Lithium Metal Battery Market by Type (Solid-State, Titanate, Sulfur, Air, Metal-Polymer), Operational Type, Capacity Form, Application and Region (Asia Pacific, North America, Europe, South America & MEA) - Global Forecast to 2030

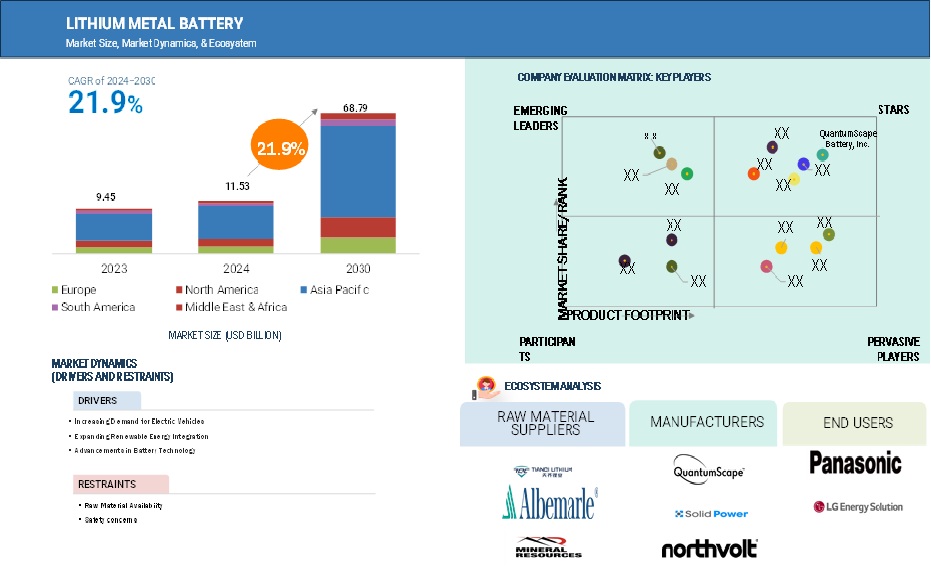

The global lithium metal battery market is projected to grow from 11.53 billion in 2024 to USD 68.79 billion by 2030, at a CAGR of 21.9% from 2024 to 2030. Lithium metal batteries (LMBs), with an exceptionally high energy density, are considered the next big thing in energy storage. Using lithium metal as the anode increases the possibility of LMBs performing about three times better than lithium-ion batteries in energy capacity. This opens up a wide field of application, especially in the EV sector. With increasing worldwide demand for EVs comes the hope that LMBs will provide longer driving ranges with less charging. Besides this, their high energy density creates the potential for compact devices to ensure longer battery life in consumer electronics.

Recognizing these LMB-related challenges, a lot of research effort has been devoted to the elaboration of safe, more stable LMBs. Of these, so-called solid-state LMBs boast nonflammable electrolytes and hence have come to the forefront recently. Then again, advances in charging technology offer faster recharge times, factors identified by both the EV and portable devices segment. Due to such technological obstacles that could be conquered, it is firmly said that in no time will the development of energy storage systems with LMBs and green transportation continue to grow.

Attractive Opportunities in the Lithium Metal Battery Market

To know about the assumptions considered for the study, Request for Free Sample Report

