Marine Sensors Market by Sensor Type (Pressure Sensors, Temperature Sensors, Force Sensors, Torque Sensors, Speed Sensors, Position and Displacement Sensors, Others), Application, Ship Type, End-use, Connectivity, and Region - Global Forecast to 2028

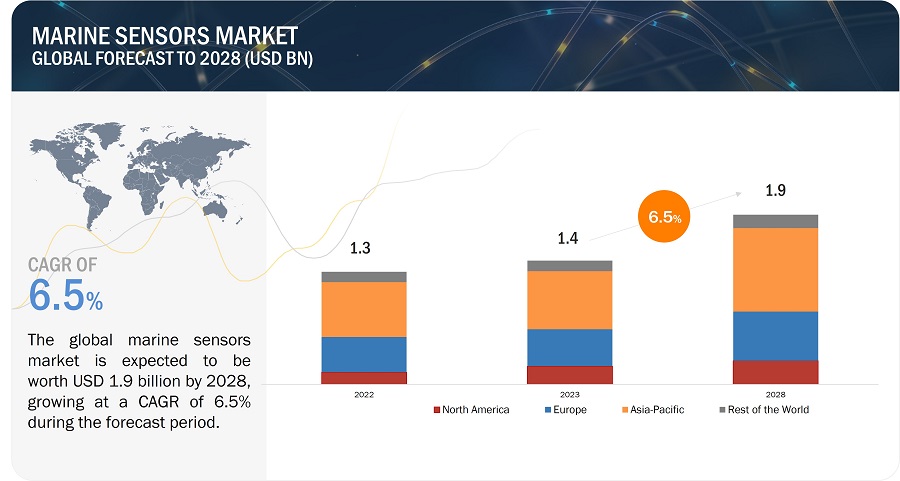

The Marine Sensors Market size was estimated at USD 1.3 billion in 2022 and is predicted to increase from USD 1.4 Billion in 2023 to approximately USD 1.9 Billion by 2028, expanding at a CAGR of 6.5% from 2023 to 2028.

Marine Sensors Market Key Takeaways

-

By Market Size & Growth, Marine Sensors Market is projected to reach USD 1.9 Billion by 2028, growing from USD 1.4 Billion in 2023 at a CAGR of 6.5% during the forecast period from 2023 to 2028.

-

By enhancing navigation and safety, demand for sensors that track depth, temperature, pressure, and vessel position is rising as shipping companies and navies aim to boost situational awareness and operational reliability.

-

By advancing unmanned and hybrid fleets, sensors for autonomous surface and underwater vessels are gaining traction, supporting real-time mapping, object detection, and collision avoidance in remote marine environments.

-

By responding to environmental monitoring needs, governments and scientific institutions are deploying sensors to collect ocean data—such as salinity, currents, and pollution—to support climate research and regulatory compliance.

-

By trending toward integration and smart systems, modern vessels are outfitted with sensor suites connected through onboard networks, enabling centralized data analysis and maintenance alerts to reduce downtime.

-

By capitalizing on offshore energy growth, the expansion of offshore wind and oil & gas exploration is creating higher demand for sensors that ensure structural health, safety inspections, and environmental compliance.

-

By seeing strong regional demand in Asia Pacific, this region leads in market growth due to expanding shipbuilding sectors in countries like China, South Korea, and Japan, alongside investment in coastal surveillance infrastructure.

-

By becoming essential in maritime defense, navies worldwide are equipping submarines, patrol boats, and ROVs with advanced marine sensors, enhancing their surveillance, navigation, and mission-readiness capabilities.

Market Size & Forecast Report

-

2023 Market Size: USD 1.4 Billion

-

2028 Projected Market Size: USD 1.9 Billion

-

CAGR (2023-2028): 6.5%

-

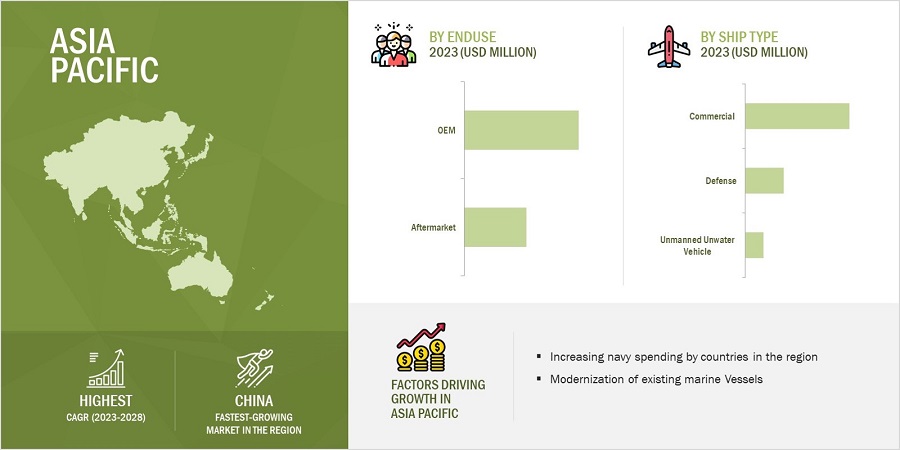

Asia Pacific: Highest CAGR

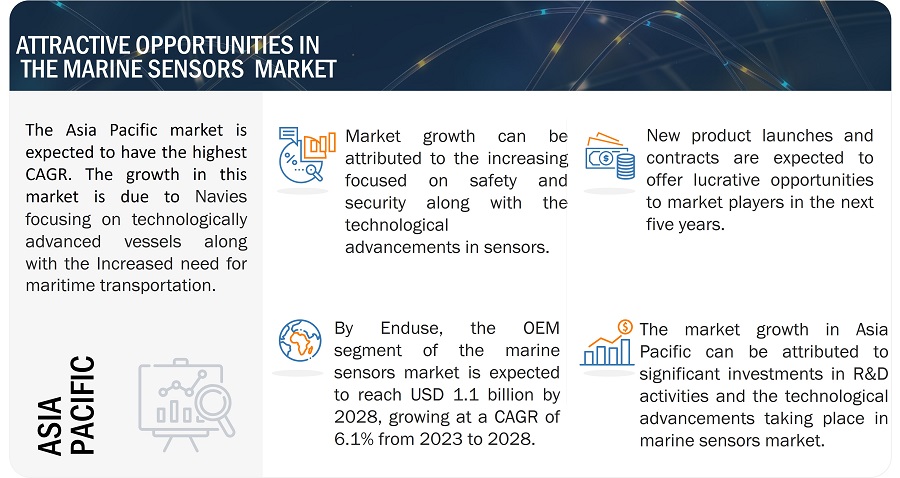

The Marine Sensors Industry is driven by factors such as increasing demand for UUV’s and AUV’, along with the increasing demand of the maritime transportation, navies are focusing on technologically advanced marine vessels.

