Metal Foam Market by Material (Aluminum, Copper, Nickel), Application (Anti-Intrusion Bars, Heat Exchangers, Sound Insulation), End-Use Industry (Automotive, Construction & Infrastructure, Industrial), and Region - Global Forecast to 2024

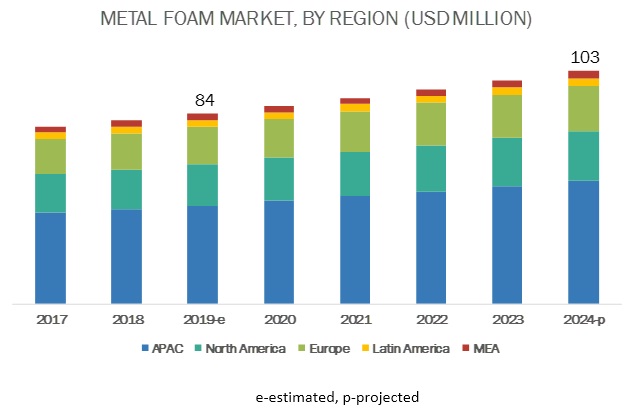

The metal foam market is projected to reach USD 103 million by 2024, at a CAGR of 4.2%. The market is witnessing significant growth because of the rising demand for metal foam from various end-use industries such as automotive and construction & infrastructure. Metal foam offers various advantages, such as cost-benefit, low weight, and thermal conductivity, resulting in its increasing adoption.

The automotive end-use industry is expected to witness high CAGR between 2019 and 2024

Metal foam is finding increasing applications in the automotive industry due to the growing demand for high-performance and lightweight metal foam. Metal foam is used in various applications in the automotive industry. This technology helps in creating lightweight components.

The anti-intrusion bars application segment is projected to account for a significant share in the overall metal foam market during the forecast period.

The anti-intrusion bars application dominated the metal foam market due to the high demand for metal foam in the automotive end-use industry. Anti-intrusion bars are mostly used in ground vehicles and passenger cars. They protect passengers from side impacts. Side impacts are particularly dangerous as these impacts are generally very close to the passenger. Anti-intrusion bars play an important role in absorbing the kinetic energy of the colliding vehicles. Metal foam offers high energy absorption property, which makes it an ideal material for usage in anti-intrusion bars.

APAC is expected to lead the metal foam market during the forecast period.

APAC is the largest and projected to be the fastest-growing metal foam market. The automotive industry is the major consumer of metal foam in the region. The presence of a large number of manufacturers makes the region the most important market for metal foam. The growth is also attributed to the high demand for metal foam in the automotive end-use industry. China, India, and South Korea are the major countries in the metal foam market in APAC.

Key Market Players in Metal Foam Market

Some of the key players in the metal foam market are ERG Aerospace Corporation (US), CYMAT Technologies Ltd. (Canada), Alantum (South Korea), Mott Corporation (US), Liaoning Rontec Advanced Material Technology Co., Ltd. (China), Shanxi Putai Aluminum Foam Manufacturing Co., Ltd. (China), Mayser GmbH & Co. KG (Germany), Ultramet (US), Aluminum King Co., Ltd (China), and Pohltec Metalfoam GmbH (Germany). The key strategies adopted by the major players for enhancing their business revenue are expansions and joint ventures.

Metal Foam Market Report Scope

|

Report Metric |

Details |

|

Years considered for the study |

2017–2024 |

|

Base year |

2018 |

|

Forecast period |

2019–2024 |

|

Units considered |

Value (USD thousand), Volume (ton) |

|

Segments |

Material, Application, End-use Industry, and Region |

|

Regions |

APAC, North America, Europe, Latin America, and MEA |

|

Companies |

ERG Aerospace Corporation (US), CYMAT Technologies Ltd. (Canada), Alantum (South Korea), Mott Corporation (US), Liaoning Rontec Advanced Material Technology Co., Ltd. (China), Shanxi Putai Aluminum Foam Manufacturing Co., Ltd. (China), Mayser GmbH & Co. KG (Germany), Ultramet (US), Aluminum King Co., Ltd (China), and Pohltec Metalfoam GmbH (Germany) |

This research report categorizes the metal foam market based on material, application, end-use industry, and region.

