Metaverse in Education Market by Component (Hardware (AR devices, VR devices, MR devices, and interactive displays and projectors), Software, Professional Services), End User (Academic and Corporate) and Region - Global Forecast to 2028

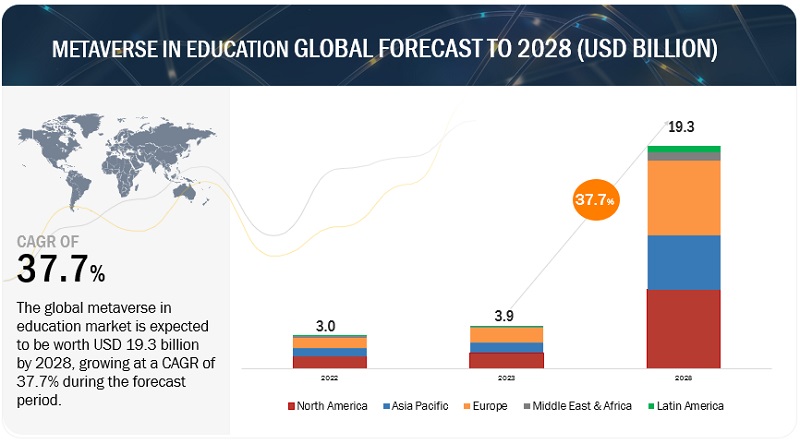

The global Metaverse in Education Market was estimated at USD 3.9 billion in 2023 and is expected to reach USD 19.3 billion in 2028, with a CAGR of 37.7%. The Metaverse provides a unique outlook on the future education path; experiential learning will be improved through simulations and virtual recreations. Metaverse can enable students to participate in experiments and scenarios precisely rendered in 3D. It helps make intangible ideas more tangible. Anyone with an internet connection can access virtual learning environments and materials in the Metaverse. The Metaverse facilitates collaborative learning by enabling students to collaborate in virtual spaces. Students can engage in group projects, brainstorm ideas, and solve problems collectively. Such factors are expected to drive the adoption of Metaverse in the education market.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Metaverse in Education Market Dynamics

Driver: Increase in industry training and deployment in the education sector

Comprehensive reality technologies could significantly alter the learning process. Educational institutions are under intense pressure to provide the best learning environments and excellent, technology-based instruction to a student who is becoming increasingly diverse. Making knowledge extraordinarily accessible and engaging for students has been the primary goal of this technology's deployment in education. Extended reality technology goes far further than this by improving learning experiences for students through incredibly realistic information displays, improved engagement with simulated settings, and significant cognitive load reductions for learners. Extensive expenditures are being made by universities such as the University of Michigan to integrate virtual reality technology into their residential and online courses for teaching and learning. The metaverse development has also given the education sector many options to modify many facets. Students can use VR to experience field trips, business visits, museums, exhibitions, and other activities.

Restraint: Requires reliable and scalable technology infrastructure

A dependable and scalable technical infrastructure is necessary to create a strong Metaverse in education. To meet the demands of virtual environments, educational institutions will need to invest in high-performance technology and network infrastructure. Further, due to considerations including location, socioeconomic background, and technological restrictions, certain students and teachers may not have full access to the Metaverse in the classroom. User adoption will be vital to the Metaverse's success in the classroom. Virtual worlds may include a learning curve, and teachers and students may be reluctant to adopt new technologies. Creating exciting and instructive information for the virtual world can be difficult. A unique set of abilities and knowledge are necessary to produce content that is both educational and interesting. Thus, the Metaverse in education will raise privacy and security issues like any other online platform. Educational institutions must ensure enough security measures to protect student information and keep a safe learning environment.

Opportunity: Students can study through the immersive experience offered by Metaverse

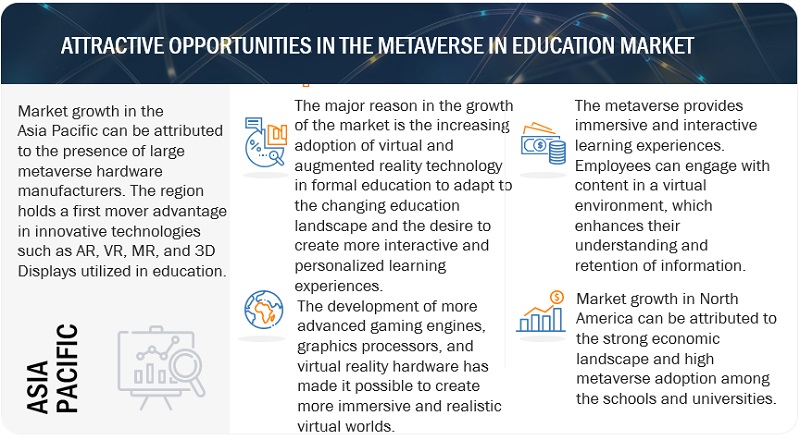

The Metaverse is a virtual environment where users can interact with others and participate in various activities. The Metaverse offers students, teachers, and educational institutions several educational opportunities. Here are some fundamental changes in the Metaverse's educational industry. The Metaverse can be tailored to each learner's specific need. This entails developing customized avatars, establishing unique learning objectives, and personalizing the learning environment to accommodate various learning preferences. Regardless of where they are physically located, students can cooperate and communicate with others in real-time via the Metaverse. Enhancing interpersonal skills encourages teamwork and social learning. For students who might not have access to conventional educational resources, the Metaverse offers access to education. For instance, accessible and inclusive virtual learning environments can help students from remote locations or those with disabilities.

