Magnetic Separator Market by Type (Drum, Overband, Roller, Pulleys, Plates, Grates, and Bars), Magnet Type (Permanent Magnets, Electromagnets), Material Type, Cleaning Type, Industry (Mining, Recycling, Food & Beverages) & Region - Global Forecast to 2025

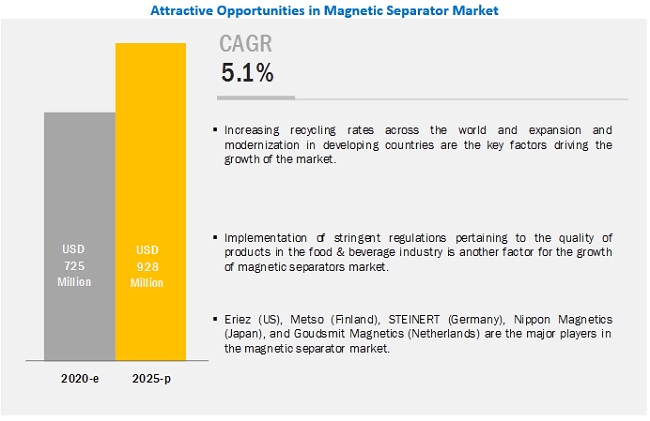

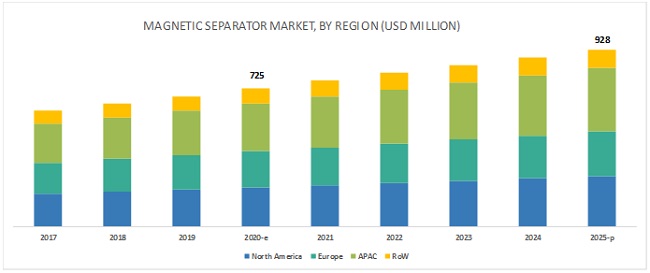

The global magnetic separator market is expected to grow USD 928 million by 2025, at a CAGR of 5.1%. The increase in recycling rates across the world is one of the key factors driving the growth of the market. The expansion and urbanization in developing countries, along with the stringent rules and regulations pertaining to quality in the food & beverage industry, are among the other factors driving the market growth.

Impact of AI on Magnetic Separator Market

Artificial Intelligence (AI) is reshaping the magnetic separator market by improving separation efficiency, enhancing operational automation, and enabling real-time monitoring. Through machine learning algorithms and sensor integration, AI-powered magnetic separators can automatically adjust magnetic field strength and separation parameters based on material composition, leading to higher accuracy and reduced material loss. AI also enables predictive maintenance by analyzing equipment performance data to forecast potential failures, minimizing downtime and extending equipment life. Additionally, AI-driven systems can continuously monitor and optimize the separation process, increasing productivity and reducing energy consumption. As industries such as mining, recycling, food processing, and pharmaceuticals demand more efficient and sustainable material handling solutions, the adoption of AI in magnetic separators is driving innovation, operational efficiency, and market growth.

Equipment type to dominate global magnetic separator market during forecast period

Equipment type magnetic separators are expected to hold a majority of the global magnetic separator market share in 2020, and the segment is projected to dominate the market during the forecast period. Magnetic separator equipment include drums, overband, rollers, and eddy current separators. Increasing demand from industries such as mining, recycling, ceramics, paper, and plastics is expected to propel the demand for equipment type magnetic separators during the forecast period. Overband magnetic separators are ideal for removing high volumes of iron particles from materials and are expected to grow at the fastest rate as their demand in the recycling and mining industries is increasing.

Automatic cleaning type magnetic separator to dominate magnetic separator market by 2025

Automatic cleaning type of magnetic separators, also known as self-cleaning type of magnetic separators, have been in huge demand in recent times as they help reduce or avoid the manpower required to clean magnetic separators. As the need for any manual activity is eliminated in self-cleaning magnetic separators, they can be installed in a fully automatic production line, thereby increasing the efficiency of the production process. The advantage of these separators is that safety is high as the metal contaminants are removed automatically. These factors are expected to drive the market for automatic cleaning type of magnetic separators during the forecast period.

Food & beverage industry to grow at highest CAGR during 2020–2025

The food & beverage industry is regulated by the Food and Drug Administration (FDA) in the US and the European Food Safety Authority (EFSA) in Europe. These authorities have framed stringent rules and regulations pertaining to the production of food products in the food & beverage industry along with the equipment used in the facilities. Hence, magnetic separators are vital in the food & beverage industry as they help in removing ferrous contaminants from food products, which, if consumed, can adversely affect health. Owing to the rise in food consumption, attributed to the growing population, along with framing of new rules and regulations by food authorities (such as Food Safety Modernization Act) to enhance the quality of products, the demand for magnetic separators from the food & beverage industry is expected to grow significantly during the forecast period.

