MOOC Market by Component (Platforms (XMOOC and CMOOC), Services), Course (Humanities, Computer Science and Programming, and Business Management), User Type (High School, Undergraduate, Postgraduate, and Corporate) and Region - Global Forecast to 2023

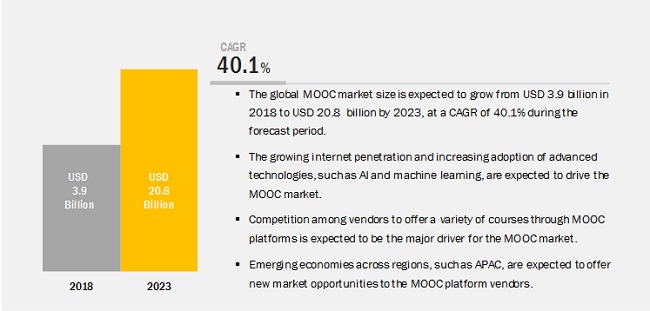

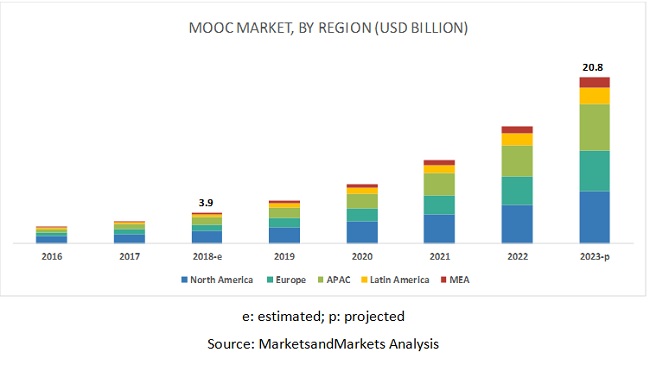

[145 Pages Report] The global MOOC market size is expected to grow from USD 3.9 billion in 2018 to USD 20.8 billion by 2023, at a Compound Annual Growth Rate (CAGR) of 40.1% during the forecast period. MOOC is a course with the option of free and open registration and is a publicly shared platform with open-ended groups. MOOCs integrate social networking and accessible online resources facilitated by leading practitioners in their respective fields of study. MOOC builds on the engagement of learners who self-organize their participation according to learning goals, prior knowledge and skills, and common interests. The need of the scalable and economical educational platform to cater to the need of learners across the globe is boosting the growth of the Massive Open Online Course Market at a high CAGR.

The MOOC market study aims at estimating the market size and growth potential of the market across segments, such as component (platform and services), course, user type, and region.

Service segment to hold the largest market size during the forecast period

The MOOC market by component covers MOOC platform and associated services. The service segment is expected to outgrow the platform segment and see the maturation in the future due to the higher adoption.

Corporate user type segment to continue its dominance in terms of revenue generation during the forecast period

Corporates are increasingly adopting the MOOC as a part of their employee engagement and development program. They implement MOOC platforms for various purposes, such as training and development, professional certification, and professional courses for developing their employees’ strategic thinking abilities and improve the production and brand value of the company. The Massive Open Online Course acts as a cost-effective learning platform to enhance the skillsets of the employees and enable organizations to track their employees progress.

Education and training course type to grow at the highest CAGR during the forecast period

Education and training facilitates learners with knowledge, values, beliefs, habits, and skills, and helps them to implement the same in various enterprises. In the era of continuous advancements where professional upfront demands adaptation to innovative technologies, education and training courses help teachers, educators, professors, and trainers to enhance their teaching or training skills. These MOOC courses also equip the faculty and teaching staff of universities and colleges to understand the modern pedagogical approaches required by the learners. Several companies have formed partnerships with MOOC market vendors to equip their employees with knowledge, how to implement required skills for competences in particular occupations or more broadly on the labor market.

North America to hold the largest market size during the forecast period

The global market by region covers 5 major geographic regions: North America, Asia Pacific (APAC), Europe, the Middle East and Africa (MEA), and Latin America. North America is projected to hold the largest market size during the forecast period, owing to a large presence of many solution vendors in the US.

Key Target Players for MOOC Market

The Massive Open Online Course Market comprises major solution providers, such as Coursera (US), edX (US), Pluralsight (US), Edureka (India), Alison (Ireland), Udacity (US), Udemy (US), Miríadax (Spain), Jigsaw Academy (India), Simplilearn (US), iversity (Germany), Intellipaat (India), Edmodo (US), FutureLearn (UK), LinkedIn (US), NovoEd (US), Open2Study (Australia), WizIQ (India), Skillshare (US), XuetangX (China), Federica (Italy), Linkstreet Learning (India), Khan Academy (US), and Kadenze (Spain).