Challenge: Fear of content development, digital inequality, and access issues

Access and connectivity are two significant obstacles to using the Metaverse for education. High-speed internet and cutting-edge electronics are necessary for the Metaverse to function correctly. High-speed internet is still not generally accessible or reasonably priced in many parts of the world, making it difficult for students and teachers to access metaverse content. Another challenge facing the education sector is the digital divide. Not all students and teachers have the same access to tools such as PCs, VR headsets, and other metaverse-related devices. This may lead to differences in education, making it challenging for everyone to use the Metaverse as a learning tool. Lastly, producing top-notch content for the Metaverse takes a lot of work and time. Various abilities, such as 3D modeling, programming, and game design, are needed. It can be extremely difficult for educators and developers to create educational content that adheres to curricular standards while simultaneously being exciting and participatory.

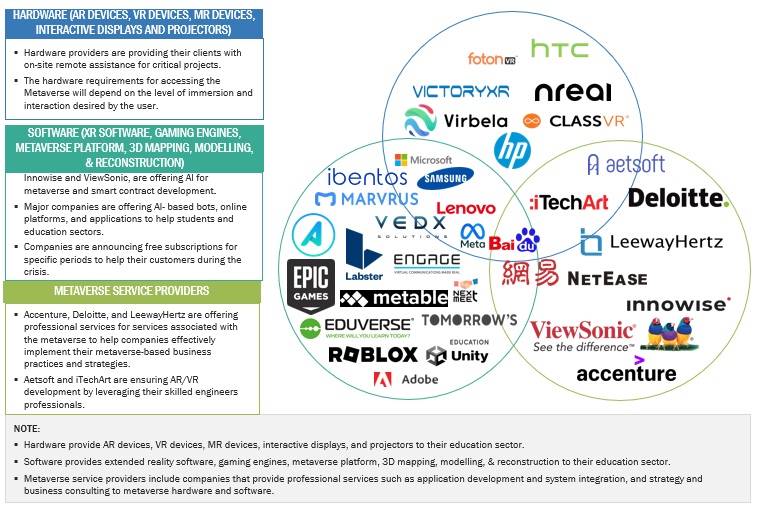

Metaverse in the Education Market Ecosystem

Prominent companies in this market are responsible for delivering Metaverse in education solutions and services to end users via various deployment models. These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Prominent companies in this market include Meta Platforms, Inc. (US), Microsoft Corporation (US), Adobe Inc. (US), HP Inc. (US), and Unity Software Inc. (US).

Based on end-user, the academic segment holds the largest market share during the forecast period

Based on the end user, the Metaverse in the education market is segmented as academic and corporate. As per segment, academics is expected to hold the largest market share during the forecast period. The academic segment includes K-12 and higher education. The concept of the Metaverse has gained significant attention in both K-12 and higher education. The use of the Metaverse for immersive and interactive learning experiences is being investigated by academics interested in education. They look at how virtual learning environments, computer simulations, and teamwork situations can enhance education and training. The typical education courses for K–12 and higher education are in the academic user's category. Academics utilize Metaverse to increase the effectiveness of the learning process. Many colleges use this technology to boost academic achievement since it facilitates mobility, interaction, and real-time instruction, streamlining the educational process.

Based on academic, the K-12 segment holds the highest CAGR during the forecast period

Based on the academic segment, the Metaverse in the education market is segmented as K-12 and higher education. As per academic segment, K-12 is expected to hold the highest CAGR during the forecast period. The K–12 education system, which typically serves students from 4 to 18 years old, includes essential elementary and secondary education. Each country has a unique spectrum of these levels. The K–12 educational system is designed to provide students with a strong foundation of knowledge and skills they can use to further their education or find work. It also intends to help students in acquiring the critical thinking, problem-solving, and communication skills essential for success in the twenty-first century. Further, children's lives are substantially impacted by technology due to how it dominates so many of their daily activities. In kindergarten courses, technology is easy to utilize and beneficial for teachers as well as students. This educational technology has a significant impact on their learning preferences, which makes students active participants in the learning process. The way that students learn in K–12 is fundamentally changing. More flexible, blended programs are taking the place of traditional classrooms. Teachers are employing more digital technologies to enhance the overall learning experience for students. Additionally, K–12 educational institutions can create digital classrooms that resemble real classrooms using the metaverse. Learning may be made more engaging and interactive by allowing students to interact with objects and scenarios to increase their understanding of the subject. Students may have the opportunity to collaborate and communicate with one another through the metaverse, promoting a more social learning environment. Students may profit from this since they gain valuable social skills and the opportunity to learn from many views.

The US market is projected to contribute the largest share of the metaverse in education market in North America.

North America is expected to lead the Metaverse in the education market in 2023. The US is estimated to account for the largest market share in North America in 2023 in the Metaverse education market, and the trend is expected to continue until 2028. Metaverse in education has attracted a lot of interest and funding in the United States at present. Universities consider employing augmented reality (AR) and virtual reality (VR) technologies to provide immersive learning environments. Harvard University has produced a VR experience that enables students to investigate the molecular structure of proteins.

Key market players

The Metaverse in the education market is dominated by a few globally established players such as Meta Platforms, Inc. (US), Microsoft Corporation (US), Adobe Inc. (US), HP Inc. (US), Unity Software Inc. (US), Samsung Electronics (South Korea), Lenovo (China), Roblox Corporation (US), Epic Games (US), and Baidu, Inc. (China) among others, are the key vendors that secured Metaverse in education contracts in last few years. These vendors can bring global processes and execution expertise; the local players only have local expertise. Driven by increased disposable incomes, easy access to knowledge, and fast adoption of technological products, buyers are more willing to experiment/test new things in the Metaverse in the education market.

Scope of the Report

|

Report Metrics |

Details |

|

Market size value in 2023 |

USD 3.9 Billion |

|

Market size value in 2028 |

USD 19.3 Billion |

|

Growth rate |

CAGR of 37.7% |

|

Market size available for years |

2018–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD Billion) |

|

Segments Covered |

Component, End User, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, Middle East and Africa, and Latin America |

|

Companies Covered |

Some of the significant metaverses in education market vendors are Meta Platforms, Inc. (US), Microsoft Corporation (US), Adobe Inc. (US), HP Inc. (US), Unity Software Inc. (US), Samsung Electronics (South Korea), Lenovo (China), Roblox Corporation (US), Epic Games (US), and Baidu, Inc. (China). |

This research report categorizes the metaverse in the education market based on component, end user, and regions.

