Ligation Devices Market by Product (Hand-held Instruments, Accessories), Procedure (Minimally Invasive & Open Surgery), Application (Gynaecology, GIT, Cardiothoracic, Urology), End User (Hospital, Nursing Homes) - Global Forecast to 2024

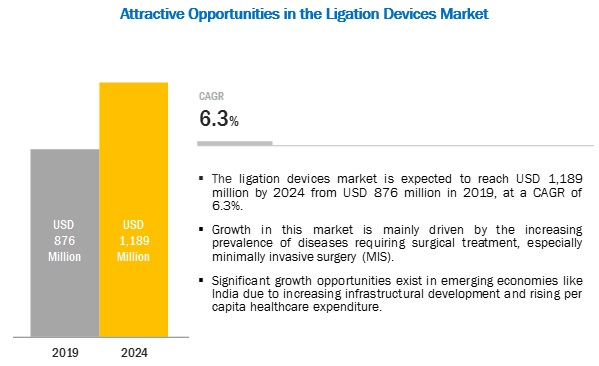

[110 Pages Report] The ligation devices market is projected to reach USD 1,189 million by 2024 from USD 876 million in 2019, at a CAGR of 6.3% during the forecast period. Growth in this market is mainly driven by the increasing prevalence of diseases requiring surgical treatment, especially minimally invasive surgery (MIS). However, the high cost of ligation devices is a major restraint for this market, particularly in emerging countries.

“Accessories are expected to fuel the growth of the ligation devices market over the forecast period.”

By product, the ligation devices market is segmented into handheld instruments and accessories. The accessories segment accounted for a share of 68.2% in 2018 and is anticipated to grow at a CAGR of 6.9% during the forecast period. This growth can be attributed to the increasing number of surgical procedures, especially in emerging markets.

“Increasing use of ligation devices in gastrointestinal & abdominal surgeries to drive market growth during the forecast period”

Based on applications, the ligation devices market is segmented into gastrointestinal & abdominal surgeries, gynecological surgeries, cardiovascular surgeries, urological surgeries, and other applications such as wound, ENT, and cosmetic applications. The cardiovascular surgeries segment is anticipated to drive growth in the market at a CAGR of 6.9% over the forecast period. This growth can be attributed to the increase in the incidence of cardiovascular diseases. Additionally, with technological advancements in cardiovascular robotic surgery, the demand for ligation devices is anticipated to increase.

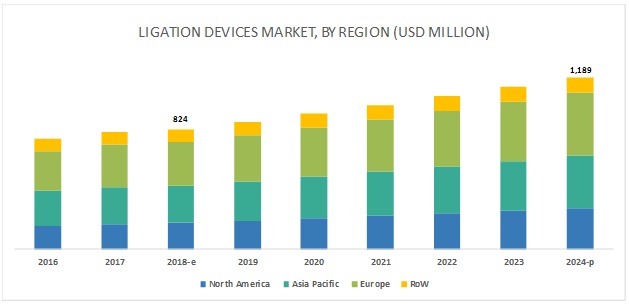

“Asia Pacific to grow at the highest rate during the forecast period (2018–2023)”

The ligation devices market is geographically segmented into North America, Europe, Asia Pacific, and the Rest of the World (RoW). While North America dominated the market in 2018, Asia Pacific is expected to register the highest CAGR in the market during the forecast period. Growth in the APAC region is largely driven by the large patient population and increasing infrastructural development in the region.

Key Market Players

Some of the prominent players in the ligation devices market are are Ethicon (Johnson and Johnson) (US), Teleflex Incorporated (US), Olympus (Japan), Applied Medical (US), ConMed (US), Cooper Surgical (US), Genicon (US), Grena Think Medical (UK), B.Braun (Germany), and Medtronic (Ireland).

Johnson & Johnson (Ethicon) is the largest player in the ligation devices market. The company focuses on the development of devices, consumables, accessories, and software required to perform minimally invasive surgeries and open surgeries. The company also invests a significant amount on research and development activities. In 2018, it spent ~7% of its revenue on R&D activities.

Medtronic (Covidien) is a major player in the ligation devices market. The company has a global distribution network and a good brand reputation among end users. The company’s strong presence and wide distribution channels across the globe have helped it to maintain its leading position in the ligation devices market.