Marine Sensors Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Marine Sensors Market Dynamics:

Driver: Growing Demand for ROV and AUV Propels the Demand for Marine Sensors

ROVs and AUVs are used in offshore oil and gas operations for a variety of tasks, such as inspecting pipelines and platforms, performing maintenance and repair tasks, and conducting seabed surveys. ROVs and AUVs are used in oceanographic research to collect data on a variety of oceanographic conditions, such as temperature, salinity, currents, and waves. This data can be used to study the ocean and its inhabitants, and to develop new oceanographic models. These ROV’s and AUV’s are equipped with various types of sensors such as sonar and other sensors to help operators navigate and perform tasks underwater. For example, ROVs used in offshore oil and gas operations are typically equipped with cameras and sonar to inspect pipelines and platforms for damage. AUVs are typically equipped with a wider range of sensors than ROVs. This is because AUVs are able to operate autonomously and for longer periods of time. This leads as a driving factor for marine sensors market

Restraint: Development of Marine Sensors That Can Withstand the Harsh and Corrosive Marine Environment

The development of sensors which can withstand harsh and corrosive marine environment is a restrain for the marine sensors market because it is a challenging and expensive task. The marine environment is harsh and corrosive due to a number of factors which includes, the salinity of seawater is high, which can corrode sensors, the temperature of seawater can vary widely, which can also damage sensors, the pressure of seawater increases with depth, which can also damage sensors, biofouling is the growth of marine organisms on surfaces, which can interfere with the operation of sensors.

In order to withstand these harsh conditions, marine sensors must be made from durable materials and be carefully designed to prevent corrosion and biofouling. This makes marine sensors more expensive to develop and manufacture than sensors for other environments. Additionally, the development of new and innovative marine sensors requires significant investment in research and development. This can also be a barrier for companies that are developing marine sensors.

Opportunity: Integration of Artificial Intelligence (AI), Internet of Things (IoT) With Advanced Marine Sensors Technology

The integration of AI and IoT is a significant opportunity for the marine sensors market. AI can be used to analyze the data collected by marine sensors to identify patterns and trends that would be difficult or impossible to detect manually. This information can then be used to improve marine safety, efficiency, and environmental protection. AI can be used to analyze data from marine sensors to predict when maintenance is needed. This can help to reduce downtime and costs. AI can be used to monitor data from marine sensors in real time to identify potential problems. This can help to prevent accidents and environmental damage. AI can be used to analyze data from marine sensors to optimize fleet operations. This can help to reduce fuel consumption and emissions. Hence with many other benefits the integration of AI and IoT in marine is a huge opportunity for the marine sensors market.

Challenges: Maintenance Process and Calibration of Sensors

The maintenance process and calibration of marine sensors is a challenge for the marine sensors market for a number of reasons such as situations where marine sensors are exposed to a harsh and corrosive marine environment, which can damage sensors and make them inaccurate many marine sensors are located in remote and inaccessible locations, which make it difficult and expensive to perform maintenance and calibration, downtime caused by sensor failures can be very costly for marine operations. Marine sensors are becoming increasingly complex, which makes it difficult and time-consuming to perform maintenance and calibration. These challenges lead to a number of problems, including inaccurate sensors leading to safety hazards and financial losses. Sensor failures causes downtime, which becomes very costly for marine operations. The high cost of maintaining and calibrating marine sensors adds to the overall cost of ownership. Hence the maintenance process and calibration is a challenge for marine sensors market.

Marine Sensors Market Ecosystem:

Based on Enduse, the OEM Segment is Projected to Have the Highest Share in 2023

Based on Enduse, the marine sensors market has been segmented into OEM and Aftermarket. Original equipment manufacturers (OEMs) have a strong understanding of the needs of their ship owners. They are able to design and develop sensors that meet the specific requirements of their products and are backed with warranties and support. This makes it a convenient one-stop shop for customers. OEMs have a strong sales and distribution network. This allows them to reach a wide range of customers and to provide them with the support they need. Hence, we could se the OEM to have the highest share in 2023 for marine sensors market.

Based on Ship Type, the Commercial Segment of the Market is Projected to Have the Highest Market Share for Year 2023

Based on ship type, marine sensors market has been segmented into commercial, defense and UUV’s. The commercial ship segment has the highest market share in the marine sensors market due to a number of factors, such as the commercial ship fleet is large and growing, which is driving demand for marine sensors, commercial ships are subject to stringent safety and environmental regulations, which require the use of marine sensors, commercial shipping companies are increasingly adopting autonomous ships, which rely heavily on marine sensors, commercial shipping companies are increasingly demanding real-time data from their marine sensors to improve safety, efficiency, and profitability. These are the reasons which mainly contribute to the commercial segment to have the highest market share in the marine sensors market.

Based on Application, the Fuel and Propulsion Segment of the Market is Projected to Have the Second Highest Share for 2023

Based on application, the marine sensors market has been segmented into ballast and bilge system, fuel and propulsion system, refrigeration system, HVAC system, firefighting system, navigation and positioning system and Other. The marine industry is under increasing pressure to improve fuel efficiency and reduce emissions. Marine sensors can help to achieve these goals by providing real-time data on fuel consumption, engine performance, and emissions. Advanced propulsion systems, such as electric and hybrid propulsion systems, are becoming increasingly popular in the marine industry. These systems rely on marine sensors to operate safely and efficiently. Marine engines are subject to a lot of wear and tear. Marine sensors can help to monitor engine health and performance, and to identify potential problems before they cause a breakdown. Hence based on application the fuel and propulsion segment of the marine sensors market has the second highest share for 2023.

Asia Pacific is Expected to Account for the Highest CAGR in the Forecasted Period

Asia Pacific is estimated to account for the highest CAGR in the forecasted period. The market growth in this region is expected to be fueled by an advancement in technology and investments in sensors during the forecast period. The major countries considered under this region are the China, India, South Korea, Japan, Australia and Rest of Asia Pacific. The Asia Pacific region is leading the way in the adoption of autonomous ships and UUVs. These vessels rely heavily on marine sensors to operate safely and effectively. The Asia Pacific region is experiencing rapid economic development. This is leading to increased investment in maritime infrastructure and operations, which is driving demand for marine sensors. Governments in the Asia Pacific region is supportive of the marine sensors industry. They are providing financial and other incentives to encourage the development and adoption of marine sensor technologies.

Marine Sensors Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Marine Sensors Industry Companies - Top Key Market Players

The Marine Sensors Companies are dominated by globally established players such as Honeywell International Inc. (US), Eaton Corporation (Ireland), TE Connectivity (Switzerland), Garmin Ltd. (US), and Curtiss Wright (US) wich covers various industry trends and new technological innovations in the Marine Sensors Companies for the period 2019-2028.

Scope of the Report

|

Report Metric |

Details |

|

Estimated Market Size |

USD 1.4 Billion in 2023 |

|

Projected Market Size |

USD 1.9 Billion by 2028 |

|

Growth Rate |

CAGR of 6.5% |

|

Market Size Available for Years |

2019-2028 |

|

Base Year Considered |

2022 |

|

Forecast Period |

2023-2023 |

|

Forecast Units |

Value (USD) |

|

Segments Covered |

By sensor type, by ship type, by connectivity, by enduse, by application |

|

Geographies Covered |

North America, Europe, Asia Pacific, and Rest of the World |

|

Companies Covered |

Honeywell International Inc. (US), Eaton Corporation (Ireland), TE Connectivity (Switzerland), Garmin Ltd. (US), and Curtiss Wright (US) are some of the major players of marine sensors market. (25 Companies) |

Marine Sensors Market Highlights

This research report categorizes the marine sensors market based on sensor type, ship type, connectivity, enduse, application and region.

|

Segment |

Subsegment |

|

By Sensor Type |

|

|

By Application |

|

|

By Connectivity |

|

|

By Enduse |

|

|

By Ship Type |

|

|

By Region |

|

Recent Developments

- In July 2023, Curtiss-Wright secured contracts exceeding USD 250 million. These contracts pertain to the supply of propulsion valves, pumps, and advanced instrumentation and control systems for the esteemed U.S. Navy programs, specifically the Virginia-class nuclear-powered attack submarines, Columbia-class submarines, and Ford-class aircraft carriers.

