Marine Electric Vehicle Market by Technology (Fully Electric, Hybrid), Vehicle Type (Commercial (Passenger Vessel, Cargo Vessel, Others), Defense (Destroyers, Frigates, Corvette, Submarine, Others), UMV (UUV, USV)), Mode of Operation, Vessel Transport, Range, and Region - Global Forecast to 2030

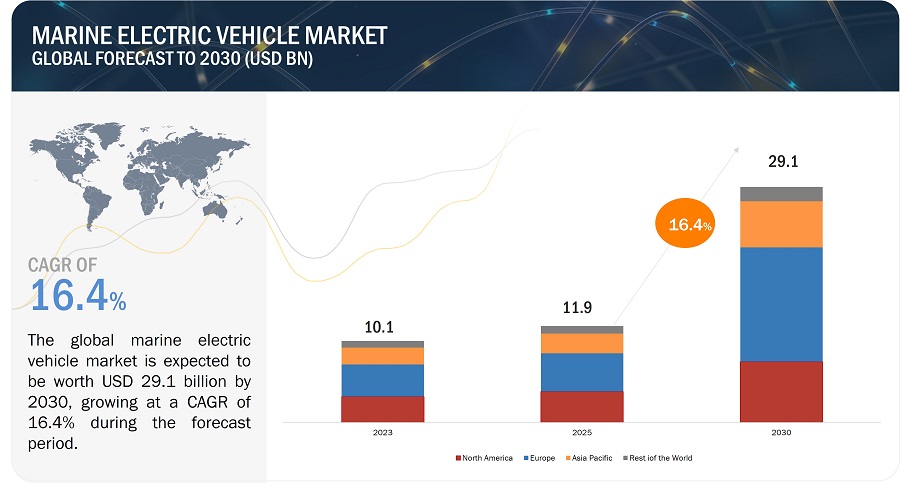

[284 Pages Report] The Marine Electric Vehicle Market size is projected to grow from USD 10.1 Billion in 2023 to USD 29.1 Billion by 2030, at a CAGR of 16.4% from 2023 to 2030. The rise in global regulations aimed at mitigating emissions and promoting sustainable maritime solutions is a pivotal factor driving the growth in Marine Electric Vehicle Market

Marine Electric Vehicle Market Forecast to 2030

To know about the assumptions considered for the study, Request for Free Sample Report

Marine Electric Vehicle Market Dynamics

Driver: Growing maritime tourism, including underwater and surface water sport industry

The growth of the global maritime tourism industry has led to an increased demand for cruises, ferries, motorboats, and other marine passenger transport vessels. In 2022, according to UNWTO (United Nations World Tourism Organization), international tourism receipts surged past the USD 1 trillion mark, registering a remarkable 50% growth in real terms compared to 2021. This impressive rebound in international travel fueled the resurgence of international visitor spending, which reached 64% of pre-pandemic levels, representing a decline of 36% compared to 2019. Europe emerged as the top-performing region, generating nearly USD 550 billion (EUR 520 billion) in tourism receipts, equivalent to 87% of pre-pandemic levels. Africa, the Middle East, and the Americas also showcased significant recovery rates, achieving 75%, 70%, and 68% of their pre-pandemic receipts. However, Asian destinations faced greater challenges due to prolonged border closures, resulting in a modest 28% of pre-pandemic earnings. These figures underscore the resilience and gradual revitalization of the global tourism industry.

Restraints: Limited resources of raw materials used in the manufacturing of batteries

The production of batteries for MEVs requires significant quantities of certain raw materials, such as lithium, cobalt, and nickel. The availability of these materials can be limited, and their extraction and processing can face environmental and social challenges. Dependence on a limited number of geographic sources for these raw materials can create supply chain vulnerabilities and price fluctuations, impacting the cost and availability of batteries for MEVs.

Some raw materials used in batteries, such as cobalt, are associated with environmental and social challenges. Environmental concerns arise from the extraction and processing of raw materials, such as the carbon emissions and water pollution associated with lithium mining. Democratic Republic of the Congo (DRC) is the world's top cobalt producer, providing a sizable percentage of the market. However, because of worries about child labor, hazardous working conditions, and environmental degradation, cobalt mining in the nation has come under attention. Standards are being raised, and responsible sourcing methods are being followed.

Opportunity: Increasing adoption of electric propulsion technologies into the UUV market

Improved operational capabilities, increased endurance, and improved environmental sustainability may result from the adoption of electric technology in the UUV market. In fields including environmental monitoring, offshore energy, underwater exploration, defense, and others, this creates chances for cooperation, knowledge transfer, and market expansion.

UUVs are used for a variety of purposes in defense and security, such as submarine detection, underwater surveillance, mine countermeasures, and intelligence gathering. Utilizing electric technologies allows UUVs to operate for extended periods of time, increasing their efficacy and lowering the logistical difficulties related to refueling or changing power sources while on missions. Defense contractors, IT companies, and military organizations can benefit from the integration of MEV capabilities in UUVs.

Electric technology innovations and developments can be used for UUVs and vice versa, promoting cross-domain cooperation and information sharing. This partnership has the potential to quicken the pace of innovation and support the overall expansion of the MEV and UUV sectors. Both sectors call for effective energy management, navigation and control algorithms, and underwater communication systems.

Challenge: High initial capital expenditure

Compared to conventional marine boats, MEVs may have higher initial expenditures, including the purchase of electric propulsion systems and related infrastructure. Particularly, the price of batteries continues to represent a sizeable amount of the overall cost of MEVs. Although the costs are anticipated to decline with time, it is currently difficult to match the costs of conventional boats. Particularly, the price of batteries continues to represent a sizeable amount of the overall cost of MEVs. Even while economies of scale and technology developments are predicted to drive down costs over time, affordability is still a problem for many prospective users.

Due to the necessity for vessel modifications, infrastructure integration, and potential electrical system constraints, retrofitting existing vessels with electric propulsion systems can be difficult. Some vessel owners may be discouraged from making the switch to MEVs by the complicated and expensive retrofitting process.

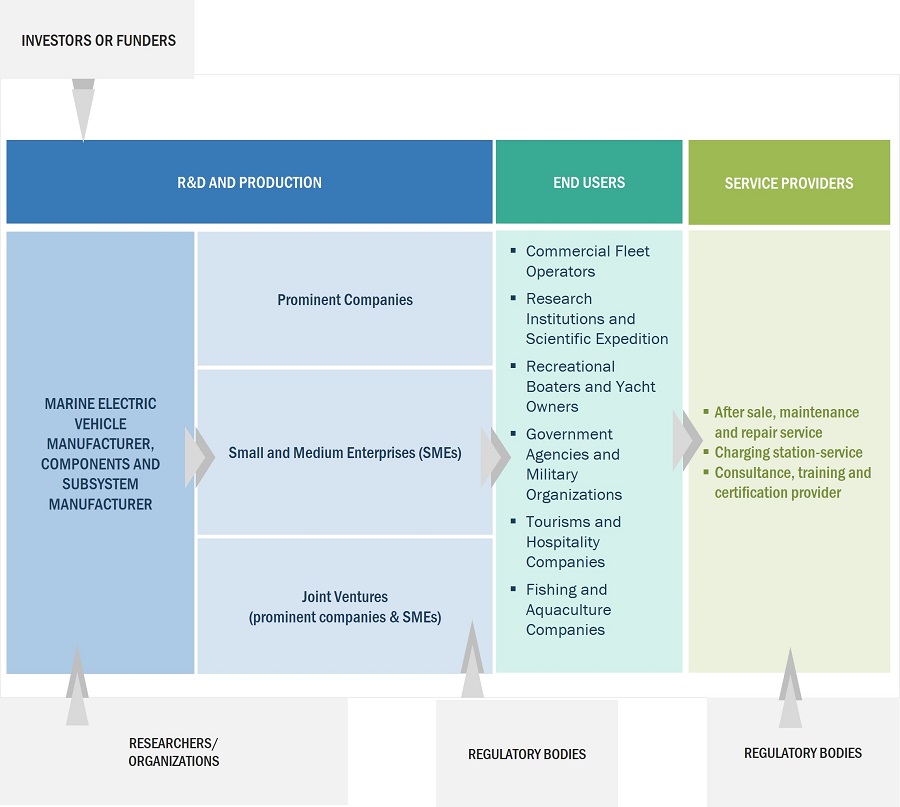

Marine Electric Vehicle Market Ecosystem

Prominent companies in this market include well-established, financially stable manufacturers of Marine Electric Vehicles. These companies have established a strong foothold in the market through diversified product portfolios, advanced technologies, and robust global sales and marketing networks. The prominent companies are ABB (Switzerland), Siemens AG (Germany), BAE Systems (UK), General Electric (US), and Kongsberg Gruppen (Norway). Commercial Passenger vessel operators, Cargo and tanker operators, defense organizations, private watercraft users, fishing organizations, oil and gas exploration companies, and research companies are some of the major consumers of marine electric vehicles.

