLE 113 MIDDLE EAST & AFRICA: METAVERSE IN EDUCATION MARKET, BY HARDWARE, 2023–2028 (USD MILLION)

- TABLE 114 MIDDLE EAST & AFRICA: METAVERSE IN EDUCATION MARKET, BY PROFESSIONAL SERVICE, 2018–2022 (USD MILLION)

- TABLE 115 MIDDLE EAST & AFRICA: METAVERSE IN EDUCATION MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 116 MIDDLE EAST & AFRICA: METAVERSE IN EDUCATION MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 117 MIDDLE EAST & AFRICA: METAVERSE IN EDUCATION MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 118 MIDDLE EAST & AFRICA: METAVERSE IN EDUCATION MARKET, BY ACADEMIC END USER, 2018–2022 (USD MILLION)

- TABLE 119 MIDDLE EAST & AFRICA: METAVERSE IN EDUCATION MARKET, BY ACADEMIC END USER, 2023–2028 (USD MILLION)

- TABLE 120 MIDDLE EAST & AFRICA: METAVERSE IN EDUCATION MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 121 MIDDLE EAST & AFRICA: METAVERSE IN EDUCATION MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 122 KINGDOM OF SAUDI ARABIA: METAVERSE IN EDUCATION MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 123 KINGDOM OF SAUDI ARABIA: METAVERSE IN EDUCATION MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 124 UAE: METAVERSE IN EDUCATION MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 125 UAE: METAVERSE IN EDUCATION MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 126 REST OF THE MIDDLE EAST & AFRICA: METAVERSE IN EDUCATION MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 127 REST OF THE MIDDLE EAST & AFRICA: METAVERSE IN EDUCATION MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 128 LATIN AMERICA: METAVERSE IN EDUCATION MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 129 LATIN AMERICA: METAVERSE IN EDUCATION MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 130 LATIN AMERICA: METAVERSE IN EDUCATION MARKET, BY HARDWARE, 2018–2022 (USD MILLION)

- TABLE 131 LATIN AMERICA: METAVERSE IN EDUCATION MARKET, BY HARDWARE, 2023–2028 (USD MILLION)

- TABLE 132 LATIN AMERICA: METAVERSE IN EDUCATION MARKET, BY PROFESSIONAL SERVICE, 2018–2022 (USD MILLION)

- TABLE 133 LATIN AMERICA: METAVERSE IN EDUCATION MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 134 LATIN AMERICA: METAVERSE IN EDUCATION MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 135 LATIN AMERICA: METAVERSE IN EDUCATION MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 136 LATIN AMERICA: METAVERSE IN EDUCATION MARKET, BY ACADEMIC END USER, 2018–2022 (USD MILLION)

- TABLE 137 LATIN AMERICA: METAVERSE IN EDUCATION MARKET, BY ACADEMIC END USER, 2023–2028 (USD MILLION)

- TABLE 138 LATIN AMERICA: METAVERSE IN EDUCATION MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 139 LATIN AMERICA: METAVERSE IN EDUCATION MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 140 BRAZIL: METAVERSE IN EDUCATION MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 141 BRAZIL: METAVERSE IN EDUCATION MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 142 MEXICO: METAVERSE IN EDUCATION MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 143 MEXICO: METAVERSE IN EDUCATION MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 144 REST OF LATIN AMERICA: METAVERSE IN EDUCATION MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 145 REST OF LATIN AMERICA: METAVERSE IN EDUCATION MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 146 OVERVIEW OF STRATEGIES ADOPTED BY KEY VENDORS