- In March 2022, The U.S. Navy awarded Raytheon, USD 651 million contract to equip all newly commissioned surface ships, ranging from small patrol vessels to massive aircraft carriers, with advanced radar systems capable of detecting and monitoring both hostile missiles and aircraft simultaneously. This contract also includes additional options, potentially increasing its total value to USD 3.16 Billion.

- In November 2021 , Eaton entered into aa agreement with the U.S. Department of Defense (DoD) to produce inductive proximity sensors specifically designed for essential operations in challenging naval conditions.

- In October 2022, Teledyne FLIR Defense secured a USD 48.7 Million contract to supply Maritime Forward Looking Infrared (MARFLIR) II sensors and various versions of its SeaFLIR® 280-HD surveillance systems to the United States Coast Guard (USCG) under a firm-fixed-price, indefinite-delivery/indefinite-quantity agreement.

Frequently Asked Questions (FAQ’s)

What is the current size of the Marine Sensors Market?

The global Marine Sensors Market size is estimated to grow from USD 1.4 Billion in 2023 to USD 1.9 Billion by 2028, at a CAGR of 6.5% in the forecasted period.

Who are the winners in the Marine Sensors Market?

Honeywell International Inc. (US), Eaton Corporation (Ireland), TE Connectivity (Switzerland), Garmin Ltd. (US), and Curtiss Wright (US).

What are some of the opportunities of the Marine Sensors Market?

Integration of Artificial Intelligence (AI), Internet of Things (IoT) with advanced marine sensors technology.

What are some of the technological advancements in the market?

Automation, the Internet of Things, and advancement in marine sensors, are some of the technological advancements in the marine sensors market.

What are the factors driving the growth of the market?

The Navies focusing on technologically advanced marine vessels, and Increased need for maritime transportation fuels demand for marine sensors.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing demand for autonomous underwater vehicles and remotely operated vehicles- Growing maritime transportation- Rising procurement of technologically advanced vesselsRESTRAINTS- Harsh and corrosive marine environmentOPPORTUNITIES- AI and IoT integration in marine sensorsCHALLENGES- Data management issues- Frequent maintenance and system checks

- 5.3 MARKET SCENARIO ANALYSIS

-

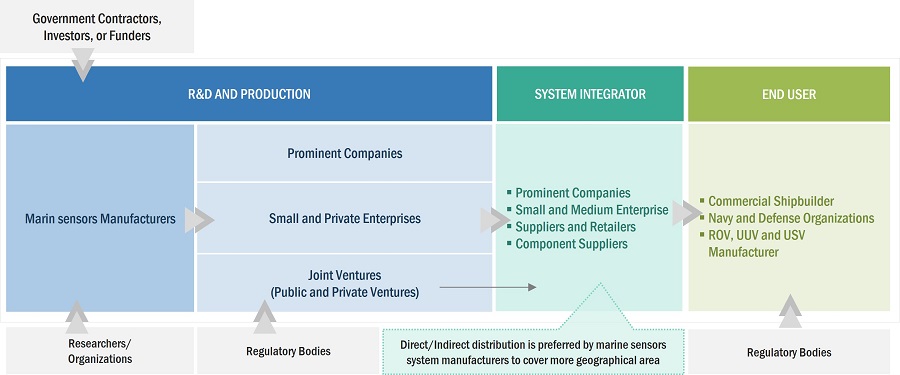

5.4 VALUE CHAIN ANALYSISRAW MATERIALSR&DMANUFACTURINGEND USERSAFTER-SALE SERVICES

-

5.5 ECOSYSTEM ANALYSISPROMINENT COMPANIESPRIVATE AND SMALL ENTERPRISESEND USERS

-

5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

-

5.7 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

- 5.8 PRICING ANALYSIS

- 5.9 VOLUME DATA ANALYSIS

- 5.10 TRADE DATA ANALYSIS

- 5.11 TARIFF AND REGULATORY LANDSCAPE

- 5.12 KEY CONFERENCES AND EVENTS, 2023–2024

-

5.13 USE CASE ANALYSISOIL SPILL DETECTION AND MONITORING USING AUTONOMOUS UNDERWATER VEHICLESUTILIZATION OF SPECIALIZED SENSORS AND INSTRUMENTS FOR OCEANOGRAPHIC RESEARCH

-

5.14 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 6.1 INTRODUCTION

-

6.2 TECHNOLOGY TRENDSARTIFICIAL INTELLIGENCE AND MACHINE LEARNINGINTERNET OF THINGSECO-FRIENDLY MARINE SENSORSREMOTE SENSING AND SATELLITE INTEGRATION

-

6.3 IMPACT OF MEGATRENDSELECTRIFICATION OF MARINE INDUSTRYAUTOMATION OF MARINE VESSELSSMART AND CONNECTED MARINE VESSELS

- 6.4 INNOVATIONS AND PATENT REGISTRATIONS

- 6.5 ROADMAP FOR MARINE SENSOR COMMERCIALIZATION

- 7.1 INTRODUCTION

-

7.2 PRESSURE SENSORSASSISTANCE IN EQUIPMENT CONDITION MONITORING TO DRIVE MARKET

-

7.3 TEMPERATURE SENSORSINCREASING USE IN LARGER VESSELS TO DRIVE MARKET

-

7.4 FORCE SENSORSGROWING USE IN MARITIME STRUCTURES TO DRIVE MARKET

-

7.5 TORQUE SENSORSINCREASING DEMAND FOR EFFICIENT MARINE PROPULSION SYSTEMS TO DRIVE MARKET

-

7.6 SPEED SENSORSNEED FOR SPEED-BASED DATA TO MONITOR VESSEL PERFORMANCE TO DRIVE MARKET

-

7.7 POSITION AND DISPLACEMENT SENSORSAPPLICATIONS IN SHIP NAVIGATION SYSTEMS, DYNAMIC POSITIONING SYSTEMS, AND REMOTELY OPERATED VEHICLES TO DRIVE MARKET

