Liquid Paints & Coatings Market by Resin Type (Acrylic, Alkyd, Epoxy, Polyurethane, Fluoropolymer, Vinyl, Polyester), Technology (Waterborne Coatings, Solvent-borne Coatings), End Use (Architectural, Industrial), & Region - Global Forecast to 2030

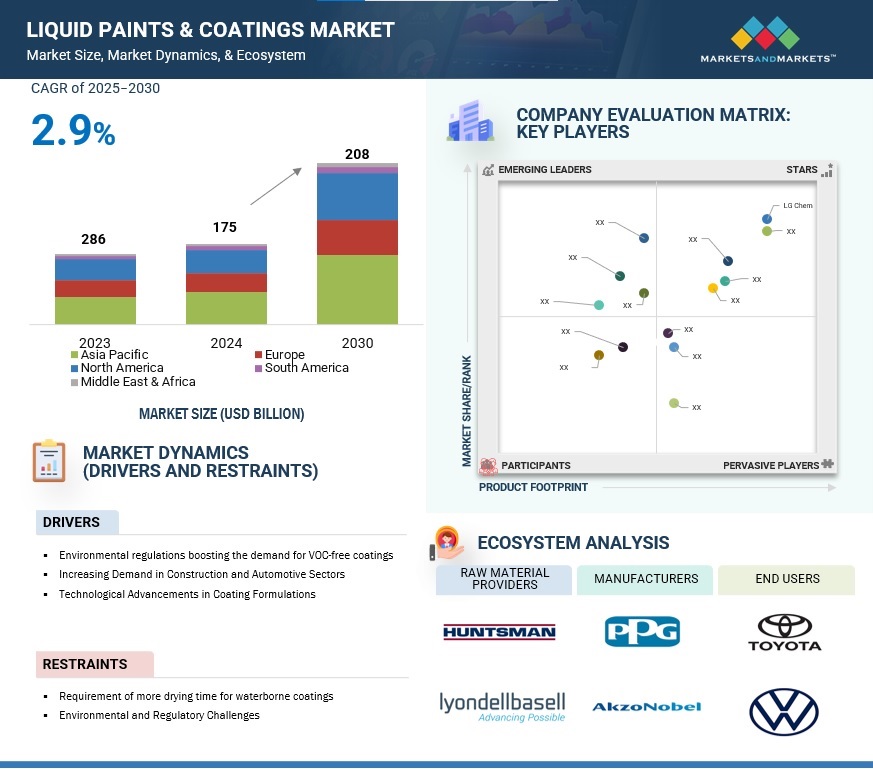

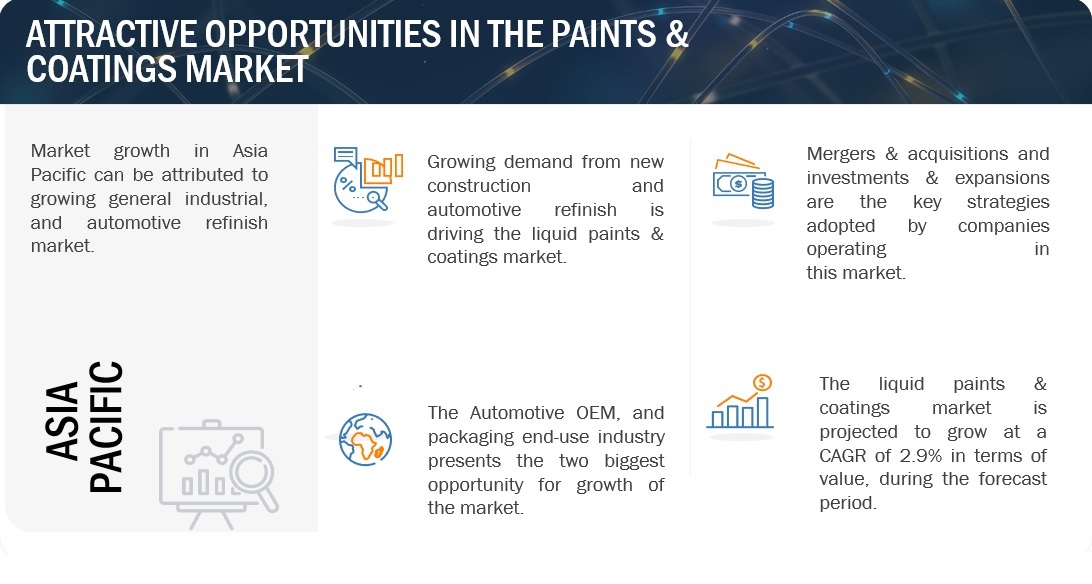

The liquid paints & coatings market is projected to grow from USD 175 billion in 2024 to USD 208 billion by 2030, at a CAGR of 2.9% between 2025 and 2030. The worldwide paints & coatings market has been expanding steadily, and this development pattern is anticipated to continue. Important industries include architecture, car manufacture, automotive repair, and construction are the main drivers of demand. The paint & coatings market is dominated by China and India. The major markets are in Asia Pacific, followed by North America and Europe. The robust economic performance and significant investments made in a range of industries in the Asia Pacific region are credited with this expansion. The manufacturing sector has prospered due to the global economic recovery, and the need for new infrastructure and building has increased due to rising urbanization.

Attractive Opportunities in the Liquid Paints & Coatings Market

Source: Interviews with Experts, Secondary Sources, and MarketsandMarkets Analysis

Source: Interviews with Experts, Secondary Sources, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, Request for Free Sample Report

Source: Expert Interviews, Secondary Sources, and MarketsandMarkets Analysis

Source: Expert Interviews, Secondary Sources, and MarketsandMarkets Analysis

Liquid Paints & Coatings Market Dynamics

Driver: Environmental regulations boosting the demand for VOC-free coatings

The increasing demand for environment-friendly characteristics has been one of the most important trends observed in the coatings industry for the last 10 years, largely influenced by stringent EU regulations regarding the reduction of volatile organic compounds (VOC) emissions in the coating life cycle. This has shifted the demand from solventborne coatings to environment-friendly products such as waterborne and powder paints and coatings.

New rules and regulations such as the Eco-product Certification Scheme (ECS) are set by the European Commission and other federal government agencies. These regulations ensure a green and sustainable environment with minimum or zero harmful VOC emissions. Also, the regulations on lead control in households and paints & coatings were implemented in 2016 after the Quality Council of India (QCI), Pollution Control Board