Lighting Control System Market by Installation Type (New and Retrofit), Offering (Hardware, Software, and Services), End-use Application (Indoor and Outdoor), Communication Protocol, and Geography - Global Forecast to 2025-2035

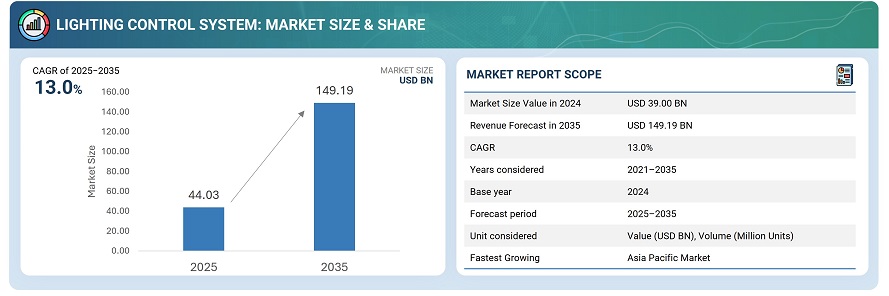

The global lighting control systems market was valued at USD 39.00 billion in 2024 and is estimated to reach USD 149.19 billion by 2035, growing at a CAGR of 13.0% between 2025 and 2035.

The lighting control system market is witnessing strong momentum driven by rapid smart building adoption, energy efficiency mandates, and advancements in IoT-enabled and wireless communication protocols. Increasing integration with HVAC, security, and occupancy systems enhances centralized management and reduces operational costs. The shift toward cloud-based lighting management, adaptive daylight solutions, and intelligent sensors continues to redefine user experience, sustainability, and connected infrastructure efficiency across residential, commercial, and industrial environments.

Lighting control systems are intelligent networks of luminaires, sensors, control devices, and software that manage lighting levels, color, and operation based on factors such as occupancy, daylight availability, or time schedules. These systems enable automated or manual lighting adjustment for enhanced comfort, energy efficiency, and visual performance. Modern lighting control systems often integrate wireless communication, IoT connectivity, and cloud-based analytics for centralized monitoring and adaptive illumination management.

Market by Application

Indoor

Indoor lighting control systems dominate the market owing to widespread use across residential, commercial, and industrial buildings. The increasing deployment of intelligent dimming, occupancy-based controls, and daylight harvesting solutions enhances user comfort and energy efficiency. Integration with building management systems (BMS) and IoT platforms enables centralized control and predictive maintenance. The growth of smart offices, green buildings, and adaptive lighting in educational and healthcare facilities continues to propel demand for advanced indoor lighting controls.

Outdoor

Outdoor lighting control systems are witnessing faster growth, driven by smart city initiatives, roadway modernization, and the adoption of connected streetlights. Wireless and sensor-based lighting networks enable adaptive brightness and remote monitoring, improving safety and reducing energy consumption. Municipalities are increasingly integrating outdoor lighting with environmental and traffic management systems. The expansion of public infrastructure, parks, and transportation hubs further accelerates the adoption of intelligent outdoor lighting solutions worldwide.

Market by Communication Protocol

Wired

Wired lighting control systems currently hold the larger market share, primarily due to their high reliability, low latency, and suitability for large-scale commercial and industrial installations. Protocols such as DALI, KNX, and Ethernet-based systems remain preferred for complex building infrastructures requiring stable connectivity. Despite the growing shift toward wireless systems, wired solutions continue to dominate in legacy buildings, data centers, and critical facilities where signal stability and long-term scalability are essential.

Wireless

Wireless lighting control systems are expanding rapidly, driven by the proliferation of IoT-enabled devices, retrofit installations, and smart home ecosystems. Technologies such as Zigbee, Bluetooth Mesh, Wi-Fi, and Thread are enabling flexible, cost-effective deployments with minimal wiring. Their ease of integration with mobile apps and cloud platforms enhances user convenience and analytics capabilities. As energy efficiency mandates and smart infrastructure initiatives grow, wireless systems are expected to record the highest growth rate during the forecast period.

Market by Geography

Geographically, the lighting control system market is witnessing strong growth across North America, Europe, the Asia Pacific, and the Middle East & Africa. Asia Pacific leads the market, driven by rapid urbanization, large-scale smart city initiatives, and the expansion of commercial and industrial infrastructure. North America follows, supported by stringent energy efficiency mandates, retrofit demand, and widespread adoption of IoT-based lighting in smart buildings. Europe shows steady growth due to strict sustainability regulations, green building programs, and human-centric lighting adoption. Meanwhile, the Middle East & Africa region is emerging as a high-potential market with ongoing infrastructure investments, hospitality expansion, and growing preference for energy-optimized lighting solutions.