APAC expected to dominate magnetic separator market during forecast period

APAC is likely to continue to lead the global magnetic separator market during 2020–2025. Rising demand for medicines, hygienic food products, and beverages, as well as government initiatives to increase the recycling rates in the region, are expected to propel the demand for magnetic separators in APAC.

China is expected to hold the largest market share and is likely to witness the highest CAGR in the magnetic separator market during 2020–2025. China holds one of the largest reserves of rare earth minerals across the world. This has enabled huge growth in the mining industry in the country. Also, with the growing urban population, the pharmaceutical industry is expected to thrive in China, which, in turn, is expected to drive the market for magnetic separators.

Key Players in Magnetic Separator Market

Major companies in the magnetic separator market are Eriez (US), Goudsmit Magnetics (Netherlands), Industrial Magnetics (US), Eclipse Magnetics (UK), Nippon Magnetics (Japan), Metso (Finland), Bunting Magnetics (US), Multotec (South Africa), K.W. Supply Magneetsystemen (Netherlands), STEINERT (Germany), LONGi Magnet (China), Kanetec (Japan), Sollau (Czech Republic), Shandong Huate Magnet Technology (China), Malvern Engineering (South Africa), Jupiter Magnetics (India), Permanent Magnets (India), Magnetic Products (US), Innovative Magnetic Technologies (Canada), and Weifang GUOTE Mining Equipment (China).

Eriez (US) is among the leaders in the manufacturing and distribution of magnetic separators worldwide. The company has adopted a combination of organic and inorganic growth strategies in the last two years. It has expanded its operations in the US. As a part of its growth strategy, the company concentrates on technological developments and promotion for sustained offering of benefits to its customers. It also promotes its products through various conferences and exhibitions. Owing to its high-quality products, the company maintains a strong brand image in the magnetic separator market. The integrated product portfolio of the company also caters to the requirements of various end-use industries, which has helped it to gain a competitive advantage over its peers.

Magnetic Separator Market Report Scope:

|

Report Metric |

Details |

|

Estimated Market Size |

USD 725 Million |

|

Projected Market Size |

USD 928 Million |

|

Growth Rate |

CAGR of 5.1% |

|

Market Size Available for Years |

2017–2025 |

|

Base Year |

2019 |

|

Forecast Period |

2020–2025 |

|

Forecast Unit |

Value (USD Million/Billion) |

|

Segments Covered |

|

|

Geographic Regions Covered |

|

|

Market Leaders |

Goudsmit Magnetics (Netherlands), Eclipse Magnetics (UK), Nippon Magnetics (Japan), Metso (Finland), Multotec (South Africa), K.W. Supply Magneetsystemen (Netherlands), STEINERT (Germany), LONGi Magnet (China), Kanetec (Japan), Sollau (Czech Republic), Shandong Huate Magnet Technology (China), Malvern Engineering (South Africa), Jupiter Magnetics (India), Permanent Magnets (India), Innovative Magnetic Technologies (Canada), and Weifang GUOTE Mining Equipment (China) |

|

Top Companies in North America |

Eriez (US), Industrial Magnetics (US), Bunting Magnetics (US), Magnetic Products (US) |

|

Key Market Driver |

Stringent rules and regulations pertaining to quality in the food & beverages industry along with the increasing recycling rates across the world |

| Key Market Opportunity | Advancements in magnetic separation technology along with the increasing use of superconducting magnets in magnetic separators. |

| Largest Growing Region | Asia Pacific |

| Highest CAGR Segment | Food & beverage industry to grow at highest CAGR |

This report categorizes the magnetic separator market based on type, magnet type, cleaning type, intensity, material type, and industry, and region.

Magnetic Separator Market, by Type

-

Magnetic Separator Equipment

- Drum

- Roller

- Overband

- Eddy Current Separators

-

Standalone Magnetic Separators

- Bars & Rods

- Plate

- Grates

- Drawers

- Pulleys

- Filters

- Chute& Humps

- Others (strip magnets, wedge magnets, bullet/pipe magnets, and cascade magnets)

-

By Magnet Type

- Electromagnets

- Permanent Magnets

Magnetic Separator Market, by Material Type

- Wet

- Dry

Magnetic Separator Market, by Cleaning Type

- Manual

- Automatic

Magnetic Separator Market, by Industry

- Recycling

- Mining

- Chemical & Pharmaceutical

- Ceramics, Paper, and Plastics

- Food & Beverages

- Glass & Textile

- Others (oil & gas, power & energy, construction)

Magnetic Separator Market, by Region:

-

North America

- US

- Mexico

- Canada

-

Europe

- UK

- Germany

- France

- Italy

- Rest of Europe

-

APAC

- China

- Japan

- South Korea

- Rest of APAC

-

RoW

- Middle East & Africa

- South America

Recent Developments

- In November 2019, Eriez announced the expansion of its US manufacturing facility to support strategic growth initiatives for repair, testing, and R&D activities. This expansion is expected to grow the company’s repair business, facilitate product development, and provide better testing support for its products.