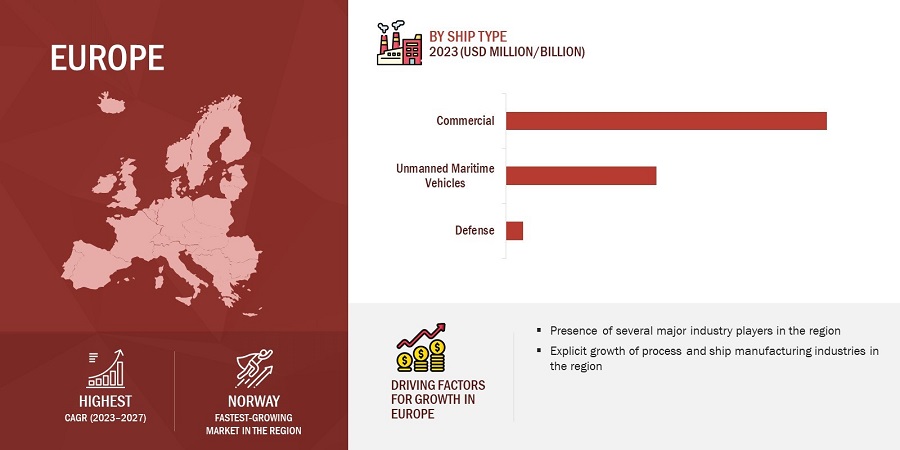

Commercial Segment to dominate market share during the forecast period

Based on Ship Type, the Marine Electric Vehicle Market has been segmented into commercial and defense. Commercial Segment is witnessing high growth and market share due to the increasing adoption of electric vehicles for passenger transportation, recreational use, and other commercial usage such as fishing and research.

Hybrid electric segment is expected grow the highest during the forecast period

Based on technology, the hybrid electric segment is expected to grow the highest during the forecast period. In larger vessels, it becomes difficult to provide fully electric solutions due to lower load-bearing capacity and lower range. Also, since more adoption is being made in larger vessels to curb emissions, hybrid is being considered as the best option in larger maritime vessels.

The inland vessels segment is to witness higher growth during the forecast period

Based on vessel transport, the Marine Electric Vehicle Market has been segmented into seafaring and inland vessels. Inland vessels are either being converted into electric or more users are opting for electric vessels to reduce localized emissions in waterways closer to civilization.

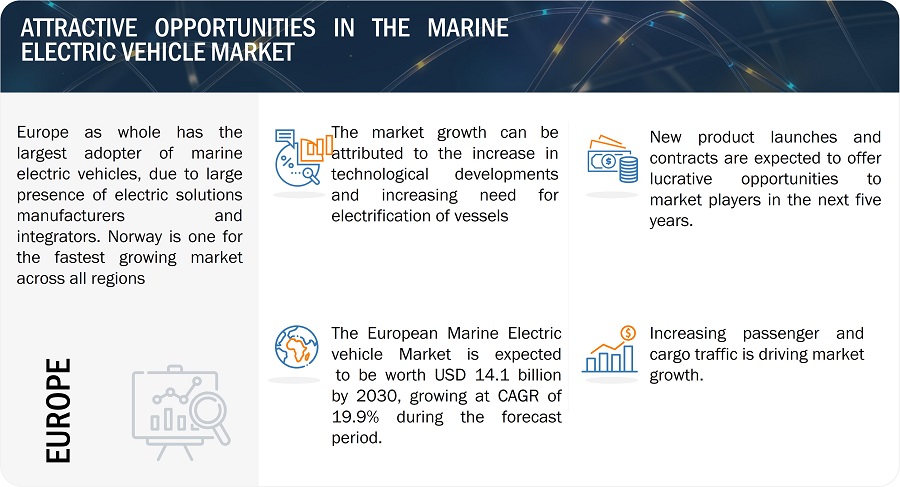

Europe is projected to witness the highest market share during the forecast period.

Europe leads the Marine Electric Vehicle Market due presence of key players, vessel manufacturers, and component manufacturers, which are a few factors expected to boost the growth of the Marine Electric Vehicle Market in the region. These players invest in extensive R&D to develop electric maritime solutions with improved efficiency and reliability. Major manufacturers and suppliers of Marine Electric Vehicles in this region include ABB (Switzerland), Leclanché S.A. (Switzerland), Siemens AG (Germany), Wartsila (Finland), and Kongsberg Gruppen (Norway).

Marine Electric Vehicle Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

Major players operating in the Marine Electric Vehicle companies include ABB (Switzerland), Siemens AG (Germany), BAE Systems (UK), General Electric (US), and Kongsberg Gruppen (Norway).

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2019-2030 |

|

Base year considered |

2022 |

|

Forecast period |

2023-2030 |

|

Forecast units |

Value (USD Million/Billion) |

|

Segments Covered |

Technology, Ship Type, Mode of Operation, Vessel Transport, Range, and Region |

|

Geographies Covered |

North America, Europe, Asia-Pacific, Rest of the World |

|

Companies Covered |

ABB (Switzerland), Siemens AG (Germany), BAE Systems (UK), General Electric (US) and Kongsberg Gruppen (Norway). |

Marine Electric Vehicle Market Highlights

This research report categorizes the Marine Electric Vehicle Market based on Technology, Ship Type, Mode of Operation, Vessel Transport, Range, and Region

|

Segment |

Subsegment |

|

By Ship Type |

|

|

By Technology |

|

|

By Mode of Operation |

|

|

By Vessel Transport |

|

|

By Range |

|

|

By Region |

|

Recent Developments

- In March 2023, Wärtsilä supplied the main propulsion machinery along with a range of other electrical solutions for two new 110-meter-long amphibious transport vessels that were built for the Chilean Navy.

- In February 2023, Kongsberg Maritime (KONGSBERG) announced it would provide electrical solutions to a newbuild ship named SDO-SuRS (Special and Diving Operations - Submarine Rescue Ship) to be built by the Italian shipyard T.Mariotti for Marina Militare Italiana (The Italian Navy).

- In February 2023, GE's subsidiary in India announced that it had signed a contract with Cochin Shipyard to provide a digital solutions package to increase the capabilities of the LM2500 marine gas turbines that will power the Indian Navy's first Indigenous Aircraft Carrier-1 (IAC-1) Vikrant, which was commissioned in August 2022.

Frequently Asked Questions (FAQ):

What are your views on the growth prospect of the Marine Electric Vehicle Market?

The Marine Electric Vehicle Market is being driven by the electrification of fleets and the need for reduced emissions.

What are the key sustainability strategies adopted by leading players operating in the Marine Electric Vehicle Market?

Key players have adopted various organic and inorganic strategies to strengthen their position in the Marine Electric Vehicle Market. The major players include ABB (Switzerland), Siemens AG (Germany), BAE Systems (UK), General Electric (US), and Kongsberg Gruppen (Norway). These players have adopted various strategies, such as acquisitions, contracts, expansions, new product launches, and partnerships & agreements, to expand their presence in the market.

What are the new emerging technologies and use cases disrupting the Marine Electric Vehicle Market?

Some of the major emerging technologies and use cases disrupting the market include high-energy batteries and research to find the adoption of hydrogen fuel cells. Recreational boating manufacturers are already incorporating solar panels to drive their boats and are finding ways to use renewable energy sources to drive low-load vessels.

Who are the key players and innovators in the ecosystem of the Marine Electric Vehicle Market?

The key players in the Marine Electric Vehicle Market include ABB (Switzerland), Siemens AG (Germany), BAE Systems (UK), General Electric (US), and Kongsberg Gruppen (Norway), to name a few.

Which region is expected to hold the highest market share in the Marine Electric Vehicle Market?

