Lithium-Sulfur Battery Market Size, Share, Statistics, Trends and Industry Growth Analysis by Component (Cathode, Anode, Electrolytes), Type (Liquid, Semi-solid, Solid-state), Capacity (Below 500 mAh, 501 to 1,000 mAh, Above 1,000 mAh), Application (Aerospace, Automotive) and Region - Global Forecast to 2028

Updated on : August 11, 2025

Lithium-sulfur Battery Market Size & Share

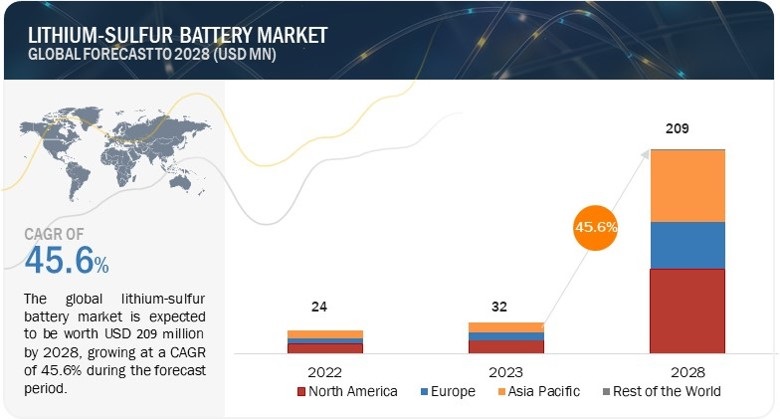

[181 Pages Report] The global lithium-sulfur battery market size is expected to grow from USD 32 million in 2023 to USD 209 million in 2028, growing at a CAGR of 45.6% from 2023 to 2028.

Several factors are driving the growth of the lithium-sulfur battery market. For instance, rising research and development practices to commercialize the product has been undertaken by several manufacturers and technology developers. Also, various research institutes are also undertaking research activities to enhance the safety and performance of the battery. Furthermore, various EV manufacturers are also investing in this technology to evaluate the prototypes in their EVs and further proceed with their commercialization.

Lithium-Sulfur Battery Market Statistics Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Lithium-sulfur Battery Market Trends & Dynamics

DRIVERS: Rising R&D activities to commercialize lithium-sulfur batteries

Numerous manufacturers and research institutes are actively engaged in research and development to enhance the durability and safety of lithium-sulfur batteries. With the global shift towards embracing clean energy solutions, there has been a notable upswing in the R&D endeavors pursued by battery manufacturers to explore diverse battery chemistries. This proactive approach aims to advance battery technologies, ensuring they align with the demands of a cleaner energy landscape while also meeting stringent safety requirements. As theoretically the energy density of the lithium-sulfur batteries is extremely high as compared to other battery chemistries available in the market, various manufacturers are rigorously investing in the commercialization of the battery.

RESTRAINTS: Technical drawbacks of lithium-sulfur battery

Lithium-sulfur (Li-S) batteries hold immense promise for high-energy-density applications, but they also face several technical challenges that need to be overcome for successful implementation. Tackling challenges demands advancements in materials design, electrolyte stability, and electrode architecture, all of which are critical for realizing the full potential of Li-S batteries in the energy storage landscape. The major issues associated with the lithium-sulfur battery are polysulfide shuttle effect, lithium dendrite formation, cathode expansion and failure, and heat during charging.

OPPORTUNITIES: Li-S battery benefits over other technologies

Lithium-sulfur batteries have theoretically higher energy density than other battery chemistries present in the market. As we shift away from fossil fuels, the development of batteries exceeding the inherent limitations of lithium-ion technology becomes imperative. Among the more advanced beyond Li-ion options, lithium-sulfur batteries stand out. In Li-S cells, the conventional metal-rich cathode of Li-ion cells is substituted with economically accessible elemental sulfur. This transition holds the potential for a fivefold increase in capacity for the same weight, a substantial advancement compared to widely used Li-ion cell materials. This utilization of sulfur enables the creation of lightweight cells employing more cost-efficient resources, addressing environmental and societal concerns associated with nickel and cobalt production.

CHALLENGES: Complexities involved in manufacturing Li-S battery

The manufacturing of lithium-sulfur batteries poses significant challenges due to several technical drawbacks inherent to this technology. Li-S batteries offer a high theoretical energy density, making them attractive for various applications, including electric vehicles and portable electronics. However, their practical implementation faces hurdles such as issues related to sulfur cathodes, including poor conductivity, volume expansion, and dissolution of intermediate polysulfides. Moreover, integrating Li-S battery production into existing lithium-ion (Li-ion) manufacturing facilities is complicated, as it requires significant process modifications and optimizations. The transition from Li-ion to Li-S involves addressing unique material interactions and adjusting production techniques to accommodate the distinctive chemistry of sulfur-based systems. As researchers work to overcome these challenges, the manufacturing processes for Li-S batteries remain under development, underscoring the ongoing efforts to harness the full potential of this promising energy storage technology.

