Metabolism Assays Market Size, Share & Trends by Product (Instruments, Assays Kits), Technology (Colorimetry, Fluorimetry, Spectrometry), Application (Diagnostics (Diabetes, Obesity), Research), End User (Hospitals, Diagnostic Laboratories), & Region - Global Forecast to 2028

Metabolism Assays Market Size, Share & Trends

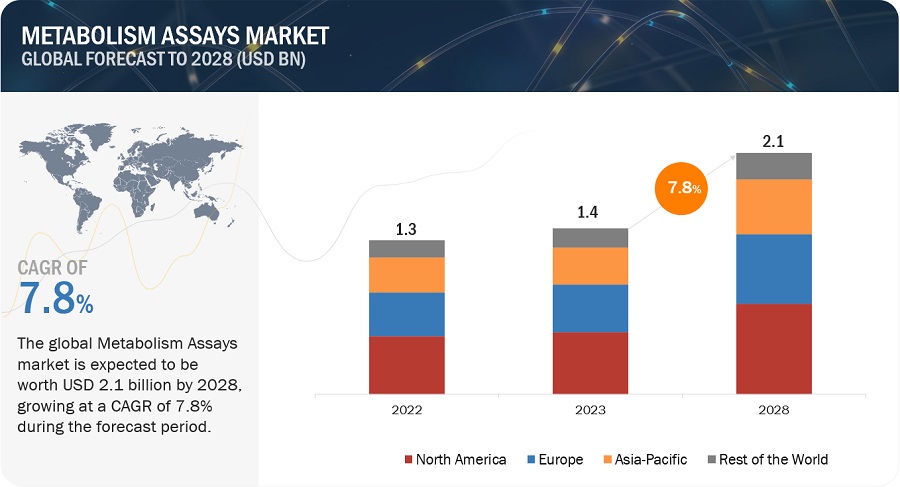

The global metabolism assays market, valued at US$1.3 billion in 2022, is forecasted to grow at a robust CAGR of 7.8%, reaching US$1.4 billion in 2023 and an impressive US$2.1 billion by 2028. The comprehensive research encompasses an exhaustive examination of industry trends, meticulous pricing analysis, patent scrutiny, insights derived from conferences and webinars, identification of key stakeholders, and a nuanced understanding of market purchasing dynamics.

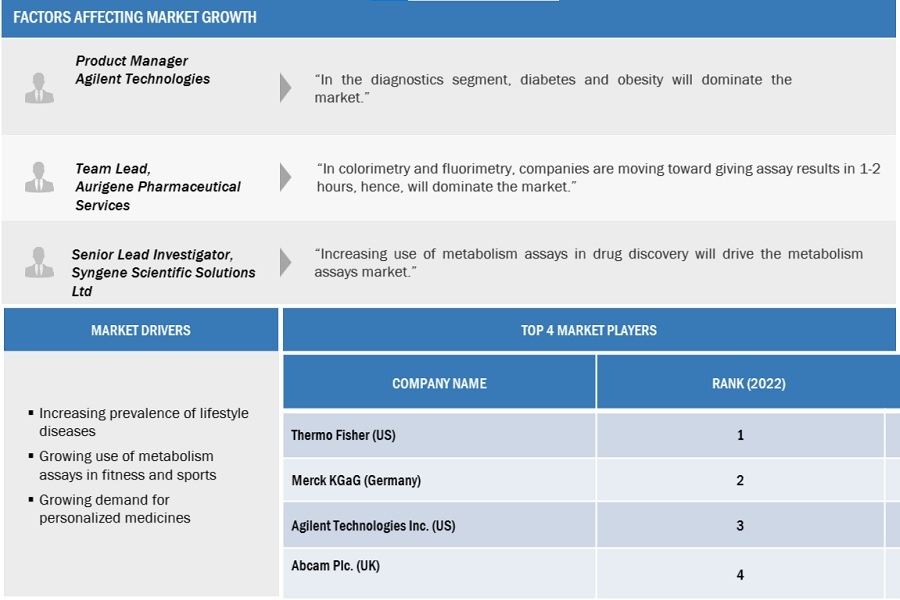

The growth in this market is attributed to the growing prevalence of diabetes, the global increase in the number of hospitals, and the high rate of obese population. However, alternative methods or techniques restrain the growth of this market.

Metabolism Assays Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Metabolism Assays Market Dynamics

