Medical Terminology Software Market Size by Application (Data Aggregation, Reimbursement, Data Integration, Clinical Trials), Products & Services (Services, Platforms), End User (Healthcare Providers, Healthcare Payers, IT Vendors) & Region - Global Forecast to 2027

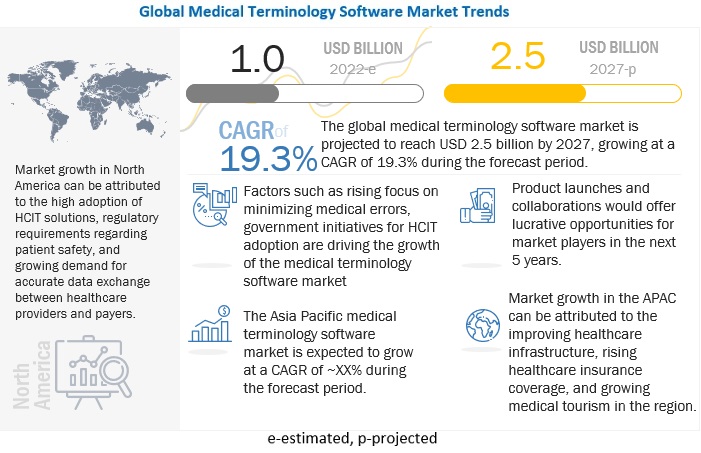

The global medical terminology software market was valued at $1.0 billion in 2022 and is expected to reach $2.5 billion by 2027, with a CAGR of 19.3%. Key drivers include government support for HCIT solutions and the need to address medical errors, while challenges involve interoperability issues and reluctance to adopt new technologies. Opportunities arise from the increasing need to maintain data integrity. North America leads the market due to high HCIT adoption and regulatory requirements. Major players include Wolters Kluwer N.V., 3M, and Intelligent Medical Objects, Inc. The market is segmented by application, product & service, end user, and region, with quality reporting projected to see the highest growth. Recent developments include acquisitions and strategic partnerships aimed at expanding capabilities and improving integration.

To know about the assumptions considered for the study, Request for Free Sample Report

Medical terminology software Market Dynamics

Driver: Disparity & fragmentation in the terminology content of healthcare organizations

Currently, healthcare ecosystems are quite fragmented in terms of content and infrastructure. A health delivery organization may manage 40 or more separate IT systems, with each system having its own clinical terminology content and infrastructure. These terminology silos make it difficult for organizations to leverage isolated clinical data, which impacts downstream activities such as data analytics. The problem further intensifies when a health system seeks to share data with other healthcare partners. In that scenario, the relevant data resides in numerous isolated systems scattered across multiple healthcare organizations. The lack of a common clinical vocabulary across a magnitude of standalone systems is a key obstacle to national efforts to increase interoperability, transparency, and collaboration within the healthcare system.

Enterprise terminology management, however, aims to help healthcare organizations overcome the interoperability issues associated with multiple, incompatible medical terminologies. Enterprise terminology management lets healthcare organizations adopt a single, integrated, and trusted source of terminology set across an enterprise. Also, a clean, normalized data model ensures departmental systems rely on approved and up-to-date terminologies, maps, and value sets. Normalization also facilitates data exchange across organizations.

Restraint: Interoperability issues

The healthcare industry is highly information-intensive, wherein patient information is generated in all departments at all points of care within a healthcare organization. However, this information can be unusable if not integrated properly to create an exhaustive and accurate patient record. Since a number of healthcare IT tools are used within healthcare systems, there is a greater need to integrate IT systems to aid with accurate decision-making by healthcare professionals at different points of care. Moreover, the lack of interoperability of health organizations with a regional or national health IT platform for exchanging data hinders the full exploitation of healthcare IT solutions.

