Medical Coding Market Size, Growth, Share & Trends Analysis

Medical Coding Market by Offering (Software, Outsourcing Services), Classification (ICD, CPT, HCPCS), Specialty (Surgical, Radiology), Function (Code, Assignment, Reimbursement, Analytics, Denial, Audit), End User (Healthcare Providers, Healthcare Payers) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

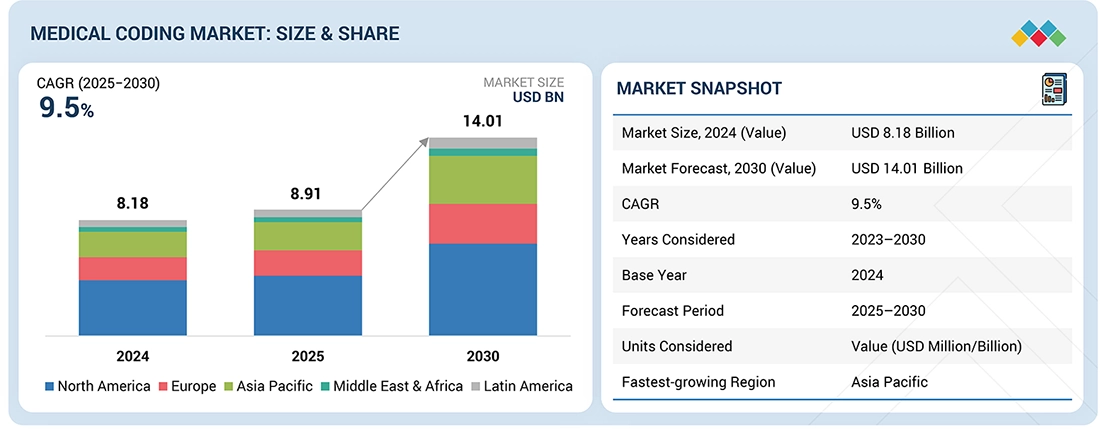

The medical coding market is projected to reach USD 14.01 billion by 2030 from USD 8.91 billion in 2025, at a CAGR of 9.5%. The market is growing steadily, driven by the rising volume of healthcare services, increasing adoption of electronic health records (EHRs), and the need for accurate billing and reimbursement.

KEY TAKEAWAYS

-

By RegionThe North American medical coding market dominated, with a share of 48.0% in 2024.

-

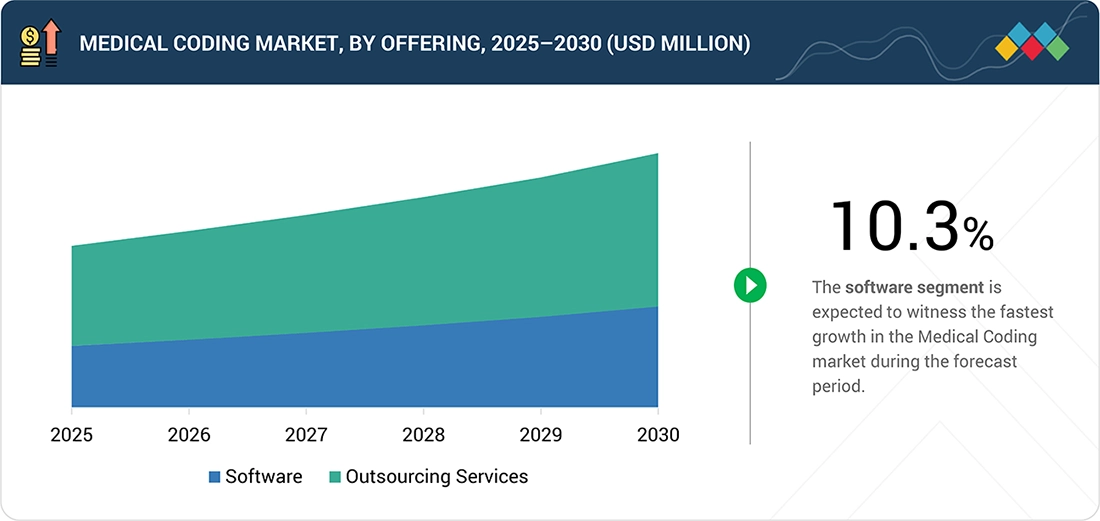

By OfferingBy offering, the software segment is projected to register the highest CAGR of 10.3%

-

By Specialty TypeBy specialty type, the radiology & imaging segment is estimated to register the highest CAGR of 10.4%

-

By Classification TypeBy classification, the ICD segment is estimated to lead the market.