DRIVER: Increasing funding and investments in metabolic research

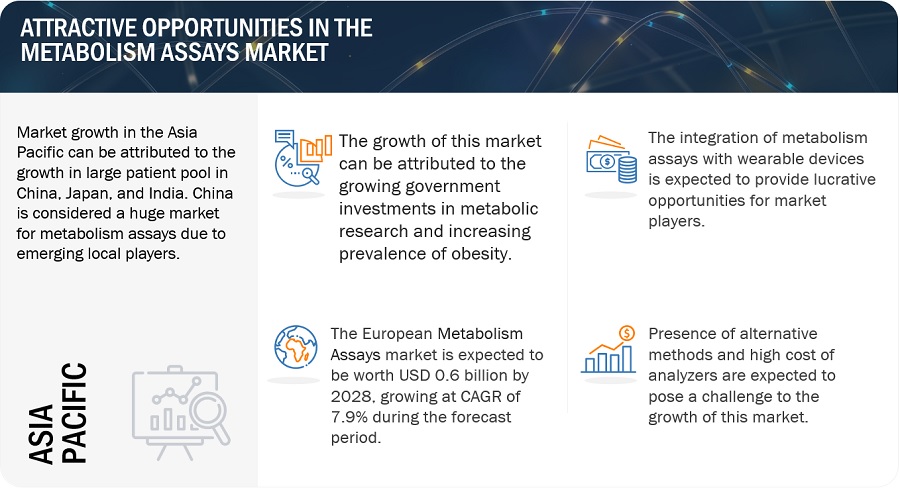

Metabolic research funding and investments are crucial for advancing the metabolic processes understanding, producing new metabolic disease treatments, and improving public health. Diseases like diabetes, obesity, lipid metabolism, mitochondrial disorders, and metabolic pathways are being considered as metabolic diseases. Various sources, including government agencies, private foundations, pharmaceutical companies, and academic institutions are the sources for funding. For instance, clinical-stage biotechnology firm Eccogene raised USD 25.23m (CNY180m) in a Series B financing round to support the development of its clinical-stage metabolic pipeline, in June 2023.

RESTRAINT: High cost of metabolism assay analyzers

The adoption of metabolism assays can be hindered due to the high costs, especially with limited budgeted facilities like smaller research laboratories or healthcare facilities. To mitigate these costs, the organizations may explore options like group purchasing, leasing or financing agreements, and collaborations with larger institutions. There is the development of more cost-effective analyzers or alternative testing methods that reduce expenses while maintaining accuracy and reliability, as technology advances and competition increases. For instance, the Seahorse Xfe 96 Cell Analyzer System and Seahorse XF HS Mini Analyzer by Agilent Technologies, Inc. (US) cost USD 189,612 and USD 68,611, respectively.

OPPORTUNITY: Integration with wearable devices

The overall health monitoring and management experience for individuals can be enhanced by integrating metabolism assay data with digital health platforms, apps, and wearable devices. For instance, Sweat-based wearable technologies have great potential to collect important data on biomarkers which are related to metabolic syndrome and its associated diseases. These wearable devices can measure glucose, CRP, cortisol, and sodium levels, making them invaluable for patients at risk of developing diabetes and cardiovascular diseases.

CHALLENGE: Complexity of assay development

Due to the intricate nature of metabolic pathways and the need for precise measurement techniques, it can be complex and time-consuming to develop accurate and reliable metabolism assays. Ensuring consistency and reproducibility across different experiments and laboratories can be a challenge. A multidisciplinary approach is required for these complexities which involves expertise in biochemistry, cell biology, molecular biology, analytical chemistry, and computational biology.

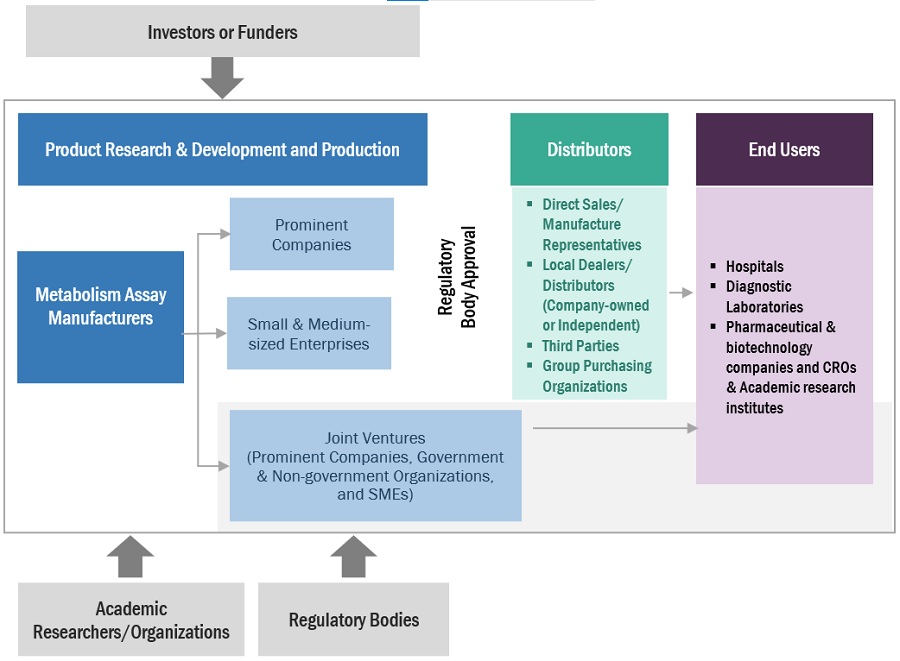

Metabolism Assays Market Ecosystem

Prominent companies in this market include well-established, financially stable manufacturers of metabolism assays. These companies have been operating in the market for several years and possess diversified state-of-the-art technologies, strong global sales and product portfolios, and marketing networks. Prominent companies in this market include Merck KGaA (Germany), Thermo Fisher (US), Abcam Plc. (UK), and Agilent Technologies Inc. (US).