The increasing development of new medical apps and health information exchange solutions from consumer technology companies presents difficulties in integrating older available solutions. Many healthcare organizations have already invested in various information management systems and medical devices from different vendors, which have their own makes and models. As healthcare organizations are increasingly adopting various healthcare IT systems, there is a greater need for integrating different information technology systems into the IT architecture of an organization to ensure their optimal utilization. As a result, the successful integration of healthcare IT systems with other systems is a major area of focus for IT infrastructure development projects.

Opportunity: Increasing need to maintain data integrity

Healthcare institutions have a growing need for solutions that fully utilize clinical data from within and outside the EHR system. Clean, accurate data is fundamental to maintaining the integrity of information shared across the healthcare industry. However, hospitals face several difficulties in keeping up with the changes in requirements, coding, and the exchange of patient records across different healthcare providers. Currently, the exchange of EHR data from within the healthcare ecosystem does not work as implemented, and incorporating external data is sub-optimal. Without solutions to properly standardize, organize, clean, and maintain clinical data, granularity is lost during the exchange of information, usually due to human or machine readability errors. The existing environment of cluttered data within EHRs raises concerns about data validity and trust, making it challenging for EHR system users to make sense of the existing disorganized data.

The leading providers of medical terminology content and services (in an effort to support clinical workflows in hospitals and medical offices) have recognized the importance of developing solutions that support coding information across the healthcare industry. These companies are trying to tap this opportunity to help healthcare providers leverage high-quality health information quickly and easily to improve patient care.

Challenge: Reluctance to use medical terminology solutions over conventional practices

Although the adoption of medical terminology solutions is gradually increasing, several healthcare providers are still reluctant to use these solutions over conventional practices. This can be attributed to the lack of IT knowledge among healthcare providers. For instance, physicians and practice managers are well-adapted to complicated groups of spreadsheets and have experience in searching codes across multiple sources. These personnel are thus reluctant to switch from conventional methods to automated terminology standardization. Also, several healthcare organizations that are willing to switch to automated terminology management either lack adequate consensus between the staff or do not have the required resources to support the extra cost burden. Similarly, physicians and other staff require sufficient technical knowledge and skills to enter patient medical information, notes, and prescriptions into EMRs.

In the rural areas across the world, factors such as lower internet penetration and a shortage of experts for providing technical assistance further exacerbate the situation, thereby affecting the uptake of clinical workflow solutions by healthcare organizations.

Quality reporting will have the highest growth in the application segment of the medical terminology software market.

On the basis of application, the quality reporting segment to register highest growth. The high growth of this segment can be attributed to the government initiatives in various countries are implementing several regulations to encourage the adoption of quality reporting.

Healthcare service providers will be the largest and fastest-growing end-user segment among healthcare providers in the medical terminology software market.

Based on end user, the healthcare providers segment accounted for the largest share and highest growth rate in the global market during the forecast period. The large share & high growth of this segment can be attributed to the growing HCIT adoption, increasing focus on patient safety, significant growth in healthcare spending, rising medical error rates, increasing healthcare costs, the shift of risk from payers to providers, and government mandates to follow quality measures.

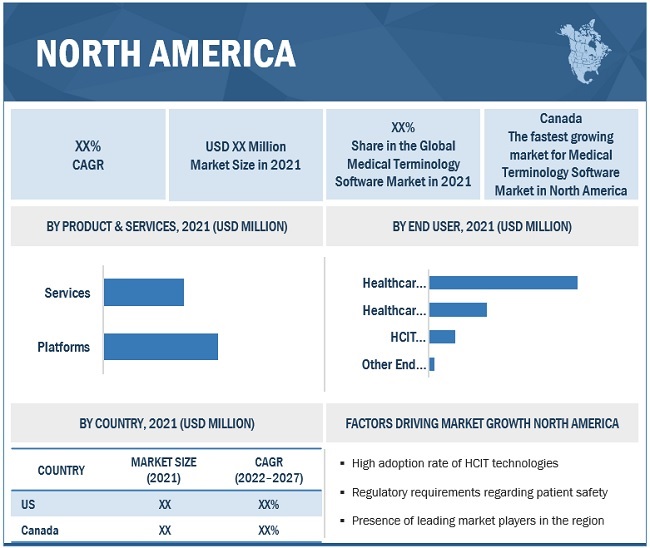

North America accounted for the largest share of the medical terminology software market during the forecast period.

