Log Management Market by Component (Solution and Services), Organization Size (Large Enterprises and SMEs), Deployment Mode (Cloud and On-premises), Vertical (IT and ITeS, BFSI, Healthcare, Telecom, and Education), and Region - Global Forecast to 2026

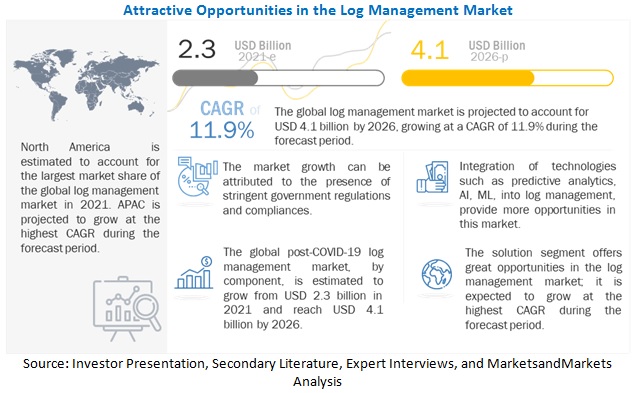

[243 Pages Report] The global Log Management Market size is expected to grow from USD 2.3 billion in 2021 to USD 4.1 billion by 2026, at a Compound Annual Growth Rate (CAGR) of 11.9% from 2021 to 2026.

The major factors fueling the log management market include creasing sophistication of cyberattacks necessitating log management for early detection of cyberattacks, presence of stringent government regulations and compliances, and generation of large data due to increased dependence on IT infrastructure. Moreover, rising demand for business intelligence, rising trend of cloud-based log management practices, and integration of technologies such as predictive analytics, AI, ML into log management would provide lucrative opportunities for Log management vendors.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID 19 Impact

- Adopting rapid digital transformation strategies due to COVID-19 has instantly increased the number of access points and endpoints, leading to a rapid increase in event log data, followed by other issues such as performance, availability, security, and increased IT costs, necessitating log management solutions and services.

- COVID-19 has increased the focus of organizations on centrally managing multiple cloud resources. This is increasing the importance of log data for measuring and optimizing the performance and security of applications, networks, and endpoints. In addition, log data is valuable to identify and rectify critical issues to improve performance quickly. Hence, the demand for log management solutions and services is increasing to collect and correlate log data from cloud services, applications, and infrastructure. It helps in identifying issues, measuring performance, and optimizing configurations.

- Due to advantages such as scalability and pay-as-you-go and the use of external expertise, cloud-based log management solutions and services witnessed an increased demand during the pandemic.

- With maximum companies still working in WFH and hybrid work models, the demand for log management for security assessments is further expected to increase for effective SIEM and threat intelligence across the globe.

- With the increased dependence of IT due to the boom in digital transformation as a result of COVID-19, every new device is creating a large amount of distributed log data.

- By using AI and ML in log analysis, more log data is analyzed and used for creating algorithms for effectively analyzing threat patterns.

- The exponential increase in log data after the outbreak of COVID 19 is complicating the analysis process even more and makes it more time taking. The lack of a standard log format complicates the process of log analysis. Standard log format will enable enterprises in quicker and more efficient threat intelligent practices.

Market Dynamics

Driver: Increase in the sophistication of cyberattacks necessitating log management for early detection of cyberattacks

Not only the numbers of cyberattacks have grown significantly, but the sophistication of those threats has also increased dramatically since the last few years. Even though 98% of cyber-attacks rely on social engineering, hackers are exploiting technologies such as AI, ML, and analytics, to increase the sophistication of cyberattacks. Such sophisticated cyberattacks often go undetected; even if detected, they take more time for remediation. Events that occur during cyber-attack-related activities are also stored as logs. When an incident is detected or suspected, gathering enough data to surmise what happened requires several hours of work, piecing the logs together. Real-time log analysis of such logs integrated with technologies, such as predictive analytics, can help an enterprise in identifying and detecting the occurrence of a cyberattack, generate an alert for the same, and take necessary action for mitigating a cyberattack. According to Retarus, the average time to identify and contain a breach in 2020 was a staggering 280 days; every minute, USD 2.9 million is lost to cybercrime. As of 2020, the average cost of a data breach was USD 3.86 million. By using log management solutions and services, the time taken to identify a cyberattack can be reduced, and such losses can be prevented. Hence, preventing cyberattacks is vital for organizations, which, in turn, is driving the need for log management solutions and services across organizations of all sizes.

Restraint: Presence of open source log management tools

Open-source log management solutions, such as Logstash, Fluentd, GoAccess, and LOGalyze, offer almost all the major features provided by prominent vendors in the market. These offerings are easily available over the internet as free downloads. Various SMEs and startups that adopt such free software need to pay for upgrades, customizations, and support fees, making them affordable and preferable against paid solutions. However, the presence of such offerings in the market hampers the market presence of major log management solution providers. Hence, the availability of such free solutions is expected to restrain the market growth during the forecast period.

Opportunity: Integration of technologies such as predictive analytics, AI, ML into log management

With the increased dependence of IT and boom on technologies such as IoT, every new device creates a large amount of distributed log data. According to Logic Monitor, this machine data is growing 50 times faster than traditional business data. Everything in a stack is continuously writing new events to log files, including error logs that contain a record of critical errors encountered by a running application, operating system, or server, contributing to log overload. In the application of machine learning to log analysis, when more logs are gathered in a log analysis tool, more information can be used to create algorithms. These log intelligence algorithms are used to detect and identify patterns resulting in time-saving as time spent sifting through logs is reduced. The deployment of log intelligence, viz., a log analysis method powered by AI and automation, is gaining traction among enterprises. This extra layer of log intelligence analyzes logs automatically, finding the root cause of issues and surfacing anomalies that exist within log data that sometimes help organizations in preventing an issue even before its occurrence.

Challenge: Management of a huge amount of data

With the increasing complexity and the number of network devices, a large amount of log entries has been generated. According to Ipswitch, an IT management software company, approximately 10,000 log entries are generated from various network devices on a day-to-day basis. The study also stated that a medium-sized enterprise generates around 4 GB of log data per day. Enterprises are under the pressure of complying with the regulatory compliances, such as PCI-DSS, SOX, and HIPAA, as the retention period of each compliance is high. Several organizations are facing problems in managing and archiving the log data to meet the compliance retention period.

Large enterprises segment to grow at a higher CAGR during the forecast period

Industry standards, such as PCI DSS, HIPAA, and SOX, which require logs to be retained for periods ranging between 1 and 7 years, are expected to drive the deployment of log management solutions and services across large enterprises. A very high volume of logs is created every day from IT systems. This log data is crucial for other security solutions, such as SIEM, for ensuring security. This is also expected to drive the demand for log management across large enterprises.

IT and ITeS vertical to hold the largest market size during the forecast period

The IT and ITeS segment includes IT solution and service providers considered early adopters of advanced technologies. IT and ITeS companies are a major target for cybercrimes. The IT and ITeS vertical requires the log management solution at a large scale due to the voluminous information produced daily. IT and ITeS organizations typically store personal data, such as name, address, and financial data, which is a compelling target for cybercriminals or insiders (insider threats). A lot of companies from other verticals, such as BFSI, healthcare, and eCommerce, are dependent on IT and ITeS for digitalizing their processes as well as ensuring the smooth functioning of their businesses. The presence of even the smallest weaknesses can result in huge losses, not just for the IT company but for the companies from various other verticals as well. Log management enables IT and ITeS companies to keep checking the system and the network and plug all loopholes and weaknesses immediately. Hence, the IT and ITeS vertical is continuously adopting advanced log management solutions and services to enhance its overall security posture.

To know about the assumptions considered for the study, download the pdf brochure

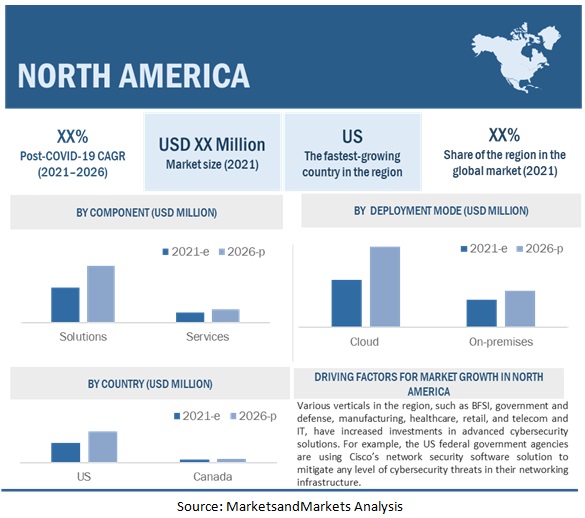

North America to hold the largest market size during the forecast period

North America consists of developed countries, such as the US and Canada, which are the top contributing countries to the North American log management market and are technologically advanced. The region is the most advanced and adaptable in terms of the adoption of security infrastructure and technological development. It comprises a country-wise analysis of the US and Canada. The adoption and acceptance of log management by SMEs would enable the expansion of the customer base and enhancement of business efficiency. With the increase in advanced persistent threats (APTs) and targeted attacks, the demand for advanced log management solutions is growing in log management to secure the IT infrastructure by managing logs and network events. The region includes several large enterprises and rapidly growing SMEs, where implementation of log management solutions is the prime objective of organizations. The US continues to host the most botnet control servers in the world. In 2020, 36% of these servers were hosted in America, while 24% were hosted in undefined countries. With technological advancements and growing economies, such as the US and Canada, the region can invest significantly in upcoming technologies that can lead to the usage of log management solutions.

Asia Pacific to grow at the highest CAGR during the forecast period

APAC has been one of the fastest-growing markets in terms of mobile workforce expansion, propagated with the rising adoption of mobile devices in this region. Countries in APAC such as Australia, China, and Japan have widely adopted log management to protect data from being stolen. According to the International Data Corporations (IDC) research, with South Korea, Australia, and Japan being among the top five countries, APAC leads to adopting advanced technologies. Developing countries such as India are moving toward the rapid digitalization of processes by different initiatives taken by governments, such as Digital India, and the increased use of mobile applications and web-based applications across sectors, such as BFSI, retail, and IT. According to Sophos, organizations in APAC state that they are becoming more mature with cybersecurity, but they continue to be hit by several attacks; for instance, the company observed 56% of organizations suffering from a successful attack in 2021, up from 32% in 2019. According to the Malwarebytes State of Malware report 2019, Asian countries, such as Australia, the Philippines, Indonesia, India, Thailand, and Malaysia, are more susceptible to malware infections, such as crypto mining, backdoors, and information thefts.

