Marine Defense Outlook 2035: Market Overview (Ecosystem, Macroeconomics, Regulatory, Programs, Expenditure, Alliances, Dynamics), Industry Trends (Technologies, Use Cases, Maturity Curve), Market Segments (Naval and Unmanned Vessels), Customer Insights (Operators, OEMs, Shifts, initiatives, Business Models, Market Position), Competitive Landscape (Competitors, Partners, Evaluation Matrix, Key Profiles) and Future Opportunities (Future Landscape, Technology Roadmap, Major Projects, Top Opportunities)

The marine defense industry is entering a new era of technological transformation and geopolitical significance. By 2035, naval forces worldwide will integrate cutting-edge innovations, including autonomous maritime systems, next-generation submarines, and directed-energy weapons. This report explores the outlook for marine defense, analyzing market trends, industry developments, customer preferences, and competitive dynamics while identifying future opportunities for investment and growth.

Market Overview

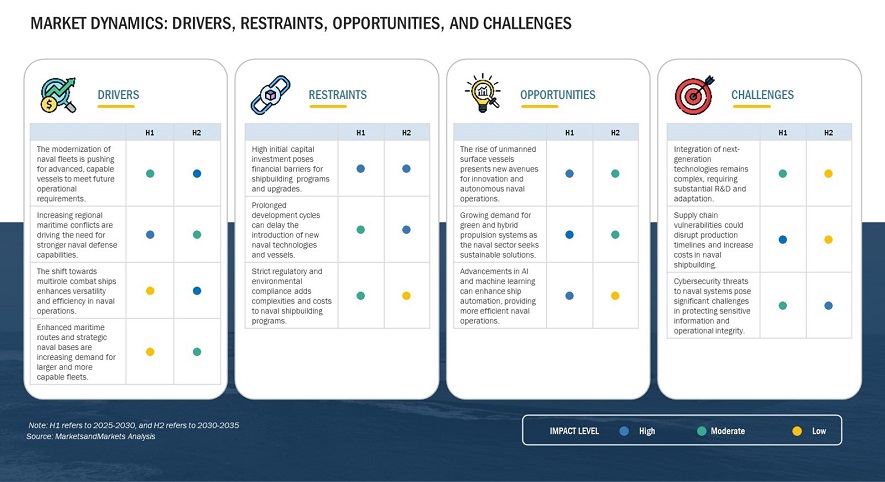

The global marine defense market is projected to experience significant expansion, surpassing an estimated $700 billion by 2035. Several key factors are driving this growth:

- Geopolitical Tensions and Naval Modernization: Countries are enhancing their naval capabilities in response to territorial disputes, particularly in the Indo-Pacific, Arctic, and South China Sea regions.

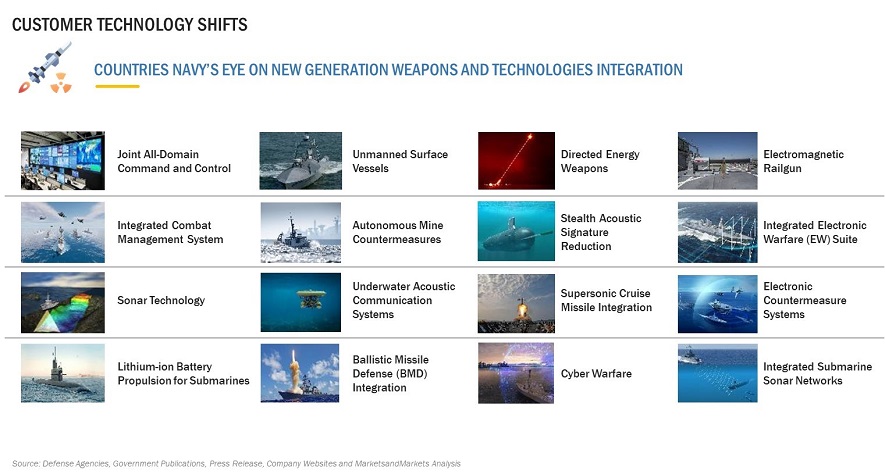

- Advancements in Naval Technology: The adoption of artificial intelligence (AI), cyber warfare, and hypersonic missile systems is revolutionizing marine defense.

- Rise of Unmanned Surface and Underwater Vessels: Autonomous maritime technologies are gaining traction, reducing operational risks and enhancing surveillance.

- Increasing Investments in Submarine Warfare: Nations are prioritizing stealth, nuclear deterrence, and deep-sea warfare capabilities to maintain strategic advantages.

- Strengthened Alliances and Defense Collaborations: Global partnerships, including NATO, QUAD, and AUKUS, are driving joint naval exercises and defense technology sharing.

The leading markets for marine defense include North America, Europe, and the Asia-Pacific region, with countries such as the United States, China, Russia, India, and Australia playing dominant roles in naval expansion and modernization.