Based on material, the metal foam market has been segmented as follows:

- Aluminum

- Nickel

- Copper

- Others (Tantalum, Tungsten)

Based on application, the metal foam market has been segmented as follows:

- Anti-intrusion Bars

- Heat Exchangers

- Sound Insulation

- Others (Railway Buffer, Medical Implants)

Based on end-use industry, the metal foam market has been segmented as follows:

- Automotive

- Construction & infrastructure

- Industrial

- Others (Aerospace, Defense, Medical)

Based on region, the metal foam market has been segmented as follows:

- APAC

- North America

- Europe

- Latin America

- MEA

Recent Developments

- In July 2017, ERG Aerospace Corporation opened a facility for manufacturing operations at Sparks, Nevada, in the US. The company invested USD 2.1 million in the plant. The location of the plant offers logistic advantages and low-cost labor. This expansion has helped the company to increase its geographical presence.

- In December 2017, the company Mayser GmbH & Co. KG invested in a new factory in Michigan, US, to meet the growing demand in the automotive sector. The factory also develops metal foam products for non-automotive field, products for safety, and foam technology. This expansion has led to the growth of the metal foam market in the North American region.

- In December 2017, CYMAT announced a joint-venture with Alucoil SA (Spain) for producing aluminum composite panels with metallurgically-bonded aluminum foam cores. This joint venture resulted in increasing the geographical presence of the company.

Key Questions Addressed by the Report

- Which are the major end-use industries of metal foam?

- What are the major applications of metal foam?

- Which material is mainly used in metal foam?

- Which is the largest and the fastest-growing regional metal foam market?

- What are the major strategies adopted by leading market players?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 18)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Scope of the Report

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Units Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 23)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Research Assumptions

2.5 Limitations

3 Executive Summary (Page No. - 31)

4 Premium Insights (Page No. - 34)

4.1 Attractive Opportunities in the Metal Foam Market

4.2 Metal Foam Market, By Material and Region

4.3 Metal Foam Market, By End-Use Industry

4.4 Metal Foam Market, By Application

4.5 Metal Foam Market, By Country

5 Market Overview (Page No. - 37)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Superior Properties Offered By Metal Foams Over Polymer Foams