Key Market Players

Major vendors in the global Log management market include IBM (US), Splunk (US), Solarwinds (US), Sumo Logic (US), LogRhythm (US).

Micro Focus is a global software company. The company provides solutions to organizations in four areas: Enterprise DevOps, Hybrid Information Management (IT), Predictive Analytics, and Security, Risk, and Governance to run and digitally transform their businesses. Its products and solutions include analytics and big data, application delivery management, application modernization and connectivity, business continuity, collaboration, information management and governance, and IT operations management services. It also offers Micro Focus Software-as-a-Service (SaaS) and Micro Focus government solutions. In September 2017, Micro Focus completed the acquisition of HPEs software business to drive customer-centered innovation at an enterprise scale to deliver software solutions across hybrid IT environments. According to the company, it is the seventh-largest software company in the world, the largest technology company listed on Financial Times Stock Exchange (FTSE), and the largest UK technology company listed on New York Stock Exchange. With 12,000 employees and more than 500 products, Micro Focus caters to 40,000 customers across 49 countries. It helps organizations gain incremental and sustainable returns on investments and preserves and protects their data and business logic. It has adopted various organic and inorganic growth strategies for achieving growth in the market. The clientele of Micro Focus includes companies such as BMW, Accenture, Ameritas, ICC, Fiserv, and GUESS.

Scope of the Report:

|

Report Metric |

Details |

|

Market Size available for years |

2016-2026 |

|

Base Year Considered |

2020 |

|

Forecast period |

2021-2026 |

|

Forecast Unit |

Value(USD) |

|

Segments covered |

Log Management Market: |

|

Geographies covered |

|

|

Companies Covered |

IBM (US), Splunk (US), Solarwinds (US), Rapid7 (US), Micro Focus (US), RSA (US), McAfee (US), Alert Logic (US), Manage Engine (US), LogRhythm (US), Sumo Logic (US), BlackStratus (US), LogDNA (US), Logit.io (UK), Paessler AG (Germany), Sematext (US), Xpolog (US), Humio (UK), Logz.io (Israel), Anodot (US), Loom Systems (US), Chaos Search (US), Coralogix (US), Datadog (US). |

The research report categorizes the log management market into the following segments and subsegments:

Log Management Market, By Component

- Solution

- Services

Market, By Deployment Mode

- Cloud Based

- On Premises

Log Management Market, By Organization Size

- Small and Medium-Sized Enterprises

- Large Enterprises

Market, By Vertical

- IT and ITeS

- Banking, Financial Services, And Insurance

- Healthcare

- Retail and Ecommerce

- Telecom

- Education

- Others

Log Management Market, by Region

- North America

- US

- Canada

- Europe

- UK

- Germany

- France

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

- Middle East and Africa

- Middle East

- Africa

- Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments

- In July 2020, Micro Focus acquired Atar Labs. Atar Labs infrastructure helped Micro Focus detect threats with greater speed and confidence, reduce the risk of time-consuming false alarms, focus resources sharply on the highest value activities, and improve the overall efficiency and effectiveness of their reaction and responses.

- In February 2019, Micro Focus acquired Interset. This acquisition brought advanced ML and User and Entity Behavioral Analytics (UEBA) to Micro Focus deep security, risk, and governance portfolio.

Frequently Asked Questions (FAQ):

What does Log management mean?

Log management is the process of handling log events generated by all software applications and infrastructure on which they run. It involves log collection, aggregation, parsing, storage, analysis, search, archiving, and disposal, with the ultimate goal of using the data for troubleshooting and gaining business insights, while also ensuring the compliance and security of applications and infrastructure.

What are the top trends that are impacting Log management market?

Trends that are impacting Log management market include:

- Increasing sophistication of cyberattacks necessitating log management for early detection of cyberattacks

- Presence of stringent government regulations and compliances

- Generation of large data due to increased dependence on IT infrastructure

- Rising demand for business intelligence

- Rising trend of cloud-based log management practices

- Integration of technologies such as predictive analytics, AI, ML into log management

Who are the prominent players in the Log management market?

IBM (US), Splunk (US), Solarwinds (US), Rapid7 (US), Micro Focus (US), RSA (US), McAfee (US), Alert Logic (US), Manage Engine (US), LogRhythm (US), Sumo Logic (US), BlackStratus (US), LogDNA (US), Logit.io (UK), Paessler AG (Germany), Sematext (US), Xpolog (US), Humio (UK), Logz.io (Israel), Anodot (US), Loom Systems (US), Chaos Search (US), Coralogix (US), Datadog (US).

What are the major application areas of Log management?

There various applications of Log management are as follows:

- SIEM

- Threat Intelligence

- Incident response

What is the Log management market size?

The global Log management market size is expected to grow from USD 2.3 billion in 2021 to USD 4.1 billion by 2026, at a Compound Annual Growth Rate (CAGR) of 11.9% during the forecast period. Log management market is expected to witness rapid growth worldwide due to various factors, such as increasing sophistication of cyberattacks necessitating log management for early detection of cyberattacks, presence of stringent government regulations and compliances, and generation of large data due to increased dependence on IT infrastructure. However, management of a huge amount of data and lack of standard log format may hinder the growth of the market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 31)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 REGIONS COVERED

1.3.3 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY CONSIDERED

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 35)

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakup of primaries

2.1.2.2 Key industry insights

2.2 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

2.4 MARKET FORECAST

2.5 ASSUMPTIONS FOR THE STUDY

2.6 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 43)

4 PREMIUM INSIGHTS (Page No. - 46)

4.1 ATTRACTIVE MARKET OPPORTUNITIES IN THE LOG MANAGEMENT MARKET

4.2 MARKET BY COMPONENT

4.3 MARKET BY SERVICE

4.4 MARKET BY DEPLOYMENT MODE

4.5 MARKET BY ORGANIZATION SIZE

4.6 MARKET BY VERTICAL

4.7 MARKET INVESTMENT SCENARIO, BY KEY REGIONS

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 50)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Increasing sophistication of cyberattacks necessitating log management for early detection of cyberattacks

5.2.1.2 Presence of stringent government regulations and compliances

5.2.1.3 Generation of large data due to increased dependence on IT infrastructure

5.2.2 RESTRAINTS

5.2.2.1 Presence of open-source log management tools

5.2.3 OPPORTUNITIES

5.2.3.1 Rising demand for business intelligence

5.2.3.2 Rising trend of cloud-based log management practices

5.2.3.3 Integration of technologies such as predictive analytics, AI, ML into log management

5.2.4 CHALLENGES

5.2.4.1 Management of a huge amount of data

5.2.4.2 Lack of a standard log format

5.3 IMPACT OF COVID-19 ON MARKET DYNAMICS

5.3.1 DRIVERS AND OPPORTUNITIES

5.3.2 RESTRAINTS AND CHALLENGES

5.3.3 CUMULATIVE GROWTH ANALYSIS

5.4 VALUE CHAIN

5.5 ECOSYSTEM

5.6 PRICING MODEL OF LOG MANAGEMENT MARKET PLAYERS, 20202021

5.7 TECHNOLOGY ANALYSIS

5.7.1 MARKET: TOP TRENDS

5.7.1.1 AI and ML

5.7.1.2 Predictive analytics

5.7.1.3 Log mining with deep learning

5.8 USE CASES

5.8.1 USE CASE 1: WONGA MEETS PCI COMPLIANCE NEEDS FOR SIEM AND FIM USING NNT

5.8.2 USE CASE 2: HEALTHCARE SECURITY TEAM PROVES STRONG ROI WITH LOGRHYTHM

5.8.3 USE CASE 3: LOGENTRIES EMPOWERS TRACKIFS SMALL ENGINEERING TEAM TO PERFORM PRODUCTION MONITORING AND DEBUGGING IN REAL TIME