- In September 2019, Goudsmit Magnetics launched a new version of the automatically cleanable Easy Clean Flow magnet. This magnetic separator is expected to remove metal particles and weakly magnetic stainless steel particles from powders as fine as 30 µm in the food, chemicals, ceramics, and plastics industries.

- In August 2019, Eriez announced a partnership with Industrial Applications Group (US) to market Eriez products related to fluid recycling, material handling, magnetic separation, and vibratory feeding and conveying in Colorado, New Mexico, Utah, and Wyoming.

- In July 2019, Metso signed an agreement with Outotec (Finland) to merge Metso Minerals, the minerals division of Metso, and Outotec, to create a new company named Metso Outotec. This merger is expected to be completed by the second quarter of 2020.

- In March 2019, Danfoss expanded its semi-welded plate heat exchanger portfolio with the addition of a new range—SW19-59. This new range is expected to help industrial refrigeration professionals achieve safe and energy-efficient operations.

Key Questions Addressed in the Report

- Who are the key players operating in the magnetic separator market, and what are the factors contributing to their domination over other players?

- In the value chain analysis of the magnetic separator ecosystem, what are the major phases and which phase(s) contribute the maximum value?

- Which are the leading industries in the magnetic separator market?

- What magnet type would lead the market during the forecast period?

- Which region is expected to dominate the magnetic separator market during the next 5 years?

Frequently Asked Questions (FAQ):

Which are the major companies in the magnetic separator market? What are their major strategies to strengthen their market presence?

The major companies in the magnetic separator market includes ERIEZ (US), Metso (Finland), STEINERT (Germany), Nippon Magnetics (Japan), and Goudsmit Magnetics (Netherlands). ERIEZ is the dominant player in the global magnetic separator market. It is a leading manufacturer of magnetic separators like tube magnets, plate magnets, grate magnets, and magnetic pulleys. The major strategies adopted by these players are product launches and expansion strategy.

What are the drivers and opportunities for the magnetic separator market?

Factors such as stringent rules and regulations pertaining to quality in the food & beverages industry along with the increasing recycling rates across the world are the major factors driving the magnetic separator market. Advancements in magnetic separation technology along with the increasing use of superconducting magnets in magnetic separators provide significant opportunities for the market players.

Which are the major end-use industries for magnetic separators and which among these industries hold the largest market share?

The major end-use industries for magnetic separators are recycling, mining, food & beverages, chemical & pharmaceutical, ceramics, paper, and plastics, and glass & textile among others. The recycling industry held the largest market share in the magnetic separator market, while the food & beverages industry is expected to grow at the highest CAGR during the forecast period.

Which is the potential market for magnetic separators in terms of region?

The magnetic separator market in APAC is expected to lead during the forecast period. The mining industry in APAC is growing at a significant pace led by China, among other countries. Also, South Korea stands 3rd in the list of countries having the best recycling rates in the world. The country is looking to further improve its recycling rate in near future which is expected to push the magnetic separator market in the region.

Will permanent magnet-based magnetic separators be replaced by electromagnetic separators in near future?

Permanent magnet-based magnetic separators hold a larger share as compared to electromagnetic magnetic separators and this trend is expected to continue during the forecast period. Permanent magnet-based magnetic separators offer numerous advantages over their electromagnetic counterpart which include no electricity requirement, less expensive and lightweight, and are maintenance-free. Although permanent magnets are widely used for magnetic separators, electromagnets are also preferred in applications, such as heavy iron object/scrap removals, where different strength levels of magnetism are required. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 18)

1.1 Study Objectives

1.2 Market Definition and Scope

1.3 Inclusions and Exclusions

1.4 Study Scope

1.4.1 Markets Covered

1.4.2 Years Considered

1.5 Currency

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 22)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Secondary Sources

2.1.2 Primary Data

2.1.2.1 Breakdown of Primary Interviews

2.1.2.2 Key Data From Primary Sources

2.1.2.3 Key Industry Insights

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.1.1 Approach for Capturing Market Size By Bottom-Up Analysis (Demand Side)

2.2.2 Top-Down Approach

2.2.2.1 Approach for Capturing Market Size By Top-Down Analysis (Supply Side)

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 32)

4 Premium Insights (Page No. - 37)

4.1 Attractive Opportunities in the Magnetic Separator Market

4.2 Market, By Magnet Type and Industry

4.3 Market, By Equipment Type

4.4 Country-Wise Market Growth Rate

5 Market Overview (Page No. - 39)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Expansion and Urbanization in Developing Countries