Scope of the Report

|

Report Metric |

Details |

|

Market Size Available for Years |

2017–2024 |

|

Base Year Considered |

2017 |

|

Forecast Period |

2019–2024 |

|

Forecast Units |

Value (USD) |

|

Segments Covered |

Ligation device products, procedures, applications, end users, and regions |

|

Geographies Covered |

North America (US and Canada), Europe (Germany, France, UK, and RoE), APAC (Japan, China, India, and RoAPAC), and the RoW (Latin America and the Middle East & Africa) |

|

Companies Covered |

Major 10 players covered, including |

This research report categorizes the ligation devices market into the following segments and subsegments:

Ligation Devices Market, by Product

- Handheld instruments

- Accessories

Ligation Devices Market, by Procedure

- MIS

- Open Surgery

Ligation Devices Market, by Application

- Gastrointestinal & Abdominal Surgeries

- Gynecological Surgeries

- Cardiovascular Surgeries

- Urological Surgeries

- Other Applications

Ligation Devices Market, by End User

- Hospitals

- Other End Users

Ligation Devices Market, by Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

-

Rest of the World

- Latin America

- Middle East & Africa

Recent developments:

- In 2018, Genicon, Inc. entered into a distribution agreement with Greenpine Pharma, China to distribute its complete range of products in China.

- In 2017, B.Braun opened 5 new production and administration facilities in Penang to cater to end users in Malaysia. The company aims to manufacture medical devices for infusion therapy, pharmaceutical solutions, and surgical instruments in these facilities.

Key questions addressed in the report:

- What are the growth opportunities in the ligation devices industry across major regions in the future?

- Emerging countries have immense opportunities for the growth and adoption of ligation devices. Will this scenario continue during the next five years?

- Where will all the advancements in products offered by various companies take the industry in the mid- to long-term?

- What are the various ligation devices and their respective market shares in the overall market?

- What are the new trends and advancements in the ligation devices market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.2.1 Markets Covered

1.2.2 Years Considered for the Study

1.3 Currency

1.4 Limitations

1.5 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Secondary Data

2.1.1 Key Data From Secondary Sources

2.2 Primary Data

2.2.1 Key Data From Primary Sources

2.3 Market Size Estimation

2.3.1 Bottom-Up Approach

2.3.2 Top-Down Approach

2.4 Market Breakdown and Data Triangulation

2.5 Assumptions for the Study

3 Executive Summary (Page No. - 24)

4 Premium Insights (Page No. - 27)

4.1 Ligation Devices: Market Overview

4.2 North America: Ligation Devices Market, By Product (2018)

4.3 Geographical Snapshot of Ligation Devices Market

5 Market Overview (Page No. - 30)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growing Demand for Minimally Invasive Surgery

5.2.2 Market Restraints

5.2.2.1 High Price of Ligation Devices

5.2.3 Market Opportunities

5.2.3.1 Growth Potential in Emerging Economies

6 Ligation Devices Market, By Product (Page No. - 33)

6.1 Introduction

6.2 Handheld Instruments

6.2.1 Rising Prevalence of Cancer and Hernia to Support the Demand for Handheld Ligation Devices Worldwide

6.3 Accessories

6.3.1 Increasing Volume of Surgical Procedures Resulting in High Demand for Accessories—A Key Growth Driver for This Segment

7 Ligation Devices Market, By Procedure (Page No. - 37)

7.1 Introduction

7.2 Minimally Invasive Surgery

7.2.1 Increasing Number of Mis Procedures to Result in an Increase in the Demand for Ligation Devices

7.3 Open Surgery

7.3.1 Increasing Incidence of Cvd and the Need for Surgical Intervention as A Treatment Option is Driving the Open Surgery Market

8 Ligation Devices Market, By Application (Page No. - 41)

8.1 Introduction

8.2 Gastrointestinal and Abdominal Applications

8.2.1 Gastrointestinal and Abdominal Surgeries is the Largest Application Segment of the Ligation Devices Market

8.3 Cardiovascular Applications

8.3.1 Cardiovascular Application Segment to Register the Highest Growth in the Ligation Devices Market During the Study Period