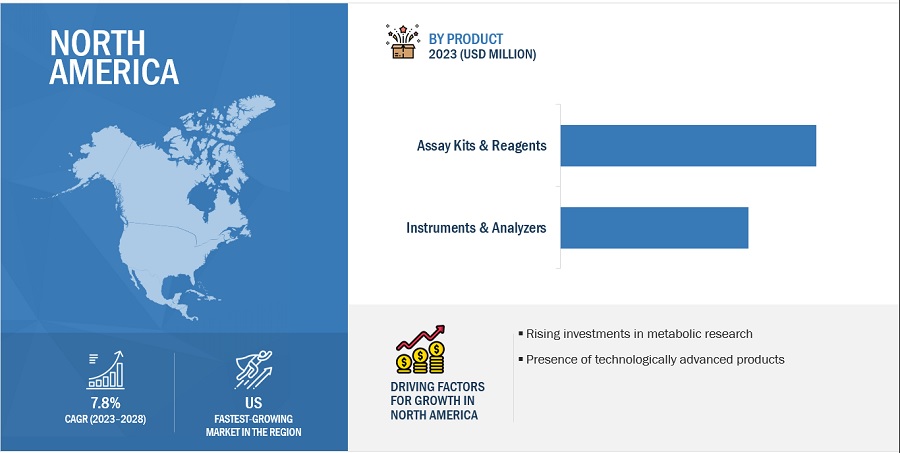

In 2022, assay kits & reagents segment to observe the highest growth rate of the metabolism assays industry, by product.

Based on product, the metabolism assays market is classified into instruments & analyzers and assay kits & reagents. In 2022, the assay kits & reagents segment dominated the products market. This segment is also estimated to grow at the highest CAGR during the forecast period. The large share can be attributed to features like availability and integration with other technologies like wearable devices.

In 2022, colorimetry segment to dominate the metabolism assays industry, by technology.

Based on technology, the metabolism assays market is segmented into colorimetry, fluorimetry, and spectrometry. The colorimetry segment accounted for the largest share of the market in 2022. Also, this segment is estimated to witness the highest growth during the forecast period. The large share is due to well-established method for measuring metabolites and biomarkers in a wide range of biological samples and large use in industrial settings to assess metabolic parameters and provide valuable data for various applications, including disease diagnosis and drug development.

In 2022, North America to dominate in metabolism assays industry.

The global metabolism assays market is segmented into North America, Europe, Asia Pacific, and Rest of the World. North America is expected to dominate during the forecast period, primarily due to the sedentary work life which will lead to obesity & diabetes, and large population consuming junk food causing obesity. However, during the forecast period, Asia Pacific is expected to register highest CAGR. The factors contributing to the growth of Asia Pacific are large patient pool, growing number of local players, increasing awareness, and rise in disease research fundings by the government.

To know about the assumptions considered for the study, download the pdf brochure

The metabolism assays market is dominated by players such as Merck KGaA (Germany), Thermo Fisher (US), Abcam Plc. (UK), and Agilent Technologies Inc. (US).

Scope of the Metabolism Assays Industry:

|

Report Metric |

Details |

|

Market Revenue Size in 2023 |

$1.4 billion |

|

Projected Revenue Size by 2028 |

$2.1 billion |

|

Industry Growth Rate |

Poised to grow at a CAGR of 7.8% |

|

Market Driver |

Increasing funding and investments in metabolic research |

|

Market Opportunity |

Integration with wearable devices |

This research report categorizes the Metabolism assays market to forecast revenue and analyze trends in each of the following submarkets:

By Region

- North America

- Europe

- Asia Pacific

- Rest of the World

By Product

- Instruments & Analyzers

- Assay Kits & Reagents

By Technology

- Colorimetry

- Fluorimetry

- Spectrometry

By Application

- Diagnostics

- Research

By End User

- Hospitals

- Diagnostics Laboratories

- Pharmaceutical & Biotechnology Companies and CROs & Academic Research Institutes

Recent Developments of Metabolism Assays Industry:

- In 2022, Thermo Fisher Scientific, Inc. (US) collaborated with Symphogen (Denmark) and Servier (France) for biopharmaceutical discovery and development laboratories.

- In 2021, Abcam Plc. (UK) acquired BioVision (UK). This acquisition of BioVision represents a compelling strategic fit for Abcam. This will bring greater control over the innovation and distribution of BioVision’s product portfolio and create value through portfolio expansion and leveraging Abcam’s global channels to market.

- In 2021, Agilent Technologies Inc. (US) launched Agilent Seahorse XF HS Miniplate which is the latest addition to Agilent’s range of Seahorse XF platforms, which analyze mitochondrial respiration, glycolysis, and ATP production in live cells, in real-time.

Frequently Asked Questions (FAQ):

What is the projected growth rate of the global metabolism assays market between 2023 and 2028?

The global metabolism assays market is estimated to grow from USD 1.4 billion in 2023 to USD 2.1 billion by 2028, at a CAGR of 7.8%, driven by the rising prevalence of diabetes, an increasing number of hospitals, and a high rate of obesity.

What are the key factors driving the metabolism assays market?

Key drivers for the metabolism assays market include increasing funding and investments in metabolic research, the growing prevalence of metabolic diseases like diabetes and obesity, and advancements in diagnostic technology.

What challenges does the metabolism assays market face?

The metabolism assays market faces challenges such as the high cost of metabolism assay analyzers and the complexity of assay development, which can hinder adoption, particularly in smaller facilities.

Which regions are expected to experience growth in the metabolism assays market?