-

By FunctionBy function, the code assignment & validation segment is set to grow the fastest during the forecast period.

-

By End UserBy end user, the healthcare providers segment dominates the medical coding market.

-

Competitive Landscape - Key PlayersOracle, 3M, and Veradigm were identified as some of the star players in the medical coding market, given their strong market share and product footprint.

-

Competitive Landscape - StartupsArintra and Clinion, among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

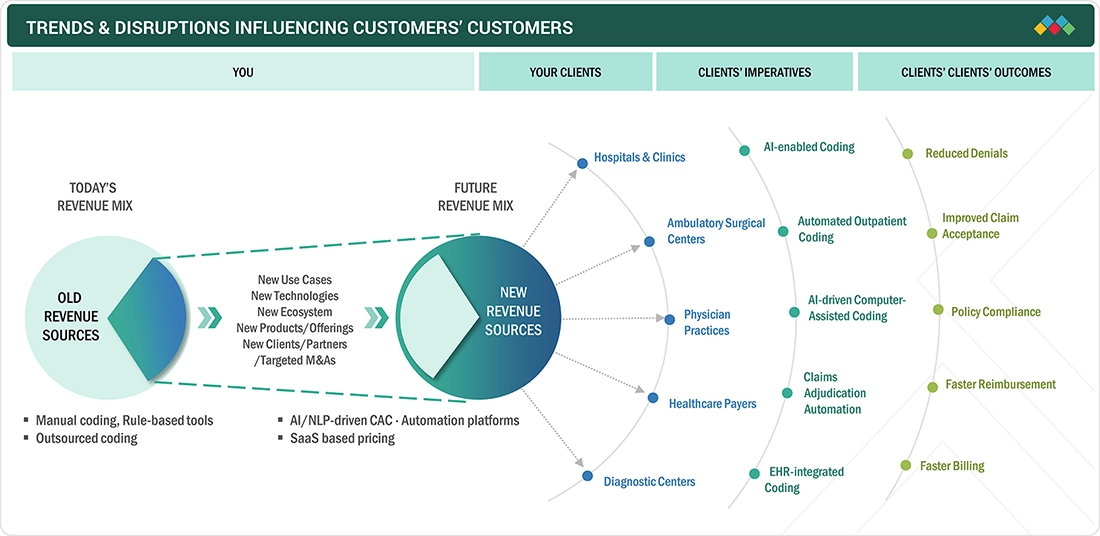

Healthcare providers and payers are increasingly outsourcing coding and adopting AI- and automation-enabled coding solutions to improve accuracy, reduce claim denials, and lower administrative costs. Additionally, evolving regulatory requirements and complex coding standards (ICD, CPT, HCPCS) continue to support sustained demand for medical coding services and platforms globally.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The medical coding market is moving from manual, rule-based workflows to AI-enabled and automated coding solutions, driven by increasing claim complexity and reimbursement scrutiny. Adoption of computer-assisted coding and EHR-integrated automation is improving coding accuracy, reducing denials, and accelerating reimbursement across healthcare providers and payers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growing Demand For Accurate Healthcare Billing And Reimbursement

-

Increasing Healthcare Expenditure And Patient Data Volume

Level

-

Shortage Of Skilled Medical Coders

-

Frequent Changes In Coding Standards And Regulations

Level

-

Scaling AI/NLP-Driven CAC Tools For Mid-Tier And Ambulatory Providers

-

Expanding Managed Coding and RCM Delivery Models

Level

-

Complex Unstructured Medical Data

-

Third-Party Vendor Lock-In

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growing Demand For Accurate Healthcare Billing And Reimbursement

The demand for accurate billing and reimbursement in the healthcare industry is fueled by the complexity inherent in the standards and processes of healthcare reimbursement. The healthcare industry is under pressure in terms of reducing denials of reimbursement, revenue leakage, and staying ahead with the changing standards of billing. The US healthcare industry must cope with very complex systems like ICD-10-CM, CPT, and payer systems while minimizing the denials and revenue leakage. Even minor errors in coding can lead to delayed payments, audits, or penalties, thereby urging hospitals, physician groups, and ambulatory centers to embrace efficient billing, coding, and revenue cycle systems.