Market Dynamics

Driver: Growing demand for energy efficiency and smart building integration

Lighting control systems are increasingly adopted as key enablers of energy-efficient infrastructure, driven by global regulations promoting sustainability and reduced power consumption. These systems enable intelligent lighting through occupancy sensors, daylight harvesting, and automated dimming, ensuring optimal illumination while minimizing energy waste. The integration of lighting controls with building management systems (BMS), HVAC, and IoT devices enhances operational efficiency, driving widespread deployment across commercial buildings, industrial spaces, and residential complexes.

Restraint: High installation and integration costs in retrofitting projects

Despite strong market potential, the high cost of installation, programming, and integration with legacy systems remains a major barrier. Retrofitting older buildings with smart lighting controls requires additional infrastructure investment, including rewiring, sensor calibration, and gateway configuration. Many end users, especially in developing economies, continue to rely on conventional switches or standalone luminaires. These cost-related limitations slow down the pace of adoption in small and medium commercial facilities and residential projects.

Opportunity: Expansion of IoT and wireless communication technologies

Advancements in IoT-enabled lighting controls, wireless connectivity, and cloud-based management platforms are unlocking new growth opportunities. Emerging protocols such as Bluetooth Mesh, Zigbee, and Thread simplify installation and enable seamless integration with smart home ecosystems. Cloud analytics and AI-based lighting optimization allow for remote monitoring, predictive maintenance, and adaptive brightness control. These innovations are encouraging adoption across new construction and retrofit applications, particularly in smart cities and connected workplaces.

Challenge: Interoperability and standardization issues among control systems

The lack of universal communication standards and interoperability among different lighting control platforms remains a key challenge. Vendors often use proprietary protocols, making integration with third-party devices complex and costly. This fragmentation limits scalability and deters end users from adopting hybrid systems. While initiatives like the DALI-2 and Matter protocols aim to establish compatibility frameworks, achieving uniform standards across global markets continues to be a long-term technical and industry hurdle.

Future Outlook

Between 2025 and 2035, the lighting control system market is expected to witness significant expansion as smart infrastructure and energy-efficient technologies become integral to modern construction. Advancements in IoT, wireless communication, and AI-driven automation will transform lighting systems from standalone setups into adaptive, data-driven solutions. Governments’ increasing focus on sustainable building codes and green certifications will further accelerate adoption. As the market evolves, intelligent lighting controls will play a pivotal role in optimizing energy use, enhancing occupant comfort, and enabling smarter, connected environments across commercial, industrial, and residential sectors.

Key Market Players

The top lighting control system companies are Signify N.V. (Netherlands), Acuity Brands, Inc. (US), Legrand S.A. (France), Lutron Electronics Co., Inc. (US), and Schneider Electric SE (France).

Key Questions addressed in this report:

- What is the current size of the lighting control system market?

- Who are the winners in the lighting control system market?

- What are the factors driving the growth of the market?

- What are the factors impeding the growth of the market?

- What are the strategies adopted by market players to strengthen their position in the market?

- What are the major applications that are expected to provide opportunities for the adoption of lighting control systems?

- Which communication protocol is expected to dominate the lighting control system market?

- What are the major factors driving the lighting control system market growth in North America?

- Lighting control systems, which offering is expected to be in demand in the next 5 years?

- Which country is expected to dominate the lighting control system market in North America?

Table of Contents

1 Introduction (Page No. - 20)

1.1 Study Objectives

1.2 Definition & Scope

1.2.1 Inclusions and Exclusions

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Geographic Scope

1.3.3 Years Considered

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 24)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

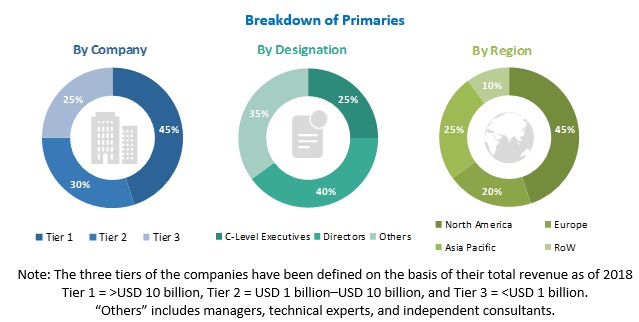

2.1.2.1 Breakdown of Primaries

2.1.2.2 Key Data From Primary Sources

2.1.2.3 Key Industry Insights

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 32)