-

7.8 LEVEL SENSORSEFFICIENT MANAGEMENT OF LUBRICANT AND FUEL OIL TO DRIVE MARKET

-

7.9 PROXIMITY SENSORSANCHOR MONITORING AND ENVIRONMENTAL RESEARCH APPLICATIONS TO DRIVE MARKET

-

7.10 FLOW SENSORSCOMPLIANCE WITH INTERNATIONAL BALLAST WATER REGULATIONS TO DRIVE MARKET

-

7.11 OPTICAL SENSORSRISING DEMAND FOR ENHANCED MARINE NAVIGATION, POSITIONING, AND SAFETY TO DRIVE MARKET

-

7.12 MOTION SENSORSINCREASING NEED FOR MONITORING CARGO STABILITY AND WEIGHT DISTRIBUTION TO DRIVE MARKET

-

7.13 RADAR SENSORSINCREASING NEED FOR DETECTING ADVERSE WEATHER CONDITIONS TO DRIVE MARKET

-

7.14 SMOKE DETECTION SENSORSGROWING NEED TO ENHANCE FIRE SAFETY TO DRIVE MARKET

-

7.15 GPS SENSORSINCREASING NEED TO OPTIMIZE MARITIME ROUTES TO DRIVE MARKET

-

7.16 ACOUSTIC SENSORSVITAL ROLE IN STUDYING OCEAN CURRENTS AND MARINE LIFE TO DRIVE MARKET

-

7.17 CURRENT SENSORSGROWING USE BY MARITIME BUSINESSES AND RESEARCH ORGANIZATIONS TO DRIVE MARKET

- 7.18 OTHER SENSORS

- 8.1 INTRODUCTION

-

8.2 WIRED SENSORSLIMITED SIGNAL LOSS AND IMPROVED DATA SECURITY TO DRIVE MARKET

-

8.3 WIRELESS SENSORSGROWING USE BY NAVY TO DRIVE MARKET

- 9.1 INTRODUCTION

-

9.2 OEMRISING DEMAND FOR ADVANCED SENSING TECHNOLOGY IN MARINE VEHICLES TO DRIVE MARKET

-

9.3 AFTERMARKETNEED FOR CUSTOMER SATISFACTION AND EFFICIENT SUPPLY OF REPLACEMENT PARTS TO DRIVE MARKET

- 10.1 INTRODUCTION

-

10.2 BALLAST AND BILGE SYSTEMSNEED TO OPTIMIZE BALLAST LEVELS IN VARYING SEA CONDITIONS TO DRIVE MARKET

-

10.3 FUEL AND PROPULSION SYSTEMSSHIFT FROM CONVENTIONAL PROPULSION SYSTEMS TO ELECTRIC MODELS TO DRIVE MARKET

-

10.4 REFRIGERATION SYSTEMSRISING NEED TO PREVENT SPOILAGE AND PRESERVE CARGO QUALITY TO DRIVE MARKET

-

10.5 HVAC SYSTEMSSHIFT FROM CONVENTIONAL HVAC SYSTEMS TO ECO-FRIENDLY OPERATIONS TO DRIVE MARKET

-

10.6 FIREFIGHTING SYSTEMSINCREASING NEED FOR FIRE SAFETY MEASURES IN MARITIME VESSELS TO DRIVE MARKET

-

10.7 NAVIGATION AND POSITIONING SYSTEMSNEED FOR ACCURATE GLOBAL POSITIONING OF VESSELS TO DRIVE MARKET

- 10.8 OTHER APPLICATIONS

- 11.1 INTRODUCTION

-

11.2 COMMERCIAL VESSELSPASSENGER VESSELS- Yachts- Passenger ferries- Cruise shipsCARGO VESSELS- Container vessels- Bulk carriers- Tankers- Gas tankers- Dry cargo ships- Barges and tugboatsOTHER SHIP TYPES- Fishing vessels- Research vessels- Dredgers

-

11.3 DEFENSE VESSELSDESTROYERS- Efforts to upgrade existing systems to drive marketFRIGATES- Rising investments by navies worldwide to drive marketCORVETTES- Rising need for maritime patrol and surveillance to drive marketAMPHIBIOUS SHIPS- Crucial role in warfare to drive marketOFFSHORE SUPPORT VESSELS- Key role in offshore operations to drive marketMINESWEEPERS- Need for safe maritime navigation to drive marketSUBMARINES- Need for secured strategic and tactical operations to drive market

-

11.4 UNMANNED UNDERWATER VEHICLESREMOTELY OPERATED VEHICLES- Need for efficient and cost-effective subsea inspection to drive marketAUTONOMOUS UNDERWATER VEHICLES- Growing need for underwater surveillance and oceanography to drive market

- 12.1 INTRODUCTION

- 12.2 REGIONAL RECESSION IMPACT ANALYSIS

-

12.3 NORTH AMERICANORTH AMERICA: RECESSION IMPACT ANALYSISNORTH AMERICA: PESTLE ANALYSISUS- Expansion of shipbuilding industry to drive marketCANADA- Government initiatives for marine industry to drive market

-

12.4 EUROPEEUROPE: RECESSION IMPACT ANALYSISEUROPE: PESTLE ANALYSISUK- National Shipbuilding Strategy to drive marketFRANCE- Government focus on strengthening navy to drive marketGERMANY- Rising investments in research & development to drive marketITALY- Development of advanced maritime technologies to drive marketRUSSIA- Development of maritime routes to drive marketREST OF EUROPE

-

12.5 ASIA PACIFICASIA PACIFIC: RECESSION IMPACT ANALYSISASIA PACIFIC: PESTLE ANALYSISCHINA- Presence of several shipbuilding firms to drive marketINDIA- Increasing investments for naval fleets to drive marketJAPAN- Initiatives by local players and government for maritime trade and shipbuilding to drive marketAUSTRALIA- Growing demand for bulkers, container ships, and general cargo vessels to drive marketSOUTH KOREA- Shipbuilding activities by local manufacturers to drive marketREST OF ASIA PACIFIC

-

12.6 REST OF THE WORLD (ROW)REST OF THE WORLD: RECESSION IMPACT ANALYSISREST OF THE WORLD: PESTLE ANALYSISMIDDLE EAST & AFRICA- Intercontinental trade and increased demand for retrofitting existing vehicles to drive marketLATIN AMERICA- Increasing investments in maritime transportation infrastructure to drive market

- 13.1 INTRODUCTION

- 13.2 MARKET RANKING ANALYSIS, 2022

- 13.3 REVENUE SHARE ANALYSIS, 2022

- 13.4 MARKET SHARE ANALYSIS, 2022

-

13.5 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT

-

13.6 STARTUP/SME EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

-

13.7 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALS

-

14.1 KEY PLAYERSHONEYWELL INTERNATIONAL INC.- Business overview- Products/Solutions/Services offered- MnM viewEATON CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewTE CONNECTIVITY- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewGARMIN LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCURTISS-WRIGHT CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewGEMS SENSORS, INC.- Business overview- Products/Solutions/Services offered- Recent developmentsSAAB AB- Business overview- Products/Solutions/Services offered- Recent developmentsRAYTHEON TECHNOLOGIES CORPORATION- Business overview- Products/Solutions/Services offered- Recent developmentsTELEDYNE FLIR LLC- Business overview- Products/Solutions/Services offered- Recent developmentsAPPLANIX- Business overview- Products/Solutions/Services offeredWÄRTSILÄ CORPORATION- Business overview- Products/Solutions/Services offered- Recent developmentsXYLEM INC.- Business overview- Products/Solutions/Services offeredYOKOGAWA ELECTRIC CORPORATION- Business overview- Products/Solutions/Services offeredROCKWELL AUTOMATION- Business overview- Products/Solutions/Services offered- Recent developmentsSEA-BIRD SCIENTIFIC- Business overview- Products/Solutions/Services offered

-

14.2 OTHER PLAYERSCHELSEA TECHNOLOGIES LTD.MIDORI AMERICA CORPORATIONSHIP MOTION CONTROLAML OCEANOGRAPHICVALEPORT LTD.GUENTHER POLSKA SP. Z O.O.BD|SENSORS GMBHNORWEGIAN SUBSEARBR LTD.AIRMAR TECHNOLOGY CORPORATION

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

- TABLE 1 INCLUSIONS AND EXCLUSIONS

- TABLE 2 USD EXCHANGE RATES

- TABLE 3 ROLE OF KEY PLAYERS IN ECOSYSTEM

- TABLE 4 IMPACT OF PORTER’S FIVE FORCES

- TABLE 5 AVERAGE PRICE ANALYSIS OF MARINE SENSORS, BY SENSOR TYPE

- TABLE 6 MARINE SENSORS MARKET, BY SHIP TYPE (UNITS) (2025–2028)

- TABLE 7 MARINE SENSORS MARKET, BY SENSOR TYPE (UNITS) (2019–2028)

- TABLE 8 COUNTRY-WISE IMPORTS, 2020–2022 (USD THOUSAND)

