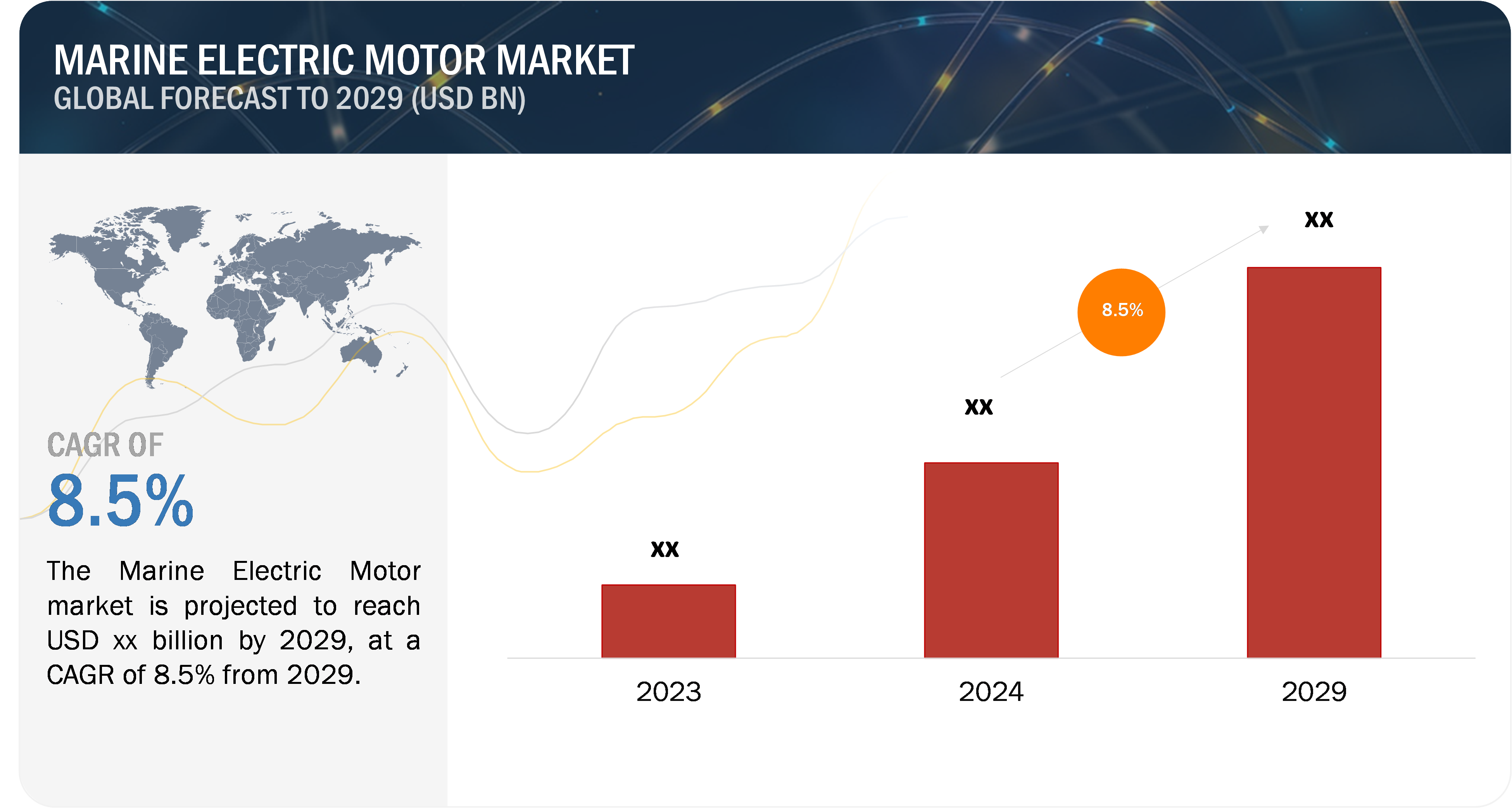

Marine Electric Motor Market By Type (AC, DC), By Power {<500 kW, 500-1000 kW, >1000 kW), By Application (Onboard, Offshore, Onshore), By Sale (OEM, Aftermarket), Vessel Type (Commercial, Defense, Unmanned Maritime Vehicles) – Global Forecast to 2029

