License Management Market by Component (Software and Services), Application Area (Audit Services, Advisory Services, Compliance Management), Deployment Type, Organization Size, Industry Vertical, and Region - Global Forecast to 2022

[128 Pages Report] Software license management is a tool used by organizations across various industry verticals to manage, control, and optimize the usage of various software within an organization. License management solutions facilitate organizations to maximize the expenditure on software and to automate software license entitlement and its delivery. Furthermore, it enables organizations to efficiently meet compliance and provide them with accurate analysis and reports regarding the usage and activation of software.

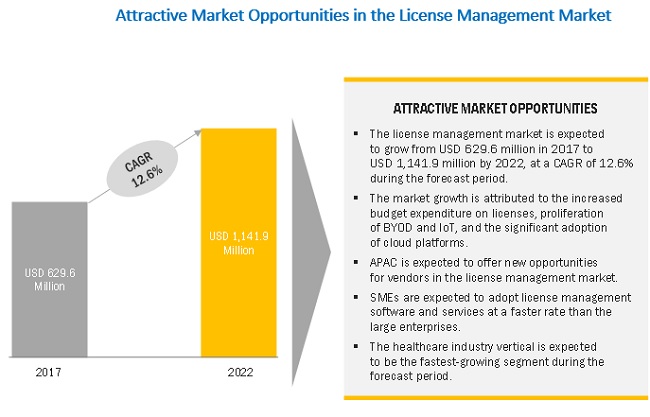

The license management market was valued at USD 577.5 Million in 2016 and is projected to reach USD 1,141.9 Million by 2022. The global market is expected to grow at a Compound Annual Growth Rate (CAGR) of 12.6% during the forecast period. The forecast period has been considered from 2017 to 2022, whereas 2016 is considered as the base year for estimating the market study.

By deployment type cloud deployment type is expected to grow at a higher CAGR during the forecast period

By deployment type, the license management market has been segmented into two sub-segments: cloud and on-premises. With increasing awareness and the global adoption trend of cloud-based license management solutions across all industry verticals, it is expected that the cloud deployment type would witness an increasing demand during the forecast period. On the other hand, the on-premises deployment type is expected to witness a slower growth rate during the forecast period. However, the on-premises deployment type is expected to have a larger market size during the forecast period. The cloud deployment type is expected to witness a huge growth potential during the forecast period, with the highest CAGR expected in the APAC region.

By component, services segment is expected to grow at a higher CAGR during the forecast period

Based on components, the license management market has been segmented into software and services. In the past few years, license management software and related services have gained significant market traction, as they lower the risks of non-compliance. This section of the report covers the software and services offered in the license management market. The services provided by the license management vendors include professional and managed services. These services provide the necessary support to uphold the efficiency of business processes, improve system reliability, maintain infrastructure, and increase growth while reducing the unwanted and unexpected operating expenses. The growing need among enterprises to optimize software investments and be audit-ready is expected to drive the growth of the license management market during the forecast period.

North America to dominate the license management market during the forecast period

North America is expected to be the largest revenue-generating region for the license management vendors during the forecast period, followed by Europe. This is mainly due to the presence of developed economies, such as Canada and the US, and due to the focus on innovations obtained from Research and Development (R&D) and technologies. The APAC region is expected to be the fastest-growing region in the license management market. The factor driving the market growth in the developing regions, such as APAC and MEA, is the rapid adoption of emerging trends, such as mobility and cloud. The MEA and Latin American regions are gradually adopting license management, which empowers organizations in these regions to analyze and manage the licenses efficiently while leveraging cost-effective cloud-based license management solutions.

Market Dynamics

Driver: Growing demand to optimize software investments

Enterprises are focused on saving operational cost, as their profit margins continue to decline. License management software is one more way to reduce cost, as enterprises are on the lookout to optimize software usage to maximize software usage and avoid any loss due to license non-compliance. Furthermore, license management enables enterprises to control all contracts, agreements, license entitlements, and software inventory from a centralized location.

License management software also helps organizations to efficiently organize and store software agreements, thereby helping organizations safeguard themselves against unexpected license fees and penalties. It has enabled organizations to optimize software procurement cost through various ways, such as fewer license purchases, avoidance of penalties due to non-compliance, reduction in renewals through the elimination of shelfware maintenance, and maximization of volume discount.

