Energy Efficient Low Horsepower AC Motors Market (2013 2018): Product (Synchronous, Asynchronous), Current (Single phase, Three-phase), Application (Consumer, Industrial, Refrigeration, Medical), Geography (North America, Europe, APAC, ROW)

The rising concern over carbon emissions and the increasing consumption of power has pushed for the development of more energy efficient systems. The major consumer of power is the industry sector, especially, manufacturing. The use of motors is ubiquitous in the current world and they consume more than half of the power generated in the world. This resulted in the ratification of energy efficient standards for electric motors. IEC and NEMA are the major bodies who have defined certain parameters for the electric motors to be more energy efficient. All these factors, even the push from the governments, will drive the market for energy efficient AC motors.

The increase in demand for consumer goods like refrigerators, air conditioners, and washing machines, particularly in APAC, has driven the market for low horsepower energy efficient AC motors. Small pumps, compressors, and robots used in various industries uses low horsepower motors. This provides a huge potential for energy savings with the use of energy efficient motors. The energy efficient low horsepower AC motors market is highly fragmented due to the presence of a number of global and regional players. Global brands are facing tough competition from the regional manufacturers, as they offer motors for very low prices and they are less efficient. The lack of awareness with regards to energy efficiency has been the major reason behind such a trend. ABB, with the acquisition of Baldor Electric Company, has gained a major market share in the North American industrial motors market. The acquisition has helped ABB to expand its product portfolio in the energy efficient motors market. Regal Beloit has gained the market share by leveraging a number of brands it has acquired, like Leeson, Marathon motors, and GE commercial motors

The report showcased a detailed breakdown of the low horsepower energy efficient AC motors market by the product types, applications, and geographies. The application market includes five major verticals: consumer, industrial, refrigeration, medical and others. These verticals are further delved into sub segments. For example, the consumer application is segmented into air conditioners, washing machines, refrigerators, printers/scanners, fans, PC fans and others. The major headers under the application section have been mapped against the major geographies. The market by geography is segmented by North America, Europe, Asia Pacific, and Rest of World (ROW). The chapter gives a detailed insight with regards to the regional profit pockets and potential emerging markets. Apart from the market segmentation, the report includes critical insights like value chain analysis, porters five forces analysis and market dynamics.

The rising energy costs and various steps taken up by governments across the world regarding the benefits of using energy efficient motors are expected to push the demand for energy efficient low horsepower AC motors, used in low-power requirement applications. A number of standards have been ratified over the years for the manufacturers to produce more energy efficient motors. Some of the important standards are Minimum Energy Performance Standard (MEPS), NEMA, and ePACT, among many others. Energy-efficient motors are manufactured usinghigher quality raw materials and newer technologies that comply with the energy-efficiency standards. In addition, the favorable policies and incentives offered by the governments to support the energy saving products have also pushed the OEMs to grab the newer opportunities. The maintenance, operation and energy costs of energy efficient low horse power AC motors contribute, significantly, towards the life cycle costs; resulting in higher demand by end customers, for better energy saving products.

The energy efficient market is expected to reach $44.32billion by the end of 2018, at a CAGR of 11.91% from 2013 to 2018. The key players in the touch-less sanitary equipment market are iTouchless (U.S.), and Simplehuman LLC (U.S.). The major companies in the market are ABB Ltd. (Switzerland), Regal Beloit (U.S.), Siemens AG (Germany), WEG Industries (Brazil) and Crompton Greaves (India), among many others.

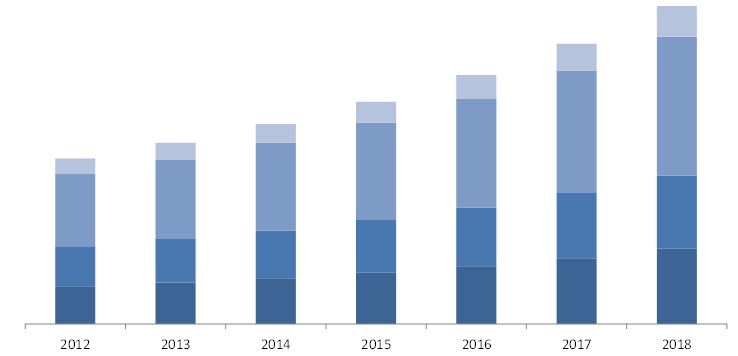

The demand for consumer appliances in the APAC region, especially, in emerging economies like India and China, is a definite driver for the energy efficient low horsepower AC motors market. The figure below shows the geographical comparison of the energy efficient low horsepower AC motors from 2012 till 2018.