Overview

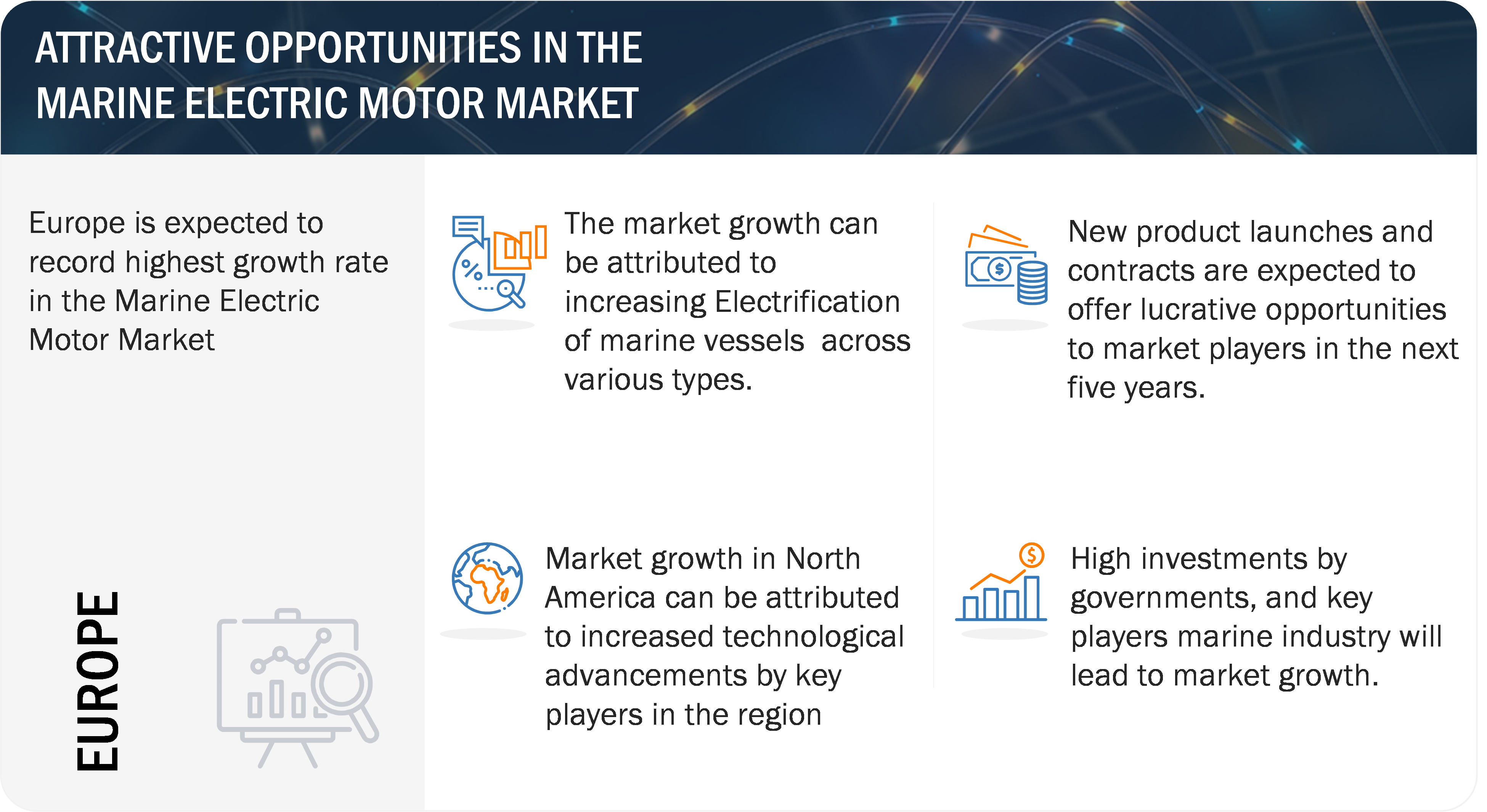

The increasing demand for energy-efficient and sustainable marine vessel systems drives the marine electric motor market, with the push for green shipping and stringent environmental regulations, such as IMO's emission standards. Other key drivers include the rise in ship electrification, advancements in hybrid and electric propulsion technologies, and increasing offshore energy activities. Such challenges include high initial costs and the regional disparity in adoption offset by the chances of growth, such as expanding offshore wind energies and port modernization plans. The market has growth opportunities, as most Asia Pacific countries build and manufacture ships while other aspects related to ship sustains rely mainly on Europe.