The Marine Electric Vehicle Market in Europe is projected to hold the highest market share during the forecast period due to the presence of several large marine electric vehicle solution providers in the region. The region also has some of the major shipyards that manufacture electric vessels, both manned and autonomous.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Implementation of Sulfur 2020 regulations- Rising demand for electric and hybrid marine vehicles- Growing maritime tourism industry, including underwater & surface water sports industry- Development of lithium-ion batteries- Increasing capital expenditure of offshore oil & gas companiesRESTRAINTS- Limited resources of raw materials used in manufacturing batteries- Increased vehicle weight due to heavy batteriesOPPORTUNITIES- Development of high-powered batteries- Battery charging via renewable energy sources- Increasing adoption of electric propulsion technologies in UUVsCHALLENGES- High initial expenditures- Inadequate charging infrastructure- Technological challenges

-

5.3 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.4 VALUE CHAIN ANALYSISRAW MATERIALSR&DCOMPONENT MANUFACTURINGOEMSEND USERSAFTERSALES SERVICES

-

5.5 ECOSYSTEM MAPPINGPROMINENT COMPANIESPRIVATE AND SMALL ENTERPRISESEND USERS

- 5.6 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.7 TRADE DATA ANALYSIS

-

5.8 TECHNOLOGY ANALYSISLITHIUM-SULFUR BATTERIESHYDROGEN FUEL CELLSHIGH ENERGY DENSITY ELECTROCHEMICAL STORAGE FOR LARGE MARINE ELECTRIC VEHICLES

-

5.9 TARIFF AND REGULATORY LANDSCAPENORTH AMERICAEUROPEASIA PACIFICMIDDLE EAST & AFRICALATIN AMERICA

- 5.10 PRICING ANALYSIS

- 5.11 VOLUME DATA

-

5.12 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 5.13 KEY CONFERENCES AND EVENTS IN 2023-2024

- 6.1 INTRODUCTION

-

6.2 TECHNOLOGICAL ADVANCEMENTSHIGH-ENERGY BATTERY SYSTEMFAST CHARGING INFRASTRUCTUREADVANCED PROPULSION SYSTEMAUTONOMOUS NAVIGATION AND CONTROL

-

6.3 EMERGING TRENDS3D PRINTINGARTIFICIAL INTELLIGENCE (AI)PREDICTIVE MAINTENANCE

- 6.4 SUPPLY CHAIN ANALYSIS

-

6.5 USE CASE ANALYSISOCEANALPHA M75 WAVE RIDERAUTONOMOUS SURFACE VEHICLE (ASV) BY ASV GLOBAL (NOW PART OF L3HARRIS TECHNOLOGIES)UNCREWED SURFACE VEHICLES (USVS) BY SAILDRONE INC.WAVE GLIDER LIQUID ROBOTICS’ (NOW PART OF BOEING) AUTONOMOUS SURFACE VEHICLE

-

6.6 PATENT ANALYSIS

- 7.1 INTRODUCTION

-

7.2 COMMERCIALPASSENGER VESSEL- Yacht- Ferry- Cruise ship- MotorboatCARGO VESSEL- Container vessel- Bulk carrier- Tanker- General cargo shipOTHERS- Fishing vessel- Dredger- Tug & workboat- Research vessel- Submarine

-

7.3 DEFENSEDESTROYER- US, UK, and India focusing on integrating electric propulsive destroyers into their fleetFRIGATE- Electric and hybrid propulsion used in frigates either directly or along with diesel engineCORVETTE- Increasing developments to convert corvettes into electricOFFSHORE SUPPORT VESSEL (OSV)- Adoption of hybrid propulsion technology for offshore support vessels to increaseAIRCRAFT CARRIER- High power demand for aircraft carriers to be challenge for converting to electricSUBMARINE- US, France, and India to develop electric propulsion systemsMILITARY BOAT- Lower power requirements to facilitate shift to electric

-

7.4 UNMANNED MARITIME VEHICLE (UMV)UNMANNED UNDERWATER VEHICLE (UUV)- REMOTELY OPERATED VEHICLE (ROV)- AUTONOMOUS UNDERWATER VEHICLE (AUV)UNMANNED SURFACE VEHICLE (USV)- Increasing use in ISR activities, ocean surveying, and oil & gas exploration

- 8.1 INTRODUCTION

-

8.2 SEAFARING VESSELHIGH POWER REQUIREMENTS TO DRIVE INCREASING ADOPTION OF HYBRID-ELECTRIC PROPULSION CONFIGURATION

-

8.3 INLAND VESSELINVOLVES LESS LOAD REQUIREMENTS

- 9.1 INTRODUCTION

-

9.2 FULLY ELECTRICLITHIUM- Major power source for hybrid and fully marine electric vehiclesLEAD ACID- Wide range of applications in marine industryELECTRO-SOLAR- Involves use of renewable energy to recharge batteries in marine vehiclesFUEL CELL- Alternative technology to lithium-ion and lead-acid batteries

-

9.3 HYBRIDDIESEL & BATTERY DRIVEN- Significant advancements in hybrid technology to encourage adoption of hybrid-electric propulsion for large cruise shipsLPG/LNG & BATTERY DRIVEN- LPG/LNG engines use electric propulsion motors to power ships

- 10.1 INTRODUCTION

-

10.2 MANNEDRETROFITTING DIESEL-DRIVEN MARINE VEHICLES WITH ELECTRIC AND HYBRID PROPULSION TO DRIVE MARKET

-

10.3 REMOTELY OPERATEDINCREASING INVESTMENTS IN REMOTELY OPERATED MARINE ELECTRIC VEHICLES TO DRIVE MARKET

-

10.4 AUTONOMOUSINCREASING INVESTMENTS IN AUTONOMOUS MARINE ELECTRIC VEHICLES TO DRIVE MARKET

- 11.1 INTRODUCTION

-

11.2 <50 KMADOPTION OF FULLY ELECTRIC PASSENGER FERRIES AND TUGS TO DRIVE MARKET

-

11.3 50-100 KMDEMAND FOR FULLY ELECTRIC INLAND CONTAINER SHIPS TO DRIVE MARKET

-

11.4 101-1,000 KMINCREASING DEMAND FOR RETROFITTING CARGO VESSELS TO DRIVE MARKET

-

11.5 >1,000 KMINCREASING DEMAND FOR ELECTRIFIED LONG-DISTANCE CARGO VESSELS TO DRIVE MARKET

- 12.1 INTRODUCTION

-

12.2 NORTH AMERICAPESTLE ANALYSISUS- Increasing demand for luxury sailing to drive marketCANADA- Strategic decision of government to develop its indigenous marine industry to drive market

-

12.3 EUROPEPESTLE ANALYSISNORWAY- Implementation of IMO rule to drive adoption of hybrid or electric driven propulsionGREECE- Stringent IMO 2020 rule to drive marketNETHERLANDS- Push toward using zero-emission ships to drive marketFINLAND- Major focus on green marine technologies to drive marketGERMANY- Upgradation of ship equipment to drive marketDENMARK- Stringent environmental regulations to drive marketREST OF EUROPE

-

12.4 ASIA PACIFICPESTLE ANALYSISCHINA- Presence of several shipbuilding companies to drive marketJAPAN- Focus on reduction of greenhouse gas emissions from international shipping to drive marketNEW ZEALAND- Increased focus on shifting from diesel-driven ships to marine electric vehicles to drive marketSOUTH KOREA- Adoption of fuel cells for development of ships and hydrogen economy to drive marketINDIA- Significant retrofit potential for navy ships to drive marketREST OF ASIA PACIFIC

-

12.5 REST OF THE WORLDPESTLE ANALYSISMIDDLE EAST & AFRICA- Retrofitting of existing fleet of ships to drive marketLATIN AMERICA- Brazil with a strong shipping industry to drive market

- 13.1 INTRODUCTION

- 13.2 MARKET RANKING OF LEADING PLAYERS

- 13.3 MARKET SHARE ANALYSIS OF LEADING PLAYERS

- 13.4 REVENUE ANALYSIS OF TOP 5 MARKET PLAYERS

-

13.5 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

- 13.6 COMPANY FOOTPRINT

-

13.7 STARTUP/SME EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING

-

13.8 COMPETITIVE SCENARIODEALSOTHERS

-

14.1 KEY PLAYERSABB- Business overview- Products offered- Recent developments- MnM viewKONGSBERG MARITIME- Business overview- Products offered- Recent developments- MnM viewGENERAL ELECTRIC- Business overview- Products offered- Recent developments- MnM viewBAE SYSTEMS- Business overview- Products offered- Recent developments- MnM viewSIEMENS- Business overview- Products offered- Recent developments- MnM viewDAMEN SHIPYARDS GROUP- Business overview- Products offered- Recent developmentsVARD (FINCANTIERI)- Business overview- Products offered- Recent developmentsBRUNSWICK CORPORATION- Business overview- Products offered- Recent developmentsXALT ENERGY- Business overview- Products offered- Recent developmentsOCEANVOLT- Business overview- Products offered- Recent developmentsMITSUBISHI- Business overview- Products offered- Recent developmentsLIG NEX 1- Business overview- Products offered- Recent developmentsSILENT-YACHTS- Business overview- Products offered- Recent developmentsCANDELA- Business overview- Products offered- Recent developmentsECHANDIA MARINE- Business overview- Products offered- Recent developments

-

14.2 OTHER PLAYERSNORWEGIAN ELECTRIC SYSTEMS (NES)CORVUS ENERGYFJELLSTRAND ASSØBY VÆRFT A/SX SHOREPURE WATERCRAFTQ YACHTSWÄRTSILÄSAFTLECLANCHÉ