Lithium-Sulfur Battery Market Ecosystem

Prominent companies in this market include well invested startups such as PolyPlus Battery Company (US), NexTech Batteries Inc. (US), Li-S Energy Limited (Australia), Lyten, Inc. (US) and Zeta Energy LLC (US). These companies are involved in rigorous research and development activities to develop their prototypes and test them in different applications. Along with these there are several other key companies operating in this market, such as Theion GmbH (Germany), Gelion plc (Australia), and Graphene Batteries AS (Norway).

Lithium-sulfur Battery Market Share

Solid-state type segment is expected to grow at the highest CAGR during the forecast period.

Solid-state lithium-sulfur batteries utilize a solid electrolyte system, opposing the necessity for liquid electrolytes and separators. Anticipated benefits include improved safety, extended lifespan, and the potential for higher energy density as compared to other counterparts. This innovative battery design replaces the traditional liquid electrolyte with a solid-state electrolyte, mitigating the dependence on flammable organic liquid electrolytes and separators, thereby enhancing safety measures. This transformative approach positions solid-state lithium-sulfur batteries as one of the safest and most efficient battery types to be used in various applications in the forecast period.

The market for power applications is projected to grow with substantial CAGR during the forecast period.”

Lithium-sulfur batteries hold significant promise for large-scale energy storage and conversion in the power sector. These batteries offer high energy density and low-cost characteristics, making them a compelling option for stationary electric energy storage. The widespread availability and low cost of sulfur contribute to the potential of lithium-sulfur batteries for large-scale energy storage applications. As the energy storage market continues to expand, the exceptional properties of lithium-sulfur batteries position them as a promising candidate for the next generation of energy storage systems. Further, ongoing research and development efforts are focused on addressing the challenges and advancing the technological readiness of these batteries to enable their widespread application in the power sector.

Lithium-sulfur Battery Market Regional Analysis

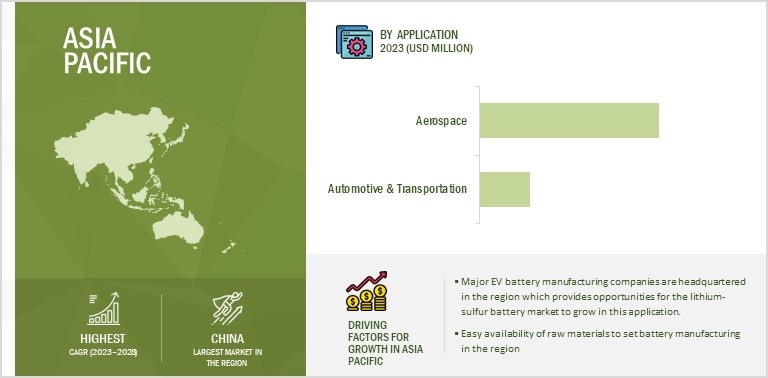

The market in Asia Pacific is projected to grow with substantial CAGR from 2023 to 2028.

Lithium-Sulfur Battery Market Statistics by Region

To know about the assumptions considered for the study, download the pdf brochure

The Asia Pacific market has been segmented into China, Japan, South Korea, India, and the Rest of Asia Pacific. The region is a major battery manufacturing hub with several lithium-ion battery manufacturers. Hence, the high expertise in the battery industry will help the new and emerging battery technologies to flourish in the region. Furthermore, the Asia Pacific region is experiencing a surge in EV adoption and their battery manufacturing. With countries like China and India leading the transition to EVs, the demand for high-performance, energy-dense batteries is soaring. Lithium-sulfur batteries, with their potential for substantial improvements in energy density and range, are well-suited to address this demand in the coming years.

China plays a pivotal role in the lithium-sulfur battery industry , emerging as a key country for several key factor’s reasons. Renowned as a major global hub for lithium battery manufacturing, the country possesses well-established expertise and infrastructure, providing a robust foundation for the development and production of lithium-sulfur batteries. The nation's strategic focus on EV adoption has propelled it to the forefront of the global market, fostering a substantial demand for high-performance batteries. As one of the world's largest EV markets, it presents a prime opportunity for the growth of lithium-sulfur battery technology in the country.

Top Lithium-Sulfur Battery Companies - Key Market Players:

- PolyPlus Battery Company (US),

- NexTech Batteries Inc. (US),

- Li-S Energy Limited (Australia),

- Lyten, Inc. (US),

- Zeta Energy LLC (US),

- Theion GmbH (Germany),

- Gelion plc (Australia),

- Rechargion Energy Private Limited (India),

- Giner Inc. (US),

- Graphene batteries AS (Norway) are among a few key players in lithium-sulfur battery companies.

