Manufacturing Execution System Market for Life Sciences & Pharmaceuticals by Offering (Software, Services), Deployment (On-Premises, On Demand, Hybrid) and Region - Global Forecast to 2030

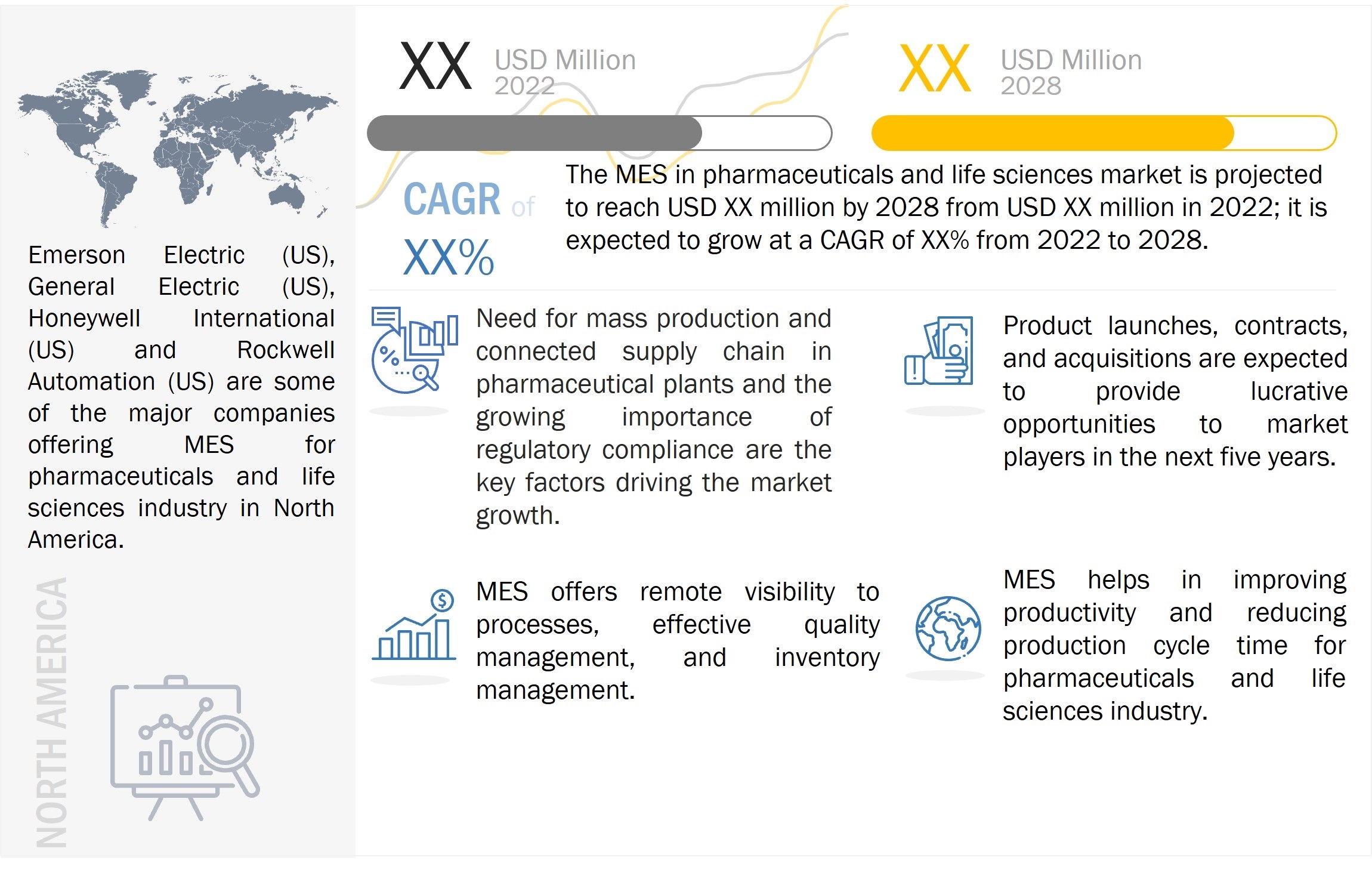

A manufacturing execution system (MES) is a software system that tracks and documents the manufacturing lifecycle in several industries. It keeps track of all the relevant information with real-time data analysis and records data from robots, machine tools, and employees. This system is also being integrated with ERP software within enterprises. There is significant growth in demand for MES in the pharmaceuticals and Life Sciences industry owing to its essential functions such as remote visibility to processes, effective quality management, inventory management, and streamlining standard operating procedures (SOPs).

The global MES in Pharmaceuticals and Life Sciences market size is expected to grow from USD XX million in 2024 to USD XX million by 2030, at a CAGR of XX%. The key factors propelling the market growth are the need for mass production and connected supply chains in pharmaceutical plants, the increasing use of industrial automation, and the growing importance of regulatory compliance.

To know about the assumptions considered for the study, Request for Free Sample Report

Drivers:The growing significance of regulatory compliance

Pharmaceuticals & life sciences industry must fulfill the regulations mandated by authorities such as the FDA, the EPA, and ISA. Increasing consumer consciousness has led to increased regulations, such as Good Manufacturing Practices (GMP), Computer Software for Manufacturing Regulatory Compliance, and the Code of Federal Regulations, for the safety and quality assessment of manufacturing processes and products.

Regulations such as 21 CFR Part 11 of the Code of Federal Regulations deal with the US FDA guidelines on electronic records and electronic signatures. In Part 11, electronic records and signatures are considered reliable and equivalent to paper records. Under the 21 CFR Part 11, drug manufacturers, manufacturers of medical devices, and biotech companies have to use manufacturing execution systems for implementing controls, audits, electronic signatures, and documentation. MES enables the tracking of procedures followed during manufacturing as they comprise all the compliance data required for the safety and quality of products. Therefore, the growing significance of regulations is expected to propel the market growth for MES in the pharmaceuticals and life sciences industry.