5.9 REVENUE SHIFT: YC/YCC SHIFT FOR THE LOG MANAGEMENT MARKET

5.10 PATENT ANALYSIS

5.11 PORTERS FIVE FORCES ANALYSIS

5.11.1 THREAT OF NEW ENTRANTS

5.11.2 THREAT OF SUBSTITUTES

5.11.3 BARGAINING POWER OF SUPPLIERS

5.11.4 BARGAINING POWER OF BUYERS

5.11.5 DEGREE OF COMPETITION

5.12 REGULATORY IMPLICATIONS

5.12.1 GENERAL DATA PROTECTION REGULATION (GDPR)

5.12.2 PAYMENT CARD INDUSTRY-DATA SECURITY STANDARD (PCI-DSS)

5.12.3 HEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT (HIPAA)

5.12.4 GRAMM-LEACH-BLILEY (GLB) ACT

5.12.5 SARBANES-OXLEY (SOX) ACT

5.12.6 SOC 2

5.12.7 ISO 27001

6 LOG MANAGEMENT MARKET, BY COMPONENT (Page No. - 68)

6.1 INTRODUCTION

6.1.1 MARKET, BY COMPONENT: DRIVERS

6.1.2 MARKET, BY COMPONENT: COVID-19 IMPACT

6.2 SOLUTIONS

6.3 SERVICES

6.3.1 PROFESSIONAL SERVICES

6.3.2 MANAGED SERVICES

7 LOG MANAGEMENT MARKET, BY DEPLOYMENT MODE (Page No. - 75)

7.1 INTRODUCTION

7.2 CLOUD

7.2.1 MARKET FOR CLOUD: DRIVERS

7.2.2 MARKET FOR CLOUD: COVID-19 IMPACT

7.3 ON-PREMISES

7.3.1 MARKET FOR ON-PREMISES: DRIVERS

7.3.2 MARKET FOR ON-PREMISES: COVID-19 IMPACT

8 LOG MANAGEMENT MARKET, BY ORGANIZATION SIZE (Page No. - 80)

8.1 INTRODUCTION

8.2 SMALL AND MEDIUM-SIZED ENTERPRISES

8.2.1 MARKET FOR SMALL AND MEDIUM-SIZED ENTERPRISES: DRIVERS

8.2.2 MARKET FOR SMALL AND MEDIUM-SIZED ENTERPRISES: COVID-19 IMPACT

8.3 LARGE ENTERPRISES

8.3.1 MARKET FOR LARGE ENTERPRISES: DRIVERS

8.3.2 MARKET FOR LARGE ORGANIZATIONS: COVID-19 IMPACT

9 LOG MANAGEMENT MARKET, BY VERTICAL (Page No. - 85)

9.1 INTRODUCTION

9.2 IT AND ITES

9.2.1 MARKET FOR IT AND ITES: DRIVERS

9.2.2 MARKET FOR IT AND ITES: COVID-19 IMPACT

9.3 BANKING, FINANCIAL SERVICES, AND INSURANCE

9.3.1 MARKET FOR BANKING, FINANCIAL SERVICES, AND INSURANCE: DRIVERS

9.3.2 MARKET FOR BANKING, FINANCIAL SERVICES, AND INSURANCE: COVID-19 IMPACT

9.4 HEALTHCARE

9.4.1 MARKET FOR HEALTHCARE: DRIVERS

9.4.2 MARKET FOR HEALTHCARE: COVID-19 IMPACT

9.5 RETAIL AND ECOMMERCE

9.5.1 LOG MANAGEMENT MARKET FOR RETAIL AND ECOMMERCE: DRIVERS

9.5.2 MARKET FOR RETAIL AND ECOMMERCE: COVID-19 IMPACT

9.6 TELECOM

9.6.1 MARKET FOR TELECOM: DRIVERS

9.6.2 MARKET FOR TELECOM: COVID-19 IMPACT

9.7 EDUCATION

9.7.1 MARKET FOR EDUCATION: DRIVERS

9.7.2 MARKET FOR EDUCATION: COVID-19 IMPACT

9.8 OTHERS

10 LOG MANAGEMENT MARKET, BY REGION (Page No. - 98)

10.1 INTRODUCTION

10.2 NORTH AMERICA

10.2.1 NORTH AMERICA: MARKET DRIVERS

10.2.2 NORTH AMERICA: COVID-19 IMPACT

10.2.3 NORTH AMERICA: LOG MANAGEMENT MARK REGULATIONS

10.2.4 MARKET ESTIMATES AND FORECASTS, BY COMPONENT

10.2.5 MARKET ESTIMATES AND FORECASTS, BY SERVICE

10.2.6 MARKET ESTIMATES AND FORECASTS, BY DEPLOYMENT TYPE

10.2.7 MARKET ESTIMATES AND FORECASTS, BY ORGANIZATION SIZE

10.2.8 MARKET ESTIMATES AND FORECASTS BY VERTICAL

10.2.9 MARKET ESTIMATES AND FORECASTS, BY COUNTRY

10.2.9.1 United States

10.2.9.2 Market estimates and forecasts, by component

10.2.9.3 Market estimates and forecasts, by service

10.2.9.4 Market estimates and forecasts, by deployment type

10.2.9.5 Market estimates and forecasts, by organization size

10.2.9.6 Market estimates and forecasts by vertical

10.2.9.7 Canada

10.2.9.8 Market estimates and forecasts, by component

10.2.9.9 Market estimates and forecasts, by service

10.2.9.10 Market estimates and forecasts, by deployment type

10.2.9.11 Market estimates and forecasts, by organization size

10.2.9.12 Market estimates and forecasts by vertical

10.3 EUROPE

10.3.1 EUROPE: LOG MANAGEMENT MARKET DRIVERS

10.3.2 EUROPE: COVID-19 IMPACT

10.3.3 EUROPE: MARKET REGULATIONS

10.3.4 MARKET ESTIMATES AND FORECASTS, BY COMPONENT

10.3.5 MARKET ESTIMATES AND FORECASTS, BY SERVICE

10.3.6 MARKET ESTIMATES AND FORECASTS, BY DEPLOYMENT TYPE

10.3.7 MARKET ESTIMATES AND FORECASTS, BY ORGANIZATION SIZE

10.3.8 MARKET ESTIMATES AND FORECASTS BY VERTICAL

10.3.9 MARKET ESTIMATES AND FORECASTS, BY COUNTRY

10.3.9.1 United Kingdom

10.3.9.2 Market estimates and forecasts, by component

10.3.9.3 Market estimates and forecasts, by service

10.3.9.4 Market estimates and forecasts, by deployment type

10.3.9.5 Market estimates and forecasts, by organization size

10.3.9.6 Market estimates and forecasts by vertical

10.3.9.7 Germany

10.3.9.8 Market estimates and forecasts, by component

10.3.9.9 Market estimates and forecasts, by service

10.3.9.10 Market estimates and forecasts, by deployment type

10.3.9.11 Market estimates and forecasts, by organization size

10.3.9.12 Market estimates and forecasts by vertical

10.3.9.13 France

10.3.9.14 Market estimates and forecasts, by component

10.3.9.15 Market estimates and forecasts, by service

10.3.9.16 Market estimates and forecasts, by deployment type

10.3.9.17 Market estimates and forecasts, by organization size

10.3.9.18 Market estimates and forecasts, by vertical

10.3.9.19 Rest of Europe

10.3.9.20 Market estimates and forecasts, by component

10.3.9.21 Market estimates and forecasts, by service

10.3.9.22 Market estimates and forecasts, by deployment type

10.3.9.23 Market estimates and forecasts, by organization size

10.3.9.24 Market estimates and forecasts by vertical

10.4 ASIA PACIFIC

10.4.1 ASIA PACIFIC: LOG MANAGEMENT MARKET DRIVERS

10.4.2 ASIA PACIFIC: COVID-19 IMPACT

10.4.3 ASIA PACIFIC: MARKET REGULATIONS/ COMPLIANCES

10.4.4 MARKET ESTIMATES AND FORECASTS, BY COMPONENT

10.4.5 MARKET ESTIMATES AND FORECASTS, BY SERVICE

10.4.6 MARKET ESTIMATES AND FORECASTS, BY DEPLOYMENT TYPE

10.4.7 MARKET ESTIMATES AND FORECASTS, BY ORGANIZATION SIZE

10.4.8 MARKET ESTIMATES AND FORECASTS, BY VERTICAL

10.4.9 MARKET ESTIMATES AND FORECASTS, BY COUNTRY

10.4.9.1 China

10.4.9.2 Market estimates and forecasts, by component

10.4.9.3 Market estimates and forecasts, by service

10.4.9.4 Market estimates and forecasts, by deployment type

10.4.9.5 Market estimates and forecasts, by organization size

10.4.9.6 Market estimates and forecasts by vertical

10.4.9.7 Japan

10.4.9.8 Market estimates and forecasts, by component

10.4.9.9 Market estimates and forecasts, by service

10.4.9.10 Market estimates and forecasts, by deployment type

10.4.9.11 Market estimates and forecasts, by organization size

10.4.9.12 Market estimates and forecasts by vertical

10.4.9.13 India

10.4.9.14 Market estimates and forecasts, by service

10.4.9.15 Market estimates and forecasts, by deployment type

10.4.9.16 Market estimates and forecasts, by organization size

10.4.9.17 Market estimates and forecasts by vertical

10.4.9.18 Rest of Asia Pacific

10.4.9.19 Market estimates and forecasts, by component

10.4.9.20 Market estimates and forecasts, by service

10.4.9.21 Market estimates and forecasts, by deployment type

10.4.9.22 Market estimates and forecasts, by organization size

10.4.9.23 Market estimates and forecasts, by vertical

10.5 MIDDLE EAST AND AFRICA

10.5.1 MIDDLE EAST AND AFRICA: LOG MANAGEMENT MARKET DRIVERS

10.5.2 MIDDLE EAST AND AFRICA: COVID-19 IMPACT

10.5.3 MIDDLE EAST AND AFRICA: MARKET REGULATIONS/COMPLIANCES

10.5.4 MARKET ESTIMATES AND FORECASTS, BY COMPONENT

10.5.5 MARKET ESTIMATES AND FORECASTS, BY SERVICE

10.5.6 MARKET ESTIMATES AND FORECASTS, BY DEPLOYMENT TYPE

10.5.7 MARKET ESTIMATES AND FORECASTS, BY ORGANIZATION SIZE

10.5.8 MARKET ESTIMATES AND FORECASTS BY VERTICAL

10.5.9 MARKET ESTIMATES AND FORECASTS, BY REGION

10.5.9.1 Middle East

10.5.9.2 Market estimates and forecasts, by component

10.5.9.3 Market estimates and forecasts, by service

10.5.9.4 Market estimates and forecasts, by deployment type

10.5.9.5 Market estimates and forecasts, by organization size

10.5.9.6 Market estimates and forecasts by vertical

10.5.9.7 Africa

10.5.9.8 Market estimates and forecasts, by component

10.5.9.9 Market estimates and forecasts, by service

10.5.9.10 market estimates and forecasts, by deployment type

10.5.9.11 Market estimates and forecasts, by organization size

10.5.9.12 Market estimates and forecasts by vertical

10.6 LATIN AMERICA