Authorities, and the National Referral Centre for Lead Projects in India (NRCLPI) strongly recommended to the Government of India (GOI) to fix lead content below 90 ppm for all decorative and household paints. These regulations encourage liquid paints & coatings manufacturers to invest in bio-based raw materials for liquid paints & coatings, making the final products eco-friendlier. In addition, government regulations in the US and Western Europe, especially concerning air pollution, will continue to drive the adoption of new, low-polluting coating technologies.

Restraints: Requirement of more drying time for waterborne coatings

The drying and curing of waterborne coatings require more time than that of solventborne coatings. In addition, waterborne coatings have excellent flow properties that change with humidity, affecting the coating application. During high humidity, water does not easily evaporate, resulting in poor cure and a decrease in performance. Waterborne coatings are also sensitive to freezing conditions. Many waterborne coatings are not usable after freezing.

Opportunity: Increasing applications of fluoropolymers in the building & construction industry

In the building & construction industry, fluoropolymers such as polyvinylidene difluoride (PVDF) are used in both industrial as well as architectural coatings. PVDF is used in architectural applications, where both excellent appearance and substrate protection must be maintained for a long period. PVDF is the most preferred fluoropolymer since it has enough solvency in ester and ketone solvents, and the same can be formulated into solvent dispersion coatings.

PVDF-based coatings can be applied by spray coating or conventional coil techniques and baked at temperatures from 230°C to 250°C. They have high dielectric strength, excellent resistance to weathering, and the ability to self-extinguish. Moreover, PVDF is stable to sunlight and other sources of ultraviolet radiation. It is widely used as a base resin for long-lasting exterior coatings. PVDF coatings also offer long-lasting performance in architectural coating applications and are used by licensed industrial paint manufacturers in formulating hard, long-lasting coatings.

Challenges: Stringent regulatory policy

With the increasing number of regulatory policies adopted by various governments, paints & coatings producers must improve their processes to comply with the new policies constantly. Products that fail to meet the legal requirements are not allowed in countries that have strict environmental regulations, especially in Western Europe and North America.