8.4 Gynecological Applications

8.4.1 Increasing Prevalence of Ovarian & Cervical Cancers to Drive Market Growth

8.5 Urological Applications

8.5.1 Increasing Incidence of Urological Diseases has Driven the Adoption of Ligation Devices

8.6 Other Applications

9 Ligation Devices Market, By End User (Page No. - 49)

9.1 Introduction

9.2 Hospitals

9.2.1 Hospitals are the Largest End Users of Ligation Devices

9.3 Other End Users

10 Ligation Devices Market, By Region (Page No. - 53)

10.1 Introduction

10.2 North America

10.2.1 US

10.2.1.1 US Dominates the North American Market for Ligation Devices

10.2.2 Canada

10.2.2.1 Increase in Surgical Volumes in Canada Will Drive the Market for Ligation Devices

10.3 Europe

10.3.1 Germany

10.3.1.1 Germany Holds the Largest Share of the Ligation Devices Market in Europe

10.3.2 UK

10.3.2.1 Over A Fourth of UK Adults Were Obese in 2016

10.3.3 France

10.3.3.1 Steady Rise in Surgical Volumes Indicates Potential Growth in Demand for Ligation Devices

10.3.4 Rest of Europe

10.4 Asia Pacific

10.4.1 China

10.4.1.1 Rising Disease Prevalence Can Be Attributed to Changing Lifestyles in China

10.4.2 India

10.4.2.1 Rising Obesity Levels in India Will Contribute to Market Growth

10.4.3 Japan

10.4.3.1 Japan has the World’s Fastest-Growing Geriatric Population

10.4.4 Rest of Asia Pacific

10.5 Rest of the World

11 Competitive Landscape (Page No. - 81)

11.1 Overview

11.2 Market Ranking Analysis, 2017

11.3 Key Strategies

11.3.1 Acquisition, 2015–2018

11.3.2 Expansions, 2015–2018

11.3.3 Agreements & Collaborations, 2015–2018

11.4 Competitive Leadership Mapping (2017)

11.4.1 Visionary Leaders

11.4.2 Innovators

11.4.3 Dynamic Differentiators

11.4.4 Emerging Companies

12 Company Profiles (Page No. - 86)

(Introduction, Products & Services, Strategy, & Analyst Insights, Developments, MnM View)*

12.1 Medtronic

12.2 Johnson & Johnson

12.3 The Cooper Companies, Inc.

12.4 Conmed Corporation

12.5 B. Braun Melsungen AG

12.6 Teleflex Incorporated

12.7 Olympus Corporation

12.8 Applied Medical Resources Corporation

12.9 Grena Think Medical

12.10 Genicon, Inc.

*Details on Marketsandmarkets View, Introduction, Product & Services, Strategy, & Analyst Insights, New Developments Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 104)

13.1 Insights of Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.4 Available Customizations

13.5 Related Reports

13.6 Author Details

List of Tables (80 Tables)

Table 1 Laparoscopic Procedures Data Per 100,000 Inhabitants in Hospitals, 2010 vs 2015

Table 2 Market, By Product, 2017–2024 (USD Million)

Table 3 Market for Handheld Instruments, By Region, 2017–2024 (USD Million)

Table 4 Market for Accessories, By Region, 2017–2024 (USD Million)

Table 5 Market, By Procedure, 2017–2024 (USD Million)

Table 6 Market for Minimally Invasive Surgery, By Region, 2017–2024 (USD Million)

Table 7 Market for Open Surgery, By Region, 2017–2024 (USD Million)

Table 8 Market, By Application, 2017–2024 (USD Million)

Table 9 Market for Gastrointestinal and Abdominal Applications, By Region, 2017–2024 (USD Million)

Table 10 Market for Gastrointestinal and Abdominal Applications, By Procedure, 2017–2024 (USD Million)

Table 11 Market for Cardiovascular Applications, By Region, 2017–2024 (USD Million)

Table 12 Market for Cardiovascular Applications, By Procedure, 2017–2024 (USD Million)

Table 13 Market for Gynecological Applications, By Region, 2017–2024 (USD Million)

Table 14 Market for Gynecological Applications, By Procedure, 2017–2024 (USD Million)

Table 15 Market for Urological Applications, By Region, 2017–2024 (USD Million)

Table 16 Market for Urological Applications, By Procedure, 2017–2024 (USD Million)

Table 17 Market for Other Applications, By Region, 2017–2024 (USD Million)

Table 18 Market, By End User, 2017–2024 (USD Million)

Table 19 Market for Hospitals, By Region, 2017–2024 (USD Million)

Table 20 Market for Other End Users, By Region, 2017–2024 (USD Million)

Table 21 Market, By Region, 2017–2024 (USD Million)

Table 22 North America: Ligation Devices Market, By Country, 2017–2024 (USD Million)

Table 23 North America: Market, By Product, 2017–2024 (USD Million)

Table 24 North America: Market, By Procedure, 2017–2024 (USD Million)

Table 25 North America: Market, By Application, 2017–2024 (USD Million)

Table 26 North America: Market, By End User, 2017–2024 (USD Million)

Table 27 US: Ligation Devices Market, By Product, 2017–2024 (USD Million)

Table 28 US: Market, By Procedure, 2017–2024 (USD Million)

Table 29 US: Market, By Application, 2017–2024 (USD Million)

