Low Voltage Disconnect Switch Market by Type (Fused & Non-Fused), by Mount (Panel, DIN Rail, & Others), by Voltage (0-240 V, 240- 480 V, 480-690 V), by Application (Industrial & Commercial) & by Region - Global Trends & Forecasts to 2021

[167 Pages Report] The low voltage disconnect switch market is projected to reach a market size of USD 3.51 Billion by 2021 from an estimated value of USD 2.81 Billion in 2016 at a CAGR of 4.5% during the forecast period. The low voltage disconnect switch market is broken down into several segments; Type (Fused and Non-fused), by Mount (Panel, DIN Rail and Others), By Voltage (0-240V, 240-480V, and 480-690V) By Application (Industrial and Commercial) & By Region (North America, South America, Europe, Asia-Pacific, and the Middle East & Africa).

Base Year: 2015

Forecast years: 2016-estimated, 2021-predicted

Research Methodology:

- Major regions were identified along with countries contributing the maximum share

- Secondarys were conducted to find the number of low voltage disconnect switches in the region, trends for low voltage disconnect switch industry, and their contribution

- The key players in the market have been identified through secondary research, while their market shares in respective regions have been determined through both, primary and secondary research. The research methodology includes the study of annual and financial reports of top market players, as well as interviews with industry experts (such as CEOs, VPs, directors, and marketing executives) for key insights (both, quantitative and qualitative) into the low voltage disconnect switch market.

- This was further broken down into several segments and sub-segments on the basis of information gathered.

To know about the assumptions considered for the study, download the pdf brochure

Target Audience

The stakeholder’s for the report includes:

- Disconnect Switch Manufacturers

- Distribution Utility Players

- Private Utility Players

- Government and Research Organizations

- Distribution Consultancies

Scope of the Report:

- This study estimates the global market of low voltage disconnect switch, in terms of dollar value, till 2021

- It offers a detailed qualitative and quantitative analysis of this market

- It provides a comprehensive review of major market drivers, restraints, opportunities, challenges, winning imperatives, and key issues of the market

- It covers various important aspects of the market. These include analysis of value chain, Porter’s Five Forces model, competitive landscape, market dynamics, market estimates in terms of value, and future trends in the low voltage disconnect switch market.

The market has been segmented into -

On the basis of Application

- Industrial (Utility Infrastructure, Motor Protection, Power Distribution Boards, Photovoltaic and others)

- Commercial

On the basis of Type

- Fused

- Non-Fused

On the basis of Mount

- Panel

- DIN Rail

- Others (Base Mounted and Floor Mounted)

On the basis of Voltage

- 0-240V

- 240-480V

- 480-690V

On the basis of Region

- North America

- South America

- Europe

- Asia-Pacific

- Middle East & Africa

Available Customization

With the market data provided above, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players (Up to 5)

- Country-wise analysis can be extended by one country for every region

The global low voltage disconnect switch market is projected to reach USD 3.51 Billion by 2021 from an estimated value of USD 2.81 Billion in 2016. The growing worldwide transmission and distribution expenditure, growing infrastructural and industrial developmental activities, along with growing safety concerns would propel the market for low voltage disconnect switches. These factors are expected to drive the growth of the low voltage disconnect switch market.

The global low voltage disconnect switch market is segmented based on type into fused and non-fused switches. The market has been segmented on the basis of mounting techniques into panel mounted, DIN rail mounted, and others, where others include base mounted and floor mounted. The market is further segmented by voltage into 0-240V, 240-480V, and 480-690V. The major applications covered in this report are industrial and commercial applications. Industrial applications are further sub-segmented into utility infrastructure, motor protection, photovoltaic (PV), distribution boards, and others, where others include infrastructure and transportation. Regions considered are North America, South America, Europe, the Asia-Pacific, and Middle East & Africa.