North America is projected to dominate the metabolism assays market, while the Asia Pacific region is expected to register the highest CAGR due to a large patient pool and increased awareness.

What are the primary products in the metabolism assays market?

The primary products in the metabolism assays market include instruments and analyzers, as well as assay kits and reagents, with the latter segment expected to grow at the highest rate during the forecast period.

How does the integration with wearable devices impact the metabolism assays market?

Integrating metabolism assay data with wearable devices enhances health monitoring and management, allowing for real-time tracking of biomarkers related to metabolic diseases.

What recent developments are occurring in the metabolism assays market?

Recent developments include collaborations between major companies for biopharmaceutical research and the launch of innovative products such as the Agilent Seahorse XF HS Miniplate, enhancing real-time analysis capabilities.

What role do hospitals play in the metabolism assays market?

Hospitals are significant players in the metabolism assays market, being primary users of these assays for diagnostics and patient management, driving demand for innovative and accurate testing solutions.

How is obesity influencing the metabolism assays market?

The high rate of obesity is significantly impacting the metabolism assays market, as it increases the prevalence of metabolic disorders, thus driving demand for effective metabolic assays for diagnosis and treatment.

What advancements in technology are shaping the metabolism assays market?

Technological advancements, including the development of cost-effective analyzers and integration with digital health platforms, are driving innovation and improving the reliability and accessibility of metabolism assays.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing funding and investments in metabolic research- Drug discovery and development- Rise in prevalence of chronic diseases- Increased use of metabolism assays in fitness and sports- Growing demand for personalized medicinesRESTRAINTS- High cost of metabolism assay analyzers- Presence of alternative methods and techniquesOPPORTUNITIES- Integration with wearable devices- Growing life science research in emerging economiesCHALLENGES- Complexity of assay development

- 5.3 PRICING ANALYSIS

-

5.4 PATENT ANALYSISLIST OF KEY PATENTS

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 SUPPLY CHAIN ANALYSIS

-

5.7 ECOSYSTEM ANALYSISMETABOLISM ASSAYS MARKET: ROLE IN ECOSYSTEM

-

5.8 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.9 REGULATORY ANALYSISNORTH AMERICA- US- CanadaEUROPEASIA PACIFIC- Japan- China- India

- 5.10 TRADE ANALYSIS

- 5.11 TECHNOLOGY ANALYSIS

- 5.12 KEY CONFERENCES AND EVENTS IN 2023–2024

-

5.13 TRENDS/DISRUPTIONS IMPACTING BUSINESSESREVENUE SHIFT IN METABOLISM ASSAYS

-

5.14 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 6.1 INTRODUCTION

-

6.2 ASSAY KITS & REAGENTSCOST-EFFECTIVENESS TO INCREASE ADOPTION IN DRUG DISCOVERY

-

6.3 INSTRUMENTS & ANALYZERSAUTOMATION IN INSTRUMENTS, ALONG WITH ADOPTION OF SOFTWARE, TO DRIVE SEGMENTAL GROWTH

- 7.1 INTRODUCTION

-

7.2 COLORIMETRYCOST-EFFECTIVENESS TO DRIVE MARKET

-

7.3 FLUORIMETRYHIGH SENSITIVITY AND SPECIFICITY TO DRIVE MARKET

-

7.4 SPECTROMETRYINCREASED IMPORTANCE IN RESEARCH AND CLINICAL DIAGNOSTICS TO DRIVE MARKET

- 8.1 INTRODUCTION

-

8.2 DIAGNOSTICSGROWING PREVALENCE OF METABOLIC AND CHRONIC DISEASES TO DRIVE MARKETDIABETESOBESITYCANCERCARDIOVASCULAR DISEASESOTHER DIAGNOSTICS

-

8.3 RESEARCHINCREASE IN AWARENESS OF METABOLISM ASSAY IN DISEASE RESEARCH

- 9.1 INTRODUCTION

-

9.2 HOSPITALSAFFORDABILITY AND CONVENIENCE TO DRIVE SEGMENT

-

9.3 DIAGNOSTIC LABORATORIESINCREASED OUTSOURCING OF LABORATORY DIAGNOSES FOR REDUCTION IN COSTS TO DRIVE MARKET

-

9.4 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES AND CROS & ACADEMIC RESEARCH INSTITUTESPHARMACEUTICAL & BIOPHARMACEUTICAL COMPANIES TO DOMINATE MARKET DURING FORECAST PERIOD

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICARECESSION IMPACTUS- High rate of drug discovery and toxicity testing to drive marketCANADA- High prevalence of obesity to fuel market growth

-

10.3 EUROPERECESSION IMPACTGERMANY- Growth of pharmaceutical companies to drive marketUK- Growing cancer research funding to drive marketFRANCE- Rising obese population and prevalence of metabolic disorders to drive marketSPAIN- Increasing prevalence of aging population and diabetes to drive marketITALY- Growth of pharmaceutical industry to boost marketREST OF EUROPE

-

10.4 ASIA PACIFICRECESSION IMPACTJAPAN- Government initiatives to drive marketCHINA- Increasing health awareness to drive demandINDIA- Prevalence of chronic diseases to fuel demandREST OF ASIA PACIFIC