Source: MarketsandMarkets Analysis

Table of Contents

1 Introduction (Page No. - 17)

1.1 Key Take-Aways

1.2 Report Description

1.3 Stakeholders

1.4 Research Methodology

1.4.1 Market Size

1.4.2 Key Data Points Taken From Secondary Sources

1.4.3 Key Data Points Taken From Primary Sources

1.4.4 Assumptions Made For This Report

2 Executive Summary (Page No. - 26)

3 Market Overview (Page No. - 31)

3.1 Introduction

3.2 Market Segmentation

3.3 History & Evolution Of Energy Efficient Low Horsepower AC Motors

3.4 Market Dynamics

3.4.1 Drivers

3.4.1.1 Reduction In Costs Incurred For Energy In Industry

3.4.1.2 Encouragement By The Governments Through Funding And Other Incentives

3.4.1.3 Increasing Concern Over Greenhouse Gases And Pressure To Reduce These Emissions

3.4.1.4 Huge Demand From The Industrial Sector In Emerging Economies

3.4.2 Restraints

3.4.2.1 High Initial Cost Of Energy Efficient Low Horsepower AC Motors Restricts Their Use In Consumer Applications

3.4.2.2 Lack Of Awareness Of End User Regarding The Advantages

3.4.2.3 Uncertain Economic Conditions

3.4.3 Opportunities

3.4.3.1 Adoption Of The International Standards In The Developing Regions

3.4.3.2 Emerging Green Field Plants In The Developing Nations

3.5 Porters Five Forces

3.5.1 Bargaining Power Of Buyers

3.5.2 Bargaining Power Of Suppliers

3.5.3 Threat Of New Entrants

3.5.4 Threat Of Substitutes

3.5.5 Intensity Of Rivalry

3.6 Value Chain Analysis

3.6.1 Materials

3.6.2 Manufacture & Assemble

3.6.3 System Integration

3.6.4 End-Users

3.6.5 Supporting Institutions

4 Market By Type (Page No. - 52)

4.1 Market By Product Type

4.1.1 Synchronous Motors

4.1.1.1 Permanent Magnet Synchronous Motors Have Higher Efficiency Than The Induction Motors

4.1.2 Types Of Energy-Efficient Synchronous Motors

4.1.2.1 Reluctance Motor

4.1.2.2 Permanent Magnet Motor

4.1.3 Asynchronous Motors

4.1.3.1 Majority Of IE3 Efficiency Class Motors Are Asynchronous Type

4.1.3.2 Types Of Energy-Efficient Asynchronous Motors

4.1.3.2.1 Squirrel Cage Motor

4.1.3.2.2 Wound Rotor Induction Motor

4.2 Market By Current Type

5 Market By Applications (Page No. - 69)

5.1 Introduction

5.2 Consumer Applications

5.2.1 Air-Conditioners

5.2.2 Washing Machines

5.2.3 Optical Disk CD/DVD Spindle Motors

5.2.4 Printers/Scanners

5.2.5 Electronic Toys

5.2.6 Fans

5.2.7 PC Fans

5.2.8 Mixers

5.2.9 Others

5.3 Industrial Applications

5.3.1 Small Capacity Pumps

5.3.2 Surveillance Cameras

5.3.3 Direct-Drive Turntables

5.3.4 Compressors

5.3.5 Small Centrifuge /Separator Spindle Motors

5.3.6 Robots

5.3.7 Portable Power Tools

5.3.8 Packaging

5.3.9 Material Handling

5.3.10 Others

5.4 Refrigeration

5.4.1 Bottle Coolers

5.4.2 Vending Machines

5.4.3 Freezer Cabinets

5.4.4 Display Units

5.4.5 Others

5.5 Medical

5.5.1 Sleep Apnea Treatment

5.5.2 Medical Analysers

5.5.3 Others

5.6 Others

6 Market By Geography (Page No. - 99)

6.1 Introduction

6.2 North America

6.2.1 U.S. Leads In The Penetration Of Higher Efficiency Class Motors