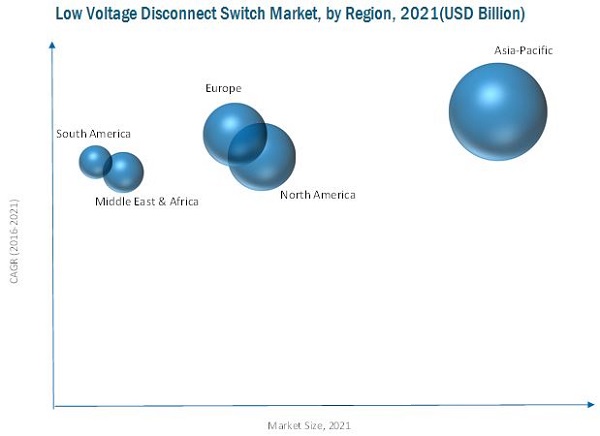

The demand for electricity is increasing in developed nations in North America and Europe as well as in fast-growing economies in the Asia-Pacific. Generation, transmission, and distribution are increasing at a good pace which has led to the growth in sales of associated components, such as switchgear, circuit breakers and disconnect switches. The market for low voltage disconnect switches is growing at a healthy rate especially in developing countries, where the transmission and distribution industry is in the growth stage.

The Asia-Pacific region dominates the low voltage disconnect switch market and is estimated to grow at a good pace in the next five years. The growth is attributed to the increase in transmission and distribution activities in China, India, Malaysia, Australia, and Thailand. North America and Europe stood at the second and third position, respectively, in terms of market size, in the global low voltage disconnect switch market.

The report also segments the low voltage disconnect switch market on the basis of its type; fused and non-fused. The non-fused disconnect switch market is expected to register high growth due to the increase in industrial activities in developing countries. The global fused disconnect switch market share is declining as this type is being replaced by non-fused disconnect switches due to the use of other protection devices along with the disconnect switches.

In terms of mounting techniques, panel mounted and DIN rail mounted are two mostly used configurations to mount disconnect switch components. Panel mount dominated the low voltage disconnect switch market in 2015 and is expected to maintain its dominance throughout the forecast period. However, its market share is expected to decline by 2021 due to the increased use of DIN rail mounting in industrial applications.

The report segments the global low voltage disconnect switch market based on regions into the Asia-Pacific, North America, Europe, South America, and Middle East & Africa. The market has also been analyzed for key countries in each region, such as the U.S., Canada, Mexico, China, India, Japan, Australia, Germany, the U.K., France, Brazil, Saudi Arabia, Kuwait, and UAE, among others.

The applications areas vary with the specified voltage ratings of low voltage disconnect switches. 480-690V disconnect switches which hold major share over other voltage ranges are largely used in distribution, photovoltaic, infrastructure, light commercial and light manufacturing applications.

However, the disconnector switch market is characterized by a large number of market players including local as well as global players. The local players provide cheap and low quality products when compared to the global firms. The local players take advantage of local distribution channels, as the market is very fragmented and highly competitive, given the number of local and global players.

Some of the leading players in the low voltage disconnect switch market include Eaton Corporation (Ireland), ABB Ltd. (Switzerland), Schneider Electric SA (France), and Siemens AG (Germany), among others. New product development was the most commonly used strategy by top players in the market, constituting half of the total development share. It was followed by partnerships/ agreements/collaborations, expansions, and other developments.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 12)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.2 Secondary Data