- TABLE 9 COUNTRY-WISE EXPORTS, 2020–2022 (USD THOUSAND)

- TABLE 10 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER AGENCIES

- TABLE 11 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER AGENCIES

- TABLE 12 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER AGENCIES

- TABLE 13 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHERS

- TABLE 14 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHERS

- TABLE 15 KEY CONFERENCES AND EVENTS, 2023–2024

- TABLE 16 INFLUENCE OF STAKEHOLDERS ON BUYING MARINE SENSORS, BY END USE (%)

- TABLE 17 KEY BUYING CRITERIA FOR MARINE SENSORS, BY END USE

- TABLE 18 INNOVATIONS AND PATENT REGISTRATIONS, 2023

- TABLE 19 BY SENSOR TYPE, 2019–2022 (USD MILLION)

- TABLE 20 BY SENSOR TYPE, 2023–2028 (USD MILLION)

- TABLE 21 BY CONNECTIVITY, 2019–2022 (USD MILLION)

- TABLE 22 BY CONNECTIVITY, 2023–2028 (USD MILLION)

- TABLE 23 BY END USE, 2019–2022 (USD MILLION)

- TABLE 24 BY END USE, 2023–2028 (USD MILLION)

- TABLE 25 BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 26 BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 27 BY SHIP TYPE, 2019–2022 (USD MILLION)

- TABLE 28 BY SHIP TYPE, 2023–2028 (USD MILLION)

- TABLE 29 BY COMMERCIAL VESSELS, 2019–2022 (USD MILLION)

- TABLE 30 BY COMMERCIAL VESSELS, 2023–2028 (USD MILLION)

- TABLE 31 BY PASSENGER VESSELS, 2019–2022 (USD MILLION)

- TABLE 32 BY PASSENGER VESSELS, 2023–2028 (USD MILLION)

- TABLE 33 BY CARGO VESSELS, 2019–2022 (USD MILLION)

- TABLE 34 BY CARGO VESSELS, 2023–2028 (USD MILLION)

- TABLE 35 BY OTHER SHIP TYPES, 2019–2022 (USD MILLION)

- TABLE 36 BY OTHER SHIP TYPES, 2023–2028 (USD MILLION)

- TABLE 37 BY DEFENSE VESSELS, 2019–2022 (USD MILLION)

- TABLE 38 BY DEFENSE VESSELS, 2023–2028 (USD MILLION)

- TABLE 39 BY UNMANNED UNDERWATER VEHICLES, 2019–2022 (USD MILLION)

- TABLE 40 BY UNMANNED UNDERWATER VEHICLES, 2023–2028 (USD MILLION)

- TABLE 41 BY REGION, 2019–2022 (USD MILLION)

- TABLE 42 BY REGION, 2023–2028 (USD MILLION)

- TABLE 43 NORTH AMERICA: BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 44 NORTH AMERICA: BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 45 NORTH AMERICA: BY END USE, 2019–2022 (USD MILLION)

- TABLE 46 NORTH AMERICA: BY END USE, 2023–2028 (USD MILLION)

- TABLE 47 NORTH AMERICA: BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 48 NORTH AMERICA: BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 49 NORTH AMERICA: BY SHIP TYPE, 2019–2022 (USD MILLION)

- TABLE 50 NORTH AMERICA: BY SHIP TYPE, 2023–2028 (USD MILLION)

- TABLE 51 US: BY END USE, 2019–2022 (USD MILLION)

- TABLE 52 US: BY END USE, 2023–2028 (USD MILLION)

- TABLE 53 US: BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 54 US: BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 55 US: BY SHIP TYPE, 2019–2022 (USD MILLION)

- TABLE 56 US: BY SHIP TYPE, 2023–2028 (USD MILLION)

- TABLE 57 CANADA: BY END USE, 2019–2022 (USD MILLION)

- TABLE 58 CANADA: BY END USE, 2023–2028 (USD MILLION)

- TABLE 59 CANADA: BY APPLICATION, 2019–2022(USD MILLION)

- TABLE 60 CANADA: BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 61 CANADA: BY SHIP TYPE, 2019–2022 (USD MILLION)

- TABLE 62 CANADA: BY SHIP TYPE, 2023–2028 (USD MILLION)

- TABLE 63 EUROPE: BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 64 EUROPE: BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 65 EUROPE: BY END USE, 2019–2022 (USD MILLION)

- TABLE 66 EUROPE: BY END USE, 2023–2028 (USD MILLION)

- TABLE 67 EUROPE: BY APPLICATION, 2019–2022(USD MILLION)

- TABLE 68 EUROPE: BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 69 EUROPE: BY SHIP TYPE, 2019–2022 (USD MILLION)

- TABLE 70 EUROPE: BY SHIP TYPE, 2023–2028 (USD MILLION)

- TABLE 71 UK: BY END USE, 2019–2022 (USD MILLION)

- TABLE 72 UK: BY END USE, 2023–2028 (USD MILLION)

- TABLE 73 UK: BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 74 UK: BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 75 UK: BY SHIP TYPE, 2019–2022 (USD MILLION)

- TABLE 76 UK: BY SHIP TYPE, 2023–2028 (USD MILLION)

- TABLE 77 FRANCE: BY END USE, 2019–2022 (USD MILLION)

- TABLE 78 FRANCE: BY END USE, 2023–2028 (USD MILLION)

- TABLE 79 FRANCE: BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 80 FRANCE: BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 81 FRANCE: BY SHIP TYPE, 2019–2022 (USD MILLION)

- TABLE 82 FRANCE: BY SHIP TYPE, 2023–2028 (USD MILLION)

- TABLE 83 GERMANY: BY END USE, 2019–2022 (USD MILLION)

- TABLE 84 GERMANY: BY END USE, 2023–2028 (USD MILLION)

- TABLE 85 GERMANY: BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 86 GERMANY: BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 87 GERMANY: BY SHIP TYPE, 2019–2022 (USD MILLION)

- TABLE 88 GERMANY: BY SHIP TYPE, 2023–2028 (USD MILLION)

- TABLE 89 ITALY: BY END USE, 2019–2022 (USD MILLION)

- TABLE 90 ITALY: BY END USE, 2023–2028 (USD MILLION)

- TABLE 91 ITALY: BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 92 ITALY: BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 93 ITALY: BY SHIP TYPE, 2019–2022 (USD MILLION)

- TABLE 94 ITALY: BY SHIP TYPE, 2023–2028 (USD MILLION)

- TABLE 95 RUSSIA: BY END USE, 2019–2022 (USD MILLION)

- TABLE 96 RUSSIA: BY END USE, 2023–2028 (USD MILLION)

- TABLE 97 RUSSIA: BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 98 RUSSIA: BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 99 RUSSIA: BY SHIP TYPE, 2019–2022 (USD MILLION)

- TABLE 100 RUSSIA: BY SHIP TYPE, 2023–2028 (USD MILLION)

- TABLE 101 REST OF EUROPE: BY END USE, 2019–2022 (USD MILLION)

- TABLE 102 REST OF EUROPE: BY END USE, 2023–2028 (USD MILLION)

- TABLE 103 REST OF EUROPE: BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 104 REST OF EUROPE: BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 105 REST OF EUROPE: BY SHIP TYPE, 2019–2022 (USD MILLION)

- TABLE 106 REST OF EUROPE: BY SHIP TYPE, 2023–2028 (USD MILLION)