- TABLE 147 MARKET SHARE OF KEY VENDORS, 2022

- TABLE 148 OVERALL COMPANY FOOTPRINT FOR KEY PLAYERS

- TABLE 149 OVERALL COMPANY FOOTPRINT FOR STARTUPS/SMES

- TABLE 150 KEY STARTUPS/SMES

- TABLE 151 METAVERSE IN EDUCATION MARKET: PRODUCT LAUNCHES AND ENHANCEMENT, 2020–2023

- TABLE 152 METAVERSE IN EDUCATION MARKET: DEALS, 2020–2023

- TABLE 153 META PLATFORMS, INC.: BUSINESS OVERVIEW

- TABLE 154 META PLATFORMS, INC.: PRODUCTS/SERVICES OFFERED

- TABLE 155 META PLATFORMS, INC.: PRODUCT LAUNCHES & ENHANCEMENT

- TABLE 156 META PLATFORMS, INC.: DEALS

- TABLE 157 MICROSOFT CORPORATION: BUSINESS OVERVIEW

- TABLE 158 MICROSOFT CORPORATION: PRODUCTS/SERVICES OFFERED

- TABLE 159 MICROSOFT CORPORATION: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 160 MICROSOFT CORPORATION: DEALS

- TABLE 161 ADOBE INC.: BUSINESS OVERVIEW

- TABLE 162 ADOBE INC.: PRODUCT/SERVICES OFFERED

- TABLE 163 ADOBE INC.: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 164 ADOBE INC.: DEALS

- TABLE 165 HP INC.: BUSINESS OVERVIEW

- TABLE 166 HP INC.: PRODUCTS/SERVICES OFFERED

- TABLE 167 HP INC.: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 168 HP INC.: DEALS

- TABLE 169 UNITY SOFTWARE INC.: BUSINESS OVERVIEW

- TABLE 170 UNITY SOFTWARE INC.: PRODUCTS/SERVICES OFFERED

- TABLE 171 UNITY SOFTWARE INC.: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 172 UNITY SOFTWARE INC.: DEALS

- TABLE 173 SAMSUNG ELECTRONICS: BUSINESS OVERVIEW

- TABLE 174 SAMSUNG ELECTRONICS: PRODUCTS/SERVICES OFFERED

- TABLE 175 SAMSUNG ELECTRONICS: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 176 SAMSUNG ELECTRONICS: DEALS

- TABLE 177 LENOVO: BUSINESS OVERVIEW

- TABLE 178 LENOVO: PRODUCTS/SERVICES OFFERED

- TABLE 179 LENOVO: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 180 LENOVO: DEALS

- TABLE 181 ROBLOX CORPORATION: BUSINESS OVERVIEW

- TABLE 182 ROBLOX CORPORATION: PRODUCTS/SERVICES OFFERED

- TABLE 183 ROBLOX CORPORATION: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 184 ROBLOX CORPORATION: DEALS

- TABLE 185 EPIC GAMES: BUSINESS OVERVIEW

- TABLE 186 EPIC GAMES: PRODUCTS/SERVICES OFFERED

- TABLE 187 EPIC GAMES: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 188 EPIC GAMES: DEALS

- TABLE 189 BAIDU, INC.: BUSINESS OVERVIEW

- TABLE 190 BAIDU, INC.: PRODUCTS/SERVICES OFFERED

- TABLE 191 BAIDU, INC.: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 192 BAIDU, INC.: DEALS

- TABLE 193 EXTENDED REALITY MARKET, 2019–2022 (USD MILLION)

- TABLE 194 EXTENDED REALITY MARKET, 2023–2028 (USD MILLION)

- TABLE 195 AUGMENTED REALITY MARKET, BY OFFERING, 2018–2021 (USD MILLION)

- TABLE 196 AUGMENTED REALITY MARKET, BY OFFERING, 2022–2027 (USD MILLION)

- TABLE 197 VIRTUAL REALITY MARKET, BY OFFERING, 2018–2021 (USD MILLION)

- TABLE 198 VIRTUAL REALITY MARKET, BY OFFERING, 2022–2027 (USD MILLION)

- TABLE 199 METAVERSE MARKET, BY COMPONENT, 2018–2021 (USD BILLION)

- TABLE 200 METAVERSE MARKET, BY COMPONENT, 2022–2027 (USD BILLION)