Lithium-sulfur Battery Market Report Scope :

|

Report Metric |

Details |

| Estimated Market Size | USD 32 million in 2023 |

| Projected Market Size |

USD 209 million in 2028

|

| Growth Rate |

CAGR of 45.6%

|

|

Lithium-sulfur Battery Market Size Available for Years |

2020–2028 |

|

Base Year |

2022 |

|

Lithium-sulfur Battery Market Size Forecast Period |

2023–2028 |

|

Units |

Value (USD Million) |

|

Segments Covered |

|

|

Geographic Regions Covered |

|

|

Companies Covered |

Major Players: PolyPlus Battery Company (US), NexTech Batteries Inc. (US), Li-S Energy Limited (Australia), Lyten, Inc. (US), Theion GmbH (Germany), Gelion plc (Australia), Zeta Energy LLC (US), and Others- (Total 20 players have been covered) |

Lithium-Sulfur Battery Market Highlights

This research report categorizes the lithium-sulfur battery market by component, type, trends capacity, application, and region.

|

Segment |

Subsegment |

|

By Component: |

|

|

By Type: |

|

|

By Capacity: |

|

|

Lithium-sulfur Battery Market Size By Application |

|

|

Lithium-sulfur Battery Market Share, By Region |

|

Recent Developments in Lithium-sulfur Battery Industry

- In May 2023, Stellantis N.V. and Lyten, Inc. revealed that Stellantis Ventures, the corporate venture fund of Stellantis, has made an investment in Lyten to foster the commercialization of Lyten 3D Graphene applications in the mobility sector. This collaboration will encompass the development of LytCell lithium-sulfur EV batteries, lightweight composites, and innovative onboard sensing technologies.

- In April 2023, Li-S Energy, V-TOL Aerospace, and Halocell signed an agreement to develop Australian-made HALE drones, combining battery technology, solar cells, and drone design for stratospheric flights. The prototype drones will employ Li-S Energy's lithium-sulfur batteries, Halocell's perovskite solar cells, and V-TOL's Pegasus aircraft designs to achieve long-endurance capabilities.

- In July 2022, NexTech Batteries Inc., and Mullen Technologies, Inc., a rising player in electric vehicle manufacturing, announced a strategic collaboration.

Frequently Asked Questions (FAQs):

What is the total CAGR expected to be recorded for the lithium-sulfur battery market from 2023 to 2028?

The global lithium-sulfur battery market is expected to record a CAGR of 45.6% from 2023–2028.

What are the driving factors for the lithium-sulfur battery market?

Increasing EV sales globally and rising R&D activities to commercialize lithium-sulfur battery are some of the driving factors for the lithium-sulfur battery market.

Which application will grow at a fast rate in the future?

The consumer electronics application is expected to grow at the highest CAGR during the forecast period. The rising penetration of electronics and consumer wearables globally is anticipated to contribute toward the growth of the lithium-sulfur battery market.

Which are the significant players operating in the lithium-sulfur battery market?

PolyPlus Battery Company (US), NexTech Batteries Inc. (US), Li-S Energy Limited (Australia), Lyten, Inc. (US), and Zeta Energy LLC (US) are among a few top players in the lithium-sulfur battery market.

Which region will grow at a fast rate in the future?

The lithium-sulfur battery market in Asia Pacific is expected to grow at the highest CAGR during the forecast period.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Rising R&D activities to commercialize lithium-sulfur batteries- Abundance of sulfur materials- High energy density than other batteries- Increasing demand in aerospace sector due to high durabilityRESTRAINTS- Technical drawbacks of lithium-sulfur batteriesOPPORTUNITIES- Increasing popularity of EVs and plug-in hybrid electric vehiclesCHALLENGES- Manufacturing complexities associated with lithium-sulfur batteries

- 5.3 VALUE CHAIN ANALYSIS

-

5.4 ECOSYSTEM ANALYSIS

-

5.5 PRICING ANALYSISAVERAGE SELLING PRICE (ASP) TREND OF LITHIUM-ION BATTERIESINDICATIVE PRICING ANALYSIS OF LITHIUM-SULFUR BATTERIESINDICATIVE PRICING ANALYSIS OF LITHIUM-SULFUR BATTERIES OFFERED BY KEY PLAYERSINDICATIVE PRICING ANALYSIS, BY REGION

-

5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

-

5.7 TECHNOLOGY ANALYSISLITHIUM METAL BATTERIESSODIUM-SULFUR BATTERIESSOLID-STATE BATTERIESLITHIUM-SILICON BATTERIES

-

5.8 PORTER’S FIVE FORCE ANALYSISBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESINTENSITY OF COMPETITIVE RIVALRY

-

5.9 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.10 CASE STUDY ANALYSISIMPERIAL COLLEGE LONDON DEVELOPS ZERO-DIMENSIONAL MODEL FOR LI-S BATTERIESCAMBRIDGE UNIVERSITY CONDUCTS R&D TO IMPROVE SPECIFIC ENERGY, SAFETY, AND MASS DENSITY OF LI-S BATTERIESUSC IMPROVES LITHIUM-SULFUR BATTERIES WITH NEW DESIGNS FOR ENERGY STORAGE