The study includes in-depth competitive analysis of key players in the MOOC market with their company profiles, recent developments, and key market strategies. The players in the market have embraced different growth strategies to expand their global presence and market shares. New product launches and upgradations, partnerships, agreements, and collaborations, have been major growth strategies adopted by the leading players from 2016 to 2018, which helped them innovate on their offerings and broaden their customer base.

Recent Developments:

- In October 2018, edX introduced 9 new Master’s degree programs from top global institutions in highly in-demand subjects, such as data science, cybersecurity, computer science, analytics, and supply chain management. The enhanced version of the MicroMasters Program can be stacked into a fully online Master’s degree program, thus strengthening the Master’s degree application.

- In June 2018, LinkedIn partnered with LMS providers - Cornerstone OnDemand and SAP SuccessFactors - to boost LinkedIn learner’s growth and reach on respective company websites.

- IN March 2018, Coursera partnered with 5 universities to expand its Master’s and Bachelor’s degree offerings to drive more learner base. IT would help the company expand its presence in universities to provide full degree courses.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Key Questions addressed by the report:

- Where will all these developments take the industry in the mid to long-term?

- What are the drivers, restraints, opportunities, and challenges of the MOOC Market?

- Which are the leading players operating in the Massive Open Online Course Market?

- How is the market segmented into different courses, user types, and components?

- How is the market segmented into 5 major regions–North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America?

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Segmentation

1.3.1 Regions Covered

1.4 Years Considered for the Study

1.5 Currency

1.6 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakup of Primaries

2.1.2.2 Key Industry Insights

2.2 Market Breakup and Data Triangulation

2.3 Market Size Estimation

2.3.1 Bottom-Up Approach

2.3.2 Top-Down Approach

2.3.3 Assumptions for the Study

2.4 Limitations of the Study

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 31)