Restraint: Shortage Of Skilled Medical Coders

The lack of qualified medical coders is still a significant impedance to the growth of the medical coding field because medical coders are required to be constantly updated, certified, and thoroughly aware of continuously changing medical coding rules and regulations, because many health care facilities are facing difficulties regarding the retention and acquisition of qualified medical coders, which has potentially led to complications regarding medical coding, medical coding errors, denial of claims, and lack of compliance.

Opportunity: Scaling AI/NLP-Driven CAC Tools For Mid-tier And Ambulatory Providers

Scaling AI- and NLP-enabled computer-assisted coding (CAC) solutions has immense potential within the medical coding industry, especially within medium-sized medical facilities and ambulatory care settings, which are subject to an ever-increasing volume of documentation and an inability to effectively utilize qualified coders. The need for an efficient coding solution at a low cost, which does not require many more employees, will drive a faster adoption of CAC within ambulatory care organizations, owing to recent advancements in AI technology, making it more efficient to implement within EHR infrastructures.

Challenge: Complex Unstructured Medical Data

Complex and unstructured data in the medical field has been a major concern for the medical coding industry, as a substantial amount of medical information has been represented in free text form by physician notes, discharge summaries, and narrative reports. Different styles of representation, usage of non-standard terms, and the lack of comprehensive data can lead to a time-consuming process of medical code assignments. Added to that, the dependence on manual processes, the possibility of errors, and the ineffectiveness of AI/NLP-driven medical solutions have been major concerns.

MEDICAL CODING MARKET: GROWTH, SIZE, SHARE, AND TRENDS: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Provides large-scale medical coding and coding automation services integrated with revenue cycle management (RCM), leveraging AI/ML to support ICD, CPT, and HCPCS coding across inpatient and outpatient settings | Improves coding accuracy | Reduces claim denials | Accelerates reimbursement cycles | Lowers administrative costs for providers and payers |

|

Offers EHR-embedded coding workflows and clinical documentation support tools that assist coders and clinicians in accurate code assignment | Streamlines coding within clinical workflows | Reduces documentation gaps | Supports faster billing and reimbursement |

|

Provides advanced medical coding software, CAC (computer-assisted coding), and CDI tools supporting complex inpatient and outpatient coding | Increases coding productivity | Improves code quality | Supports compliance with evolving coding standards |

|

Delivers end-to-end medical coding and auditing services as part of its RCM platform, supporting hospitals and health systems with compliant and specialty-specific coding | Enhances revenue integrity | Reduces coding backlogs, ensures regulatory compliance | Improves financial performance |

|

Provides outsourced medical coding services using certified coders and automation across inpatient and outpatient settings | Improves coding accuracy | Reduces denials | Accelerates reimbursement while lowering administrative costs |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The medical coding market ecosystem includes key coding technology vendors (Optum, Oracle, R1 RCM), startups (NYM, Arintra), regulatory bodies such as the Centers for Medicare & Medicaid Services, and end users, including hospitals, payers, and ambulatory care centers. These stakeholders collectively support accurate code assignment, compliance, and efficient claims processing across the healthcare system.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Medical Coding Market, by Offering

In 2024, the outsourcing services segment held the largest share of the medical coding market because of the lack of coders and the increased number of claims on one side, and pressure due to costs on the other side. The healthcare centers and hospitals are leaning towards outsourcing coding services from third-party service providers to ensure efficient and error-free coding practices. Outsourcing enables healthcare centers and hospitals to quickly scale and leverage the coding expertise of various specialties.

Medical Coding Market, by Classification Type

In 2024, ICD (International Classification of Diseases) held the largest share in the medical coding market as it is the base coding scheme employed for the diagnosis classification of patients in any health setup, from inpatient facilities to physician services. The ICD codes are mandatory for insurance and medical reporting purposes and play an integral role in every medical insurance claim. CPT is mainly concerned with physician services and procedures, and HCPCS codes are employed for medical supplies, medical devices, and other non-physician services. Although CPT and HCPCS play an essential role in completing the medical insurance process, ICD still retains its predominant role in the overall adoption of coding schemes.

Medical Coding Market, by Specialty Type

In 2024, general medicine held the largest share of the medical coding market due to the high volume of routine patient visits, chronic disease management, and primary care services delivered across healthcare systems. General medicine encounters generate consistent and recurring coding demand for diagnoses, procedures, and follow-up care, making them a major contributor to overall claim volumes. In addition, the broad scope of conditions treated under general medicine, combined with frequent documentation and billing requirements, reinforces its dominant share compared with the more specialized clinical segment.