- 5.11 TRADE ANALYSIS

-

5.12 PATENT ANALYSIS, 2022–2023

- 5.13 KEY CONFERENCES AND EVENTS, 2023–2024

-

5.14 REGULATORY LANDSCAPE AND STANDARDSREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSSTANDARDS

- 6.1 INTRODUCTION

- 6.2 CATHODE

- 6.3 ANODE

- 6.4 ELECTROLYTE

- 6.5 OTHER COMPONENTS

- 7.1 INTRODUCTION

-

7.2 LIQUIDABILITY TO ACHIEVE SUPERIOR ENERGY DENSITY THAN OTHER LI-ION BATTERIES TO FOSTER SEGMENTAL GROWTH

-

7.3 SEMI-SOLIDINTRODUCTION OF SEMI-SOLID “CUPCAKE” ELECTROLYTE TO FUEL SEGMENTAL GROWTH

-

7.4 SOLIDIMPROVED SAFETY AND EXTENDED LIFESPAN TO ACCELERATE DEMAND

- 8.1 INTRODUCTION

-

8.2 BELOW 500 MAHINCREASING UTILIZATION OF LOW-POWER BATTERIES IN COMPACT DEVICES TO BOOST DEMAND

-

8.3 501 TO 1,000 MAHGROWING POPULARITY OF WEARABLES TO DRIVE MARKET

-

8.4 ABOVE 1,000 MAHEXCEPTIONAL ENERGY DENSITY AND PROLONGED CYCLE LIFE TO FOSTER SEGMENTAL GROWTH

- 9.1 INTRODUCTION

-

9.2 AEROSPACEINCREASING DEPLOYMENT BY AVIATION INDUSTRY TO BOOST DEMAND

-

9.3 AUTOMOTIVE & TRANSPORTATIONRISING INVESTMENT IN COMMERCIALIZING LI-S BATTERIES FOR EV APPLICATIONS TO FOSTER SEGMENTAL GROWTH

-

9.4 CONSUMER ELECTRONICSLONG SHELF LIFE AND ENHANCED SAFETY FEATURES TO ACCELERATE ADOPTION IN CONSUMER ELECTRONICS

-

9.5 POWERGROWING ADOPTION IN POWER SYSTEMS DUE TO HIGH-ENERGY DENSITY AND LOW-COST TO DRIVE MARKET

-

9.6 MEDICALPROLONGED OPERATION WITHOUT FREQUENT CHARGING TO BOOST MARKET

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICAIMPACT OF RECESSION ON MARKET IN NORTH AMERICAUS- Ongoing R&D by key players to commercialize Li-S batteries to drive marketCANADA- Government-led initiatives to encourage adoption of EVs to boost demandMEXICO- Presence of cheap labor and lenient policies to offer lucrative growth opportunities to players

-

10.3 EUROPEIMPACT OF RECESSION ON MARKET IN EUROPEGERMANY- Established automotive sector to contribute to market growthUK- Increasing demand for compact and high-performance power sources in consumer electronics to support market growthFRANCE- Thriving e-aviation sector to fuel market growthREST OF EUROPE

-

10.4 ASIA PACIFICIMPACT OF RECESSION ON MARKET IN ASIA PACIFICCHINA- Presence of developed infrastructure to manufacture lithium batteries to drive marketJAPAN- Increasing focus on achieving carbon-neutral society by 2050 to drive marketINDIA- “Make in India” initiative to accelerate market growthSOUTH KOREA- Evolving landscape of electronic gadgets to offer lucrative growth opportunities to playersREST OF ASIA PACIFIC

-

10.5 ROWIMPACT OF RECESSION ON MARKET IN ROWGCC- Growing investments in green and renewable energy projects to drive marketSOUTH AMERICA- Availability of cheap labor to drive marketREST OF MIDDLE EAST & AFRICA- Abundance of mineral reserves to boost demand

- 11.1 OVERVIEW

- 11.2 KEY STRATEGIES ADOPTED BY MAJOR PLAYERS, 2020–2023

- 11.3 REVENUE ANALYSIS, 2018–2022

- 11.4 MARKET SHARE ANALYSIS, 2022

-

11.5 COMPANY EVALUATION MATRIX, 2022STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT

-

11.6 START-UPS/SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION MATRIX, 2022PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING

-

11.7 COMPETITIVE SCENARIOS AND TRENDSDEALS

-

12.1 KEY PLAYERSPPBC (POLYPLUS BATTERY COMPANY)- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewNEXTECH BATTERIES- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewLYTEN, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewLI-S ENERGY LIMITED- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewZETA ENERGY LLC- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewADEKA CORPORATION- Business overview- Products/Solutions/Services offeredGELION PLC- Business overview- Products/Solutions/Services offered- Recent developmentsHYBRID KINETIC GROUP- Business overview- Products/Solutions/Services offeredLG ENERGY SOLUTION- Business overview- Products/Solutions/Services offeredTHEION GMBH- Business overview- Products/Solutions/Services offered

-

12.2 OTHER PLAYERSCOHERENT CORP.GINER INC.GS YUASA INTERNATIONAL LTD.

-

12.3 STARTUPS/SMES PLAYERSCONAMIXGLOBAL GRAPHENE GROUPGRAPHENE BATTERIES ASMSE SUPPLIES LLCNEI CORPORATIONRECHARGION ENERGY PRIVATE LIMITEDXIAMEN TOB NEW ENERGY TECHNOLOGY CO., LTD.

