This research study involved the extensive use of both primary and secondary sources. It involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, the competitive landscape of market players, and key market dynamics such as drivers, opportunities, challenges, restraints, and key player strategies.

Secondary Research

This research study involved the wide use of secondary sources, directories, databases such as Dun & Bradstreet, Bloomberg Businessweek, and Factiva, white papers, and companies’ house documents. Secondary research was undertaken to identify and collect information for this extensive, technical, market-oriented, and commercial study of the medical device engineering market. It was also used to obtain important information about the top players, market classification, and segmentation according to industry trends to the bottom-most level, geographic markets, and key developments related to the market. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various supply side and demand side sources were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side included industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, engineers, and related key executives from various companies and organizations operating in the medical device engineering market. Primary sources from the demand side included hospitals, clinics, researchers, lab technicians, purchase managers etc, and stakeholders in corporate & government bodies.

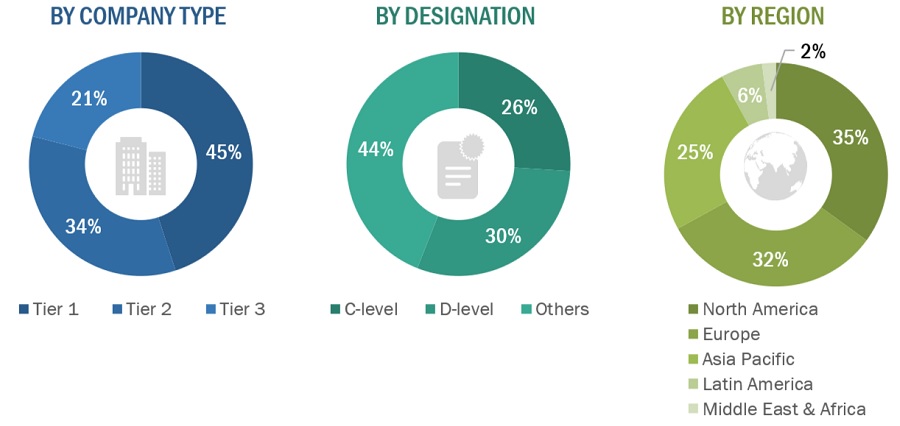

Breakdown of Primary Interviews

A breakdown of the primary respondents for medical device engineering market (supply side) market is provided below:

Note 1: Companies are classified into tiers based on their total revenue. As of 2023: Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = <USD 500 million.

Note 2: C-level executives include CEOs, COOs, CTOs, and VPs.

Note 3: Other primaries include sales managers, marketing managers, and product managers.

To know about the assumptions considered for the study, download the pdf brochure

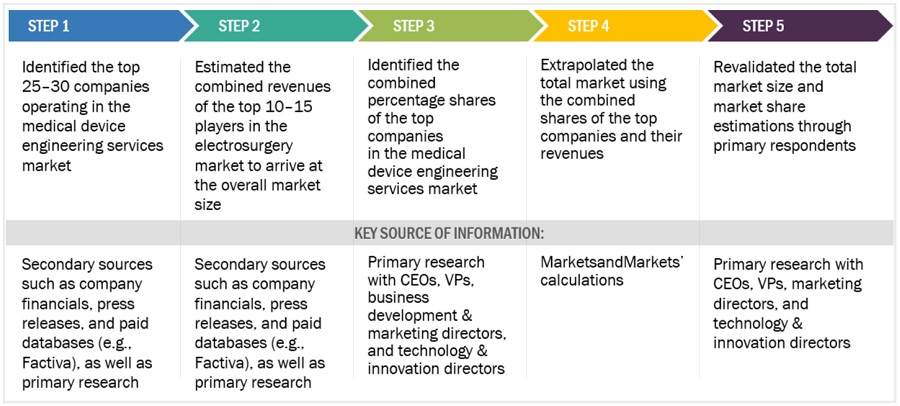

Market Size Estimation

The market size for medical device engineering market was calculated using data from three different sources, as will be discussed below. Each technique concluded and a weighted average of the four ways was calculated based on the number of assumptions each approach made. The market size for medical device engineering market was calculated using data from three distinct sources, as will be discussed below:

Approach 1: Supply-Side Analysis - Revenue Share Analysis

Medical device engineering Market: Revenue Share Analysis

Approach 2: Medical device engineering Market: Bottom-up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

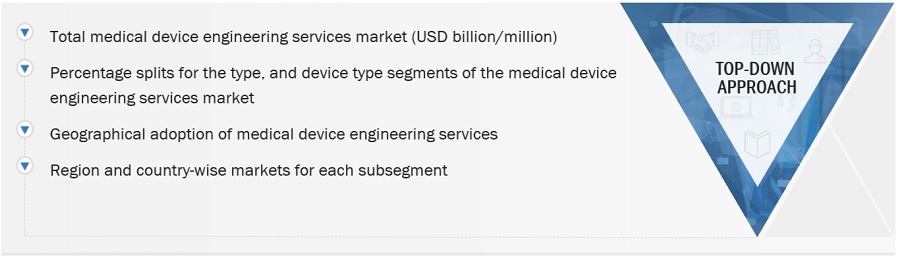

Approach 3: Medical device engineering Market: Top-Down Approach

Data Triangulation

The entire market was split up into two segments when the market size was determined. Data triangulation and market breakdown processes were used where necessary to complete the entire market engineering process and arrive at the precise statistics for all segments.

Approach to derive the market size and estimate market growth.

Using secondary data from both paid and unpaid sources, the market rankings for the major players were determined following a thorough analysis of their sales of medical device engineering. Due to data restrictions, the revenue share in certain cases was determined after a thorough analysis of the product portfolio of big corporations and their individual sales performance. This information was verified at each stage by in-depth interviews with professionals in the field.

Market Definition

Medical device engineering include a package of technical and consulting solutions concerning product innovation & design/industrial design services, prototyping services, electronics engineering services, software development & testing services, connectivity and mobility services, cybersecurity services, product testing services, regulatory consulting services and product support & maintenance services. Such services shall ensure the safety and effectiveness of the medical device for its desired purposes and in compliance with international regulatory requirements.

Key Stakeholders

-

Original equipment manufacturers (OEMs)

-

Independent service providers (ISPs)

-

Independent service organizations (ISOs)

-

Product distributors & channel partners

-

Hospitals & surgical centers

-

Dental hospitals, laboratories, and clinics

-

Dental academic & research institutes

-

Ambulatory surgical centers (ASCs) and physician-operated laboratories (POLs)

-

Contract manufacturers and third-party suppliers

-

Research laboratories & academic institutes

-

Clinical research organizations (CROs)

-

Contract manufacturing organizations (CMOs)

-

Government and non-governmental regulatory authorities

-

Venture capitalists and investors

-

Trade associations and industry bodies

-

Insurance companies

-

Market research and consulting firms

Objectives of the Study

-

To define, describe, and forecast the medical device engineering market based on by service type, device type, and region

-

To provide detailed information about the major factors influencing the market growth (such as drivers, restraints, challenges, and opportunities)

-

To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall medical device engineering market

-

To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

-

To forecast the size of the medical device engineering market in North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

-

To profile the key players and comprehensively analyze their market shares and core competencies in the medical device engineering market

-

To track and analyze competitive developments such as partnerships, expansions, acquisitions, collaborations, service launches, agreements, and other developments in the medical device engineering market

-

To benchmark players within the medical device engineering market using the Company Evaluation Quadrant framework, which analyzes market players on various parameters within the broad categories of business strategy, market share, and service offerings

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Company Information

-

Detailed analysis and profiling of additional market players (up to 5)

Geographic Analysis

-

Further breakdown of the Rest of Europe Medical device engineering Market into Denmark, Norway, and others

-

Further breakdown of the Rest of Asia Pacific Medical device engineering Market into Vietnam, New Zealand, and others

Growth opportunities and latent adjacency in Medical Device Engineering Market