Metal-air Battery Market by Metal (Zinc, Lithium, Aluminum, Iron), Voltage, Type (Primary, Secondary), Application (Electric Vehicles, Military Electronics, Electronic Devices, Stationary Power) and Region - Global Forecast to 2027

Updated on : October 29, 2024

The Metal-Air Battery Market size is poised for significant growth, driven by the increasing demand for efficient and sustainable energy storage solutions. As industries seek alternatives to traditional battery technologies, metal-air batteries—known for their high energy density and lightweight characteristics—are gaining traction in applications ranging from electric vehicles to renewable energy systems. Key trends shaping this market include advancements in battery materials, such as the development of new anodes and electrolytes, which enhance performance and longevity. Moreover, the integration of metal-air batteries with renewable energy sources is becoming a focal point, as businesses aim to optimize energy storage and reduce carbon footprints. Looking to the future, the Metal-Air Battery Market is expected to expand further, fueled by ongoing research and development efforts, increased investment in clean energy technologies, and growing consumer awareness of sustainable energy solutions. This evolution positions metal-air batteries as a promising contender in the race for next-generation energy storage options.

Metal-Air Battery Market Size & Growth

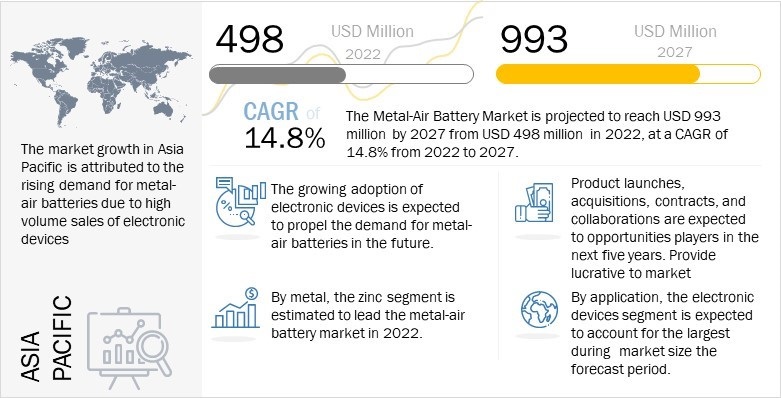

The global metal-air battery market size is projected to grow from USD 498 million in 2022 to USD 993 million by 2027, growing at a CAGR of 14.8% from 2022 to 2027. The anticipated rise in the adoption of metal-air batteries in electric vehicles and the burgeoning demand for high-energy density storage devices are some of the key factors expected to uplift the growth of the metal-air battery industry.

Global Metal-Air Battery Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Metal-Air Battery Market Dynamics

Driver: Broad scope of applications in high energy storage solutions and medical industry

Metal-air battery banks have the potential to help generate clean energy both on a small building scale and on a large grid scale. Metal-air batteries have much higher theoretical energy density and exhibit ideal features such as high safety, low cost, and environmental benignity. The performance and technological challenges involved in these batteries are primarily related to metal electrodes. However, many research institutes and companies have recommended these batteries as a solution for next-generation electrochemical storage for applications such as grid energy storage and electric vehicles. The advantages of zinc-air batteries include flat discharge voltage, safety, environmental benefits, good shelf life, and low cost. Hence, these batteries are used in devices such as hearing aids, pagers, and medical devices.

Restraint: Unavailability of proper standards for developing metal-air batteries

One of the major restraints for the market players operating in this industry is the lack of standards for developing metal-air batteries. Most of the batteries available in the market, manufactured by various companies, vary in terms of technical specifications, materials, functional designs, and others. Hence, it is difficult to compare the performance of various metal-air batteries. This creates the need to develop concrete standards to measure the performance of metal-air batteries based on design. It is also observed that the metal-air batteries for different applications vary in terms of function, size, property, and structure; for instance, metal-air batteries for grid-scale applications differ from the ones used for residential applications. Metal-air battery systems are designed according to the requirements of the end users, which may also lead to variations in cost. Thus, these metal-air batteries may differ from off-the-shelf metal-air batteries available in the market for similar applications.

Opportunity: Emerging new application areas for metal-air batteries apart from electric vehicles

The newly developed metal-air batteries that have high energy density are expected to be utilized in the IoT market during the forecast period. The technology is expected to provide an easily scalable, inexpensive, conformable, and high-capacity battery design to address a wide range of applications brought forth by IoT. Companies operating in this market are developing such metal-air batteries, which can currently meet or exceed the quality of other battery products available in the market for IoT applications. The need for better battery technologies in electric grid storage applications is driven by supportive government policies and the migration of utility providers from non-renewable to renewable energy sources. Zinc-air batteries are traditionally used in non-rechargeable, small devices such as hearing aids because these batteries provide low levels of power for a long period of time. Historically, these batteries have not been used in applications that require periodic bursts of power, such as on the electrical grid.

Challenge: Corrosion between electrolyte and anode in zinc-air batteries

The zinc-air battery is one of the most mature metal-air batteries. Unlike the other metal-air batteries, zinc-air batteries are significantly developed and commercialized. They are primarily used in small-scale applications to power watches and hearing aids. Developments are underway to use these batteries for larger applications. One of the most important challenges with these batteries is the corrosion between the electrolyte and the anode. The reaction between them can produce explosive hydrogen gas, which makes the batteries unsafe. However, research has shown that the use of zinc alloys with lead, mercury, cadmium, and lead oxides reduces the amount of hydrogen gas formed.