5.2.1.2 Stringent Rules and Regulations Pertaining to Quality in the Food & Beverages Industry

5.2.1.3 Increasing Recycling Rates Across the World

5.2.2 Restraints

5.2.2.1 Manufacturing of Low-Quality Magnetic Separators in Developing Countries

5.2.3 Opportunities

5.2.3.1 Advancements in Magnetic Separation Technology

5.2.3.2 Increasing use of Superconducting Magnets in Magnetic Separators

5.2.4 Challenges

5.2.4.1 Safety Concerns Related to use of Magnetic Separators

5.3 Value Chain Analysis

6 Magnetic Separator Market, By Type (Page No. - 46)

6.1 Introduction

6.2 Magnetic Separator Equipment

6.2.1 Drum

6.2.1.1 Drum Magnetic Separators are Used in Industries Such as Food & Beverages, Chemical & Pharmaceutical, and Glass

6.2.2 Roller

6.2.2.1 Roller Magnetic Separators are Made of Alloys of Rare Earth Elements and are More Powerful Compared to Other Magnets

6.2.3 Overband (Suspended)

6.2.3.1 Overband Magnetic Separators are Ideal for Removing High Volumes of Iron Particles and Mainly Used in Recycling and Mining Industries

6.2.4 Eddy Current Separators

6.2.4.1 Eddy Current Separators are Used to Remove Non-Ferrous Conducting Metals

6.3 Standalone Magnetic Separators

6.3.1 Pulleys

6.3.1.1 Magnetic Pulleys Find Major Applications in Mining and Recycling Industries

6.3.2 Bars & Rods

6.3.2.1 Magnetic Bars & Rods are Used to Remove Ferrous Contaminants From Both Dry and Liquid Applications

6.3.3 Plates

6.3.3.1 Plate Magnets are Used to Separate Ferrous Impurities From Free Flowing and Pneumatically Conveyed Materials

6.3.4 Grates

6.3.4.1 Grate Magnets are Mainly Used in Industries, Such as Food, Plastics & Ceramics, and Pharmaceutical

6.3.5 Drawers

6.3.5.1 Drawer Magnets Provide Excellent Equipment and Product Protection of Medium and Fine Ferrous Contaminants in Dry, Free-Flowing Products Under Gravity Flow

6.3.6 Filters

6.3.6.1 Magnetic Filters are Mostly Used for Wet Applications

6.3.7 Chutes & Humps

6.3.7.1 Chutes & Humps Provide Excellent Separation Results for High Volume, Poor Flowing, or Abrasive Materials

6.3.8 Others

6.3.8.1 Other Magnetic Separators are Used Where Product Purity is the Top-Most Priority

7 Magnetic Separator Market, By Magnet Type (Page No. - 69)

7.1 Introduction

7.2 Permanent Magnets

7.2.1 Permanent Magnet Separators are Less Expensive Than Electromagnetic Separators and Do Not Require Continuous Electrical Supply

7.3 Electromagnets

7.3.1 Electromagnetic Separators are Preferred in Applications Where Different Strength Levels of Magnetism are Required

8 Market, By Cleaning Type (Page No. - 73)

8.1 Introduction

8.2 Manual

8.2.1 Manual Magnetic Separators are Less Costly as Compared to Automatic Magnetic Separators and are Preferred in Small and Medium-Sized Industries

8.3 Automatic

8.3.1 Automatic Magnetic Separators Help to Reduce Manpower Requirement and Provide Higher Safety Than Manual Magnetic Separators

9 Market, By Material Type (Page No. - 77)

9.1 Introduction

9.2 Dry

9.2.1 Increasing Importance of Magnetic Separators for Removal of Contaminants From Coarse and Fine Materials Provides Growth Opportunity for the

Market

9.3 Wet

9.3.1 Market Growth is Driven By Wastewater Management and Beverages Applications

10 Magnetic Separator Components (Page No. - 81)

10.1 Introduction

10.2 Feed Hopper

10.3 Magnet

10.4 Conveyor Belt

10.5 Collection Tank

11 Magnetic Separator, By Intensity (Page No. - 83)

11.1 Introduction

11.2 High Intensity

11.3 Low & Medium Intensity

12 Magnetic Separator Market, By Industry (Page No. - 84)

12.1 Introduction

12.2 Recycling

12.2.1 Increase in Waste Production to Increase the Demand for Magnetic Separators in the Recycling Industry During the Forecast Period

12.3 Mining

12.3.1 Increasing Mining Projects Across the World to Drive Market Growth

12.4 Chemical & Pharmaceutical

12.4.1 Stringent Rules & Regulations for the Quality of Medicines to Drive the Market in Chemical & Pharmaceutical Industry

12.5 Ceramics, Paper, and Plastics

12.5.1 Rising Plastic Waste Across the World to Provide Growth Opportunities for the Market

12.6 Food & Beverages

12.6.1 Magnetic Separators are Vital in the Food & Beverages Industry as They Help in Removing Ferrous Contaminants From Food Products