Based on the Component:

-

Hardware

- AR Devices

- VR Devices

- MR Devices

- Interactive Displays and Projectors

-

Software

- Extended Reality Software

- Gaming Engines

- Metaverse Platforms

- 3D Mapping, Modelling, and Reconstruction

-

Professional Services

- Application Development and System Integration

- Strategy and Business Consulting

Based on the End User:

-

Academic

- K-12

- Higher Education

- Corporate

Based on the Region:

-

North America

- United States

- Canada

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

-

Middle East & Africa

- Kingdom of Saudi Arabia

- United Arab Emirates

- Rest of the Middle East & Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent developments:

- In March 2023, Microsoft launched Microsoft Mesh as a new mixed-reality platform that enables users to collaborate and interact with each other in a shared virtual space. Mesh provided users with various tools for creating and customizing virtual avatars, objects, and environments. Mesh was also integrated with other Microsoft products like HoloLens and AltspaceVR to enable cross-platform collaboration.

- In January 2022, HP Inc. unveiled HP Fortis laptops, a new line of PCs designed to handle the demands of classrooms. Further, the new HP Fortis portfolio, designed for active and mobile learners, represents the strength and toughness required to help survive drops, resist spills, and keep keys where they belong: on the keyboard. Students of all ages find gripping and handling lightweight devices simpler because of the textured surfaces.

- In April 2021, Unity Reflect launched as a real-time 3D rendering and visualization platform that allowed designers and architects to create immersive, interactive 3D models of buildings and other structures. These models could be used for virtual walkthroughs, design reviews, architecture, engineering, education, and construction applications.

Frequently Asked Questions (FAQ):

What is Metaverse in education?

According to ViewSonic, The Metaverse is a virtual environment where users may come together simultaneously and engage in rich social interactions. It's most frequently linked to blockchain technology, social media-like features, VR, AR, and controllable avatars. Further, in the Metaverse, education typically uses avatars, virtual representations of users that students can use to communicate with one another. Teachers can communicate with each other in these virtual learning environments using their avatars, simulating an educational setting. The surrounding virtual environment can be easily modified to fit the lessons being taught, drastically expanding the learning potential.

According to LeewayHertz, the integration of virtual reality (VR), augmented reality (AR), and other immersive technologies into the learning process are referred to in the field of education as the metaverse. It envisions a digital space where educators and students can communicate, work together, and study in a virtual setting that replicates the real world or opens new possibilities.

Which country is an early adopter of Metaverse in education?

The US is at the initial stage of adopting the Metaverse in education.

Who are vital clients adopting Metaverse in education?

Key clients adopting the Metaverse in the education market include: -

- Schools

- Colleges

- Universities

- Corporates

- Administrators

Which are the key vendors exploring Metaverse in education?

Some of the significant Metaverse in education vendors are Meta Platforms, Inc. (US), Microsoft Corporation (US), Adobe Inc. (US), HP Inc. (US), Unity Software Inc. (US), Samsung Electronics (South Korea), Lenovo (China), Roblox Corporation (US), Epic Games (US), Baidu, Inc. (China), Avantis Systems Ltd (UK), Axon Park (US), Tomorrow's Education (Germany), NextMeet (India), ClassVR (England), Metable GmbH (Switzerland), Virbela (US), Labster (Denmark), VictoryXR (US), ENGAGE Plc (US), VEDX Solutions (US), Stimuli (US), NetEase (China), HTC (Taiwan), and Sandbox (US).

What is the total CAGR expected to be recorded for the Metaverse in the education market during 2023-2028?

The market is expected to record a CAGR of 37.7% from 2023-2028

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increase in industrial training and deployment in education sector- Rapid adoption of virtual technologies- Decrease in price of VR headsetsRESTRAINTS- Requirement of reliable and scalable technology infrastructure- Health and mental issues from excessive use- High installation and maintenance costs of high-end metaverse componentsOPPORTUNITIES- Immersive experience offered to students- Major infusion of educational technology prompted by COVID-19 pandemic- Constantly evolving 5G technologyCHALLENGES- Fear of content development, digital inequality, and access issues- Innovation in transforming education ecosystem

-

5.3 CASE STUDY ANALYSISSTEVENS INSTITUTE OF TECHNOLOGY UTILIZED SAMSUNG INTERACTIVE BOARDS FOR DISTANT CLASSROOMSECNU XIPING BILINGUAL SCHOOL SUPPORTED SUPERIOR EDUCATIONAL EXPERIENCES WITH LENOVO THINKAGILE VX SERIESONTARIO COLLEGE TURNED TO MICROSOFT’S MIXED REALITY FOR FUTURE OF TRAININGKATHERINE WARINGTON SCHOOL ENHANCED CLASSROOM ENGAGEMENT WITH CLASSVRUNITY PREPARES TAFE QUEENSLAND STUDENTS FOR IN-DEMAND CAREERS WITH UAA

-

5.4 ECOSYSTEM

- 5.5 VALUE CHAIN ANALYSIS

-

5.6 PRICING ANALYSISINTRODUCTIONAVERAGE SELLING PRICE TRENDSAVERAGE SELLING PRICE TRENDS OF KEY PLAYERS, BY TYPE

-

5.7 PATENT ANALYSIS

-

5.8 TECHNOLOGY ANALYSISAI AND ML5G NETWORKINTERNET OF THINGSVIRTUAL REALITYAUGMENTED REALITY

-

5.9 REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSREGULATIONS, BY REGION- North America- Europe- Asia Pacific- Middle East & South Africa- Latin AmericaREGULATORY IMPLICATIONS AND INDUSTRY STANDARDS- General Data Protection Regulation- SEC Rule 17a-4- ISO/IEC 27001- System and Organization Controls 2 Type II Compliance- Financial Industry Regulatory Authority- Freedom of Information Act- Health Insurance Portability and Accountability Act