- FIGURE 1 METAVERSE IN EDUCATION MARKET: RESEARCH DESIGN

- FIGURE 2 METAVERSE IN EDUCATION MARKET: TOP-DOWN AND BOTTOM-UP APPROACH

- FIGURE 3 APPROACH 1 (SUPPLY-SIDE): REVENUE OF METAVERSE IN EDUCATION FROM VENDORS

- FIGURE 4 BOTTOM-UP APPROACH (SUPPLY SIDE): COLLECTIVE REVENUE OF METAVERSE IN EDUCATION VENDORS

- FIGURE 5 MARKET PROJECTIONS FROM SUPPLY SIDE

- FIGURE 6 APPROACH 2 (DEMAND SIDE): REVENUE OF VENDORS FROM VARIOUS SEGMENTS

- FIGURE 7 MARKET PROJECTIONS FROM DEMAND SIDE

- FIGURE 8 METAVERSE IN EDUCATION MARKET SNAPSHOT, 2020–2028

- FIGURE 9 TOP MARKET SEGMENTS IN TERMS OF GROWTH RATE

- FIGURE 10 METAVERSE SOFTWARE IN EDUCATION TO ACCOUNT FOR LARGEST MARKET BY 2028

- FIGURE 11 AR DEVICES TO ACCOUNT FOR LARGEST HARDWARE MARKET BY 2028

- FIGURE 12 STRATEGY & BUSINESS CONSULTING SERVICES TO ACCOUNT FOR LARGEST MARKET BY 2028

- FIGURE 13 ACADEMIC END USERS TO ACCOUNT FOR LARGEST MARKET BY 2028

- FIGURE 14 NORTH AMERICA TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- FIGURE 15 DRASTIC GEOGRAPHIC CHANGE AND TECHNOLOGICAL EVOLUTION TO DRIVE METAVERSE IN EDUCATION’S ARCHIVING GROWTH

- FIGURE 16 SOFTWARE COMPONENT TO ACCOUNT FOR LARGEST SHARE IN 2023 AND 2028

- FIGURE 17 AR DEVICES TO BECOME LARGEST HARDWARE MARKET BY 2028

- FIGURE 18 STRATEGY & BUSINESS CONSULTING SEGMENT TO ACCOUNT FOR LARGER SHARE AMONG PROFESSIONAL SERVICES IN 2023

- FIGURE 19 ACADEMIC END USERS TO ACCOUNT FOR LARGER SHARE THAN CORPORATE END USERS

- FIGURE 20 ASIA PACIFIC TO EMERGE AS BEST MARKET FOR INVESTMENTS IN NEXT FIVE YEARS

- FIGURE 21 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: METAVERSE IN EDUCATION MARKET

- FIGURE 22 STAGES OF VR ADOPTION IN COMPANIES

- FIGURE 23 METAVERSE IN EDUCATION MARKET ECOSYSTEM

- FIGURE 24 METAVERSE IN EDUCATION MARKET: VALUE CHAIN

- FIGURE 25 NUMBER OF PATENTS PUBLISHED, 2012–2022

- FIGURE 26 TOP TEN GLOBAL PATENT APPLICANTS IN 2022

- FIGURE 27 METAVERSE IN EDUCATION MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 28 METAVERSE IN EDUCATION MARKET: TRENDS/DISRUPTIONS IMPACTING BUYERS

- FIGURE 29 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP HARDWARE

- FIGURE 30 KEY BUYING CRITERIA FOR TOP THREE HARDWARE

- FIGURE 31 METAVERSE SOFTWARE IN EDUCATION TO ACCOUNT FOR LARGEST MARKET SIZE

- FIGURE 32 AR DEVICES TO ACCOUNT FOR LARGEST METAVERSE HARDWARE MARKET IN EDUCATION

- FIGURE 33 STRATEGY & BUSINESS CONSULTING SERVICES TO ACCOUNT FOR LARGEST PROFESSIONAL SERVICES MARKET

- FIGURE 34 ACADEMIC END USERS TO ACCOUNT FOR LARGEST MARKET

- FIGURE 35 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SHARE BY 2028

- FIGURE 36 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 37 ASIA PACIFIC: REGIONAL SNAPSHOT