By metal, the zinc segment accounted for the largest market size in 2021

Zinc-air batteries, when sealed, have an outstanding shelf life. In addition to this, these batteries can store more energy per unit of weight as compared to other types of primary batteries. Zinc-air batteries with high volume energy densities have the advantage of low cost and high safety. Zinc, on the other hand, has an electrode that is more productive and has more energizing mechanical characteristics. Primary zinc-air batteries are available in the market in a range of coin and button cell sizes. These cells are mostly used in electronic devices such as hearing aids and watches. Larger zinc-air batteries are used as cylindrical or prismatic cells for railway remote signaling.

By voltage, the low voltage segment captured the largest market size in 2021

By voltage, the low voltage segment accounted for the largest share of the metal-air battery market in 2021. The growing demand for low-voltage metal-air batteries for their use in various electronic devices coupled with the increasing number of applications for these batteries, such as communication devices, is expected to drive the low voltage segment’s growth during the forecast period.

To know about the assumptions considered for the study, download the pdf brochure

Asia Pacific accounted for the largest market size in 2021

Rapid industrialization and infrastructure developments are driving the growth of the electronics and electric vehicle industries in China and India. These developments are, in turn, expected to increase the demand for metal-air batteries in the region.

Portable electronic devices, electric vehicles, and renewable energy storage systems are the leading applications for the metal-air battery market and are witnessing significant developments in India. Technological developments, an increasing need for cleaner energy, and favorable initiatives by industry participants are likely to drive the growth of the metal-air battery market in the Asia Pacific region.

Key Market Players

Various organic and inorganic growth strategies, such as product launches, product developments, partnerships, and acquisitions, were implemented by the market players to strengthen their offerings in the market. Some of the major players in the metal-air battery companies include GP Batteries International (Hong Kong), Arotech Corporation (US), Energizer Holdings (US), Duracell (US), and Renata SA (Switzerland).

The study includes an in-depth competitive analysis of these key market players along with their company profiles, recent developments, and key market strategies.

Metal-Air Battery Market Report Scope

|

Report Metric |

Details |

| Estimated Market Size | USD 498 million in 2022 |

| Projected Market Size | USD 993 million by 2027 |

| Growth Rate | CAGR of 14.8% |

|

Years considered |

2018–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

Metal, Voltage, Type, Application, and Region |

|

Regions covered |

North America, Asia Pacific, Europe, and Rest of the World |

|

Companies covered |

GP Batteries International (Hong Kong), Arotech Corporation (US), Energizer Holdings (US), Duracell (US) and Renata SA (Switzerland) |

In this report, the overall metal-air battery market has been segmented based on metal, voltage, type, application, and region

By Metal

- Zinc

- Lithium

- Aluminum

- Iron

- Others

By Voltage

- Low (<12V)

- Medium (12−36V)

- High (>36V)

By Type

- Primary

- Secondary

By Application

- Electric Vehicles

- Military Electronics

- Electronic Devices

- Stationary Power

- Others

By Region

-

North America

- US

- Canada

- Mexico

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

-

Rest of the World

-

Middle East

- Saudi Arabia

- UAE

- Rest of Middle East

- Africa

- South America

-

Middle East

Recent Developments

- In July 2022, Phinergy and Aditya Birla Group Hindalco signed an MOU to develop and pilot the production of aluminum plates for aluminum-air batteries in India.

- In December 2021, Log9 Materials partnered with Hero Electric to offer InstaCharging battery packs for its entire range of electric vehicles.

- In January 2019, Energizer Holdings acquired Spectrum Brands and its portable lighting business which also includes the divestiture of the Varta consumer battery business including manufacturing and distribution.

Frequently Asked Questions (FAQ):

Which region is expected to adopt video surveillance systems at a fast rate?

The metal-air battery market is estimated to be valued at USD 498 million in 2022.

At what rate is the metal-air battery market expected to grow from 2022 to 2027?

The metal-air battery market is projected to record a CAGR of 14.8% from 2022 to 2027.

Which are the top players in the metal-air battery market?

The major vendors operating in the metal-air battery include GP Batteries International (Hong Kong), Arotech Corporation (US), Energizer Holdings (US), Duracell (US), and Renata SA (Switzerland).

Which types of batteries are considered in the metal-air battery market?

Primary and secondary batteries have been considered under the classification of metal-air batteries based on type.

Which major countries are considered in the North American region?

The market analysis for North America includes the US, Canada, and Mexico.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 26)

1.1 STUDY OBJECTIVES

1.2 DEFINITION AND SCOPE

1.3 INCLUSIONS AND EXCLUSIONS

1.4 STUDY SCOPE

1.4.1 MARKETS COVERED

FIGURE 1 METAL-AIR BATTERY MARKET: SEGMENTATION

1.4.2 YEARS CONSIDERED

1.5 CURRENCY CONSIDERED

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 30)

2.1 RESEARCH DATA

FIGURE 2 METAL-AIR BATTERY MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Major secondary sources

2.1.1.2 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Primary interviews with experts

2.1.2.2 Key data from primary sources

2.1.2.3 Breakdown of primaries

2.1.3 SECONDARY AND PRIMARY RESEARCH

2.1.3.1 Key industry insights

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for arriving at market size through bottom-up analysis (demand side)

FIGURE 3 BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for arriving at market size through top-down analysis (supply side)

FIGURE 4 TOP-DOWN APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 6 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS AND LIMITATIONS