4.1 Attractive Market Opportunities in the MOOC Market

4.2 Market, By Component

4.3 Market, Top 3 Segments

4.4 Market, By Region

4.5 Market in Europe: Top 3 User Types and Country

5 Market Overview and Industry Trends (Page No. - 34)

5.1 Introduction

5.1.1 Drivers

5.1.1.1 Need for Scalable Open Education

5.1.1.2 Necessity for Cost-Effective Education Platforms

5.1.1.3 Increasing Requirement for Global Training

5.1.2 Restraints

5.1.2.1 Low Completion Rate

5.1.3 Opportunities

5.1.3.1 Mobility and Ease of Use

5.1.4 Challenges

5.1.4.1 Lack of Personalized Guidance and Mentorship

5.1.4.2 Inefficiency in Tracking and Validating the Progress

5.2 Industry Trends

5.2.1 MOOC: Use Cases

5.2.1.1 Use Case #1: Providing On-Demand Learning Opportunities to Worldpac’s Employees

5.2.1.2 Use Case #2: Improving Prisoners’ Engagement Using MOOC

5.2.2 Regulations

5.2.2.1 Payment Card Industry-Data Security Standard

5.2.2.2 Health Insurance Portability and Accountability Act

5.2.2.3 Aviation Industry Computer-Based Training Committee

5.2.2.4 Common Cartridge

5.2.2.5 Experience Api

5.2.2.6 Learning Tools Interoperability

5.2.2.7 Shareable Content Object Reference Model

5.2.2.8 European Union General Data Protection Regulation

5.2.3 Future Outlook

6 MOOC Market, By Component (Page No. - 41)

6.1 Introduction

6.2 Platforms

6.2.1 XMOOC

6.2.1.1 Rise in College Fee and Shrinking Value of Undergraduate Degrees to Encourage Adoption of XMOOC Platforms

6.2.2 CMOOC

6.2.2.1 Flexibility in Scheduling Meetings and Organizing Learning Discussions to Increase

6.3 Services

6.3.1 Consulting

6.3.1.1 Increasing Need to Seamlessly Align MOOC Platforms and Meet Educational and Learning Queries

6.3.2 Implementation

6.3.2.1 Increasing Need of Universities and Organizations to Create Their Own Cost-Efficient Solutions

6.3.3 Training and Support

6.3.3.1 Need to Deploy and Implement Error-Free MOOCs

7 Market, By Course (Page No. - 50)

7.1 Introduction

7.2 Humanities

7.2.1 Number of Partnerships to Increase and New Courses to Be Introduced

7.3 Computer Science and Programming

7.3.1 Enterprises to Adopt More Iot-Based Platforms to Upskill Their Workforce

7.4 Business Management

7.4.1 Government Initiatives, and Collaborations and Partnerships to Increase the Number of University Courses

7.5 Science

7.5.1 Number of Partnerships Among Universities and Solution Vendors to Increase

7.6 Health and Medicine

7.6.1 Availability of Credit-Based Courses to Increase

7.7 Education and Training

7.7.1 Number of Partnerships Between Corporates and Solution Vendors Leads to Increase

7.8 Engineering

7.8.1 Partnerships Between Solution Vendors and Engineering Industries to Complement Each Other

7.9 Others

8 Market, By User Type (Page No. - 58)

8.1 Introduction

8.2 High School

8.2.1 Universities and Governments to Launch Initiatives for Online Courses

8.3 Undergraduate

8.3.1 Increasing Need to Reduce Attrition Rate and Disengagement of Students

8.4 Postgraduate

8.4.1 Education Sector to Undergo Digitalization

8.5 Corporate

8.5.1 Need to Enhance Skill Sets of Employees

9 MOOC Market, By Region (Page No. - 64)

9.1 Introduction

9.2 North America

9.2.1 United States

9.2.1.1 Government to Increase Investments for Adopting MOOC Platforms

9.2.2 Canada

9.2.2.1 Universities in Canada to Adopt More MOOC Platforms and Services

9.3 Europe

9.3.1 Germany

9.3.1.1 Educational Institutions to Show More Inclination Toward the Adoption of MOOC Platforms

9.3.2 United Kingdom

9.3.2.1 The UK to Invest More in MOOC Platforms and Services to Enhance the Services of the Education Sector

9.3.3 France

9.3.3.1 Platform Providers to Engage More in Partnerships and Acquisitions to Enhance Their Offerings

9.3.4 Russia

9.3.4.1 Universities’ Initiatives to Certify Competencies Attract More MOOC Vendors

9.3.5 Rest of Europe

9.4 Asia Pacific

9.4.1 Japan

9.4.1.1 Japanese Universities to Create More Awareness of MOOC Platforms Among Learners

9.4.2 China

9.4.2.1 The Well-Established Infrastructure Industry to Support the Growth of MOOC Platforms and Services

9.4.3 Singapore

9.4.3.1 More Number of Companies to Engage With the Government to Launch More MOOC Platforms

9.4.4 India

9.4.4.1 Increasing Government Initiatives and Startup Ecosystem to Support the Adoption of MOOC Platforms

9.4.5 Australia

9.4.5.1 The Ongoing Digital Transformation in the Education Sector to Foster the Growth of MOOC Platforms

9.4.6 Rest of APAC

9.5 Latin America

9.5.1 Mexico

9.5.1.1 Increasing Adoption of Smartphones and 4g to Boost the Adoption of MOOC Platforms and Services

9.5.2 Brazil

9.5.2.1 The Increasing 4g Adoption Rate to Positively Impact the Adoption of MOOC Platforms

9.5.3 Rest of Latin America

9.6 Middle East and Africa

9.6.1 Middle East

9.6.1.1 Government Initiatives and New Inventions to Boost MOOC Adoption

9.6.2 Africa

9.6.2.1 Government Initiatives for Primary Education to Boost the Adoption of MOOC Platforms

10 Competitive Landscape (Page No. - 85)

10.1 Microquadrant Overview

10.1.1 Visionaries

10.1.2 Innovators

10.1.3 Dynamic Differentiators

10.1.4 Emerging Companies

10.2 Competitive Benchmarking

10.2.1 Business Strategy Excellence Adopted By Major Players in the MOOC Market

10.2.2 Strength of Product Portfolio Adopted By Major Players in the Massive Open Online Course Market

10.3 Competitive Scenario

10.3.1 New Product Launches and Product Upgradations

10.3.2 Partnerships and Collaborations

10.3.3 Acquisitions

10.3.4 Business Expansions

11 Company Profiles (Page No. - 93)

(Business Overview, Platforms Offered, Recent Developments, SWOT Analysis, and MNM View)*