Medical Coding Market, by Function

In 2024, code assignment & validation held the largest share of the medical coding market as it is the core of the medical coding workflow, required for every inpatient, outpatient, and professional claim. All reimbursement processes depend on accurate code assignment and validation against payer and regulatory rules, making it the most widely adopted and consistently used function across healthcare providers. Other functions, such as documentation review, denial prevention, audits, and analytics, are typically layered around or built on top of code assignment rather than replacing it.

Medical Coding Market, by End User

In 2024, healthcare providers held the largest share of the medical coding market because they are directly involved in clinical documentation, code assignment, and claims reimbursement in inpatient, outpatient, and professional environments. The patient volume created in hospitals, physician practices, and ambulatory centers also necessitates accurate and time-efficient coding. It can be anticipated that the complexity in documentation processes, increased scrutiny by insurance payers, and increased emphasis on denials management would encourage providers to spend heavily on coding solutions and services, solidifying their stronghold in the market.

REGION

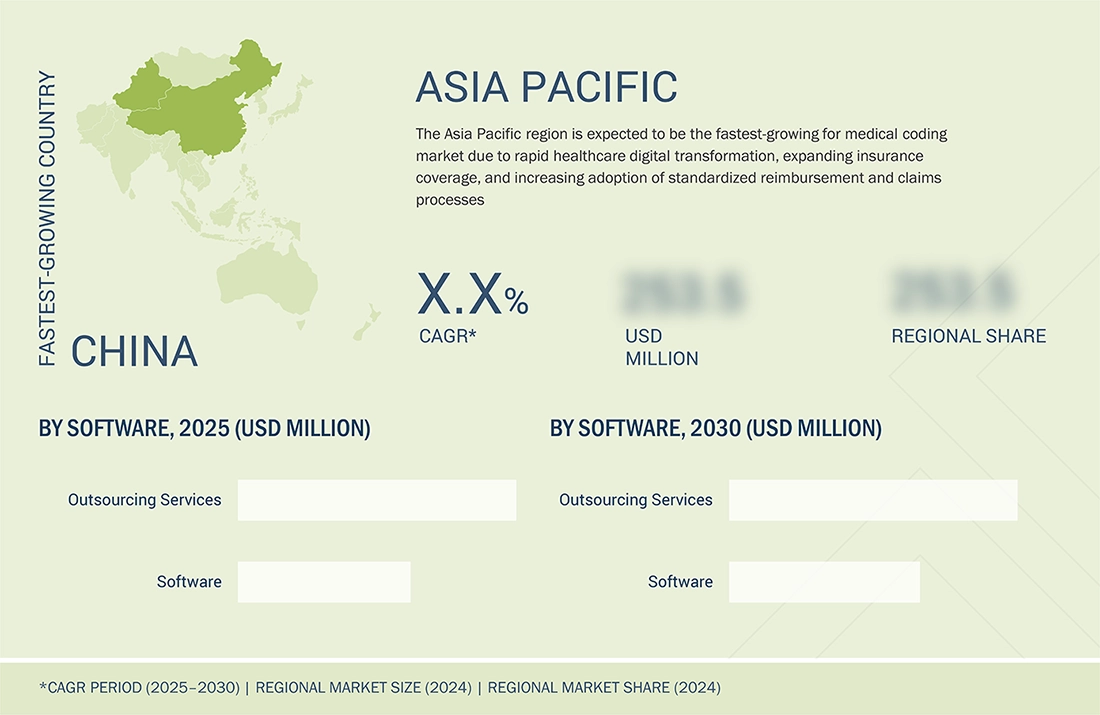

Asia Pacific is expected to be the fastest-growing region in the medical coding market during the forecast period

Asia Pacific is projected to be the fastest-growing region in the medical coding market, driven by factors such as the fast growth of digital transformation of healthcare, an increased number of people getting healthcare coverage, and an increased need for precise billing and subsequent reimbursement practices. Healthcare institutions worldwide have begun to adopt electronic medical records and systematic coding processes for enhanced support with claims and compliance. Coinciding with these developments, nations such as India and China have become hubs for outsourced medical coding services globally.