Lithium Metal Battery Market Dynamics

Driver: Increasing demand for electric vehicles

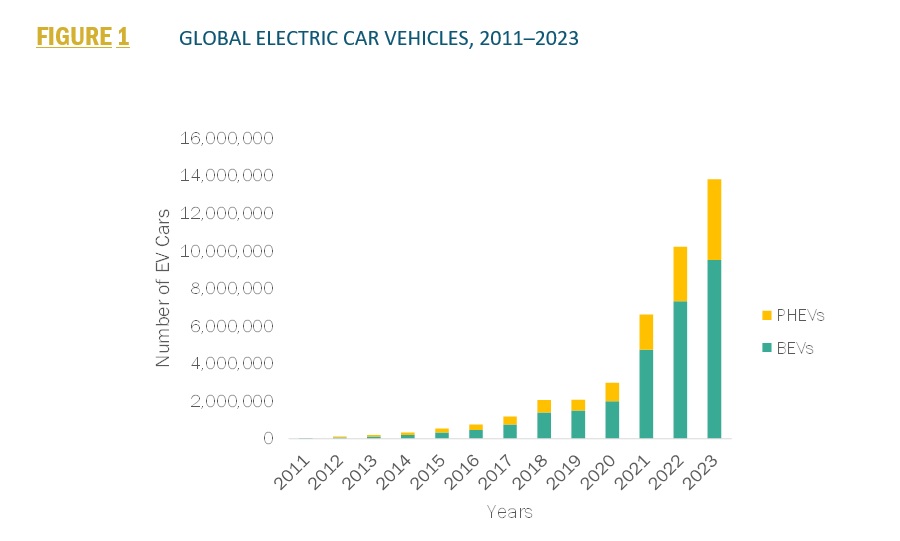

The increasing demand for EVs is one of the major drivers of developments in advanced battery technologies, including lithium metal batteries (LMBs). Consumers and manufacturers desire high energy density for longer driving ranges and fast charging times, combined with durability over thousands of charge-discharge cycles. Thus, performance needs are in accord with the capabilities of these LMBs, which come with superior energy storage and thermal management. Subsidies, tax incentives, and emission regulations on the state's side speed up EV adoption. Some initiatives by major emitters entail the proposed ICE phase-out by the European Union in 2035 and EV mandates imposed by China that create an environment full of innovation. For instance, automakers integrate high-capacity batteries into everything from high-end luxury models to mainstream models to offer affordable, efficient service.

Commercial applications are also expanding; projects include logistics, construction, and public transport transitioning to electric fleets. Delivery vans, buses, and trucks need heavy-duty batteries to bear heavy loads and long operational hours. Lithium metal batteries meet these requirements with their high capacity and quick-charging features. Advanced battery-powered trucks and vans are in the development phase by firms like Tesla and Rivian. Moreover, electrification initiatives in government fleets and carbon-neutral policies drive the demand for robust energy solutions. With growing e-commerce and global decarbonization goals, advanced EV batteries will be required well into the future, making LMBs a key technology in the sustainable transport revolution.

Restraint: Raw material availability

The significant challenge in developing lithium metal batteries in the market is the availability of raw materials, especially lithium metal. That is because lithium demand goes up with multiple battery technologies to strain the supply chains very badly globally, which risks price increases that could raise production costs. Besides these, lithium reserves are heavily headed towards a few countries like Australia, Chile, and China only, which further creates geopolitical uncertainties. It also places the supply chain greatly dependent on a particular region, making it vulnerable to trade restrictions, political instability, and monopolistic practices, further complicating access to this vital resource.

The environmental impact is another critical restraint that the accessibility of lithium metal batteries has to face. Most importantly, its extraction involves key ecological effects: water depletion and disruption of local habits, especially in dry or desert regions where most mining sites are located. These issues drive regulatory scrutiny that could lead to more restrictive mining policies and reduce production. How lithium demand balances with environmental sustainability and the fair management of resources is one of the critical barriers for the industry that may affect the scalability of advanced battery technologies like lithium metal batteries.

Opportunity: Rising demand in aerospace and defense

Lithium metal batteries (LMBs) are lightweight and have high-energy storage capacities that are in high demand in the aerospace and defense industries. In aerospace, weight reduction is critical in maximizing payload and fuel efficiency. Hence, LMB has been the best option for operating drones, satellites, and spacecraft. In fact, as compared to conventional lithium-ion batteries, these LMBs offer higher operation times with better energy-to-weight ratios that provide more performance and longer life. Satellites also benefit from LMBs, which supply energy steadily over long periods to support communications and data collection in space. Likewise, LMBs have been used in UAVs for extended flight duration in surveillance, mapping, and environmental monitoring. The very low self-discharge rate of LMBs means reliability for very long-duration missions, further improving suitability for critical aerospace applications.

In defense, LMBs must be portable, durable, and high-capacity enough to keep the equipment running in field operations. Military communications, sensors, and unmanned vehicles require good-performing batteries in extreme conditions. The compact size and lightweight nature of the LMBs enable soldiers to carry all necessary equipment without any extra burden, providing more operational flexibility. Unmanned ground and aerial systems, very often deployed for surveillance or reconnaissance missions, benefit from the capability of LMBs to provide sustained energy in such demanding environments.