4 Premium Insights (Page No. - 36)

4.1 Attractive Opportunities for Growth of Lighting Control System Market

4.2 Global Lighting Control System Market, By Offering

4.3 Global Lighting Control System Market, By Installation Type

4.4 Global Lighting Control System Market, By End-Use Application

4.5 Global Lighting Control System Market, By Indoor Application

4.6 Global Lighting Control System Market, By Outdoor Application

4.7 Global Lighting Control System Market, By Geography

5 Market Overview (Page No. - 40)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Ongoing and Upcoming Smart City Projects in Developing Economies

5.2.1.2 Increasing Use of Led Lights and Luminaries in Outdoor Lighting Applications

5.2.1.3 Government Initiatives and Policies for Energy Savings

5.2.1.4 Growing Acceptance of Standard Protocols for Lighting Control Systems

5.2.2 Restraints

5.2.2.1 Security and Reliability Issues With Smart Homes

5.2.2.2 High Initial and Deployment Costs

5.2.3 Opportunities

5.2.3.1 Rapid Transition From Traditional Lighting Systems to Connected Lighting Solutions

5.2.3.2 Growing Inclination Toward Energy-Efficient Lighting Solutions

5.2.4 Challenges

5.2.4.1 Interoperability Issues Between Different Network Components

6 Industry Trends (Page No. - 46)

6.1 Introduction

6.2 Value Chain Analysis

6.2.1 Research and Development Engineers

6.2.2 Raw Material/Input Suppliers

6.2.3 Original Equipment Manufacturers

6.2.4 System Integrators and Service Providers

6.2.5 Distributors and Sales Representatives

6.2.6 End-Use Applications

6.3 Industry Trends

7 Lighting Control System Market, By Installation Type (Page No. - 49)

7.1 Introduction

7.2 New Installations

7.2.1 New Installations Expected to Dominate Lighting Control System Market During the Forecast Period

7.3 Retrofit Installations

7.3.1 Retrofit Installations to Grow at Higher CAGR in Lighting Control System Market During Forecast Period

8 Lighting Control System Market, By Offering (Page No. - 54)

8.1 Introduction

8.2 Hardware

8.2.1 Led Drivers& Ballasts Expected to Account for Largest Share of Lighting Control System Market for Hardware During the Forecast Period

8.2.1.1 Led Drivers & Ballasts

8.2.1.2 Sensors

8.2.1.3 Switches

8.2.1.3.1 Manual On/Off Switches

8.2.1.3.2 Electronic Switches

8.2.1.4 Dimmers

8.2.1.4.1 Wired Dimmers

8.2.1.4.2 Wireless Dimmers

8.2.1.5 Relay Units

8.2.1.6 Gateways

8.3 Software

8.3.1 Cloud-Based Software Market to Exhibit Highest Growth During Forecast Period

8.3.1.1 Local/Web-Based Software

8.3.1.2 Cloud-Based Software

8.4 Services

8.4.1 Installation & Maintenance Services to Account for Largest Share of Lighting Control System Market for Services During the Forecast Period

8.4.1.1 Professional Services

8.4.1.2 Installation and Maintenance Services

9 Lighting Control System Market, By End-Use Application (Page No. - 71)

9.1 Introduction

9.2 Indoor

9.2.1 Commercial Indoor Application Expected to Grow at High CAGR in Lighting Control System Market During Forecast Period

9.2.1.1 Residential

9.2.1.2 Commercial

9.2.1.3 Industrial

9.2.1.4 Others

9.3 Outdoor

9.3.1 Highways & Roadways to Account for Major Share of Lighting Control System Market During Forecast Period

9.3.1.1 Highways & Roadways Lighting

9.3.1.2 Architectural Lighting

9.3.1.3 Lighting for Public Places

10 Lighting Control System Market, By Communication Protocol (Page No. - 82)

10.1 Introduction

10.2 Wired

10.2.1 POE Protocol to Exhibit Highest Growth in Lighting Control System Market for Wired Communication Protocol During Forecast Period

10.2.1.1 Digital Addressable Lighting Interface (DALI)

10.2.1.2 Power Line Communication (PLC)

10.2.1.3 Power Over Ethernet (POE)

10.2.1.4 Hybrid (Wired)

10.2.1.5 Others

10.3 Wireless

10.3.1 Zigbee Expected to Dominate Lighting Control System Market for Wireless Communication Protocol During Forecast Period