Table 30 US: Market, By End User, 2017–2024 (USD Million)

Table 31 Canada: Ligation Devices Market, By Product, 2017–2024 (USD Million)

Table 32 Canada: Market, By Procedure, 2017–2024 (USD Million)

Table 33 Canada: Market, By Application, 2017–2024 (USD Million)

Table 34 Canada: Market, By End User, 2017–2024 (USD Million)

Table 35 Europe: Ligation Devices Market, By Country, 2017–2024 (USD Million)

Table 36 Europe: Market, By Product, 2017–2024 (USD Million)

Table 37 Europe: Market, By Procedure, 2017–2024 (USD Million)

Table 38 Europe: Market, By Application, 2017–2024 (USD Million)

Table 39 Europe: Market, By End User, 2017–2024 (USD Million)

Table 40 Germany: Ligation Devices Market, By Product, 2017–2024 (USD Million)

Table 41 Germany: Market, By Procedure, 2017–2024 (USD Million)

Table 42 Germany: Market, By Application, 2017–2024 (USD Million)

Table 43 Germany: Market, By End User, 2017–2024 (USD Million)

Table 44 UK: Ligation Devices Market, By Product, 2017–2024 (USD Million)

Table 45 UK: Market, By Procedure, 2017–2024 (USD Million)

Table 46 UK: Market, By Application, 2017–2024 (USD Million)

Table 47 UK: Market, By End User, 2017–2024 (USD Million)

Table 48 France: Ligation Devices Market, By Product, 2017–2024 (USD Million)

Table 49 France: Market, By Procedure, 2017–2024 (USD Million)

Table 50 France: Market, By Application, 2017–2024 (USD Million)

Table 51 France: Market, By End User, 2017–2024 (USD Million)

Table 52 RoE: Ligation Devices Market, By Product, 2017–2024 (USD Million)

Table 53 RoE: Market, By Procedure, 2017–2024 (USD Million)

Table 54 RoE: Market, By Application, 2017–2024 (USD Million)

Table 55 RoE: Market, By End User, 2017–2024 (USD Million)

Table 56 APAC: Ligation Devices Market, By Country, 2017–2024 (USD Million)

Table 57 APAC: Market, By Product, 2017–2024 (USD Million)

Table 58 APAC: Market, By Procedure, 2017–2024 (USD Million)

Table 59 APAC: Market, By Application, 2017–2024 (USD Million)

Table 60 APAC: Market, By End User, 2017–2024 (USD Million)

Table 61 China: Ligation Devices Market, By Product, 2017–2024 (USD Million)

Table 62 China: Market, By Procedure, 2017–2024 (USD Million)

Table 63 China: Market, By Application, 2017–2024 (USD Million)

Table 64 China: Market, By End User, 2017–2024 (USD Million)

Table 65 India: Ligation Devices Market, By Product, 2017–2024 (USD Million)

Table 66 India: Market, By Procedure, 2017–2024 (USD Million)

Table 67 India: Market, By Application, 2017–2024 (USD Million)

Table 68 India: Market, By End User, 2017–2024 (USD Million)

Table 69 Japan: Ligation Devices Market, By Product, 2017–2024 (USD Million)

Table 70 Japan: Market, By Procedure, 2017–2024 (USD Million)

Table 71 Japan: Market, By Application, 2017–2024 (USD Million)

Table 72 Japan: Market, By End User, 2017–2024 (USD Million)

Table 73 RoAPAC: Ligation Devices Market, By Product, 2017–2024 (USD Million)

Table 74 RoAPAC: Market, By Procedure, 2017–2024 (USD Million)

Table 75 RoAPAC: Market, By Application, 2017–2024 (USD Million)

Table 76 RoAPAC: Market, By End User, 2017–2024 (USD Million)

Table 77 RoW: Ligation Devices Market, By Product, 2017–2024 (USD Million)

Table 78 RoW: Market, By Procedure, 2017–2024 (USD Million)

Table 79 RoW: Market, By Application, 2017–2024 (USD Million)

Table 80 RoW: Market, By End User, 2017–2024 (USD Million)

List of Figures (30 Figures)

Figure 1 Research Design

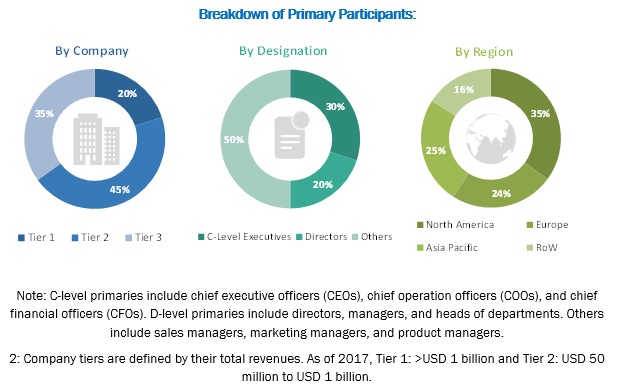

Figure 2 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 3 Ligation Devices Market: Bottom-Up Approach