Unfortunately, some legislators continue to limit emission values based only on the concentration of VOC in exhaust gases. This can lead to the approval for high mass emissions from processes, which require high airflows as against low mass emissions that need only very low airflows. The concentration approach also ignores the reduced atmospheric emissions when low-VOC coatings are used.

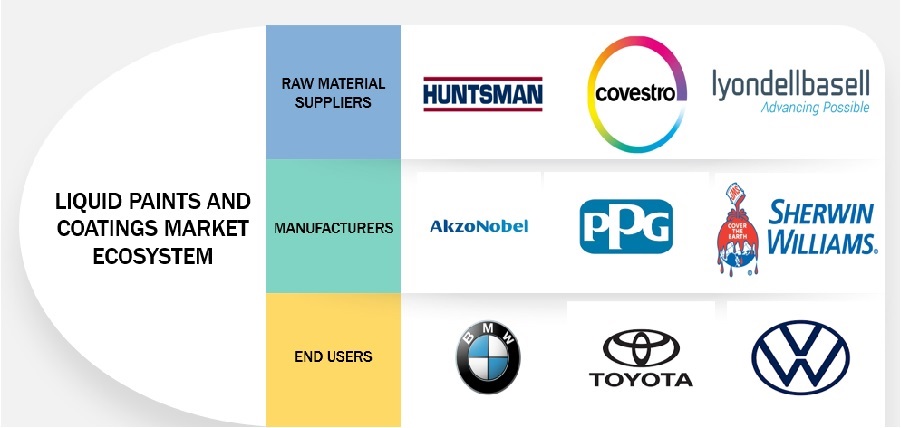

Liquid Paints & Coatings Market Ecosystem

Prominent companies in this market include well established, financially stable manufacturers of liquid paints & coatings. These companies have been operating in the market for several years and possess a diversified product portfolio and strong global sales and marketing networks. Prominent companies in the market include Akzo Nobel N.V. (Netherlands), PPG Industries Inc. (US), The Sherwin-Williams Company (US), Axalta Coating Systems LLC. (US), Jotun A/S (Norway).

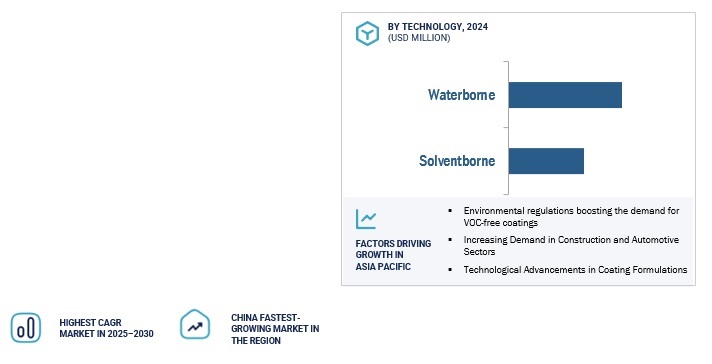

Growing share of waterborne coatings to support eco-friendly coatings

The increasing need for eco-friendly products is driving a substantial growth in the market for waterborne coatings. The decorative coatings market is the main industry witnessing the trend of waterborne paints and coatings replacing solventborne paints and coatings. Manufacturers are making paint in a greener manner as a result of growing public awareness of the negative effects of volatile organic compounds (VOCs). Waterborne coatings are predicted to continue to grow in market share within the paints and coatings industry.

The necessity for environmentally friendly goods has led to a demand for environmentally friendly raw materials, especially for waterborne resins like epoxy, acrylic, and alkyd. For example, improvements in waterborne alkyd technology have made it possible to produce alkyd resins with almost no volatile organic compounds (VOCs) and comparable performance to solventborne alkyd resins.

Acrylic Resins is projected to be the fastest growing resin type of liquid paints & coatings market.

Acrylic resins' remarkable qualities, such as their superior hardness, durability, adherence to a variety of substrates, gloss, weather resistance, and chemical resistance, have made them the one of the fastest-growing segment in the coatings business. These resins are widely utilized in architectural and automobile coatings, especially in developing nations like China and India where the need for premium paints has been fueled by rising infrastructure spending and rising living standards. One major factor predicted to propel infrastructure growth in Asia and increase demand for acrylic resins in the coatings sector is China's Belt and Road Initiative, a huge infrastructure development initiative that spans Asia, Africa, the Middle East, and Europe.