-

5.10 PORTER’S FIVE FORCES MODELINTENSITY OF COMPETITIVE RIVALRYBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTES

- 5.11 KEY CONFERENCES AND EVENTS

-

5.12 TRENDS/DISRUPTIONS IMPACTING BUYERS

-

5.13 KEY STAKEHOLDERS & BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

6.1 INTRODUCTIONCOMPONENT: METAVERSE IN EDUCATION MARKET DRIVERS

-

6.2 HARDWAREAR DEVICES- Facilitating more efficient and interactive engagement with subjectsVR DEVICES- Allowing students to manipulate virtual objects using natural hand gesturesMR DEVICES- High-performance graphics to experience enhanced learningINTERACTIVE DISPLAYS & PROJECTORS- Enhanced students’ cognitive learning capabilities

-

6.3 SOFTWAREEXTENDED REALITY SOFTWARE- Improved learning capabilities and reduction in learning timeGAMING ENGINES- Creating fun and engaging ways for studentsMETAVERSE PLATFORM- More engaging experience than traditional classroom lectures or online courses3D MAPPING, MODELING, AND RECONSTRUCTION- Creating natural-looking spaces to enhance student engagement

-

6.4 PROFESSIONAL SERVICESAPPLICATION DEVELOPMENT & SYSTEM INTEGRATION- Deep understanding of various components involved and ability to implement interfacesSTRATEGY & BUSINESS CONSULTING SERVICES- Helping clients identify and solve problems, achieve their goals, and improve their overall performance

-

7.1 INTRODUCTIONEND USER: METAVERSE IN EDUCATION MARKET DRIVERS

-

7.2 ACADEMICINCREASED USAGE OF HANDHELD DEVICES FOR LEARNINGK–12- Multiple innovative resources to access metaverse in schoolsHIGHER EDUCATION- Students offered benefits of learning from anywhere

-

7.3 CORPORATECOLLABORATION AND SOCIAL LEARNING FOR EMPLOYEES WITHIN VIRTUAL ENVIRONMENT

- 8.1 INTRODUCTION

-

8.2 NORTH AMERICANORTH AMERICA: METAVERSE IN EDUCATION MARKET DRIVERSNORTH AMERICA: RECESSION IMPACTUS- Adoption of advanced technologies such as AR and VRCANADA- Combination of games and education offered in institutions

-

8.3 EUROPEEUROPE: METAVERSE IN EDUCATION MARKET DRIVERSEUROPE: RECESSION IMPACTUK- Growth in use of VR headsetsGERMANY- Increase in digitalization and effective management of metaverse in education through various stagesFRANCE- Strong support from French government for adoption of metaverse in education sectorREST OF EUROPE

-

8.4 ASIA PACIFICASIA PACIFIC: METAVERSE IN EDUCATION MARKET DRIVERSASIA PACIFIC: RECESSION IMPACTCHINA- Presence of innovative technologiesJAPAN- Increased R&D investments and skilled professionalsINDIA- Continuous upgrades to metaverse IT infrastructure and applicationsREST OF ASIA PACIFIC

-

8.5 MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA: METAVERSE IN EDUCATION MARKET DRIVERSMIDDLE EAST & AFRICA: RECESSION IMPACTKINGDOM OF SAUDI ARABIA- Commitment to collaborating with educational institutions and policymakersUAE- Rise in government investments and economic developmentREST OF THE MIDDLE EAST & AFRICA

-

8.6 LATIN AMERICALATIN AMERICA: METAVERSE IN EDUCATION MARKET DRIVERSLATIN AMERICA: RECESSION IMPACTBRAZIL- Promotion of creativity and innovation among students through latest softwareMEXICO- Major digital transformation in education sectorREST OF LATIN AMERICA

- 9.1 INTRODUCTION

- 9.2 RIGHT TO WIN

- 9.3 MARKET SHARE ANALYSIS

- 9.4 HISTORICAL REVENUE ANALYSIS OF TOP VENDORS

-

9.5 KEY COMPANY EVALUATION QUADRANTSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

9.6 OTHER PLAYER AND STARTUP/SME EVALUATION QUADRANTRESPONSIVE COMPANIESPROGRESSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING OF STARTUPS/SMES

- 9.7 COMPANY FINANCIAL METRICS

- 9.8 BAL SNAPSHOT OF KEY MARKET PARTICIPANTS

- 9.9 KEY MARKET DEVELOPMENTS

- 10.1 INTRODUCTION

-

10.2 KEY PLAYERSMETA PLATFORMS, INC.- Business overview- Products/Services offered- Recent developments- MnM viewMICROSOFT CORPORATION- Business overview- Products/Services offered- Recent developments- MnM viewADOBE INC.- Business overview- Product/Services offered- Recent developments- MnM viewHP INC.- Business overview- Products/Services offered- Recent developments- MnM viewUNITY SOFTWARE INC.- Business overview- Products/Services offered- Recent developments- MnM viewSAMSUNG ELECTRONICS- Business overview- Products/Services offered- Recent developmentsLENOVO- Business overview- Products/Services offered- Recent developmentsROBLOX CORPORATION- Business overview- Products/Services offered- Recent developmentsEPIC GAMES- Business overview- Products/Services offered- Recent developmentsBAIDU, INC.- Business overview- Products/Services offered- Recent developments

-

10.3 OTHER PLAYERSAVANTIS SYSTEMS LTD.AXON PARKTOMORROW’S EDUCATIONNEXTMEETCLASSVRMETABLE GMBHVIRBELALABSTERVICTORYXRENGAGE PLCVEDX SOLUTIONSSTEMULINETEASEHTCSANDBOX