- 13.1 INTRODUCTION

-

13.2 LITHIUM-ION BATTERY MARKET, BY VOLTAGEINTRODUCTIONLOW- Built-in battery management feature to drive adoption by consumer electronicsMEDIUM- Rising adoption of medium-voltage li-ion batteries in solar energy systems to drive marketHIGH- Enhanced safety features to boost utilization in marine and military applications

- 14.1 INSIGHTS FROM INDUSTRY EXPERTS

- 14.2 DISCUSSION GUIDE

- 14.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.4 CUSTOMIZATION OPTIONS

- 14.5 RELATED REPORTS

- 14.6 AUTHOR DETAILS

- TABLE 1 COMPARISON OF LITHIUM-ION BATTERIES WITH LITHIUM-SULFUR BATTERIES

- TABLE 2 COMPANIES AND THEIR ROLES IN LITHIUM-SULFUR BATTERY ECOSYSTEM

- TABLE 3 INDICATIVE PRICING ANALYSIS TREND OF LITHIUM-SULFUR BATTERIES

- TABLE 4 INDICATIVE PRICING ANALYSIS OF LITHIUM-SULFUR BATTERIES OFFERED BY KEY PLAYERS

- TABLE 5 INDICATIVE PRICING ANALYSIS, BY REGION

- TABLE 6 LITHIUM-SULFUR BATTERY MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 7 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE INDUSTRIES

- TABLE 8 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 9 TOP 20 PATENT OWNERS IN US IN LAST 10 YEARS

- TABLE 10 LITHIUM-SULFUR BATTERY MARKET: LIST OF PATENTS, 2022–2023

- TABLE 11 LITHIUM-SULFUR BATTERY MARKET: LIST OF CONFERENCES AND EVENTS

- TABLE 12 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 STANDARDS FOR LITHIUM-SULFUR BATTERIES

- TABLE 17 LITHIUM-SULFUR BATTERY MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 18 LITHIUM-SULFUR BATTERY MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 19 LITHIUM-SULFUR BATTERY MARKET, BY CAPACITY, 2020–2022 (USD MILLION)

- TABLE 20 LITHIUM-SULFUR BATTERY MARKET, BY CAPACITY, 2023–2028 (USD MILLION)

- TABLE 21 BELOW 500 MAH: LITHIUM-SULFUR BATTERY MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 22 BELOW 500 MAH: LITHIUM-SULFUR BATTERY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 23 501 TO 1,000 MAH: LITHIUM-SULFUR BATTERY MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 24 501 TO 1,000 MAH: LITHIUM-SULFUR BATTERY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 25 ABOVE 1,000 MAH: LITHIUM-SULFUR BATTERY MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 26 ABOVE 1,000 MAH: LITHIUM-SULFUR BATTERY MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 27 ABOVE 1,000 MAH: LITHIUM-SULFUR BATTERY MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 28 ABOVE 1,000 MAH: LITHIUM-SULFUR BATTERY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 29 LITHIUM-SULFUR BATTERY MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 30 LITHIUM-SULFUR BATTERY MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 31 AEROSPACE: LITHIUM-SULFUR BATTERY MARKET, BY CAPACITY, 2020–2022 (USD MILLION)

- TABLE 32 AEROSPACE: LITHIUM-SULFUR BATTERY MARKET, BY CAPACITY, 2023–2028 (USD MILLION)

- TABLE 33 AEROSPACE: LITHIUM-SULFUR BATTERY MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 34 AEROSPACE: LITHIUM-SULFUR BATTERY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 35 AUTOMOTIVE & TRANSPORTATION: LITHIUM-SULFUR BATTERY MARKET, BY CAPACITY, 2020–2022 (USD MILLION)

- TABLE 36 AUTOMOTIVE & TRANSPORTATION: LITHIUM-SULFUR BATTERY MARKET, BY CAPACITY, 2023–2028 (USD MILLION)

- TABLE 37 AUTOMOTIVE & TRANSPORTATION: LITHIUM-SULFUR BATTERY MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 38 AUTOMOTIVE & TRANSPORTATION: LITHIUM-SULFUR BATTERY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 39 CONSUMER ELECTRONICS: LITHIUM-SULFUR BATTERY MARKET, BY CAPACITY, 2023–2028 (USD MILLION)

- TABLE 40 CONSUMER ELECTRONICS: LITHIUM-SULFUR BATTERY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 41 POWER: LITHIUM-SULFUR BATTERY MARKET, BY CAPACITY, 2023–2028 (USD MILLION)

- TABLE 42 POWER: LITHIUM-SULFUR BATTERY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 43 MEDICAL: LITHIUM-SULFUR BATTERY MARKET, BY CAPACITY, 2023–2028 (USD MILLION)

- TABLE 44 MEDICAL: LITHIUM-SULFUR BATTERY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 45 LITHIUM-SULFUR BATTERY MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 46 LITHIUM-SULFUR BATTERY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 47 NORTH AMERICA: LITHIUM-SULFUR BATTERY MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 48 NORTH AMERICA: LITHIUM-SULFUR BATTERY MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 49 NORTH AMERICA: LITHIUM-SULFUR BATTERY MARKET, BY CAPACITY, 2020–2022 (USD MILLION)

- TABLE 50 NORTH AMERICA: LITHIUM-SULFUR BATTERY MARKET, BY CAPACITY, 2023–2028 (USD MILLION)

- TABLE 51 NORTH AMERICA: LITHIUM-SULFUR BATTERY MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 52 NORTH AMERICA: LITHIUM-SULFUR BATTERY MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 53 EUROPE: LITHIUM-SULFUR BATTERY MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 54 EUROPE: LITHIUM-SULFUR BATTERY MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 55 EUROPE: LITHIUM-SULFUR BATTERY MARKET, BY CAPACITY, 2020–2022 (USD MILLION)

