Marine Mining Market by Technology (Remotely Operated Vehicles (ROVs), Sonar, Marine Seismic Methods), Element (Polymetallic Nodules, Polymetallic Sulphides, Cobalt-rich ferromanganese crusts, and Others), Application, and Region - Global Forecast to 2029

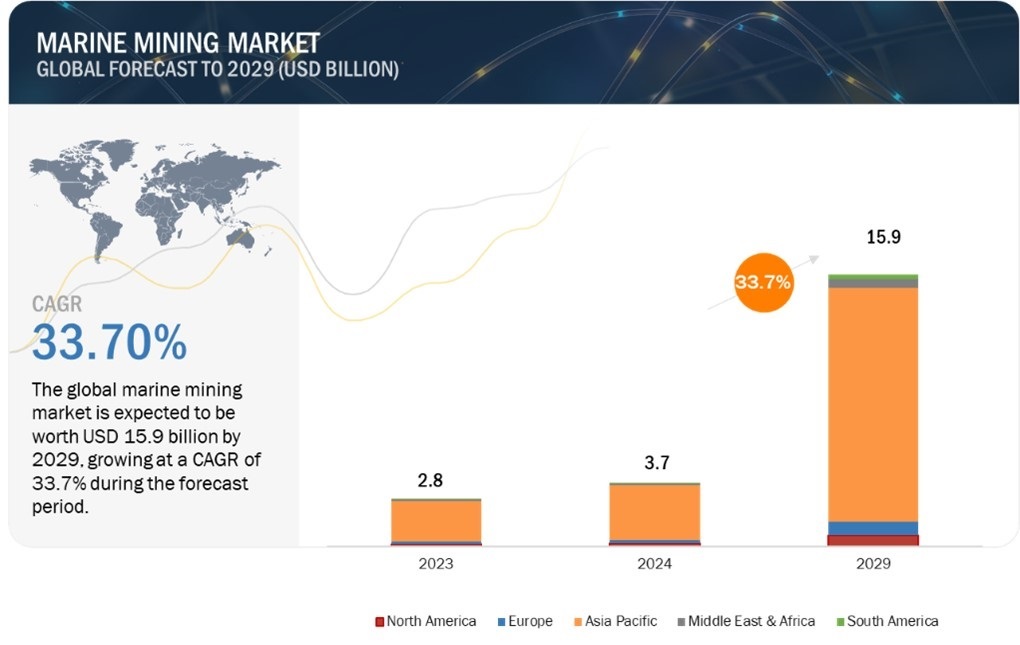

The marine mining market is estimated to grow from USD 3.7 billion in 2024 to USD 15.9 billion by 2029, at a CAGR of 33.7%. Marine mining is extracting all valuable resources from the ocean floor, often hundreds or thousands of kilometers below the surface. From the ocean floor, it has been done for polymetallic nodules, polymetallic sulfides, cobalt-rich crusts, and others above the ocean water. These elements are most used in electronics, automotive, construction, and other sectors. Marine mining is usually conducted in the deep sea at locations such as the Clarion-Clipperton Zone (Pacific Ocean), mid-ocean ridges, and seamounts. When terrestrial reserves of crucial materials such as cobalt and nickel run dry and others deplete, the seabed has become the potential new frontier for alluring resources. Several technologies are now available for marine mining, including highly developed systems such as effectively operated vehicles (ROVs), autonomous underwater vehicles (AUVs), and others. However, there are serious effects these technologies bring concerning marine mining purified in exploration and extraction efficiency since marine mining devastates the marine environment: habitat disruption, sediment plumes, and impacts on deep-economy ecosystems, many unknown. Thus came the need for regulatory frameworks such as the International Seabed Authority (ISA) to enable the duality of marine mining and its economic exploitation and environmental protection. This will be important when demand increases, but it can only develop with sustainable practices and technological advances.