-

10.5 REST OF THE WORLDRECESSION IMPACT

- 11.1 OVERVIEW

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 11.3 REVENUE SHARE ANALYSIS OF TOP MARKET PLAYERS

- 11.4 MARKET RANKING ANALYSIS

-

11.5 COMPANY EVALUATION QUADRANT (2022)STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

11.6 COMPANY EVALUATION QUADRANT FOR STARTUPS/SMES (2022)PROGRESSIVE COMPANIESSTARTING BLOCKSRESPONSIVE COMPANIESDYNAMIC COMPANIES

- 11.7 COMPETITIVE BENCHMARKING

-

11.8 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALSOTHER DEVELOPMENTS

-

12.1 KEY PLAYERSTHERMO FISHER SCIENTIFIC INC.- Business overview- Products offered- Recent developments- MnM viewMERCK KGAA- Business overview- Products offered- MnM viewABCAM PLC.- Business overview- Products offered- MnM viewAGILENT TECHNOLOGIES INC.- Business overview- Products offered- Recent developments- MnM viewKANEKA EUROGENTEC S.A.- Business overview- Products offered- MnM viewSARTORIUS AG- Business overview- Products offeredPROMEGA CORPORATION- Business overview- Products offeredELABSCIENCE BIOTECHNOLOGY INC.- Business overview- Products offeredRAYBIOTECH LIFE, INC.- Business overview- Products offeredBMG LABTECH- Business overview- Products offered- Recent developmentsBIOTREND CHEMIKALIEN GMBH- Business overview- Products offered

-

12.2 OTHER PLAYERS3H BIOMEDICAL ABBIOASSAY SYSTEMSEMELCA BIOSCIENCECREATIVE BIOARRAYTEMPO BIOSCIENCE, INC.NCARDIANOVOCIBETON BIOSCIENCE, INC.CAYMAN CHEMICAL COMPANYENZO LIFE SCIENCES, INC.ABNOVA CORPORATION

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 INCLUSIONS AND EXCLUSIONS

- TABLE 2 KEY DATA FROM PRIMARY SOURCES

- TABLE 3 AVERAGE SELLING PRICE OF PRODUCT, BY KEY PLAYERS

- TABLE 4 PORTER’S FIVE FORCES ANALYSIS: METABOLISM ASSAYS MARKET

- TABLE 5 US FDA: MEDICAL DEVICE CLASSIFICATION

- TABLE 6 CANADA: LEVEL OF RISK, TIME, COST, AND COMPLEXITY OF REGISTRATION PROCESS

- TABLE 7 JAPAN: MEDICAL DEVICE CLASSIFICATION UNDER PMDA

- TABLE 8 CHINA: CLASSIFICATION OF MEDICAL DEVICES

- TABLE 9 IMPORT DATA FOR DIAGNOSTIC OR LABORATORY REAGENTS ON A BACKING, PREPARED DIAGNOSTIC OR LABORATORY REAGENTS WHETHER OR NOT ON A BACKING, AND CERTIFIED REFERENCE MATERIALS, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 10 EXPORT DATA FOR DIAGNOSTIC OR LABORATORY REAGENTS ON A BACKING, PREPARED DIAGNOSTIC OR LABORATORY REAGENTS WHETHER OR NOT ON A BACKING, AND CERTIFIED REFERENCE MATERIALS, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 11 METABOLISM ASSAYS MARKET: DETAILED LIST OF KEY CONFERENCES AND EVENTS, 2023–2024

- TABLE 12 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF METABOLISM ASSAYS

- TABLE 13 KEY BUYING CRITERIA FOR METABOLISM ASSAYS

- TABLE 14 METABOLISM ASSAYS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 15 ASSAY KITS AVAILABLE IN MARKET

- TABLE 16 METABOLISM ASSAYS MARKET: ASSAY KITS & REAGENTS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 17 INSTRUMENTS & ANALYZERS AVAILABLE IN MARKET

- TABLE 18 METABOLISM ASSAYS MARKET: INSTRUMENTS & ANALYZERS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 19 METABOLISM ASSAYS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 20 METABOLISM ASSAYS MARKET FOR COLORIMETRY, BY REGION, 2021–2028 (USD MILLION)

- TABLE 21 METABOLISM ASSAYS MARKET FOR FLUORIMETRY, BY REGION, 2021–2028 (USD MILLION)

- TABLE 22 METABOLISM ASSAYS MARKET FOR SPECTROMETRY, BY REGION, 2021–2028 (USD MILLION)

- TABLE 23 METABOLISM ASSAYS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 24 DIAGNOSTICS: METABOLISM ASSAYS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 25 METABOLISM ASSAYS MARKET FOR DIAGNOSTICS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 26 DIAGNOSTICS: METABOLISM ASSAYS MARKET FOR DIABETES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 27 DIAGNOSTICS: METABOLISM ASSAYS MARKET FOR OBESITY, BY REGION, 2021–2028 (USD MILLION)

- TABLE 28 DIAGNOSTICS: METABOLISM ASSAYS MARKET FOR CANCER, BY REGION, 2021–2028 (USD MILLION)