Restraint: Stringent regulations

With the intensifying competition, organizations across the globe are looking for ways to expand their business. Organizations have to face several challenges due to various country-specific legal rules and regulations. The usage of licenses in remote offices in different countries creates several non-compliance issues. Most of the software license agreement contracts limit the usage within the country of purchase. Global organizations having offices across various countries need to purchase licenses in one location and use it in another location. Such organizations have to bear extra costs for global deployment cases.

Opportunity: Growing cloud hosting business

Organizations are considering the cloud as a crucial part of IT strategy to remain competitive in the global market. The cloud computing technology offers clients with the advantage of low cost, scalable, and flexible solutions. Over 90% of companies claim to use cloud computing in some way or the other. With advancements in cloud technology, organizations across industry verticals are looking forward to leverage business opportunities in cloud hosting. It has created opportunities for the license management hosting team to leverage commercial opportunities of the hosting business in the cloud. For instance, DXC offers hosting programs for Microsoft SPLA, Citrix, and VMware; Reprise Software offers RLMCloud, and Flexera Software offers FlexNet Cloud Licensing Service for management of software licenses in the cloud.

Challenge: Cracks, malicious codes, keygens, and pirated software

Many times, organizations fail to detect the use of cracks, malicious codes, keygens and pirated software in their environment owing to the lack of proficiency and knowledge regarding piracy. Pirated software may be downloaded by an employee or a vendor to attack an organizations IT systems. The growing trend of BYOD among the enterprises allowing employees to access the companys information from their devices has further aggravated this concern.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

20152022 |

|

Base year considered |

2016 |

|

Forecast period |

20172022 |

|

Forecast units |

Value (USD, million/billion) |

|

Segments covered |

By Component (Software, Services), By Audit Area (Audit Services, Advisory Services, Compliance Management, License Entitlement, and Optimization, Operation and Analytics, Software Inventory Management, Usage Monitoring, Others), By Organization Size (Large Enterprises, SMEs), By Deployment Type (On-premises, Cloud), By Industry Vertical (IT, BFSI, Telecom, Manufacturing, Healthcare, Media and Entertainment, Retail and Consumer Goods, Others) |

|

Geographies covered |

North America, Europe, APAC, MEA, Latin America |

|

Companies covered |

Aspera Technologies (US), Cherwell Software (US), DXC Technology (US), Flexera Software (US), Gemalto (Netherlands), IBM (US), Oracle (US), Quest Software (US), ServiceNow (US), Snow Software (Sweden), Labs64 NetLicensing (Germany), Reprise Software (US), and TeamEDA (US) |

The research report categorizes the license management market to forecast revenues and analyze trends in each of the following submarkets:

By Component

- Software

- Services

- Professional Services

- Deployment and Integration

- Consulting

- Support and Maintenance

- Managed Services

By Application Area

- Audit Services

- Advisory Services

- Compliance Management

- License Entitlement and Optimization

- Operations and Analytics

- Software Inventory Management

- Usage Monitoring

- Others (Security and Vendor Information Management)

By Deployment Type

- On-premises

- Cloud

By Organization Size

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

By Industry Vertical

- IT

- Banking, Financial Services, and Insurance (BFSI)

- Telecom

- Manufacturing

- Healthcare

- Media and Entertainment

- Retail and Consumer Goods

- Others (Energy and Utilities, Government, and Travel and Transportation)

By Region

- North America

- Europe

- MEA

- APAC

- Latin America

Key Market Players

Aspera Technologies (US), Cherwell Software (US), Flexera Software US), Gemalto (Netherlands), IBM (US)

Recent Developments

- In November 2017, DXC Technology opened a new digital transformation center in Louisiana, US. The new center would focus on development, delivery, and ongoing support for services and solutions, including applications, cloud computing, cybersecurity, data analytics, and intelligent automation.

- In October 2017, IBM released the IBM License Management Tool (ILMT) 9.2.9. This version offers features such as adding custom fields to license metric reports, providing information about the detailed version of software elements and enhancing the security, user interface, and software catalog.

- In September 2017, Flexera Software acquired BDNA. The acquisition has enabled Flexera Software to empower organizations with the largest repository of decision-support data.