12.7 Glass & Textile

12.7.1 Growing Glass Industry Across Major Economies Provides Huge Opportunities for Magnetic Separator Providers

12.8 Others

13 Geographic Analysis (Page No. - 96)

13.1 Introduction

13.2 North America

13.2.1 US

13.2.1.1 Growing Recycling Industry in the US to Provide Growth Opportunities for the Market Players

13.2.2 Canada

13.2.2.1 Growing Chemical & Pharmaceutical Industry in the Country Set to Offer Significant Opportunities for the Market

13.2.3 Mexico

13.2.3.1 Various International Magnetic Separator Providers Have Set Up Their Manufacturing and Sales Offices in Mexico in Recent Years

13.3 Europe

13.3.1 UK

13.3.1.1 Growing Application of Magnetic Separators for Plastic Processing to Boost the Market During Forecast Period

13.3.2 Germany

13.3.2.1 Market in Germany to Grow at Highest CAGR During Forecast Period

13.3.3 France

13.3.3.1 Growing Food & Beverages Industry in France to Drive Market Growth

13.3.4 Italy

13.3.4.1 Growing Awareness About Benefits of Waste Management to Drive the Market Growth in Italy

13.3.5 Rest of Europe

13.3.5.1 Countries in Rest of Europe Contribute Significantly to the Growth of the Market

13.4 Asia Pacific (APAC)

13.4.1 China

13.4.1.1 China Expected to Account for the Largest Market Share in APAC

13.4.2 Japan

13.4.2.1 Growing Pharmaceutical Industry in Japan Presents Significant Growth Opportunities

13.4.3 South Korea

13.4.3.1 South Korean Government has Taken Various Initiatives to Strengthen the Recycling Industry in the Country

13.4.4 Rest of APAC

13.4.4.1 Countries in Rest of APAC Present an Attractive Opportunity for Magnetic Separator Providers During Forecast Period

13.5 Rest of the World (RoW)

13.5.1 South America

13.5.1.1 South America Expected to Grow at a Higher CAGR During Forecast Period

13.5.2 Middle East & Africa

13.5.2.1 Growing Mining and Construction Industries in the Region to Propel the Demand for Magnetic Separators

14 Competitive Landscape (Page No. - 122)

14.1 Overview

14.2 Market Ranking Analysis: Magnetic Separator Market, 2019

14.3 Competitive Leadership Mapping

14.3.1 Visionary Leaders

14.3.2 Innovators

14.3.3 Dynamic Differentiators

14.3.4 Emerging Companies

14.4 Strength of Product Portfolio (25 Players)

14.5 Business Strategy Excellence (25 Players)

14.6 Competitive Situations and Trends

14.6.1 Product Launches

14.6.2 Partnerships, Agreements & Joint Ventures

14.6.3 Expansions

14.6.4 Mergers & Acquisitions

15 Company Profiles (Page No. - 131)

15.1 Key Players

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View)*

15.1.1 Eriez

15.1.2 Metso

15.1.3 STEINERT

15.1.4 Nippon Magnetics

15.1.5 GouDSMit Magnetics

15.1.6 Bunting Magnetics

15.1.7 Eclipse Magnetics

15.1.8 Industrial Magnetics

15.1.9 K.W. Supply Magneetsystemen

15.1.10 Multotec

* Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View Might Not be Captured in Case of Unlisted Companies.

15.2 Right to Win

15.3 Other Players

15.3.1 Innovative Magnetic Technologies

15.3.2 Jupiter Magnetics

15.3.3 Kanetec

15.3.4 Longi Magnet

15.3.5 Magnetic Products

15.3.6 Malvern Engineering

15.3.7 Permanent Magnets

15.3.8 Shandong Huate Magnet Technology

15.3.9 Slon Magnetic Separator

15.3.10 Sollau

15.3.11 Weifang Guote Mining Equipment

16 Appendix (Page No. - 161)

16.1 Discussion Guide

16.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

16.3 Available Customizations

16.4 Related Reports

16.5 Author Details

List of Tables (108 Tables)

Table 1 Countries With Highest Recycling Rates

Table 2 Magnetic Separator Market Size, By Type, 2017–2025 (USD Million)

Table 3 Market Size, for Equipment, By Type, 2017–2025 (USD Million)

Table 4 Market Size, for Equipment, By Magnet Type, 2017–2025 (USD Million)

Table 5 Market Size, for Equipment, By Material Type, 2017–2025 (USD Million)

Table 6 Market Size, for Equipment, By Cleaning Type, 2017–2025 (USD Million)

Table 7 Market Size, for Equipment, By Region, 2017–2025 (USD Million)

Table 8 Market Size, for Equipment, By Industry, 2017–2025 (USD Million)

Table 9 Market Size, for Equipment, in Recycling Industry, By Region, 2017–2025 (USD Million)

Table 10 Market Size, for Equipment, in Mining Industry, By Region, 2017–2025 (USD Million)

Table 11 Market Size, for Equipment, in Ceramics, Paper, and Plastics Industry, By Region, 2017–2025 (USD Million)

Table 12 Market Size, for Equipment, in Food & Beverages, By Region, 2017–2025 (USD Million)

