Marine biofuel market by Platform, Fuel Type (Heavy Fuel Oil, Marine Diesel Oil, Liquified Natural Gas, Fatty Acid Methyl Ester, Hydrotreated Vegetable Oil, Ethanol, Methanol, Butanol), Production (Feedstock Type, Feedstock Processing, Fuel Precursor Type, Fuel Precursor Processing), Propulsion (Hybrid, Duel Fuel, Conventional), and Region (North America, Europe, Asia Pacific, and Rest of the World) - Forecast to 2030

The Marine biofuel market is estimated to be USD xx billion in 2024 and is projected to reach USD xx billion by 2030, at a CAGR of xx% from 2024 to 2030. The market is driven by factors such as innovations in Marine biofuel based propulsion systems used in different inland and seafaring vessels across the world.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 has led to several challenges for many industries. The marine industry is no exception to that. The budget allotted to the defense sector has been reduced by several countries due to the COVID-19 pandemic. This puts most research projects on hold. The export of Marine biofuel to several countries in the Middle East, Africa, and Latin America has also been reduced. All these scenarios affect the development of Marine biofuel.

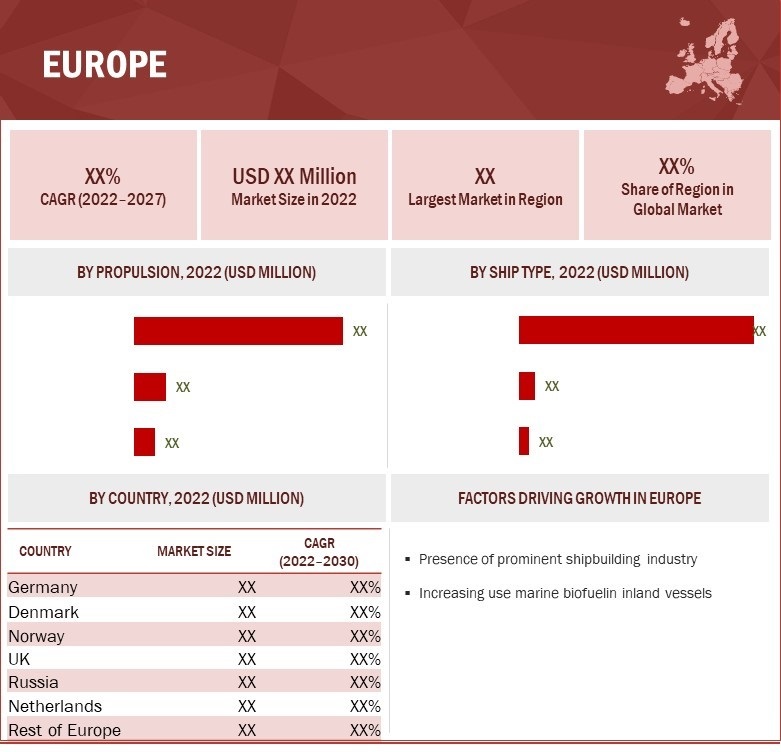

The Europe market is projected to contribute the largest share from 2022 to 2027

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players:

Major players in the Marine biofuel market include Archer Daniels Midland (ADM) (US), Chevron Lummus Globa (US), Avril Group (France), Solazyme (US), Emerald Biofuels (US), Neste Corporation (Finland), and UPM (Finland). The report covers various industry trends and new technological innovations in the Marine biofuel market for the period, 2018-2027.

Frequently Asked Questions (FAQ):

What are your views on the growth prospect of the Marine biofuel market?

Response: The Marine biofuel market is expected to grow substantially owing to the technological development in the making of the Marine biofuel using several different feedstocks.

What are the key sustainability strategies adopted by leading players operating in the Marine biofuel market?

Response: Key players have adopted various organic and inorganic strategies to strengthen their position in the Marine biofuel market. Major players in the Marine biofuel market include Archer Daniels Midland (ADM) (US), Chevron Lummus Globa (US), Avril Group (France), Solazyme (US), Emerald Biofuels (US), Neste Corporation (Finland), and UPM (Finland) have adopted various strategies, such as contracts and agreements, to expand their presence in the market further.