- In September 2017, Gemalto launched Sentinel Fit, a secure licensing solution for embedded software and IoT devices. It offers complete licensing and entitlement management solutions to maximize the monetization of software-based products.

- In May 2017, Aspera Technologies launched Rapid Vendor Analysis for Salesforce to optimize the Salesforce license cost. This newly launched product also helps organizations reduce the overall cost related to Salesforce Cloud.

Key Questions Answered

- Which regions are likely to grow at the highest CAGR?

- What are the recent trends affecting the license management market?

- Who are the key players in the market, and how intense is the competition?

- What are the application areas of license management?

- What are the challenges hindering the adoption of license management services?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.4 Years Considered for the Study

1.5 Currency

1.6 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakdown of Primaries

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.3 Research Assumptions

2.4 Limitations

3 Executive Summary (Page No. - 22)

4 Premium Insights (Page No. - 25)

4.1 Attractive Market Opportunities in the License Management Market

4.2 Market By Deployment Type

4.3 Market By Component

4.4 Market By Organization Size

4.5 Market By Industry Vertical and Region

4.6 Life Cycle Analysis, By Region (2017)

5 License Management Market Overview (Page No. - 29)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growing Demand to Optimize Software Investments

5.2.1.2 Increasing Need for Audit-Readiness Among Enterprises

5.2.2 Restraints

5.2.2.1 Stringent Regulations

5.2.3 Opportunities

5.2.3.1 Growing Cloud Hosting Business

5.2.3.2 Evolution of IoT and Rapidly Growing Number of IoT Devices

5.2.3.3 Virtualized Environment

5.2.3.4 Adoption of Anti-Counterfeiting and Anti-Piracy Initiatives

5.2.4 Challenges

5.2.4.1 Cracks, Malicious Codes, Keygens, and Pirated Software

5.2.4.2 Difficulties in Migration Between Market Changes

5.2.4.3 Lack of Awareness About License Management Software

5.3 License Management Use Cases

5.3.1 Gemalto

5.3.2 Agilis Software

6 License Management Market, By Component (Page No. - 33)

6.1 Introduction

6.2 Software

6.3 Services

6.3.1 Professional Services

6.3.1.1 Deployment and Integration

6.3.1.2 Consulting

6.3.1.3 Support and Maintenance

6.3.2 Managed Services

7 License Management Market, By Application Area (Page No. - 41)

7.1 Introduction

7.2 Audit Services

7.3 Advisory Services

7.4 Compliance Management

7.5 License Entitlement and Optimization

7.6 Operations and Analytics

7.7 Software Inventory Management

7.8 Usage Monitoring

7.9 Others

8 License Management Market, By Deployment Type (Page No. - 51)

8.1 Introduction

8.2 On-Premises

8.3 Cloud

9 License Management Market, By Organization Size (Page No. - 55)

9.1 Introduction

9.2 Large Enterprises

9.3 Small and Medium-Sized Enterprises

10 License Management Market, By Industry Vertical (Page No. - 59)

10.1 Introduction

10.2 Information Technology

10.3 Banking, Financial Services, and Insurance

10.4 Telecom

10.5 Manufacturing

10.6 Healthcare

10.7 Media and Entertainment

10.8 Retail and Consumer Goods

10.9 Others

11 License Management Market, By Region (Page No. - 67)

11.1 Introduction

11.2 North America

11.3 Europe

11.4 Asia Pacific

11.5 Middle East and Africa

11.6 Latin America

12 Competitive Landscape (Page No. - 87)

12.1 Overview

12.2 Competitive Scenario

12.2.1 New Product Launches

12.2.2 Business Expansions

12.2.3 Acquisitions/Partnerships/Collaborations

12.3 Market Ranking

13 Company Profiles (Page No. - 91)

13.1 Aspera Technologies

(Business Overview, Services Offered, Recent Developments, and MnM View)

13.2 Cherwell Software

13.3 DXC Technology

13.4 Flexera Software

13.5 Gemalto

13.6 IBM

13.7 Oracle

13.8 Quest Software

13.9 Servicenow

13.10 Snow Software

*Details on Business Overview, Services Offered, Recent Developments, and MnM View Might Not Be Captured in Case of Unlisted Companies.