2.2.1 Key Data From Secondary Sources

2.3 Primary Data

2.3.1 Key Data From Primary Sources

2.3.1.1 Key Industry Insights

2.3.1.2 Breakdown of Primaries

2.4 Market Size Estimation

2.4.1 Bottom-Up Approach

2.4.2 Top-Down Approach

2.5 Market Breakdown and Data Triangulation

2.6 Research Assumptions & Limitations

2.6.1 Assumptions

2.6.2 Limitations

3 Market Overview (Page No. - 29)

3.1 Introduction

3.2 Market Segmentation

3.2.1 Low Voltage Disconnect Switch Market: By Voltage Range

3.2.2 Low Voltage Disconnect Switch Market: By Type

3.2.3 Low Voltage Disconnect Switch Market: By Mount

3.2.4 Low Voltage Disconnect Switch Market: By Application

3.2.5 Low Voltage Disconnect Switch Market: By Region

3.3 Market Dynamics

3.3.1 Drivers

3.3.1.1 High Economic Growth and Rapid Urbanization

3.3.1.2 Growing Investment in Industrial Automation

3.3.1.3 Aging Transmission & Distribution Infrastructure

3.3.1.4 Increase in the Demand of Photovoltaic Systems

3.3.2 Restraints

3.3.2.1 Cost of Raw Materials

3.3.2.2 Low Quality and Cheap Products

3.3.3 Opportunities

3.3.3.1 Rapid Growth in the Renewable Industry

3.3.4 Challenges

3.3.4.1 Price Competition Among Market Players

4 Industry Trends (Page No. - 39)

4.1 Introduction

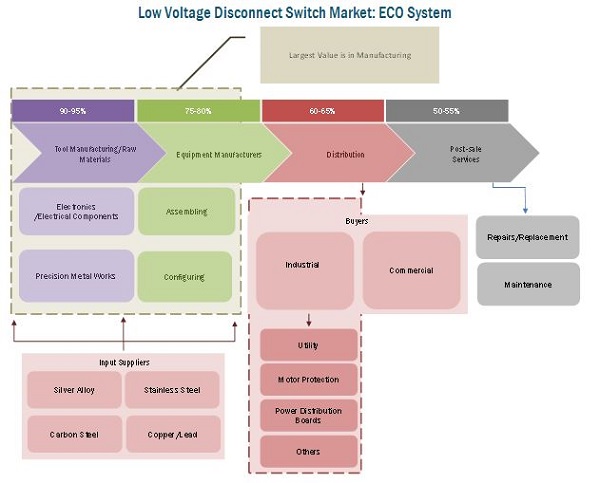

4.2 Value Chain Analysis

4.3 Porter’s Five Forces Analysis

4.3.1 Threat of Substitutes

4.3.2 Bargaining Power of Buyers

4.3.3 Bargaining Power of Suppliers

4.3.4 Threat of New Entrants

4.3.5 Intensity of Competitive Rivalry

5 Low Voltage Disconnect Switch Market, By Type (Page No. - 49)

5.1 Introduction

5.2 Nonfused

5.3 Fused

6 Low Voltage Disconnect Switch Market, By Mount (Page No. - 56)

6.1 Introduction

6.2 Panel Mounted

6.3 Din Rail Mounted

6.4 Others

7 Low Voltage Disconnect Switch, By Application (Page No. - 65)

7.1 Introduction

7.2 Industrial

7.3 Commercial

8 Low Voltage Disconnect Switch Market, By Voltage Range (Page No. - 69)

8.1 Introduction

8.2 0-240 V Disconnect Switch

8.3 240-480 V Disconnect Switch

8.4 480-690 V Disconnect Switch

9 Low Voltage Disconnect Switch Market, By Region (Page No. - 77)

9.1 Introduction

9.2 Asia-Pacific

9.2.1 By Country

9.2.1.1 China

9.2.1.2 India

9.2.1.3 Japan

9.2.1.4 Australia

9.2.1.5 Rest of Asia-Pacific

9.2.2 By Type

9.2.3 By Mount

9.2.4 By Voltage

9.2.5 By Application

9.3 North America

9.3.1 By Country

9.3.1.1 U.S.

9.3.1.2 Canada

9.3.1.3 Mexico

9.3.2 By Type

9.3.3 By Mount

9.3.4 By Voltage Range

9.3.5 By Application

9.4 Europe

9.4.1 By Country

9.4.1.1 Germany

9.4.1.2 U.K.

9.4.1.3 France

9.4.1.4 Rest of Europe

9.4.2 By Type

9.4.3 By Mount

9.4.4 By Voltage

9.4.5 By Application

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 Saudi Arabia

9.5.1.2 U.A.E

9.5.1.3 Kuwait

9.5.1.4 South Africa

9.5.1.5 Rest of Middle East & Africa

9.5.2 By Type

9.5.3 By Mount

9.5.4 By Voltage Range

9.5.5 By Application

9.6 South America

9.6.1 By Country

9.6.1.1 Brazil

9.6.1.2 Argentina

9.6.1.3 Rest of South America

9.6.2 By Type

10 Competitive Landscape (Page No. - 104)

10.1 Overview

10.2 Competitive Situation & Trends

10.2.1 New Product Development