Attractive Opportunities in the Marine Electric Motor Market

Marine Electric Motor Market Dynamics:

Driver: Increasing Adoption of Hybrid and Electric Propulsion Systems

The marine industry is shifting towards hybrid and fully electric propulsion systems, owning to stricter environmental regulations such as the IMO 2020 sulfur cap and the targets of the Paris Agreement. Shipowners and operators are investing more in electric motors to reduce their reliance on conventional fuels, decrease emissions, and enhance energy efficiency. This is especially evident in commercial vessel operations where electrification provides immediate cost and environmental benefits. Advances in battery technology and energy storage systems make electric propulsion feasible for larger vessels like cargo ships and offshore support vessels. The trend toward hybrid solutions where electric and conventional systems are combined for greater operational flexibility also promotes its adoption, further encouraged by governmental incentives and industry-wide decarbonization initiatives.

Restraint: High initial investment cost

Marine electric motors are associated with technologies with high upfront capital costs, including system integration and retrofitting of older vessels. For small and medium-sized companies and vessel operators, these expenses are high for adopting electric propulsion systems. Additionally, extra costs of installed hybrid systems, such as controllers, auxiliary motors, and a power management system, include additional fees. Whereas precise long-term operational cost and environmental compliance benefits may result in high initial investment, the upfront investment itself can be a high risk to businesses with limited capital and, in regions with little or no regulatory enforcement, makes it difficult for the marine electrification business to obtain financing support and subsidies available to companies in developed markets.

Opportunity: Expansion of Offshore Wind Energy Projects

The rapid development of offshore wind projects presents a substantial growth opportunity for the marine electric motor market. These projects require specialized vessels with dynamic positioning systems, thrusters, and cranes powered by efficient electric motors to install, maintain, and service offshore turbines. As countries like China, the United States, and Europe ramp up investments in renewable energy, the demand for electric-powered service vessels is increasing. The push to electrify offshore vessels aligns with the sustainability goals of wind energy projects, creating synergies between the renewable energy and marine industries. In addition to vessel demand, the maintenance of underwater cables and subsea structures associated with wind farms further drives the requirement for electric motors in remotely operated vehicles (ROVs) and subsea tools. This sector is expected to be a significant contributor to the growth of the marine electric motor market.

Challenge: Limited Infrastructure for Electric Marine Operations

Regulatory One major challenge to marine electric motor adoption is the absence of supporting infrastructure. Most ports cannot provide enough charging stations or shores-to-ship power and maintenance hubs tailored for pure electric and hybrid vessels. The existing infrastructure is designed for traditional diesel-powers, which makes it a hard sell to vessel operators to make a significant port upgrade before transitioning. In remote areas or small ports, the lack of good electric grids makes electrified marine operations challenging. Also, non-uniformity in electric marine technology regarding charging compatibility between one manufacturer and another and differing vessel types complicates things for operators who want to take up these systems. The infrastructural gaps challenge electric vessels' operational horizons and cause them to become more dependent on traditional propulsion methods in long-distance and heavy-power applications.