-

10.4 STARTUPS/SMESMEDROOMMARVRUSFOTONVRIBENTOSLEGEND OF LEARNINGSOPHIADEVDENIMMERSEKWARK EDUCATIONHATCHXRMETAVERSE LEARNING LIMITED

-

11.1 INTRODUCTIONRELATED MARKETSLIMITATIONS

- 11.2 EXTENDED REALITY MARKET

- 11.3 AUGMENTED REALITY AND VIRTUAL REALITY MARKET

- 11.4 METAVERSE MARKET

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES, 2019–2022

- TABLE 2 LIST OF KEY SECONDARY SOURCES

- TABLE 3 METAVERSE IN EDUCATION MARKET: PRIMARY RESPONDENTS

- TABLE 4 FACTOR ANALYSIS

- TABLE 5 ASSUMPTIONS

- TABLE 6 MARKET: PRICING ANALYSIS, BY VENDOR

- TABLE 7 TOP PATENT OWNERS

- TABLE 8 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 13 MARKET: KEY CONFERENCES AND EVENTS, 2023–2024

- TABLE 14 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP HARDWARE

- TABLE 15 KEY BUYING CRITERIA FOR TOP THREE HARDWARE

- TABLE 16 METAVERSE IN EDUCATION MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 17 MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 18 HARDWARE: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 19 HARDWARE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 20 MARKET, BY HARDWARE, 2018–2022 (USD MILLION)

- TABLE 21 MARKET, BY HARDWARE, 2023–2028 (USD MILLION)

- TABLE 22 AR DEVICES: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 23 AR DEVICES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 24 VR DEVICES: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 25 VR DEVICES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 26 MR DEVICES: METAVERSE IN EDUCATION MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 27 MR DEVICES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 28 INTERACTIVE DISPLAYS & PROJECTORS: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 29 INTERACTIVE DISPLAYS & PROJECTORS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 30 SOFTWARE: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 31 SOFTWARE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 32 PROFESSIONAL SERVICES: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 33 PROFESSIONAL SERVICES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 34 MARKET, BY PROFESSIONAL SERVICE, 2018–2022 (USD MILLION)

- TABLE 35 MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 36 APPLICATION DEVELOPMENT & SYSTEM INTEGRATION: METAVERSE IN EDUCATION MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 37 APPLICATION DEVELOPMENT & SYSTEM INTEGRATION: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 38 STRATEGY & BUSINESS CONSULTING SERVICES: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 39 STRATEGY & BUSINESS CONSULTING SERVICES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 40 MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 41 MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 42 ACADEMIC: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 43 ACADEMIC: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 44 MARKET, BY ACADEMIC END USER, 2018–2022 (USD MILLION)

- TABLE 45 MARKET, BY ACADEMIC END USER, 2023–2028 (USD MILLION)

- TABLE 46 K–12: METAVERSE IN EDUCATION MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 47 K–12: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 48 HIGHER EDUCATION: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 49 HIGHER EDUCATION: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 50 CORPORATE: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 51 CORPORATE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 52 MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 53 MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 54 NORTH AMERICA: MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 55 NORTH AMERICA: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 56 NORTH AMERICA: MARKET, BY HARDWARE, 2018–2022 (USD MILLION)

- TABLE 57 NORTH AMERICA: METAVERSE IN EDUCATION MARKET, BY HARDWARE, 2023–2028 (USD MILLION)

- TABLE 58 NORTH AMERICA: MARKET, BY PROFESSIONAL SERVICE, 2018–2022 (USD MILLION)

- TABLE 59 NORTH AMERICA: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 60 NORTH AMERICA: MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 61 NORTH AMERICA: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 62 NORTH AMERICA: MARKET, BY ACADEMIC END USER, 2018–2022 (USD MILLION)

- TABLE 63 NORTH AMERICA: MARKET, BY ACADEMIC END USER, 2023–2028 (USD MILLION)

- TABLE 64 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 65 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 66 US: MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 67 US: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 68 CANADA: METAVERSE IN EDUCATION MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 69 CANADA: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 70 EUROPE: MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 71 EUROPE: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 72 EUROPE: MARKET, BY HARDWARE, 2018–2022 (USD MILLION)

- TABLE 73 EUROPE: MARKET, BY HARDWARE, 2023–2028 (USD MILLION)

- TABLE 74 NORTH AMERICA: MARKET, BY PROFESSIONAL SERVICE, 2018–2022 (USD MILLION)

- TABLE 75 NORTH AMERICA: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 76 EUROPE: MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 77 EUROPE: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 78 EUROPE: METAVERSE IN EDUCATION MARKET, BY ACADEMIC END USER, 2018–2022 (USD MILLION)

- TABLE 79 EUROPE: MARKET, BY ACADEMIC END USER, 2023–2028 (USD MILLION)

- TABLE 80 EUROPE: MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 81 EUROPE: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 82 UK: MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 83 UK: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 84 GERMANY: MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 85 GERMANY: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 86 FRANCE: MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 87 FRANCE: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 88 REST OF EUROPE: MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 89 REST OF EUROPE: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 90 ASIA PACIFIC: METAVERSE IN EDUCATION MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 91 ASIA PACIFIC: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 92 ASIA PACIFIC: MARKET, BY HARDWARE, 2018–2022 (USD MILLION)

- TABLE 93 ASIA PACIFIC: MARKET, BY HARDWARE, 2023–2028 (USD MILLION)

- TABLE 94 ASIA PACIFIC: MARKET, BY PROFESSIONAL SERVICE, 2018–2022 (USD MILLION)

- TABLE 95 ASIA PACIFIC: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 96 ASIA PACIFIC: MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 97 ASIA PACIFIC: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 98 ASIA PACIFIC: MARKET, BY ACADEMIC END USER, 2018–2022 (USD MILLION)