North America holds the largest share of the market. Growth in the North American market can be attributed to factors such as high adoption rate of HCIT adoption, regulatory requirements regarding patient safety, presence of leading market players in the region.

To know about the assumptions considered for the study, download the pdf brochure

The global medical terminology software market is dominated by players such as Wolters Kluwer N.V. (Netherlands), 3M (US), Intelligent Medical Objects, Inc. (US), Apelon, Inc. (US), Clinical Architecture, LLC (US), CareCom (Denmark), BiTAC (Spain), B2i Healthcare (Hungary), BT Clinical Computing (Belgium), and HiveWorx (Ireland).

Scope of the Medical Terminology Software Industry

|

Report Metric |

Details |

|

Market Revenue Size in 2022 |

$1.0 billion |

|

Projected Revenue Size by 2027 |

$2.5 billion |

|

Industry Growth Rate |

Poised to Grow at a CAGR of 19.3% |

|

Market Driver |

Disparity & fragmentation in the terminology content of healthcare organizations |

|

Market Opportunity |

Increasing need to maintain data integrity |

The study categorizes the medical terminology software market to forecast revenue and analyze trends in each of the following submarkets:

By Application

- Introduction

- Data Aggregation

- Reimbursement

- Public Health Surveillance

- Data Integration

- Decision Support

- Clinical Trials

- Quality Reporting

- Clinical Guidelines

By Product & Service

- Introduction

- Services

- Platforms

By End User

- Introduction

-

Healthcare Providers

- Healthcare Service Providers

- Health Information Exchanges

-

Healthcare Payers

- Private Payers

- Public Payers

- Healthcare IT Vendors

- Others

By Region

- North America

- US

- Canada

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Recent Developments

- In March 2022, Thomas H. Lee Partners, L.P. entered into an agreement to acquire Intelligent Medical Objects for ~USD 1.5 billion to support IMO’s product development and expand commercial relationships with hospitals and other healthcare providers.

- In January 2021, Wolters Kluwer partnered with Henry Schein to integrate Henry Schein MicroMD, a practice management and electronic medical record (EMR) solution, with Health Language Clinical Interface Terminology (CIT) to quickly map over a million medical abbreviations, typos, incomplete terms, and acronyms so as to standardize terminology.

- In December 2020, CareCom and J2 Interactive entered into a strategic partnership to launch a new offering, J2 Managed Terminology, that delivers cloud-hosted, best-of-breed clinical terminology services to provider networks, payers, health information exchanges, and software vendors serving the healthcare industry.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global medical terminology software market?

The global medical terminology software market boasts a total revenue value of $2.5 billion by 2027.

What is the estimated growth rate (CAGR) of the global medical terminology software market?

The global medical terminology software market has an estimated compound annual growth rate (CAGR) of 19.3% and a revenue size in the region of $1.0 billion in 2022.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 14)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

FIGURE 1 MEDICAL TERMINOLOGY SOFTWARE MARKET SEGMENTATION

FIGURE 2 REGIONAL SEGMENTS COVERED

1.4 YEARS CONSIDERED

1.5 CURRENCY

TABLE 1 STANDARD CURRENCY CONVERSION RATES

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 18)

2.1 RESEARCH DATA

FIGURE 3 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS (SUPPLY SIDE): BY COMPANY TYPE, DESIGNATION, AND REGION

FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS (DEMAND SIDE): BY END USER, DESIGNATION, AND REGION

2.2 MARKET SIZE ESTIMATION

FIGURE 6 MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

FIGURE 7 TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION METHODOLOGY

2.4 ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 26)

FIGURE 9 MEDICAL TERMINOLOGY SOFTWARE MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