10.3.1.1 Zigbee

10.3.1.2 Bluetooth Low Energy (BLE)

10.3.1.3 Enocean

10.3.1.4 Wi-Fi

10.3.1.5 6lowpan

10.3.1.6 Hybrid (Wireless)

10.3.1.7 Others

11 Geographic Analysis (Page No. - 91)

11.1 Introduction

11.2 North America

11.2.1 US

11.2.1.1 US to Hold Major Share of Lighting Control System Market in North America During Forecast Period

11.2.2 Canada

11.2.2.1 Outdoor Lighting to Drive the Lighting Control System Market in Canada During Forecast Period

11.2.3 Mexico

11.2.3.1 Government Initiatives to Implement Energy-Efficient Lighting Systems to Drive Lighting Control System Market in Mexico

11.3 Europe

11.3.1 UK

11.3.1.1 Demand for Energy-Saving Lighting Solutions for Indoor Application to Drive Lighting Control System Market in UK

11.3.2 Germany

11.3.2.1 Germany to Hold Major Share of Lighting Control System Market in Europe in 2018

11.3.3 France

11.3.3.1 Hardware Segment of Lighting Control System Market to Hold Major Share in France During Forecast Period

11.3.4 Italy

11.3.4.1 Outdoor Lighting Application to Create Demand for Lighting Control Systems in Italy

11.3.5 Spain

11.3.5.1 Government Regulations for Reducing Emissions Driving Adoption of Lighting Control Systems in Spain

11.3.6 Rest of Europe

11.3.6.1 Rest of Europe to Exhibit Highest Growth in European Lighting Control System Market

11.3.6.1.1 Russia

11.3.6.1.2 Netherlands

11.3.6.1.3 Switzerland

11.3.6.1.4 Sweden

11.3.6.1.5 Poland

11.3.6.1.6 Norway

11.4 APAC

11.4.1 China

11.4.1.1 Increasing Government Expenditure on Public Infrastructure to Drive the Lighting Control System Market in China

11.4.2 Japan

11.4.2.1 Indoor Lighting Application to Boost Demand for Lighting Control Systems in Japan

11.4.3 India

11.4.3.1 Government Support Expected to Drive Lighting Control System Market in India

11.4.4 South Korea

11.4.4.1 Energy Efficiency Labels & Standard Program Expected to Boost Growth of Lighting Control Systems in South Korea

11.4.5 Rest of APAC

11.4.5.1 Rest of APAC to Witness Rapid Growth in Market for Outdoor Application During Forecast Period

11.5 Rest of the World

11.5.1 Middle East & Africa

11.5.1.1 Rapid Growth in Urbanization to Drive Lighting Control System Market

11.5.2 South America

11.5.2.1 South America to Witness High Growth in Lighting Control System Market on Back of Indoor Application

12 Competitive Landscape (Page No. - 132)

12.1 Overview

12.2 Lighting Control System Market: Market Ranking Analysis, 2018

12.3 Competitive Situations and Trends

12.3.1 Product Launches & Developments

12.3.2 Agreements, Partnerships, Collaborations, Contracts, and Joint Ventures

12.3.3 Mergers & Acquisitions

12.4 Competitive Leadership Mapping

12.4.1 Visionary Leaders

12.4.2 Dynamic Differentiators

12.4.3 Innovators

12.4.4 Emerging Companies

13 Company Profiles (Page No. - 147)

13.1 Introduction

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View)*

13.2 Key Players

13.2.1 Signify Holding (Philips Lighting)

13.2.2 Legrand S.A.

13.2.3 Eaton Corporation PLC

13.2.4 General Electric Company (Current-Powered By Ge)

13.2.5 Osram Licht Ag

13.2.6 Acuity Brands, Inc.

13.2.7 Lutron Electronics Co., Inc.

13.2.8 Schneider Electric Se

13.2.9 Honeywell International Inc.

13.2.10 Ideal Industries, Inc.

13.2.11 Hubbell Incorporated

13.3 Other Important Players

13.3.1 Leviton Manufacturing Company, Inc.

13.3.2 Dialight PLC

13.3.3 Helvar

13.3.4 Zumtobel Group

13.4 Key Innovators

13.4.1 Lightwaverf PLC

13.4.2 Rab Lighting Inc.

13.4.3 Synapse Wireless, Inc. (Mcwane, Inc.)

13.4.4 Panasonic

13.4.5 Adesto Technologies (Echelon Corporation)

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 195)

14.1 Insights From Industry Experts

14.2 Discussion Guide

14.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.4 Available Customization

14.5 Related Reports

14.6 Author Details

List of Tables (102 Tables)

Table 1 Lighting Control System Market, By Installation Type, 2016—2024 (USD Billion)

Table 2 Lighting Control System Market for New Installations, By Region, 2016—2024 (USD Million)

Table 3 Lighting Control System Market for Retrofit Installations, By Region, 2016—2024 (USD Million)

Table 4 Lighting Control System Market, By Offering, 2016—2024 (USD Billion)