11.1 Pluralsight

11.2 Coursera

11.3 EDX

11.4 Iversity

11.5 Udacity

11.6 Linkedin

11.7 Futurelearn

11.8 Novoed

11.9 Udemy

11.10 Xuetangx

11.11 Alison

11.12 Edmodo

11.13 Edureka

11.14 Federica EU

11.15 Intellipaat

11.16 Jigsaw Academy

11.17 Kadenze

11.18 Khan Academy

11.19 Linkstreet Learning

11.20 Miríadax

11.21 My MOOC

11.22 Open2study

11.23 Simplilearn

11.24 Skillshare

11.25 Wiziq

*Details on Business Overview, Platforms Offered, Recent Developments, SWOT Analysis, and MNM View might not be captured in case of unlisted companies.

12 Appendix (Page No. - 137)

12.1 Insights From Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.4 Available Customizations

12.5 Related Reports

12.6 Author Details

List of Tables (67 Tables)

Table 1 MOOC Market Size and Growth Rate, 2016–2023 (USD Million, Y-O-Y %)

Table 2 Market Size, By Component, 2016–2023 (USD Million)

Table 3 Platforms: Market Size, By Region, 2016–2023 (USD Million)

Table 4 Platforms: Massive Open Online Course Market Size, By Type, 2016–2023 (USD Million)

Table 5 XMOOC Market Size, By Region, 2016–2023 (USD Million)

Table 6 XMOOC Market Size, By User Type, 2016–2023 (USD Million)

Table 7 CMOOC Market Size, By Region, 2016–2023 (USD Million)

Table 8 CMOOC Market Size, By User Type, 2016–2023 (USD Million)

Table 9 Services: MOOC Market Size, By Region, 2016–2023 (USD Million)

Table 10 Services: Market Size, By Type, 2016–2023 (USD Million)

Table 11 Consulting Market Size, By Region, 2016–2023 (USD Million)

Table 12 Implementation Market Size, By Region, 2016–2023 (USD Million)

Table 13 Training and Support Market Size, By Region, 2016–2023 (USD Million)

Table 14 Market Size, By Course, 2016–2023 (USD Million)

Table 15 Humanities: Market Size, By Region, 2016–2023 (USD Million)

Table 16 Computer Science and Programming: MOOC Market Size, By Region, 2016–2023 (USD Million)

Table 17 Business Management: Massive Open Online Course Market Size, By Region, 2016–2023 (USD Million)

Table 18 Science: Market Size, By Region, 2016–2023 (USD Million)

Table 19 Health and Medicine: Market Size, By Region, 2016–2023 (USD Million)

Table 20 Education and Training: Market Size, By Region, 2016–2023 (USD Million)

Table 21 Engineering: Market Size, By Region, 2016–2023 (USD Million)

Table 22 Others: Market Size, By Region, 2016–2023 (USD Million)

Table 23 Market Size, By User Type, 2016–2023 (USD Million)

Table 24 High School: MOOC Market Size, By Platform, 2016–2023 (USD Million)

Table 25 High School: Massive Open Online Course Market Size, By Region, 2016–2023 (USD Million)

Table 26 Undergraduate: Market Size, By Platform, 2016–2023 (USD Million)

Table 27 Undergraduate: Market Size, By Region, 2016–2023 (USD Million)

Table 28 Postgraduate: Market Size, By Platform, 2016–2023 (USD Million)

Table 29 Postgraduate: Market Size, By Region, 2016–2023 (USD Million)

Table 30 Corporate: Market Size, By Platform, 2016–2023 (USD Million)

Table 31 Corporate: Market Size, By Region, 2016–2023 (USD Million)

Table 32 Market Size, By Region, 2016–2023 (USD Million)

Table 33 North America: MOOC Market Size, By Component, 2016–2023 (USD Million)

Table 34 North America: Massive Open Online Course Market Size, By Platform, 2016–2023 (USD Million)

Table 35 North America: Market Size, By Service, 2016–2023 (USD Million)

Table 36 North America: Market Size, By User Type, 2016–2023 (USD Million)

Table 37 North America: Market Size, By Course, 2016–2023 (USD Million)

Table 38 North America: Market Size, By Country, 2016–2023 (USD Million)

Table 39 Europe: MOOC Market Size, By Component, 2016–2023 (USD Million)

Table 40 Europe: Market Size, By Platform, 2016–2023 (USD Million)

Table 41 Europe: Market Size, By Service, 2016–2023 (USD Million)