Challenge: High production costs

The high production costs are a significant challenge for the lithium metal batteries (LMBs) market. First, lithium metal is much more expensive than graphite and silicon-based anodes in traditional lithium-ion batteries. Moreover, lithium metal should be produced with highly pure materials, increasing the manufacturing cost. Advanced solid or hybrid electrolytes are required beyond these issues for safety and performance and require state-of-the-art technologies and sophisticated manufacturing processes. These naturally elevate the material co and bring the initial investment against production facilities correspondingly high. LMBs are usually much more expensive than LIBs and, hence, less competitive in cost-sensitive applications, such as budget EVs or mass-market consumer electronics.

Complex methods of manufacturing exacerbate this situation by raising production costs. LMB production necessitates specialized equipment capable of safely and efficiently handling the reactive nature of lithium metal. Advanced machineries such as roll-to-roll solid electrolyte production and precision anode layering increases capital investment. In addition, these processes are less mature than the well-established LIB production lines, which often leads to lower yields and higher wastage. Besides that, the heavy research and development costs needed to enhance safety and cycle life make the production of LMBs on a large scale difficult. This keeps their adoption limited in price-sensitive markets, such as developing regions and consumer electronics, where price is an important consideration. Overcoming these cost barriers will be key for LMBs to realize their potential in various applications.

Lithium Metal Battery Market Ecosystem Analysis

The lithium metal battery ecosystem consists of primary raw material supplying companies that include Tianqi Lithium (China), Albemarle Corporation (US), Ganfeng Lithium (China), and Mineral Resources Limited (Australia). The manufacturers of lithium metal batteries include Quantumscape Battery Inc (US), Solid Power Inc. (US), Sion Power (US), and Northvolt AB (Sweden), collaborate with end-use industries, including LG Energy Solutions, Panasonic, Samsung, CATL, to help the supply chain meet the growing demands of the automotive and electronics sectors.

Another significant advantage is that their energy density is much higher than in lithium-ion and other lithium-metal battery types; this will enable manufacturers to offer lighter, smaller batteries without giving up anything in terms of capacity, a critical factor given the target for extended driving ranges of many EVs. Further, several recent advances in solid-state technology and significant investments from top automakers and leading battery developers have accelerated the pace of commercialization. Therefore, companies like Toyota, QuantumScape, and Solid Power are heavily working on scaling up production and reducing costs so that these batteries become more reachable to mass markets. Combining the above-mentioned superior safety and energy efficiency with heavy industry support, solid-state lithium metal batteries constitute the most promising solution for responding to energy storage challenges in a rapidly electrifying world.