10.6.1 LATIN AMERICA: LOG MANAGEMENT MARKET DRIVERS

10.6.2 LATIN AMERICA: COVID-19 IMPACT

10.6.3 MARKET ESTIMATES AND FORECASTS, BY COMPONENT

10.6.4 MARKET ESTIMATES AND FORECASTS, BY SERVICE

10.6.5 MARKET ESTIMATES AND FORECASTS, BY DEPLOYMENT TYPE

10.6.6 MARKET ESTIMATES AND FORECASTS, BY ORGANIZATION SIZE

10.6.7 MARKET ESTIMATES AND FORECASTS BY VERTICAL

10.6.8 MARKET ESTIMATES AND FORECASTS, BY COUNTRY

10.6.8.1 Brazil

10.6.8.2 Market estimates and forecasts, by component

10.6.8.3 Market estimates and forecasts, by service

10.6.8.4 Market estimates and forecasts, by deployment type

10.6.8.5 Market estimates and forecasts, by organization size

10.6.8.6 Market estimates and forecasts by vertical

10.6.8.7 Mexico

10.6.8.8 Market estimates and forecasts, by component

10.6.8.9 Market estimates and forecasts, by service

10.6.8.10 Market estimates and forecasts, by deployment type

10.6.8.11 Market estimates and forecasts, by organization size

10.6.8.12 Market estimates and forecasts, by vertical

10.6.8.13 Rest of Latin America

10.6.8.14 Market estimates and forecasts, by component

10.6.8.15 Market estimates and forecasts, by service

10.6.8.16 Market estimates and forecasts, by deployment type

10.6.8.17 Market estimates and forecasts, by organization size

10.6.8.18 Market estimates and forecasts, by vertical

11 COMPETITIVE LANDSCAPE (Page No. - 172)

11.1 INTRODUCTION

11.2 MARKET EVALUATION FRAMEWORK

11.3 REVENUE ANALYSIS OF LEADING PLAYERS

11.4 MARKET SHARE ANALYSIS OF TOP MARKET PLAYERS

11.5 HISTORICAL REVENUE ANALYSIS

11.6 RANKING OF KEY PLAYERS IN THE LOG MANAGEMENT MARKET, 20201

11.7 COMPANY EVALUATION MATRIX

11.7.1 COMPANY EVALUATION MATRIX DEFINITIONS AND METHODOLOGY

11.7.2 STARS

11.7.3 PERVASIVE PLAYERS

11.7.4 EMERGING LEADERS

11.7.5 PARTICIPANTS

11.8 STRENGTH OF PRODUCT PORTFOLIO

11.9 BUSINESS STRATEGY EXCELLENCE

11.10 STARTUP/SME EVALUATION MATRIX, 2020

11.10.1 PROGRESSIVE COMPANIES

11.10.2 RESPONSIVE COMPANIES

11.10.3 DYNAMIC COMPANIES

12 COMPANY PROFILES (Page No. - 181)

12.1 INTRODUCTION

12.2 MAJOR PLAYERS

12.2.1 SPLUNK

12.2.1.1 Business overview

12.2.1.2 Products/Solutions offered

12.2.1.3 Recent developments

12.2.1.4 Splunk: Response to COVID-19

12.2.1.5 MNM view

12.2.1.5.1 Key strengths/Right to win

12.2.1.5.2 Strategic choices made

12.2.1.5.3 Weaknesses and competitive threats

12.2.2 SOLARWINDS

12.2.2.1 Business overview

12.2.2.2 Products/Solutions offered

12.2.2.3 SolarWinds: Response to COVID-19

12.2.2.4 MNM view

12.2.2.4.1 Key strengths/Right to win

12.2.2.4.2 Strategic choices made

12.2.2.4.3 Weaknesses and competitive threats

12.2.3 IBM

12.2.3.1 Business overview

12.2.3.2 Products/Solutions offered

12.2.3.3 Recent developments

12.2.3.4 IBM: Response to COVID-19

12.2.3.5 MNM view

12.2.3.5.1 Key strengths/Right to win

12.2.3.5.2 Strategic choices made

12.2.3.5.3 Weaknesses and competitive threats

12.2.4 MICRO FOCUS

12.2.4.1 Business overview

12.2.4.2 Products/Solutions offered

12.2.4.3 Recent developments

12.2.4.4 Micro Focus: Response to COVID-19

12.2.4.5 MNM view

12.2.4.5.1 Key strengths/Right to win

12.2.4.5.2 Strategic choices made

12.2.4.5.3 Weaknesses and competitive threats

12.2.5 RAPID7

12.2.5.1 Business overview

12.2.5.2 Products/Solutions and Services offered

12.2.5.3 Rapid7: Response to COVID-19

12.2.5.4 MNM view

12.2.5.4.1 Key strengths/Right to win

12.2.5.4.2 Strategic choices made

12.2.5.4.3 Weaknesses and competitive threats

12.2.6 RSA

12.2.6.1 Business overview

12.2.6.2 Products/Solutions and Services offered

12.2.6.3 Recent developments

12.2.6.4 MNM view

12.2.6.4.1 Key strengths/Right to win

12.2.6.4.2 Strategic choices made

12.2.6.4.3 Weaknesses and competitive threats

12.2.7 MCAFEE

12.2.7.1 Business overview

12.2.7.2 Products/Solutions offered

12.2.7.3 McAfee: Response to COVID-19

12.2.8 ALERT LOGIC

12.2.8.1 Business overview

12.2.8.2 Products/Solutions offered

12.2.8.3 Recent developments

12.2.9 MANAGEENGINE

12.2.9.1 Business overview

12.2.9.2 Products/Solutions offered

12.2.9.3 ManageEngine: Response to COVID-19

12.2.10 LOGRHYTHM

12.2.10.1 Business overview

12.2.10.2 Products/Solutions offered

12.2.10.3 Recent developments

12.2.11 SUMO LOGIC

12.2.12 BLACKSTRATUS

12.2.13 LOGDNA

12.2.14 LOGIT.IO

12.2.15 PAESSLER AG

12.2.16 SEMATEXT GROUP

12.2.17 XPOLOG

12.3 STARTUP PLAYERS

12.3.1 HUMIO

12.3.2 LOGZ.IO

12.3.3 ANODOT

12.3.4 LOOM SYSTEMS

12.3.5 CHAOSSEARCH

12.3.6 CORALOGIXSS

12.3.7 DATADOG

13 ADJACENT MARKETS (Page No. - 218)

13.1 INTRODUCTION TO ADJACENT MARKETS

13.2 LIMITATIONS

13.3 LOG MANAGEMENT MARKET ECOSYSTEM AND ADJACENT MARKETS

13.4 SECURITY INFORMATION AND EVENT MANAGEMENT MARKET

13.5 SECURITY AS A SERVICE MARKET

13.6 THREAT INTELLIGENCE MARKET

13.6.1 MARKET ESTIMATES AND FORECASTS, BY APPLICATION, 2014-2025

13.6.2 MARKET ESTIMATES AND FORECASTS, BY ORGANIZATION SIZE, 20142025

13.6.3 MARKET ESTIMATES AND FORECASTS, BY DEPLOYMENT MODE, 20142025

13.6.4 MARKET ESTIMATES AND FORECASTS, BY VERTICAL, 20142025

13.6.5 MARKET ESTIMATES AND FORECASTS, BY REGION, 20142025

14 APPENDIX (Page No. - 235)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

LIST OF TABLES (336 Tables)

TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 20152021

TABLE 2 FACTOR ANALYSIS

TABLE 3 LOG MANAGEMENT MARKET: PRICING MODELS OF FEW VENDORS

TABLE 4 PATENTS RELATED TO LOG MANAGEMENT SOLUTIONS AND SERVICES, 2015-2021

TABLE 5 IMPACT OF PORTERS FIVE FORCES ON MARKET

TABLE 6 MARKET SIZE, BY COMPONENT, 20162020 (USD MILLION)

TABLE 7 MARKET SIZE, BY COMPONENT, 20202026 (USD MILLION)

TABLE 8 SOLUTIONS: MARKET SIZE, BY REGION, 20162020 (USD MILLION)

TABLE 9 SOLUTIONS: MARKET SIZE, BY REGION, 20202026 (USD MILLION)

TABLE 10 SERVICES: MARKET SIZE, BY TYPE, 20162020 (USD MILLION)

TABLE 11 SERVICES: MARKET SIZE, BY TYPE, 20202026 (USD MILLION)

TABLE 12 SERVICES: MARKET SIZE, BY REGION, 20162020 (USD MILLION)

TABLE 13 SERVICES: MARKET SIZE, BY REGION, 20202026 (USD MILLION)

TABLE 14 PROFESSIONAL SERVICES: MARKET SIZE, BY REGION, 20162020 (USD MILLION)

TABLE 15 PROFESSIONAL SERVICES: MARKET SIZE, BY REGION, 20202026 (USD MILLION)

TABLE 16 MANAGED SERVICES: LOG MANAGEMENT MARKET SIZE, BY REGION, 20162020 (USD MILLION)

TABLE 17 MANAGED SERVICES: MARKET SIZE, BY REGION, 20202026 (USD MILLION)

TABLE 18 MARKET SIZE, BY DEPLOYMENT MODE, 20162020 (USD MILLION)

TABLE 19 MARKET SIZE, BY DEPLOYMENT MODE, 20202026 (USD MILLION)

TABLE 20 CLOUD: MARKET SIZE, BY REGION, 20162020 (USD MILLION)

TABLE 21 CLOUD: MARKET SIZE, BY REGION, 20202026 (USD MILLION)

TABLE 22 ON-PREMISES: MARKET SIZE, BY REGION, 20162020 (USD MILLION)

TABLE 23 ON-PREMISES: MARKET SIZE, BY REGION, 20202026 (USD MILLION)

TABLE 24 MARKET SIZE, BY ORGANIZATION SIZE, 20162020 (USD MILLION)

TABLE 25 MARKET SIZE, BY ORGANIZATION SIZE, 20202026 (USD MILLION)

TABLE 26 SMALL AND MEDIUM-SIZED ENTERPRISES: LOG MANAGEMENT MARKET SIZE, BY REGION, 20162020 (USD MILLION)

TABLE 27 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 20202026 (USD MILLION)

TABLE 28 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 20162020 (USD MILLION)

TABLE 29 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 20202026 (USD MILLION)

TABLE 30 MARKET SIZE, BY VERTICAL, 20162020 (USD MILLION)

TABLE 31 MARKET SIZE, BY VERTICAL, 20202026 (USD MILLION)

TABLE 32 IT AND ITES: MARKET SIZE, BY REGION, 20162020 (USD MILLION)

TABLE 33 IT AND ITES: MARKET SIZE, BY REGION, 20202026 (USD MILLION)

TABLE 34 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET SIZE, BY REGION, 20162020 (USD MILLION)

TABLE 35 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET SIZE, BY REGION, 20202026 (USD MILLION)

TABLE 36 HEALTHCARE: LOG MANAGEMENT MARKET SIZE, BY REGION, 20162020 (USD MILLION)

TABLE 37 HEALTHCARE: MARKET SIZE, BY REGION, 20202026 (USD MILLION)

TABLE 38 RETAIL AND ECOMMERCE: MARKET SIZE, BY REGION, 20162020 (USD MILLION)