5.2.1.2 Increasing Usage of Metal Foams in Applications Such as Heat Exchangers and Anti-Intrusion Bars

5.2.2 Restraints

5.2.2.1 Difficulty in Bonding, Welding, and Soldering of Metal Foams

5.2.2.2 Cost of Metal Foam is Very High as Compared to Substitutes Such as Polymer Foam

5.2.3 Opportunities

5.2.3.1 Increasing Usage of Metal Foams in the Automotive Industry

5.2.3.2 Increasing Demand for Lightweight Structural Materials in the Construction Industry

5.2.4 Challenges

5.2.4.1 Use of Metal Foams at Nascent Stage

5.2.4.2 Developing Cost-Efficient Manufacturing Methods

5.3 Porter’s Five Forces Analysis

5.3.1 Threat of New Entrants

5.3.2 Threat of Substitutes

5.3.3 Bargaining Power of Suppliers

5.3.4 Bargaining Power of Buyers

5.3.5 Intensity of Competitive Rivalry

5.4 Macroeconomic Overview and Key Trends

5.4.1 Introduction

5.4.2 Trends and Forecast of GDP

5.4.3 Trends in Automotive Industry

5.4.4 Trends of the Construction Industry

5.4.4.1 Contribution of the Construction Industry to the GDP, By Country

6 Metal Foam Market, By Material (Page No. - 47)

6.1 Introduction

6.2 Aluminum

6.2.1 Aluminum to Hold the Largest Market Share Through 2024

6.3 Nickel

6.3.1 Nickel has High Porosity Therefore Preferred Widely for Metal Foams

6.4 Copper

6.4.1 Superior Properties of Copper Contribute to Its Higher Share

6.5 Others

7 Metal Foam Market, By Application (Page No. - 55)

7.1 Introduction

7.2 Anti-Intrusion Bars

7.2.1 Anti-Intrusion Bars Application to Lead the Demand for Metal Foams

7.3 Heat Exchangers

7.3.1 The Demand for Heat Exchangers is Increasing Due to the Higher Porosity Quality

7.4 Sound Insulation

7.4.1 Demand From Sound Insulation has Increased With the Increasing Noise Pollution

7.5 Others

7.5.1 Railway Buffers

7.5.2 Medical Implants

8 Metal Foam Market, By End-Use Industry (Page No. - 62)

8.1 Introduction

8.2 Automotive

8.2.1 Increasing Demand for Metal Foams in High-End Vehicle Will Influence the Market Growth

8.3 Construction & Infrastructure

8.3.1 Growing Construction Activities in APAC are Likely to Drive the Market

8.4 Industrial

8.4.1 Low Weight Makes Metal Foams Suitable for Industrial Machines

8.5 Other End-Use Industries

8.5.1 Aerospace

8.5.2 Defense

8.5.3 Medical

9 Metal Foam Market, By Region (Page No. - 70)

9.1 Introduction

9.2 APAC

9.2.1 By Country

9.2.2 By Material

9.2.3 By Application

9.2.4 By End-Use Industry

9.2.5 China

9.2.5.1 China to Be the Fastest-Growing Metal Foam Market in APAC

9.2.5.1.1 By End-Use Industry

9.2.6 South Korea

9.2.6.1 Increasing Demand From the Construction Industry to Drive the Metal Foam Market in South Korea

9.2.6.1.1 By End-Use Industry

9.2.7 India

9.2.7.1 Growing End-Use Industries to Support the Metal Foam Market in India

9.2.7.1.1 By End-Use Industry

9.2.8 Rest of APAC

9.2.8.1 Automotive to Remain the Largest Segment of the Metal Foam Market in Rest of APAC

9.2.8.1.1 By End-Use Industry

9.3 North America

9.3.1 By Country

9.3.2 By Material

9.3.3 By Application

9.3.4 By End-Use Industry

9.3.5 US

9.3.5.1 The US is the Largest Country-Level Market for Metal Foams

9.3.5.1.1 By End-Use Industry

9.3.6 Canada

9.3.6.1 Automotive is the Most Significant Segment in the Metal Foam Market

9.3.6.1.1 By End-Use Industry

9.4 Europe

9.4.1 By Country

9.4.2 By Material

9.4.3 By Application

9.4.4 By End-Use Industry

9.4.5 Germany

9.4.5.1 Germany to Dominate the Metal Foam Market in Europe

9.4.5.1.1 By End-Use Industry

9.4.6 France

9.4.6.1 France to Be the Second-Largest Market for Metal Foam in Europe

9.4.6.1.1 By End-Use Industry

9.4.7 Austria

9.4.7.1 Increasing Demand for Metal Foam From the Automotive End-Use Industry to Support the Growth of the Metal Foam Market in Austria