Table 5 Lighting Control System Market for Hardware, By Device Type, 2016—2024 (USD Million)

Table 6 Lighting Control System Market for Switches, By Type, 2016—2024 (USD Billion)

Table 7 Lighting Control System Market for Dimmers, By Type, 2016—2024 (USD Million)

Table 8 Lighting Control System Market for Hardware, By Region, 2016—2024 (USD Million)

Table 9 Lighting Control System Market for Hardware in North America, By Country, 2016—2024 (USD Million)

Table 10 Lighting Control System Market for Hardware in Europe, By Country, 2016—2024 (USD Million)

Table 11 Lighting Control System Market for Hardware in APAC, By Country, 2016—2024 (USD Million)

Table 12 Lighting Control System Market for Hardware in RoW, By Region, 2016—2024 (USD Million)

Table 13 Lighting Control System Market for Software, By Deployment Type, 2016—2024 (USD Million)

Table 14 Lighting Control System Market for Software, By Region, 2016—2024 (USD Million)

Table 15 Lighting Control System for Software in North America, By Country, 2016—2024 (USD Million)

Table 16 Lighting Control System for Software in Europe, By Country, 2016—2024 (USD Million)

Table 17 Lighting Control System for Software in APAC, By Country, 2016—2024 (USD Million)

Table 18 Lighting Control System for Software in RoW, By Region, 2016—2024 (USD Million)

Table 19 Lighting Control System Market for Services, By Service Type, 2016—2024 (USD Million)

Table 20 Lighting Control System Market for Services, By Region, 2016—2024 (USD Million)

Table 21 Lighting Control System Services Market in North America, By Country, 2016—2024 (USD Million)

Table 22 Lighting Control System Market for Services in Europe, By Country, 2016—2024 (USD Million)

Table 23 Lighting Control System Market for Services in APAC, By Country, 2016—2024 (USD Million)

Table 24 Lighting Control System Market for Services in RoW, By Region, 2016—2024 (USD Million)

Table 25 Lighting Control System Market, By End-Use Application, 2016—2024 (USD Billion)

Table 26 Lighting Control System Market, By Indoor Application, 2016—2024 (USD Million)

Table 27 Lighting Control System Market for Indoor Application, By Region, 2016—2024, USD (Billion)

Table 28 Lighting Control System Market for Residential Indoor Application, By Region, 2016—2024 (USD Million)

Table 29 Lighting Control System Market for Commercial Indoor Application, By Region, 2016—2024, (USD Million)

Table 30 Lighting Control System Market for Industrial Indoor Application, By Region, 2016—2024 (USD Million)

Table 31 Lighting Control System Market for Other Indoor Application, By Region, 2016—2024 (USD Million)

Table 32 Lighting Control System Market for Outdoor Application, By Type, 2016—2024 (USD Million)

Table 33 Lighting Control System Market for Outdoor Application, By Region, 2016—2024 (USD Million)

Table 34 Lighting Control System Market for Highways & Roadways Lighting Application, By Region, 2016—2024 (USD Million)

Table 35 Lighting Control System Market for Architectural Lighting Application, By Region, 2016—2024 (USD Million)

Table 36 Lighting Control System Market for Lighting of Public Places, By Region, 2016—2024 (USD Million)

Table 37 Lighting Control System Market, By Communication Protocol, 2016—2024 (USD Billion)

Table 38 Lighting Control System Market, By Wired Communication Protocol, 2016—2024 (USD Million)

Table 39 Lighting Control System Market, By Wireless Communication Protocol, 2016—2024 (USD Million)

Table 40 Lighting Control System Market, By Region, 2016—2024 (USD Billion)

Table 41 Lighting Control System Market in North America, By Offering, 2016—2024 (USD Million)

Table 42 Lighting Control System Market in North America, By End-Use Application, 2016—2024 (USD Million)

Table 43 Lighting Control System Market in North America, By Indoor Application, 2016—2024 (USD Million)

Table 44 Lighting Control System Market in North America, By Outdoor Application, 2016—2024 (USD Million)

Table 45 Lighting Control System Market in North America, By Installation Type, 2016—2024 (USD Million)

Table 46 Lighting Control System Market in North America, By Country, 2016—2024 (USD Million)

Table 47 Lighting Control System Market in US, By Offering, 2016—2024 (USD Million)

Table 48 Lighting Control System Market in US, By End-Use Application, 2016—2024 (USD Million)

Table 49 Lighting Control System Market in US, By Installation Type, 2016—2024 (USD Million)

Table 50 Lighting Control System Market in Canada, By Offering, 2016—2024 (USD Million)

Table 51 Lighting Control System Market in Canada, By End-Use Application, 2016—2024 (USD Million)