Attractive Opportunities in the Marine Mining Market

To know about the assumptions considered for the study, Request for Free Sample Report

Marine Mining Market Dynamics

Driver: Growing demand for minerals and metals for renewable energy and cutting-edge technologies

In the last couple of years, electric vehicle (EV) markets have developed steadily, as have renewable energy systems, such as wind and solar, which spur the growing global activity toward decarbonization. These two sectors depend heavily on resources such as cobalt, nickel, lithium, and other elements used mainly in batteries, magnets, and other components that require high performance. However, the sources for these minerals are becoming scarce because of excessive mining, geopolitical pressure, and others. Hence, as a result, industries are now seeking alternative sources, in which the ocean floor is promising. Significant deposits of polymetallic nodules, polymetallic sulfides, and cobalt-rich crusts in the oceans offer an untapped resource base to meet the growing demand for minerals.

In addition, marine mining can open new avenues for many regions dependent on imports, as diversifying resource sourcing may prove crucial in addressing supply chain vulnerabilities. This increasing demand for a stable and secure supply of raw materials, therefore induced by advances in energy transitions on a global scale and modern technology advances, is one of the major drivers for the development and investment of technologies and operations in marine mining.

Restraints: Stringent regulatory compliances and environmental degradation

While the ocean is a repository of unexplored wealth, extracting minerals from its seabed raises serious concerns about ecological impacts. Mining, especially in deep-sea operations, can disrupt sensitive marine ecosystems and create sediment plumes that smother coral reefs, destroy habitats, and threaten marine biodiversity. Other environmental risks associated with mining operations include contaminating surrounding waters with heavy metals, chemicals, and other pollutants from mining equipment and processes. More dangerously, the depth of our ignorance regarding deep-sea ecosystems and the long-term living impacts mining has on habitats presents much uncertainty. Thus, organizations such as the International Seabed Authority (ISA) and each country's government are enforcing stringent regulatory frameworks and guidelines to mitigate these risks. However, the same regulations usually delay, incur very high costs, and impose strict restrictions on operation, making investment in marine mining projects unattractive. Sustainable practices and rising environmental and public pressures have compelled companies to invest in more advanced technologies within their operations, increasing operational costs and making companies deviate as they are diverted to the high-cost technology option. All these regulatory barriers and their environmental impacts stand as strong restraints for the marine mining market.

Opportunity: Collaborations Between Governments, Research Institutions, and Private Companies to Advance Marine Mining

Strategic collaborations and partnerships for research and development in marine mining provide a great opportunity in the market, allowing innovation and tackling problems associated with this emerging industry. The mining companies, technology businesses, environmental organizations, and academic institutes need these partnerships to spearhead resolution from technical, environmental, and regulatory points of view. Partnerships can fuel better technology development in exploration by advancing AUVs, sensor systems, etc., which can create a more nuanced mapping of these areas rich in minerals, allowing for improved extraction process efficiency. Joint research initiatives will facilitate the development of environmentally sustainable mining practices, e.g., sediment plume management and biodiversity conservation. Cross-industry collaboration, particularly with renewable energy and electric vehicles, will develop a continuous market demand for seabed minerals, such as cobalt, nickel, and rare earth, essentially used for batteries and green technologies. Such alliances help navigate international regulations and license acquisitions in particular regions under International Seabed Authority (ISA) jurisdiction. Such partnerships accelerate innovation by pooling resources, expertise, and funding while reducing operational risks and moving the marine mining market toward a sustainable, economically feasible solution to global resource shortages.