- TABLE 29 DIAGNOSTICS: METABOLISM ASSAYS MARKET FOR CARDIOVASCULAR DISEASES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 30 DIAGNOSTICS: METABOLISM ASSAYS MARKET FOR OTHER DIAGNOSTICS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 31 RESEARCH: METABOLISM ASSAYS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 32 METABOLISM ASSAYS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 33 METABOLISM ASSAYS MARKET FOR HOSPITALS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 34 METABOLISM ASSAYS MARKET FOR DIAGNOSTIC LABORATORIES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 35 METABOLISM ASSAYS MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES AND CROS & ACADEMIC RESEARCH INSTITUTES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 36 METABOLISM ASSAYS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 37 NORTH AMERICA: METABOLISM ASSAYS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 38 NORTH AMERICA: METABOLISM ASSAYS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 39 NORTH AMERICA: METABOLISM ASSAYS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 40 NORTH AMERICA: METABOLISM ASSAYS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 41 NORTH AMERICA: METABOLISM ASSAYS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 42 US: METABOLISM ASSAYS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 43 US: METABOLISM ASSAYS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 44 US: METABOLISM ASSAYS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 45 US: METABOLISM ASSAYS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 46 CANADA: METABOLISM ASSAYS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 47 CANADA: METABOLISM ASSAYS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 48 CANADA: METABOLISM ASSAYS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 49 CANADA: METABOLISM ASSAYS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 50 EUROPE: METABOLISM ASSAYS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 51 EUROPE: METABOLISM ASSAYS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 52 EUROPE: METABOLISM ASSAYS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 53 EUROPE: METABOLISM ASSAYS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 54 EUROPE: METABOLISM ASSAYS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 55 GERMANY: METABOLISM ASSAYS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 56 GERMANY: METABOLISM ASSAYS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 57 GERMANY: METABOLISM ASSAYS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 58 GERMANY: METABOLISM ASSAYS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 59 UK: METABOLISM ASSAYS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 60 UK: METABOLISM ASSAYS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 61 UK: METABOLISM ASSAYS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 62 UK: METABOLISM ASSAYS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 63 FRANCE: METABOLISM ASSAYS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 64 FRANCE: METABOLISM ASSAYS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 65 FRANCE: METABOLISM ASSAYS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 66 FRANCE: METABOLISM ASSAYS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 67 SPAIN: METABOLISM ASSAYS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 68 SPAIN: METABOLISM ASSAYS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 69 SPAIN: METABOLISM ASSAYS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 70 SPAIN: METABOLISM ASSAYS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 71 ITALY: METABOLISM ASSAYS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 72 ITALY: METABOLISM ASSAYS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 73 ITALY: METABOLISM ASSAYS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 74 ITALY: METABOLISM ASSAYS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 75 REST OF EUROPE: METABOLISM ASSAYS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 76 REST OF EUROPE: METABOLISM ASSAYS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 77 REST OF EUROPE: METABOLISM ASSAYS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 78 REST OF EUROPE: METABOLISM ASSAYS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 79 ASIA PACIFIC: METABOLISM ASSAYS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 80 ASIA PACIFIC: METABOLISM ASSAYS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 81 ASIA PACIFIC: METABOLISM ASSAYS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 82 ASIA PACIFIC: METABOLISM ASSAYS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 83 ASIA PACIFIC: METABOLISM ASSAYS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 84 JAPAN: METABOLISM ASSAYS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 85 JAPAN: METABOLISM ASSAYS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 86 JAPAN: METABOLISM ASSAYS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 87 JAPAN: METABOLISM ASSAYS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 88 CHINA: METABOLISM ASSAYS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 89 CHINA: METABOLISM ASSAYS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 90 CHINA: METABOLISM ASSAYS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 91 CHINA: METABOLISM ASSAYS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 92 INDIA: METABOLISM ASSAYS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 93 INDIA: METABOLISM ASSAYS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 94 INDIA: METABOLISM ASSAYS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 95 INDIA: METABOLISM ASSAYS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 96 REST OF ASIA PACIFIC: METABOLISM ASSAYS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 97 REST OF ASIA PACIFIC: METABOLISM ASSAYS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 98 REST OF ASIA PACIFIC: METABOLISM ASSAYS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 99 REST OF ASIA PACIFIC: METABOLISM ASSAYS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 100 REST OF THE WORLD: METABOLISM ASSAYS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 101 REST OF THE WORLD: METABOLISM ASSAYS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 102 REST OF THE WORLD: METABOLISM ASSAYS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 103 REST OF THE WORLD: METABOLISM ASSAYS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 104 OVERVIEW OF STRATEGIES DEPLOYED BY KEY COMPANIES

- TABLE 105 METABOLISM ASSAYS MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS

- TABLE 106 PRODUCT FOOTPRINT OF KEY PLAYERS

- TABLE 107 REGIONAL FOOTPRINT OF KEY PLAYERS

- TABLE 108 METABOLISM ASSAYS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 109 PRODUCT LAUNCHES, JANUARY 2020–AUGUST 2023