Table 52 Lighting Control System Market in Mexico, By Offering, 2016—2024 (USD Million)

Table 53 Lighting Control System Market in Mexico, By End-Use Application, 2016—2024 (USD Million)

Table 54 Lighting Control System Market in Europe, By Offering, 2016—2024 (USD Million)

Table 55 Lighting Control System Market in Europe, By Application, 2016—2024 (USD Million)

Table 56 Lighting Control System Market in Europe, By Indoor Application, 2016—2024 (USD Million)

Table 57 Lighting Control System Market in Europe, By Outdoor Application, 2016—2024 (USD Million)

Table 58 Lighting Control System Market in Europe, By Installation Type, 2016—2024 (USD Billion)

Table 59 Lighting Control System Market in Europe, By Country, 2016—2024 (USD Million)

Table 60 Lighting Control System Market in UK, By Offering, 2016—2024 (USD Million)

Table 61 Lighting Control System Market in UK, By End-Use Application, 2016—2024 (USD Million)

Table 62 Lighting Control System Market in UK, By Installation Type, 2016—2024 (USD Million)

Table 63 Lighting Control System Market in Germany, By Offering, 2016—2024 (USD Million)

Table 64 Lighting Control System Market in Germany, By End-Use Application, 2016—2024 (USD Million)

Table 65 Lighting Control System Market in Germany, By Installation Type, 2016—2024 (USD Million)

Table 66 Lighting Control System Market in France, By Offering, 2016—2024 (USD Million)

Table 67 Lighting Control System Market in France, By End-Use Application, 2016—2024 (USD Million)

Table 68 Lighting Control System Market in Italy, By Offering, 2016—2024 (USD Million)

Table 69 Lighting Control System Market in Italy, By End-Use Application, 2016—2024 (USD Million)

Table 70 Lighting Control System Market in Spain, By Offering, 2016—2024 (USD Million)

Table 71 Lighting Control System Market in Spain, By End-Use Application, 2016—2024 (USD Million)

Table 72 Lighting Control System Market in Rest of Europe, By Offering, 2016—2024 (USD Million)

Table 73 Lighting Control System Market in Rest of Europe, By Country, 2016—2024 (USD Million)

Table 74 Lighting Control System Market in Rest of Europe, By End-Use Application, 2016—2024 (USD Million)

Table 75 Lighting Control System Market in APAC, By Offering, 2016—2024 (USD Million)

Table 76 Lighting Control System Market in APAC, By Application, 2016—2024 (USD Billion)

Table 77 Lighting Control System Market in APAC, By Indoor Application, 2016—2024 (USD Million)

Table 78 Lighting Control System Market in APAC, By Outdoor Application, 2016—2024 (USD Million)

Table 79 Lighting Control System Market in APAC, By Installation Type, 2016—2024 (USD Billion)

Table 80 Lighting Control System Market in APAC, By Country, 2016—2024 (USD Million)

Table 81 Lighting Control System Market in China, By Offering, 2016—2024 (USD Million)

Table 82 Lighting Control System Market in China, By End-Use Application, 2016—2024 (USD Million)

Table 83 Lighting Control System Market in China, By Installation Type, 2016—2024 (USD Million)

Table 84 Lighting Control System Market in Japan, By Offering, 2016—2024 (USD Million)

Table 85 Lighting Control System Market in Japan, By End-Use Application, 2016—2024 (USD Million)

Table 86 Lighting Control System Market in India, By Offering, 2016—2024 (USD Million)

Table 87 Lighting Control System Market in India, By End-Use Application, 2016—2024 (USD Million)

Table 88 Lighting Control System Market in South Korea, By Offering, 2016—2024 (USD Million)

Table 89 Lighting Control System Market in South Korea, By End-Use Application, 2016—2024 (USD Million)

Table 90 Lighting Control System Market in Rest of APAC, By Offering, 2016—2024 (USD Million)

Table 91 Lighting Control System Market in Rest of APAC, By End-Use Application, 2016—2024 (USD Million)

Table 92 Lighting Control System Market in RoW, By Offering, 2016—2024 (USD Million)

Table 93 Lighting Control System Market in RoW, By Application, 2016—2024 (USD Million)

Table 94 Lighting Control System Market in RoW, By Indoor Application, 2016—2024 (USD Million)

Table 95 Lighting Control System Market in RoW, By Outdoor Application, 2016—2024 (USD Million)

Table 96 Lighting Control System Market in RoW, By Installation Type, 2016—2024 (USD Million)

Table 97 Lighting Control System Market in RoW, By Region, 2016—2024 (USD Million)