9.4.7.1.1 By End-Use Industry

9.4.8 Netherlands

9.4.8.1 Demand for Metal Foam is Expected to Increase at A Faster Pace in the Netherlands, in Terms of Value

9.4.8.1.1 By End-Use Industry

9.4.9 Rest of Europe

9.4.9.1 Automotive to Remain the Largest Segment of the Metal Foam Market in Rest of Europe

9.4.9.1.1 By End-Use Industry

9.5 MEA

9.5.1 By Country

9.5.2 By Material

9.5.3 By Application

9.5.4 By End-Use Industry

9.5.5 UAE

9.5.5.1 The UAE to Have the Largest Share in the MEA Metal Foam Market, in Terms of Value

9.5.5.1.1 By End-Use Industry

9.5.6 Saudi Arabia

9.5.6.1 Saudi Arabia to Grow at the Highest Cagr During the Forecast Period

9.5.7 Qatar

9.5.7.1 Qatar to Be Rapidly Growing Economies in MEA

9.5.7.1.1 By End-Use Industry

9.5.8 Rest of MEA

9.5.8.1 Automotive Industry to Be the Fastest-Growing Segment of the Metal Foam Market in Rest of MEA

9.5.8.1.1 By End-Use Industry

9.6 Latin America

9.6.1 By Country

9.6.2 By Material

9.6.3 By Application

9.6.4 By End-Use Industry

9.6.5 Brazil

9.6.5.1 Brazil to Be the Largest Market for Metal Foams in Latin America

9.6.5.1.1 By End-Use Industry

9.6.6 Mexico

9.6.6.1 Rapidly Growing End-Use Industries to Drive the Metal Foam Market

9.6.6.1.1 By End-Use Industry

9.6.7 Rest of Latin America

9.6.7.1 Automotive to Remain the Largest Industry Segment of the Metal Foam Market in Rest of Latin America

9.6.7.1.1 By End-Use Industry

10 Competitive Landscape (Page No. - 108)

10.1 Introduction

10.2 Competitive Leadership Mapping

10.2.1 Visionary Leaders

10.2.2 Dynamic Differentiators

10.2.3 Emerging Companies

10.2.4 Innovators

10.3 Strength of Product Portfolio

10.4 Business Strategy Excellence

10.5 Market Ranking

10.6 Competitive Scenario

10.6.1 Expansion

10.6.2 Joint Venture

11 Company Profile (Page No. - 115)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, Winning Imperatives, Current Focus, and Strategies, Threat From Competition, Right to Win)*

11.1 ERG Aerospace Corporation

11.2 Cymat Technologies Ltd.

11.3 Alantum

11.4 Mott Corporation

11.5 Liaoning Rontec Advanced Material Technology Material Co., Ltd.

11.6 Shanxi Putai Aluminum Foam Manufacturing Co., Ltd.

11.7 Mayser GmbH & Co. KG

11.8 Ultramet

11.9 Aluminum King Co., Ltd.

11.10 Pohltec Metalfoam GmbH

11.11 Other Players

11.11.1 Wuhan Jingchu Chenshi Pharmaceutical Chemical Co. Ltd.

11.11.2 Hollomet GmbH

11.11.3 Spectra-Mat, Inc.

11.11.4 IWE

11.11.5 American Elements

11.11.6 Versarien Technologies Limited

11.11.7 Goodfellow

11.11.8 Havel Metal Foam

11.11.9 Aluinvent

11.11.10 Foamtech North America

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, Winning Imperatives, Current Focus, and Strategies, Threat From Competition, Right to Win Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 139)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets Subscription Portal

12.3 Available Customizations

12.4 Related Reports

12.5 Author Details

List of Tables (128 Tables)

Table 1 Trends and Forecast of GDP, 2017–2024 (USD Billion)

Table 2 Automotive Production, Million Units (2017–2018)

Table 3 North America: Contribution of the Construction Industry to GDP, By Country, 2014–2021 (USD Billion)

Table 4 Europe: Contribution of Construction Industry to GDP, By Country, 2014–2021 (USD Billion)

Table 5 APAC: Contribution of Construction Industry to GDP, By Country, 2014–2021 (USD Billion)

Table 6 MEA: Contribution of Construction Industry to GDP, By Country, 2014–2021 (USD Billion)

Table 7 Latin America: Contribution of Construction Industry to GDP, By Country, 2014–2021 (USD Billion)

Table 8 Metal Foam Market Size, By Material Type, 2017–2024 (USD Thousand)

Table 9 Metal Foam Market Size, By Material Type, 2017–2024 (Ton)

Table 10 Aluminum Foam Market Size, By Region, 2017–2024 (USD Thousand)