13.11 Key Innovators

13.11.1 Labs64 Netlicensing

13.11.2 Reprise Software

13.11.3 Teameda

14 Appendix (Page No. - 118)

14.1 Industry Excerpts

14.2 Discussion Guide

14.3 Knowledge Store: Marketsandmarkets Subscription Portal

14.4 Introduction Rt: Real-Time Market Intelligence

14.5 Available Customizations

14.6 Author Details

List of Tables (73 Tables)

Table 1 United States Dollar Exchange Rate

Table 2 License Management Market Size and Growth Rate, 20152022 (USD Million, Y-O-Y %)

Table 3 Market Size By Component, 20152022 (USD Million)

Table 4 Software: Market Size By Region, 20152022 (USD Million)

Table 5 Services: Market Size By Region, 20152022 (USD Million)

Table 6 Services: Market Size By Type, 20152022 (USD Million)

Table 7 Professional Services Market Size, By Type, 20152022 (USD Million)

Table 8 Professional Services Market Size, By Region, 20152022 (USD Million)

Table 9 Deployment and Integration Market Size, By Region, 20152022 (USD Million)

Table 10 Consulting Market Size, By Region, 20152022 (USD Million)

Table 11 Support and Maintenance Market Size, By Region, 20152022 (USD Million)

Table 12 Managed Services Market Size, By Region, 20152022 (USD Million)

Table 13 License Management Market Size, By Application Area, 20152022 (USD Million)

Table 14 Audit Services: Market Size By Region, 20152022 (USD Million)

Table 15 Advisory Services: Market Size By Region, 20152022 (USD Million)

Table 16 Compliance Management: Market Size By Region, 20152022 (USD Million)

Table 17 License Entitlement and Optimization: Market Size By Region, 20152022 (USD Million)

Table 18 Operations and Analytics: Market Size By Region, 20152022 (USD Million)

Table 19 Software Inventory Management: Market Size mBy Region, 20152022 (USD Million)

Table 20 Usage Monitoring: Market Size By Region, 20152022 (USD Million)

Table 21 Others: Market Size, By Region, 20152022 (USD Million)

Table 22 License Management Market Size, By Deployment Type, 20152022 (USD Million)

Table 23 On-Premises: Market Size By Region, 20152022 (USD Million)

Table 24 Cloud: Market Size By Region, 20152022 (USD Million)

Table 25 License Management Market Size, By Organization Size, 20152022 (USD Million)

Table 26 Large Enterprises: Market Size By Region, 20152022 (USD Million)

Table 27 Small and Medium-Sized Enterprises: Market Size By Region, 20152022 (USD Million)

Table 28 License Management Market Size, By Industry Vertical, 20152022 (USD Million)

Table 29 Information Technology: Market Size By Region, 20152022 (USD Million)

Table 30 Banking, Financial Services, and Insurance: Market Size By Region, 20152022 (USD Million)

Table 31 Telecom: Market Size By Region, 20152022 (USD Million)

Table 32 Manufacturing: Market Size By Region, 20152022 (USD Million)

Table 33 Healthcare: Market Size By Region, 20152022 (USD Million)

Table 34 Media and Entertainment: Market Size By Region, 20152022 (USD Million)

Table 35 Retail and Consumer Goods: Market Size By Region, 20152022 (USD Million)

Table 36 Others: Market Size By Region, 20152022 (USD Million)

Table 37 License Management Market Size, By Region, 20152022 (USD Million)

Table 38 North America: Market Size By Component, 20152022 (USD Million)

Table 39 North America: Market Size By Service, 20152022 (USD Million)

Table 40 North America: Market Size By Professional Service, 20152022 (USD Million)

Table 41 North America: Market Size By Application Area, 20152022 (USD Million)

Table 42 North America: Market Size By Deployment Type, 20152022 (USD Million)

Table 43 North America: Market Size By Organization Size, 20152022 (USD Million)

Table 44 North America: Market Size By Industry Vertical, 20152022 (USD Million)

Table 45 Europe: License Management Market Size, By Component, 20152022 (USD Million)

Table 46 Europe: Market Size By Service, 20152022 (USD Million)

Table 47 Europe: Market Size By Professional Service, 20152022 (USD Million)

Table 48 Europe: Market Size By Application Area, 20152022 (USD Million)