Table 98 Lighting Control System Market in Middle East & Africa, By Offering, 2016—2024 (USD Million)

Table 99 Lighting Control System Market in Middle East & Africa, By End-Use Application, 2016—2024 (USD Million)

Table 100 Lighting Control System Market in Middle East & Africa, By Installation Type, 2016—2024 (USD Million)

Table 101 Lighting Control System Market in South America, By Offering, 2016—2024 (USD Million)

Table 102 Lighting Control System Market in South America, By End-Use Application, 2016—2024 (USD Million)

List of Figures (64 Figures)

Figure 1 Lighting Control System Market: Market Segmentation

Figure 2 Lighting Control System Market: Process Flow of Market Size Estimation

Figure 3 Lighting Control System Market: Research Design

Figure 4 Bottom-Up Approach to Arrive at Market Size

Figure 5 Top-Down Approach to Arrive at Market Size

Figure 6 Data Triangulation

Figure 7 Assumptions of Research Study

Figure 8 New Installations to Hold Larger Size of Lighting Control System Market During Forecast Period

Figure 9 Lighting Control System Market for Services Expected to Grow at Highest CAGR During Forecast Period

Figure 10 Lighting Control System Market for Wireless Communication Protocols Expected to Grow at Higher CAGR During Forecast Period

Figure 11 APAC Held Major Share of Lighting Control System Market in 2018

Figure 12 Lighting Control System Market Expected to Exhibit High Growth From 2019 to 2024

Figure 13 Lighting Control System for Hardware to Hold Largest Share During Forecast Period

Figure 14 Lighting Control System Market for New Installations to Hold Larger Size During Forecast Period

Figure 15 Indoor Application to Hold Larger Size of Lighting Control System Market During Forecast Period

Figure 16 Lighting Control System Market for Commercial Application to Hold Largest Size in 2024

Figure 17 Highways and Roadways Lighting to Account for Largest Market Size During Forecast Period

Figure 18 APAC to Account for Largest Size of Lighting Control System Market During Forecast Period

Figure 19 Government Initiatives and Policies to Drive Lighting Control System Market

Figure 20 Smart Cities Market (USD Billion)

Figure 21 Lighting Control System Market: Value Chain Analysis

Figure 22 Leading Trends in Lighting Control System Market

Figure 23 Lighting Control System Market, By Installation Type

Figure 24 New Installations to Hold Larger Size During Forecast Period

Figure 25 APAC to Hold Largest Size of Lighting Control System Market for New Installations During Forecast Period

Figure 26 Lighting Control System Market, By Offering

Figure 27 Lighting Control System Market for Services Expected to Grow at Highest CAGR During Forecast Period

Figure 28 Lighting Control System Market, By Hardware

Figure 29 Lighting Control System Market for Sensors to Grow at Highest CAGR During Forecast Period

Figure 30 Shipment of Electronic Switches to Grow at Higher CAGR During Forecast Period

Figure 31 Lighting Control System Market, By Software

Figure 32 Lighting Control System Market, By Service

Figure 33 Lighting Control System Market, By End-Use Application

Figure 34 Indoor Application to Hold Larger Size of Lighting Control System Market During Forecast Period

Figure 35 Residential Indoor Application Held Largest Size of Lighting Control System Market in 2018

Figure 36 Highways & Roadways Lighting to Hold Larger Size of Lighting Control System Market for Outdoor Application During Forecast Period

Figure 37 Lighting Control System Market, By Communication Protocol

Figure 38 Lighting Control System Market for Wireless Communication Protocols to Grow at Higher CAGR During Forecast Period

Figure 39 DALI Protocol to Hold Largest Size of Lighting Control System Market for Wired Communication Protocol During Forecast Period

Figure 40 Lighting Control System Market for BLE Wireless Protocol to Grow at Highest CAGR During Forecast Period

Figure 41 Lighting Control System Market, By Geography

Figure 42 Lighting Control System Market, Geographic Snapshot

Figure 43 Snapshot: Lighting Control System Market in North America

Figure 44 Market for Commercial End-Use Application in North America Expected to Grow at Highest CAGR During Forecast Period

Figure 45 US to Account for Largest Size of Lighting Control System Market in North America During Forecast Period

Figure 46 Snapshot: Lighting Control System Market in Europe

Figure 47 Residential Indoor Application in Europe Held Largest Size of Lighting Control System Market in 2018

Figure 48 Germany to Hold Largest Size of Lighting Control System Market in Europe

Figure 49 Snapshot: Lighting Control System Market in APAC

Figure 50 Residential Indoor Application in APAC Held Largest Size of Lighting Control System Market in 2018