Table 13 Market Size, for Equipment, in Chemical & Pharmaceutical Industry, By Region, 2017–2025 (USD Million)

Table 14 Market Size, for Equipment, in Glass & Textile Industry, By Region, 2017–2025 (USD Million)

Table 15 Market Size, for Equipment, in Other Industries, By Region, 2017–2025 (USD Million)

Table 16 Drum Magnetic Separator Market Size, By Region, 2017–2025 (USD Million)

Table 17 Roller Market Size, By Region, 2017–2025 (USD Million)

Table 18 Overband Market Size, By Region, 2017–2025 (USD Million)

Table 19 Eddy Current Market Size, By Region, 2017–2025 (USD Million)

Table 20 Standalone Market Size, By Type, 2017–2025 (USD Million)

Table 21 Standalone Market Size By Magnet Type, 2017–2025 (USD Million)

Table 22 Standalone Market Size, By Material Type, 2017–2025 (USD Million)

Table 23 Standalone Market Size, By Cleaning Type, 2017–2025 (USD Million)

Table 24 Standalone Market Size, By Region, 2017–2025 (USD Million)

Table 25 Standalone Market Size, By Industry, 2017–2025 (USD Million)

Table 26 Standalone Market Size in Recycling Industry, By Region, 2017–2025 (USD Million)

Table 27 Standalone Market Size in Mining Industry, By Region, 2017–2025 (USD Million)

Table 28 Standalone Market Size in Ceramics, Paper, and Plastics Industry, By Region, 2017–2025 (USD Million)

Table 29 Standalone Market Size in Food & Beverages Industry, By Region, 2017–2025 (USD Million)

Table 30 Standalone Market Size in Chemical & Pharmaceutical Industry, By Region, 2017–2025 (USD Million)

Table 31 Standalone Market Size in Glass & Textile Industry, By Region, 2017–2025 (USD Million)

Table 32 Standalone Market Size in Other Industries, By Region, 2017–2025 (USD Million)

Table 33 Magnetic Pulley Market Size, By Region, 2017–2025 (USD Million)

Table 34 Bars & Rods Magnetic Separator Market Size, By Region, 2017–2025 (USD Million)

Table 35 Plate Market Size, By Region, 2017–2025 (USD Million)

Table 36 Grate Market Size, By Region, 2017–2025 (USD Million)

Table 37 Drawer Market Size, By Region, 2017–2025 (USD Million)

Table 38 Filter Market Size, By Region, 2017–2025 (USD Million)

Table 39 Chutes & Humps Market Size, By Region, 2017–2025 (USD Million)

Table 40 Other Magnetic Separators Market Size, By Region, 2016-2025 (USD Million)

Table 41 Market Size, By Magnet Type, 2017–2025 (USD Million)

Table 42 Market Size, for Permanent Magnet, By Type, 2017–2025 (USD Million)

Table 43 Market Size for Permanent Magnet Type, By Region, 2017–2025 (USD Million)

Table 44 Market Size, for Electromagnet Type, By Type, 2017–2025 (USD Million)

Table 45 Market Size for Electromagnet Type, By Region, 2017–2025 (USD Million)

Table 46 Market Size, By Cleaning Type, 2017–2025 (USD Million)

Table 47 Market Size for Manual Cleaning, By Type, 2017–2025 (USD Million)

Table 48 Market Size for Manual Cleaning, By Region, 2017–2025 (USD Million)

Table 49 Market Size for Automatic Cleaning, By Type, 2017–2025 (USD Million)

Table 50 Market Size for Automatic Cleaning, By Region, 2017–2025 (USD Million)

Table 51 Market Size, By Material Type, 2017–2025 (USD Million)

Table 52 Market Size for Dry Material, By Type, 2017–2025 (USD Million)

Table 53 Market Size for Dry Material, By Region, 2017–2025 (USD Million)

Table 54 Market Size for Wet Material, By Type, 2017–2025 (USD Million)

Table 55 Market Size for Wet Material, By Region, 2017–2025 (USD Million)

Table 56 Market Size, By Industry, 2017–2025 (USD Million)

Table 57 Market Size in Recycling Industry, By Type, 2017–2025 (USD Million)

Table 58 Market Size in Recycling Industry, By Region, 2017–2025 (USD Million)

Table 59 Market Size in Mining Industry, By Type, 2017–2025 (USD Million)

Table 60 Market Size in Mining Industry, By Region, 2017–2025 (USD Million)

Table 61 Market Size in Chemical & Pharmaceutical Industry, By Type, 2017–2025 (USD Million)

Table 62 Market Size in Chemical & Pharmaceutical Industry, By Region, 2017–2025 (USD Million)

Table 63 Market Size in Ceramics, Paper, and Plastics Industry, By Type, 2017–2025 (USD Million)

Table 64 Market Size for Ceramics, Paper, and Plastics Industry, By Region, 2017–2025 (USD Million)

Table 65 Market Size in Food & Beverages Industry, By Type, 2017–2025 (USD Million)

