Manufacturing Operations Management (MOM) software Market by Component (Solution and Services), Function (Planning and Scheduling, Quality Process Management, Labour Management, and Others) Organization Size, Vertical (BFSI, Government, Healthcare, IT & Telecom) and Region - Global Forecast to 2027

Manufacturing operations management (MOM) includes activities that improve production, inventory and staffing processes in manufacturing firms. The organizations are adopting MOM software to improve product quality by minimizing damage and increase efficiency, profits and customer satisfaction.

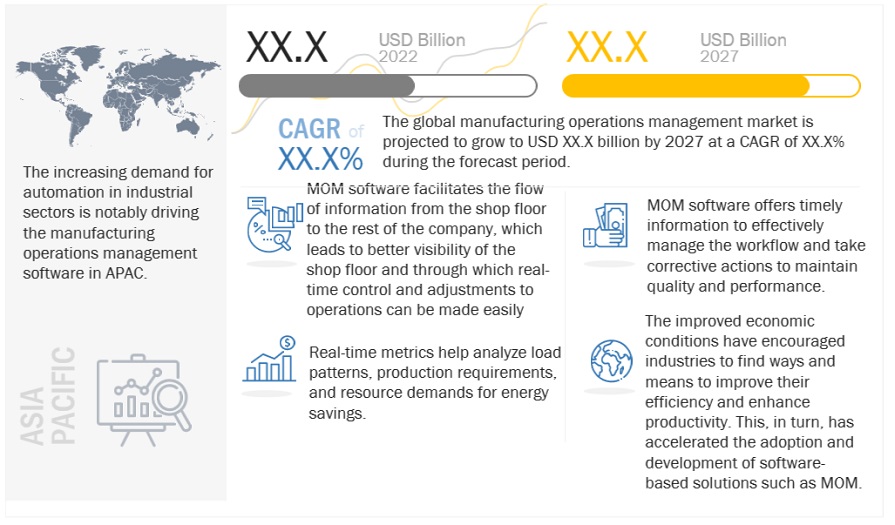

The global manufacturing operations management software market size is expected to grow from USD XX.X billion in 2022 to USD XX.X billion by 2027, at a CAGR of XX.X%. MOM software minimizes damage and waste of raw materials which helps companies to improve order taking and fulfillment accuracy such factors are expected to drive the adoption of MOM software during the forecast period.

Drivers: Increasing need for real-time data monitoring

The advent of Industry 4.0 has compelled manufacturers to adopt digitized technologies, which enabled the operational and manufacturing efficiencies. Analyzing and acting on real-time information leads to decisions that help operations run more smoothly and cost-efficiently. MOM software assists in digitalizing production processes and information into a unified system. It also helps improve execution systems, advance planning and scheduling, and manage quality and research and development (R&D) projects.

Drivers: Rapid growth of digitized technologies in operations

AR and IoT help manufacturers to get their jobs done faster and more accurately. They can view task instructions, checklists, troubleshooting procedures, and get real-time video assistance from remote experts. With the help of AI analytics MOM software enables organizations to practice manufacturing management. A company also minimizes damage to and waste of raw materials. That means better products. Increased efficiencies also improve product consistency and overall quality. Thus, to attain such goals and improve operational efficiency at Svebølle-Viskinge district heating plant in Denmark the authorities implemented ABB Ability MOM Process and Production Intelligence solution. The solution helps the district heating plat to reduce the loss to 33 percent, equivalent to 500 MWh which is around 14,000 USD for fuel.

Challenges: Lack of adequate resources and inadequate software training tools

To install new software and develop an effective onboarding plan, an employee should have adequate knowledge of the overall process. After the initial onboarding, there needs to be continuous employee training on new features and workflows. As there are MOM tools in the market so if the employees do not get proper training, then it might affect the employee productivity. A digital adoption platform is a proven way to onboard new software users quickly and with minimal disruption. When implementing new software, there may be resistance from employees who are happy with the existing system and do not want to learn new processes. It is crucial to fully prepare staff for the changes. Set some time ahead of the implementation to show them the benefits of the new software.