Figure 51 Lighting Control System Market in India Expected to Grow at Highest CAGR During Forecast Period

Figure 52 Middle East & Africa Expected to Hold Largest Size of Lighting Control System Market in RoW By 2024

Figure 53 Key Developments By Leading Players in Market From 2016 to 2019

Figure 54 Market Ranking of Top 5 Players in Lighting Control System Market, 2018

Figure 55 Lighting Control System Market (Global) Competitive Leadership Mapping, 2018

Figure 56 Signify: Company Snapshot

Figure 57 Legrand: Company Snapshot

Figure 58 Eaton Corporation PLC: Company Snapshot

Figure 59 General Electric Company: Company Snapshot

Figure 60 Osram Licht AG: Company Snapshot

Figure 61 Acuity Brands: Company Snapshot

Figure 62 Schneider Electric: Company Snapshot

Figure 63 Honeywell International Inc.: Company Snapshot

Figure 64 Hubbell Incorporated: Company Snapshot

The study involved four major activities for estimating the size of the lighting control system market. Exhaustive secondary research has been done to collect information on the market, including its peer markets. These findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the complete market size. After that, market breakdown and data triangulation methods have been employed to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information important for this study. Secondary sources include corporate filings (such as annual reports, press releases, investor presentations, and financial statements); trade, business, and professional associations; white papers, lighting control system-based marketing-related journals, certified publications, and articles from recognized authors; gold and silver standard websites; directories; and databases. Secondary data has been collected and analyzed to arrive at the overall market size, which has further been validated through primary research. The secondary data has been collected and analyzed to arrive at the overall market size, which has further been validated by primary research.

Primary Research

In the primary research process, various primary sources from the supply and demand sides have been interviewed to obtain the qualitative and quantitative information relevant to this report. Primary sources from the supply side include key industry participants, subject matter experts (SMEs), C-level executives of key companies, and consultants from various key companies and organizations operating in the lighting control system market.

Primary research has also been conducted to identify segmentation types and key players, as well as analyze the competitive landscape, key market dynamics (drivers, restraints, opportunities, and challenges), and major growth strategies adopted by market players. During market engineering, both top-down and bottom-up approaches have been extensively used, along with several data triangulation methods, to estimate and forecast the market, including the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analyses have been performed during the complete market engineering process to list the key information/insights throughout the report. Primary data has been collected through questionnaires, e-mails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the market engineering process, both top-down and bottom-up approaches, along with several data triangulation methods, have been used to estimate and validate the size of the overall market and other dependent submarkets listed in this report. Extensive qualitative and quantitative analyses have been performed during market engineering to list key information/insights.

Major players in the market have been identified through secondary research, and their market ranking has been determined through primary and secondary research. This involved studying the annual and financial reports of top market players, and interviews with industry experts (such as CEOs, vice presidents, directors, and marketing executives) for key insights—both quantitative and qualitative.

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources. All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Data Triangulation

After arriving at the overall market size through the process explained above, the total market has been split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all the segments, the market breakdown and data triangulation procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Study Objectives

- To describe and forecast the size of the lighting control system market, in terms of value, by installation type, offering, end-use application, communication protocol, and geography

- To provide market statistics with detailed classifications, along with the respective market sizes for a few of the segments

- To analyze the opportunities in the lighting control system market for stakeholders and detailing the competitive landscape for the market leaders

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contribution to the total market

- To forecast the market size for various segments with respect to the following regions: North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW)

- To provide detailed information on the major factors influencing the growth of the lighting control system market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically profile the key players and comprehensively analyze their market rankings and core competencies

- To analyze competitive developments such as contracts, joint ventures, mergers and acquisitions, product developments, and research and development (R&D) in the lighting control system market

- To benchmark players within the market using competitive leadership mapping, which analyzes market players on various parameters within the broad categories of business and product strategy

- To map the competitive intelligence based on company profiles, key player strategies, and game-changing developments such as contracts, product launches, collaborations, and acquisitions

Available Customization

With the given market data, MarketsandMarkets offers customizations according to companies’ specific needs. The following customization options are available for the report.

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Lighting Control System Market

Hi, we were wondering we get information related to major manufactures of lighting controllers, and their market shares. Could you please let us know if the report includes the information at these detailed levels by country?

Can we get a look at what is defined in the "offerings" section of the report?

Hi, Could you comment on market numbers for 2017? From your webpage: The global light control switches market is expected to reach USD 6.25 Billion (in terms of value) and 2.85 Billion units (in terms of volume) by 2022, at a CAGR of 7.9% and 8.8%, respectively, between 2016 and 2022.

I want to know how big is the opportunity of lighting control for commercial projects?