Industry Trends

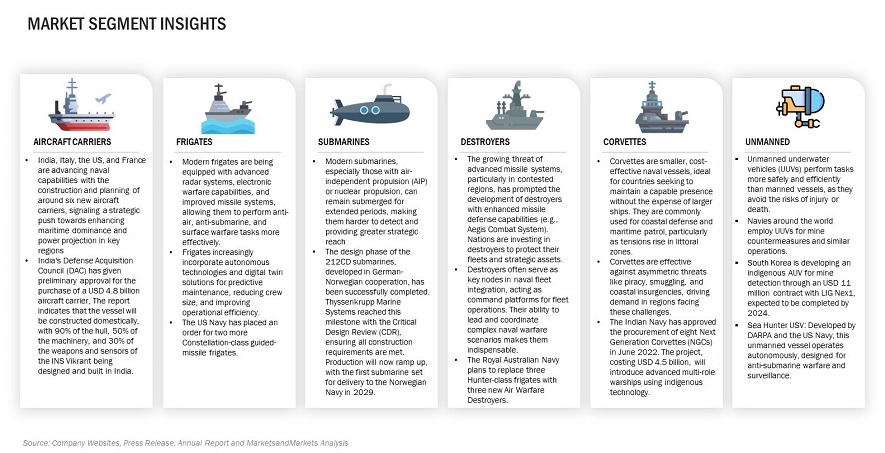

1. Autonomous and Unmanned Maritime Systems

Navies are increasingly integrating autonomous surface and underwater vessels into their fleets. These platforms provide enhanced surveillance, reconnaissance, and combat capabilities with reduced human risk.

2. Hypersonic and Long-Range Missile Systems

The development of hypersonic cruise missiles and long-range anti-ship weapons is altering naval warfare strategies. These advanced weapons can evade traditional missile defense systems, increasing the need for countermeasures.

3. AI and Cyber Warfare in Naval Operations

Artificial intelligence is enhancing situational awareness, predictive maintenance, and decision-making in naval combat. Additionally, cyber warfare threats are prompting investments in cybersecurity measures for naval networks.

4. Underwater and Deep-Sea Warfare

Countries are prioritizing deep-sea warfare capabilities with advanced submarines, underwater drones, and seabed monitoring technologies to secure maritime dominance.

5. Modular and Flexible Ship Designs

Next-generation naval vessels are being designed with modularity in mind, allowing for quick mission reconfiguration, enhanced adaptability, and reduced operational costs.

6. Green and Sustainable Naval Technologies

Sustainability initiatives in marine defense include hybrid-electric propulsion, alternative fuels, and eco-friendly naval base infrastructure to minimize environmental impact.

Customer Insights

Naval defense customers, including governments, defense agencies, and allied forces, are shifting their procurement and operational priorities based on evolving threats and mission requirements:

- Emphasis on Multi-Domain Warfare: Naval forces are integrating air, land, sea, cyber, and space operations to enhance battlefield superiority.

- Increased Focus on Naval Deterrence: Investments in submarine fleets and strategic missile systems are shaping deterrence strategies against potential adversaries.

- Demand for Enhanced Maritime Surveillance: Customers seek advanced reconnaissance and anti-submarine warfare (ASW) systems to monitor vast ocean territories.

- Growth in Private Sector Collaborations: Defense agencies are increasingly partnering with private defense firms to accelerate technological innovation and deployment.

Competitive Landscape

The marine defense industry is dominated by major defense contractors, each investing heavily in next-generation naval technologies. Key players include:

- Lockheed Martin: Specializes in naval missile systems, cybersecurity, and undersea warfare technologies.

- BAE Systems: A leading supplier of warships, aircraft carriers, and advanced naval radar systems.

- General Dynamics: Produces nuclear-powered submarines and next-generation destroyers.

- Northrop Grumman: Focuses on unmanned naval systems, electronic warfare, and AI-driven maritime surveillance.

- Raytheon Technologies: Develops naval missile defense systems and advanced sensor networks.

- China State Shipbuilding Corporation (CSSC): A key player in China’s naval expansion, producing aircraft carriers and destroyers.

- Naval Group: A European defense contractor known for submarine technology and naval fleet modernization.

Future Opportunities

1. Expansion of Unmanned Maritime Operations

The rise of unmanned surface and underwater vehicles offers significant investment opportunities in AI-driven naval defense, autonomous combat platforms, and remote-controlled maritime security.

2. Growth in Anti-Submarine Warfare (ASW) Capabilities

Given the increasing presence of submarines in contested waters, there is a growing demand for ASW technologies, including sonar systems, underwater drones, and depth charge innovations.

3. Investments in Hypersonic Missile Defense

As hypersonic threats become more prevalent, there will be a surge in investments toward counter-hypersonic missile defense systems capable of intercepting high-speed projectiles.

4. Renewable Energy and Green Naval Technologies

Navies are actively seeking sustainable propulsion systems, alternative fuel technologies, and eco-friendly base infrastructure, opening new avenues for defense firms focused on green solutions.

5. Enhanced Naval Cybersecurity and AI Integration

With increasing cyber threats targeting naval operations, cybersecurity solutions for marine defense networks and AI-driven threat detection systems present lucrative opportunities for defense contractors.

6. Strategic Defense Alliances and Military Partnerships

Global defense collaborations and multinational naval exercises are fostering joint technology development and cross-border defense investments, leading to new market expansion opportunities.

The marine defense industry is poised for rapid advancements by 2035, driven by technological innovation, evolving security threats, and shifting geopolitical landscapes. Investments in AI, autonomous systems, hypersonic defense, and sustainable naval technologies will shape the future of naval warfare. Defense firms that prioritize research and development, interoperability, and cost-effective solutions will be best positioned to capitalize on the market’s growth. As maritime security remains a critical focus for global powers, the demand for next-generation naval defense capabilities will continue to surge, presenting significant opportunities for governments, defense contractors, and investors alike.

Growth opportunities and latent adjacency in Marine Defense Outlook 2035: Market