TABLE 39 RETAIL AND ECOMMERCE: MARKET SIZE, BY REGION, 20202026 (USD MILLION)

TABLE 40 TELECOM: MARKET SIZE, BY REGION, 20162020 (USD MILLION)

TABLE 41 TELECOM: MARKET SIZE, BY REGION, 20202026 (USD MILLION)

TABLE 42 EDUCATION: MARKET SIZE, BY REGION, 20162020 (USD MILLION)

TABLE 43 EDUCATION: MARKET SIZE, BY REGION, 20202026 (USD MILLION)

TABLE 44 OTHERS: MARKET SIZE, BY REGION, 20162020 (USD MILLION)

TABLE 45 OTHERS: MARKET SIZE, BY REGION, 20202026 (USD MILLION)

TABLE 46 MARKET SIZE, BY REGION, 20162020 (USD MILLION)

TABLE 47 LOG MANAGEMENT MARKET SIZE, BY REGION, 20202026 (USD MILLION)

TABLE 48 NORTH AMERICA: MARKET SIZE, BY COMPONENT, 20162020 (USD MILLION)

TABLE 49 NORTH AMERICA: MARKET SIZE, BY COMPONENT, 20202026 (USD MILLION)

TABLE 50 NORTH AMERICA: MARKET SIZE, BY SERVICE, 20162020 (USD MILLION)

TABLE 51 NORTH AMERICA: MARKET SIZE, BY SERVICE, 20202026 (USD MILLION)

TABLE 52 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT TYPE, 20162020 (USD MILLION)

TABLE 53 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT TYPE, 20202026 (USD MILLION)

TABLE 54 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 20162020 (USD MILLION)

TABLE 55 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 20202026 (USD MILLION)

TABLE 56 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 20162020 (USD MILLION)

TABLE 57 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 20202026 (USD MILLION)

TABLE 58 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 20162020 (USD MILLION)

TABLE 59 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 20202026 (USD MILLION)

TABLE 60 US: LOG MANAGEMENT MARKET SIZE, BY COMPONENT, 20162020 (USD MILLION)

TABLE 61 US: MARKET SIZE, BY COMPONENT, 20202026 (USD MILLION)

TABLE 62 US: MARKET SIZE, BY SERVICE, 20162020 (USD MILLION)

TABLE 63 US: MARKET SIZE, BY SERVICE, 20202026 (USD MILLION)

TABLE 64 US: MARKET SIZE, BY DEPLOYMENT TYPE, 20162020 (USD MILLION)

TABLE 65 US: MARKET SIZE, BY DEPLOYMENT TYPE, 20202026 (USD MILLION)

TABLE 66 US: MARKET SIZE, BY ORGANIZATION SIZE, 20162020 (USD MILLION)

TABLE 67 US: MARKET SIZE, BY ORGANIZATION SIZE, 20202026 (USD MILLION)

TABLE 68 US: MARKET SIZE, BY VERTICAL, 20162020 (USD MILLION)

TABLE 69 US: MARKET SIZE, BY VERTICAL, 20202026 (USD MILLION)

TABLE 70 CANADA: LOG MANAGEMENT MARKET SIZE, BY COMPONENT, 20162020 (USD MILLION)

TABLE 71 CANADA: MARKET SIZE, BY COMPONENT, 20202026 (USD MILLION)

TABLE 72 CANADA: MARKET SIZE, BY SERVICE, 20162020 (USD MILLION)

TABLE 73 CANADA: MARKET SIZE, BY SERVICE, 20202026 (USD MILLION)

TABLE 74 CANADA: MARKET SIZE, BY DEPLOYMENT TYPE, 20162020 (USD MILLION)

TABLE 75 CANADA: MARKET SIZE, BY DEPLOYMENT TYPE, 20202026 (USD MILLION)

TABLE 76 CANADA: MARKET SIZE, BY ORGANIZATION SIZE, 20162020 (USD MILLION)

TABLE 77 CANADA: MARKET SIZE, BY ORGANIZATION SIZE, 20202026 (USD MILLION)

TABLE 78 CANADA: MARKET SIZE, BY VERTICAL, 20162020 (USD MILLION)

TABLE 79 CANADA: MARKET SIZE, BY VERTICAL, 20202026 (USD MILLION)

TABLE 80 EUROPE: LOG MANAGEMENT MARKET SIZE, BY COMPONENT, 20162020 (USD MILLION)

TABLE 81 EUROPE: MARKET SIZE, BY COMPONENT, 20202026 (USD MILLION)

TABLE 82 EUROPE: MARKET SIZE, BY SERVICE, 20162020 (USD MILLION)

TABLE 83 EUROPE: MARKET SIZE, BY SERVICE, 20202026 (USD MILLION)

TABLE 84 EUROPE: MARKET SIZE, BY DEPLOYMENT TYPE, 20162020 (USD MILLION)

TABLE 85 EUROPE: MARKET SIZE, BY DEPLOYMENT TYPE, 20202026 (USD MILLION)

TABLE 86 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 20162020 (USD MILLION)

TABLE 87 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 20202026 (USD MILLION)

TABLE 88 EUROPE: MARKET SIZE, BY VERTICAL, 20162020 (USD MILLION)

TABLE 89 EUROPE: MARKET SIZE, BY VERTICAL, 20202026 (USD MILLION)

TABLE 90 EUROPE: MARKET SIZE, BY COUNTRY, 20162020 (USD MILLION)

TABLE 91 EUROPE: MARKET SIZE, BY COUNTRY, 20202026 (USD MILLION)

TABLE 92 UK: LOG MANAGEMENT MARKET SIZE, BY COMPONENT, 20162020 (USD MILLION)

TABLE 93 UK: MARKET SIZE, BY COMPONENT, 20202026 (USD MILLION)

TABLE 94 UK: MARKET SIZE, BY SERVICE, 20162020 (USD MILLION)

TABLE 95 UK: MARKET SIZE, BY SERVICE, 20202026 (USD MILLION)

TABLE 96 UK: MARKET SIZE, BY DEPLOYMENT TYPE, 20162020 (USD MILLION)

TABLE 97 UK: MARKET SIZE, BY DEPLOYMENT TYPE, 20202026 (USD MILLION)

TABLE 98 UK: MARKET SIZE, BY ORGANIZATION SIZE, 20162020 (USD MILLION)

TABLE 99 UK: MARKET SIZE, BY ORGANIZATION SIZE, 20202026 (USD MILLION)

TABLE 100 UK: MARKET SIZE, BY VERTICAL, 20162020 (USD MILLION)

TABLE 101 UK: MARKET SIZE, BY VERTICAL, 20202026 (USD MILLION)

TABLE 102 GERMANY: LOG MANAGEMENT MARKET SIZE, BY COMPONENT, 20162020 (USD MILLION)

TABLE 103 GERMANY: MARKET SIZE, BY COMPONENT, 20202026 (USD MILLION)

TABLE 104 GERMANY: MARKET SIZE, BY SERVICE, 20162020 (USD MILLION)

TABLE 105 GERMANY: MARKET SIZE, BY SERVICE, 20202026 (USD MILLION)

TABLE 106 GERMANY: MARKET SIZE, BY DEPLOYMENT TYPE, 20162020 (USD MILLION)

TABLE 107 GERMANY: MARKET SIZE, BY DEPLOYMENT TYPE, 20202026 (USD MILLION)

TABLE 108 GERMANY: MARKET SIZE, BY ORGANIZATION SIZE, 20162020 (USD MILLION)

TABLE 109 GERMANY: MARKET SIZE, BY ORGANIZATION SIZE, 20202026 (USD MILLION)

TABLE 110 GERMANY: MARKET SIZE, BY VERTICAL, 20162020 (USD MILLION)

TABLE 111 GERMANY: MARKET SIZE, BY VERTICAL, 20202026 (USD MILLION)

TABLE 112 FRANCE: LOG MANAGEMENT MARKET SIZE, BY COMPONENT, 20162020 (USD MILLION)

TABLE 113 FRANCE: MARKET SIZE, BY COMPONENT, 20202026 (USD MILLION)

TABLE 114 FRANCE: MARKET SIZE, BY SERVICE, 20162020 (USD MILLION)

TABLE 115 FRANCE: MARKET SIZE, BY SERVICE, 20202026 (USD MILLION)

TABLE 116 FRANCE: MARKET SIZE, BY DEPLOYMENT TYPE, 20162020 (USD MILLION)

TABLE 117 FRANCE: MARKET SIZE, BY DEPLOYMENT TYPE, 20202026 (USD MILLION)

TABLE 118 FRANCE: MARKET SIZE, BY ORGANIZATION SIZE, 20162020 (USD MILLION)

TABLE 119 FRANCE: MARKET SIZE, BY ORGANIZATION SIZE, 20202026 (USD MILLION)

TABLE 120 FRANCE: MARKET SIZE, BY VERTICAL, 20162020 (USD MILLION)

TABLE 121 FRANCE: MARKET SIZE, BY VERTICAL, 20202026 (USD MILLION)

TABLE 122 REST OF EUROPE: LOG MANAGEMENT MARKET SIZE, BY COMPONENT, 20162020 (USD MILLION)

TABLE 123 REST OF EUROPE: MARKET SIZE, BY COMPONENT, 20202026 (USD MILLION)

TABLE 124 REST OF EUROPE: MARKET SIZE, BY SERVICE, 20162020 (USD MILLION)

TABLE 125 REST OF EUROPE: MARKET SIZE, BY SERVICE, 20202026 (USD MILLION)

TABLE 126 REST OF EUROPE: MARKET SIZE, BY DEPLOYMENT TYPE, 20162020 (USD MILLION)

TABLE 127 REST OF EUROPE: MARKET SIZE, BY DEPLOYMENT TYPE, 20202026 (USD MILLION)

TABLE 128 REST OF EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 20162020 (USD MILLION)

TABLE 129 REST OF EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 20202026 (USD MILLION)

TABLE 130 REST OF EUROPE: MARKET SIZE, BY VERTICAL, 20162020 (USD MILLION)

TABLE 131 REST OF EUROPE: MARKET SIZE, BY VERTICAL, 20202026 (USD MILLION)