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

- TABLE 1 MARINE ELECTRIC VEHICLE MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 PRIMARY INTERVIEW DETAILS

- TABLE 3 LIST OF PUBLICATION & ORDER BOOK OF SHIPYARD/COMPONENT SUPPLIER /REGULATORY PUBLICATION CONSIDERED FOR MARKET STUDY

- TABLE 4 LIST OF MAGAZINES/PRESS RELEASES/NEWSLETTERS CONSIDERED FOR MARKET STUDY

- TABLE 5 SULFUR CONTENT REGULATIONS IN BUNKER FUEL

- TABLE 6 CURRENT BATTERY CAPACITY AND REQUIREMENTS OF SOME MARINE ELECTRIC VEHICLES

- TABLE 7 MARINE ELECTRIC VEHICLE MARKET: IMPACT OF PORTER’S FIVE FORCES

- TABLE 8 MARINE ELECTRIC VEHICLE MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 9 MARINE ELECTRIC VEHICLE MARKET: TRADE DATA ANALYSIS

- TABLE 10 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHERS

- TABLE 11 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHERS

- TABLE 12 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHERS

- TABLE 13 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHERS

- TABLE 14 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHERS

- TABLE 15 CASE 1: CAPITAL EXPENDITURE, SAVINGS, AND PAYBACK

- TABLE 16 CASE 2: CAPITAL EXPENDITURE, SAVINGS, AND PAYBACK

- TABLE 17 CASE 3: CAPITAL EXPENDITURE, SAVINGS, AND PAYBACK

- TABLE 18 AVERAGE SELLING PRICE OF ELECTRIC SHIPPING HARDWARE (USD MILLION)

- TABLE 19 MARINE ELECTRIC VEHICLE MARKET SIZE, BY VEHICLE TYPE, 2019–2022 (UNITS)

- TABLE 20 MARINE ELECTRIC VEHICLE MARKET SIZE, BY TYPE (UNITS) (2023–2028)

- TABLE 21 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS IN MARINE ELECTRIC VEHICLE MARKET (%)

- TABLE 22 MARINE ELECTRIC VEHICLE MARKET: KEY BUYING CRITERIA

- TABLE 23 MARINE ELECTRIC VEHICLE MARKET: KEY CONFERENCES AND EVENTS, 2023–2024

- TABLE 24 MARINE ELECTRIC VEHICLE MARKET: KEY PATENTS

- TABLE 25 MARINE ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2019–2022 (USD MILLION)

- TABLE 26 MARINE ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2023–2030 (USD MILLION)

- TABLE 27 COMMERCIAL MARINE ELECTRIC VEHICLE MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 28 COMMERCIAL MARINE ELECTRIC VEHICLE MARKET, BY TYPE, 2023–2030 (USD MILLION)

- TABLE 29 ELECTRIC PASSENGER VESSEL MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 30 ELECTRIC PASSENGER VESSEL MARKET, BY TYPE, 2023–2030 (USD MILLION)

- TABLE 31 ELECTRIC CARGO VESSEL MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 32 ELECTRIC CARGO VESSEL MARKET, BY TYPE, 2023–2030 (USD MILLION)

- TABLE 33 OTHER COMMERCIAL VESSELS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 34 OTHER COMMERCIAL VESSELS MARKET, BY TYPE, 2023–2030 (USD MILLION)

- TABLE 35 DEFENSE MARINE ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2019–2022 (USD MILLION)

- TABLE 36 DEFENSE MARINE ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2023–2030 (USD MILLION)

- TABLE 37 UNMANNED MARITIME VEHICLE MARKET, BY VEHICLE TYPE, 2019–2022 (USD MILLION)

- TABLE 38 UNMANNED MARITIME VEHICLE MARKET, BY VEHICLE TYPE, 2023–2030 (USD MILLION)

- TABLE 39 UNMANNED UNDERWATER VEHICLE MARKET, BY VEHICLE TYPE, 2019–2022 (USD MILLION)

- TABLE 40 UNMANNED UNDERWATER VEHICLE MARKET, BY VEHICLE TYPE, 2023–2030 (USD MILLION)

- TABLE 41 MARINE ELECTRIC VEHICLE MARKET, BY VESSEL TRANSPORT, 2019–2022 (USD MILLION)

- TABLE 42 MARINE ELECTRIC VEHICLE MARKET, BY VESSEL TRANSPORT, 2023–2030 (USD MILLION)

- TABLE 43 MARINE ELECTRIC VEHICLE MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 44 MARINE ELECTRIC VEHICLE MARKET, BY TECHNOLOGY, 2023–2030 (USD MILLION)

- TABLE 45 GLOBAL MARINE ELECTRIC VEHICLE PROJECTS

- TABLE 46 ONGOING FUEL CELL PROJECTS IN SHIPPING INDUSTRY

- TABLE 47 MARINE ELECTRIC VEHICLE MARKET, BY MODE OF OPERATION, 2019–2022 (USD MILLION)

- TABLE 48 MARINE ELECTRIC VEHICLE MARKET, MODE OF OPERATION, 2023–2030 (USD MILLION)

- TABLE 49 MARINE ELECTRIC VEHICLE MARKET, BY RANGE, 2019–2022 (USD MILLION)

- TABLE 50 MARINE ELECTRIC VEHICLE MARKET, BY RANGE, 2023–2030 (USD MILLION)

- TABLE 51 REGIONAL RECESSION IMPACT ANALYSIS

- TABLE 52 MARINE ELECTRIC VEHICLE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 53 MARINE ELECTRIC VEHICLE MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 54 NORTH AMERICA: MARINE ELECTRIC VEHICLE MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 55 NORTH AMERICA: MARINE ELECTRIC VEHICLE MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 56 NORTH AMERICA: MARINE ELECTRIC VEHICLE MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 57 NORTH AMERICA: MARINE ELECTRIC VEHICLE MARKET, BY TECHNOLOGY, 2023–2030 (USD MILLION)

- TABLE 58 NORTH AMERICA: MARINE ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2019–2022 (USD MILLION)

- TABLE 59 NORTH AMERICA: MARINE ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2023–2030 (USD MILLION)

- TABLE 60 NORTH AMERICA: COMMERCIAL MARINE ELECTRIC VEHICLE MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 61 NORTH AMERICA: COMMERCIAL MARINE ELECTRIC VEHICLE MARKET, BY TYPE, 2023–2030(USD MILLION)

- TABLE 62 NORTH AMERICA: ELECTRIC PASSENGER VESSEL MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 63 NORTH AMERICA: ELECTRIC PASSENGER VESSEL MARKET, BY TYPE, 2023–2030 (USD MILLION)

- TABLE 64 NORTH AMERICA: ELECTRIC CARGO VESSEL MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 65 NORTH AMERICA: ELECTRIC CARGO VESSEL MARKET, BY TYPE, 2023–2030 (USD MILLION)

- TABLE 66 NORTH AMERICA: OTHER COMMERCIAL VESSELS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 67 NORTH AMERICA: OTHER COMMERCIAL VESSELS MARKET, BY TYPE, 2023–2030 (USD MILLION)

- TABLE 68 NORTH AMERICA: MARINE ELECTRIC VEHICLE MARKET, BY VESSEL TRANSPORT, 2019–2022 (USD MILLION)

- TABLE 69 NORTH AMERICA: MARINE ELECTRIC VEHICLE MARKET, BY VESSEL TRANSPORT, 2023–2030 (USD MILLION)

- TABLE 70 NORTH AMERICA: MARINE ELECTRIC VEHICLE MARKET, BY RANGE, 2019–2022 (USD MILLION)

- TABLE 71 NORTH AMERICA: MARINE ELECTRIC VEHICLE MARKET, BY RANGE, 2023–2030 (USD MILLION)

- TABLE 72 US: MARINE ELECTRIC VEHICLE MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 73 US: MARINE ELECTRIC VEHICLE MARKET, BY TECHNOLOGY, 2023–2030 (USD MILLION)

- TABLE 74 US: MARINE ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2019–2022 (USD MILLION)

- TABLE 75 US: MARINE ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2023–2030 (USD MILLION)

- TABLE 76 US: MARINE ELECTRIC VEHICLE MARKET, BY VESSEL TRANSPORT, 2019–2022 (USD MILLION)

- TABLE 77 US: MARINE ELECTRIC VEHICLE MARKET, BY VESSEL TRANSPORT, 2023–2030 (USD MILLION)

- TABLE 78 CANADA: MARINE ELECTRIC VEHICLE MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 79 CANADA: MARINE ELECTRIC VEHICLE MARKET, BY TECHNOLOGY, 2023–2030 (USD MILLION)

- TABLE 80 CANADA: MARINE ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2019–2022 (USD MILLION)

- TABLE 81 CANADA: MARINE ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2023–2030 (USD MILLION)

- TABLE 82 CANADA: MARINE ELECTRIC VEHICLE MARKET, BY VESSEL TRANSPORT, 2019–2022 (USD MILLION)