2.4.1 RESEARCH ASSUMPTIONS

FIGURE 7 ASSUMPTIONS FOR RESEARCH STUDY

2.4.2 LIMITATIONS

2.5 RISK ASSESSMENT

3 EXECUTIVE SUMMARY (Page No. - 40)

FIGURE 8 GLOBAL METAL-AIR BATTERY MARKET, 2018–2027

FIGURE 9 ZINC-AIR BATTERIES TO HOLD LARGEST MARKET SHARE DURING 2022–2027

FIGURE 10 SECONDARY BATTERY SEGMENT ACCOUNTED FOR LARGER MARKET SHARE FOR METAL-AIR BATTERIES IN 2022

FIGURE 11 METAL-AIR BATTERY MARKET FOR ELECTRONIC DEVICES TO ACCOUNT FOR LARGEST SHARE BY 2027

FIGURE 12 ASIA PACIFIC HELD LARGEST SHARE OF METAL-AIR BATTERY MARKET IN 2021

4 PREMIUM INSIGHTS (Page No. - 44)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES FOR KEY PLAYERS IN METAL-AIR BATTERY MARKET

FIGURE 13 INCREASING ADOPTION OF ELECTRONIC DEVICES TO FOSTER DEMAND FOR METAL-AIR BATTERIES

4.2 METAL-AIR BATTERY MARKET, BY METAL

FIGUREE 14 ZINC-AIR BATTERIES TO HOLD LARGEST MARKET SHARE BY 2027

4.3 METAL-AIR BATTERY MARKET, BY APPLICATION AND METAL

FIGUREE 15 ELECTRONIC DEVICES AND ZINC TO BE LARGEST SHAREHOLDERS IN METAL-AIR BATTERY MARKET BY 2027

4.4 METAL-AIR BATTERY MARKET, BY VOLTAGE

FIGUREE 16 LOW VOLTAGE METAL-AIR BATTERIES TO DOMINATE MARKET DURING FORECAST PERIOD

4.5 METAL-AIR BATTERY MARKET, BY REGION

FIGUREE 17 MARKET IN GERMANY TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 47)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 18 METAL-AIR BATTERY MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Growth in demand for high energy-density storage solutions and inherent properties of metal-air batteries

TABLE 1 ELECTROCHEMICAL REACTIONS ASSOCIATED WITH VARIOUS METAL-AIR BATTERIES AND THEIR CORRESPONDING THEORETICAL ENERGY AND VOLTAGE

5.2.1.2 Increase in use of zinc-air batteries in electronic devices

5.2.1.3 Global shift toward green-energy sources

FIGURE 19 METAL-AIR BATTERY MARKET: IMPACT ANALYSIS OF DRIVERS

5.2.2 RESTRAINTS

5.2.2.1 Absence of proper standards for developing metal-air batteries

5.2.2.2 Massive deployment of lithium-ion batteries to divert focus from metal-air batteries

FIGURE 20 METAL-AIR BATTERY MARKET: IMPACT ANALYSIS OF RESTRAINTS

5.2.3 OPPORTUNITIES

5.2.3.1 Newer applications of metal-air batteries apart from electric vehicles

5.2.3.2 Substantial growth in demand for electric vehicles

FIGURE 21 METAL-AIR BATTERY MARKET: IMPACT ANALYSIS OF OPPORTUNITIES

5.2.4 CHALLENGES

5.2.4.1 Corrosion between electrolyte and anode in zinc-air batteries

5.2.4.2 Rapid discharging of aluminum- and magnesium-air batteries

FIGURE 22 METAL-AIR BATTERY MARKET: IMPACT ANALYSIS OF CHALLENGES

5.3 VALUE CHAIN ANALYSIS

FIGURE 23 VALUE CHAIN ANALYSIS: METAL-AIR BATTERY MARKET

5.4 ECOSYSTEM ANALYSIS

FIGURE 24 METAL-AIR BATTERY MARKET: ECOSYSTEM

TABLE 2 METAL-AIR BATTERY MARKET PLAYERS: ROLE IN ECOSYSTEM

5.5 PRICING ANALYSIS

5.5.1 ASP ANALYSIS OF KEY PLAYERS

FIGURE 25 ASP OF ZINC-AIR BATTERIES BASED ON CAPACITY

TABLE 3 APPROXIMATE AVERAGE SELLING PRICES OF ZINC-AIR BATTERIES BASED ON CAPACITY, BY COMPANY (USD)

5.5.2 ASP TREND

TABLE 4 AVERAGE SELLING PRICES OF METAL-AIR BATTERIES

5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS

FIGURE 26 REVENUE SHIFT IN METAL-AIR BATTERY MARKET

5.7 TECHNOLOGY ANALYSIS

5.7.1 SODIUM-SULFUR BATTERIES

5.7.2 COBALT-FREE BATTERIES

5.7.3 SILICON-AIR BATTERIES

5.7.4 LIQUID-METAL BATTERIES

5.8 PORTER’S FIVE FORCES ANALYSIS

TABLE 5 METAL-AIR BATTERY MARKET: PORTER’S FIVE FORCES ANALYSIS

5.9 KEY STAKEHOLDERS AND BUYING CRITERIA

5.9.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 27 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR THREE MAJOR APPLICATIONS

TABLE 6 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR THREE MAJOR APPLICATIONS (%)