Table 42 Europe: Market Size, By User Type, 2016–2023 (USD Million)

Table 43 Europe: Market Size, By Course, 2016–2023 (USD Million)

Table 44 Europe: Market Size, By Country, 2016–2023 (USD Million)

Table 45 Asia Pacific: MOOC Market Size, By Component, 2016–2023 (USD Million)

Table 46 Asia Pacific: Massive Open Online Course Market Size, By Platform, 2016–2023 (USD Million)

Table 47 Asia Pacific: Market Size, By Service, 2016–2023 (USD Million)

Table 48 Asia Pacific: Market Size, By User Type, 2016–2023 (USD Million)

Table 49 Asia Pacific: Market Size, By Course, 2016–2023 (USD Million)

Table 50 Asia Pacific: Market Size, By Country, 2016–2023 (USD Million)

Table 51 Latin America: MOOC Market Size, By Component, 2016–2023 (USD Million)

Table 52 Latin America: Market Size, By Platform, 2016–2023 (USD Million)

Table 53 Latin America: Market Size, By Service, 2016–2023 (USD Million)

Table 54 Latin America: Market Size, By User Type, 2016–2023 (USD Million)

Table 55 Latin America: Market Size, By Course, 2016–2023 (USD Million)

Table 56 Latin America: Market Size, By Country, 2016–2023 (USD Million)

Table 57 Middle East and Africa: MOOC Market Size, By Component, 2016–2023 (USD Million)

Table 58 Middle East and Africa: Market Size, By Platform, 2016–2023 (USD Million)

Table 59 Middle East and Africa: Market Size, By Service, 2016–2023 (USD Million)

Table 60 Middle East and Africa: Market Size, By User Type, 2016–2023 (USD Million)

Table 61 Middle East and Africa: Market Size, By Course, 2016–2023 (USD Million)

Table 62 MEA: Market Size, By Subregion, 2016–2023 (USD Million)

Table 63 Market Ranking for the Massive Open Online Course Market, 2018

Table 64 New Product Launches and Product Upgradations, 2016–2018

Table 65 Partnerships and Collaborations, 2016–2018

Table 66 Acquisitions, 2016–2018

Table 67 Business Expansions, 2016–2018

List of Figures (29 Figures)

Figure 1 MOOC Market: Research Design

Figure 2 Market: Bottom-Up Approach

Figure 3 Market: Top-Down Approach

Figure 4 Global Market to Register Significant Growth During the Forecast Period

Figure 5 Market Snapshot, By Component, 2018 vs 2023

Figure 6 Market Snapshot, By Platform, 2018 vs 2023

Figure 7 Market Snapshot, By Service, 2018 vs 2023

Figure 8 Market Snapshot, By Course, 2018 vs 2023

Figure 9 Market Snapshot, By User Type, 2018–2023

Figure 10 Growing Internet Penetration to Be A Major Driver for the Massive Open Online Course Market

Figure 11 Services Segment to Dominate the MOOC Market During Forecast Period

Figure 12 Services Segment to Hold the Highest MArket Share During the Forecast Period

Figure 13 Asia Pacific to Grow at the Highest CAGR During the Forecast Period

Figure 14 Corporate User Type and the United Kingdom to Hold the Highest Market Shares in 2018

Figure 15 Market: Drivers, Restraints, Opportunities, and Challenges

Figure 16 Services Segment to Grow at A Higher CAGR During the Forecast Period

Figure 17 Education and Training Segment to Grow at the Highest CAGR During the Forecast Period

Figure 18 Postgraduate Segment to Grow at the Highest CAGR During the Forecast Period

Figure 19 Asia Pacific to Emerge as A New Hotspot in 2023

Figure 20 North America: Market Snapshot

Figure 21 Asia Pacific: Market Snapshot

Figure 22 MOOC Market (Global), Competitive Leadership Mapping, 2018

Figure 23 Key Developments By Leading Players in the Massive Open Online Course Market, 2015–2018

Figure 24 Pluralsight: Company Snapshot

Figure 25 SWOT Analysis: Pluralsight

Figure 26 SWOT Analysis: Coursera

Figure 27 SWOT Analysis: EDX

Figure 28 SWOT Analysis: Iversity

Figure 29 SWOT Analysis: Udacity

The study involved 4 major activities to estimate the current market size for MOOC platform and services. Exhaustive secondary research was done to collect information on market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakup and data triangulation were used to estimate the MOOC Market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as D&B Hoovers and Bloomberg BusinessWeek, , have been referred to for identifying and collecting information for this study. The secondary sources included annual reports; press releases and investor presentations of companies; white papers, certified publications, articles by recognized authors; gold standard and silver standard websites; education and learning technology Research and Development (R&D) organizations; regulatory bodies; and databases.