- TABLE 56 EUROPE: LITHIUM-SULFUR BATTERY MARKET, BY CAPACITY, 2023–2028 (USD MILLION)

- TABLE 57 EUROPE: LITHIUM-SULFUR BATTERY MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 58 EUROPE: LITHIUM-SULFUR BATTERY MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 59 ASIA PACIFIC: LITHIUM-SULFUR BATTERY MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 60 ASIA PACIFIC: LITHIUM-SULFUR BATTERY MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 61 ASIA PACIFIC: LITHIUM-SULFUR BATTERY MARKET, BY CAPACITY, 2020–2022 (USD MILLION)

- TABLE 62 ASIA PACIFIC: LITHIUM-SULFUR BATTERY MARKET, BY CAPACITY, 2023–2028 (USD MILLION)

- TABLE 63 ASIA PACIFIC: LITHIUM-SULFUR BATTERY MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 64 ASIA PACIFIC: LITHIUM-SULFUR BATTERY MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 65 ROW: LITHIUM-SULFUR BATTERY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 66 ROW: LITHIUM-SULFUR BATTERY MARKET, BY CAPACITY, 2023–2028 (USD MILLION)

- TABLE 67 ROW: LITHIUM-SULFUR BATTERY MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 68 LITHIUM-SULFUR BATTERY MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2020–2023

- TABLE 69 LITHIUM-SULFUR BATTERY MARKET SHARE ANALYSIS, 2022

- TABLE 70 OVERALL COMPANY FOOTPRINT

- TABLE 71 COMPANY APPLICATION FOOTPRINT

- TABLE 72 COMPANY REGION FOOTPRINT

- TABLE 73 LITHIUM-SULFUR BATTERY MARKET: LIST OF KEY START-UPS/SMES

- TABLE 74 LITHIUM-SULFUR BATTERY MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

- TABLE 75 LITHIUM-SULFUR BATTERY MARKET: DEALS, 2020–2023

- TABLE 76 PPBC: COMPANY OVERVIEW

- TABLE 77 PPBC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 78 PPBC: DEALS

- TABLE 79 NEXTECH BATTERIES: COMPANY OVERVIEW

- TABLE 80 NEXTECH BATTERIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 81 NEXTECH BATTERIES: DEALS

- TABLE 82 LYTEN, INC.: COMPANY OVERVIEW

- TABLE 83 LYTEN, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 84 LYTEN, INC.: DEALS

- TABLE 85 LYTEN, INC.: OTHERS

- TABLE 86 LI-S ENERGY LIMITED: BUSINESS OVERVIEW

- TABLE 87 LI-S ENERGY LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 88 LI-S ENERGY LIMITED: DEALS

- TABLE 89 ZETA ENERGY LLC: COMPANY OVERVIEW

- TABLE 90 ZETA ENERGY LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 91 ZETA ENERGY LLC: DEALS

- TABLE 92 ADEKA CORPORATION: COMPANY OVERVIEW

- TABLE 93 ADEKA CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 94 GELION PLC: COMPANY OVERVIEW

- TABLE 95 GELION PLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 96 GELION PLC: DEALS

- TABLE 97 GELION PLC: OTHERS

- TABLE 98 HYBRID KINETIC GROUP: COMPANY OVERVIEW

- TABLE 99 HYBRID KINETIC GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 100 LG ENERGY SOLUTION: COMPANY OVERVIEW

- TABLE 101 LG ENERGY SOLUTION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 102 THEION GMBH: COMPANY OVERVIEW

- TABLE 103 THEION GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 104 LITHIUM-ION BATTERY MARKET, BY VOLTAGE, 2019–2022 (USD BILLION)

- TABLE 105 LITHIUM-ION BATTERY MARKET, BY VOLTAGE, 2023–2032 (USD BILLION)

- FIGURE 1 LITHIUM-SULFUR BATTERY: MARKET SEGMENTATION

- FIGURE 2 LITHIUM-SULFUR BATTERY MARKET: RESEARCH DESIGN

- FIGURE 3 LITHIUM-SULFUR BATTERY MARKET: RESEARCH APPROACH

- FIGURE 4 LITHIUM-SULFUR BATTERY MARKET: BOTTOM-UP APPROACH

- FIGURE 5 LITHIUM-SULFUR BATTERY MARKET: TOP-DOWN APPROACH

- FIGURE 6 LITHIUM-SULFUR BATTERY MARKET: MARKET SIZE ESTIMATION METHODOLOGY

- FIGURE 7 DATA TRIANGULATION

- FIGURE 8 LITHIUM-SULFUR BATTERY MARKET, 2020–2028 (USD MILLION)

- FIGURE 9 SOLID TYPE SEGMENT TO DISPLAY HIGHEST CAGR THROUGHOUT FORECAST PERIOD

- FIGURE 10 ABOVE 1,000 MAH SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2028

- FIGURE 11 CONSUMER ELECTRONICS APPLICATION TO DISPLAY HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 12 ASIA PACIFIC TO REGISTER HIGHEST CAGR IN GLOBAL LITHIUM-SULFUR BATTERY MARKET DURING FORECAST PERIOD