5.9.2 BUYING CRITERIA

FIGURE 28 KEY BUYING CRITERIA FOR THREE MAJOR APPLICATIONS

TABLE 7 KEY BUYING CRITERIA FOR THREE MAJOR APPLICATIONS

5.1 CASE STUDY ANALYSIS

TABLE 8 ZINC8 ENERGY SOLUTIONS PROVIDED ZINC-AIR ENERGY STORAGE SYSTEM TO HELP POWER NEW YORK APARTMENT BUILDING

TABLE 9 ZINC8 ENERGY SOLUTIONS PROVIDED ZINC-AIR TECHNOLOGY TO OVERCOME DECARBONIZATION CHALLENGES IN NEW YORK CITY

5.11 TRADE ANALYSIS

5.11.1 IMPORT SCENARIO

FIGURE 29 IMPORTS, BY KEY COUNTRIES, 2017–2021 (USD MILLION)

5.11.2 EXPORT SCENARIO

FIGURE 30 EXPORTS, BY KEY COUNTRIES, 2017–2021 (USD MILLION)

5.12 PATENT ANALYSIS

FIGURE 31 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS (2012–2021)

TABLE 10 TOP 20 PATENT OWNERS IN US (2012–2021)

FIGURE 32 NUMBER OF PATENTS GRANTED PER YEAR FROM 2012 TO 2021

TABLE 11 LIST OF FEW PATENTS IN METAL-AIR BATTERY MARKET

5.13 KEY CONFERENCES AND EVENTS (2022–2023)

TABLE 12 METAL-AIR BATTERY MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

5.14 REGULATORY LANDSCAPE

5.14.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS RELATED TO METAL-AIR BATTERIES

TABLE 13 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 14 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 15 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.14.2 STANDARDS AND REGULATIONS RELATED TO METAL-AIR BATTERIES

TABLE 16 NORTH AMERICA: SAFETY STANDARDS FOR METAL-AIR BATTERY MARKET

TABLE 17 EUROPE: SAFETY STANDARDS FOR METAL-AIR BATTERY MARKET

TABLE 18 ASIA PACIFIC: SAFETY STANDARDS FOR METAL-AIR BATTERY MARKET

6 COMPONENTS OF METAL-AIR BATTERIES (Page No. - 76)

6.1 INTRODUCTION

FIGURE 33 COMPONENTS OF METAL-AIR BATTERIES

6.2 ANODE

6.3 CATHODE

6.4 ELECTROLYTE

6.5 OTHERS

7 METAL-AIR BATTERY MARKET, BY METAL (Page No. - 78)

7.1 INTRODUCTION

FIGURE 34 METAL-AIR BATTERY MARKET, BY METAL

FIGURE 35 ZINC-AIR BATTERY TO CONTRIBUTE LARGEST MARKET SHARE DURING FORECAST PERIOD

TABLE 19 METAL-AIR BATTERY MARKET, BY METAL, 2018–2021 (USD MILLION)

TABLE 20 METAL-AIR BATTERY MARKET, BY METAL, 2022–2027 (USD MILLION)

7.2 ZINC

7.2.1 SUBSTANTIAL APPLICATIONS IN ELECTRONIC DEVICES

TABLE 21 ZINC: METAL-AIR BATTERY MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 22 ZINC: METAL-AIR BATTERY MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 23 ZINC: METAL-AIR BATTERY MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 24 ZINC: METAL-AIR BATTERY MARKET, BY REGION, 2022–2027 (USD MILLION)

7.3 LITHIUM

7.3.1 GREAT POWER SOLUTION FOR MILITARY APPLICATIONS

TABLE 25 LITHIUM: METAL-AIR BATTERY MARKET, BY APPLICATION, 2024–2027 (USD MILLION)

TABLE 26 LITHIUM: METAL-AIR BATTERY MARKET, BY REGION, 2024–2027 (USD MILLION)

7.4 ALUMINUM

7.4.1 INCREASING ADOPTION OF ELECTRIC VEHICLES TO ACCELERATE DEMAND

TABLE 27 ALUMINUM: METAL-AIR BATTERY MARKET, BY APPLICATION, 2018−2021 (USD MILLION)

TABLE 28 ALUMINUM: METAL-AIR BATTERY MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 29 ALUMINUM: METAL-AIR BATTERY MARKET, BY REGION, 2018−2021 (USD MILLION)

TABLE 30 ALUMINUM: METAL-AIR BATTERY MARKET, BY REGION, 2022–2027 (USD MILLION)

7.5 IRON

7.5.1 GROWING USE OF IRON-AIR BATTERIES OWING TO LOW COST, LONG OPERATIONAL LIFE, AND SAFE OPERATIONS

TABLE 31 IRON: METAL-AIR BATTERY MARKET, BY APPLICATION, 2023–2027 (USD MILLION)

TABLE 32 IRON: METAL-AIR BATTERY MARKET, BY REGION, 2023–2027 (USD MILLION)

7.6 OTHERS

TABLE 33 OTHERS: METAL-AIR BATTERY MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 34 OTHERS: METAL-AIR BATTERY MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 35 OTHERS: METAL-AIR BATTERY MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 36 OTHERS: METAL-AIR BATTERY MARKET, BY REGION, 2022–2027 (USD MILLION)

8 METAL-AIR BATTERY MARKET, BY VOLTAGE (Page No. - 90)

8.1 INTRODUCTION

FIGURE 36 METAL-AIR BATTERY MARKET, BY VOLTAGE

FIGURE 37 LOW-VOLTAGE BATTERIES TO LEAD METAL-AIR BATTERY MARKET IN 2022

TABLE 37 METAL-AIR BATTERY MARKET, BY VOLTAGE, 2018–2021 (USD MILLION)

TABLE 38 METAL-AIR BATTERY MARKET, BY VOLTAGE, 2022–2027 (USD MILLION)