- TABLE 99 ASIA PACIFIC: MARKET, BY ACADEMIC END USER, 2023–2028 (USD MILLION)

- TABLE 100 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 101 ASIA PACIFIC: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 102 CHINA: METAVERSE IN EDUCATION MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 103 CHINA: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 104 JAPAN: MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 105 JAPAN: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 106 INDIA: MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 107 INDIA: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 108 REST OF ASIA PACIFIC: MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 109 REST OF ASIA PACIFIC: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 110 MIDDLE EAST & AFRICA: MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 111 MIDDLE EAST & AFRICA: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 112 MIDDLE EAST & AFRICA: MARKET, BY HARDWARE, 2018–2022 (USD MILLION)

- TABLE 113 MIDDLE EAST & AFRICA: MARKET, BY HARDWARE, 2023–2028 (USD MILLION)

- TABLE 114 MIDDLE EAST & AFRICA: METAVERSE IN EDUCATION MARKET, BY PROFESSIONAL SERVICE, 2018–2022 (USD MILLION)

- TABLE 115 MIDDLE EAST & AFRICA: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 116 MIDDLE EAST & AFRICA: MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 117 MIDDLE EAST & AFRICA: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 118 MIDDLE EAST & AFRICA: MARKET, BY ACADEMIC END USER, 2018–2022 (USD MILLION)

- TABLE 119 MIDDLE EAST & AFRICA: MARKET, BY ACADEMIC END USER, 2023–2028 (USD MILLION)

- TABLE 120 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 121 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 122 KINGDOM OF SAUDI ARABIA: MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 123 KINGDOM OF SAUDI ARABIA: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 124 UAE: MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 125 UAE: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 126 REST OF THE MIDDLE EAST & AFRICA: MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 127 REST OF THE MIDDLE EAST & AFRICA: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 128 LATIN AMERICA: METAVERSE IN EDUCATION MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 129 LATIN AMERICA: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 130 LATIN AMERICA: MARKET, BY HARDWARE, 2018–2022 (USD MILLION)

- TABLE 131 LATIN AMERICA: MARKET, BY HARDWARE, 2023–2028 (USD MILLION)

- TABLE 132 LATIN AMERICA: MARKET, BY PROFESSIONAL SERVICE, 2018–2022 (USD MILLION)

- TABLE 133 LATIN AMERICA: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 134 LATIN AMERICA: MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 135 LATIN AMERICA: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 136 LATIN AMERICA: MARKET, BY ACADEMIC END USER, 2018–2022 (USD MILLION)

- TABLE 137 LATIN AMERICA: MARKET, BY ACADEMIC END USER, 2023–2028 (USD MILLION)

- TABLE 138 LATIN AMERICA: MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 139 LATIN AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 140 BRAZIL: MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 141 BRAZIL: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 142 MEXICO: MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 143 MEXICO: METAVERSE IN EDUCATION MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 144 REST OF LATIN AMERICA: MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 145 REST OF LATIN AMERICA: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 146 OVERVIEW OF STRATEGIES ADOPTED BY KEY VENDORS

- TABLE 147 MARKET SHARE OF KEY VENDORS, 2022

- TABLE 148 OVERALL COMPANY FOOTPRINT FOR KEY PLAYERS

- TABLE 149 OVERALL COMPANY FOOTPRINT FOR STARTUPS/SMES

- TABLE 150 KEY STARTUPS/SMES

- TABLE 151 MARKET: PRODUCT LAUNCHES AND ENHANCEMENT, 2020–2023

- TABLE 152 METAVERSE IN EDUCATION MARKET: DEALS, 2020–2023

- TABLE 153 META PLATFORMS, INC.: BUSINESS OVERVIEW

- TABLE 154 META PLATFORMS, INC.: PRODUCTS/SERVICES OFFERED

- TABLE 155 META PLATFORMS, INC.: PRODUCT LAUNCHES & ENHANCEMENT

- TABLE 156 META PLATFORMS, INC.: DEALS

- TABLE 157 MICROSOFT CORPORATION: BUSINESS OVERVIEW

- TABLE 158 MICROSOFT CORPORATION: PRODUCTS/SERVICES OFFERED

- TABLE 159 MICROSOFT CORPORATION: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 160 MICROSOFT CORPORATION: DEALS

- TABLE 161 ADOBE INC.: BUSINESS OVERVIEW

- TABLE 162 ADOBE INC.: PRODUCT/SERVICES OFFERED

- TABLE 163 ADOBE INC.: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 164 ADOBE INC.: DEALS

- TABLE 165 HP INC.: BUSINESS OVERVIEW

- TABLE 166 HP INC.: PRODUCTS/SERVICES OFFERED

- TABLE 167 HP INC.: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 168 HP INC.: DEALS

- TABLE 169 UNITY SOFTWARE INC.: BUSINESS OVERVIEW

- TABLE 170 UNITY SOFTWARE INC.: PRODUCTS/SERVICES OFFERED

- TABLE 171 UNITY SOFTWARE INC.: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 172 UNITY SOFTWARE INC.: DEALS

- TABLE 173 SAMSUNG ELECTRONICS: BUSINESS OVERVIEW

- TABLE 174 SAMSUNG ELECTRONICS: PRODUCTS/SERVICES OFFERED

- TABLE 175 SAMSUNG ELECTRONICS: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 176 SAMSUNG ELECTRONICS: DEALS

- TABLE 177 LENOVO: BUSINESS OVERVIEW

- TABLE 178 LENOVO: PRODUCTS/SERVICES OFFERED

- TABLE 179 LENOVO: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 180 LENOVO: DEALS