TABLE 132 ASIA PACIFIC: LOG MANAGEMENT MARKET SIZE, BY COMPONENT, 20162020 (USD MILLION)

TABLE 133 ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 20202026 (USD MILLION)

TABLE 134 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 20162020 (USD MILLION)

TABLE 135 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 20202026 (USD MILLION)

TABLE 136 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT TYPE, 20162020 (USD MILLION)

TABLE 137 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT TYPE, 20202026 (USD MILLION)

TABLE 138 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 20162020 (USD MILLION)

TABLE 139 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 20202026 (USD MILLION)

TABLE 140 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 20162020 (USD MILLION)

TABLE 141 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 20202026 (USD MILLION)

TABLE 142 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 20162020 (USD MILLION)

TABLE 143 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 20202026 (USD MILLION)

TABLE 144 CHINA: LOG MANAGEMENT MARKET SIZE, BY COMPONENT, 20162020 (USD MILLION)

TABLE 145 CHINA: MARKET SIZE, BY COMPONENT, 20202026 (USD MILLION)

TABLE 146 CHINA: MARKET SIZE, BY SERVICE, 20162020 (USD MILLION)

TABLE 147 CHINA: MARKET SIZE, BY SERVICE, 20202026 (USD MILLION)

TABLE 148 CHINA: MARKET SIZE, BY DEPLOYMENT TYPE, 20162020 (USD MILLION)

TABLE 149 CHINA: MARKET SIZE, BY DEPLOYMENT TYPE, 20202026 (USD MILLION)

TABLE 150 CHINA: MARKET SIZE, BY ORGANIZATION SIZE, 20162020 (USD MILLION)

TABLE 151 CHINA: MARKET SIZE, BY ORGANIZATION SIZE, 20202026 (USD MILLION)

TABLE 152 CHINA: MARKET SIZE, BY VERTICAL, 20162020 (USD MILLION)

TABLE 153 CHINA: MARKET SIZE, BY VERTICAL, 20202026 (USD MILLION)

TABLE 154 JAPAN: LOG MANAGEMENT MARKET SIZE, BY COMPONENT, 20162020 (USD MILLION)

TABLE 155 JAPAN: MARKET SIZE, BY COMPONENT, 20202026 (USD MILLION)

TABLE 156 JAPAN: MARKET SIZE, BY SERVICE, 20162020 (USD MILLION)

TABLE 157 JAPAN: MARKET SIZE, BY SERVICE, 20202026 (USD MILLION)

TABLE 158 JAPAN: MARKET SIZE, BY DEPLOYMENT TYPE, 20162020 (USD MILLION)

TABLE 159 JAPAN: MARKET SIZE, BY DEPLOYMENT TYPE, 20202026 (USD MILLION)

TABLE 160 JAPAN: MARKET SIZE, BY ORGANIZATION SIZE, 20162020 (USD MILLION)

TABLE 161 JAPAN: MARKET SIZE, BY ORGANIZATION SIZE, 20202026 (USD MILLION)

TABLE 162 JAPAN: MARKET SIZE, BY VERTICAL, 20162020 (USD MILLION)

TABLE 163 JAPAN: MARKET SIZE, BY VERTICAL, 20202026 (USD MILLION)

TABLE 164 INDIA: LOG MANAGEMENT MARKET SIZE, BY COMPONENT, 20162020 (USD MILLION)

TABLE 165 INDIA: MARKET SIZE, BY COMPONENT, 20202026 (USD MILLION)

TABLE 166 INDIA: MARKET SIZE, BY SERVICE, 20162020 (USD MILLION)

TABLE 167 INDIA: MARKET SIZE, BY SERVICE, 20202026 (USD MILLION)

TABLE 168 INDIA: MARKET SIZE, BY DEPLOYMENT TYPE, 20162020 (USD MILLION)

TABLE 169 INDIA: MARKET SIZE, BY DEPLOYMENT TYPE, 20202026 (USD MILLION)

TABLE 170 INDIA: MARKET SIZE, BY ORGANIZATION SIZE, 20162020 (USD MILLION)

TABLE 171 INDIA: MARKET SIZE, BY ORGANIZATION SIZE, 20202026 (USD MILLION)

TABLE 172 INDIA: MARKET SIZE, BY VERTICAL, 20162020 (USD MILLION)

TABLE 173 INDIA: MARKET SIZE, BY VERTICAL, 20202026 (USD MILLION)

TABLE 174 REST OF ASIA PACIFIC: LOG MANAGEMENT MARKET SIZE, BY COMPONENT, 20162020 (USD MILLION)

TABLE 175 REST OF ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 20202026 (USD MILLION)

TABLE 176 REST OF ASIA PACIFIC: MARKET SIZE, BY SERVICE, 20162020 (USD MILLION)

TABLE 177 REST OF ASIA PACIFIC: MARKET SIZE, BY SERVICE, 20202026 (USD MILLION)

TABLE 178 REST OF ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT TYPE, 20162020 (USD MILLION)

TABLE 179 REST OF ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT TYPE, 20202026 (USD MILLION)

TABLE 180 REST OF ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 20162020 (USD MILLION)

TABLE 181 REST OF ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 20202026 (USD MILLION)

TABLE 182 REST OF ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 20162020 (USD MILLION)

TABLE 183 REST OF ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 20202026 (USD MILLION)

TABLE 184 MIDDLE EAST AND AFRICA: LOG MANAGEMENT MARKET SIZE, BY COMPONENT, 20162020 (USD MILLION)

TABLE 185 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 20202026 (USD MILLION)

TABLE 186 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 20162020 (USD MILLION)

TABLE 187 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 20202026 (USD MILLION)

TABLE 188 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT TYPE, 20162020 (USD MILLION)

TABLE 189 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT TYPE, 20202026 (USD MILLION)

TABLE 190 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 20162020 (USD MILLION)

TABLE 191 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 20202026 (USD MILLION)

TABLE 192 MIDDLE EAST AND AFRICA: MARKET SIZE, BY VERTICAL, 20162020 (USD MILLION)

TABLE 193 MIDDLE EAST AND AFRICA: MARKET SIZE, BY VERTICAL, 20202026 (USD MILLION)

TABLE 194 MIDDLE EAST AND AFRICA: MARKET SIZE, BY REGION, 20162020 (USD MILLION)

TABLE 195 MIDDLE EAST AND AFRICA: MARKET SIZE, BY REGION, 20202026 (USD MILLION)

TABLE 196 MIDDLE EAST: LOG MANAGEMENT MARKET SIZE, BY COMPONENT, 20162020 (USD MILLION)

TABLE 197 MIDDLE EAST: MARKET SIZE, BY COMPONENT, 20202026 (USD MILLION)

TABLE 198 MIDDLE EAST: MARKET SIZE, BY SERVICE, 20162020 (USD MILLION)

TABLE 199 MIDDLE EAST: MARKET SIZE, BY SERVICE, 20202026 (USD MILLION)

TABLE 200 MIDDLE EAST: MARKET SIZE, BY DEPLOYMENT TYPE, 20162020 (USD MILLION)

TABLE 201 MIDDLE EAST: MARKET SIZE, BY DEPLOYMENT TYPE, 20202026 (USD MILLION)

TABLE 202 MIDDLE EAST: MARKET SIZE, BY ORGANIZATION SIZE, 20162020 (USD MILLION)

TABLE 203 MIDDLE EAST: MARKET SIZE, BY ORGANIZATION SIZE, 20202026 (USD MILLION)

TABLE 204 MIDDLE EAST: MARKET SIZE, BY VERTICAL, 20162020 (USD MILLION)

TABLE 205 MIDDLE EAST: MARKET SIZE, BY VERTICAL, 20202026 (USD MILLION)

TABLE 206 AFRICA: LOG MANAGEMENT MARKET SIZE, BY COMPONENT, 20162020 (USD MILLION)

TABLE 207 AFRICA: MARKET SIZE, BY COMPONENT, 20202026 (USD MILLION)

TABLE 208 AFRICA: MARKET SIZE, BY SERVICE, 20162020 (USD MILLION)

TABLE 209 AFRICA: MARKET SIZE, BY SERVICE, 20202026 (USD MILLION)

TABLE 210 AFRICA: MARKET SIZE, BY DEPLOYMENT TYPE, 20162020 (USD MILLION)

TABLE 211 AFRICA: MARKET SIZE, BY DEPLOYMENT TYPE, 20202026 (USD MILLION)

TABLE 212 AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 20162020 (USD MILLION)

TABLE 213 AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 20202026 (USD MILLION)

TABLE 214 AFRICA: MARKET SIZE, BY VERTICAL, 20162020 (USD MILLION)

TABLE 215 AFRICA: MARKET SIZE, BY VERTICAL, 20202026 (USD MILLION)

TABLE 216 LATIN AMERICA: LOG MANAGEMENT MARKET SIZE, BY COMPONENT, 20162020 (USD MILLION)

TABLE 217 LATIN AMERICA: MARKET SIZE, BY COMPONENT, 20202026 (USD MILLION)

TABLE 218 LATIN AMERICA: MARKET SIZE, BY SERVICE, 20162020 (USD MILLION)

TABLE 219 LATIN AMERICA: MARKET SIZE, BY SERVICE, 20202026 (USD MILLION)

TABLE 220 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT TYPE, 20162020 (USD MILLION)

TABLE 221 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT TYPE, 20202026 (USD MILLION)

TABLE 222 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 20162020 (USD MILLION)

TABLE 223 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 20202026 (USD MILLION)

TABLE 224 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 20162020 (USD MILLION)

TABLE 225 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 20202026 (USD MILLION)

TABLE 226 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 20162020 (USD MILLION)

TABLE 227 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 20202026 (USD MILLION)

TABLE 228 BRAZIL: LOG MANAGEMENT MARKET SIZE, BY COMPONENT, 20162020 (USD MILLION)

TABLE 229 BRAZIL: MARKET SIZE, BY COMPONENT, 20202026 (USD MILLION)

TABLE 230 BRAZIL: MARKET SIZE, BY SERVICE, 20162020 (USD MILLION)

TABLE 231 BRAZIL: MARKET SIZE, BY SERVICE, 20202026 (USD MILLION)

TABLE 232 BRAZIL: MARKET SIZE, BY DEPLOYMENT TYPE, 20162020 (USD MILLION)