What are the new emerging technologies and use cases disrupting the Marine biofuel market?

Response: Some of the major emerging technologies and use cases disrupting the market include the use of algae as a feedstock.

Who are the key players and innovators in the ecosystem of the Marine biofuel market?

Response: Major players in the Marine biofuel market include Archer Daniels Midland (ADM) (US), Chevron Lummus Globa (US), Avril Group (France), Solazyme (US), Emerald Biofuels (US), Neste Corporation (Finland), and UPM (Finland).

Which region is expected to hold the highest market share in the Marine biofuel market?

Response: Marine biofuel market in The Europe region is estimated to account for the largest share of XX% of the market in 2022 and is expected to grow at the highest CAGR of XX% during the forecast period.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERSRESTRAINTSOPPORTUNITIESCHALLENGES

-

5.3 PRICING ANALYSISAVERAGE SELLING PRICE TREND, BY FUEL TYPEAVERAGE SELLING PRICE TREND, BY REGION

- 5.4 VALUE CHAIN ANALYSIS

-

5.5 ECOSYSTEM ANALYSISPROMINENT COMPANIESPRIVATE AND SMALL ENTERPRISESEND USERS

- 5.6 TECHNOLOGY ANALYSIS

-

5.7 DISRUPTION IMPACTING MARINE BIO FUEL MARKETREVENUE SHIFT & NEW REVENUE POCKETS FOR MARINE BIOFUEL MANUFACTURERS

- 5.8 TRADE ANALYSIS

-

5.9 REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

-

5.10 CASE STUDY ANALYSIS

-

5.11 KEY STAKEHOLDERS & BUYING CRITERIAKEY STAKEHOLDERS IN THE BUYING PROCESSBUYING CRITERIA

- 5.12 KEY CONFERENCES & EVENTS IN 2025-2026

- 5.13 INVESTMENT & FUNDING SCENARIO

- 5.14 OPERATIONAL DATA

-

5.15 MACRO ECONOMIC OUTLOOKMACROECONOMIC OUTLOOK: NORTH AMERICAMACROECONOMIC OUTLOOK: EUROPEMACROECONOMIC OUTLOOK: ASIA PACIFICMACROECONOMIC OUTLOOK: MIDDLE EASTMACROECONOMIC OUTLOOK: LATIN AMERICA & AFRICA

- 5.16 TECHNOLOGY ROADMAP (TRM)

- 5.17 TOTAL COST OF OWNERSHIP (TCO)

- 5.18 BUSINESS MODEL (NBM)

-

5.19 IMPACT OF AI/GEN AIyes

- 6.1 INTRODUCTION

- 6.2 TECHNOLOGY TRENDS

- 6.3 IMPACT OF MEGATRENDS

- 6.4 USE CASE ANALYSIS

-

6.5 PATENT ANALYSISyes

- 7.1 INTRODUCTION

-

7.2 COMMERCIALPASSENGER VESSELS- CRUISES- PASSENGER FERRIES- YACHTS & MOTOR BOATSCARGO VESSELS- TANKERS- BULK CARRIERS- GAS TANKERS- DRY CARGO VESSELS- CONTAINER VESSELS- BARGES & TUG BOATSOTHERS- FISHING BOATS- RESEARCH VESSELS- DREDGERS

-

7.3 MILITARYAIRCRAFT CARRIERAMPHIBIOUS SHIPSFRIGATESCORVETTESDESTROYERSSUBMARINES (ATTACK SUBMARINES, NUCLEAR SUBMARINES)