Challenges: Technical and operational complexities

The greatest challenge of the marine mining industry lies in technical and operational complications related to deep-sea extraction. The harsh underwater environment bears extreme pressures and low temperatures, possessing visibility scarcely suitable for searching and mining operations. Investment and advanced engineering are prerequisites for developing and using high-tech equipment such as autonomous underwater vehicles, deep-sea drills, and remotely operating vehicles. Operational difficulties can cause havoc in the remaining stability and functionality of equipment designed for depths of several kilometers. Repair and maintenance of such equipment become extremely expensive and complicated. Innovative means and handling processes simultaneously become necessary for the efficient and safe transport of materials from the seabed to the surface. The absence of standardized processes suggests that infrastructure further complicates the operational landscape in a risk-heavy composition of expected delay and cost overruns. These technical hurdles are further complicated in lean conditions with criteria for real-time operation and monitoring systems to ensure accuracy in functioning and reduced environmental footprint. Such real-time high-end technology would require stakeholders' cooperation and great capital investments, all leading to the high-risk nature of investments in marine mining.

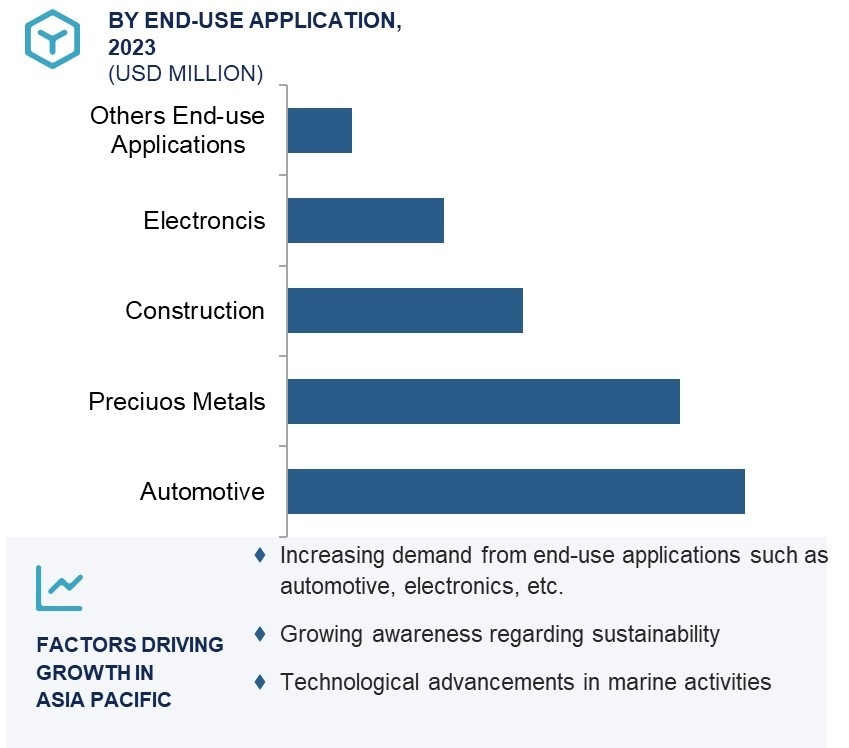

MARINE MINING MARKET ECOSYSTEM ANALYSIS

The marine mining ecosystem includes exploration and surveying service providers, key players, and end-users. Exploration and surveying service providers are involved in mapping seabed mineral deposits using technologies like sonar and remotely operated vehicles (ROVs) and conducting geophysical surveys. In addition, key players play a crucial role by extracting the minerals from deposits and providing them to end-users. At the final stage, end-use applications such as automotive, precious metals, electronics, construction, and others incorporate these minerals into their products to adhere to environmental regulations and meet their sustainability goals.

MARINE MINING MARKET SEGMENTATION

Remotely Operated Vehicles hold the largest share in the marine mining market.