Table 11 Aluminum Foam Market Size, By Region, 2017–2024 (Ton)

Table 12 Nickel Metal Foam Market Size, By Region, 2017–2024 (USD Thousand)

Table 13 Nickel Metal Foam Market Size, By Region, 2017–2024 (Ton)

Table 14 Copper Metal Foam Market Size, By Region, 2017–2024 (USD Thousand)

Table 15 Copper Metal Foam Market Size, By Region, 2017–2024 (Ton)

Table 16 Other Metal Foam Materials Market Size, By Region, 2017–2024 (USD Thousand)

Table 17 Other Metal Foam Materials Market Size, By Region, 2017–2024 (Ton)

Table 18 Metal Foam Market Size, By Application, 2017–2024 (USD Thousand)

Table 19 Metal Foam Market Size, By Application, 2017–2024 (Ton)

Table 20 Metal Foam Market Size in Anti-Intrusion Bars Application, By Region, 2017–2024 (USD Thousand)

Table 21 Metal Foam Market Size in Anti-Intrusion Bars Application, By Region, 2017–2024 (Ton)

Table 22 Metal Foam Market Size in Heat Exchangers Application, By Region, 2017–2024 (USD Thousand)

Table 23 Metal Foam Market Size in Heat Exchangers Application, By Region, 2017–2024 (Ton)

Table 24 Metal Foam Market Size in Sound Insulation Application, By Region, 2017–2024 (USD Thousand)

Table 25 Metal Foam Market Size in Sound Insulation Application, By Region, 2017–2024 (Ton)

Table 26 Metal Foam Market Size in Other Applications, By Region, 2017–2024 (USD Thousand)

Table 27 Metal Foam Market Size in Other Applications, By Region, 2017–2024 (Ton)

Table 28 Metal Foam Market Size, By End-Use Industry, 2017–2024 (USD Thousand)

Table 29 Metal Foam Market Size, By End-Use Industry, 2017–2024 (Ton)

Table 30 Metal Foam Market Size in Automotive End-Use Industry, By Region, 2017–2024 (USD Thousand)

Table 31 Metal Foam Market Size in Automotive End-Use Industry, By Region, 2017–2024 (Ton)

Table 32 Metal Foam Market Size in Construction & Infrastructure End-Use Industry, By Region, 2017–2024 (USD Thousand)

Table 33 Metal Foam Market Size in Construction & Infrastructure End-Use Industry, By Region, 2017–2024 (Ton)

Table 34 Metal Foam Market Size in Industrial End-Use Industry, By Region, 2017–2024 (USD Thousand)

Table 35 Metal Foam Market Size in Industrial End-Use Industry, By Region, 2017–2024 (Ton)

Table 36 Metal Foam Market Size in Other End-Use Industries, By Region, 2017–2024 (USD Thousand)

Table 37 Metal Foam Market Size in Other End-Use Industries, By Region, 2017–2024 (Ton)

Table 38 Metal Foam Market Size, By Region, 2017–2024 (USD Thousand)

Table 39 Metal Foam Market Size, By Region, 2017–2024 (Ton)

Table 40 APAC: Metal Foam Market Size, By Country, 2017–2024 (USD Thousand)

Table 41 APAC: Metal Foam Market Size, By Country, 2017–2024 (Ton)

Table 42 APAC: Metal Foam Market Size, By Material, 2017–2024 (USD Thousand)

Table 43 APAC: Metal Foam Market Size, By Material, 2017–2024 (Ton)

Table 44 APAC: Metal Foam Market Size, By Application, 2017–2024 (USD Thousand)

Table 45 APAC: Metal Foam Market Size, By Application, 2017–2024 (Ton)

Table 46 APAC: Metal Foam Market Size, By End-Use Industry, 2017–2024 (USD Thousand)

Table 47 APAC: Metal Foam Market Size, By End-Use Industry, 2017–2024 (Ton)