A cylindrical segment to record the highest CAGR during the forecast period

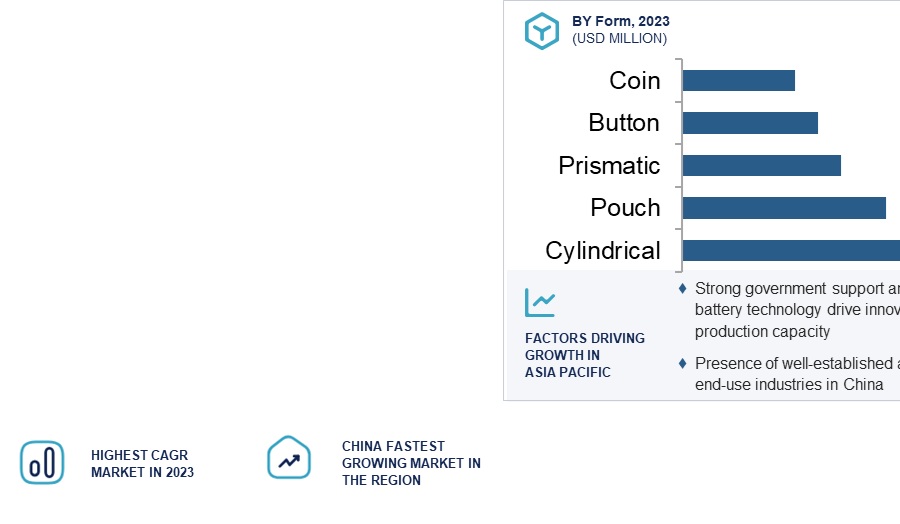

Cylindrical segments dominate the market share in the lithium metal battery market and are expected to dominate over the forecast period. Key advantages, some of which are high energy density that allows the cylindrical cells for applications needing compact yet powerful energy storage. Besides, cylindrical batteries boast long cycle life, hence excellent durability for application in EVs, consumer electronics, and power tools. Relatively lower production cost because of standardized manufacturing processes and established supply chains further bolsters their positions in the market. Therefore, cylindrical batteries find their main applications in fields like automotive and electronics when considering reliability and integrating them easily into existing designs. The pouch segment On the other hand, it is expected to develop notably during the forecast period, mainly due to its flexibility and lightweight design. The pouch cells provide compact form factors for superior space utilization, making them apt for portable electronics, drones, and next-generation EVs. The flexible pouch design allows manufacturers to create custom battery shapes that are in tune with innovative product designs in emerging applications./p>

Asia Pacific to dominate the lithium metal battery market during the forecast period.

The strong industrial ecosystem and strategic investments in many battery technologies have catapulted the Asia-Pacific region to the leading player position within the lithium metal battery market. Several well-known Lithium-ion battery producers from the region, including Panasonic, CATL, and BYD, are currently working to transition to Lithium metal battery production. This is because they can attain economies of scale, have more advanced manufacturing infrastructure, and receive considerable government support. Another aspect is the Asia-Pacific region while bragging about EV manufacture, which includes nations with a huge demand for the battery: China, Japan, and South Korea, which have great demand for improved batteries. These countries strongly provide this platform through immense dispensations across countries on EV manufacturers like Tesla in China, Hyundai in South Korea, and more in Japan manufactured produced by Toyota.

Another critical factor is the region's control of critical raw materials. The Asia-Pacific region has come forward with huge responsibility throughout the global supply chain in lithium, starting from Australia to China in refining and processing. This vertical supply chain integration has been giving a competitive advantage in the low-cost production of lithium metal batteries. Proactive government policies providing subsidies for adopting EVs, renewable energy projects, and incentives offered for battery R&D also help in growth prospects. For instance, the "Made in China 2025" program in China has marked priority on the development of battery technology. The Asia-Pacific region, with control over resources and industrial capability and favorable government policies, will be able to continue its dominance in the lithium metal battery market during the forecast period.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

- QuantumScape Battery, Inc. (US)

- Solid Power Inc. (US)

- Ion Storage Systems (US)

- Sion Power Corporation (US)

- Northvolt AB (Sweden)

- Poly Plus (France)

- BYD Company Ltd. (China)

- Sepion Technologies (US)

- SES AI Corporation (US)

- Bluesolutions AS (Norway)

- Solithor (Belgium)

- Factorial Inc. (US)

Recent Developments in Lithium Metal Battery Market

- In August 2024, Arcadium Lithium bought Li-Metal's lithium metal business. The transaction includes intellectual property, assets, and a pilot manufacturing plant in Ontario, Canada. The acquisition is intended to commercialize Arcadium Lithium's technology for producing lithium metal.

- In December 2021, Ilika (a solid-state battery technology provider) expanded its geographical reach by establishing a Stereax solid-state battery manufacturing facility in Chandlers Ford, UK. The new facility will develop Stereax micro batteries for powering next-generation implanted medical devices and industrial wireless sensors leveraged in the Industrial Internet of Things.

- In May 2021, QuantumScape, a US-based firm that develops solid-state rechargeable lithium metal batteries for electric vehicles, inked an agreement with Volkswagen Group of America, Inc. to determine the location for their joint-venture solid-state battery pilot-line plant by the end of 2021. The pre-pilot line QS-1 will be a commercial production unit for electric vehicle batteries with a capacity of 1 GWh. The same production capacity will be raised to 20 GWh.

- In October 2020, SK Innovation, a South Korean energy and chemical company, signed a partnership deal with Solid Power, a U.S.-based company, to develop all-solid-state batteries. Under the deal, the volume-based energy density for any of the packs, where current energy density is available for such batteries, is at least 33% greater at 930Wh/L.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Frequently Asked Questions (FAQ):

What is a lithium metal battery?