- TABLE 110 DEALS, JANUARY 2020–AUGUST 2023

- TABLE 111 OTHER DEVELOPMENTS, JANUARY 2020–AUGUST 2023

- TABLE 112 THERMO FISHER SCIENTIFIC, INC.: BUSINESS OVERVIEW

- TABLE 113 MERCK KGAA: BUSINESS OVERVIEW

- TABLE 114 ABCAM PLC.: BUSINESS OVERVIEW

- TABLE 115 ABCAM PLC.: DEALS

- TABLE 116 AGILENT TECHNOLOGIES INC.: BUSINESS OVERVIEW

- TABLE 117 AGILENT TECHNOLOGIES INC.: PRODUCT LAUNCHES

- TABLE 118 KANEKA EUROGENTEC S.A.: BUSINESS OVERVIEW

- TABLE 119 SARTORIUS AG: BUSINESS OVERVIEW

- TABLE 120 SARTORIUS AG: PRODUCT LAUNCHES

- TABLE 121 PROMEGA CORPORATION: BUSINESS OVERVIEW

- TABLE 122 ELABSCIENCE BIOTECHNOLOGY INC.: BUSINESS OVERVIEW

- TABLE 123 RAYBIOTECH LIFE, INC.: BUSINESS OVERVIEW

- TABLE 124 BMG LABTECH: BUSINESS OVERVIEW

- TABLE 125 BMG LABTECH: PRODUCT LAUNCHES

- TABLE 126 BIOTREND CHEMIKALIEN GMBH: BUSINESS OVERVIEW

- FIGURE 1 METABOLISM ASSAYS MARKET: RESEARCH DESIGN METHODOLOGY

- FIGURE 2 KEY INDUSTRY INSIGHTS

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

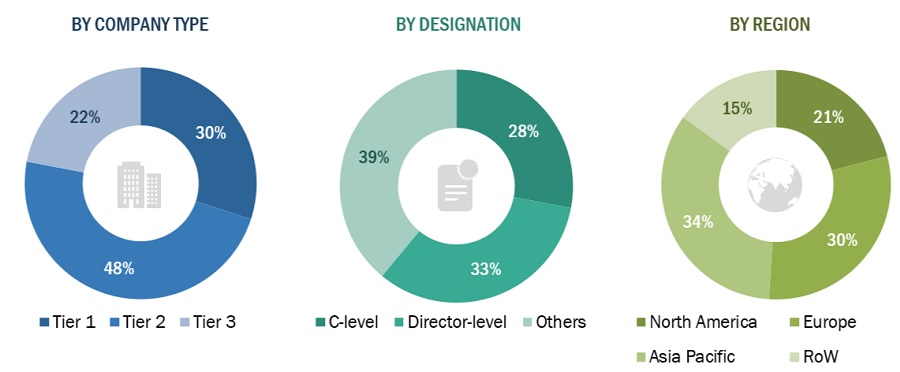

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 5 BOTTOM-UP APPROACH: REVENUE-BASED APPROACH

- FIGURE 6 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- FIGURE 7 METABOLISM ASSAYS MARKET: TOP-DOWN APPROACH

- FIGURE 8 DATA TRIANGULATION METHODOLOGY

- FIGURE 9 METABOLISM ASSAYS MARKET, BY PRODUCT, 2023 VS. 2028 (USD BILLION)

- FIGURE 10 METABOLISM ASSAYS MARKET, BY TECHNOLOGY, 2023 VS. 2028 (USD BILLION)

- FIGURE 11 METABOLISM ASSAYS MARKET, BY APPLICATION, 2023 VS. 2028 (USD BILLION)

- FIGURE 12 METABOLISM ASSAYS MARKET, BY END USER, 2023 VS. 2028 (USD BILLION)

- FIGURE 13 REGIONAL SNAPSHOT OF METABOLISM ASSAYS MARKET

- FIGURE 14 INCREASED PREVALENCE OF OBESITY AND DIABETES TO DRIVE METABOLISM ASSAYS MARKET

- FIGURE 15 ASSAY KITS & REAGENTS ACCOUNTED FOR LARGEST SHARE IN 2022

- FIGURE 16 GERMANY TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 17 ASIA PACIFIC MARKET TO WITNESS FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 18 DEVELOPING ECONOMIES TO REGISTER HIGHER GROWTH DURING FORECAST PERIOD

- FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN METABOLISM ASSAYS MARKET

- FIGURE 20 PATENT ANALYSIS FOR METABOLISM ASSAYS (JANUARY 2013–DECEMBER 2022)

- FIGURE 21 VALUE CHAIN ANALYSIS: MAJOR VALUE ADDITION DURING MANUFACTURING & ASSEMBLY PHASES

- FIGURE 22 METABOLISM ASSAYS MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 23 METABOLISM ASSAYS MARKET: ECOSYSTEM ANALYSIS

- FIGURE 24 KEY PLAYERS IN METABOLISM ASSAYS MARKET

- FIGURE 25 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF METABOLISM ASSAYS

- FIGURE 26 KEY BUYING CRITERIA FOR METABOLISM ASSAYS

- FIGURE 27 NORTH AMERICA: METABOLISM ASSAYS MARKET SNAPSHOT

- FIGURE 28 ASIA PACIFIC: METABOLISM ASSAYS MARKET SNAPSHOT

- FIGURE 29 REVENUE SHARE ANALYSIS OF TOP PLAYERS IN METABOLISM ASSAYS MARKET

- FIGURE 30 METABOLISM ASSAYS MARKET RANKING ANALYSIS, BY KEY PLAYER (2022)

- FIGURE 31 METABOLISM ASSAYS MARKET: COMPANY EVALUATION QUADRANT FOR KEY PLAYERS, 2022

- FIGURE 32 METABOLISM ASSAY MARKET: COMPANY EVALUATION QUADRANT FOR STARTUPS/SMES, 2022

- FIGURE 33 THERMO FISHER SCIENTIFIC, INC.: COMPANY SNAPSHOT (2022)