Remotely Operated Vehicles (ROVs) dominate the marine mining market because of their unrivaled versatility, precision, and capability for operating in extreme environments under the ocean surface. ROVs are tethered robotic systems equipped to do various tasks, from exploration to materials extraction, at depths where human beings cannot operate. These have high-resolution cameras, sonar, manipulator arms, and other specialized instruments that cannot be replaced in deep-sea mining operations. They will then enable the operator to observe the seafloor visually, gather geological samples, and mine mineral-rich deposits with minimum environmental disturbance, including polymetallic nodules, cobalt crusts, and sulfides. ROVs are used significantly because they can withstand the dire conditions of deep-sea environments, such as very high pressure, low temperature, and unpredictable terrain. These allow them to be remotely controlled from a surface vessel, allowing operational safety and lowering the risk to human workers. Moreover, new advancements in robotics and sensor technology have made such tools much better in efficiency, accuracy, and reliability than ever. Most importantly, they become economically viable for mining companies that use them. ROVs can easily integrate with other systems like dynamic positioning, thereby granting stability and real-time monitoring systems concerning environmental compliance issues, making them even more popular. The increase in demand for critical minerals for renewable energy and electronics will make ROVs even more popular as they are the best solution for the double need for operational efficiency and environmental responsibility in marine mining.

Polymetallic Nodules hold the largest share of the element segment in the marine mining market.

Polymetallic Nodules hold the largest share of the marine mining market due to their abundantly loose occurrence on the deep-sea floor and their rich composition of valuable metals like manganese, nickel, cobalt, and copper. Giant quantities of such polymetallic nodules are found on the abyssal plains of the oceans, especially in the Clarion-Clipperton Zone in the Pacific Ocean. These jewels of the seabed are more coveted because of their cruciality in the manufacture of several highly demanded products. Manganese is integral in making steel, while nickel and cobalt together are very much needed in batteries, especially in electric vehicles (EVs) and renewable energy storage systems. Copper is also essential for infrastructural and electric wiring applications, which are now vital in green energy technologies, including solar energy systems, wind energy systems, and others. Moreover, polymetallic nodules are relatively easier to access than other seabed resources, thus attracting marine mining companies in search of a constant, assured supply of these critical metals for the long term. Mining polymetallic nodules seem to have economic prospects in providing an increasingly viable solution to the growing needs for these metals, especially as the demand rises for clean energy technologies needed globally.

Automotive holds the largest share of the marine mining market.

Automotive applications account for a considerable part of the marine mining market as the demand for critical minerals and metals that manufacture electric vehicles (EVs) and other advanced automotive technologies grows. Indeed, its high-performance batteries, electric drivetrains, as well as some other automotive components are produced with necessary materials like cobalt, nickel, and other rare earth elements, all located at depths in the ocean. The growing demand for EVs due to the rising emphasis on achieving sustainable goals and clean energy movements also positively impacts the demand for metals. For example, lithium & cobalt are essential in making lithium-ion batteries for electric vehicles. With sustainability and reduced carbon emissions at the center of the automotive industry, demand for these materials keeps rising. Marine mining is emerging as one source increasingly critical for the metals needed to realize green transportation. Securing such metals from marine deposits also helps establish a stable and environmentally sustainable supply chain, thus making the automotive sector one of the key drivers in expanding marine mining activities.

Asia Pacific holds the largest share of the marine mining market.

Widespread demand for high metals, including those for electronic, renewable energy, and electric vehicles (EVs) industries, has placed this region at the largest marine-mining share due to its strategic location, underwater mineral richness, and demand. At the same time, countries such as China, Japan, and Australia perform active marine mining in an attempt to address the dire demand for sourcing stable supplies of cobalt, nickel, and rare earth elements, which are essential in the processing of batteries, renewable energy technologies, and high-tech electronics. This dominance is also attributable to an emphasis on technological advancements and innovation in marine exploration and extraction. Consequently, the Asia Pacific will be the biggest audience for all sorts of investment in autonomous underwater vehicles (AUVs) and remotely operated vehicles (ROVs) that will facilitate deep-sea resource exploration and extraction. The long coastline and mining wealth, such as the Clarion-Clipperton Zone found in the Pacific Ocean and various seamounts, make the region more accessible to these valuable resources. An impetus has also been added from the green push worldwide towards energy and infrastructure, where now Asian economies, particularly China and Japan, put more effort into securing critical minerals for the development of clean technologies such as electric vehicles (EVs) and solar panels, making it a priority for marine mining. After that, joint international collaboration and supportive government policies and regulative measures further positioned the region as a titan in the market. Thus, this results in a promising future for Asia Pacific in terms of holding market share in the marine mining market due to its economic priorities, technological advancements, and other factors.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