10.2.2 Partnerships/Agreements/Collaborations

10.2.3 Expansion

10.2.4 Mergers & Acquisitions

10.2.5 Other Developments

11 Company Profiles (Page No. - 115)

11.1 Introduction

11.2 Eaton Corporation

11.2.1 Business Overview

11.2.2 Products Offered

11.2.3 Developments, 2011–2016

11.2.4 SWOT Analysis

11.2.5 MnM View

11.3 ABB Ltd.

11.3.1 Business Overview

11.3.2 Products Offered

11.3.3 Developments, 2013–2015

11.3.4 SWOT Analysis

11.3.5 MnM View

11.4 Schneider Electric SA

11.4.1 Business Overview

11.5 Products Offered

11.6 Developments, 2012–2014

11.6.1 SWOT Analysis

11.6.2 MnM View

11.7 Siemens AG

11.7.1 Business Overview

11.7.2 Products Offered

11.7.3 Developments, 2012–2016

11.7.4 SWOT Analysis

11.7.5 MnM View

11.8 Socomec

11.8.1 Business Overview

11.9 Products Offered

11.10 Developments, 2014–2016

11.11 Salzer Electronics Limited

11.11.1 Business Overview

11.11.2 Products Offered

11.11.3 Developments, 2015

11.12 Katko

11.12.1 Business Overview

11.13 Products Offered

11.14 Developments

11.15 Ensto

11.15.1 Business Overview

11.16 Products Offered

11.17 Developments

11.18 Lovato Electric

11.18.1 Business Overview

11.18.2 Products Offered

11.18.3 Developments, 2014–2016

11.19 Benedict GmbH

11.19.1 Business Overview

11.19.2 Products Offered

11.19.3 Developments

11.20 Kraus & Naimer

11.20.1 Business Overview

11.21 Products Offered

11.22 Developments, 2015

11.23 General Electric

11.23.1 Business Overview

11.24 Products Offered

11.25 Developments, 2014–2015

11.26 SWOT Analysis

11.27 MnM View

12 Appendix (Page No. - 163)

12.1 Insights of Industry Experts

12.2 Discussion Guide

12.3 Introducing RT: Real Time Market Intelligence

12.4 Available Customizations

12.5 Related Reports

List of Tables (62 Tables)

Table 1 Low Voltage Disconnect Switch (LVDS) Market Size, By Type, 2014–2021 (USD Million)

Table 2 Nonfused: Low Voltage Disconnect Switch (LVDS) Market Size, By Region, 2014–2021 (USD Million)

Table 3 Fused: Low Voltage Disconnect Switch (LVDS) Market Size, By Region, 2014–2021 (USD Million)

Table 4 Low Voltage Disconnect Switch (LVDS) Market Size, By Mount, 2014–2021 (USD Million)

Table 5 Panel-Mounted: Low Voltage Disconnect Switch (LVDS) Market Size, By Region, 2014–2021 (USD Million)

Table 6 Din Rail-Mounted: Low Voltage Disconnect Switch (LVDS) Market Size, By Region, 2014–2021 (USD Million)

Table 7 Others: Low Voltage Disconnect Switch (LVDS) Market Size, By Region, 2014–2021 (USD Million)

Table 8 Low Voltage Disconnect Switch (LVDS) Market Size, By Application, 2014–2021 (USD Million)

Table 9 Industrial: Low Voltage Disconnect Switch (LVDS) Market Size, By Region, 2014–2021 (USD Million)

Table 10 Commercial: Low Voltage Disconnect Switch (LVDS) Market Size, By Region, 2014–2021 (USD Million)

Table 11 Low Voltage Disconnect Switch (LVDS) Market Size, By Voltage, 2014-2021 (USD Million)

Table 13 240-480 V Disconnect Switch Market Size, By Region, 2014-2021 (USD Million)

Table 14 480-690 V Disconnect Switch Market Size, By Region, 2016-2021 (USD Million)

Table 15 Low Voltage Disconnect Switch (LVDS) Market Size, By Region, 2014-2021 (USD Million)