- TABLE 181 ROBLOX CORPORATION: BUSINESS OVERVIEW

- TABLE 182 ROBLOX CORPORATION: PRODUCTS/SERVICES OFFERED

- TABLE 183 ROBLOX CORPORATION: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 184 ROBLOX CORPORATION: DEALS

- TABLE 185 EPIC GAMES: BUSINESS OVERVIEW

- TABLE 186 EPIC GAMES: PRODUCTS/SERVICES OFFERED

- TABLE 187 EPIC GAMES: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 188 EPIC GAMES: DEALS

- TABLE 189 BAIDU, INC.: BUSINESS OVERVIEW

- TABLE 190 BAIDU, INC.: PRODUCTS/SERVICES OFFERED

- TABLE 191 BAIDU, INC.: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 192 BAIDU, INC.: DEALS

- TABLE 193 EXTENDED REALITY MARKET, 2019–2022 (USD MILLION)

- TABLE 194 EXTENDED REALITY MARKET, 2023–2028 (USD MILLION)

- TABLE 195 AUGMENTED REALITY MARKET, BY OFFERING, 2018–2021 (USD MILLION)

- TABLE 196 AUGMENTED REALITY MARKET, BY OFFERING, 2022–2027 (USD MILLION)

- TABLE 197 VIRTUAL REALITY MARKET, BY OFFERING, 2018–2021 (USD MILLION)

- TABLE 198 VIRTUAL REALITY MARKET, BY OFFERING, 2022–2027 (USD MILLION)

- TABLE 199 METAVERSE MARKET, BY COMPONENT, 2018–2021 (USD BILLION)

- TABLE 200 METAVERSE MARKET, BY COMPONENT, 2022–2027 (USD BILLION)

- FIGURE 1 METAVERSE IN EDUCATION MARKET: RESEARCH DESIGN

- FIGURE 2 MARKET: TOP-DOWN AND BOTTOM-UP APPROACH

- FIGURE 3 APPROACH 1 (SUPPLY-SIDE): REVENUE OF METAVERSE IN EDUCATION FROM VENDORS

- FIGURE 4 BOTTOM-UP APPROACH (SUPPLY SIDE): COLLECTIVE REVENUE OF METAVERSE IN EDUCATION VENDORS

- FIGURE 5 MARKET PROJECTIONS FROM SUPPLY SIDE

- FIGURE 6 APPROACH 2 (DEMAND SIDE): REVENUE OF VENDORS FROM VARIOUS SEGMENTS

- FIGURE 7 MARKET PROJECTIONS FROM DEMAND SIDE

- FIGURE 8 METAVERSE IN EDUCATION MARKET SNAPSHOT, 2020–2028

- FIGURE 9 TOP MARKET SEGMENTS IN TERMS OF GROWTH RATE

- FIGURE 10 METAVERSE SOFTWARE IN EDUCATION TO ACCOUNT FOR LARGEST MARKET BY 2028

- FIGURE 11 AR DEVICES TO ACCOUNT FOR LARGEST HARDWARE MARKET BY 2028

- FIGURE 12 STRATEGY & BUSINESS CONSULTING SERVICES TO ACCOUNT FOR LARGEST MARKET BY 2028

- FIGURE 13 ACADEMIC END USERS TO ACCOUNT FOR LARGEST MARKET BY 2028

- FIGURE 14 NORTH AMERICA TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- FIGURE 15 DRASTIC GEOGRAPHIC CHANGE AND TECHNOLOGICAL EVOLUTION TO DRIVE METAVERSE IN EDUCATION’S ARCHIVING GROWTH

- FIGURE 16 SOFTWARE COMPONENT TO ACCOUNT FOR LARGEST SHARE IN 2023 AND 2028

- FIGURE 17 AR DEVICES TO BECOME LARGEST HARDWARE MARKET BY 2028

- FIGURE 18 STRATEGY & BUSINESS CONSULTING SEGMENT TO ACCOUNT FOR LARGER SHARE AMONG PROFESSIONAL SERVICES IN 2023

- FIGURE 19 ACADEMIC END USERS TO ACCOUNT FOR LARGER SHARE THAN CORPORATE END USERS

- FIGURE 20 ASIA PACIFIC TO EMERGE AS BEST MARKET FOR INVESTMENTS IN NEXT FIVE YEARS

- FIGURE 21 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: MARKET

- FIGURE 22 STAGES OF VR ADOPTION IN COMPANIES

- FIGURE 23 MARKET ECOSYSTEM

- FIGURE 24 MARKET: VALUE CHAIN

- FIGURE 25 NUMBER OF PATENTS PUBLISHED, 2012–2022

- FIGURE 26 TOP TEN GLOBAL PATENT APPLICANTS IN 2022

- FIGURE 27 METAVERSE IN EDUCATION MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 28 MARKET: TRENDS/DISRUPTIONS IMPACTING BUYERS

- FIGURE 29 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP HARDWARE

- FIGURE 30 KEY BUYING CRITERIA FOR TOP THREE HARDWARE

- FIGURE 31 METAVERSE SOFTWARE IN EDUCATION TO ACCOUNT FOR LARGEST MARKET SIZE

- FIGURE 32 AR DEVICES TO ACCOUNT FOR LARGEST METAVERSE HARDWARE MARKET IN EDUCATION

- FIGURE 33 STRATEGY & BUSINESS CONSULTING SERVICES TO ACCOUNT FOR LARGEST PROFESSIONAL SERVICES MARKET

- FIGURE 34 ACADEMIC END USERS TO ACCOUNT FOR LARGEST MARKET

- FIGURE 35 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SHARE BY 2028

- FIGURE 36 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 37 ASIA PACIFIC: REGIONAL SNAPSHOT

- FIGURE 38 METAVERSE IN EDUCATION MARKET SHARE ANALYSIS

- FIGURE 39 HISTORICAL REVENUE ANALYSIS, 2018–2022 (USD MILLION)