Table 48 China: Metal Foam Market Size, By End-Use Industry, 2017–2024 (USD Thousand)

Table 49 China: Metal Foam Market Size, By End-Use Industry, 2017–2024 (Ton)

Table 50 South Korea: Metal Foam Market Size, By End-Use Industry, 2017–2024 (USD Thousand)

Table 51 South Korea: Metal Foam Market Size, By End-Use Industry, 2017–2024 (Ton)

Table 52 India: Metal Foam Market Size, By End-Use Industry, 2017–2024 (USD Thousand)

Table 53 India: Metal Foam Market Size, By End-Use Industry, 2017–2024 (Ton)

Table 54 Rest of APAC: Metal Foam Market Size, By End-Use Industry, 2017–2024 (USD Thousand)

Table 55 Rest of APAC: Metal Foam Market Size, By End-Use Industry, 2017–2024 (Ton)

Table 56 North America: Metal Foam Market Size, By Country, 2017–2024 (USD Thousand)

Table 57 North America: Metal Foam Market Size, By Country, 2017–2024 (Ton)

Table 58 North America: Metal Foam Market Size, By Material, 2017–2024 (USD Thousand)

Table 59 North America: Metal Foam Market Size, By Material, 2017–2024 (Ton)

Table 60 North America: Metal Foam Market Size, By Application, 2017–2024 (USD Thousand)

Table 61 North America: Metal Foam Market Size, Application, 2017–2024 (Ton)

Table 62 North America: Metal Foam Market Size, By End-Use Industry, 2017–2024 (USD Thousand)

Table 63 North America: Metal Foam Market Size, By End-Use Industry, 2017–2024 (Ton)

Table 64 US: Metal Foam Market Size, By End-Use Industry, 2017–2024 (USD Thousand)

Table 65 US: Metal Foam Market Size, By End-Use Industry, 2017–2024 (Ton)

Table 66 Canada: Metal Foam Market Size, By End-Use Industry, 2017–2024 (USD Thousand)

Table 67 Canada: Metal Foam Market Size, By End-Use Industry, 2017–2024 (Ton)

Table 68 Europe: Metal Foam Market Size, By Country, 2017–2024 (USD Thousand)

Table 69 Europe: Metal Foam Market Size, By Country, 2017–2024 (Ton)

Table 70 Europe: Metal Foam Market Size, By Material, 2017–2024 (USD Thousand)

Table 71 Europe: Metal Foam Market Size, By Material, 2017–2024 (Ton)

Table 72 Europe: Metal Foam Market Size, By Application, 2017–2024 (USD Thousand)

Table 73 Europe: Metal Foam Market Size, By Application, 2017–2024 (Ton)

Table 74 Europe: Metal Foam Market Size, By End-Use Industry, 2017–2024 (USD Thousand)

Table 75 Europe: Metal Foam Market Size, By End-Use Industry, 2017–2024 (Ton)

Table 76 Germany: Metal Foam Market Size, By End-Use Industry, 2017–2024 (USD Thousand)

Table 77 Germany: Metal Foam Market Size, By End-Use Industry, 2017–2024 (Ton)

Table 78 France: Metal Foam Market Size, By End-Use Industry, 2017–2024 (USD Thousand)

Table 79 France: Metal Foam Market Size, By End-Use Industry, 2017–2024 (Ton)

Table 80 Austria: Metal Foam Market Size, By End-Use Industry, 2017–2024 (USD Thousand)

Table 81 Austria: Metal Foam Market Size, By End-Use Industry, 2017–2024 (Ton)

Table 82 Netherlands: Metal Foam Market Size, By End-Use Industry, 2017–2024 (USD Thousand)

Table 83 Netherlands: Metal Foam Market Size, By End-Use Industry, 2017–2024 (Ton)

Table 84 Rest of Europe: Metal Foam Market Size, By End-Use Industry, 2017–2024 (USD Thousand)

Table 85 Rest of Europe: Metal Foam Market Size, By End-Use Industry, 2017–2024 (Ton)