- FIGURE 38 METAVERSE IN EDUCATION MARKET SHARE ANALYSIS

- FIGURE 39 HISTORICAL REVENUE ANALYSIS, 2018–2022 (USD MILLION)

- FIGURE 40 COMPANY EVALUATION MATRIX FOR KEY PLAYERS: CRITERIA WEIGHTAGE

- FIGURE 41 COMPANY EVALUATION QUADRANT FOR KEY PLAYERS

- FIGURE 42 EVALUATION MATRIX FOR STARTUPS/SMES: CRITERIA WEIGHTAGE

- FIGURE 43 COMPANY EVALUATION QUADRANT FOR OTHER PLAYERS AND STARTUPS/SMES

- FIGURE 44 COMPANY FINANCIAL METRICS, 2022

- FIGURE 45 GLOBAL SNAPSHOT OF KEY METAVERSE IN EDUCATION MARKET PARTICIPANTS, 2022

- FIGURE 46 META PLATFORMS, INC.: COMPANY SNAPSHOT

- FIGURE 47 MICROSOFT CORPORATION: COMPANY SNAPSHOT

- FIGURE 48 ADOBE INC.: COMPANY SNAPSHOT

- FIGURE 49 HP INC.: COMPANY SNAPSHOT

- FIGURE 50 UNITY SOFTWARE INC.: COMPANY SNAPSHOT

- FIGURE 51 SAMSUNG ELECTRONICS: COMPANY SNAPSHOT

- FIGURE 52 LENOVO: COMPANY SNAPSHOT

- FIGURE 53 ROBLOX CORPORATION: COMPANY SNAPSHOT

- FIGURE 54 BAIDU, INC.: COMPANY SNAPSHOT

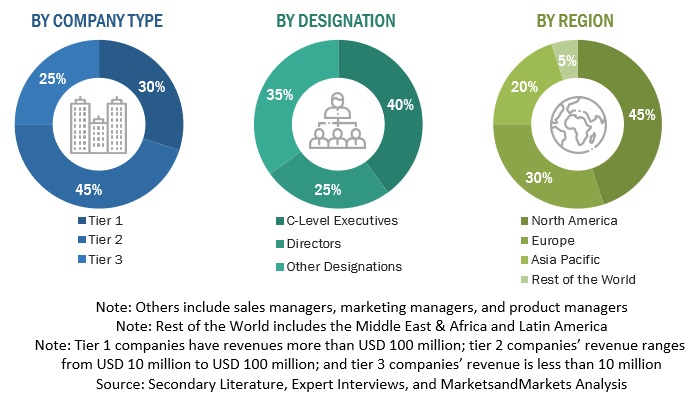

The study involved four major activities in estimating the current size of the metaverse in gaming market. Exhaustive secondary research was done to collect information on the lending industry. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and sub segments of the Metaverse in gaming market.

Secondary Research

The market size of the companies offering metaverse solutions and services in gaming was arrived at based on the secondary data available through paid and unpaid sources. It involved analyzing the product portfolios of major companies in the ecosystem and rating the companies based on their product capabilities and business strategies. In the secondary research process, various sources were referred to, for identifying and collecting information for the study. Secondary sources included annual reports; press releases and investor presentations of companies; product data sheets, white papers, journals, and certified publications; and articles from recognized authors, government websites, directories, and databases.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, such as Chief Experience Officers (CXOs), Vice Presidents (VPs), directors from business development, marketing, and product development/innovation teams, and related key executives from metaverse in gaming vendors, industry associations, independent consultants, and key opinion leaders. Various stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), and Chief Security Officers (CSOs), and installation teams, of governments/end users using metaverse solutions in gaming, project teams were interviewed. This interview helped to understand the buyer’s perspective on the suppliers, products, service providers, and their current use of solutions, which would affect the overall metaverse in gaming market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the size of the metaverse in gaming market and various other dependent sub-markets in the overall market.