FIGURE 10 GLOBAL MARKET, BY PRODUCT & SERVICE, 2022 VS. 2027 (USD MILLION)

FIGURE 11 GLOBAL MARKET, BY END USER, 2022 VS. 2027 (USD MILLION)

FIGURE 12 GEOGRAPHICAL SNAPSHOT OF THE MEDICAL TERMINOLOGY SOFTWARE MARKET

4 PREMIUM INSIGHTS (Page No. - 30)

4.1 MARKET OVERVIEW

FIGURE 13 RISING FOCUS ON MINIMIZING MEDICAL ERRORS TO DRIVE GROWTH IN THE GLOBAL MARKET

4.2 ASIA PACIFIC: MARKET, BY PRODUCT & SERVICE AND END USER (2021)

FIGURE 14 MEDICAL TERMINOLOGY SERVICES ACCOUNTED FOR THE LARGEST SHARE OF THE ASIA PACIFIC MARKET IN 2021

4.3 GLOBAL MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

FIGURE 15 ASIA PACIFIC TO REGISTER THE HIGHEST GROWTH IN THE GLOBAL MARKET DURING THE FORECAST PERIOD

4.4 REGIONAL MIX: GLOBAL MARKET (2020–2027)

FIGURE 16 NORTH AMERICA TO CONTINUE TO DOMINATE THE GLOBAL MARKET IN 2027

5 MARKET OVERVIEW (Page No. - 34)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 17 MEDICAL TERMINOLOGY SOFTWARE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

TABLE 2 MARKET DYNAMICS: IMPACT ANALYSIS

5.2.1 DRIVERS

5.2.1.1 Rising focus on minimizing medical errors

5.2.1.2 Government initiatives for HCIT adoption

5.2.1.3 Disparity and fragmentation in the terminology content of healthcare organizations

5.2.2 RESTRAINTS

5.2.2.1 IT infrastructural constraints in developing countries

5.2.2.2 Interoperability issues

5.2.3 OPPORTUNITIES

5.2.3.1 Emerging markets

5.2.3.2 Increasing need to maintain data integrity

5.2.4 CHALLENGES

5.2.4.1 Reluctance to use terminology solutions over conventional practices

6 INDUSTRY INSIGHTS (Page No. - 40)

6.1 INDUSTRY TRENDS

6.1.1 INCREASING PREFERENCE FOR CLOUD-BASED SOLUTIONS

6.1.2 INTRODUCTION TO ICD-11 GUIDELINES

6.1.3 GROWING TREND OF SEMANTIC INTEROPERABILITY

6.2 REVENUE STREAM MODELS

FIGURE 18 GLOBAL MARKET: REVENUE STREAM

6.3 REGULATORY ANALYSIS

6.4 TERMINOLOGY STANDARDS

6.5 FAST HEALTHCARE INTEROPERABILITY RESOURCES (FHIR)

7 MEDICAL TERMINOLOGY SOFTWARE MARKET, BY APPLICATION (Page No. - 45)

7.1 INTRODUCTION

TABLE 3 GLOBAL MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

7.2 DATA AGGREGATION

7.2.1 WITHOUT A COMMON TERMINOLOGY FOR AGGREGATING PATIENT DATA, THE POTENTIAL FOR MEDICAL ERRORS CAN INCREASE—A KEY FACTOR DRIVING MARKET GROWTH

TABLE 4 GLOBAL MARKET FOR DATA AGGREGATION APPLICATIONS, BY REGION, 2020–2027

7.3 REIMBURSEMENT

7.3.1 TERMINOLOGY SOLUTIONS PLAY AN IMPORTANT ROLE IN ENSURING APPROPRIATE REIMBURSEMENT FOR HEALTHCARE SERVICES RENDERED

TABLE 5 GLOBAL MARKET FOR REIMBURSEMENT APPLICATIONS, BY REGION, 2020–2027 (USD MILLION)