8.2 LOW (<12 V)

8.2.1 SUBSTANTIAL APPLICATIONS IN ELECTRONIC DEVICES

8.3 MEDIUM (12–36 V)

8.3.1 GROWING DEMAND FOR REMOTE MONITORING AND MILITARY ELECTRONICS APPLICATIONS

8.4 HIGH (>36 V)

8.4.1 SIGNIFICANT USE IN ELECTRIC VEHICLES

9 METAL-AIR BATTERY MARKET, BY TYPE (Page No. - 94)

9.1 INTRODUCTION

FIGURE 38 METAL-AIR BATTERY MARKET, BY TYPE

FIGURE 39 SECONDARY BATTERIES TO LEAD METAL-AIR BATTERY MARKET DURING FORECAST PERIOD

TABLE 39 METAL-AIR BATTERY MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 40 METAL-AIR BATTERY MARKET, BY TYPE, 2022–2027 (USD MILLION)

9.2 PRIMARY

9.2.1 PRIMARY BATTERIES HAVE SHORTER LIFE SPAN

9.3 SECONDARY

9.3.1 IMMENSE OPPORTUNITIES IN ELECTRIC VEHICLES

10 METAL-AIR BATTERY MARKET, BY APPLICATION (Page No. - 98)

10.1 INTRODUCTION

FIGURE 40 METAL-AIR BATTERY MARKET, BY APPLICATION

FIGURE 41 ELECTRONIC DEVICES TO LEAD METAL-AIR BATTERY MARKET DURING FORECAST PERIOD

TABLE 41 METAL-AIR BATTERY MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 42 METAL-AIR BATTERY MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

10.2 ELECTRIC VEHICLES

10.2.1 ANTICIPATED DEMAND FOR METAL-AIR BATTERIES DUE TO HIGH-POWER DENSITY AND THERMAL STABILITY

TABLE 43 ELECTRIC VEHICLES: METAL-AIR BATTERY MARKET, BY METAL, 2026–2027 (USD MILLION)

TABLE 44 ELECTRIC VEHICLES: METAL-AIR BATTERY MARKET, BY TYPE, 2026–2027 (USD MILLION)

TABLE 45 ELECTRIC VEHICLES: METAL-AIR BATTERY MARKET, BY REGION, 2026–2027 (USD MILLION)

10.3 MILITARY ELECTRONICS

10.3.1 METAL-AIR BATTERIES HAVE SIGNIFICANT APPLICATIONS IN COMMUNICATION DEVICES, RADIOS, AND GUIDED MISSILES

FIGURE 42 NORTH AMERICA TO HOLD LARGEST SHARE OF METAL-AIR BATTERY MARKET FOR MILITARY ELECTRONICS DURING 2022−2027

TABLE 46 MILITARY ELECTRONICS: METAL-AIR BATTERY MARKET, BY METAL, 2018–2021 (USD MILLION)

TABLE 47 MILITARY ELECTRONICS: METAL-AIR BATTERY MARKET, BY METAL, 2022–2027 (USD MILLION)

TABLE 48 MILITARY ELECTRONICS: METAL-AIR BATTERY MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 49 MILITARY ELECTRONICS: METAL-AIR BATTERY MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 50 MILITARY ELECTRONICS: METAL-AIR BATTERY MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 51 MILITARY ELECTRONICS: METAL-AIR BATTERY MARKET, BY REGION, 2022–2027 (USD MILLION)

10.4 ELECTRONIC DEVICES

10.4.1 INCREASING ADOPTION OF ELECTRONIC DEVICES DUE TO HIGH OUTPUT, HIGH-ENERGY DENSITY, AND LOW DISCHARGING RATE

TABLE 52 ELECTRONIC DEVICES: METAL-AIR BATTERY MARKET, BY METAL, 2018–2021 (USD MILLION)

TABLE 53 ELECTRONIC DEVICES: METAL-AIR BATTERY MARKET, BY METAL, 2022–2027 (USD MILLION)

TABLE 54 ELECTRONIC DEVICES: METAL-AIR BATTERY MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 55 ELECTRONIC DEVICES: METAL-AIR BATTERY MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 56 ELECTRONIC DEVICES: METAL-AIR BATTERY MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 57 ELECTRONIC DEVICES: METAL-AIR BATTERY MARKET, BY REGION, 2022–2027 (USD MILLION)

10.5 STATIONARY POWER

10.5.1 METAL-AIR BATTERIES USED FOR GRID-LEVEL ELECTRICAL ENERGY STORAGE

TABLE 58 STATIONARY POWER: METAL-AIR BATTERY MARKET, BY METAL, 2018–2021 (USD MILLION)

TABLE 59 STATIONARY POWER: METAL-AIR BATTERY MARKET, BY METAL, 2022–2027 (USD MILLION)

TABLE 60 STATIONARY POWER: METAL-AIR BATTERY MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 61 STATIONARY POWER: METAL-AIR BATTERY MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 62 STATIONARY POWER: METAL-AIR BATTERY MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 63 STATIONARY POWER: METAL-AIR BATTERY MARKET, BY REGION, 2022–2027 (USD MILLION)

10.6 OTHERS

TABLE 64 OTHERS: METAL-AIR BATTERY MARKET, BY METAL, 2018–2021 (USD MILLION)

TABLE 65 OTHERS: METAL-AIR BATTERY MARKET, BY METAL, 2022–2027 (USD MILLION)

TABLE 66 OTHERS: METAL-AIR BATTERY MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 67 OTHERS: METAL-AIR BATTERY MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 68 OTHERS: METAL-AIR BATTERY MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 69 OTHERS: METAL-AIR BATTERY MARKET, BY REGION, 2022–2027 (USD MILLION)