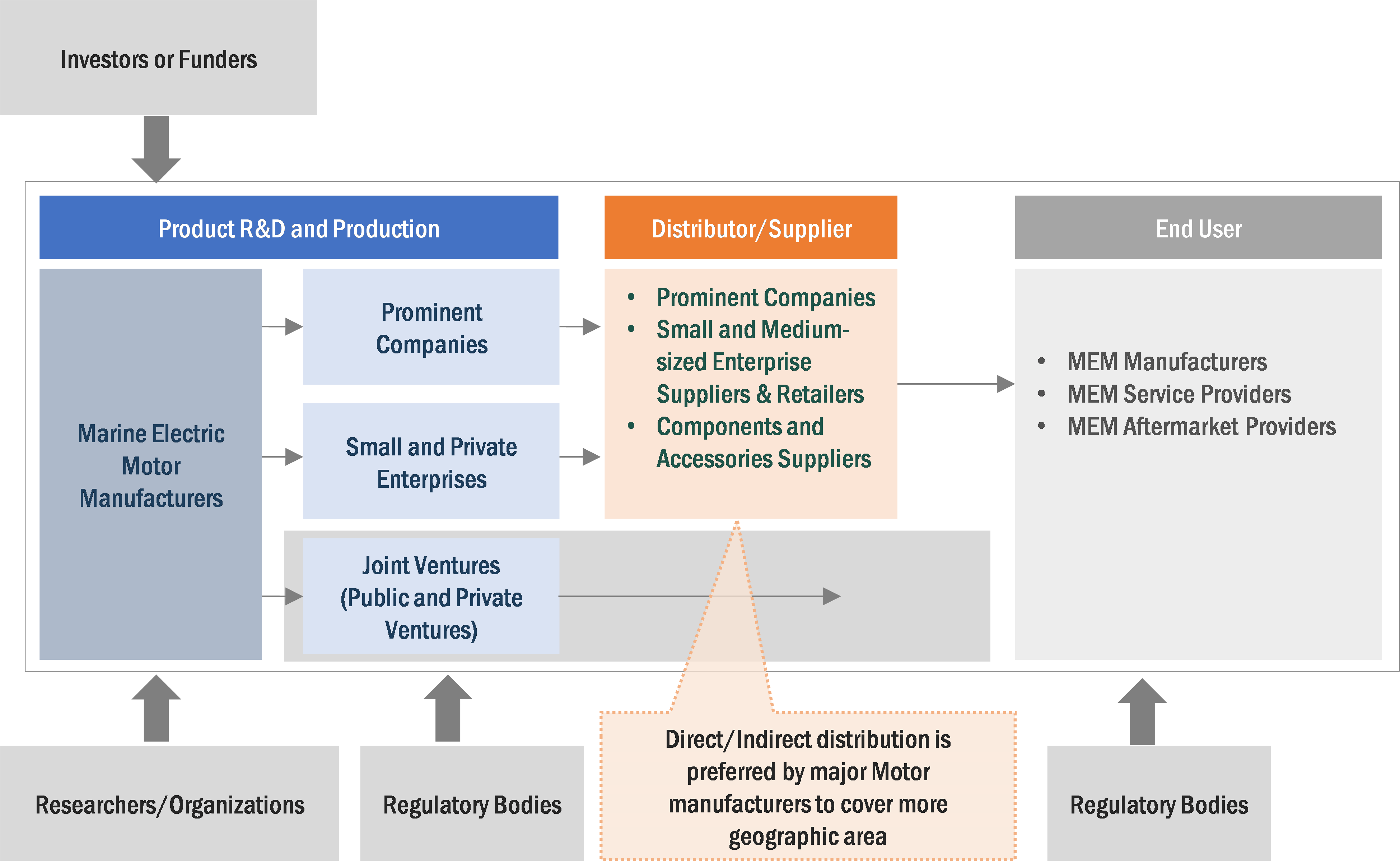

Ecosystem Map: Marine Electric Motor Market

Exhaustive secondary research collected information on the Marine Electric Motor Market, its adjacent markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Demand-side analyses were carried out to estimate the overall size of the market. Both top-down and bottom-up approaches were employed to assess the complete market size. Thereafter, market breakdown and data triangulation were used to calculate the size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as D&B Hoovers, Bloomberg, Business Week, and different magazines, were referred to identify and collect information for this study. Secondary sources also included company annual reports, press releases, investor presentations, certified publications, articles by recognized authors, and research papers.