Table 66 Market Size in Food & Beverages Industry, By Region, 2017–2025 (USD Million)

Table 67 Market Size in Glass & Textile Industry, By Type, 2017–2025 (USD Million)

Table 68 Market Size in Glass & Textile Industry, By Region, 2017–2025 (USD Million)

Table 69 Market Size in Other Industries, By Type, 2017–2025 (USD Million)

Table 70 Market Size in Other Industries, By Region, 2017–2025 (USD Million)

Table 71 Market Size, By Region, 2017–2025 (USD Million)

Table 72 North America: Market Size, By Country, 2017–2025 (USD Million)

Table 73 North America: Market Size, By Type, 2017–2025 (USD Million)

Table 74 North America: Market Size, for Equipment, By Type, 2017–2025 (USD Million)

Table 75 North America: Standalone Market Size, By Type, 2017–2025 (USD Million)

Table 76 North America: Market Size, By Magnet Type, 2017–2025 (USD Million)

Table 77 North America: Market Size, By Material Type, 2017–2025 (USD Million)

Table 78 North America: Market Size, By Cleaning Type, 2017–2025 (USD Million)

Table 79 North America: Market Size, By Industry, 2017–2025 (USD Million)

Table 80 Top 15 Countries With Highest Recycling Rates in Europe, 2019

Table 81 Europe: Market Size, By Country, 2017–2025 (USD Million)

Table 82 Europe: Market, By Type, 2017–2025 (USD Million)

Table 83 Europe: Market Size, for Equipment, By Type, 2017–2025 (USD Million)

Table 84 Europe: Standalone Magnetic Separator Market Size, By Type, 2017–2025 (USD Million)

Table 85 Europe: Market Size, By Magnet Type, 2017–2025 (USD Million)

Table 86 Europe: Market Size, Material Type, 2017–2025 (USD Million)

Table 87 Europe: Market Size, By Cleaning Type, 2017–2025 (USD Million)

Table 88 Europe: Market Size, By Industry, 2017–2025 (USD Million)

Table 89 APAC: Market Size, By Country, 2017–2025 (USD Million)

Table 90 APAC: Market Size, By Type, 2017–2025 (USD Million)

Table 91 APAC: Market Size, for Equipment, By Type, 2017–2025 (USD Million)

Table 92 APAC: Standalone Market Size, By Type, 2017–2025 (USD Million)

Table 93 APAC: Market Size, By Magnet Type, 2017–2025 (USD Million)

Table 94 APAC: Market Size, By Material Type, 2017–2025 (USD Million)

Table 95 APAC: Market Size, By Cleaning Type, 2017–2025 (USD Million)

Table 96 APAC: Market Size, By Industry, 2017–2025 (USD Million)

Table 97 RoW: Market Size, By Region, 2017–2025 (USD Million)

Table 98 RoW: Market Size, By Type, 2017–2025 (USD Million)

Table 99 RoW: Market Size, for Equipment, By Type, 2017–2025 (USD Million)

Table 100 RoW: Standalone Market Size, By Type, 2017–2025 (USD Million)

Table 101 RoW: Market Size, By Magnet Type, 2017–2025 (USD Million)

Table 102 RoW: Market Size, By Material Type, 2017–2025 (USD Million)

Table 103 RoW: Market Size, By Cleaning Type, 2017–2025 (USD Million)

Table 104 RoW: Market Size, By Industry, 2017–2025 (USD Million)

Table 105 Product Launches, 2017–2019

Table 106 Partnerships, Agreements, & Joint Ventures, 2018–2019

Table 107 Expansions, 2017–2019

Table 108 Mergers & Acquisitions, 2017–2019

List of Figures (42 Figures)

Figure 1 Magnetic Separator Market: Process Flow of Market Size Estimation

Figure 2 Market: Research Design

Figure 3 Market: Bottom-Up Approach

Figure 4 Market: Top-Down Approach

Figure 5 Data Triangulation

Figure 6 Assumptions for Research Study

Figure 7 Market to Exhibit Higher CAGR

Figure 8 Permanent Type of Magnetic Separators to Exhibit Higher CAGR in the Market

Figure 9 Automatic Cleaning Type of Market to Witness Significant Growth

Figure 10 Recycling to Account for Largest Size of Market During the Forecast Period

Figure 11Market in APAC to Grow at Highest CAGR During Forecast Period

Figure 12 Increasing Adoption of Magnetic Separators in Recycling and Food & Beverages Industries to Drive Growth of the Market

Figure 13 Permanent Magnetic Separators and Mining Industry Had the Largest Market Share in APAC, in 2019

Figure 14 Overband Magnetic Separators to Grow at Highest CAGR in Equipment Category During the Forecast Period

Figure 15 China to Record Highest CAGR in Market

Figure 16 Market Drivers and Their Impact

Figure 17 Market Opportunities and Their Impact

Figure 18 Market Restraints and Challenges and Their Impact

Figure 19 Value Chain Analysis of Magnetic Separation Ecosystem: R&D and Manufacturing Phases Contribute Maximum Value