11 METAL-AIR BATTERY MARKET, BY REGION (Page No. - 113)

11.1 INTRODUCTION

FIGURE 43 METAL-AIR BATTERY MARKET IN GERMANY TO GROW AT HIGHEST CAGR FROM 2022 TO 2027

TABLE 70 METAL-AIR BATTERY MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 71 METAL-AIR BATTERY MARKET, BY REGION, 2022–2027 (USD MILLION)

11.2 NORTH AMERICA

FIGURE 44 NORTH AMERICA: METAL-AIR BATTERY MARKET SNAPSHOT

TABLE 72 NORTH AMERICA: METAL-AIR BATTERY MARKET, BY METAL, 2018–2021 (USD MILLION)

TABLE 73 NORTH AMERICA: METAL-AIR BATTERY MARKET, BY METAL, 2022–2027 (USD MILLION)

TABLE 74 NORTH AMERICA: METAL-AIR BATTERY MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 75 NORTH AMERICA: METAL-AIR BATTERY MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 76 NORTH AMERICA: METAL-AIR BATTERY MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 77 NORTH AMERICA: METAL-AIR BATTERY MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

11.2.1 US

11.2.1.1 Government and private sector focusing on new energy storage technologies

11.2.2 CANADA

11.2.2.1 Growing investments in start-ups

11.2.3 MEXICO

11.2.3.1 Growing demand for electric vehicles

11.3 EUROPE

FIGURE 45 EUROPE: METAL-AIR BATTERY MARKET SNAPSHOT

TABLE 78 EUROPE: METAL-AIR BATTERY MARKET, BY METAL, 2018–2021 (USD MILLION)

TABLE 79 EUROPE: METAL-AIR BATTERY MARKET, BY METAL, 2022–2027 (USD MILLION)

TABLE 80 EUROPE: METAL-AIR BATTERY MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 81 EUROPE: METAL-AIR BATTERY MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 82 EUROPE: METAL-AIR BATTERY MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 83 EUROPE: METAL-AIR BATTERY MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

11.3.1 UK

11.3.1.1 Government initiatives to promote metal-air batteries

11.3.2 FRANCE

11.3.2.1 France expected to hold significant share of European metal-air battery market

11.3.3 GERMANY

11.3.3.1 Country's automotive industry to drive metal-air battery market

11.3.4 REST OF EUROPE

11.4 ASIA PACIFIC

FIGURE 46 ASIA PACIFIC: METAL-AIR BATTERY MARKET SNAPSHOT

TABLE 84 ASIA PACIFIC: METAL-AIR BATTERY MARKET, BY METAL, 2018–2021 (USD MILLION)

TABLE 85 ASIA PACIFIC: METAL-AIR BATTERY MARKET, BY METAL, 2022–2027 (USD MILLION)

TABLE 86 ASIA PACIFIC: METAL-AIR BATTERY MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 87 ASIA PACIFIC: METAL-AIR BATTERY MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 88 ASIA PACIFIC: METAL-AIR BATTERY MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 89 ASIA PACIFIC: METAL-AIR BATTERY MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

11.4.1 CHINA

11.4.1.1 Consumer electronics industry to support market growth

11.4.2 INDIA

11.4.2.1 Ongoing partnerships and collaborations among metal-air battery players

11.4.3 JAPAN

11.4.3.1 Growing focus on adoption of modern technologies and presence of major battery manufacturers

11.4.4 REST OF ASIA PACIFIC

11.5 ROW

TABLE 90 ROW: METAL-AIR BATTERY MARKET, BY METAL, 2018–2021 (USD MILLION)

TABLE 91 ROW: METAL-AIR BATTERY MARKET, BY METAL, 2022–2027 (USD MILLION)

TABLE 92 ROW: METAL-AIR BATTERY MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 93 ROW: METAL-AIR BATTERY MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 94 ROW: METAL-AIR BATTERY MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 95 ROW: METAL-AIR BATTERY MARKET, BY REGION, 2022–2027 (USD MILLION)

11.5.1 MIDDLE EAST

TABLE 96 MIDDLE EAST: METAL-AIR BATTERY MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 97 MIDDLE EAST: METAL-AIR BATTERY MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