- 8.1 INTRODUCTION

- 8.2 HEAVY FUEL OIL

- 8.3 MARINE DIESEL OIL

- 8.4 LIQUIFIED NATURAL GAS

- 8.5 FATTY ACID METHYL ESTER

- 8.6 HYDROTREATED VEGETABLE OIL

- 8.7 ETHANOL

- 8.8 METHANOL

- 8.9 BUTANOL

- 9.1 INTRODUCTION

-

9.2 FEEDSTOCK TYPEOIL CROPSLIGNOCELLULOSIC BIOMASSSTARCH CROPSWOOD EXTRACTIVESALGAE

-

9.3 FEEDSTOCK PROCESSINGPRESSING OR EXTRACTIONTHERMOCHEMICAL PROCESSINGPRETREATMENT & HYDROLYSISGASIFICATIONPYROLYSISPULPINGOIL EXTRACTION

-

9.4 FUEL PRECURSOR TYPEVEGETABLE OILBIO-CRUDESUGARSYNGASTALL OILGREEN CRUDELIGNIN RESIDUE

-

9.5 FUEL PRECURSOR PROCESSINGHYDROTREATING & REFININGCATALYTIC REFININGFERMENTATIONESTERIFICAITONSOLVOLYSISCATALYZED UPGRADINGCATALYZED SYNTHESISMARINE BIOFUEL MARKET, BY PROPULSION

- 10.1 INTRODUCTION

- 10.2 HYBRID (ELECTRIC + OTHER FUEL)

- 10.3 DUAL FUEL (DIESEL + OTHER FUEL)

- 10.4 CONVENTIONAL

- 11.1 INTRODUCTION

-

11.2 NORTH AMERICAPESTLE ANALYSIS: NORTH AMERICAUSCANADA

-

11.3 EUROPEPESTLE ANALYSIS: EUROPEUKFRANCEITALYGERMANYREST OF EUROPE

-

11.4 ASIA PACIFICPESTLE ANALYSIS: ASIA PACIFICINDIAJAPANSOUTH KOREAAUSTRALIAREST OF ASIA PACIFIC

-

11.5 MIDDLE EASTPESTLE ANALYSIS: MIDDLE EASTGCC COUNTRIESREST OF MIDDLE EAST

-

11.6 REST OF THE WORLDPESTLE ANALYSIS: LATIN AMERICA & AFRICAAFRICALATIN AMERICA

- 12.1 INTRODUCTION

- 12.2 KEY PLAYERS STRATEGIES/RIGHTS TO WIN

- 12.3 MARKET SHARE ANALYSIS OF LEADING PLAYERS, 2024

- 12.4 REVENUE ANALYSIS OF TOP 5 MARKET PLAYERS, 2024

- 12.5 COMPETITIVE OVERVIEW

-

12.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT: KEY PLAYERS, 2024- FUEL TYPE FOOTPRINT- VESSEL TYPE FOOTPRINT- PROPULSION FOOTPRINT- REGION FOOTPRINT

-

12.7 COMPANY EVALUATION MATRIX: START-UP/SME, 2024PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING: START-UPS/SMES, 2024- DETAILED LIST OF KEY STARTUPS/SMES- COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 12.8 COMPANY VALUATION AND FINANCIAL MATRIX

- 12.9 BRAND/PRODUCT COMPARISION

-

12.10 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALSOTHERS

- 13.1 INTRODUCTION

-

13.2 KEY PLAYERSARCHER DANIELS MIDLAND (ADM)CHEVRON LUMMUS GLOBAAVRIL GROUPSOLAZYMEEMERALD BIOFUELSNESTE CORPORATIONUPMSUNPINENVERGENT TECH (A HONEYWELL COMPANY)STEEPER ENERGYLICELLAALTACA ENERGI INC.RENMATIXVELOCYS (FORMERLY OXFORD CATALYSTS)BETARENEWABLESPOET-DSM ADVANCED BIOFUELENERKEMSTENA LINEPROGRESSION INDUSTRYAMYRISGALP

-

13.3 OTHER PLAYERSSUNSHINE BIOFUELSGEVOMÆRSKENIEVOLEUMGOODFUELS MARINERENEWABLE ENERGY GROUP

- 19.1 DISCUSSION GUIDE

- 19.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 19.3 AVAILABLE CUSTOMIZATION

- 19.4 RELATED REPORTS

- 19.5 AUTHOR DETAILS

Growth opportunities and latent adjacency in Marine biofuel market