Table 86 MEA: Metal Foam Market Size, By Country, 2017–2024 (USD Thousand)

Table 87 MEA: Metal Foam Market Size, By Country, 2017–2024 (Ton)

Table 88 MEA: Metal Foam Market Size, By Material, 2017–2024 (USD Thousand)

Table 89 MEA: Metal Foam Market Size, By Material, 2017–2024 (Ton)

Table 90 MEA: Metal Foam Market Size, By Application, 2017–2024 (USD Thousand)

Table 91 MEA: Metal Foam Market Size, By Application, 2017–2024 (Ton)

Table 92 MEA: Metal Foam Market Size, By End-Use Industry, 2017–2024 (USD Thousand)

Table 93 MEA: Metal Foam Market Size, By End-Use Industry, 2017–2024 (Ton)

Table 94 UAE: Metal Foam Market Size, By End-Use Industry, 2017–2024 (USD Thousand)

Table 95 UAE: Metal Foam Market Size, By End-Use Industry, 2017–2024 (Ton)

Table 96 Saudi Arabia: Metal Foam Market Size, By End-Use Industry, 2017–2024 (USD Thousand)

Table 97 Saudi Arabia: Metal Foam Market Size, By End-Use Industry, 2017–2024 (Ton)

Table 98 Qatar: Metal Foam Market Size, By End-Use Industry, 2017–2024 (USD Thousand)

Table 99 Qatar: Metal Foam Market Size, By End-Use Industry, 2017–2024 (Ton)

Table 100 Rest of MEA: Metal Foam Market Size, By End-Use Industry, 2017–2024 (USD Thousand)

Table 101 Rest of MEA: Metal Foam Market Size, By End-Use Industry, 2017–2024 (Ton)

Table 102 Latin America: Metal Foam Market Size, By Country, 2017–2024 (USD Thousand)

Table 103 Latin America: Metal Foam Market Size, By Country, 2017–2024 (Ton)

Table 104 Latin America: Metal Foam Market Size, By Material, 2017–2024 (USD Thousand)

Table 105 Latin America: Metal Foam Market Size, By Material, 2017–2024 (Ton)

Table 106 Latin America: Metal Foam Market Size, By Application, 2017–2024 (USD Thousand)

Table 107 Latin America: Metal Foam Market Size, By Application, 2017–2024 (Ton)

Table 108 Latin America: Metal Foam Market Size, By End-Use Industry, 2017–2024 (USD Thousand)

Table 109 Latin America: Metal Foam Market Size, By End-Use Industry, 2017–2024 (Ton)

Table 110 Brazil: Metal Foam Market Size, By End-Use Industry, 2017–2024 (USD Thousand)

Table 111 Brazil: Metal Foam Market Size, By End-Use Industry, 2017–2024 (Ton)

Table 112 Mexico: Metal Foam Market Size, By End-Use Industry, 2017–2024 (USD Thousand)

Table 113 Mexico: Metal Foam Market Size, By End-Use Industry, 2017–2024 (Ton)

Table 114 Rest of Latin America: Metal Foam Market Size, By End-Use Industry, 2017–2024 (USD Thousand)

Table 115 Rest of Latin America: Metal Foam Market Size, By End-Use Industry, 2017–2024 (Ton)

Table 116 Expansion, 2016–2019

Table 117 Joint Venture, 2016–2019

Table 118 Major Manufacturing Plants Location

Table 119 Major Manufacturing Plants Location

Table 120 Key Customers

Table 121 Major Manufacturing Plants Location

Table 122 Major Manufacturing Plants Location

Table 123 Major Manufacturing Plants Location

Table 124 Major Manufacturing Plants Location

Table 125 Major Manufacturing Plants Location

Table 126 Major Manufacturing Plants Location

Table 127 Major Manufacturing Plants Location

Table 128 Major Manufacturing Plants Location

List of Figures (37 Figures)