- FIGURE 34 MERCK KGAA: COMPANY SNAPSHOT (2022)

- FIGURE 35 ABCAM PLC.: COMPANY SNAPSHOT (2022)

- FIGURE 36 AGILENT TECHNOLOGIES INC.: COMPANY SNAPSHOT (2022)

- FIGURE 37 KANEKA EUROGENTEC S.A.: COMPANY SNAPSHOT (2022)

- FIGURE 38 SARTORIUS AG: COMPANY SNAPSHOT (2022)

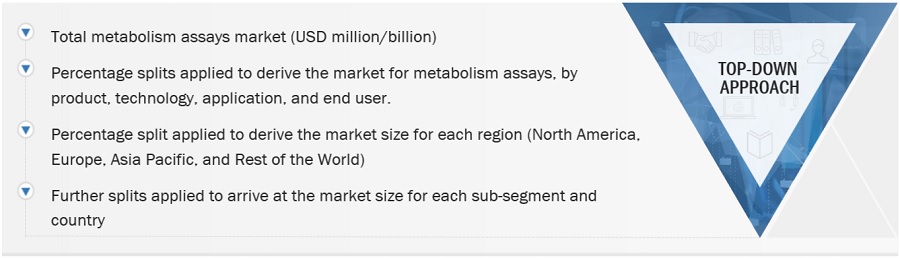

The objective of the study is to analyze the key market dynamics, such as drivers, opportunities, challenges, restraints, and key player strategies. To track company developments such as acquisitions, product launches, expansions, collaborations, agreements, and partnerships of the leading players, the competitive landscape of the metabolism assays market to analyze market players on various parameters within the broad categories of business and product strategy. Top-down and bottom-up approaches were used to estimate the market size. To estimate the market size of segments and subsegments, the market breakdown and data triangulation were used.

The four steps involved in estimating the market size are

Collecting Secondary Data

The secondary research data collection process involves the usage of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B), annual reports, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the metabolism assays market. A database of the key industry leaders was also prepared using secondary research.

Collecting Primary Data

The primary research data was conducted after acquiring knowledge about the metabolism assays market scenario through secondary research. A significant number of primary interviews were conducted with stakeholders from both the demand side (such as hospitals, clinics, fitness centers, home users, and academic & research institutes) and supply side (such as included various industry experts, such as Directors, Chief X Officers (CXOs), Vice Presidents (VPs) from business development, marketing, and product development teams, product manufacturers, wholesalers, channel partners, and distributors) across major countries of North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. Approximately 40% of the primary interviews were conducted with stakeholders from the demand side, while those from the supply side accounted for the remaining 60%. Primary data for this report was collected through questionnaires, emails, and telephonic interviews.

A breakdown of the primary respondents is provided below:

Breakdown of Primary Participants:

Note 1: *Others include sales managers, marketing managers, and product managers.

Note 2: Tiers are defined based on a company’s total revenue as of 2022: Tier 1=> USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3=< USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

All major product manufacturers offering various metabolism assays were identified at the global/regional level. Revenue mapping was done for the major players and was extrapolated to arrive at the global market value of each type of segment. The market value metabolism assays market was also split into various segments and subsegments at the region and country level based on:

- Product mapping of various manufacturers for each type of metabolism assays market at the regional and country-level

- Relative adoption pattern of each metabolism assays market among key application segments at the regional and/or country-level

- Detailed primary research to gather qualitative and quantitative information related to segments and subsegments at the regional and/or country level.

- Detailed secondary research to gauge the prevailing market trends at the regional and/or country-level

Global Metabolism assays Market Size: Top Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Metabolism assays Market Size: Bottom-Up Approach.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the Metabolism assays industry.

Market Definition

Metabolic assay is used to identify metabolic stability in chemical structures in connection with hepatic metabolism. It evaluates the rate of clearance of a drug using the liver hepatocytes or microsomes. The disappearance of the parent chemical with time is an example of a change. Metabolism assay is available in comprehensive packages equipped with the essential components and detailed protocols required to investigate specific facets of cellular metabolism. These kits offer researchers a convenient and standardized approach to explore and understand metabolic processes accurately, efficiently, and consistently.

Key Stakeholders

- Senior Management

- Finance/Procurement Department

- Pathologist/Researchers/Technician

Report Objectives

- To provide detailed information about the factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To define, describe, segment, and forecast the metabolism assays market by product, technology, application, end-user, and region

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To analyze micro markets with respect to individual growth trends, prospects, and contributions to the overall metabolism assay market

- To forecast the size of the metabolism assays market in five main regions along with their respective key countries, namely, North America, Europe, the Asia Pacific, Rest of the world.

- To profile key players in the metabolism assays market and comprehensively analyze their core competencies and market shares

- To track and analyze competitive developments, such as acquisitions; product launches; expansions; collaborations, agreements, & partnerships; and R&D activities of the leading players in the metabolism assays market.

- To benchmark players within the metabolism assays market using the Competitive Leadership Mapping framework, which analyzes market players on various parameters within the broad categories of business and product strategy

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

Additional country-level analysis of the Metabolism assays market

Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the Metabolism assays Market

Growth opportunities and latent adjacency in Metabolism Assays Market