7.4 PUBLIC HEALTH SURVEILLANCE

7.4.1 POPULATION-BASED ANALYTICS INCLUDES THOSE INVESTIGATIONS THAT BENEFIT THE ENTIRE POPULATION, INCLUDING PUBLIC HEALTH SURVEILLANCE

TABLE 6 GLOBAL MARKET FOR PUBLIC HEALTH SURVEILLANCE APPLICATIONS, BY REGION, 2020–2027 (USD MILLION)

7.5 DATA INTEGRATION

7.5.1 TERMINOLOGY SOLUTIONS CAN UNIFY, CLEAN, AND NORMALIZE THE DATA COLLECTED FROM MULTIPLE DATA SOURCES

TABLE 7 GLOBAL MARKET FOR DATA INTEGRATION APPLICATIONS, BY REGION, 2020–2027 (USD MILLION)

7.6 DECISION SUPPORT

7.6.1 INCORPORATION OF STANDARDIZED TERMINOLOGY IN CDSS WILL HELP FACILITATE THE COMPARABILITY OF MEDICAL DATA

TABLE 8 GLOBAL MARKET FOR DECISION SUPPORT APPLICATIONS, BY REGION, 2020–2027 (USD MILLION)

7.7 CLINICAL TRIALS

7.7.1 USE OF CONSISTENT TERMINOLOGY WITHIN AND BETWEEN STUDIES IS CRITICAL TO CLINICAL TRIAL PROCESSES

TABLE 9 GLOBAL MARKET FOR CLINICAL TRIAL APPLICATIONS, BY REGION, 2020–2027 (USD MILLION)

7.8 QUALITY REPORTING

7.8.1 GOVERNMENTS ACROSS VARIOUS COUNTRIES ARE IMPLEMENTING A NUMBER OF REGULATIONS TO ENCOURAGE THE ADOPTION OF QUALITY REPORTING

TABLE 10 GLOBAL MARKET FOR QUALITY REPORTING APPLICATIONS, BY REGION, 2020–2027 (USD MILLION)

7.9 CLINICAL GUIDELINES

7.9.1 IMPLEMENTATION OF GUIDELINES HELPS ORGANIZE AND PROVIDE THE BEST AVAILABLE EVIDENCE TO SUPPORT CLINICAL DECISION-MAKING

TABLE 11 GLOBAL MARKET FOR CLINICAL GUIDELINE APPLICATIONS, BY REGION, 2020–2027 (USD MILLION)

8 MEDICAL TERMINOLOGY SOFTWARE MARKET, BY PRODUCT & SERVICE (Page No. - 55)

8.1 INTRODUCTION

TABLE 12 GLOBAL MARKET, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

8.2 SERVICES

8.2.1 SERVICES CONTRIBUTE AN IMPORTANT SHARE TO THE MARKET DUE TO THEIR ABILITY TO BRIDGE GAPS IN THE STANDARDIZATION OF DATA FROM VARIOUS SOURCES

TABLE 13 MEDICAL TERMINOLOGY SERVICES MARKET, BY REGION, 2020–2027 (USD MILLION)

8.3 PLATFORMS

8.3.1 PLATFORMS PROVIDE A SINGLE SOURCE FOR ALL TERMINOLOGY NEEDS

TABLE 14 MEDICAL TERMINOLOGY PLATFORMS MARKET, BY REGION, 2020–2027 (USD MILLION)

9 MEDICAL TERMINOLOGY SOFTWARE MARKET, BY END USER (Page No. - 59)

9.1 INTRODUCTION

TABLE 15 GLOBAL MARKET, BY END USER, 2020–2027 (USD MILLION)

9.2 HEALTHCARE PROVIDERS

FIGURE 19 US: HOSPITAL EHR ADOPTION (2007–2018)

TABLE 16 GLOBAL MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 17 GLOBAL MARKET FOR HEALTHCARE PROVIDERS, BY REGION, 2020–2027 (USD MILLION)