Asia Pacific leads the liquid paints & coatings market with global growth trends and regional shifts

The paint and coatings industry is changing quickly, and the largest market worldwide is currently in the Asia Pacific region, followed by North America and Europe. The region's strong economic growth and significant investments in industries like building, architecture, automotive, and industry are major factors contributing to this expansion.

The demand for new residential and infrastructural projects has been fueled by expanding urbanization, and the global economic recovery has greatly boosted manufacturing. The requirement for paints and coatings has grown even more as a result of the construction and repair of smart cities, water and sewage systems, highways, and bridges.

On the other hand, the market has grown in industrialized nations including the US, Germany, the UK, France, and Japan. As a result, businesses are concentrating on areas with consistent demand to make up for falling revenues in their established sectors.

In developed regions, manufacturers have several obstacles like unstable economies, erratic prices for raw materials, unstable exchange rates, slow economic expansion, and disparities in supply and demand. In order to tackle these problems, businesses are expanding into emerging markets, investing in R&D, and diversifying their product offerings in order to meet the increasing demand that exists throughout the world.

In order to prosper in a constantly changing global market, players in the sector must strike a balance between innovation, sustainability, and strategic relationships as it adjusts to these changes.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

Akzo Nobel N.V.(Netherlands), PPG Industries Inc.(US), The Sherwin-Williams Company.(US), Jotun A/S(Norway), Axalta Coating Systems(US) are the key players in the global liquid paints & coatings market.

Axalta Coating Systems Ltd. is a diversified coatings company. It majorly operates through Performance Coatings and Transportation Coatings segments. The Performance Coatings segment is further sub segmented into refinishing and industrial segments. In contrast, the transportation segment is sub segmented into light and commercial vehicles. The company manufactures liquid and powder coatings used for various applications by automotive OEMs in automotive refinish, transportation, general industrial, and architectural & decorative coatings.

Recent Developments in Liquid Paints & Coatings Market

- In May 2021, Axalta completed the expansion of its waterborne coatings plant in Jiading, Shanghai, China. The expanded site is designed to meet the rising demand for sustainable coating solutions for automotive, commercial vehicle, and industrial markets in China and the Asia Pacific region.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Frequently Asked Questions (FAQs):

What are the growth driving factors of the paints & coatings market?

Application growth in the automotive OEM industry.

What is the major resin type?

The major resin type of paints & coatings is acrylic resin.

What are the major end-use industries of paints & coatings?

The major end-use industries of paints & coatings are architectural, general industrial, new construction, and automotive OEM.

Who are the major manufacturers?

Akzo Nobel N.V. (Netherlands), PPG Industries Inc. (US), The Sherwin-Williams Company (US), Axalta Coating Systems LLC. (US), and Jotun A/S (Norway) are some of the leading players operating in the global paints & coatings market.

Which is the largest region in the paints & coatings market?

Asia Pacific is the largest region in the paints & coatings market.