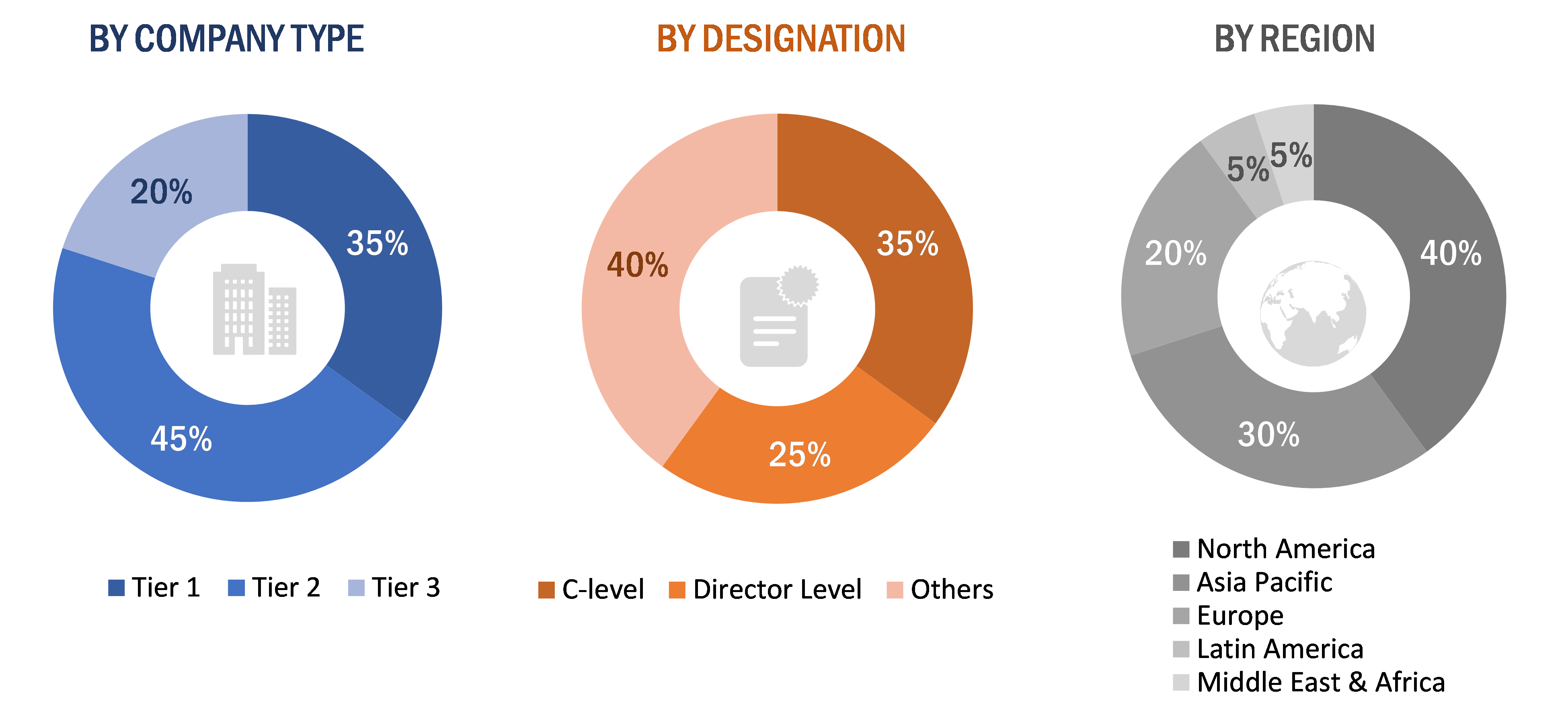

Primary Research

Extensive primary research was conducted after obtaining information about the current scenario of the Marine Electric Motor Market through secondary research. In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. Primary sources from the supply side included industry experts such as vice presidents (VPs), directors from business development, marketing, and product development/innovation teams, related key executives from the marine industry, marine component manufacturers, and key opinion leaders. The primary sources from the demand side included defense agencies and departments, armed forces, defense contractors, and military research institutions.

Market Size Estimation

The size of the marine electric motor market was estimated and validated using both top-down and bottom-up approaches. The figure below represents this study's overall market size estimation process.

The research methodology used to estimate the market size includes the following details.

- Key market players were identified through secondary research, and their market shares were determined through primary and secondary research. This included an extensive study of top market players' annual and financial reports and interviews with CEOs, directors, and marketing executives.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

- Market growth trends were defined based on approaches such as the product revenues of the major 10-15 companies from 2020 to 2023, R&D expenditures, contracts by different companies from 2020 to 2024, and historic growth patterns between 2020 and 2024, among others.