Key players in the market

ABB (Switzerland), Aegis Industrial Software (US), Aspen Technology (US), AVEVA Group (UK), Critical Manufacturing (Portugal), Dassault Systemes (France), Durr (Germany), Emerson Electric (US), iBASEt (US), and SAP (Germany) are few key players in the manufacturing operations management software market globally.

Recent Developments

- In March 2022, SymphonyAI Industrial launched AI embedded MOM 360 manufacturing operations management with integrated manufacturing execution systems (MES) capabilities, enterprise-level governance and AI-based process optimization to help companies achieve Industry 4.0 smart manufacturing goals of data-driven process optimization at enterprise scale.

- In March 2022, iBASEt formed a new strategic partnership with Cyient, a global engineering, manufacturing, and digital technology solutions company. The aim of the partnership is to develop purpose-built software products that can help to ease the transition to digital operations management solutions.

- In September 2021, AVEVA launched AVEVA Operations Control software, with features including IIoT architectures and cloud-driven remote edge management to multi-site supervisory control via a flexible user-centric model, through the AVEVA Flex Subscription program in three core packages including Edge, Supervisory and Enterprise.

TABLE OF CONTENTS

1 INTRODUCTION

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 REGIONS COVERED

1.3.3 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakup of primary profiles

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

2.4 MARKET FORECAST

2.5 ASSUMPTIONS

2.6 LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 BRIEF OVERVIEW OF MANUFACTURING OPERATIONS MANAGEMENT SOFTWARE MARKET