Table 16 Asia-Pacific: Low Voltage Disconnect Switch (LVDS) Market Size, By Country, 2014-2021 (USD Million)

Table 17 China: Low Voltage Disconnect Switch (LVDS) Market Size, By Application, 2014-2021 (USD Million)

Table 18 India: Low Voltage Disconnect Switch (LVDS) Market Size, By Application, 2014-2021 (USD Million)

Table 19 Japan: Low Voltage Disconnect Switch (LVDS) Market Size, By Application, 2014-2021 (USD Million)

Table 20 Australia: Low Voltage Disconnect Switch (LVDS) Market Size, By Application, 2014-2021 (USD Million)

Table 21 Rest of Asia-Pacific: By Market Size, By Application, 2014-2021 (USD Million)

Table 22 Asia-Pacific: By Market Size, By Type, 2014-2021 (USD Million)

Table 23 Asia-Pacific: By Market Size, By Mount, 2014-2021 (USD Million)

Table 24 Asia-Pacific: By Market Size, By Voltage Range, 2014-2021 (USD Million)

Table 25 Asia-Pacific: By Market Size, By Application, 2014-2021 (USD Million)

Table 26 North America: By Market Size, By Country, 2014-2021 (USD Million)

Table 27 U.S.: By Market Size, By Application, 2014-2021 (USD Million)

Table 28 Canada: By Market Size, By Application, 2014-2021 (USD Million)

Table 29 Mexico: By Market Size, By Application, 2014-2021 (USD Million)

Table 30 North America: By Market Size, By Type, 2014-2021 (USD Million)

Table 31 North America: By Market Size, By Mount, 2014-2021 (USD Million)

Table 32 North America: By Market Size, By Voltage Range, 2014-2021 (USD Million)

Table 33 North America: By Market Size, By Application, 2014-2021 (USD Million)

Table 34 Europe: By Market Size, By Country, 2014-2020 (USD Million)

Table 35 Germany: By Market Size, By Application, 2014-2021 (USD Million)

Table 36 U.K.: By Market Size, By Application, 2014-2021 (USD Million)

Table 37 France: By Market Size, By Application, 2014-2021 (USD Million)

Table 38 Rest of Europe: By Market Size, By Application, 2014-2021 (USD Million)

Table 39 Europe: By Market Size, By Type, 2014-2021 (USD Million)

Table 40 Europe: By Market Size, By Mount, 2014-2021 (USD Million)

Table 41 Europe: By Market Size, By Voltage Range, 2014-2021 (USD Million)

Table 42 Europe: By Market Size, By Application, 2014-2021 (USD Million)

Table 43 Middle East & Africa: Low Voltage Disconnect Switch Market Size, By Country, 2014-2021 (USD Million)

Table 44 Saudi Arabia: Low Voltage Disconnect Switch Market Size, By Application, 2014-2021 (USD Million)

Table 45 UAE: Low Voltage Disconnect Switch Market Size, By Application, 2014-2021 (USD Million)

Table 46 Kuwait: Low Voltage Disconnect Switch Market Size, By Application, 2014-2021 (USD Million)

Table 47 South Africa: Low Voltage Disconnect Switch Market Size, By Application, 2014-2021 (USD Million)

Table 48 Rest of Middle East & Africa: By Market Size, By Application, 2014-2021 (USD Million)

Table 49 Middle East & Africa: By Market Size, By Type, 2014-2021 (USD Million)

Table 50 Middle East & Africa: By Market Size, By Mount, 2014-2021 (USD Million)

Table 51 Middle East & Africa: By Market Size, By Voltage Range, 2014-2021 (USD Million)

Table 52 Middle East & Africa: By Market Size, By Application, 2014-2021 (USD Million)

Table 53 South America: By Market Size, By Country, 2014-2021 (USD Million)

Table 54 Brazil: By Market Size, By Application, 2014-2021 (USD Million)

Table 55 Argentina: By Market Size, By Application, 2014-2021 (USD Million)

Table 56 Rest of South America: By Market Size, By Application, 2014-2021 (USD Million)

Table 57 South America: By Market Size, By Type, 2014-2021 (USD Million)