- TABLE 83 CANADA: MARINE ELECTRIC VEHICLE MARKET, BY VESSEL TRANSPORT, 2023–2030 (USD MILLION)

- TABLE 84 EUROPE: MARINE ELECTRIC VEHICLE MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 85 EUROPE: MARINE ELECTRIC VEHICLE MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 86 EUROPE: MARINE ELECTRIC VEHICLE MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 87 EUROPE: MARINE ELECTRIC VEHICLE MARKET, BY TECHNOLOGY, 2023–2030 (USD MILLION)

- TABLE 88 EUROPE: MARINE ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2019–2022 (USD MILLION)

- TABLE 89 EUROPE: MARINE ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2023–2030 (USD MILLION)

- TABLE 90 EUROPE: COMMERCIAL MARINE ELECTRIC VEHICLE MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 91 EUROPE: COMMERCIAL MARINE ELECTRIC VEHICLE MARKET, TYPE, 2023–2030 (USD MILLION)

- TABLE 92 EUROPE: ELECTRIC PASSENGER VESSEL MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 93 EUROPE: ELECTRIC PASSENGER VESSEL MARKET, BY TYPE, 2023–2030 (USD MILLION)

- TABLE 94 EUROPE: ELECTRIC CARGO VESSEL MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 95 EUROPE: ELECTRIC CARGO VESSEL MARKET, BY TYPE, 2023–2030 (USD MILLION)

- TABLE 96 EUROPE: OTHER COMMERCIAL VESSELS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 97 EUROPE: OTHER COMMERCIAL VESSELS MARKET, BY TYPE, 2023–2030 (USD MILLION)

- TABLE 98 EUROPE: MARINE ELECTRIC VEHICLE MARKET, BY VESSEL TRANSPORT, 2019–2022 (USD MILLION)

- TABLE 99 EUROPE: MARINE ELECTRIC VEHICLE MARKET, BY VESSEL TRANSPORT, 2023–2030 (USD MILLION)

- TABLE 100 EUROPE: MARINE ELECTRIC VEHICLE MARKET, BY RANGE, 2019–2022 (USD MILLION)

- TABLE 101 EUROPE: MARINE ELECTRIC VEHICLE MARKET, BY RANGE, 2023–2030 (USD MILLION)

- TABLE 102 NORWAY: MARINE ELECTRIC VEHICLE MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 103 NORWAY: MARINE ELECTRIC VEHICLE MARKET, BY TECHNOLOGY, 2023–2030 (USD MILLION)

- TABLE 104 NORWAY: MARINE ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2019–2022 (USD MILLION)

- TABLE 105 NORWAY: MARINE ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2023–2030 (USD MILLION)

- TABLE 106 NORWAY: MARINE ELECTRIC VEHICLE MARKET, BY VESSEL TRANSPORT, 2019–2022 (USD MILLION)

- TABLE 107 NORWAY: MARINE ELECTRIC VEHICLE MARKET, BY VESSEL TRANSPORT, 2023–2030 (USD MILLION)

- TABLE 108 GREECE: MARINE ELECTRIC VEHICLE MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 109 GREECE: MARINE ELECTRIC VEHICLE MARKET, BY TECHNOLOGY, 2023–2030 (USD MILLION)

- TABLE 110 GREECE: MARINE ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2019–2022 (USD MILLION)

- TABLE 111 GREECE: MARINE ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2023–2030 (USD MILLION)

- TABLE 112 GREECE: MARINE ELECTRIC VEHICLE MARKET, BY VESSEL TRANSPORT, 2019–2022 (USD MILLION)

- TABLE 113 GREECE: MARINE ELECTRIC VEHICLE MARKET, BY VESSEL TRANSPORT, 2023–2030 (USD MILLION)

- TABLE 114 NETHERLANDS: MARINE ELECTRIC VEHICLE MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 115 NETHERLANDS: MARINE ELECTRIC VEHICLE MARKET, BY TECHNOLOGY, 2023–2030 (USD MILLION)

- TABLE 116 NETHERLANDS: MARINE ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2019–2022 (USD MILLION)

- TABLE 117 NETHERLANDS: MARINE ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2023–2030 (USD MILLION)

- TABLE 118 NETHERLANDS: MARINE ELECTRIC VEHICLE MARKET, BY VESSEL TRANSPORT, 2019–2022 (USD MILLION)

- TABLE 119 NETHERLANDS: MARINE ELECTRIC VEHICLE MARKET, BY VESSEL TRANSPORT, 2023–2030 (USD MILLION)

- TABLE 120 FINLAND: MARINE ELECTRIC VEHICLE MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 121 FINLAND: MARINE ELECTRIC VEHICLE MARKET, BY TECHNOLOGY, 2023–2030 (USD MILLION)

- TABLE 122 FINLAND: MARINE ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2019–2022 (USD MILLION)

- TABLE 123 FINLAND: MARINE ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2023–2030 (USD MILLION)

- TABLE 124 FINLAND: MARINE ELECTRIC VEHICLE MARKET, BY VESSEL TRANSPORT, 2019–2022 (USD MILLION)

- TABLE 125 FINLAND: MARINE ELECTRIC VEHICLE MARKET, BY VESSEL TRANSPORT, 2023–2030 (USD MILLION)

- TABLE 126 GERMANY: MARINE ELECTRIC VEHICLE MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 127 GERMANY: MARINE ELECTRIC VEHICLE MARKET, BY TECHNOLOGY, 2023–2030 (USD MILLION)

- TABLE 128 GERMANY: MARINE ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2019–2022 (USD MILLION)

- TABLE 129 GERMANY: MARINE ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2023–2030 (USD MILLION)

- TABLE 130 GERMANY: MARINE ELECTRIC VEHICLE MARKET, BY VESSEL TRANSPORT, 2019–2022 (USD MILLION)

- TABLE 131 GERMANY: MARINE ELECTRIC VEHICLE MARKET, BY VESSEL TRANSPORT, 2023–2030 (USD MILLION)

- TABLE 132 DENMARK: MARINE ELECTRIC VEHICLE MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 133 DENMARK: MARINE ELECTRIC VEHICLE MARKET, BY TECHNOLOGY, 2023–2030 (USD MILLION)

- TABLE 134 DENMARK: MARINE ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2019–2022 (USD MILLION)

- TABLE 135 DENMARK: MARINE ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2023–2030 (USD MILLION)

- TABLE 136 DENMARK: MARINE ELECTRIC VEHICLE MARKET, BY VESSEL TRANSPORT, 2019–2022 (USD MILLION)

- TABLE 137 DENMARK: MARINE ELECTRIC VEHICLE MARKET, BY VESSEL TRANSPORT, 2023–2030 (USD MILLION)

- TABLE 138 REST OF EUROPE: MARINE ELECTRIC VEHICLE MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 139 REST OF EUROPE: MARINE ELECTRIC VEHICLE MARKET, BY TECHNOLOGY, 2023–2030 (USD MILLION)

- TABLE 140 REST OF EUROPE: MARINE ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2019–2022 (USD MILLION)

- TABLE 141 REST OF EUROPE: MARINE ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2023–2030 (USD MILLION)

- TABLE 142 REST OF EUROPE: MARINE ELECTRIC VEHICLE MARKET, BY VESSEL TRANSPORT, 2019–2022 (USD MILLION)

- TABLE 143 REST OF EUROPE: MARINE ELECTRIC VEHICLE MARKET, BY VESSEL TRANSPORT, 2023–2030 (USD MILLION)

- TABLE 144 ASIA PACIFIC: MARINE ELECTRIC VEHICLE MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 145 ASIA PACIFIC: MARINE ELECTRIC VEHICLE MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 146 ASIA PACIFIC: MARINE ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2019–2022 (USD MILLION)

- TABLE 147 ASIA PACIFIC: MARINE ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2023–2030 (USD MILLION)

- TABLE 148 ASIA PACIFIC: COMMERCIAL MARINE ELECTRIC VEHICLE MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 149 ASIA PACIFIC: COMMERCIAL MARINE ELECTRIC VEHICLE MARKET, BY TYPE, 2023–2030 (USD MILLION)

- TABLE 150 ASIA PACIFIC: ELECTRIC PASSENGER VESSEL MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 151 ASIA PACIFIC: ELECTRIC PASSENGER VESSEL MARKET, BY TYPE, 2023–2030 (USD MILLION)

- TABLE 152 ASIA PACIFIC: ELECTRIC CARGO VESSEL MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 153 ASIA PACIFIC: ELECTRIC CARGO VESSEL MARKET, BY TYPE, 2023–2030 (USD MILLION)

- TABLE 154 ASIA PACIFIC: OTHER COMMERCIAL ELECTRIC VESSELS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 155 ASIA PACIFIC: OTHER COMMERCIAL ELECTRIC VESSELS MARKET, BY TYPE, 2023–2030 (USD MILLION)

