Massive IoT Market - Global Forecast to 2028

Massive IoT, also known as massive Machine-Type Communications (mMTC) in the 5G world, refers to applications using many endpoints to supply small amounts of data continuously. It involves low-cost, low-energy applications with large amounts of tiny data reported to the cloud periodically. IoT sensors on billions of devices, objects, and machines communicate with one another, are often low-cost, and consume relatively less energy.

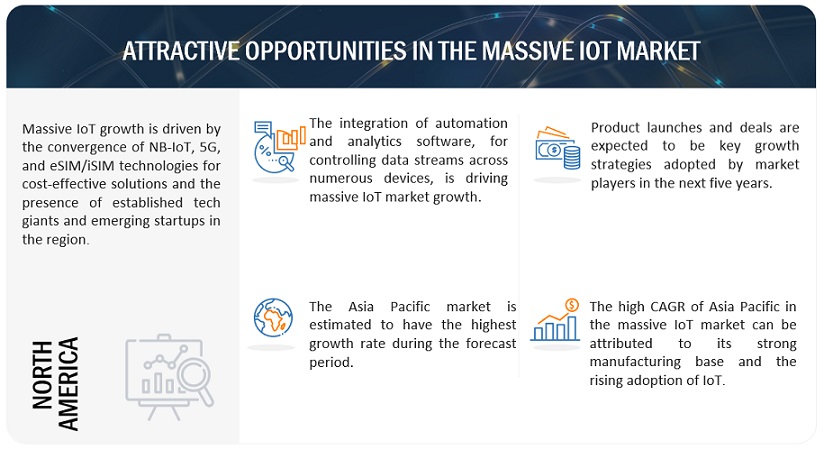

The global massive IoT market size is projected to grow from USD XX.X billion in 2023 to USD XX.X billion by 2028, at a compound annual growth rate (CAGR) of XX.X% during the forecast period. Massive IoT enables cloud systems to save costs by allowing real-time updates and remote management of connected equipment. It helps machines communicate without human intervention, enabling companies to control large amounts of machinery or monitor production processes remotely.

To know about the assumptions considered for the study, Request for Free Sample Report

Driver: Growing demand for industrial automation and remote management of connected devices

Massive IoT plays an important role in transforming business operations and helping them generate new business models. In an integrated control system, massive IoT enables wireless connectivity between various movable machines and eventually reduces downtime, shutdowns, and monetary losses during manufacturing. It plays a vital role in implementing and enhancing smart systems with numerous connected devices and helps remotely monitor machines using attached sensors. It enables machines to interact with each other and remotely automate repetitive tasks by aligning processes, procedures, and orders according to supply chain requirements. Companies can remotely monitor their production processes using mobile apps instead of having someone physically check every machine daily. As a result, it saves operational costs and increases productivity levels due to fewer disruptions in production.

Driver: Increasing popularity of NB-IoT and LTE-M technologies over 4G/LTE

NB-IoT (Narrowband-IoT) offers low-power connectivity alternatives for small devices such as sensors and wearables. NB-IoT and LTE-M both use low-power wireless networks that are simple to set up. They are suitable for large-scale IoT deployments as they help manage vast amounts of data faster while providing higher mobility, lower latency, and improved performance. NB-IoT and LTE-M technologies are less power-intensive and less expensive than 4G/LTE, making them low-cost alternatives to 4G/LTE. They are ideal for connecting many devices in various applications. NB-IoT is ideal for applications requiring long battery life and low data rates, such as asset tracking and environmental monitoring. On the other hand, LTE-M is a better fit for applications requiring higher data speeds, such as networked sensors in industrial environments. The increasing popularity of NB-IoT and LTE-M is a prominent trend in the IoT market that is expected to continue in the coming years.

Challenge: Concerns regarding data security and privacy

The rising number of interconnected devices in IoT has brought tremendous opportunities for innovation and automation. However, this huge network has created many data security and privacy challenges. Businesses require solutions that assist them with authentication, encryption, and privacy policies while sharing data from their systems to the network. It becomes important for organizations to examine the security design before incorporating new technology into their systems. This ensures that businesses only access the required information and do not expose private information to unwanted parties. Furthermore, it is important that data privacy policies comply with personal information protection requirements such as California's CCPA (2020) and CPRA (2023), the EU's GDPR (2018), and Brazil's LGPD (2020), to ensure that organizations do not encounter any complications while dealing with consumer data.

Key players in the market

The major players in the global Massive IoT market are Cisco Systems, Inc. (US), Comcast Corporation (US), IBM (US), Microsoft (US), Intel Corporation (US), NEC Corporation (Japan), Telefonaktiebolaget LM Ericsson (Sweden), Amazon Web Services, Inc. (US), KORE Wireless (US), Telit Cinterion (UK), SK Telecom Co., Ltd. (South Korea), PTC (US), Murata Manufacturing Co., Ltd. (Japan), AT&T Inc. (US), Verizon (US), UnaBiz (Singapore), Kerlink (France), Digi International Inc. (US), Actility (Paris), Loriot AG. (Switzerland), HiveMQ (Germany), Senet Inc. (US), and Cavli Wireless (US).

Recent Developments:

- In February 2023, Telit Cinterion introduced new ultra-compact 5G low-power wireless access (LPWA) modules for various indoor and outdoor IoT applications requiring long battery and service life.

- In February 2023, Murata Manufacturing introduced the next-generation LTE-M/NB-IoT module. The module provides ultra-low power and multiple LPWA communication protocols, including non-terrestrial networks (NTN) satellite connectivity support in a single system-on-chip (SoC) package.

- In March 2023, Senet partnered with UnaBiz to provide customers seamless access to LoRaWAN network services offered by Senet. The partnership will enable multiple UnaBiz global customers to penetrate into the North American market using Public LoRaWAN Network-as-a-Service (NAAS) and Platform-as-a-Service (PAAS) offered by Senet.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Growth opportunities and latent adjacency in Massive IoT Market