11.5.1.1 UAE

11.5.1.1.1 UAE expected to account for largest market share in Middle East

11.5.1.2 Saudi Arabia

11.5.1.2.1 Government initiatives to promote clean energy

11.5.1.3 Rest of the Middle East

11.5.2 AFRICA

11.5.2.1 High emphasis on clean energy to stimulate market growth

11.5.3 SOUTH AMERICA

11.5.3.1 Foreign investments in energy sector

12 COMPETITIVE LANDSCAPE (Page No. - 135)

12.1 OVERVIEW

12.2 STRATEGIES OF KEY PLAYERS/RIGHT-TO-WIN

TABLE 98 OVERVIEW OF STRATEGIES DEPLOYED BY KEY METAL-AIR BATTERY MANUFACTURERS

12.3 REVENUE ANALYSIS OF TOP COMPANIES

FIGURE 47 FIVE-YEAR COMPANY REVENUE ANALYSIS

12.4 MARKET SHARE ANALYSIS

TABLE 99 MARKET SHARE OF TOP FIVE PLAYERS IN METAL-AIR BATTERY MARKET, 2021

12.5 KEY COMPETITIVE EVALUATION QUADRANT

12.5.1 STARS

12.5.2 EMERGING LEADERS

12.5.3 PERVASIVE PLAYERS

12.5.4 PARTICIPANTS

FIGURE 48 METAL-AIR BATTERY MARKET (GLOBAL) KEY COMPANY EVALUATION QUADRANT, 2021

12.6 SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION QUADRANT, 2021

12.6.1 PROGRESSIVE COMPANIES

12.6.2 RESPONSIVE COMPANIES

12.6.3 DYNAMIC COMPANIES

12.6.4 STARTING BLOCKS

FIGURE 49 METAL-AIR BATTERY MARKET (GLOBAL) SME EVALUATION QUADRANT, 2021

12.7 METAL-AIR BATTERY MARKET: COMPANY FOOTPRINT

TABLE 100 OVERALL COMPANY FOOTPRINT

TABLE 101 COMPANY METAL FOOTPRINT

TABLE 102 COMPANY APPLICATION FOOTPRINT

TABLE 103 COMPANY REGION FOOTPRINT

12.8 COMPETITIVE BENCHMARKING

TABLE 104 METAL-AIR BATTERY MARKET: LIST OF KEY START-UPS/SMES

TABLE 105 METAL-AIR BATTERY MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

12.9 COMPETITIVE SCENARIO

TABLE 106 METAL-AIR BATTERY MARKET: PRODUCT LAUNCHES, 2021−2022

TABLE 107 METAL-AIR BATTERY MARKET: DEALS, 2019–2022

13 COMPANY PROFILES (Page No. - 149)

(Business overview, Products/Services/Solutions offered, Recent Developments, MNM view)*

13.1 KEY PLAYERS

13.1.1 GP BATTERIES INTERNATIONAL

TABLE 108 GP BATTERIES INTERNATIONAL: BUSINESS OVERVIEW

TABLE 109 GP BATTERIES INTERNATIONAL: PRODUCT/SERVICE/SOLUTION OFFERINGS

13.1.2 AROTECH CORPORATION

TABLE 110 AROTECH CORPORATION: BUSINESS OVERVIEW

TABLE 111 AROTECH CORPORATION: PRODUCT/SERVICE/SOLUTION OFFERINGS

13.1.3 ENERGIZER HOLDINGS

TABLE 112 ENERGIZER HOLDINGS: BUSINESS OVERVIEW

FIGURE 50 ENERGIZER HOLDING: COMPANY SNAPSHOT

TABLE 113 ENERGIZER HOLDINGS: PRODUCT/SERVICE/SOLUTION OFFERINGS

TABLE 114 ENERGIZER HOLDINGS INC: DEALS

13.1.4 DURACELL

TABLE 115 DURACELL: BUSINESS OVERVIEW

TABLE 116 DURACELL: PRODUCT/SERVICE/SOLUTION OFFERINGS

13.1.5 RENATA SA

TABLE 117 RENATA SA: BUSINESS OVERVIEW

TABLE 118 RENATA SA: PRODUCT/SERVICE/SOLUTION OFFERINGS

13.1.6 PHINERGY

TABLE 119 PHINERGY: BUSINESS OVERVIEW

TABLE 120 PHINERGY: PRODUCT/SERVICE/SOLUTION OFFERINGS

TABLE 121 PHINERGY: DEALS

13.1.7 LOG 9 MATERIALS

TABLE 122 LOG 9 MATERIALS: BUSINESS OVERVIEW

TABLE 123 LOG 9 MATERIALS: PRODUCT/SERVICE/SOLUTION OFFERINGS

TABLE 124 LOG 9 MATERIALS: DEALS

13.1.8 POLYPLUS BATTERY

TABLE 125 POLYPLUS BATTERY: BUSINESS OVERVIEW

TABLE 126 POLYPLUS BATTERY: PRODUCT/SERVICE/SOLUTION OFFERINGS

TABLE 127 POLYPLUS BATTERY: PRODUCT LAUNCHES

13.1.9 ZINC8 ENERGY SOLUTIONS

TABLE 128 ZINC8 ENERGY SOLUTIONS: BUSINESS OVERVIEW

TABLE 129 ZINC8 ENERGY SOLUTIONS: PRODUCT/SERVICE/SOLUTION OFFERINGS

TABLE 130 ZINC8 ENERGY SOLUTIONS: PRODUCT LAUNCHES

TABLE 131 ZINC8 ENERGY SOLUTIONS: DEALS

13.1.10 PANASONIC BATTERIES

TABLE 132 PANASONIC BATTERIES: BUSINESS OVERVIEW

TABLE 133 PANASONIC BATTERIES: PRODUCT/SERVICE/SOLUTION OFFERINGS

*Details on Business overview, Products/Services/Solutions offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