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were implemented wherever applicable to complete the overall market engineering process and arrive at the exact statistics for market segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. The market size was also validated using both the top-down and bottom-up approaches.

Report Objectives

- To define, describe, and forecast the Marine Electric Motor Market size based on Type, Power, Application, Sale, and Vessel Type from 2023 to 2029.

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the Marine Electric Motor Market.

- To strategically analyze micro markets concerning individual growth trends, prospects, and their contribution to the Marine Electric Motor Market.

- To analyze opportunities for stakeholders in the Marine Electric Motor Market by identifying key market trends.

- To analyze competitive developments such as contracts, acquisitions and expansions, agreements, joint ventures and partnerships, product launches, and R&D activities in the Marine Electric Motor Market.

- To provide a detailed competitive landscape of the Marine Electric Motor Market and an analysis of business and corporate strategies adopted by leading market players.

- To strategically profile key market players and comprehensively analyze their core competencies.

Scope Of the Report

|

Report Metric |

Details |

|

Market size available for years |

2020–2029 |

|

Base year considered |

2023 |

|

Forecast period |

2024-2029 |

|

Forecast units |

Value (USD Million) |

|

Segments Covered |

By Type, By Power, By Application, By Sale, By Vessel Type |

|

Companies covered |

ABB (Switzerland), Schottel GmbH (Germany), Siemens AG (Germany), WEG Industries (Brazil), GE Marine (USA), VEM Group (Germany) |

The study categorizes the Marine Electric Motor Market based on Type, Power, Application, Sale, and vessel Type.

-

By Type

- AC Motor

- DC Motor

-

By Power

- <500 kW

- 500 - 1000 kW

- >1000 W

-

By Application

- Onboard

- Onshore

- Offshore

-

By Sales

- OEM

- Aftermarket

-

By Vessel Type

- Commerical

- Defense

- Unmanned Maritime Vehicles Market

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

Company Information

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the Marine Electric Motor market.

1... INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

1.3.2 REGIONs Covered

1.3.3 YEARS CONSIDERED

1.4 INCLUSIONS & EXCLUSIONS

1.5 CURRENCY consideration

1.6 MARKET STAKEHOLDERS

2... RESEARCH METHODOLOGY

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 KEY DATA FROM SECONDARY SOURCES