Substantial requirement for effective operations and quality control in pharmaceutical plants

MES alters paper-based processes that are prone to human errors and too slow for the present-day progressive pharmaceutical industry. MES monitors, controls, and documents the processes digitally in real time for the complete production cycle. Moreover, it also improves production efficiency, enhances product quality, and can be easily integrated with ERP.

Product quality and inventory management are crucial factors in pharmaceutical plants. The MES functions as a central system with efficient communication between manufacturing systems and other departments, such as these plants' operations, maintenance, quality, and inventory control. MES allows direct execution of production orders which can change with dynamically changing orders, machine operations, and quality checks.

Challenge: Complexities in the deployment of MES in plants

Upgrading existing infrastructure with MES is not easy, especially for medium-sized companies. The deployment of MES is complex because every such system is different according to the individual plant requirements and the processes involved in the pharmaceuticals and life sciences industry. Also, the deployment of MES is a lengthy process. Therefore, the complexity of the processes involved in implementing manufacturing execution systems with every system of a production floor and the time-consuming implementation process are significant challenges for the MES market for the pharmaceuticals and life sciences industry.

Key Market Players:

Honeywell International (US), Rockwell Automation (US), Siemens (Germany), Dassault Systèmes (France), SAP (Germany), ABB (Switzerland), Schneider Electric (France), and Werum IT Solutions (Germany) are some of the few players offering MES for pharmaceuticals and life sciences industry.

- In September 2021, Honeywell International (US) acquired Performix (US), a key provider of MES software for the pharmaceutical manufacturing and biotech industries. The acquisition supports Honeywell's strategy to create a leading integrated software platform for life sciences customers aiming to achieve faster compliance and improved reliability.