- TABLE 107 ASIA PACIFIC: MARINE SENSORS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 108 ASIA PACIFIC: MARINE SENSORS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 109 ASIA PACIFIC: MARINE SENSORS MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 110 ASIA PACIFIC: MARINE SENSORS MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 111 ASIA PACIFIC: MARINE SENSORS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 112 ASIA PACIFIC: MARINE SENSORS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 113 ASIA PACIFIC: MARINE SENSORS MARKET, BY SHIP TYPE, 2019–2022 (USD MILLION)

- TABLE 114 ASIA PACIFIC: MARINE SENSORS MARKET, BY SHIP TYPE, 2023–2028 (USD MILLION)

- TABLE 115 CHINA: MARINE SENSORS MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 116 CHINA: MARINE SENSORS MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 117 CHINA: MARINE SENSORS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 118 CHINA: MARINE SENSORS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 119 CHINA: MARINE SENSORS MARKET, BY SHIP TYPE, 2019–2022 (USD MILLION)

- TABLE 120 CHINA: MARINE SENSORS MARKET, BY SHIP TYPE, 2023–2028 (USD MILLION)

- TABLE 121 INDIA: MARINE SENSORS MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 122 INDIA: MARINE SENSORS MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 123 INDIA: MARINE SENSORS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 124 INDIA: MARINE SENSORS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 125 INDIA: MARINE SENSORS MARKET, BY SHIP TYPE, 2019–2022 (USD MILLION)

- TABLE 126 INDIA: MARINE SENSORS MARKET, BY SHIP TYPE, 2023–2028 (USD MILLION)

- TABLE 127 JAPAN: MARINE SENSORS MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 128 JAPAN: MARINE SENSORS MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 129 JAPAN: MARINE SENSORS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 130 JAPAN: MARINE SENSORS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 131 JAPAN: MARINE SENSORS MARKET, BY SHIP TYPE, 2019–2022 (USD MILLION)

- TABLE 132 JAPAN: MARINE SENSORS MARKET, BY SHIP TYPE, 2023–2028 (USD MILLION)

- TABLE 133 AUSTRALIA: MARINE SENSORS MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 134 AUSTRALIA: MARINE SENSORS MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 135 AUSTRALIA: MARINE SENSORS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 136 AUSTRALIA: MARINE SENSORS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 137 AUSTRALIA: MARINE SENSORS MARKET, BY SHIP TYPE, 2019–2022 (USD MILLION)

- TABLE 138 AUSTRALIA: MARINE SENSORS MARKET, BY SHIP TYPE, 2023–2028 (USD MILLION)

- TABLE 139 SOUTH KOREA: MARINE SENSORS MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 140 SOUTH KOREA: MARINE SENSORS MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 141 SOUTH KOREA: MARINE SENSORS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 142 SOUTH KOREA: MARINE SENSORS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 143 SOUTH KOREA: MARINE SENSORS MARKET, BY SHIP TYPE, 2019–2022 (USD MILLION)

- TABLE 144 SOUTH KOREA: MARINE SENSORS MARKET, BY SHIP TYPE, 2023–2028 (USD MILLION)

- TABLE 145 REST OF ASIA PACIFIC: MARINE SENSORS MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 146 REST OF ASIA PACIFIC: MARINE SENSORS MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 147 REST OF ASIA PACIFIC: MARINE SENSORS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 148 REST OF ASIA PACIFIC: MARINE SENSORS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 149 REST OF ASIA PACIFIC: MARINE SENSORS MARKET, BY SHIP TYPE, 2019–2022 (USD MILLION)

- TABLE 150 REST OF ASIA PACIFIC: MARINE SENSORS MARKET, BY SHIP TYPE, 2023–2028 (USD MILLION)

- TABLE 151 REST OF THE WORLD: MARINE SENSORS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 152 REST OF THE WORLD: MARINE SENSORS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 153 REST OF THE WORLD: MARINE SENSORS MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 154 REST OF THE WORLD: MARINE SENSORS MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 155 REST OF THE WORLD: MARINE SENSORS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 156 REST OF THE WORLD: MARINE SENSORS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 157 REST OF THE WORLD: MARINE SENSORS MARKET, BY SHIP TYPE, 2019–2022 (USD MILLION)

- TABLE 158 REST OF THE WORLD: MARINE SENSORS MARKET, BY SHIP TYPE, 2023–2028 (USD MILLION)

- TABLE 159 MIDDLE EAST & AFRICA: BY END USE, 2019–2022 (USD MILLION)

- TABLE 160 MIDDLE EAST & AFRICA: BY END USE, 2023–2028 (USD MILLION)

- TABLE 161 MIDDLE EAST & AFRICA: BY APPLICATION, 2019–2022(USD MILLION)

- TABLE 162 MIDDLE EAST & AFRICA: BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 163 MIDDLE EAST & AFRICA: BY SHIP TYPE, 2019–2022 (USD MILLION)

- TABLE 164 MIDDLE EAST & AFRICA: BY SHIP TYPE, 2023–2028 (USD MILLION)

- TABLE 165 LATIN AMERICA: BY END USE, 2019–2022 (USD MILLION)

- TABLE 166 LATIN AMERICA: BY END USE, 2023–2028 (USD MILLION)

- TABLE 167 LATIN AMERICA: BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 168 LATIN AMERICA: BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 169 LATIN AMERICA: BY SHIP TYPE, 2019–2022 (USD MILLION)

- TABLE 170 LATIN AMERICA: BY SHIP TYPE, 2023–2028 (USD MILLION)

- TABLE 171 STRATEGIES ADOPTED BY KEY PLAYERS IN MARINE SENSORS MARKET, 2022–2023

- TABLE 172 MARINE SENSORS MARKET: DEGREE OF COMPETITION

- TABLE 173 COMPANY FOOTPRINT

- TABLE 174 COMPANY FOOTPRINT, BY END USE

- TABLE 175 COMPANY FOOTPRINT, BY CONNECTIVITY

- TABLE 176 COMPANY FOOTPRINT, BY REGION

- TABLE 177 DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 178 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 179 MARINE SENSORS MARKET: PRODUCT LAUNCHES, JANUARY 2020– DECEMBER 2023

- TABLE 180 MARINE SENSORS MARKET: DEALS, JANUARY 2020–DECEMBER 2023

- TABLE 181 HONEYWELL INTERNATIONAL INC.: COMPANY OVERVIEW

- TABLE 182 HONEYWELL INTERNATIONAL INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED?

- TABLE 183 EATON CORPORATION: COMPANY OVERVIEW

- TABLE 184 EATON CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED?

- TABLE 185 EATON CORPORATION: DEALS

- TABLE 186 TE CONNECTIVITY: COMPANY OVERVIEW

- TABLE 187 TE CONNECTIVITY: PRODUCTS/SOLUTIONS/SERVICES OFFERED?

- TABLE 188 TE CONNECTIVITY: DEALS

- TABLE 189 GARMIN LTD.: COMPANY OVERVIEW

- TABLE 190 GARMIN LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED?

- TABLE 191 GARMIN LTD.: PRODUCT LAUNCHES

- TABLE 192 CURTISS-WRIGHT CORPORATION: COMPANY OVERVIEW

- TABLE 193 CURTISS-WRIGHT CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED?

- TABLE 194 CURTISS-WRIGHT CORPORATION: DEALS

- TABLE 195 GEMS SENSORS, INC.: COMPANY OVERVIEW

- TABLE 196 GEMS SENSORS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED?