Figure 4 Ligation Devices Market: Top-Down Approach

Figure 5 Data Triangulation Methodology

Figure 6 Ligation Devices Market, By Product, 2019 vs 2024 (USD Million)

Figure 7 Ligation Devices Market, By Procedure, 2019 vs 2024 (USD Million)

Figure 8 Ligation Devices Market, By Application, 2019 vs 2024 (USD Million)

Figure 9 Ligation Devices Market, By End User, 2019 vs 2024 (USD Million)

Figure 10 Ligation Devices Market, By Region, 2019 vs 2024 (USD Million)

Figure 11 Rising Global Demand for MIS Procedures and Global Ageing Population to Drive Market Growth During the Forecast Period

Figure 12 Accessories Dominated the North American Ligation Devices Market in 2018

Figure 13 Countries in Asia Pacific to Register A Higher Growth Rate During the Forecast Period

Figure 14 Ligation Devices Market: Drivers, Restraint, and Opportunities

Figure 15 Accessories to Register the Highest CAGR During the Forecast Period

Figure 16 Minimally Invasive Surgical Procedures to Witness the Highest Growth During the Forecast Period

Figure 17 Cardiovascular Applications Segment to Witness the Highest Growth During the Forecast Period

Figure 18 Ligation Devices Market, By End User, 2019 vs 2024 (USD Million)

Figure 19 North America Dominates the Ligation Devices Market

Figure 20 North America: Ligation Devices Market Snapshot

Figure 21 APAC: Ligation Devices Market Snapshot

Figure 22 Key Developments in the Ligation Devices Market From 2015 to 2018

Figure 23 Ligation Devices Market Ranking, By Key Player, 2017

Figure 24 MnM Dive-Vendor Comparison Matrix: Ligation Devices Market

Figure 25 Medtronic: Company Snapshot

Figure 26 Johnson & Johnson: Company Snapshot

Figure 27 The Cooper Companies, Inc: Company Snapshot

Figure 28 Conmed Corporation: Company Snapshot

Figure 29 B. Braun Melsungen AG: Company Snapshot

Figure 30 Teleflex Incorporated: Company Snapshot

The study involved four major activities to estimate the current size of the ligation devices market. Exhaustive secondary research was done to collect information on the market and its different subsegments. The next step was to validate these findings, assumptions, and sizing estimates with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation procedures were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard & silver-standard websites, regulatory bodies, and databases (such as D&B Hoovers, Bloomberg Business, and Factiva) were referred to in order to identify and collect information for this study.

Primary Research

Several stakeholders such as ligation device manufacturers, vendors, distributors and surgeons, and doctors from hospitals and clinics were consulted for this report. The demand side of this market is characterized by significant use of ligation device accessories due to the increasing number of surgical procedures and increasing reimbursements for MIS procedures. The supply side is characterized by advancements in MIS procedures and increasing number of GIT surgeries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The following is a breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the ligation devices market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Data Triangulation

After arriving at the overall market size using the market size estimation processes the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the ligation devices industry.

Report Objectives

- To define, describe, and forecast the ligation devices market by product, procedure, application, end user, and region

- To forecast the revenue of the market segments with respect to four main regional segments, namely, North America, Europe, Asia Pacific, and the Rest of the World (RoW)

- To identify the micromarkets with respect to drivers, industry-specific challenges, opportunities, and trends affecting the growth of the market

- To analyze market segments and subsegments with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To profile the key players and comprehensively analyze their market shares and core competencies in terms of market developments and growth strategies

- To track and analyze competitive developments such as partnerships, agreements, collaborations, acquisitions, product launches, and research and development activities in the ligation devices market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

- Product Analysis: Product matrix, which gives a detailed comparison of the product portfolios of each company

- Geographic Analysis: Further breakdown of the European, Asia Pacific, and the Rest of World regional segments into their respective countries for this market

- Company Information: Detailed analysis and profiling of additional market players (up to 5)

- Volume Data: Customization options for volume data (number of units sold) and customization options for volume data (number of tests)

- Opportunities Assessment: A detailed report underlining the various growth opportunities presented in the market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Ligation Devices Market