- In July 2019, Lonza (Switzerland), a multinational chemicals and biotechnology company, selected Rockwell Automation (US) to implement Lonza's strategic vision of bringing the digital factory to nine former Capsugel facilities that manufacture drug capsules. Rockwell Automation's PharmaSuite Manufacturing Execution System (MES) software helped the company digitize its manufacturing environments' operations.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 Introduction

1.1. Study Objectives

1.2. Market Definition

1.3. Study Scope

1.4. Currency

1.5. Stakeholders

1.6. Limitations

2 Research Methodology

2.1. Research Data

2.1.1. Secondary Data

2.1.2. Primary Data

2.2. Market Size Estimation

2.2.1. Bottom-Up Approach

2.2.2. Top-Down Approach

2.3. Market Breakdown and Data Triangulation

2.4. Research Assumptions

2.5. Risk Assessment

3 Executive Summary

4 Premium Insights

5 Market Overview

5.1. Introduction

5.2. Market Dynamics

5.2.1. Drivers

5.2.2. Restraints

5.2.3. Opportunities

5.2.4. Challenges

5.3. Value Chain Analysis

5.4. Ecosystem Analysis

5.5. Trends/Disruptions impacting customer’s business

5.6. Porter’s Five Forces Analysis

5.7. Case Study Analysis

5.8. Technology Analysis

5.9. Pricing Analysis

5.9.1. ASP Analysis of Key Players

5.9.2. ASP Trend

5.10. Trade Analysis

5.11. Key Conferences & Events in 2022−2023

5.12. Patent Analysis

5.13. Regulatory Landscape

5.13.1. Regulatory Bodies, Government Agencies & Other Organizations

5.13.2. Major Standards

5.14. Key Stakeholders and Buying Criteria

6 Major Functions of MES in Pharmaceuticals and Life Sciences Industry

6.1. Introduction

6.2. Digitization of Manufacturing Processes

6.3. Remote Operations

6.4. Remote Visibility to Processes

6.5. Quality Management and Assurance

6.6. Enhancement of Process Efficiency

6.7. Inventory Management

6.8. Streamlining Standard Operating Procedures (SOPs)

7 MES for Pharmaceuticals and Life Sciences Market, By Offering

7.1. Introduction

7.2. Software

7.3. Services

8 MES for Pharmaceuticals and Life Sciences Market, By Deployment

8.1. Introduction

8.2. On-premises

8.3. On-demand

8.4. Hybrid

9 MES for Pharmaceuticals and Life Sciences Market, By Region

9.1. Introduction

9.2. North America

9.2.1. US

9.2.2. Canada

9.2.3. Mexico

9.3. Europe

9.3.1. UK

9.3.2. Germany

9.3.3. France

9.3.4. Rest of Europe

9.4. Asia Pacific

9.4.1. China

9.4.2. Japan

9.4.3. India

9.4.4. South Korea

9.4.5. Rest of Asia Pacific

9.5. Rest of the World

9.5.1. Middle East

9.5.2. Africa

9.5.3. South America

10 Competitive Landscape

10.1. Introduction

10.2. Top 5 Company Revenue Analysis

10.3. Market Share Analysis (2021)

10.4. Company Evaluation Quadrant, 2021

10.4.1. Star

10.4.2. Emerging Leader

10.4.3. Pervasive

10.4.4. Participants

10.5. Small and Medium Enterprises (SMEs) Evaluation Quadrant, 2021

10.5.1. Progressive Companies

10.5.2. Responsive Companies

10.5.3. Dynamic Companies

10.5.4. Starting Blocks

10.6. Company Footprint

10.7. Competitive Benchmarking

10.8. Competitive Scenario

11 Company Profiles

11.1. Honeywell International

11.2. Schneider Electric

11.3. General Electric

11.4. Rockwell Automation

11.5. Emerson Electric

11.6. Siemens

11.7. ABB

11.8. SAP

11.9. Dassault Systemes

11.10. ATS Global

11.11. Werum IT Solutions

11.12. Atachi Systems

12 Appendix

Growth opportunities and latent adjacency in Manufacturing Execution System Market