9.2.1 HEALTHCARE SERVICE PROVIDERS

9.2.1.1 Need to capture and document large amounts of data in healthcare organizations—a key driver for market growth

TABLE 18 GLOBAL MARKET FOR HEALTHCARE SERVICE PROVIDERS, BY REGION, 2020–2027 (USD MILLION)

9.2.2 HEALTH INFORMATION EXCHANGES

9.2.2.1 HIEs provide healthcare professionals and patients with electronic access to therapeutic data when and where they require it

TABLE 19 GLOBAL MARKET FOR HEALTH INFORMATION EXCHANGES, BY REGION, 2020–2027 (USD MILLION)

9.3 HEALTHCARE PAYERS

TABLE 20 GLOBAL MARKET FOR HEALTHCARE PAYERS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 21 GLOBAL MARKET FOR HEALTHCARE PAYERS, BY REGION, 2020–2027 (USD MILLION)

9.3.1 PRIVATE PAYERS

9.3.1.1 Terminology management solutions provide private payers with the data needed to leverage competitive agreements during provider contract negotiations

TABLE 22 GLOBAL MARKET FOR PRIVATE PAYERS, BY REGION, 2020–2027 (USD MILLION)

9.3.2 PUBLIC PAYERS

9.3.2.1 Increasing government initiatives to improve healthcare coverage and quality of care are driving the adoption of terminology solutions among public payers

TABLE 23 GLOBAL MARKET FOR PUBLIC PAYERS, BY REGION, 2020–2027 (USD MILLION)

9.4 HEALTHCARE IT VENDORS

9.4.1 MEDICAL TERMINOLOGY IMPLEMENTATION PROVIDES VARIOUS BENEFITS TO HEALTHCARE IT VENDORS

TABLE 24 GLOBAL MARKET FOR HEALTHCARE IT VENDORS, BY REGION, 2020–2027 (USD MILLION)

9.5 OTHER END USERS

TABLE 25 GLOBAL MARKET FOR OTHER END USERS, BY REGION, 2020–2027 (USD MILLION)

10 MEDICAL TERMINOLOGY SOFTWARE MARKET, BY REGION (Page No. - 70)

10.1 INTRODUCTION

TABLE 26 GLOBAL MARKET, BY REGION, 2020–2027 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 20 NORTH AMERICA: MARKET SNAPSHOT

TABLE 27 NORTH AMERICA: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 28 NORTH AMERICA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 29 NORTH AMERICA: MARKET, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

TABLE 30 NORTH AMERICA: MARKET, BY END USER, 2020–2027 (USD MILLION)

TABLE 31 NORTH AMERICA: MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 32 NORTH AMERICA: MARKET FOR HEALTHCARE PAYERS, BY TYPE, 2020–2027 (USD MILLION)

10.2.1 US

10.2.1.1 Presence of major market players in the US makes it the largest market for medical terminology solutions

TABLE 33 US: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 34 US: MARKET, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

TABLE 35 US: MARKET, BY END USER, 2020–2027 (USD MILLION)

TABLE 36 US: MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 37 US: MARKET FOR HEALTHCARE PAYERS, BY TYPE, 2020–2027 (USD MILLION)

10.2.2 CANADA

10.2.2.1 Canada is projected to register the highest CAGR during the forecast period

TABLE 38 CANADA: MEDICAL TERMINOLOGY SOFTWARE MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 39 CANADA: MARKET, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

TABLE 40 CANADA: MARKET, BY END USER, 2020–2027 (USD MILLION)

TABLE 41 CANADA: MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 42 CANADA: MARKET FOR HEALTHCARE PAYERS, BY TYPE, 2020–2027 (USD MILLION)

10.3 EUROPE

10.3.1 GROWING IMPLEMENTATION OF VARIOUS EHEALTH INITIATIVES MAKES EUROPE A LUCRATIVE MARKET FOR MEDICAL TERMINOLOGY SOLUTIONS

TABLE 43 EUROPE: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 44 EUROPE: MARKET, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

TABLE 45 EUROPE: MARKET, BY END USER, 2020–2027 (USD MILLION)