MEDICAL CODING MARKET: GROWTH, SIZE, SHARE, AND TRENDS: COMPANY EVALUATION MATRIX

In the medical coding market matrix, Optum (Star Player) leads with a dominant presence, supported by its deep integration of medical coding within end-to-end revenue cycle management (RCM), and strong use of AI and analytics. TruBridge (Emerging Leader) is driven by its scalable global delivery model, specialty coding expertise, and growing use of technology-enabled and AI-assisted coding solutions.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Optum, Inc. (US)

- Oracle (US)

- Solventum (US)

- R1 RCM (US)

- AGS Health (US)

- Access Healthcare (US)

- NXGN Management, LLC (US)

- Conifer Health Solutions (US)

- Veradigm LLC (US)

- eClinicalWorks (US)

- Cognizant (US)

- athenahealth (US)

- Coronis Health (US)

- Quest Diagnostics (US)

- GeBBS (US)

- TruBridge (US)

- CareCloud, Inc. (US)

- Nuance Communications, Inc.

- AdvancedMD, Inc. (US)

- Dolbey (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size, 2024 (Value) | USD 8.18 Billion |

| Market Forecast, 2030 (Value) | USD 14.01 Billion |

| Growth Rate | CAGR of 9.5% from 2025 to 2030 |

| Years Considered | 2023–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million/Billion) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Region Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

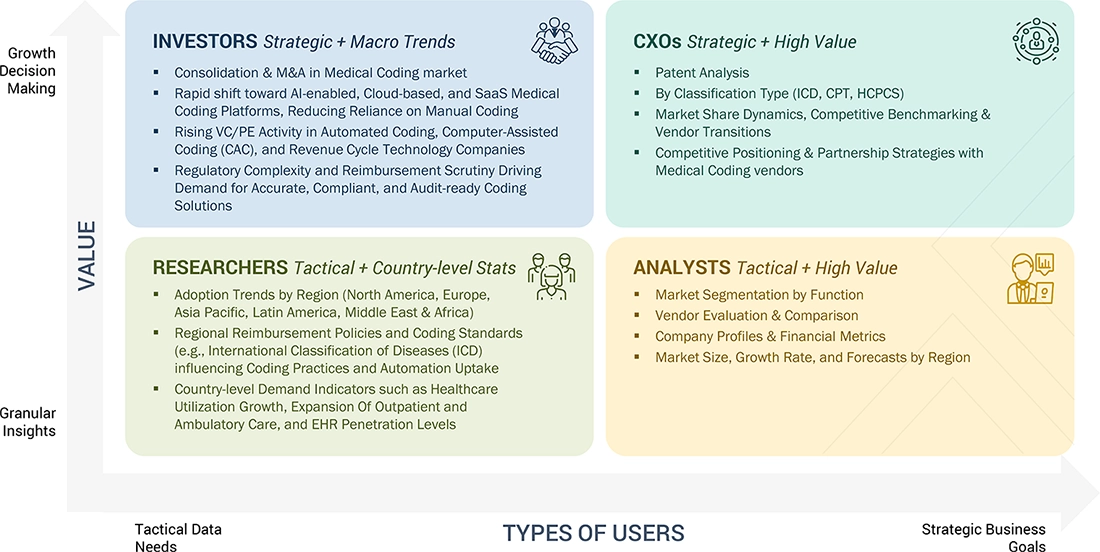

WHAT IS IN IT FOR YOU: MEDICAL CODING MARKET: GROWTH, SIZE, SHARE, AND TRENDS REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Local Competitive Landscape | Analysis of leading medical coding providers covering coding scope, automation capabilities, compliance standards, delivery models, and pricing structures | Supports competitive benchmarking, vendor selection, partnership evaluation, and market positioning |

| Regional Market Entry Strategy | Assessment of regional reimbursement systems, coding standards, regulatory requirements, provider adoption, and outsourcing ecosystems across key markets | Enables faster market entry, optimized go-to-market strategy, and regulatory alignment |

| Local Risk & Opportunity Assessment | Evaluation of compliance risks, workforce availability, data security requirements, denial trends, and specialty-level growth opportunities | Strengthens risk mitigation, guides investment decisions, and identifies high-growth segments |

| Technology Adoption by Region | Mapping adoption of AI-assisted coding, CAC, EHR-integrated workflows, and coding analytics across regions | Informs technology strategy and supports automation-led, compliant coding solutions |

RECENT DEVELOPMENTS

- October 2025 : R1 RCM entered into an agreement to acquire Phare Health, an AI-native platform focused on automating inpatient coding and pre-bill clinical documentation improvement.