Figure 20 Standalone Magnetic Separator Market to Grow at a Higher CAGR

Figure 21 Drum Magnetic Separators to Account for Largest Share in Equipment Category of Market

Figure 22 Magnetic Separator Equipment Market in Recycling Industry to Grow at the Highest CAGR

Figure 23 Drum Market in APAC to Account for the Largest Share

Figure 24 The Market for Pulleys is Expected to Grow at the Highest CAGR

Figure 25 Standalone Market in Food & Beverages Industry to Grow at Highest CAGR

Figure 26 Magnetic Pulley Market in APAC to Grow at the Highest CAGR

Figure 27 Market for Permanent Magnet Type Expected to Grow at a Higher CAGR

Figure 28 Market to Grow at a Higher CAGR

Figure 29 Dry Magnetic Separators Expected to Grow at a Higher CAGR

Figure 30 Market in Food & Beverages Industry to Grow at Highest CAGR

Figure 31 Equipment Type to Lead the Market in the Recycling Industry

Figure 32 APAC Market in Mining Industry to Grow at Highest CAGR

Figure 33 North America Market in Food & Beverages Industry to Account for the Largest Share

Figure 34 Market in APAC to Grow at the Highest CAGR During the Forecast Period

Figure 35 North America: Market Snapshot

Figure 36 Europe: Market Snapshot

Figure 37 APAC: Market Snapshot

Figure 38 South America Market to Grow at a Higher CAGR in RoW

Figure 39 Players in the Market Adopted Product Launch as Their Key Strategy for Business Expansion From 2018–2019

Figure 40 Market Ranking of Major Players in the Market, 2019

Figure 41 Magnetic Separator Market (Global) Competitive Leadership Mapping, 2019

Figure 42 Metso: Company Snapshot

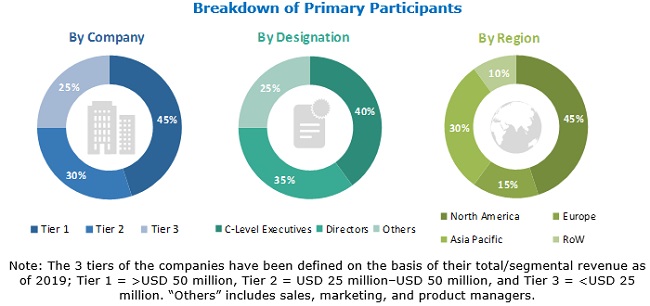

The study involved 4 major activities in estimating the current size of the magnetic separator market. Exhaustive secondary research has been done to collect information about the market, the peer market, and the parent market. Validating findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the complete market size. After that, market breakdown and data triangulation methods have been used to estimate the market size of segments and subsegments.

Secondary Research

The research methodology used to estimate and forecast the magnetic separator market begins with capturing data on revenues of the key vendors in the market through secondary research. This study incorporates the use of extensive secondary sources, directories, and databases such as Hoovers, Bloomberg Businessweek, Factiva, and OneSource to identify and collect information useful for a technical, market-oriented, and commercial study of the magnetic separator market. Vendor offerings have also been considered to determine the market segmentation. This entire research methodology includes the study of annual and financial reports of top players, presentations, press releases, journals, paid databases, trade directories, regulatory bodies, and safety standard organizations.

Primary Research

The magnetic separator market comprises several stakeholders, such as equipment manufacturers and suppliers, and service players. The demand side of this market includes end users from various industries such as mining, food and beverage, and recycling. Several primary interviews have been conducted with market experts from both the demand and supply sides across 4 major regions—North America, Europe, APAC, and RoW—to gather qualitative and quantitative information. Following is the breakdown of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches have been used to estimate and validate the overall size of the magnetic separator market. These methods have also been used extensively to estimate the size of various market subsegments. The research methodology used to estimate the market size includes the following:

- Key players in major industries and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- Players offering different equipment such as drum magnetic separators, suspended magnetic separators, and Eddy current magnetic separators are considered, and their revenues are observed to arrive at a global number.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size using the estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides of the magnetic separator market.

Report Objectives

- To describe and forecast the market by type, magnet type, material type, cleaning type, and industry, in terms of value

- To describe and forecast the market for various segments with regard to main regions, namely, North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW), in terms of value

- To provide detailed information regarding the major factors, including drivers, restraints, opportunities, and challenges, that influence the growth of the market

- To provide a detailed overview of the value chain pertaining to the magnetic separation ecosystem

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To strategically profile key players and comprehensively analyze their market positions in terms of revenue and core competencies2, along with detailing the competitive landscape for market leaders

- To analyze competitive developments, such as mergers & acquisitions, agreements, partnerships, and product launches, in the magnetic separator market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to a company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix that gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Magnetic Separator Market