6.3 Europe

6.3.1 Industrial Application To Witness Fastest Growth In Europe

6.4 Asia Pacific

6.4.1 China Is One Of The Major Exporter Of Efficient Motors

6.5 Rest Of The World

6.5.1 Brazil To Be The Key Market For Energy Efficient Low Horsepower AC Motors Amongst ROW Countries

7 Competitive Landscape (Page No. - 114)

7.1 Key Growth Strategies

7.2 Competitive Situation & Trends

7.3 New Product Developments & Announcements

7.4 Agreements, Partnerships, Joint Ventures And Collaborations

7.5 Mergers & Acquisitions

7.6 Others

8 Company Profiles (Overview, Products And Services, Financials, Strategy And Developments)* (Page No. - 133)

8.1 ABB Ltd.

8.2 Bosch Rexroth Ag

8.3 Crompton Greaves

8.4 Emerson Electric CO.

8.5 General Electric

8.6 Honeywell International Inc.

8.7 Johnson Electric

8.8 Kirloskar Electric Company

8.9 Leeson Electric Corporation

8.10 Magnetek, Inc.

8.11 Marathon Electric

8.12 Mitsubishi Electric Corporation

8.13 Nidec Motor Corporation

8.14 Power Efficiency Corporation

8.15 Regal Beloit Corporation

8.16 Schneider Electric S.A.

8.17 Siemens AG

8.18 Toshiba Corporation

8.19 UQM Technologies, Inc

8.20 WEG S.A.

8.21 Wellington Drive Technologies Ltd.

*Details On Overview, Financials, Products And Services, Strategy & Development Might Not Be Captured In Case Of Unlisted Companies.

List of Tables (64 Tables)

Table 1 Global Energy Efficient Motors: Low Horsepower Ac Motors Market Revenue, 2012-2018 ($Billion)

Table 2 Global Energy Efficient Motors: Low Horsepower (FHP+1HP-3HP) Ac Motors Market Revenue, By Application, 2012-2018 ($Billion)

Table 3 Global Energy Efficient Motors: Low Horsepower (FHP+1HP-3HP) Ac Motors Market Revenue, By Geography, 2012-2018 ($Billion)

Table 4 Major Programs Under The Clean Energy Future Package, By Australian Government

Table 5 Different Regulations In Different Regions

Table 6 Global Energy Efficient Low Horsepower (FHP+1HP-3HP) AC Motors Market By Type, 2012-2018 ($Billion)

Table 7 Global FHP Ac Motors Market By Type, 2012-2018 ($Billion)

Table 8 Global Energy Efficient Low Horsepower (1HP-3HP) AC Motors Market By Type, 2012-2018 ($Billion)

Table 9 Global Synchronous FHP Ac Motors Market By Application, 2012-2018 ($Billion)

Table 10 Global Synchronous Energy Efficient Low Horsepower (1hp-3hp) Ac Motors Market By Application, 2012-2018 ($Billion)

Table 11 Global Asynchronous FHP Ac Motors Market By Application, 2012-2018 ($Billion)

Table 12 Global Asynchronous Energy Efficient Low Horsepower (1hp-3hp) Ac Motors Market By Application, 2012-2018 ($Billion)

Table 13 Induction Motor Applications According To Nema Design

Table 14 Global Low Horsepower Single Phase AC Motors Market, 2012-2018 ($Billion)

Table 15 Global Low Horsepower Three Phase AC Motors Market, 2012-2018 ($Billion)

Table 16 Global FHP AC Motors Market By Application, 2012-2018 ($Billion)

Table 17 Global Energy Efficient Low Horsepower (1hp-3hp) AC Motors Market By Application, 2012-2018 ($Billion)