Table 49 Europe: Market Size By Deployment Type, 20152022 (USD Million)

Table 50 Europe: Market Size By Organization Size, 20152022 (USD Million)

Table 51 Europe: Market Size By Industry Vertical, 20152022 (USD Million)

Table 52 Asia Pacific: License Management Market Size, By Component, 20152022 (USD Million)

Table 53 Asia Pacific: Market Size By Service, 20152022 (USD Million)

Table 54 Asia Pacific: Market Size By Professional Service, 20152022 (USD Million)

Table 55 Asia Pacific: Market Size By Application Area, 20152022 (USD Million)

Table 56 Asia Pacific: Market By Deployment Type, 20152022 (USD Million)

Table 57 Asia Pacific: Market Size By Organization Size, 20152022 (USD Million)

Table 58 Asia Pacific: Market Size By Industry Vertical, 20152022 (USD Million)

Table 59 Middle East and Africa: License Management Market Size, By Component, 20152022 (USD Million)

Table 60 Middle East and Africa: Market Size By Service, 20152022 (USD Million)

Table 61 Middle East and Africa: Market Size By Professional Service, 20152022 (USD Million)

Table 62 Middle East and Africa: Market Size By Application Area, 20152022 (USD Million)

Table 63 Middle East and Africa: Market Size By Deployment Type, 20152022 (USD Million)

Table 64 Middle East and Africa: Market Size By Organization Size, 20152022 (USD Million)

Table 65 Middle East and Africa: Market By Industry Vertical, 20152022 (USD Million)

Table 66 Latin America: License Management Market Size, By Component, 20152022 (USD Million)

Table 67 Latin America: Market Size By Service, 20152022 (USD Million)

Table 68 Latin America: Market Size By Professional Service, 20152022 (USD Million)

Table 69 Latin America: Market Size By Application Area, 20152022 (USD Million)

Table 70 Latin America: Market Size By Deployment Type, 20152022 (USD Million)

Table 71 Latin America: Market Size By Organization Size, 20152022 (USD Million)

Table 72 Latin America: Market Size By Industry Vertical, 20152022 (USD Million)

Table 73 Market Ranking for the License Management Market

List of Figures (38 Figures)

Figure 1 License Management Market Segmentation

Figure 2 Market Research Design

Figure 3 Data Triangulation

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 License Management Market: Assumptions

Figure 7 Top 3 Segments With the Largest Market Shares in 2017

Figure 8 Market Regional Snapshot

Figure 9 Market By Application Area

Figure 10 Market By Professional Service

Figure 11 Rising Demand to Optimize Software Investment is Expected to Drive the Growth of the License Management Market During the Forecast Period

Figure 12 Cloud Deployment Type is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 13 Services Segment is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 14 Small and Medium-Sized Enterprises Segment is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 15 Information Technology Industry Vertical and North America Region are Estimated to Dominate the License Management Market in 2017

Figure 16 Asia Pacific is Expected to Grow Rapidly in the Coming Years

Figure 17 License Management Market: Drivers, Restraints, Opportunities, and Challenges

Figure 18 Services Segment is Expected to Witness A Higher CAGR During the Forecast Period

Figure 19 Managed Services Segment is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 20 License Entitlement and Optimization Application Area is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 21 Cloud Deployment Type is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 22 Small and Medium-Sized Enterprises Segment is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 23 Healthcare Industry Vertical is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 24 North America is Expected to Have the Largest Market Size During the Forecast Period

Figure 25 Asia Pacific is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 26 North America: Market Snapshot

Figure 27 Asia Pacific: Market Snapshot

Figure 28 Key Developments By Leading Players in the Global License Management Market, 20142017

Figure 29 DXC Technology: Company Snapshot

Figure 30 DXC Technology: SWOT Analysis

Figure 31 Gemalto: Company Snapshot

Figure 32 Gemalto: SWOT Analysis

Figure 33 IBM: Company Snapshot

Figure 34 IBM: SWOT Analysis

Figure 35 Oracle: Company Snapshot

Figure 36 Oracle: SWOT Analysis

Figure 37 Servicenow: Company Snapshot

Figure 38 Servicenow: SWOT Analysis

Growth opportunities and latent adjacency in License Management Market