Table 58 New Product Developments, 2011–2016

Table 59 Partnerships/Agreements/Collaborations, 2011–2016

Table 60 Expansions, 2011–2016

Table 61 Mergers & Acquisitions, 2011–2012

Table 62 Other Developments, 2011–2016

List of Figures (42 Figures)

Figure 1 Markets Covered: Low Voltage Disconnect Switch Market

Figure 2 Low Voltage Disconnect Switch Market: Research Design

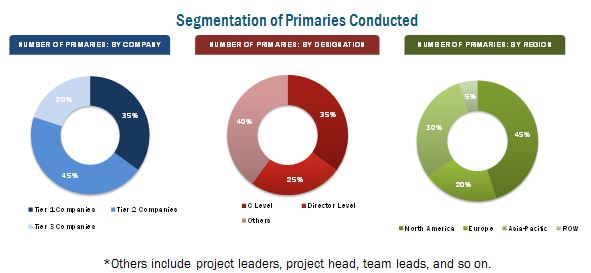

Figure 3 Breakdown of Primary Interviews: By Company Type, Designation, & Region

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Data Triangulation Methodology

Figure 7 Low Voltage Disconnect Switch (LVDS) Market Segmentation

Figure 8 Low Voltage Disconnect Switch (LVDS) Market: By Voltage Range

Figure 9 Low Voltage Disconnect Switch (LVDS) Market: By Type

Figure 10 Low Voltage Disconnect Switch (LVDS) Market: By Mount

Figure 11 Low Voltage Disconnect Switch (LVDS) Market: By Application

Figure 12 Low Voltage Disconnect Switch (LVDS) Market: By Region

Figure 13 Adoption of Renewable Energy Systems and Rapid Urbanization Will Propel the Gorwth of Low Voltage Disconnect Switch Market

Figure 14 Renewable Energy Investment, Developed vs Developing Nation, 2005-2014 (USD Billion)

Figure 15 Value Chain Analysis: Major Value is Added During the Manufacturing & Assembly Process

Figure 16 Low Voltage Disconnect Switch (LVDS) Market: Porter’s Five Forces Analysis

Figure 17 Nonfused Low Voltage Disconnect Switch Segment is Expected to Dominate the Market With the Highest Growth Rate & Maximum Market Share

Figure 18 Nonfused Low Voltage Disconnect Switch Market is Expected to Grow the Fastest in Asia-Pacific By 2021

Figure 19 Panel–Mounted Segment is Expected to Dominate this Market During 2016–2021

Figure 20 Panel-Mounted Low Voltage Disconnect Switch Market is Expected to Grow the Highest in Asia-Pacific By 2021

Figure 21 480-690v Range is Expected to Dominate this Market

Figure 22 Regional Snapshot: New Emerging Economies are the Hot Spot for Market

Figure 23 Companies Adopted New Product Development as the Key Growth Strategy From 2011 to 2015

Figure 24 Market Evolution Framework: Partnerships/Agreements/Collaborations & New Product Developments Fuelled Growth From 2011 to 2016

Figure 25 Region-Wise Revenue Mix of the Top 5 Market Players

Figure 26 Eaton Corporation: Company Snapshot

Figure 27 Eaton Corporation: SWOT Analysis

Figure 28 ABB Ltd.: Company Snapshot

Figure 29 ABB Ltd.: SWOT Analysis

Figure 30 Schneider Electric SA: Company Snapshot

Figure 31 Schneider Electric SA: SWOT Analysis

Figure 32 Siemens AG: Company Snapshot

Figure 33 Siemens AG: SWOT Analysis

Figure 34 Socomec: Company Snapshot

Figure 35 Salzer Electronics Limited: Company Snapshot

Figure 36 Katko: Company Snapshot

Figure 37 Ensto: Company Snapshot

Figure 38 Lovato Electric: Company Snapshot

Figure 39 Benedict GmbH: Company Snapshot

Figure 40 Kraus & Naimer: Company Snapshot

Figure 41 General Electric: Company Snapshot

Figure 42 General Electric: SWOT Analysis

Growth opportunities and latent adjacency in Low Voltage Disconnect Switch Market