TABLE 233 BRAZIL: MARKET SIZE, BY DEPLOYMENT TYPE, 20202026 (USD MILLION)

TABLE 234 BRAZIL: MARKET SIZE, BY ORGANIZATION SIZE, 20162020 (USD MILLION)

TABLE 235 BRAZIL: MARKET SIZE, BY ORGANIZATION SIZE, 20202026 (USD MILLION)

TABLE 236 BRAZIL: MARKET SIZE, BY VERTICAL, 20162020 (USD MILLION)

TABLE 237 BRAZIL: MARKET SIZE, BY VERTICAL, 20202026 (USD MILLION)

TABLE 238 MEXICO: LOG MANAGEMENT MARKET SIZE, BY COMPONENT, 20162020 (USD MILLION)

TABLE 239 MEXICO: MARKET SIZE, BY COMPONENT, 20202026 (USD MILLION)

TABLE 240 MEXICO: MARKET SIZE, BY SERVICE, 20162020 (USD MILLION)

TABLE 241 MEXICO: MARKET SIZE, BY SERVICE, 20202026 (USD MILLION)

TABLE 242 MEXICO: MARKET SIZE, BY DEPLOYMENT TYPE, 20162020 (USD MILLION)

TABLE 243 MEXICO: MARKET SIZE, BY DEPLOYMENT TYPE, 20202026 (USD MILLION)

TABLE 244 MEXICO: MARKET SIZE, BY ORGANIZATION SIZE, 20162020 (USD MILLION)

TABLE 245 MEXICO: MARKET SIZE, BY ORGANIZATION SIZE, 20202026 (USD MILLION)

TABLE 246 MEXICO: MARKET SIZE, BY VERTICAL, 20162020 (USD MILLION)

TABLE 247 MEXICO: MARKET SIZE, BY VERTICAL, 20202026 (USD MILLION)

TABLE 248 REST OF LATIN AMERICA: LOG MANAGEMENT MARKET SIZE, BY COMPONENT, 20162020 (USD MILLION)

TABLE 249 REST OF LATIN AMERICA: MARKET SIZE, BY COMPONENT, 20202026 (USD MILLION)

TABLE 250 REST OF LATIN AMERICA: MARKET SIZE, BY SERVICE, 20162020 (USD MILLION)

TABLE 251 REST OF LATIN AMERICA: MARKET SIZE, BY SERVICE, 20202026 (USD MILLION)

TABLE 252 REST OF LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT TYPE, 20162020 (USD MILLION)

TABLE 253 REST OF LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT TYPE, 20202026 (USD MILLION)

TABLE 254 REST OF LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 20162020 (USD MILLION)

TABLE 255 REST OF LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 20202026 (USD MILLION)

TABLE 256 REST OF LATIN AMERICA: MARKET SIZE, BY VERTICAL, 20162020 (USD MILLION)

TABLE 257 REST OF LATIN AMERICA: MARKET SIZE, BY VERTICAL, 20202026 (USD MILLION)

TABLE 258 LOG MANAGEMENT MARKET: DEGREE OF COMPETITION

TABLE 259 EVALUATION CRITERIA

TABLE 260 SPLUNK: BUSINESS OVERVIEW

TABLE 261 SPLUNK: PRODUCTS/SOLUTIONS OFFERED

TABLE 262 SPLUNK: PRODUCT LAUNCHES

TABLE 263 SPLUNK: DEALS

TABLE 264 SOLARWINDS: BUSINESS OVERVIEW

TABLE 265 SOLARWINDS: PRODUCTS/SOLUTIONS OFFERED

TABLE 266 SOLARWINDS: DEALS

TABLE 267 IBM: BUSINESS OVERVIEW

TABLE 268 IBM: PRODUCTS/SOLUTIONS OFFERED

TABLE 269 IBM: DEALS

TABLE 270 MICRO FOCUS: BUSINESS OVERVIEW

TABLE 271 MICRO FOCUS: PRODUCTS/SOLUTIONS OFFERED

TABLE 272 MICRO FOCUS: DEALS

TABLE 273 RAPID7: BUSINESS OVERVIEW

TABLE 274 RAPID7: PRODUCTS/SOLUTIONS OFFERED

TABLE 275 RAPID7: DEALS

TABLE 276 RSA: BUSINESS OVERVIEW

TABLE 277 RSA: PRODUCTS/SOLUTIONS OFFERED

TABLE 278 RSA: SERVICES OFFERED

TABLE 279 RSA: SERVICE LAUNCHES

TABLE 280 RSA: DEALS

TABLE 281 MCAFEE: BUSINESS OVERVIEW

TABLE 282 MCAFEE: PRODUCTS/SOLUTIONS OFFERED

TABLE 283 MCAFEE: DEALS

TABLE 284 ALERT LOGIC: BUSINESS OVERVIEW

TABLE 285 ALERT LOGIC: PRODUCTS/SOLUTIONS OFFERED

TABLE 286 ALERT LOGIC: PRODUCT LAUNCHES

TABLE 287 ALERT LOGIC: DEALS

TABLE 288 MANAGEENGINE: BUSINESS OVERVIEW

TABLE 289 MANAGEENGINE: PRODUCTS/SOLUTIONS OFFERED

TABLE 290 LOGRHYTHM: BUSINESS OVERVIEW

TABLE 291 LOGRHYTHM: PRODUCTS/SOLUTIONS OFFERED

TABLE 292 LOGRHYTHM: PRODUCT LAUNCHES

TABLE 293 LOGRHYTHM: DEALS

TABLE 294 ADJACENT MARKETS AND FORECASTS

TABLE 295 SECURITY INFORMATION AND EVENT MANAGEMENT MARKET SIZE, BY COMPONENT, 20182025 (USD MILLION)

TABLE 296 SECURITY INFORMATION AND EVENT MANAGEMENT MARKET SIZE, BY APPLICATION, 20182025 (USD MILLION)

TABLE 297 SECURITY INFORMATION AND EVENT MANAGEMENT MARKET SIZE, BY DEPLOYMENT MODE, 20182025 (USD MILLION)

TABLE 298 SECURITY INFORMATION AND EVENT MANAGEMENT MARKET SIZE, BY ORGANIZATION SIZE, 20182025 (USD MILLION)

TABLE 299 SECURITY INFORMATION AND EVENT MANAGEMENT MARKET SIZE, BY VERTICAL, 20182025 (USD MILLION)

TABLE 300 SECURITY INFORMATION AND EVENT MANAGEMENT MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 301 NORTH AMERICA: SECURITY INFORMATION AND EVENT MANAGEMENT MARKET SIZE, BY COUNTRY, 20182025 (USD MILLION)

TABLE 302 EUROPE: SECURITY INFORMATION AND EVENT MANAGEMENT MARKET SIZE, BY COUNTRY, 20182025 (USD MILLION)

TABLE 303 ASIA PACIFIC: SECURITY INFORMATION AND EVENT MANAGEMENT MARKET SIZE, BY COUNTRY, 20182025 (USD MILLION)

TABLE 304 MIDDLE EAST AND AFRICA: SECURITY INFORMATION AND EVENT MANAGEMENT MARKET SIZE, BY COUNTRY, 20182025 (USD MILLION)

TABLE 305 LATIN AMERICA: SECURITY INFORMATION AND EVENT MANAGEMENT MARKET SIZE, BY COUNTRY, 20182025 (USD MILLION)

TABLE 306 SECURITY AS A SERVICE MARKET SIZE, BY COMPONENT, 20142019 (USD MILLION)

TABLE 307 PRE-COVID-19: SECURITY AS A SERVICE MARKET SIZE, BY COMPONENT, 20192025 (USD MILLION)

TABLE 308 POST-COVID-19: SECURITY AS A SERVICE MARKET SIZE, BY COMPONENT, 20192025 (USD MILLION)

TABLE 309 SECURITY AS A SERVICE MARKET SIZE, BY SOLUTION, 20142019 (USD MILLION)

TABLE 310 PRE-COVID-19: SECURITY AS A SERVICE MARKET SIZE, BY SOLUTION, 20192025 (USD MILLION)

TABLE 311 POST-COVID-19: SECURITY AS A SERVICE MARKET SIZE, BY SOLUTION, 20192025 (USD MILLION)

TABLE 312 SECURITY AS A SERVICE MARKET SIZE, BY SERVICE, 20142019 (USD MILLION)

TABLE 313 PRE-COVID-19: SECURITY AS A SERVICE MARKET SIZE, BY SERVICE, 20192025 (USD MILLION)

TABLE 314 POST-COVID-19: SECURITY AS A SERVICE MARKET SIZE, BY SERVICE, 20192025 (USD MILLION)

TABLE 315 SECURITY AS A SERVICE MARKET SIZE, BY APPLICATION AREA, 20142019 (USD MILLION)

TABLE 316 PRE-COVID-19: SECURITY AS A SERVICE MARKET SIZE, BY APPLICATION AREA, 20192025 (USD MILLION)

TABLE 317 POST-COVID-19: SECURITY AS A SERVICE MARKET SIZE, BY APPLICATION AREA, 20192025 (USD MILLION)

TABLE 318 SECURITY AS A SERVICE MARKET SIZE, BY ORGANIZATION SIZE, 20142019 (USD MILLION)

TABLE 319 PRE-COVID-19: SECURITY AS A SERVICE MARKET SIZE, BY ORGANIZATION SIZE, 20192025 (USD MILLION)

TABLE 320 POST-COVID-19:SECURITY AS A SERVICE MARKET SIZE, BY ORGANIZATION SIZE, 20192025 (USD MILLION)

TABLE 321 SECURITY AS A SERVICE MARKET SIZE, BY VERTICAL, 20142019 (USD MILLION)

TABLE 322 PRE-COVID-19: SECURITY AS A SERVICE MARKET SIZE, BY VERTICAL, 20192025 (USD MILLION)

TABLE 323 POST-COVID-19: SECURITY AS A SERVICE MARKET SIZE, BY VERTICAL, 20192025 (USD MILLION)

TABLE 324 SECURITY AS A SERVICE MARKET SIZE, BY REGION, 20142019 (USD MILLION)

TABLE 325 SECURITY AS A SERVICE MARKET SIZE, PRE-COVID-19, BY REGION, 20192025 (USD MILLION)