In the top-down approach, an exhaustive list of all vendors offering metaverse in gaming solutions was prepared. The revenue contribution of all vendors in the market was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Each vendor was evaluated based on its product/solution offerings, hardware, software, services, game genres, and regional presence. The aggregate of all companies’ revenue was extrapolated to reach the overall market size. Each subsegment was studied and analyzed for its market size and regional penetration. The markets were triangulated through both primary and secondary research. The primary procedure included extensive interviews for key insights from industry leaders, such as CEOs (Chief Executive Officer), VPs (Vice President), directors, and marketing executives. These market numbers were further triangulated with the existing MarketsandMarkets’ repository for validation.

In the bottom-up approach, the adoption trend of metaverse in gaming solutions among different end users in key countries with respect to the regions that contribute to most of the market share was identified. For cross-validation, the adoption trend of solutions, along with different use cases, with respect to their business segments, has been identified and extrapolated. Weightage has been given to the use cases identified in the different application areas for the calculation.

In the bottom-up approach, the adoption trend of metaverse in gamings solutions between the major two applications in key countries, with respect to regions that contribute to most of the market share, has been identified. For cross-validation, the adoption trend of metaverse in gaming, along with different use cases with respect to their business segments, has been identified and generalized. Weightage has been given to the use cases identified in different solution areas for calculation. An exhaustive list of all vendors offering solutions and services in the metaverse in gaming market has been prepared. The revenue contribution of all vendors in the market has been estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Vendors with metaverse in gaming or online learning offerings have been considered to evaluate the market size. Each vendor has been evaluated based on its solution and service offerings across verticals. The aggregate of all companies' revenue has been extrapolated to reach the overall market size. Each sub-segment has been studied and analyzed for its market size and regional penetration. Based on these numbers, primary and secondary sources have determined the region split.

All possible parameters affecting the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data has been consolidated and added with detailed inputs and analysis from MarketsandMarkets.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Metaverse is an online experience of shared 3D virtual worlds created through the convergence of physical and digital worlds. These virtual worlds are created by leveraging state-of-the-art technologies, such as Augmented Reality (AR), Virtual Reality (VR), Mixed Reality (MR), Real-time 3D (RT3D), and interactive video. Metaverse is experienced through various AR, VR, and MR devices, such as Head-mounted Displays (HMD), Head-up Displays (HUD), smart glasses, and smart helmets. It can also be experienced using displays, projectors, smartphones, and computers. Metaverse in gaming refers to the games played by end users in virtual and 3D environments. These games are of various genres, such as action, adventure, casual, role-playing, simulation, sports & racing, and strategy. Such games are developed using all metaverse-related technologies, including AR, VR, and MR.

Key stakeholders of the market include:

- Metaverse platform and service providers

- Augmented Reality (AR), Virtual Reality (VR), and Mixed Reality (MR) device manufacturers

- Professional service providers and consulting companies

- Raw material suppliers

- Semiconductor foundries

- Original Equipment Manufacturers (OEMs)

- Government organizations, forums, alliances, and associations

- System Integrators (SIs) and Value-added Resellers (VARs)

- Research organizations

- Technology standard organizations, forums, alliances, and associations

- Technology investors

- End-use verticals

Report Objectives

- To describe and forecast the metaverse in gaming market based on components, hardware, software, services, game genres, and regions

- To forecast the market size of five main regions: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America

- To strategically analyze the market’s subsegments for individual growth trends, prospects, and contributions to the total market

- To provide detailed information related to the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To analyze industry trends, patents and innovations, and pricing data related to the market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape

- To track and analyze competitive developments, such as product developments, product enhancements, partnerships, and collaborations, in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Metaverse in Gaming Market