- TABLE 156 ASIA PACIFIC: UNMANNED MARITIME VEHICLE MARKET, BY VEHICLE TYPE, 2019–2022 (USD MILLION)

- TABLE 157 ASIA PACIFIC: UNMANNED MARITIME VEHICLE MARKET, BY VEHICLE TYPE, 2023–2030 (USD MILLION)

- TABLE 158 ASIA PACIFIC: UNMANNED UNDERWATER VEHICLE MARKET, BY VEHICLE TYPE, 2019–2022 (USD MILLION)

- TABLE 159 ASIA PACIFIC: UNMANNED UNDERWATER VEHICLE MARKET, BY VEHICLE TYPE, 2023–2030 (USD MILLION)

- TABLE 160 ASIA PACIFIC: MARINE ELECTRIC VEHICLE MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 161 ASIA PACIFIC: MARINE ELECTRIC VEHICLE MARKET, BY TECHNOLOGY, 2023–2030 (USD MILLION)

- TABLE 162 ASIA PACIFIC: MARINE ELECTRIC VEHICLE MARKET, BY VESSEL TRANSPORT, 2019–2022 (USD MILLION)

- TABLE 163 ASIA PACIFIC: MARINE ELECTRIC VEHICLE MARKET, BY VESSEL TRANSPORT, 2023–2030 (USD MILLION)

- TABLE 164 ASIA PACIFIC: MARINE ELECTRIC VEHICLE MARKET, BY RANGE, 2019–2022 (USD MILLION)

- TABLE 165 ASIA PACIFIC: MARINE ELECTRIC VEHICLE MARKET, BY RANGE, 2023–2030 (USD MILLION)

- TABLE 166 CHINA: MARINE ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2019–2022 (USD MILLION)

- TABLE 167 CHINA: MARINE ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2023–2030 (USD MILLION)

- TABLE 168 CHINA: MARINE ELECTRIC VEHICLE MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 169 CHINA: MARINE ELECTRIC VEHICLE MARKET, BY TECHNOLOGY, 2023–2030 (USD MILLION)

- TABLE 170 CHINA: MARINE ELECTRIC VEHICLE MARKET, BY VESSEL TRANSPORT, 2019–2022 (USD MILLION)

- TABLE 171 CHINA: MARINE ELECTRIC VEHICLE MARKET, BY VESSEL TRANSPORT, 2023–2030 (USD MILLION)

- TABLE 172 JAPAN: MARINE ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2019–2022 (USD MILLION)

- TABLE 173 JAPAN: MARINE ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2023–2030 (USD MILLION)

- TABLE 174 JAPAN: MARINE ELECTRIC VEHICLE MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 175 JAPAN: MARINE ELECTRIC VEHICLE MARKET, BY TECHNOLOGY, 2023–2030 (USD MILLION)

- TABLE 176 JAPAN: MARINE ELECTRIC VEHICLE MARKET, BY VESSEL TRANSPORT, 2019–2022 (USD MILLION)

- TABLE 177 JAPAN: MARINE ELECTRIC VEHICLE MARKET, BY VESSEL TRANSPORT, 2023–2030 (USD MILLION)

- TABLE 178 NEW ZEALAND: MARINE ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2019–2022 (USD MILLION)

- TABLE 179 NEW ZEALAND: MARINE ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2023–2030 (USD MILLION)

- TABLE 180 NEW ZEALAND: MARINE ELECTRIC VEHICLE MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 181 NEW ZEALAND: MARINE ELECTRIC VEHICLE MARKET, BY TECHNOLOGY, 2023–2030 (USD MILLION)

- TABLE 182 NEW ZEALAND: MARINE ELECTRIC VEHICLE MARKET, BY VESSEL TRANSPORT, 2019–2022 (USD MILLION)

- TABLE 183 NEW ZEALAND: MARINE ELECTRIC VEHICLE MARKET, BY VESSEL TRANSPORT, 2023–2030 (USD MILLION)

- TABLE 184 SOUTH KOREA: MARINE ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2019–2022 (USD MILLION)

- TABLE 185 SOUTH KOREA: MARINE ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2023–2030 (USD MILLION)

- TABLE 186 SOUTH KOREA: MARINE ELECTRIC VEHICLE MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 187 SOUTH KOREA: MARINE ELECTRIC VEHICLE MARKET, BY TECHNOLOGY, 2023–2030 (USD MILLION)

- TABLE 188 SOUTH KOREA: MARINE ELECTRIC VEHICLE MARKET, BY VESSEL TRANSPORT, 2019–2022 (USD MILLION)

- TABLE 189 SOUTH KOREA: MARINE ELECTRIC VEHICLE MARKET, BY VESSEL TRANSPORT, 2023–2030 (USD MILLION)

- TABLE 190 INDIA: MARINE ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2019–2022 (USD MILLION)

- TABLE 191 INDIA: MARINE ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2023–2030 (USD MILLION)

- TABLE 192 INDIA: MARINE ELECTRIC VEHICLE MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 193 INDIA: MARINE ELECTRIC VEHICLE MARKET, BY TECHNOLOGY, 2023–2030 (USD MILLION)

- TABLE 194 INDIA: MARINE ELECTRIC VEHICLE MARKET, BY VESSEL TRANSPORT, 2019–2022 (USD MILLION)

- TABLE 195 INDIA: MARINE ELECTRIC VEHICLE MARKET, BY VESSEL TRANSPORT, 2023–2030 (USD MILLION)

- TABLE 196 REST OF ASIA PACIFIC: MARINE ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2019–2022 (USD MILLION)

- TABLE 197 REST OF ASIA PACIFIC: MARINE ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2023–2030 (USD MILLION)

- TABLE 198 REST OF ASIA PACIFIC: MARINE ELECTRIC VEHICLE MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 199 REST OF ASIA PACIFIC: MARINE ELECTRIC VEHICLE MARKET, BY TECHNOLOGY, 2023–2030 (USD MILLION)

- TABLE 200 REST OF ASIA PACIFIC: MARINE ELECTRIC VEHICLE MARKET, BY VESSEL TRANSPORT, 2019–2022 (USD MILLION)

- TABLE 201 REST OF ASIA PACIFIC: MARINE ELECTRIC VEHICLE MARKET, BY VESSEL TRANSPORT, 2023–2030 (USD MILLION)

- TABLE 202 REST OF THE WORLD: MARINE ELECTRIC VEHICLE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 203 REST OF THE WORLD: MARINE ELECTRIC VEHICLE MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 204 REST OF THE WORLD: MARINE ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2019–2022 (USD MILLION)

- TABLE 205 REST OF THE WORLD: MARINE ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2023–2030 (USD MILLION)

- TABLE 206 REST OF THE WORLD: COMMERCIAL ELECTRIC VEHICLE MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 207 REST OF THE WORLD: COMMERCIAL ELECTRIC VEHICLE MARKET, BY TYPE, 2023–2030 (USD MILLION)

- TABLE 208 REST OF THE WORLD: ELECTRIC PASSENGER VESSEL MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 209 REST OF THE WORLD: ELECTRIC PASSENGER VESSEL MARKET, BY TYPE, 2023–2030 (USD MILLION)

- TABLE 210 REST OF THE WORLD: ELECTRIC CARGO VESSEL MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 211 REST OF THE WORLD: ELECTRIC CARGO VESSEL MARKET, BY TYPE, 2023–2030 (USD MILLION)

- TABLE 212 REST OF THE WORLD: OTHER COMMERCIAL VESSELS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 213 REST OF THE WORLD: OTHER COMMERCIAL VESSELS MARKET, BY TYPE, 2023–2030 (USD MILLION)

- TABLE 214 REST OF THE WORLD: UNMANNED MARITIME VEHICLE MARKET, BY VEHICLE TYPE, 2019–2022 (USD MILLION)

- TABLE 215 REST OF THE WORLD: UNMANNED MARITIME VEHICLE MARKET, BY VEHICLE TYPE, 2023–2030 (USD MILLION)

- TABLE 216 REST OF THE WORLD: UNMANNED UNDERWATER VEHICLE MARKET, BY VEHICLE TYPE, 2019–2022 (USD MILLION)

- TABLE 217 REST OF THE WORLD: UNMANNED UNDERWATER VEHICLE MARKET, BY VEHICLE TYPE, 2023–2030 (USD MILLION)

- TABLE 218 REST OF THE WORLD: MARINE ELECTRIC VEHICLE MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 219 REST OF THE WORLD: MARINE ELECTRIC VEHICLE MARKET, BY TECHNOLOGY, 2023–2030 (USD MILLION)

- TABLE 220 REST OF THE WORLD: MARINE ELECTRIC VEHICLE MARKET, BY VESSEL TRANSPORT, 2019–2022 (USD MILLION)