Figure 1 Metal Foam Market Segmentation

Figure 2 Metal Foam Market: Research Design

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 The Following Methodology for Supply-Side Sizing of the Metal Foam Market has Been Used

Figure 6 Metal Foam Market: Data Triangulation

Figure 7 Aluminum Remains the Dominating Segment in the Metal Foam Market During the Forecast Period

Figure 8 Automotive to Be the Fastest-Growing End-USe IndUStry of Metal Foam Between 2019 and 2024

Figure 9 Anti-IntrUSion Bars Application is Expected to Dominate the Market During the Forecast Period

Figure 10 APAC Dominated the Metal Foam Market, 2018

Figure 11 High Demand From the Automotive End-USe IndUStry to Drive the Market

Figure 12 APAC Accounted for the Largest Market Share

Figure 13 Automotive End-USe IndUStry to Dominate the Overall Metal Foam Market

Figure 14 Anti-IntrUSion Bars Application Accounted for the Largest Share of the Overall Metal Foam Market

Figure 15 China to Register the Highest Cagr in the Metal Foam Market

Figure 16 Factors Governing the Metal Foam Market

Figure 17 Porter’s Five Forces Analysis

Figure 18 Trends and Forecast of GDP, 2018–2024 (USD Billion)

Figure 19 Automotive Production in Key Countries, Million Units (2017 vs. 2018)

Figure 20 Aluminum to Be the Widely Used Material for Metal Foam

Figure 21 APAC to Drive the Aluminum Foam Market

Figure 22 Anti-Intrusion Bars Segment to Account for the Largest Share in the Metal Foam Market

Figure 23 APAC to Register the Highest Cagr in the Anti-Intrusion Bars Segment

Figure 24 Automotive Industry to Dominate the Metal Foam Market During the Forecast Period

Figure 25 APAC to Drive the Metal Foam Market in the Automotive Industry Between 2019–2024

Figure 26 Regional Snapshot (2019–2024): China is Projected to Register the Highest Growth Rate

Figure 27 APAC: Metal Foam Market Snapshot

Figure 28 North America: Metal Foam Market Snapshot

Figure 29 Europe: Metal Foam Market Snapshot

Figure 30 Expansion and Joint Venture are the Key Growth Strategies Adopted Between 2016 and 2019

Figure 31 Metal Foam Market: Competitive Leadership Mapping, 2018

Figure 32 ERG Aerospace Corporation: SWOT Analysis

Figure 33 Cymat Technologies Ltd.: Company Snapshot

Figure 34 Cymat Technologies Ltd.: SWOT Analysis

Figure 35 Alantum: SWOT Analysis

Figure 36 Mott Corporation: SWOT Analysis

Figure 37 Liaoning Rontec Advanced Material Technology Material Co., Ltd.: SWOT Analysis

The study involved four major activities in estimating the current metal foam market size. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation procedures were used to estimate the size of market segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; gold standard & silver standard websites; regulatory bodies; trade directories; and databases.

Primary Research

The metal foam market comprises several stakeholders, such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by the development of various industry sectors such as building and infrastructure. Advancements in technology across diverse applications characterize the supply side. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Following is the breakdown of primary interviews:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total metal foam market size. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size included the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size using the market size estimation process, as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the building and infrastructure end-use sectors.

Objectives of the Report

- To define, describe, and forecast the market size of metal foam, in terms of value and volume

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To provide detailed information about the technological advancements influencing the growth of the market

- To forecast the market based on the material, application and end-use industry

- To define, describe, and forecast the market based on five regions, namely, North America, Europe, APAC, Latin America, and MEA

- To strategically analyze micro-markets with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for the market leaders

- To analyze recent developments such as expansions and joint ventures in the market

- To strategically profile the key players and comprehensively analyze their market share and core competencies

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of Rest of Europe metal foam market

- Further breakdown of Rest of APAC metal foam market

- Further breakdown of Rest of MEA metal foam market

- Further breakdown of Rest of Latin America metal foam market

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Metal Foam Market