- Nautilus Minerals Inc. (Canada)

- Loke Marine Minerals (Norway)

- Keppel Ltd. (Singapore)

- Soil Machine Dynamics Ltd. (UK)

- Royal IHC (Netherlands)

- Ocean Minerals LLC (US)

- China Minmetals Corporation (China)

- The Metals Company (Canada)

- De Beers Group (UK)

- Deep Ocean Engineering (US)

- DEME Group (Netherlands)

- RJE International Inc. (US)

- Odyssey Marine Exploration (US)

- Acteon Group (UK)

- Debmarine Namibia (South Africa)

- Teledyne Marine Technologies Incorporated (US)

- Impossible Metals Inc. (US)

- Scandinavian Ocean Minerals (Sweden)

- Mariscope (Chile)

- Japan Organization for Metals and Energy Security (Japan)

- Deep Ocean Resources Development Co., Ltd. (Japan)

- Bundesanstalt für Geowissenschaften und Rohstoffe (BGR) (Germany)

- Allseas (Switzerland)

- KONGSBERG (Norway)

- Bosch Rexroth Corporation (US)

Recent Developments in Marine Mining Market

- On June 2023, Odyssey Marine Exploration Announces Partnership with Ocean Minerals LLC for a New Cook Islands Exploration Project.

- On March 2023, UK Seabed Resources, or UKSR, was acquired by Loke Marine Minerals from Lockheed Martin. UKSR is the leaseholder of two deep-sea mineral licenses in the Clarion-Clipperton Zone of the Pacific Ocean.

- In August 2021, TechnipFMC declared the strategic investment in Loke Marine Minerals for technologies that will help extract seabed minerals.

- In July 2019, wholly-owned subsidiary IHC Robbins of Royal IHC announced that the term had entered into a Heads of Agreement with Dome Gold Mines, an Australian company.

- In February 2019, Nautilus Minerals Inc. announced that the Government of Papua New Guinea granted the company a two-year Exploration License. The license would allow the company to explore the southeast Bismarck Sea. The Exploration License EL2537 covers 2,558 km2 and includes the same prospective geology that hosts Nautilus' Solwara 1 deposit.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Frequently Asked Questions (FAQ):

Key questions addressed in the report

What are the major drivers for the growth of the marine mining market?

The key drivers for the marine mining market include growing demand for metals and minerals, growing adoption of electric vehicles, the need for battery materials such as nickel, cobalt, and copper, and technological advancements in mining activities.

What are the significant challenges in the marine mining market?

The main challenges in the marine mining market are technological and operational complexities.

What are the restraining factors for the marine mining market?

The primary constraints in the marine mining market are stringent regulatory compliances & environmental degradation, and high capital investment.

What is the key opportunity in the marine mining market?

Collaborations between governments, research institutions, and private companies to advance marine mining are the major opportunities in the marine mining market.

What are the major end-use applications of marine mining?

Marine mining has key end-use applications in automotive, precious metals, construction, electronics, and other industries.

Who are the major manufacturers of marine mining?

Major players in the marine mining market include Nautilus Minerals Inc. (Canada), Loke Marine Minerals (Norway), Keppel Ltd. (Singapore), Soil Machine Dynamics Ltd (UK), Royal IHC (Netherlands), Ocean Minerals LLC (US), China Minmetals Corporation (China), The Metals Company (Canada), De Beers Group (UK), and DEME Group (Netherlands).

Marine Mining Market

Growth opportunities and latent adjacency in Marine Mining Market