- October 2025 : athenahealth has introduced AI-native capabilities in its athenaOne platform, embedding artificial intelligence across practice operations and revenue cycle workflows.

- October 2025 : R1 RCM launched Phare, an AI-powered revenue operating system that unifies automation, clinical documentation, and medical coding into a single, integrated platform, reducing reliance on fragmented point solutions

Table of Contents

Methodology

During this research study, major players operating in the medical coding market in various regions have been identified, and their offerings, regional presence, and distribution channels have been analyzed through in-depth discussions. Top-down and bottom-up approaches have been used to determine the overall market size. Sizes of the other individual markets have been estimated using the percentage splits obtained through secondary sources such as Hoovers, Bloomberg BusinessWeek, and Factiva, along with primary respondents. The entire procedure includes the study of the annual and financial reports of the top market players and extensive interviews with industry experts such as CEOs, VPs, directors, and marketing executives for key insights (both qualitative and quantitative) pertaining to the market. The figure below shows the breakdown of the primaries on the basis of the company type, designation, and region considered during the research study.

To know about the assumptions considered for the study, download the pdf brochure

The medical coding market comprises a network of players involved in the research and product development; raw material supply; component manufacturing; distribution and sale; and post-sales services. Key players considered in the analysis of the medical coding market are 3M Health Information Systems (US), Optum (US), McKesson Corporation (US), Nuance Communications (US), Cerner Corporation (US), Dolbey Systems (US), Precyse Solutions (nThrive) (US), Craneware (UK), Artificial Medical Intelligence (US), and TruCode (US). Other players include Quest Diagnostics (US), Streamline Health Solutions (US), M-scribe Technologies (US), eZDI Inc. (US), Alpha II LLC. (US), ID GmbH & Co. KGaA (Germany), ZyDoc (US), Coding Strategies (US), Patient Code Software (US), and Flash Code (US) among others.

Major Market Developments

- 3M Company (US) launched the 3M 360 Encompass System – Professional medical coding software in 2016.

- 3M Company (US) acquired Semfinder (Switzerland), a medical coding technology company, provided 3M with important new coding technology to help accelerate the availability of the 3M 360 Encompass System in countries adopting electronic medical records in 2016.

- In 2016, Optum (US) collaborated with Quest Diagnostics (US), a provider of diagnostic information services, to deliver improved health systems solutions to all segments of the healthcare marketplace.

Target Audience

- Computer-assisted coding software vendors

- Computer-assisted coding service providers

- Healthcare IT solution providers

- Hospitals and clinics

- Academic medical centers

- Nursing homes

- Assisted living facilities

- Healthcare insurance providers

- Market research and consulting firms

- Venture capitalists and investors

Medical Coding Market Report Scope

Global Computer-assisted Coding Market, by Product & Service

-

Computer-assisted coding solutions

- Standalone computer-assisted coding software

- Integrated computer-assisted coding software

-

Computer-assisted coding services

- Support & maintenance services

- Education & training Services

Global Computer-assisted Coding Market, by Mode Of Delivery

- Web-based

- Cloud-based

- On Premises

Global Computer-assisted Coding Market, by Application

- Automated computer-assisted encoding

- Management reporting & analytics

- Clinical code auditing

Global Computer-assisted Coding Market, by End User

- Payers

-

Providers

- Hospitals

- Physicians/Clinics

- Clinical laboratories & diagnostic centers

- Academic medical centers

- Other healthcare institutions*

*Other Healthcare Institutions (Nursing Homes, Rehabilitation Centers, and Clinical Research Organizations)

Global Computer-assisted Coding Market, by Region

-

North America

- US

- Canada

-

Europe

- France

- Germany

- UK

- Spain

- Italy

- Rest of Europe

-

Asia-Pacific

- China

- Japan

- Australia

- Rest of Asia-Pacific

-

Rest of the world

- Latin America

- Middle East and Africa

Critical questions which the report answers

- What are new application areas which the medical coding companies are exploring?

- Which are the key players in the market and how intense is the competition?

Available Customizations

Based on the given market data, MarketsandMarkets offers customizations in the reports as per the client’s specific requirements. The available customization options are as follows:

Geographic Analysis

- Further country-wise breakdown of the market in Rest of APAC, Latin America, and Middle East and Africa based on product

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Medical Coding Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Medical Coding Market