TABLE 46 EUROPE: MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 47 EUROPE: MARKET FOR HEALTHCARE PAYERS, BY TYPE, 2020–2027 (USD MILLION)

10.4 ASIA PACIFIC

10.4.1 IMPROVING HEALTHCARE INFRASTRUCTURE IN SEVERAL APAC COUNTRIES DRIVES GROWTH IN THIS REGIONAL SEGMENT

FIGURE 21 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 48 ASIA PACIFIC: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 49 ASIA PACIFIC: MARKET, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

TABLE 50 ASIA PACIFIC: MARKET, BY END USER, 2020–2027 (USD MILLION)

TABLE 51 ASIA PACIFIC: MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 52 ASIA PACIFIC: MARKET FOR HEALTHCARE PAYERS, BY TYPE, 2020–2027 (USD MILLION)

10.5 LATIN AMERICA

10.5.1 FAVORABLE GOVERNMENT INITIATIVES IN SEVERAL LATIN AMERICAN COUNTRIES PROMOTE THE ADOPTION OF MEDICAL TERMINOLOGY SOLUTIONS

TABLE 53 LATIN AMERICA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 54 LATIN AMERICA: MARKET, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

TABLE 55 LATIN AMERICA: MARKET, BY END USER, 2020–2027 (USD MILLION)

TABLE 56 LATIN AMERICA: MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 57 LATIN AMERICA: MARKET FOR HEALTHCARE PAYERS, BY TYPE, 2020–2027 (USD MILLION)

10.6 MIDDLE EAST & AFRICA

10.6.1 MIDDLE EASTERN COUNTRIES ARE INVESTING IN EHRS TO SUPPORT THE MANAGEMENT OF DATA AND IMPROVE THE QUALITY AND EFFICIENCY OF CARE DELIVERY

TABLE 58 MIDDLE EAST & AFRICA: MEDICAL TERMINOLOGY SOFTWARE MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 59 MIDDLE EAST & AFRICA: MARKET, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

TABLE 60 MIDDLE EAST & AFRICA: MARKET, BY END USER, 2020–2027 (USD MILLION)

TABLE 61 MIDDLE EAST & AFRICA: MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 62 MIDDLE EAST & AFRICA: MARKET FOR HEALTHCARE PAYERS, BY TYPE, 2020–2027 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 93)

11.1 OVERVIEW

FIGURE 22 KEY GROWTH STRATEGIES ADOPTED BETWEEN JANUARY 2019 AND JUNE 2022

11.2 RANKING OF KEY PLAYERS, 2021

FIGURE 23 INTELLIGENT MEDICAL OBJECTS, INC. DOMINATED THE MEDICAL TERMINOLOGY SOFTWARE MARKET IN 2021

11.3 COMPANY EVALUATION MATRIX

11.3.1 STARS

11.3.2 EMERGING LEADERS

11.3.3 PERVASIVE PLAYERS

11.3.4 PARTICIPANTS

FIGURE 24 GLOBAL MARKET: COMPETITIVE LEADERSHIP MAPPING, 2022

11.4 COMPETITIVE SITUATIONS AND TRENDS

11.4.1 PRODUCT/SERVICE LAUNCHES & UPGRADES

TABLE 63 KEY PRODUCT/SERVICE LAUNCHES & UPGRADES (2019−2022)

11.4.2 DEALS

TABLE 64 KEY DEALS (2019−2022)

12 COMPANY PROFILES (Page No. - 99)

(Business Overview, Products & Services, Recent Developments, MnM View)*

12.1 INTELLIGENT MEDICAL OBJECTS, INC.

TABLE 65 INTELLIGENT MEDICAL OBJECTS, INC.: BUSINESS OVERVIEW

12.2 WOLTERS KLUWER N.V.

TABLE 66 WOLTERS KLUWER N.V.: BUSINESS OVERVIEW

FIGURE 25 WOLTERS KLUWER N.V.: COMPANY SNAPSHOT (2021)