- FIGURE 40 COMPANY EVALUATION MATRIX FOR KEY PLAYERS: CRITERIA WEIGHTAGE

- FIGURE 41 COMPANY EVALUATION QUADRANT FOR KEY PLAYERS

- FIGURE 42 EVALUATION MATRIX FOR STARTUPS/SMES: CRITERIA WEIGHTAGE

- FIGURE 43 COMPANY EVALUATION QUADRANT FOR OTHER PLAYERS AND STARTUPS/SMES

- FIGURE 44 COMPANY FINANCIAL METRICS, 2022

- FIGURE 45 GLOBAL SNAPSHOT OF KEY MARKET PARTICIPANTS, 2022

- FIGURE 46 META PLATFORMS, INC.: COMPANY SNAPSHOT

- FIGURE 47 MICROSOFT CORPORATION: COMPANY SNAPSHOT

- FIGURE 48 ADOBE INC.: COMPANY SNAPSHOT

- FIGURE 49 HP INC.: COMPANY SNAPSHOT

- FIGURE 50 UNITY SOFTWARE INC.: COMPANY SNAPSHOT

- FIGURE 51 SAMSUNG ELECTRONICS: COMPANY SNAPSHOT

- FIGURE 52 LENOVO: COMPANY SNAPSHOT

- FIGURE 53 ROBLOX CORPORATION: COMPANY SNAPSHOT

- FIGURE 54 BAIDU, INC.: COMPANY SNAPSHOT

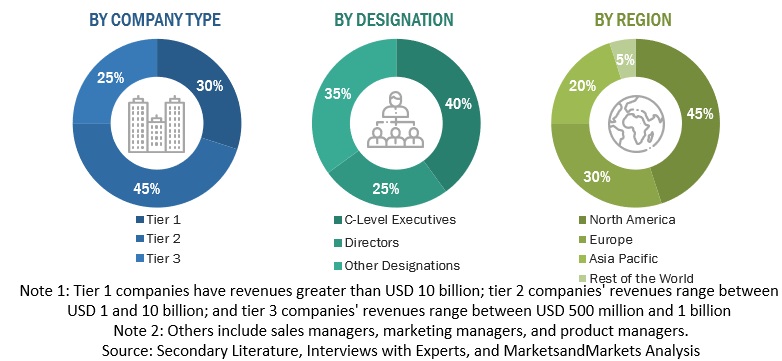

This research study involved extensive secondary sources, directories, and paid databases, to identify and collect information useful for this technical, market-oriented, and commercial study of the metaverse in the education market. In-depth interviews were conducted with various primary respondents, including key industry participants, subject matter experts, C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information and assess the market prospects. The following figure highlights the market research methodology applied in developing this report on the metaverse in the education market.

Secondary Research

The secondary research process referred to various secondary sources to identify and collect information for this study. The secondary sources included annual reports, press releases, investor presentations of companies, and whitepapers; certified publications; and articles from recognized associations and government publishing sources. Secondary research was used to obtain critical information about the industry's value chain, the pool of key players, market classification, segmentation according to industry trends to the bottom-most level, and key developments from the market and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from the supply and demand sides of the metaverse in the education market ecosystem were interviewed to obtain qualitative and quantitative information. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various vendors providing various metaverse offerings; associated service providers; and channel partners operating in the targeted countries. All parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to arrive at the final quantitative and qualitative data.

After the complete market engineering process (including calculations for market statistics, market breakup, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. The primary research also helped identify and validate the segmentation types; industry trends; key players; a competitive landscape of different market players; and fundamental market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key strategies. The bottom-up approach was extensively used in the complete market engineering process and several data triangulation methods to perform market estimation and market forecasting for the overall market segments and subsegments listed in this report. The entire market engineering process was extensive qualitative and quantitative analysis to record the critical information/insights throughout the report.

The Breakup of Primary Profiles:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and forecast the metaverse in the education market and other dependent submarkets. The bottom-up procedure was deployed to arrive at the overall market size using the revenues and offerings of the key companies in the market. With data triangulation methods and validation through primary interviews, this study determined and confirmed the exact value of the overall parent market size. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segments.

Data Triangulation

The market was split into several segments and subsegments after arriving at the overall market size—using the market size estimation processes as explained above. Where applicable, data triangulation and market breakdown procedures were employed to complete the overall market engineering process and determine the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from government agencies' demand and supply sides.

Market Definition

Metaverse in education refers to a virtual or immersive digital environment explicitly designed for educational purposes. It combines elements of VR, AR, and other interactive technologies to create a simulated world where students and educators can engage in immersive and collaborative learning experiences.

Key Stakeholders

- Metaverse platform and services providers

- Augmented Reality (AR), Virtual Reality (VR), and Mixed Reality (MR) device manufacturers

- Professional service providers and consulting companies

- Educators, universities, and corporate trainers

- Raw material suppliers

- Semiconductor Foundries

- Original Equipment Manufacturers (OEM)

- Government organizations, forums, alliances, and associations

- System Integrators (SIs) and Value-added Resellers (VARs)

- Research organizations

- Technology standard organizations, forums, alliances, and associations

- Technology investors

- End-use Verticals

Report Objectives

- To describe and forecast the metaverse in the education market based on components, end users, and regions.

- To forecast the market size of five main regions: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America

- To strategically analyze the market's subsegments for individual growth trends, prospects, and contributions to the total market

- To provide detailed information related to the significant factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To analyze industry trends, patents and innovations, and pricing data related to the market.

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape.

- To track and analyze competitive developments, such as product developments, product enhancements, partnerships, and collaborations, in the market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations per the company's specific needs. The following customization options are available for the report:

Product Analysis

- The product matrix provides a detailed comparison of the product portfolio of each company.

Geographic Analysis

- Further breakup of the metaverse in the education market

Company Information

- Detailed analysis and profiling of additional five market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Metaverse in Education Market