The lithium metal battery is rechargeable and uses lithium metal for an anode. This greatly improves energy density compared to ordinary lithium-ion batteries. The lithium metal anode allows for compact, lightweight designs with long operational lifespans, which is ideal for electric vehicles, consumer electronics, and aerospace applications. Unlike lithium-ion batteries using graphite or silicon-based anodes, LMBs provide better capacity and performance. Nevertheless, some of their challenges are that dendrite formation could give way to safety issues and that their cycle life is not good. Advances in solid-state electrolytes tend to overcome such challenges for improved safety and reliability. As research proceeds, LMBs will undoubtedly assume a vital role in energy storage performance.

What are the different types of lithium metal batteries?

Lithium metal batteries are classified into two types: Solid-state lithium metal batteries, lithium titanate batteries, lithium-sulfur batteries, lithium-air batteries, and lithium-metal-polymer batteries.

Who are the key players in the global lithium metal battery market?

QuantumScape Battery, Inc. (US), Solid Power Inc. (US), Ion Storage Systems (US), Sion Power Corporation (US), Northvolt AB (Sweden), Poly Plus (France), BYD Company Ltd. (China), Sepion Technologies (US), SES AI Corporation (US), Bluesolutions AS (Norway), Solithor (Belgium), and Factorial Inc. (US), and others are the key players.

What do market players adopt the growth strategies?

Market leaders adopt strategies such as new collaborations, expansions, and partnerships to increase their competitiveness. This helps them stay firm and increase their influence in the fluctuating lithium metal battery market.

What is the key driver of the lithium metal battery market?

The primary driver of the lithium metal battery market is the increasing number of electric vehicles.

Which region is projected to exhibit the highest CAGR in the lithium metal battery market during the forecast period?

Asia Pacific is expected to exhibit the highest CAGR during the forecast period.

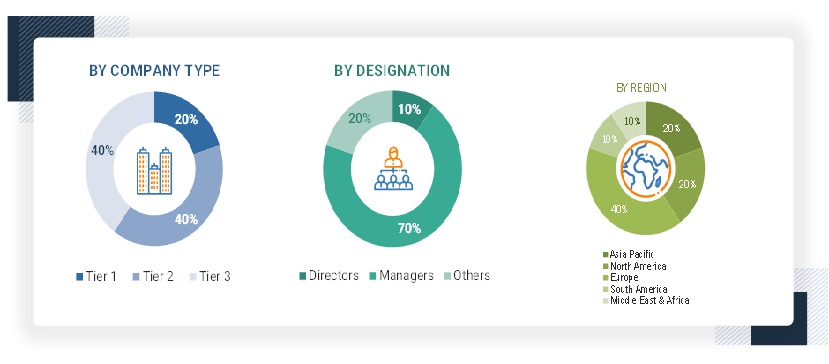

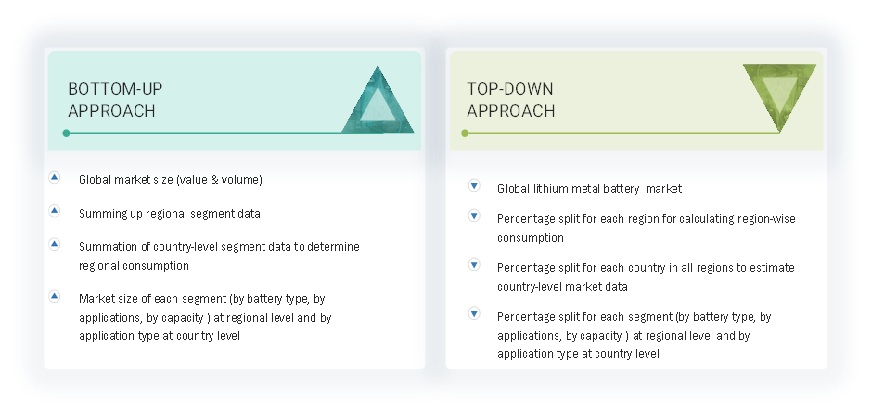

The research methodology used in estimating the current size of the lithium metal battery market included four significant activities. Extensive secondary research was performed to acquire detailed information about the market, peer markets, and parent markets. These findings, assumptions, and metrics were verified through primary research with experts from the demand side of the lithium metal battery value chain. Both top-down and bottom-up approaches were used to estimate the total market size. The market sizes of various segments and subsegments were estimated finally with the help of complete market segmentation and data triangulation techniques.