Table 18 Global Energy Efficient Motors: Low Horsepower (FHP+1HP-3HP) AC Motors Market Revenue, By Consumer Applications, 2012 -2018 ($Billion)

Table 19 Global Energy Efficient Motors: Low Horsepower (FHP+1HP-3HP) AC Motors Consumer Applications Market Revenue, By Geography, 2012-2018 ($Billion)

Table 20 Global Energy Efficient Motors: Low Horsepower (FHP+1HP-3HP) AC Motors Market Revenue, By Industrial Application, 2012-2018 ($Billion)

Table 21 Global Energy Efficient Motors: Low Horsepower (FHP+1HP-3HP) AC Motors Industrial Applications Market Revenue, By Geography, 2012-2018 ($Billion)

Table 22 Global Energy Efficient Motors: Low Horsepower (FHP+1HP-3HP) AC Motors Market Revenue, By Refrigeration Application, 2012-2018 ($Billion)

Table 23 Global Energy Efficient Motors: Low Horsepower (FHP+1HP-3HP) AC Motors Refrigeration Application Market Revenue, By Geography, 2012-2018 ($Billion)

Table 24 Global Energy Efficient Motors: Low Horsepower (FHP+1HP-3HP) AC Motors Market Revenue, By Refrigeration Application, 2012-2018 ($Billion)

Table 25 Global Energy Efficient Motors: Low Horsepower (FHP+1HP-3HP) AC Motors Medical Application Market Revenue, By Geography, 2012-2018 ($Billion)

Table 26 Global FHP Ac Motors Market Revenue, By Geography, 2012-2018 ($Billion)

Table 27 Global Energy Efficient Low Horsepower (1hp-3hp) Ac Motors Market Revenue, By Geography, 2012-2018 ($Billion)

Table 28 North America Energy Efficient Motors: Low Horsepower (Fhp+1hp-3hp) AC Motors Market Revenue, By Application, 2012-2018 ($Billion)

Table 29 Europe Energy Efficient Motors: Low Horsepower (FHP+1HP-3HP) AC Motors Market Revenue, By Application, 2012-2018 ($Billion)

Table 30 APAC Energy Efficient Motors: Low Horsepower (FHP+1HP-3HP) AC Motors Market Revenue, By Application, 2012-2018 ($Billion)

Table 31 Row Energy Efficient Motors: Low Horsepower (FHP+1HP-3HP) AC Motors Market Revenue, By Application, 2012-2018 ($Billion)

Table 32 Competitive Analysis Of Major Industry Players

Table 33 New Product Launch/Development, 2010 2013

Table 34 Agreements, Partnerships, Joint Ventures & Collaborations 2010 2013

Table 35 Mergers And Acquisitions, 2010 2013

Table 36 Other Developments, 2010 2013

Table 37 ABB Ltd.: Total Revenue And Net Income, 2011 2012 ($Billion)

Table 38 ABB Ltd.: Market Revenue, By Geography, 2011 2012 ($Billion)

Table 39 ABB Ltd.: Total Revenue, By Segments, 2011 2012 ($Billion)

Table 40 Crompton Greaves Ltd.: Energy Efficient Electric Motors, By Types

Table 41 Crompton Greaves Ltd.: Total Revenue, 2012 2013 ($Million)

Table 42 Emerson Electric Co.: Total Revenue, 2011 2012 ($Billion)

Table 43 Emerson Electric Co.: Market Revenue, By Segments, 2011 2012 ($Billion)

Table 44 Emerson Electric Co.: Market Revenue, By Geography, 2011 2012 ($Billion)

Table 45 General Electric: Total Revenue, 2011 - 2012 ($Billion)

Table 46 Honeywell International, Inc.: Total Revenue 2011 2012 ($Billion)

Table 47 Honeywell International, Inc.: Market Revenue, By Segments, 2011 2012 ($Billion)

Table 48 Honeywell International, Inc.: Market Revenue, By Geography, 2011 2012 ($Billion)

Table 49 Johnson Electric: Total Revenue, 2011 2012 ($Million)

Table 50 Johnson Electric: Total Revenue, By Geography, 2011-2012 ($Million)