TABLE 326 SECURITY AS A SERVICE MARKET SIZE, POST-COVID-19, BY REGION, 20192025 (USD MILLION)

TABLE 327 THREAT INTELLIGENCE MARKET SIZE, BY APPLICATION, 20142019 (USD MILLION)

TABLE 328 POST-COVID-19: THREAT INTELLIGENCE MARKET SIZE, BY APPLICATION, 20192025 (USD MILLION)

TABLE 329 THREAT INTELLIGENCE MARKET SIZE, BY ORGANIZATION SIZE, 20142019 (USD MILLION)

TABLE 330 POST-COVID-19: THREAT INTELLIGENCE MARKET SIZE, BY ORGANIZATION SIZE, 20192025 (USD MILLION)

TABLE 331 THREAT INTELLIGENCE MARKET SIZE, BY DEPLOYMENT MODE, 20142019 (USD MILLION)

TABLE 332 POST-COVID-19: THREAT INTELLIGENCE MARKET SIZE, BY DEPLOYMENT MODE, 20192025 (USD MILLION)

TABLE 333 THREAT INTELLIGENCE MARKET SIZE, BY VERTICAL, 20142019 (USD MILLION)

TABLE 334 POST-COVID-19: THREAT INTELLIGENCE MARKET SIZE, BY VERTICAL, 20192025 (USD MILLION)

TABLE 335 THREAT INTELLIGENCE MARKET SIZE, BY REGION, 20142019 (USD MILLION)

TABLE 336 POST-COVID-19: THREAT INTELLIGENCE MARKET SIZE, BY REGION, 20192025 (USD MILLION)

LIST OF FIGURES (41 Figures)

FIGURE 1 LOG MANAGEMENT MARKET: RESEARCH DESIGN

FIGURE 2 MARKET SIZE ESTIMATION METHODOLOGYAPPROACH 1 (SUPPLY SIDE): REVENUE FROM SOLUTIONS/SERVICES OF LOG MANAGEMENT VENDORS

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGYAPPROACH 2, BOTTOM-UP APPROACH (SUPPLY SIDE): COLLECTIVE REVENUE FROM ALL SOLUTIONS AND SERVICES OF LOG MANAGEMENT VENDORS

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGYAPPROACH 3, TOP-DOWN APPROACH DEMAND-SIDE ANALYSIS

FIGURE 5 LIMITATIONS OF MARKET REPORT

FIGURE 6 GLOBAL MARKET TO WITNESS SIGNIFICANT GROWTH DURING FORECAST PERIOD, 2016-2026

FIGURE 7 LOG MANAGEMENT MARKET: REGIONAL SNAPSHOT

FIGURE 8 INCREASING SOPHISTICATION OF CYBERATTACKS NECESSITATING LOG MANAGEMENT FOR EARLY DETECTION OF CYBERATTACKS

FIGURE 9 SERVICES SEGMENT ESTIMATED TO ACCOUNT FOR THE HIGHEST CAGR IN 2021

FIGURE 10 PROFESSIONAL SERVICE SEGMENT EXPECTED TO ACCOUNT FOR THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

FIGURE 11 CLOUD SEGMENT EXPECTED TO ACCOUNT FOR THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

FIGURE 12 SMALL AND MID-SIZED ENTERPRISE SEGMENT EXPECTED TO ACCOUNT FOR THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

FIGURE 13 IT AND ITES SEGMENT EXPECTED TO ACCOUNT FOR THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

FIGURE 14 ASIA PACIFIC TO EMERGE AS THE BEST MARKET FOR INVESTMENTS IN THE NEXT SIX YEARS

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: LOG MANAGEMENT MARKET

FIGURE 16 VALUE CHAIN ANALYSIS: MARKET

FIGURE 17 MARKET: ECOSYSTEM

FIGURE 18 YC/YCC SHIFT: MARKET

FIGURE 19 PATENTS ANALYSIS: MARKET, 2015-2021

FIGURE 20 MARKET: PORTER'S FIVE FORCE ANALYSIS

FIGURE 21 SOLUTIONS SEGMENT TO ACCOUNT FOR A LARGER MARKET SIZE DURING THE FORECAST PERIOD

FIGURE 22 MARKET FOR CLOUD DEPLOYMENT MODE EXPECTED TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

FIGURE 23 SMALL AND MEDIUM-SIZED ENTERPRISES SEGMENT EXPECTED TO RECORD A HIGHER CAGR DURING THE FORECAST PERIOD

FIGURE 24 HEALTHCARE VERTICAL EXPECTED TO RECORD THE HIGHEST GROWTH RATE DURING THE FORECAST PERIOD

FIGURE 25 LOG MANAGEMENT MARKET IN ASIA PACIFIC TO GROW AT THE HIGHEST CAGR FROM 2021 TO 2026

FIGURE 26 NORTH AMERICA: MARKET SNAPSHOT

FIGURE 27 ASIA PACIFIC: MARKET SNAPSHOT

FIGURE 28 LOG MANAGEMENT: MARKET EVALUATION FRAMEWORK

FIGURE 29 MARKET: REVENUE ANALYSIS

FIGURE 30 REVENUE ANALYSIS OF TOP FIVE MARKET PLAYERS, 20162020

FIGURE 31 KEY PLAYERS RANKING, 2021

FIGURE 32 MARKET COMPANY EVALUATION MATRIX, 2021

FIGURE 33 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN MARKET

FIGURE 34 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN THE MARKET

FIGURE 35 LOG MANAGEMENT MARKET STARTUP/SME EVALUATION MATRIX, 2021

FIGURE 36 SPLUNK: COMPANY SNAPSHOT

FIGURE 37 SOLARWINDS: COMPANY SNAPSHOT

FIGURE 38 IBM: COMPANY SNAPSHOT

FIGURE 39 MICRO FOCUS: COMPANY SNAPSHOT

FIGURE 40 RAPID7: COMPANY SNAPSHOT

FIGURE 41 MCAFEE: COMPANY SNAPSHOT

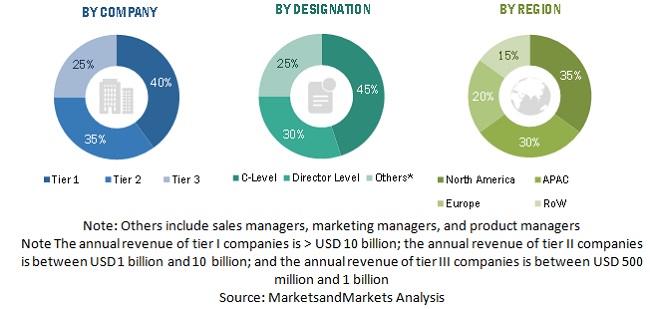

The study involved major activities in estimating the current market size for the Log Management market. An exhaustive secondary research was done to collect information on the Log Management industry. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Different approaches like Top-down, bottom-up were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and sub segments of the Log Management market.

Secondary Research

The market share and revenue of the companies offering log management solutions and services for various verticals were identified the secondary data available through paid and unpaid sources and by analyzing the product portfolio of major companies in the ecosystem and rating them on the basis of their performance and quality. In the secondary research process, various sources were referred to for identifying and collecting information for this study. The secondary sources included annual reports, press releases, and investor presentations of companies; white papers on log management sponsored by companies such as Cribl, betasystems, and Techtarget; journals such as The Ultimate Guide To Logging, Log Management - an overview, Logging and Log Management - 1st Edition - Elsevier; research papers such as a Role of Log Management in Information Security Compliances, and Automated Log management; and certified publications and articles from recognized authors, directories, and databases. Secondary research was mainly used to obtain key information about the industrys supply chain, the total pool of key players, market classification and segmentation according to the industry trends to the bottom-most level, regional markets, and key developments from the market and technology-oriented perspectiveall of which were further validated by primary sources.

Primary Research

In the primary research process, various primary sources from supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as chief executive officers (CEOs), chief information security officers (CISOs), chief technology officers (CTOs), chief operating officers (COOs), vice presidents (VPs), managing directors (MDs), technology and innovation directors, and related key executives from various key companies and organizations operating in the Log Management market.

Following is the breakup of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In this market size estimation approach, we have identified the key companies providing log management solutions, including SolarWinds, IBM, Micro Focus, Rapid7, McAfee, RSA, BlackStratus, and Sumo logic. These companies contribute to more than 50% of the global log management market. After confirming the market share of these companies with industry experts through primary interviews, we estimated their total revenue through annual reports, Securities and Exchange Commission (SEC) filings, and paid databases. The revenues of the business units (BUs) of these companies that offer log management solutions were identified through similar sources. We then estimated the revenue generated through the sale of specific log management solutions via primary research. The collective revenue of vendors offering log management solutions comprised 7580% of the market, which was again confirmed through primary interviews with industry experts. With the assumption that the rest of the market is contributed to by smaller players that are a part of the unorganized market, the market size of organized players (6070%) and unorganized players (3040%) collectively was assumed to be the size of the log management market for the financial year (FY) 2021.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the log management market by offering (solution and services), organization size, deployment mode, vertical, and region

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the markets growth

- To analyze opportunities in the market and provide the competitive landscape of the market

- To forecast the market size of segments with respect to five main regions: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To profile key players and comprehensively analyze their market rankings and core competencies

- To analyze competitive developments, such as mergers & acquisitions, product enhancements, and research and development (R&D) activities, in the market

- To analyze the impact of COVID-19 on the growth of the market

Available Customizations

Along with the market data, MarketsandMarkets offers customizations as per the companys specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakup of the North America Log Management market into countries

- Further breakup of the Europe market into countries

- Further breakup of the APAC market into countries

- Further breakup of the Middle East and Africa market into countries

- Further breakup of the Latin America market into countries

Company Information

- Detailed analysis and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Log Management Market

Log Management Market Report is a market-focused study on the subject for industry stakeholders and has been well received by many of the industry players aiming to determine the potential revenue opportunities and partnerships. We believe the study can be a good start for company to understand and extend their offerings to Log Management Market. The study will enable you to gauge the market potential within each of the product areas; and thereby make an informed decision to strategize partnerships, collaboration and marketing efforts to maximize potential revenues.

Market segmentation of log management systems market.