- TABLE 221 REST OF THE WORLD: MARINE ELECTRIC VEHICLE MARKET, BY VESSEL TRANSPORT, 2023–2030 (USD MILLION)

- TABLE 222 REST OF THE WORLD: MARINE ELECTRIC VEHICLE MARKET, BY RANGE, 2019–2022(USD MILLION)

- TABLE 223 REST OF THE WORLD: MARINE ELECTRIC VEHICLE MARKET, BY RANGE, 2023–2030 (USD MILLION)

- TABLE 224 MIDDLE EAST & AFRICA: MARINE ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2019–2022 (USD MILLION)

- TABLE 225 MIDDLE EAST & AFRICA: MARINE ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2023–2030 (USD MILLION)

- TABLE 226 MIDDLE EAST & AFRICA: MARINE ELECTRIC VEHICLE MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 227 MIDDLE EAST & AFRICA: MARINE ELECTRIC VEHICLE MARKET, BY TECHNOLOGY, 2023–2030 (USD MILLION)

- TABLE 228 MIDDLE EAST & AFRICA: MARINE ELECTRIC VEHICLE MARKET, BY VESSEL TRANSPORT, 2019–2022 (USD MILLION)

- TABLE 229 MIDDLE EAST & AFRICA: MARINE ELECTRIC VEHICLE MARKET, BY VESSEL TRANSPORT, 2023–2030 (USD MILLION)

- TABLE 230 LATIN AMERICA: MARINE ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2019–2022 (USD MILLION)

- TABLE 231 LATIN AMERICA: MARINE ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2023–2030 (USD MILLION)

- TABLE 232 LATIN AMERICA: MARINE ELECTRIC VEHICLE MARKET, BY TECHNOLOGY, 2019–2022(USD MILLION)

- TABLE 233 LATIN AMERICA: MARINE ELECTRIC VEHICLE MARKET, BY TECHNOLOGY, 2023–2030 (USD MILLION)

- TABLE 234 LATIN AMERICA: MARINE ELECTRIC VEHICLE MARKET, BY VESSEL TRANSPORT, 2019–2022 (USD MILLION)

- TABLE 235 LATIN AMERICA: MARINE ELECTRIC VEHICLE MARKET, BY VESSEL TRANSPORT, 2023–2030 (USD MILLION)

- TABLE 236 DEGREE OF COMPETITION

- TABLE 237 COMPANY PRODUCT FOOTPRINT

- TABLE 238 COMPANY VEHICLE TYPE FOOTPRINT

- TABLE 239 COMPANY TECHNOLOGY FOOTPRINT

- TABLE 240 COMPANY REGION FOOTPRINT

- TABLE 241 MARINE ELECTRIC VEHICLE MARKET: KEY STARTUPS/SMES

- TABLE 242 MARINE ELECTRIC VEHICLE MARKET: DEALS, 2019–2023

- TABLE 243 MARINE ELECTRIC VEHICLE MARKET: OTHERS, 2019–2023

- TABLE 244 ABB: COMPANY OVERVIEW

- TABLE 245 ABB: PRODUCTS OFFERED?

- TABLE 246 ABB: DEALS

- TABLE 247 KONGSBERG MARITIME: COMPANY OVERVIEW

- TABLE 248 KONGSBERG MARITIME: PRODUCTS OFFERED?

- TABLE 249 KONGSBERG MARITIME: DEALS

- TABLE 250 GENERAL ELECTRIC: COMPANY OVERVIEW

- TABLE 251 GENERAL ELECTRIC: PRODUCTS OFFERED?

- TABLE 252 GENERAL ELECTRIC: DEALS

- TABLE 253 BAE SYSTEMS: COMPANY OVERVIEW

- TABLE 254 BAE SYSTEMS: PRODUCTS OFFERED?

- TABLE 255 BAE SYSTEMS: DEALS

- TABLE 256 SIEMENS: COMPANY OVERVIEW

- TABLE 257 SIEMENS: PRODUCTS OFFERED?

- TABLE 258 SIEMENS: DEALS

- TABLE 259 DAMEN SHIPYARDS GROUP: COMPANY OVERVIEW

- TABLE 260 DAMEN SHIPYARDS GROUP: PRODUCTS OFFERED?

- TABLE 261 DAMEN SHIPYARDS GROUP: DEALS

- TABLE 262 VARD (FINCANTIERI): COMPANY OVERVIEW

- TABLE 263 VARD (FINCANTIERI): PRODUCTS OFFERED?

- TABLE 264 VARD (FINCANTIERI): DEALS

- TABLE 265 BRUNSWICK CORPORATION: COMPANY OVERVIEW

- TABLE 266 BRUNSWICK CORPORATION: PRODUCTS OFFERED?

- TABLE 267 BRUNSWICK CORPORATION: DEALS

- TABLE 268 XALT ENERGY: COMPANY OVERVIEW

- TABLE 269 XALT ENERGY: PRODUCTS OFFERED?

- TABLE 270 XALT ENERGY: DEALS

- TABLE 271 OCEANVOLT: COMPANY OVERVIEW

- TABLE 272 OCEANVOLT: PRODUCTS OFFERED?

- TABLE 273 OCEANVOLT: DEALS

- TABLE 274 MITSUBISHI: COMPANY OVERVIEW

- TABLE 275 MITSUBISHI: PRODUCTS OFFERED?

- TABLE 276 MITSUBISHI: DEALS

- TABLE 277 LIG NEX 1: COMPANY OVERVIEW

- TABLE 278 LIG NEX 1: PRODUCTS OFFERED?

- TABLE 279 LIG NEX 1: DEALS

- TABLE 280 SILENT-YACHTS: COMPANY OVERVIEW

- TABLE 281 SILENT-YACHTS: PRODUCTS OFFERED?

- TABLE 282 SILENT-YACHTS: OTHERS

- TABLE 283 CANDELA: COMPANY OVERVIEW

- TABLE 284 CANDELA: PRODUCTS OFFERED?

- TABLE 285 CANDELA: DEALS

- TABLE 286 ECHANDIA MARINE: COMPANY OVERVIEW

- TABLE 287 ECHANDIA MARINE: PRODUCTS OFFERED?

- TABLE 288 ECHANDIA MARINE: DEALS

- FIGURE 1 MARINE ELECTRIC VEHICLE MARKET SEGMENTATION

- FIGURE 2 REPORT PROCESS FLOW

- FIGURE 3 MARINE ELECTRIC VEHICLE MARKET: RESEARCH DESIGN

- FIGURE 4 US NAVAL DEFENSE BUDGET

- FIGURE 5 BREAKDOWN OF US NAVAL DEFENSE BUDGET

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 8 MARINE ELECTRIC VEHICLE MARKET: DATA TRIANGULATION

- FIGURE 9 HYBRID TECHNOLOGY TO HAVE LARGER MARKET SHARE THAN FULLY ELECTRIC SEGMENT IN 2023

- FIGURE 10 MANNED MODE OF OPERATION SEGMENT TO HAVE LARGEST MARKET SHARE IN 2023

- FIGURE 11 SEAFARING SEGMENT TO BE LARGER VESSEL TRANSPORT THAN INLAND IN 2023

- FIGURE 12 EUROPE TO LEAD MARINE ELECTRIC VEHICLE MARKET IN 2023

- FIGURE 13 COMMERCIAL VEHICLE TYPE TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 14 <50 KM RANGE SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 15 NORWAY TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 16 MARINE ELECTRIC VEHICLE: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 17 MOST COMMON LITHIUM-ION BATTERIES WITH KEY FEATURES

- FIGURE 18 MARINE ELECTRIC VEHICLE MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 19 MARINE ELECTRIC VEHICLE MARKET: VALUE CHAIN ANALYSIS

- FIGURE 20 MARINE ELECTRIC VEHICLE MARKET: ECOSYSTEM MAPPING

- FIGURE 21 TRENDS AND DISRUPTIONS IMPACTING MARINE ELECTRIC VEHICLE MARKET

- FIGURE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS IN MARINE ELECTRIC VEHICLE MARKET

- FIGURE 23 KEY BUYING CRITERIA FOR MARINE ELECTRIC VEHICLE PRODUCTS AND SYSTEMS

- FIGURE 24 TECHNOLOGY ADVANCEMENTS IMPACTING MARINE ELECTRIC VEHICLE MARKET

- FIGURE 25 MARINE ELECTRIC VEHICLE MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 26 COMMERCIAL SEGMENT TO DOMINATE MARINE ELECTRIC VEHICLE MARKET DURING FORECAST PERIOD

- FIGURE 27 SEAFARING VESSEL TRANSPORT SEGMENT TO DOMINATE MARINE ELECTRIC VEHICLE MARKET DURING FORECAST PERIOD

- FIGURE 28 HYBRID SEGMENT TO GROW AT HIGHER CAGR THAN FULLY ELECTRIC DURING FORECAST PERIOD

- FIGURE 29 AUTONOMOUS SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 30 >1,000 KM SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 31 EUROPE TO HOLD LARGEST SHARE OF MARINE ELECTRIC VEHICLE MARKET IN 2023