2.1.2 PRIMARY DATA

2.1.2.1 KEY DATA FROM PRIMARY SOURCES

2.1.2.2 BREAKDOWN OF PRIMARIES

2.2 Factor Analysis

2.2.1 Introduction

2.2.2 Demand-side Indicators

2.2.3 Supply-side indicators

2.3 market size estimation & Methodology

2.3.1 Bottom-up approach

2.3.2 top-down approach

2.4 MARKET BREAKDOWN & DATA TRIANGULATION

2.5 RISK ANALYSIS

2.6 RESEARCH ASSUMPTIONS

2.7 LIMITATIONS

3... EXECUTIVE SUMMARY

4... PREMIUM INSIGHTS

5... MARKET OVERVIEW

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.2 RESTRAINTS

5.2.3 OPPORTUNITIES

5.2.4 CHALLENGES

5.3 pricing analysis

5.3.1 AVERAGE SELLING PRICE TREND of key players, by SEGMENT

5.3.2 AVERAGE SELLING PRICE Trend, BY REGION

5.4 VALUE CHAIN ANALYSIS

5.5 ECOSYSTEM analysis

5.6 technology analysis

5.7 DISRUPTION IMPACTING MARINE electric MOTOR MARKET

5.8 trade analysis

5.9 REGULATORY LANDSCAPE

5.10 key stakeholders & buying criteria

5.11 key conferences & events in 2024-2025

5.12 Investment & Funding Scenario

5.13 macroeconomic outlook

5.14 Technology Roadmap (TRM)

6... INDUSTRY TRENDS

6.1 INTRODUCTION

6.2 technology trends for MARINe electric MOTOR MARKET

6.3 Impact of megatrends

6.4 PATENT Analysis

7.... MARINE electric MOTOR market, by type

7.1 Introduction

7.2 ac motor

7.3 dc motor

8.... MARINE electric MOTOR market, by power

8.1 Introduction

8.2 <500 kw

8.3 500 - 1000 kw

8.4 >1000 kw

9... MARINE electric MOTOR market, by APPLICATION

9.1 Introduction

9.2 onboard

9.2.1 PROPULSION

9.2.2 AUXILIARY SYSTEM

9.2.3 DECK MACHINERY

9.2.4 PUMPS AND COMPRESSORS

9.3 ONSHORE

9.3.1 PORT INFRASTRUCTURE

9.3.2 CARGO HANDELLING

9.3.3 DRY DOCK SYSTEMS

9.4 OFFSHORE

9.4.1 DRILLING AND PRODUCTION

9.4.2 SUB-SEA OPERATIONS

10.. MARINE electric MOTOR market, by point of sale

10.1 INTRODUCTION

10.2 oem

10.2 aftermarket

11.. MARINE electric MOTOR market, by onboard VESSEL TYPE

11.1 Introduction

11.2 commercial Vessels

11.2.1 PASSENGER VESSELS

11.2.2 CARGO VESSELS

11.2.3 OTHER VESSELS

11.3 defense Vessels

11.4 unmanned Maritime vehicles (UMV)

12.. MARINE MOTOR MARKET, BY region

12.1 INTRODUCTION

12.2 North America

12.2.1 PESTLE ANALYSIS: NORTH AMERICA

12.2.2 US

12.2.3 Canada

12.3 europe

12.3.1 PESTLE ANALYSIS: europe

12.3.2 UK

12.3.3 SWEDEN

12.3.4 NETHERLANDS

12.3.5 NORWAY

12.3.6 Denmark

12.3.7 Rest of Europe

12.4 asia pacific

12.4.1 PESTLE ANALYSIS: asia pacific

12.4.2 CHINA

12.4.3 INDIA

12.4.4 japan

12.4.5 South korea

12.4.6 Rest of Asia Pacific

12.5 MIDDLE EAST & AFRICA

12.5.1 PESTLE ANALYSIS: MIDDLE EAST & AFRICA

12.5.2 GCC COUNTRIES

12.5.2.1 UAE

12.5.2.2 SAUDI ARABIA

12.5.3 Turkey

12.5.4 AFRICA

12.6 LATIN AMERICA

12.6.1 PESTLE ANALYSIS: LATIN AMERICA

12.6.2 BRAZIL

12.6.3................................................................................................. MEXICO

- 13. COMPETITIVE LANDSCAPE

13.1 introduction

13.2 KEY PLAYERS STRATEGIES/RIGHTS TO WIN

13.3 MArket share analysis of leading PLAYERS, 2023

13.4 REVENUE Analysis of TOP 5 MARKET PLAYERS, 2023

13.5 COMPETITIVE overview

13.6 COMPANY EVALUATION MATRIX: key players, 2023

13.6.1 StarS

13.6.2 Emerging Leaders

13.6.3 Pervasive PLAYERS

13.6.4 ParticipantS

13.6.5 COMPANY FOOTPRINt: key players, 2023

13.7 COMPANY EVALUATION MATRIX: Start-up/SME, 2023

13.7.1 progressive companies

13.7.2 responsive companies

13.7.3 dynamic companies

13.7.4 starting blocks

13.7.5 competitive benchmarking: START-UPS/SMEs, 2023

13.8 COMPANY VALUATION AND FINANCIAL MATRIX

13.9 competitive scenario

13.9.1 product launches

13.9.2 Deals

13.9.3 others

- 14. COMPANY PROFILES

14.1 INTRODUCTION

14.2........................................................................................................ KEY PLAYERS

14.2.1 ABB

14.2.2 Schottel GmbH

14.2.3 Siemens AG

14.2.4 WEG Industries

14.2.5 GE Marine

14.2.6 VEM Group

14.2.7 Teco Electric & Machinery

14.2.8 Kawasaki Heavy Industries

14.2.9 Nidec Corporation

14.2.10 Combimac

14.3 OTHER PLAYERS

- APPENDIX

15.1 Discussion guide

15.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 AVAILABLE CUSTOMIZATION

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

Growth opportunities and latent adjacency in Marine Electric Motor Market