4.2 MARKET, BY COMPONENT, 2022 VS. 2027

4.3 MARKET, BY DEPLOYMENT MODE, 2022 VS. 2027

4.4 MARKET, BY ORGANIZATION SIZE, 2022 VS. 2027

4.5 MARKET, BY VERTICAL, 2022 VS. 2027

4.6 MARKET , BY APPLICATION, 2022 VS. 2027

5 MARKET OVERVIEW AND INDUSTRY TRENDS

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.2 RESTRAINTS

5.2.3 OPPORTUNITIES

5.2.4 CHALLENGES

5.4 CASE STUDY ANALYSIS

5.5 ECOSYSTEM

5.6 VALUE CHAIN ANALYSIS

5.7 TECHNOLOGICAL ANALYSIS

5.7.1 ARTIFICIAL INTELLIGENCE

5.7.2 DATA ANALYTICS

5.7.3 BIG DATA

5.8 PATENT ANALYSIS

5.9 PORTER’S FIVE FORCES ANALYSIS

5.9.1 THREAT OF NEW ENTRANTS

5.9.2 THREAT OF SUBSTITUTES

5.9.3 BARGAINING POWER OF SUPPLIERS

5.9.4 BARGAINING POWER OF BUYERS

5.9.5 DEGREE OF COMPETITION

5.10 REGULATORY LANDSCAPE

5.11 TRENDS/DISRUPTIONS IMPACTING BUYERS

6 MANUFACTURING OPERATIONS MANAGEMENT SOFTWARE MARKET, BY COMPONENT

6.1 INTRODUCTION

6.1.1 COMPONENT: MARKET DRIVERS

6.2 SOLUTIONS

6.3 SERVICES

7 MARKET, BY FUNCTION

7.1 INTRODUCTION

7.1.1 FUNCTION: MARKET DRIVERS

7.2 PLANNING AND SCHEDULING

7.3 QUALITY PROCESS MANAGEMENT

7.4 LABOUR MANAGEMENT

7.5 OTHERS

8 MANUFACTURING OPERATIONS MANAGEMENT SOFTWARE MARKET, BY DEPLOYMENT MODE

8.1 INTRODUCTION

8.1.1 DEPLOYMENT MODE: MARKET DRIVERS

8.2 ON-PREMISES

8.3 CLOUD

9 MARKET, BY ORGANIZATION SIZE

9.1 INTRODUCTION

9.1.1 ORGANIZATION SIZE: MARKET DRIVERS

9.2 SMALL AND MEDIUM-SIZED ENTERPRISES

9.3 LARGE ENTERPRISES

10 MANUFACTURING OPERATIONS MANAGEMENT SOFTWARE MARKET, BY VERTICAL

10.1 INTRODUCTION

10.1.1 VERTICAL: MARKET DRIVERS

10.2 BANKING, FINANCIAL SERVICES, AND INSURANCE

10.3 IT AND TELECOM

10.4 GOVERNMENT AND PUBLIC SECTOR

10.5 MANUFACTURING

10.6 RETAIL AND CONSUMER GOODS

10.7 HEALTHCARE AND LIFE SCIENCES

10.8 ENERGY AND UTILITIES

10.9 OTHER VERTICALS

11 MANUFACTURING OPERATIONS MANAGEMENT SOFTWARE MARKET, BY REGION

11.1 INTRODUCTION

11.2 NORTH AMERICA

11.2.1 NORTH AMERICA: MARKET DRIVERS

11.2.3 US

11.2.4 CANADA

11.3 EUROPE

11.3.1 EUROPE: MARKET DRIVERS

11.3.3 UK

11.3.4 GERMANY

11.3.5 FRANCE

11.3.6 REST OF EUROPE

11.4 ASIA PACIFIC

11.4.1 ASIA PACIFIC: MANUFACTURING OPERATIONS MANAGEMENT SOFTWARE MARKET DRIVERS

11.4.3 CHINA

11.4.4 JAPAN

11.4.5 INDIA

11.4.6 REST OF ASIA PACIFIC

11.5 MIDDLE EAST & AFRICA

11.5.1 MIDDLE EAST & AFRICA: CLOUD PERFORMANCE MARKET DRIVERS

11.5.3 KINGDOM OF SAUDI ARABIA

11.5.4 UNITED ARAB EMIRATES

11.5.5 REST OF MIDDLE EAST & AFRICA

11.6 LATIN AMERICA

11.6.1 LATIN AMERICA: MANUFACTURING OPERATIONS MANAGEMENT SOFTWARE MARKET DRIVERS

11.6.3 BRAZIL

11.6.4 REST OF LATIN AMERICA

12 COMPETITIVE LANDSCAPE

12.1 INTRODUCTION

12.2 MARKET SHARE OF TOP VENDORS

12.3 HISTORICAL REVENUE ANALYSIS OF TOP FIVE VENDORS

12.4 KEY MARKET DEVELOPMENTS

12.4.1 NEW LAUNCHES

12.4.2 DEALS

12.4.3 OTHERS

12.5 COMPANY EVALUATION QUADRANT

12.5.1 STARS

12.5.2 EMERGING LEADERS

12.5.3 PERVASIVE PLAYERS

12.5.4 PARTICIPANTS

12.6 COMPETITIVE BENCHMARKING

13 COMPANY PROFILES

13.1 INTRODUCTION

(Business Overview, Products, Key Insights, Recent Developments, MnM View)*

13.2 KEY PLAYERS

13.2.1 ABB

13.2.2 AEGIS INDUSTRIAL SOFTWARE

13.2.3 AVEVA

13.2.4 DURR AG

13.2.5 CRITICAL MANUFACTURING

13.2.6 IBASET

13.2.7 ORACLE

13.2.8 SAP

13.2.9 SCHNEIDER ELECTRIC

13.2.10 GENERAL ELECTRIC

*Details on Business Overview, Products, Recent Developments, MnM View might not be captured in case of unlisted companies.

12.3 OTHER COMPANIES

13.3.1 SIEMENS

13.3.2 HONEYWELL INTERNATIONAL

13.3.3 PLEX SYSTEMS

13.3.4 ROCKWELL AUTOMATION

13.3.5 EMERSON ELECTRIC

13.3.6 EPICOR SOFTWARE

13.3.7 SYSPRO

13.3.8 DASSAULT SYSTEMES

13.3.9 LIGHTHOUSE SYSTEMS

13.3.10 ASPEN TECHNOLOGY

14 ADJACENT AND RELATED MARKETS

14.1 INTRODUCTION

14.1.1 RELATED MARKET

14.1.2 LIMITATIONS

15 APPENDIX

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 AVAILABLE CUSTOMIZATIONS

15.4 RELATED REPORT

15.5 AUTHOR DETAILS

Growth opportunities and latent adjacency in Manufacturing Operations Management (MOM) software Market