Secondary Research

The research methodology for estimating and forecasting the lithium metal battery market begins with gathering data on key vendors' revenues through secondary research. The secondary research process involves consulting various secondary sources, including Hoovers, Bloomberg BusinessWeek, Factiva, the World Bank, and industry journals. These secondary sources encompass annual reports, press releases, investor presentations, white papers, certified publications, articles from recognized authors, regulatory notifications, trade directories, and databases. Also, vendor offerings are taken into consideration to inform market segmentation.

Primary Research

The lithium metal battery market comprises several stakeholders in the supply chain, such as raw material suppliers, battery manufacturers, distributors, contractors/sub-contractors, infrastructure OEM and system integrators, and end users. The development of EV, technology, telecommunications, finance and banking, retail and e-commerce, healthcare, government & public sector, and education defines the demand side of this market. Interviews were conducted with various primary sources on both the supply and demand sides of the market to gather qualitative and quantitative data. Following is the breakdown of the primary respondents:

The breakup of Primary Research:

To know about the assumptions considered for the study, download the pdf brochure

Lithium Metal Battery Market Size Estimation

Top-down and bottom-up approaches were used to estimate and validate the size of the lithium metal battery market. These methods were used to determine the market size of various segments. The research methodology used for the market size estimation is as follows:

- Extensive primary and secondary research was done to identify the key players.

- The value chain and market size of the lithium metal battery market, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were collected through secondary sources and verified through primary sources.

- All possible parameters that affect the market were covered in this research study and are viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- This research includes the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from key leaders, such as CEOs, directors, and marketing executives.

Lithium Metal Battery Market Size: Bottom-Up & Top-Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After estimating the overall market size using the above estimation, the market was split into various segments and subsegments. Data triangulation, market breakup techniques, and the market engineering process were used to reach the exact market analysis data for each segment and subsegment. Research Methodology The research methodology used to estimate and forecast the global market size began by first aggregating data and information from the country and different levels.

Market Definition

Lithium metal batteries are advanced energy storage devices using metallic lithium as the anode, offering superior energy density, lightweight design, and efficiency compared to lithium-ion batteries. They are ideal for applications like electric vehicles, aerospace, and renewable energy storage due to their high specific capacity. Unlike lithium-ion batteries, which use intercalation chemistry, lithium metal batteries achieve higher energy density through their metallic lithium anode, though challenges like dendrite formation hinder their commercialization. The market is proliferating, fueled by advancements in materials science, rising demand for high-performance batteries, and industry innovations to enhance safety and manufacturability.

Key Stakeholder

- Battery Manufacturers and Coating Material Manufacturers

- Electric Vehicle (EV) Manufacturers

- Material Suppliers

- Research and Development Institutions

- Energy Storage Providers

- Regulatory Bodies

- NGOs, Governments, Investment Banks, Venture Capitalists, and Private Equity Firms

Report Objectives:

- To define, describe, and forecast the size of the global lithium metal battery market in terms of value and volume.

- To provide detailed information regarding the key factors, such as drivers, restraints, opportunities, and industry-specific challenges, influencing the growth of the lithium metal battery market

- To analyze and forecast the size of various segments (insulation, material, and application) of the lithium metal battery market based on four major regions—North America, Europe, Asia Pacific, South America, and the Middle East & Africa—along with key countries in each region.

- To analyze recent developments and competitive strategies, such as expansions, new product developments, partnerships, and acquisitions, to draw the market's competitive landscape.

- To strategically profile the key players in the market and comprehensively analyze their core competencies.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to client-specific needs.

The following customization options are available for the report:

- Additional country-level analysis of the Lithium Metal Battery Market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company in the Lithium Metal Battery Market

Growth opportunities and latent adjacency in Lithium Metal Battery Market