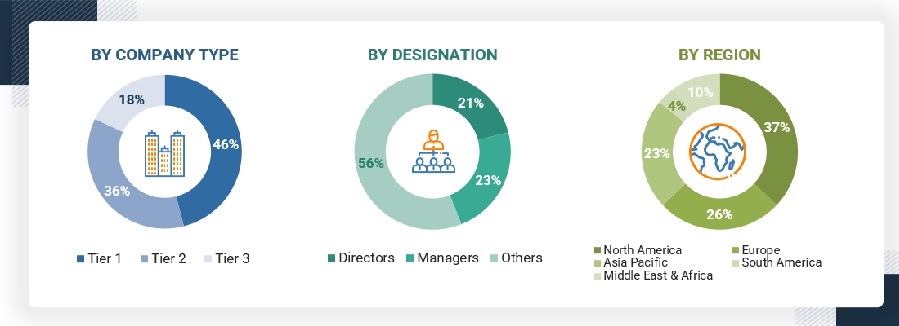

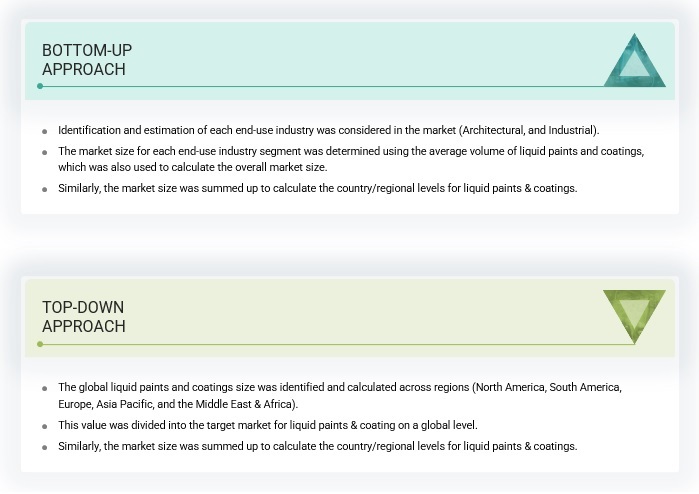

The study involved four major activities in order to estimate the current size of the liquid paints & coatings market. Exhaustive secondary research was conducted to gather information on the market. The next step was to conduct primary research to validate these findings, assumptions, and sizing with the industry experts across the value chain. Both top-down and bottom-up approaches were used to estimate the total market size. The market size of segments and subsegments was then estimated using market breakdown and data triangulation.

Secondary Research

Secondary sources include annual reports of companies, press releases, investor presentations, white papers, articles by recognized authors, and databases, such as D&B, Bloomberg, Chemical Weekly, and Factiva; and publications and databases from associations.

Primary Research

Extensive primary research was carried out after gathering information about liquid paints & coatings market through secondary research. In the primary research process, experts from the supply and demand sides have been interviewed to obtain qualitative and quantitative information and validate the data for this report. Questionnaires, emails, and telephonic interviews were used to collect primary data. Primary sources from the supply side include industry experts, such as chief executive officers (CEOs), vice presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the liquid paints & coatings market. Primary interviews were conducted to elicit information such as market statistics, revenue data collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also assisted in comprehending the various trends associated to resin type, technology, end-use industry, and region.

The breakup of Primary Research:

To know about the assumptions considered for the study, download the pdf brochure

LIQUID PIANTS and COATINGS MANUFACTURERS

|

Liquid Paints and Coatings Manufaturers |

|

|

The Sherwin-Williams Company |

Sales Manager |

|

PPG Industries, Inc. |

Project Manager |

|

AkzoNobel N. V. |

Individual Industry Expert |

|

RPM International, Inc. |

Manager |

Liquid Paints and Coatings Market Size Estimation

The following information is part of the research methodology used to estimate the size of the liquid paints & coatings market. The market sizing of the liquid paints & coatings market was undertaken from the demand side. The market size was estimated based on market size for liquid paints & coatings in various technology.

Global Liquid Paints and Coatings Market Size: Bottom-Up Approach and Top-Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size, the market has been split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all segments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

Liquid paints & coatings are generally applied to surfaces of stationary structures, such as bridges, buildings, and roads, or parts of stationary structures that include facades, pavements, and prefabricated materials. These coatings can be used for protection and esthetic purposes.

Key Stakeholder

- End User

- Raw Material Suppliers

- Senior Management

- Procurement Department

Report Objectives:

- To define, describe, segment, and forecast the size of the liquid paints & coatings market based on width, type, end – use industry, and region.

- To forecast the market size of segments with respect to various regions, including North America, Europe, Asia Pacific, South America, Middle East & Africa, along with major countries in each region

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the UV tapes market

- To analyze technological advancements and product launches in the market

- To strategically analyze micromarkets, with respect to their growth trends, prospects, and their contribution to the market

- To identify financial positions, key products, and key developments of leading companies in the market

- To provide a detailed competitive landscape of the market, along with market share analysis

- To provide a comprehensive analysis of business and corporate strategies adopted by the key players in the market

- To strategically profile key players in the market and comprehensively analyze their core competencies

Available Customizations:

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of the liquid paints & coatings market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company in the liquid paints & coatings market

Growth opportunities and latent adjacency in Liquid Paints & Coatings Market