- FIGURE 13 INCREASING INVESTMENTS IN R&D INITIATIVES TO FOSTER MARKET GROWTH

- FIGURE 14 ABOVE 1,000 MAH SEGMENT TO HOLD LARGEST MARKET SHARE IN 2028

- FIGURE 15 AEROSPACE SEGMENT TO SECURE LARGEST MARKET SHARE IN 2028

- FIGURE 16 ABOVE 1,000 MAH SEGMENT AND US TO HOLD LARGEST SHARES OF NORTH AMERICAN LITHIUM-SULFUR BATTERY MARKET IN 2028

- FIGURE 17 CHINA TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 18 GLOBAL LITHIUM-SULFUR BATTERY MARKET DYNAMICS

- FIGURE 19 LITHIUM-SULFUR BATTERY MARKET: IMPACT ANALYSIS OF DRIVERS

- FIGURE 20 LITHIUM-SULFUR BATTERY MARKET: IMPACT ANALYSIS OF RESTRAINTS

- FIGURE 21 GLOBAL DATA ON EV CAR STOCK, 2018–2022

- FIGURE 22 LITHIUM-SULFUR BATTERY MARKET: IMPACT ANALYSIS OF OPPORTUNITIES

- FIGURE 23 LITHIUM-SULFUR BATTERY MARKET: IMPACT ANALYSIS OF CHALLENGES

- FIGURE 24 LITHIUM-SULFUR BATTERY MARKET: VALUE CHAIN ANALYSIS

- FIGURE 25 LITHIUM-SULFUR BATTERY MARKET: ECOSYSTEM ANALYSIS

- FIGURE 26 AVERAGE SELLING PRICE (ASP) TREND OF LITHIUM-ION BATTERY PACKS AND CELLS, 2013–2022

- FIGURE 27 INDICATIVE PRICING ANALYSIS OF LITHIUM-SULFUR BATTERIES OFFERED BY KEY PLAYERS

- FIGURE 28 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

- FIGURE 29 LITHIUM-SULFUR BATTERY MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 30 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE APPLICATIONS

- FIGURE 31 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- FIGURE 32 IMPORT DATA FOR HS CODE 850650-COMPLIANT LITHIUM CELLS AND BATTERIES (EXCL. SPENT), BY KEY COUNTRIES, 2018–2022

- FIGURE 33 EXPORT DATA FOR HS CODE 850650-COMPLIANT LITHIUM CELLS AND BATTERIES (EXCL. SPENT), BY KEY COUNTRIES, 2018–2022

- FIGURE 34 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST 10 YEARS

- FIGURE 35 NUMBER OF PATENTS GRANTED PER YEAR FROM 2013 TO 2022

- FIGURE 36 COMPONENTS USED IN LITHIUM-SULFUR BATTERIES

- FIGURE 37 LITHIUM-SULFUR BATTERY MARKET, BY TYPE

- FIGURE 38 SOLID SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 39 LITHIUM-SULFUR BATTERY MARKET, BY CAPACITY

- FIGURE 40 ABOVE 1,000 MAH SEGMENT TO SECURE LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 41 LITHIUM-SULFUR BATTERY MARKET, BY APPLICATION