Table 51 Kirloskar Electric Co. Ltd.: Overall Revenue 2011 - 2012 ($Million)

Table 52 Magnetek Inc.: Total Revenue, 2011 2012 ($Million)

Table 53 Mitsubishi Electric Corporation: Total Revenue, 2012 2013 ($Million)

Table 54 Power Efficiency Corporation: Total Revenue, 2010 2011 ($Million)

Table 55 Regal Beloit Corporation: Overall Revenue, 2011 2012 ($Million)

Table 56 Schneider Electric S.A.: Total Revenue And Net Income, 2011 2012, ($Billion)

Table 57 Siemens Ag: Total Revenue And Net Income, 2011 2012 ($Million)

Table 58 Siemens Ag: Market Revenue, By Segments, 2011 2012 ($Million)

Table 59 Siemens Ag: Market Revenue, By Geography, 2011 2012 ($Million)

Table 60 Toshiba Corporation: Market Revenue, 2011 - 2012 ($Billion)

Table 61 Toshiba Corporation: Market Revenue, By Business Segment, 2011 - 2012 ($Billion)

Table 62 UQM Technologies, Inc.: Total Revenue, 2012 2013 ($Million)

Table 63 WEG S.A.: Total Revenue And Net Income, 2010 2011 ($Million)

Table 64 Wellington Drive Technologies Ltd.: Total Revenue, 2011 2012 ($Million)

List of Figures (41 Figures)

Figure 1 Research Methodology For The Energy Efficient Low Horsepower AC Motors Market

Figure 2 Energy Efficient Low Horsepower AC Motors Market Research Strategy

Figure 3 Energy Efficient Low Horsepower AC Motors Market Crackdown Strategy

Figure 4 Energy Efficient Low Horsepower AC Motors Market Segmentation

Figure 5 Evolution Of The Energy Efficient Low Horsepower AC Motors

Figure 6 Impact Analysis Of The Drivers

Figure 7 Comparison Of The Operating Cost

Figure 8 Impact Analysis Of The Restraints

Figure 9 Comparison Of The Initial Or Purchasing Price

Figure 10 Energy Efficient Low Horsepower AC Motors: Porters Five Force Model

Figure 11 Energy Efficient Low Horsepower AC Motors Market: Value Chain Analysis

Figure 12 Intermediary Channels In The Energy Efficient Low Horse Power Ac Motors Market

Figure 13 Energy Efficient Motors Classification

Figure 14 Basic Components Involved In Construction Of Synchronous Motors

Figure 15 Synchronous Motors Classification

Figure 16 Asynchronous Motors Classification

Figure 17 Different Types Of Fans

Figure 18 Different Types Of Pumps

Figure 19 Different Methods Used For Designing The Energy Efficient Pumps

Figure 20 Sub Types Of Compressor

Figure 21 Important Measures Adopted To Make Compressors Energy Efficient

Figure 22 Refrigeration Process

Figure 23 Energy Efficiency Techniques For Refrigeration

Figure 24 Key Growth Strategies

Figure 25 ABB Ltd.: Products And Services

Figure 26 ABB Ltd.: SWOT Analysis

Figure 27 General Electric: Products And Services

Figure 28 Honeywell International Inc.: Business Segments

Figure 29 Johnson Electric: Products And Services

Figure 30 Leeson Electric Corporation: Products And Services

Figure 31 Marathon Electric: Products And Services

Figure 32 Nidec Motor Corporation: Products And Services

Figure 33 Nidec Motor Corporation: SWOT Analysis

Figure 34 Power Efficiency Corporation: Products And Services

Figure 35 Regal Beloit Corporation: Products And Services

Figure 36 Schneider Electric SA: Products And Services

Figure 37 Siemens AG: Business Segments

Figure 38 Toshiba Corporation: Products And Services

Figure 39 UQM Technologies Inc.: Products And Services

Figure 40 Wellington Drive Technologies: ECR Series

Figure 41 Wellington Drive Technologies Ltd.: SWOT Analysis

Growth opportunities and latent adjacency in Energy Efficient Low Horsepower AC Motors Market