Primary Research

Various primary sources from both supply and demand sides of the MOOC market ecosystem were interviewed to obtain qualitative and quantitative information for this study. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various vendors providing the MOOC platform, associated service providers, and system integrators operating in the targeted regions. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data.

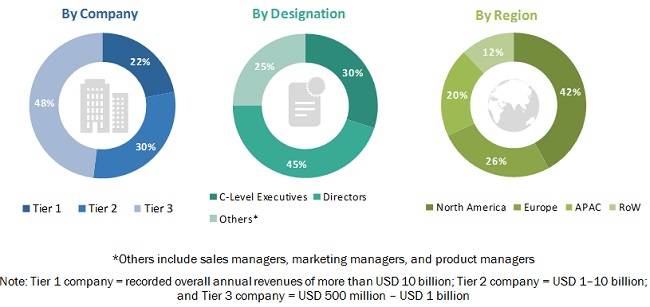

The breakup of primary respondents’ profiles is as follows:

To know about the assumptions considered for the study, download the pdf brochure

MOOC Market Size Estimation

For making market estimates and forecasting the market, and the other dependent submarkets, top-down and bottom-up approaches were used. The bottom-up procedure was used to arrive at the overall market size of the global MOOC market using key companies’ revenue and their offerings in the market. The research methodology used to estimate the market size includes the following:

- The key players in the market have been identified through extensive secondary research.

- The market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

With data triangulation and validation through primary interviews, the exact value of the overall parent market size was determined and confirmed using this study. The overall Massive Open Online Course Market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.Report Objectives

- To define, describe, and forecast the MOOC market size based on components, course, user types, and regions

- To provide detailed information related to the major factors, such as drivers, restraints, opportunities, and challenges, influencing the growth of the market

- To analyze the market’s subsegments with respect to the individual growth trends, prospects, and contributions to the total market

- To analyze opportunities in the market for stakeholders and provide the competitive landscape of the market

- To forecast the revenue of the market’s segments with respect to 5 major regions, namely, North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To profile the key players and comprehensively analyze their recent developments and positioning in the Massive Open Online Course Market

- To analyze the competitive developments, such as mergers and acquisitions, new product developments, and R&D activities in the market

Scope of the report

Report Metric |

Details |

|

Market size available for years |

2016–2023 |

|

Base year considered |

2017 |

|

Forecast period |

2018–2023 |

|

Forecast units |

Billion (USD) |

|

Segments covered |

Component, Course, User Type, and Region |

|

Geographies covered |

North America, APAC, Europe, Latin America, and MEA |

|

Companies covered |

Coursera (US), edX (US), Pluralsight (US), Edureka (India), Alison (Ireland), Udacity (US), Udemy (US), Miríadax (Spain), Jigsaw Academy (India), Simplilearn (US), iversity (Germany), Intellipaat (India), Edmodo (US), FutureLearn (UK), LinkedIn (US), NovoEd (US), Open2Study (Australia), WizIQ (India), Skillshare (US), XuetangX (China), Federica (Italy), Linkstreet Learning (India), Khan Academy (US), and Kadenze (Spain) |

This research report categorizes the MOOC market based on component, course, user type, and region.

Based on components, the market has been segmented as follows:

- Platforms

- XMOOC

- CMOOC

- Services

- Consulting

- Implementation

- Training and Support

Based on course, the MOOC market has been segmented as follows:

- Humanities

- Computer Science and Programming

- Business Management

- Science

- Health and Medicine

- Education and Training

- Engineering

- Others (Mathematics and Statistics, Art and Design, and Social Science)

Based on user type, the market has been segmented as follows:

- High Schools

- Undergraduate

- Postgraduate

- Corporate

Based on regions, the MOOC market has been segmented as follows:

- North America

- US

- Canada

- Europe

- UK

- Germany

- France

- Russia

- Rest of Europe

- APAC

- Japan

- China

- Singapore

- India

- Australia

- Rest of APAC

- Latin America

- Mexico

- Brazil

- Rest of Latin America

- MEA

- Middle East

- Africa

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players up to 5

Growth opportunities and latent adjacency in MOOC Market