- FIGURE 42 AEROSPACE APPLICATION TO CLAIM HIGHEST MARKET SHARE FROM 2023 TO 2028

- FIGURE 43 LITHIUM-SULFUR BATTERY MARKET, BY REGION

- FIGURE 44 CHINA TO EXPAND AT HIGHEST CAGR IN GLOBAL LITHIUM-SULFUR BATTERY MARKET FROM 2023 TO 2028

- FIGURE 45 NORTH AMERICA: LITHIUM-SULFUR BATTERY MARKET SNAPSHOT

- FIGURE 46 US TO DOMINATE MARKET FROM 2023 TO 2028

- FIGURE 47 EUROPE: LITHIUM-SULFUR BATTERY MARKET SNAPSHOT

- FIGURE 48 GERMANY TO DISPLAY HIGHEST CAGR IN EUROPEAN LITHIUM-SULFUR BATTERY MARKET

- FIGURE 49 ASIA PACIFIC: LITHIUM-SULFUR BATTERY MARKET SNAPSHOT

- FIGURE 50 CHINA TO DOMINATE ASIA PACIFIC LITHIUM-SULFUR BATTERY MARKET DURING FORECAST PERIOD

- FIGURE 51 GCC TO RECORD HIGHEST CAGR IN LITHIUM-SULFUR BATTERY MARKET IN ROW DURING FORECAST PERIOD

- FIGURE 52 LITHIUM-SULFUR BATTERY MARKET: REVENUE ANALYSIS OF TWO KEY PLAYERS, 2018–2022

- FIGURE 53 LITHIUM-SULFUR BATTERY MARKET SHARE ANALYSIS, 2022

- FIGURE 54 LITHIUM-SULFUR BATTERY MARKET: COMPANY EVALUATION MATRIX, 2022

- FIGURE 55 LITHIUM-SULFUR BATTERY MARKET: START-UPS/SMES EVALUATION MATRIX, 2022

- FIGURE 56 ADEKA CORPORATION: COMPANY SNAPSHOT

- FIGURE 57 LG ENERGY SOLUTION: COMPANY SNAPSHOT

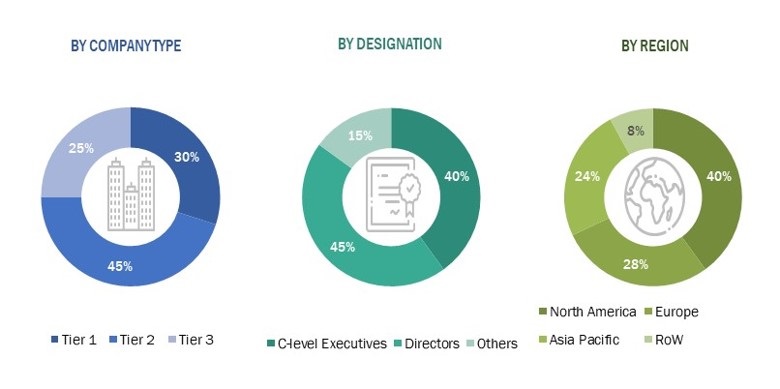

The study involved four major activities in estimating the current size of the lithium-sulfur battery market. Exhaustive secondary research has been done to collect information on the market, peer, and parent markets. The next step has been to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches have been employed to estimate the total market size. After that, market breakdown and data triangulation methods were used to estimate the market size of segments and subsegments. Two sources of information—secondary and primary—have been used to identify and collect information for an extensive technical and commercial study of the lithium-sulfur battery market.

Secondary Research

Secondary sources include company websites, magazines, industry news, associations, and databases (Factiva and Bloomberg). These secondary sources include annual reports, press releases, investor presentations of companies, white papers, certified publications, articles by recognized authors, regulatory bodies, trade directories, and databases.

Primary Research

Primary sources mainly consist of several experts from the core and related industries, along with preferred lithium-sulfur battery technology providers, distributors, alliances, standards, and certification organizations related to various segments of this industry’s value chain.

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts such as Chief Experience Officers (CXOs), Vice Presidents (VPs), and Directors from business development, marketing, product development/innovation teams, and related key executives from lithium-sulfur battery technology providers, such as PolyPlus Battery Company (US), NexTech Batteries Inc. (US), Li-S Energy Limited (Australia), Lyten, Inc. (US) and Zeta Energy LLC (US); research organizations, distributors, industry associations, and key opinion leaders. Following is the breakdown of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the total size of the lithium-sulfur battery market. These methods have also been used extensively to estimate the size of various subsegments in the market. The following research methodology has been used to estimate the market size:

- Major players in the industry have been identified through extensive secondary research.

- The industry’s value chain and market size (in terms of value) have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Top-Down Approach

In the top-down approach, the overall market size has been used to estimate the size of the individual market segments (mentioned in market segmentation) through percentage splits from secondary and primary research. For specific market segments, the size of the most appropriate immediate parent market has been used to implement the top-down approach. The bottom-up approach has also been implemented for data obtained from secondary research to validate the market size of various segments.

Lithium-Sulfur Battery Market: Top-down Approach

Bottom-Up Approach

The bottom-up approach has been used to arrive at the overall size of the lithium-sulfur battery market from the revenues of the key players and their market shares. Calculations based on revenues of key companies identified in the market led to the estimation of their overall market size.

Lithium-Sulfur Battery Market: Bottom-up Approach

Market Definition

Lithium-sulfur (Li-S) battery is a type of rechargeable battery that uses lithium as the active material in the anode and sulfur as the active material in the cathode. Lithium-sulfur batteries offer several potential advantages over traditional lithium-ion batteries, including higher energy density. Sulfur is lightweight and has a high theoretical energy capacity, providing Li-S batteries with higher potential to store more energy per unit of weight compared to other battery technologies. This higher energy density leads to longer-lasting batteries with increased energy storage capacity.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the overall market has been split into several segments and subsegments. The market breakdown and data triangulation procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Key Stakeholders

- Lithium-sulfur battery manufacturers

- Technology providers

- Material providers

- Battery Cell and Battery Pack Manufacturers

- Equipment suppliers

- System integrators

- Electronic device and electric vehicle manufacturers

- Research Institutes and Organizations

- Government Agencies and Regulatory Bodies

Report Objectives

- To define and forecast the lithium-sulfur battery market regarding type, capacity, and application.

- To describe and forecast the lithium-sulfur battery market and its value segments for four regions—North America, Europe, Asia Pacific, and the Rest of the World (RoW), along with their respective countries.

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the market

- To strategically analyze micro-markets concerning individual growth trends, prospects, and contributions to the overall market

- To study the complete value chain of the lithium-sulfur battery

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the market

- To strategically profile key players and comprehensively analyze their market position regarding ranking and core competencies, along with a detailed market competitive landscape.

- To analyze strategic approaches such as agreements, collaborations, and partnerships in the lithium-sulfur battery

- To provide an analysis of the recession impact on the growth of the market and its segments

Available Customizations:

Based on the given market data, MarketsandMarkets offers customizations in the reports according to the client’s specific requirements. The available customization options are as follows:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Lithium-Sulfur Battery Market