12.3 CLINICAL ARCHITECTURE, LLC

TABLE 67 CLINICAL ARCHITECTURE, LLC: BUSINESS OVERVIEW

12.4 3M

TABLE 68 3M: BUSINESS OVERVIEW

FIGURE 26 3M: COMPANY SNAPSHOT (2021)

12.5 APELON, INC.

TABLE 69 APELON, INC.: BUSINESS OVERVIEW

12.6 CARECOM

TABLE 70 CARECOM: BUSINESS OVERVIEW

12.7 BITAC

TABLE 71 BITAC: BUSINESS OVERVIEW

12.8 B2I HEALTHCARE

TABLE 72 B2I HEALTHCARE: BUSINESS OVERVIEW

12.9 BT CLINICAL COMPUTING

TABLE 73 BT CLINICAL COMPUTING: BUSINESS OVERVIEW

12.10 HIVEWORX

TABLE 74 HIVEWORX: BUSINESS OVERVIEW

*Details on Business Overview, Products & Services, Recent Developments, MnM View might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 117)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

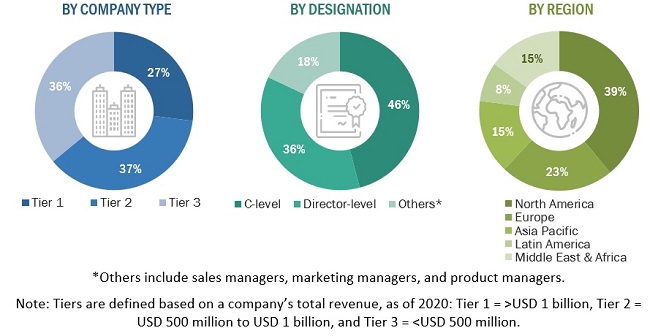

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, key market dynamics, and key player strategies.

Secondary Research

This research study involved the extensive use of secondary sources; directories; databases such as Bloomberg Business, Factiva, and Wall Street Journal; white papers; and annual reports, company house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the medical terminology software market. It was also used to obtain important information about key players, market classification & segmentation according to industry trends, and key developments related to market perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side include CEOs, vice presidents, marketing & sales directors, business development managers, and innovation directors of terminology service and platform provider companies. Demand-side primary sources include industry experts such as personnel from provider organizations, healthcare IT vendors, and other related key opinion leaders.

A breakdown of the primary respondents is provided below:

To know about the assumptions considered for the study, download the pdf brochure

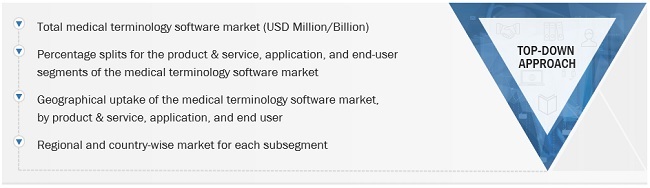

Market Size Estimation

The market size estimates and forecasts provided in this study are derived through a mix of the bottom-up approach (segmental analysis of major segments) and top-down approach (assessment of utilization/adoption/penetration trends, by product & services, application, end user, and region).

Data Triangulation

After arriving at the market size, the global market was divided into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments & subsegments, data triangulation, and market breakdown procedures were employed, wherever applicable.

Global Medical terminology software Market Size: Top-Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Objectives of the Study

- To define, describe, and forecast the medical terminology software market by product & service, application, end user, and region

- To provide detailed information regarding the major factors influencing market growth (such as drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for market players

- To forecast the size of the market segments with respect to five main regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa

- To strategically profile key players and comprehensively analyze their product portfolios, market shares, and core competencies in the global market

- To track and analyze competitive developments such as partnerships, collaborations, acquisitions, and product launches in the global market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Geographic Analysis

- A further breakdown of the European market into Germany, the UK, France, and the Rest of Europe

- A further breakdown of the Asia Pacific market into Japan, Singapore, and Australia

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Medical Terminology Software Market