- TABLE 197 GEMS SENSORS, INC.: DEALS

- TABLE 198 SAAB AB: COMPANY OVERVIEW

- TABLE 199 SAAB AB: PRODUCTS/SOLUTIONS/SERVICES OFFERED?

- TABLE 200 SAAB AB: DEALS

- TABLE 201 RAYTHEON TECHNOLOGIES CORPORATION: COMPANY OVERVIEW

- TABLE 202 RAYTHEON TECHNOLOGIES CORPORATION: PRODUCTS/SOLUTIONS/ SERVICES OFFERED?

- TABLE 203 RAYTHEON TECHNOLOGIES CORPORATION: DEALS

- TABLE 204 TELEDYNE FLIR LLC: COMPANY OVERVIEW

- TABLE 205 TELEDYNE FLIR LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED?

- TABLE 206 TELEDYNE FLIR LLC: DEALS

- TABLE 207 APPLANIX: COMPANY OVERVIEW

- TABLE 208 APPLANIX: PRODUCTS/SOLUTIONS/SERVICES OFFERED?

- TABLE 209 WÄRTSILÄ CORPORATION: COMPANY OVERVIEW

- TABLE 210 WÄRTSILÄ CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED?

- TABLE 211 WÄRTSILÄ CORPORATION: DEALS

- TABLE 212 XYLEM INC.: COMPANY OVERVIEW

- TABLE 213 XYLEM INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED?

- TABLE 214 YOKOGAWA ELECTRIC CORPORATION: COMPANY OVERVIEW

- TABLE 215 YOKOGAWA ELECTRIC CORPORATION: PRODUCTS/SOLUTIONS/ SERVICES OFFERED?

- TABLE 216 ROCKWELL AUTOMATION: COMPANY OVERVIEW

- TABLE 217 ROCKWELL AUTOMATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED?

- TABLE 218 ROCKWELL AUTOMATION: DEALS

- TABLE 219 SEA-BIRD SCIENTIFIC: COMPANY OVERVIEW

- TABLE 220 SEA-BIRD SCIENTIFIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED?

- TABLE 221 CHELSEA TECHNOLOGIES LTD.: COMPANY OVERVIEW

- TABLE 222 MIDORI AMERICA CORPORATION: COMPANY OVERVIEW

- TABLE 223 SHIP MOTION CONTROL: COMPANY OVERVIEW

- TABLE 224 AML OCEANOGRAPHIC: COMPANY OVERVIEW

- TABLE 225 VALEPORT LTD.: COMPANY OVERVIEW

- TABLE 226 GUENTHER POLSKA SP. Z O.O.: COMPANY OVERVIEW

- TABLE 227 BD|SENSORS GMBH: COMPANY OVERVIEW

- TABLE 228 NORWEGIAN SUBSEA: COMPANY OVERVIEW

- TABLE 229 RBR LTD.: COMPANY OVERVIEW

- TABLE 230 AIRMAR TECHNOLOGY CORPORATION: COMPANY OVERVIEW

- FIGURE 1 MARINE SENSORS MARKET SEGMENTATION

- FIGURE 2 REPORT PROCESS FLOW

- FIGURE 3 RESEARCH DESIGN

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS

- FIGURE 5 US NAVAL BUDGETS (2010–2023)

- FIGURE 6 BREAKDOWN OF US NAVAL DEFENSE BUDGET (2015–2023)

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 9 DATA TRIANGULATION

- FIGURE 10 AFTERMARKET SEGMENT TO RECORD HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 11 UNMANNED UNDERWATER VEHICLES TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 12 NAVIGATION AND POSITIONING SYSTEMS TO HAVE HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 13 ASIA PACIFIC MARKET TO ACCOUNT FOR LARGEST SHARE IN 2023

- FIGURE 14 INCREASED FOCUS ON SAFETY, SECURITY, AND TECHNOLOGICAL ADVANCEMENTS TO DRIVE MARKET

- FIGURE 15 WIRED SEGMENT TO HAVE LARGEST MARKET SHARE IN 2023

- FIGURE 16 OPTICAL SENSORS TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 17 CHINA AND INDIA TO BE FASTEST-GROWING MARKETS BETWEEN 2023 AND 2028