13.2 OTHER PLAYERS

13.2.1 AZA BATTERY

TABLE 134 AZA BATTERY: COMPANY OVERVIEW

13.2.2 CEGASA ENERGIA, S.L.U.

TABLE 135 CEGASA ENERGIA, S.L.U: COMPANY OVERVIEW

13.2.3 ENZINC

TABLE 136 ENZINC: COMPANY OVERVIEW

13.2.4 EVERZINC

TABLE 137 EVERZINC: COMPANY OVERVIEW

13.2.5 EXCELLATRON SOLID STATE

TABLE 138 EXCELLATRON SOLID STATE: COMPANY OVERVIEW

13.2.6 E-ZINC

TABLE 139 E-ZINC: COMPANY OVERVIEW

13.2.7 GUANGDONG TIANQIU ELECTRONICS TECHNOLOGY

TABLE 140 GUANGDONG TIANQIU ELECTRONICS TECHNOLOGY: COMPANY OVERVIEW

13.2.8 ISKRA

TABLE 141 ISKRA: COMPANY OVERVIEW

13.2.9 MAG ONE PRODUCTS

TABLE 142 MAG ONE PRODUCTS: COMPANY OVERVIEW

13.2.10 MAL RESEARCH AND DEVELOPMENT

TABLE 143 MAL RESEARCH AND DEVELOPMENT: COMPANY OVERVIEW

13.2.11 PHINERGY MARINE

TABLE 144 PHINERGY MARINE: COMPANY OVERVIEW

13.2.12 RIALAIR

TABLE 145 RIALAIR: COMPANY OVERVIEW

13.2.13 THUNDERZEE

TABLE 146 THUNDERZEE: COMPANY OVERVIEW

13.2.14 ZAF ENERGY SYSTEMS

TABLE 147 ZAF ENERGY SYSTEMS: COMPANY OVERVIEW

13.2.15 ZENIPOWER

TABLE 148 ZENIPOWER: COMPANY OVERVIEW

14 ADJACENT MARKET (Page No. - 176)

14.1 BATTERY ENERGY STORAGE SYSTEM MARKET

14.2 INTRODUCTION

FIGURE 51 BATTERY ENERGY STORAGE SYSTEM MARKET, BY ELEMENT

FIGURE 52 BATTERY SEGMENT TO HOLD LARGER SHARE OF BATTERY ENERGY STORAGE SYSTEM MARKET DURING FORECAST PERIOD

TABLE 149 BATTERY ENERGY STORAGE SYSTEM MARKET, BY ELEMENT, 2018–2021 (USD MILLION)

TABLE 150 BATTERY ENERGY STORAGE SYSTEM MARKET, BY ELEMENT, 2022–2027 (USD MILLION)

14.3 BATTERY

14.3.1 BATTERY SELECTION IS CRUCIAL FOR DEVELOPMENT OF BATTERY ENERGY STORAGE SYSTEMS

FIGURE 53 CRITERIA FOR BATTERY SELECTION

14.4 OTHER ELEMENTS

14.4.1 HARDWARE

14.4.1.1 Power conversion systems and battery management systems are essential components

FIGURE 54 LAYOUT OF BATTERY ENERGY STORAGE SYSTEM

14.4.2 OTHERS

14.4.2.1 Before commissioning BESS, EPC and development services are essential

15 APPENDIX (Page No. - 181)

15.1 INSIGHTS OF INDUSTRY EXPERTS

15.2 DISCUSSION GUIDE

15.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.4 AVAILABLE CUSTOMIZATIONS

15.5 RELATED REPORTS

15.6 AUTHOR DETAILS

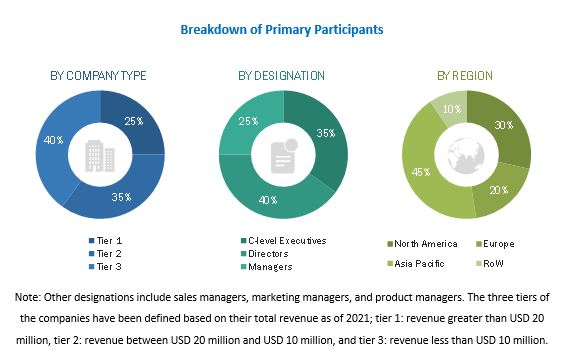

The study involves four major activities for estimating the size of the metal-air battery market. Exhaustive secondary research has been conducted to collect information related to the market. The next step has been the validation of these findings, assumptions, and sizing with the industry experts across the value chain through primary research. Both top-down and bottom-up approaches have been employed to estimate the overall size of the metal-air battery market. After that, market breakdown and data triangulation procedures have been used to determine the extent of different segments and subsegments of the market.

Secondary Research

Secondary sources referred to for this research study included corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers; certified publications; articles by recognized authors; directories; and databases. The secondary data was collected and analyzed to arrive at the overall market size, which was further validated through primary research.

Primary Research

Extensive primary research has been conducted after gaining knowledge about the current scenario of the metal-air battery market through secondary research. Several primary interviews have been conducted with experts from both demand and supply sides across four major regions—North America, Europe, Asia Pacific, and RoW. This primary data has been collected through questionnaires, e-mails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches have been implemented, along with several data triangulation methods, to estimate and validate the size of the metal-air battery market and other dependent submarkets listed in this report.

- The key players in the industry and markets have been identified through extensive secondary research.

- Both the supply chain of the industry and the market size, in terms of value, have been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size, the total market has been split into several segments. To complete the overall market engineering process and arrive at exact statistics for all segments, the market breakdown and data triangulation procedures have been employed wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Study Objectives:

- To describe and forecast the global metal-air battery market, in terms of value, based on metal, type, voltage, application, and region

- To describe and forecast the market size, in terms of value, for four major regions—North America, Europe, Asia Pacific, and Rest of the World (RoW)

- To provide detailed information regarding major factors such as drivers, restraints, opportunities, and challenges influencing the growth of the market

- To strategically analyze micromarkets1 about individual market trends, growth prospects, and contributions to the total market

- To analyze the opportunities in the metal-air battery market for various stakeholders by identifying the high-growth segments of the market

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies2, along with a detailed competitive landscape for market leaders

- To analyze major growth strategies such as product launches, expansions, partnerships, and contracts adopted by the key market players to enhance their position in the market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the company's specific needs. The following customization options are available for this report:

Company Information

- Detailed analysis and profiling of additional five market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Metal-air Battery Market