- FIGURE 32 NAVAL BUDGET TREND, BY REGION (2019–2022)

- FIGURE 33 NORTH AMERICA: MARINE ELECTRIC VEHICLE MARKET SNAPSHOT

- FIGURE 34 EUROPE: MARINE ELECTRIC VEHICLE MARKET SNAPSHOT

- FIGURE 35 CO2 EMISSIONS FROM DOMESTIC SHIPPING IN NORWAY

- FIGURE 36 ASIA PACIFIC: MARINE ELECTRIC VEHICLE MARKET SNAPSHOT

- FIGURE 37 REST OF THE WORLD: MARINE ELECTRIC VEHICLE MARKET SNAPSHOT

- FIGURE 38 RANKING OF LEADING PLAYERS IN MARINE ELECTRIC VEHICLE MARKET, 2022

- FIGURE 39 MARINE ELECTRIC VEHICLE MARKET SHARE ANALYSIS, 2022

- FIGURE 40 REVENUE ANALYSIS OF LEADING PLAYERS IN MARINE ELECTRIC VEHICLE MARKET, 2022

- FIGURE 41 MARINE ELECTRIC VEHICLE MARKET: COMPANY EVALUATION MATRIX, 2022

- FIGURE 42 MARINE ELECTRIC VEHICLE MARKET: STARTUP/SME COMPANY EVALUATION MATRIX, 2022

- FIGURE 43 ABB: COMPANY SNAPSHOT

- FIGURE 44 KONGSBERG MARITIME: COMPANY SNAPSHOT

- FIGURE 45 GENERAL ELECTRIC: COMPANY SNAPSHOT

- FIGURE 46 BAE SYSTEMS: COMPANY SNAPSHOT

- FIGURE 47 SIEMENS: COMPANY SNAPSHOT

- FIGURE 48 VARD (FINCANTIERI): COMPANY SNAPSHOT

- FIGURE 49 BRUNSWICK CORPORATION: COMPANY SNAPSHOT

- FIGURE 50 MITSUBISHI: COMPANY SNAPSHOT

- FIGURE 51 LIG NEX 1: COMPANY SNAPSHOT

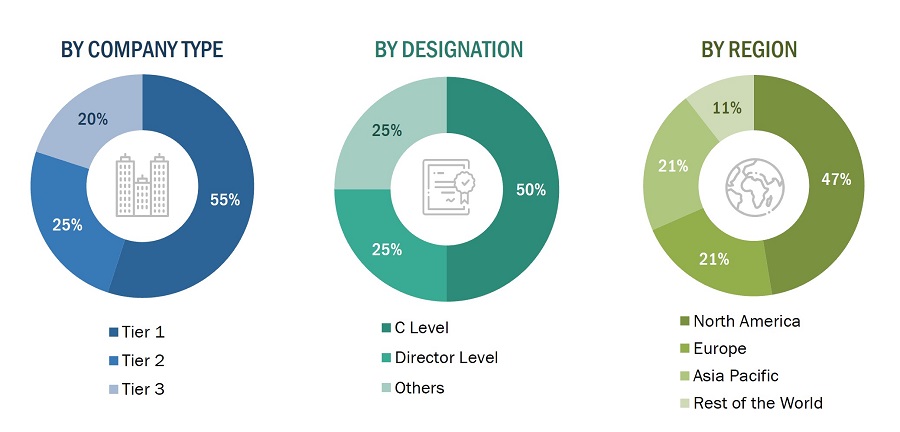

The study involved four major activities in estimating the current market size for the Marine Electric Vehicle Market. Exhaustive secondary research was conducted to collect information on the market, the peer markets, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation procedures were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as D&B Hoovers, Bloomberg, BusinessWeek, and different magazines, were referred to identify and collect information for this study. Secondary sources also included annual reports, press releases & investor presentations of companies, certified publications, articles by recognized authors, and simulator databases.

Primary Research

The Marine Electric Vehicle Market comprises several stakeholders, such as raw material providers, Electric Ship manufacturers and electrical system providers, and regulatory organizations in the supply chain. While the demand side of this market is characterized by various end users, the supply side is characterized by technological advancements in electric maritime vessels. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

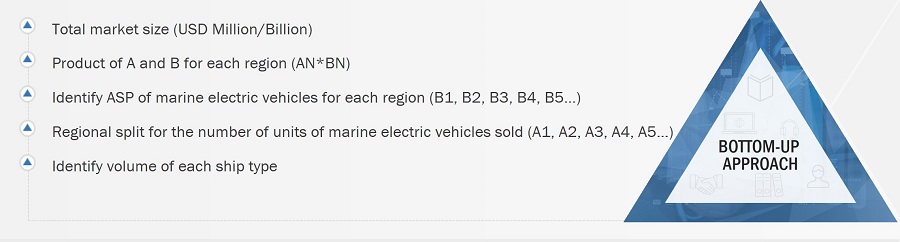

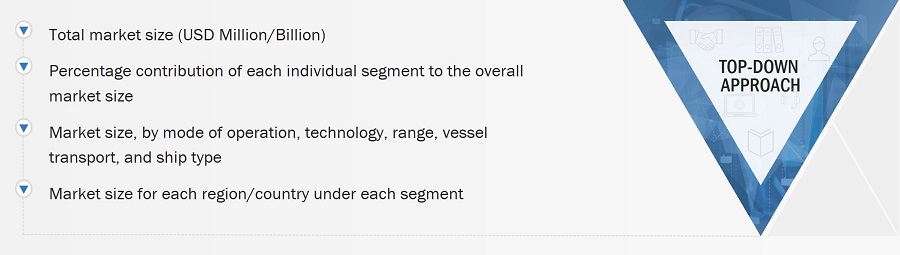

Both top-down and bottom-up approaches were used to estimate and validate the total size of the Marine Electric Vehicle Market. These methods were also used extensively to estimate the size of various subsegments of the market. The research methodology used to estimate the market size includes the following:

- Key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Market size estimation methodology: Bottom-up Approach

The market sizing was undertaken from the demand side. The market was sized based on the retrofit potential of the existing fleet and the year-on-year growth rate of ships of all categories considered in the report, along with the newly built ships and unmanned maritime vessels.

Market size estimation methodology: Top-down Approach

In the top-down approach, the overall market size was used to estimate the size of individual markets (mentioned in the market segmentation) acquired through percentage splits from secondary and primary research. For the calculation of specific market segments, the size of the most appropriate, immediate parent market was used to implement the top-down approach. The bottom-up approach was also implemented to validate the revenue obtained for various market segments.

- Companies supplying marine electric vessels, as well as components, were included in the report.

- The total revenue of these companies was identified through their annual reports and other authentic sources. In cases where annual reports were not available, company earnings were estimated based on the number of employees, press releases, and any publicly available data.

- Company revenue was calculated based on the various operating segments.

- All publicly available company contracts related to marine electric vehicles were mapped and summed up.

- Based on these parameters (contracts, agreements, partnerships, joint ventures, product matrix, secondary research), the share of electric ships in each segment was estimated.

Data Triangulation

After arriving at the overall market size-using the market size estimation process explained above-the market was split into several segments and subsegments. Data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides of the Marine Electric Vehicle Market.

Report Objectives

- To identify and analyze key drivers, restraints, challenges, and opportunities influencing the growth of the Marine Electric Vehicle Market

- To analyze the impact of macro and micro indicators on the market

- To forecast the market size of segments for four regions, namely, North America, Europe, Asia Pacific, and the Rest of the World, along with major countries in each of these regions

- To strategically analyze micro markets with respect to individual technological trends, prospects, and their contribution to the overall market

- To strategically profile key market players and comprehensively analyze their market ranking and core competencies

- To provide a detailed competitive landscape of the market, along with an analysis of business and corporate strategies, such as contracts, agreements, partnerships, and expansions.

- To identify detailed financial positions, key products, unique selling points, and key developments of leading companies in the market

Market Definition

The marine electric vehicle (MEV) market refers to the segment of the maritime industry that focuses on the development, production, and utilization of electrically powered vessels. MEVs encompass a wide range of watercraft, including but not limited to ships, boats, submarines, and other marine vehicles that rely on electric propulsion systems.

Market Stakeholders

- System/Component Manufacturers

- Passenger Vessel Operators

- Shipping Vessel Operators

- Government Organizations

- Shipbuilders

- System Integrators

Available customizations

Along with the market data, MarketsandMarkets offers customizations as per the specific needs of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the market segments at country-level

Company Information

- Detailed analysis and profiling of additional market players (up to 6)

Growth opportunities and latent adjacency in Marine Electric Vehicle Market