- FIGURE 18 MARINE SENSORS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 19 MARKET SCENARIO ANALYSIS

- FIGURE 20 VALUE CHAIN ANALYSIS

- FIGURE 21 ECOSYSTEM MAPPING

- FIGURE 22 REVENUE SHIFT AND NEW REVENUE POCKETS FOR PLAYERS IN MARINE SENSORS MARKET

- FIGURE 23 PORTER’S FIVE FORCES ANALYSIS

- FIGURE 24 INFLUENCE OF KEY STAKEHOLDERS ON BUYING MARINE SENSORS

- FIGURE 25 KEY BUYING CRITERIA FOR MARINE SENSORS, BY END USE

- FIGURE 26 DEVELOPMENT POTENTIAL OF MARINE SENSORS MARKET, 2000–2030

- FIGURE 27 MARINE SENSORS MARKET, BY SENSOR TYPE, 2023–2028

- FIGURE 28 MARINE SENSORS MARKET, BY CONNECTIVITY, 2023–2028

- FIGURE 29 MARINE SENSORS MARKET, BY END USE, 2023–2028

- FIGURE 30 MARINE SENSORS MARKET, BY APPLICATION, 2023–2028

- FIGURE 31 MARINE SENSORS MARKET, BY SHIP TYPE, 2023–2028

- FIGURE 32 MARINE SENSORS MARKET, BY REGION, 2023–2028

- FIGURE 33 NORTH AMERICA: MARINE SENSORS MARKET SNAPSHOT

- FIGURE 34 EUROPE: MARINE SENSORS MARKET SNAPSHOT

- FIGURE 35 ASIA PACIFIC: MARINE SENSORS MARKET SNAPSHOT

- FIGURE 36 REST OF THE WORLD: MARINE SENSORS MARKET SNAPSHOT

- FIGURE 37 MARKET RANKING OF KEY PLAYERS, 2022

- FIGURE 38 REVENUE SHARE ANALYSIS OF KEY PLAYERS, 2022

- FIGURE 39 MARKET SHARE OF KEY PLAYERS, 2022

- FIGURE 40 MARINE SENSORS MARKET: COMPANY EVALUATION MATRIX, 2022

- FIGURE 41 MARINE SENSORS MARKET: STARTUP/SME EVALUATION MATRIX, 2022

- FIGURE 42 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

- FIGURE 43 EATON CORPORATION: COMPANY SNAPSHOT

- FIGURE 44 TE CONNECTIVITY: COMPANY SNAPSHOT

- FIGURE 45 GARMIN LTD.: COMPANY SNAPSHOT

- FIGURE 46 CURTISS-WRIGHT CORPORATION: COMPANY SNAPSHOT

- FIGURE 47 GEMS SENSORS, INC.: COMPANY SNAPSHOT

- FIGURE 48 SAAB AB: COMPANY SNAPSHOT

- FIGURE 49 RAYTHEON TECHNOLOGIES CORPORATION: COMPANY SNAPSHOT

- FIGURE 50 TELEDYNE FLIR LLC: COMPANY SNAPSHOT

- FIGURE 51 APPLANIX: COMPANY SNAPSHOT

- FIGURE 52 WÄRTSILÄ CORPORATION: COMPANY SNAPSHOT

- FIGURE 53 XYLEM INC.: COMPANY SNAPSHOT

- FIGURE 54 YOKOGAWA ELECTRIC CORPORATION: COMPANY SNAPSHOT

- FIGURE 55 ROCKWELL AUTOMATION: COMPANY SNAPSHOT

- FIGURE 56 SEA-BIRD SCIENTIFIC: COMPANY SNAPSHOT

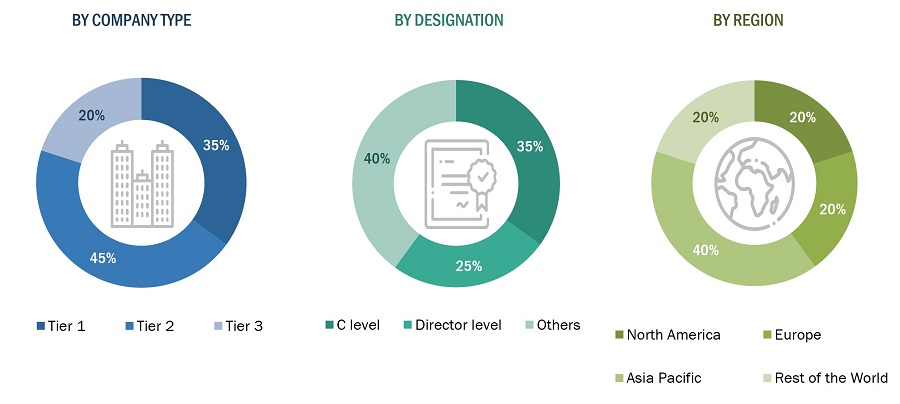

This research study used secondary sources, directories, and databases like D&B Hoovers, Bloomberg Businessweek, and Factiva to identify and collect information relevant to the ship sensors market. Primary sources included industry experts from the core and related industries, preferred suppliers, manufacturers, solution providers, technology developers, alliances, and organizations related to all the segments of this industry’s value chain. All primary sources were interviewed to obtain and verify critical qualitative and quantitative information and assess prospects for the market's growth during the forecast period.

Secondary Research:

The share of companies in the marine sensors market was determined using secondary data made available through paid and unpaid sources and by analyzing their product portfolios. The companies were rated based on the performance and quality of their products. These data points were further validated by primary sources. Secondary sources that were referred to for this research study on the marine sensors market included financial statements of companies offering and developing marine sensor products and solutions and information from various trade, business, and professional associations, among others. Secondary data was collected and analyzed to arrive at the overall size of the marine sensors market, which was further validated by primary respondents.

Primary Research:

Extensive primary research was conducted after obtaining information about the current scenario of the marine sensors market through secondary research. Several primary interviews were conducted with market experts from the demand and supply sides across North America, Europe, Asia Pacific, and Rest of the World. This primary data was collected through questionnaires, emails, and telephonic interviews.

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, such as vice presidents, directors, regional managers, technology providers, product development teams, distributors, and end users.

Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products & services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the trends related to sensor type, ship type, application, endues and connectivity. Stakeholders from the demand side, such as CXOs, production managers, engineers, and installation teams of end users of marine sensors, were interviewed to understand the buyer’s perspective on the suppliers, products, service providers, and their current usage and outlook of their business, which could affect the marine vessel sensor market.

To know about the assumptions considered for the study, download the pdf brochure

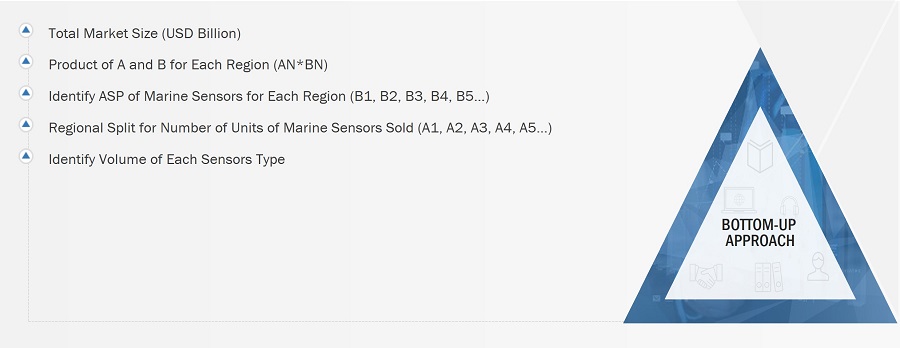

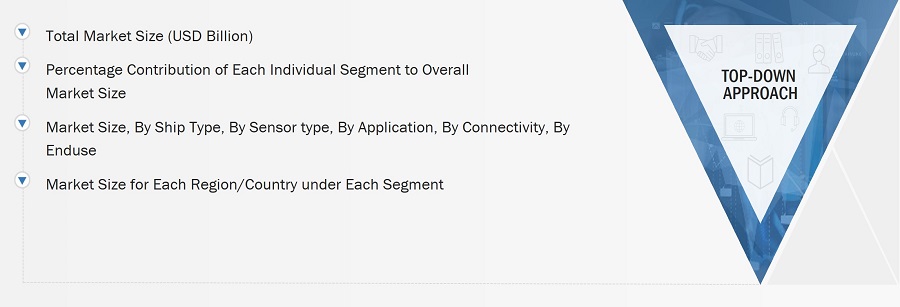

Market Size Estimation

Top-down and bottom-up approaches were used to estimate and validate the size of the marine sensors market. The research methodology used to estimate the size of the market includes the following details.

The key players in the ship sensor market were identified through secondary research, and their market shares were determined through primary and secondary research. This included a study of the annual and financial reports of the top market players and extensive interviews with leaders such as directors, engineers, marketing executives, and other stakeholders of leading companies operating in the hybrid aircraft market.

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analysed to obtain the final quantitative and qualitative data on the marine sensors market. This data was consolidated, enhanced with detailed inputs, analysed by MarketsandMarkets, and presented in this report.

Market size estimation methodology: Bottom-up Approach

Market size estimation methodology: Top-Down Approach

Market Definition

Marine sensors are instruments and devices designed to measure and monitor parameters related to ship activities. These sensors provide real-time data to operators, captains, and crews, enabling informed decision-making and enhancing the safety and efficiency of operations. The definition encompasses sensors that capture information related to navigation, propulsion, environmental conditions, safety, communication, and various other parameters.

Key Stakeholders

- Raw Material suppliers

- Marine sensors manufacturers

- Technology support providers

- Logistics and transport solution providers

- System Integrators

- Government Agencies

- Investors and Financial Community Professionals

Objectives of the Study

- To define, describe, segment, and forecast the size of the marine sensors market based on solution, location, topology, landscape, type, and region.

- To analyze the degree of competition in the market by mapping the recent developments, products, and services of key market players

- To understand the structure of the marine sensors market by identifying its various segments and subsegments

- To identify and analyze key drivers, restraints, opportunities, and challenges that influence the growth of the market.

- To provide an overview of the tariff and regulatory landscape for the adoption of marine sensors across regions

- To forecast the size of market segments across North America, Europe, Asia Pacific, and Rest of the World, along with major countries in each region

- To identify transportation industry trends, market trends, and technology trends currently prevailing in the market

- To analyze micromarkets1 with respect to individual technological trends and their contribution to the total market

- To analyze opportunities in the market for stakeholders by identifying key market trends

- To profile key market players and comprehensively analyze their market share and core competencies2

- To provide a detailed competitive landscape of the market, along with an analysis of business and strategies such as mergers and acquisitions, partnerships, agreements, and product developments in the marine sensors market

- To identify detailed financial positions, key products, and unique selling points of leading companies in the market

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of the marine sensors market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the ship sensor market.

Growth opportunities and latent adjacency in Marine Sensors Market