LED Materials Market by Material Type (Substrate, Wafer, Epitaxy, Phosphor), Application (General Lighting (Residential, Industrial, Outdoor), Automotive Lighting (Interior, Exterior), Backlighting), and Region - Global Forecast to 2021

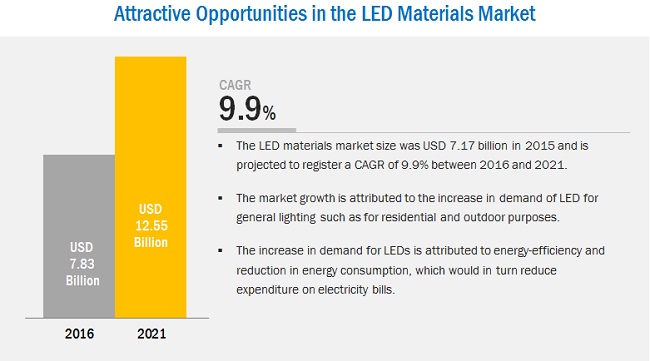

The LED materials market is projected to reach USD 12.55 billion by 2021, at a CAGR of 9.9%, in terms of value from 2016 to 2021. The base year considered for the study is 2015, while the forecast period is from 2016 to 2021. The LED materials market is driven by the increasing usage of LEDs in general and automotive lighting. The report includes analysis of the LED materials market by region, namely, North America, Europe, Asia-Pacific, Middle East & Africa, and South America.

Market Dynamics

Drivers

- Ban on the use of incandescent bulbs in many countries

- Government subsidies in emerging economies can increase LED consumption

Restraints

- Lifespan

Opportunities

- Growing demand from horticulture markets

- Development of Li-Fi

Government subsidies in emerging economies can increase LED consumption

Governments world over are focusing on reducing energy costs by implementing and developing energy-efficient devices. The Indian Government launched the Unnat Jyoti by Affordable LEDs for All (UJALA) scheme in order to replace the existing incandescent bulbs with newer and more efficient LED bulbs. The government has subsidized LED bulbs in order increase energy conservation. In 2013, according to World Bank, the per capita electric power consumption in India was 765 KWh, which was close to a quarter of the global average of 3,104 KWh. The per capita consumption in China in the same year was 3,762 KWh, after growing significantly from 2,944 KWh of 2010. India and China are rapidly developing economies. According to the National Energy Administration in China, the country accounted for the largest share in terms of total energy consumed in 2016. According to the International Monetary Fund (IMF), in 2016, China was the third-largest and India, the seventh-largest in the world, in terms of nominal GDP.

Objectives of the Study:

- To define, describe, and forecast the LED materials market on the basis of type, end-use industry, and region

- To provide detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape if the market

- To strategically profile key players and comprehensively analyze their market shares and core competencies2

Note1: Micromarkets are the subsegments of the LED materials market included in the report

Note2: Core competencies of companies are determined in terms of their key developments, SWOT analysis, and key strategies adopted by them to sustain in the market

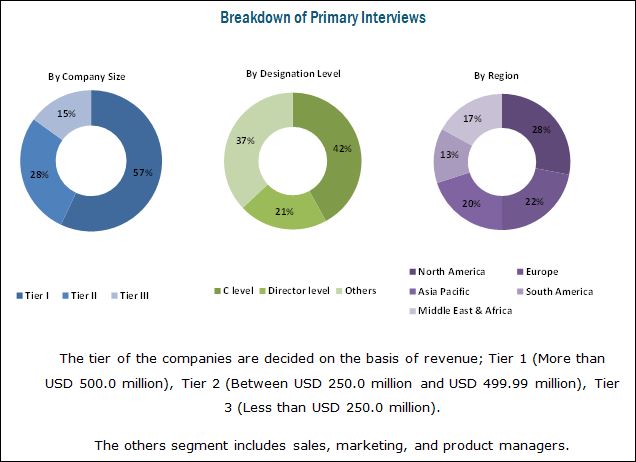

Both top-down and bottom-up approaches have been used to estimate and validate the size of the LED materials market and to determine the size of various other dependent submarkets. The research study involved the use of extensive secondary sources, directories, and databases such as Hoovers, Bloomberg, Chemical Weekly, Commonwealth Scientific and Industrial Research Organization (CSIRO), Securities And Exchange Commission (SEC), American National Standards Institute (ANSI), and other government and private websites to identify and collect information useful for a technical, market-oriented, and commercial study of the LED materials market.

To know about the assumptions considered for the study, download the pdf brochure

The major players covered in the report are Nichia Corporation (Japan), Epistar Corporation (Taiwan), Koninklijke Philips N.V. (Netherlands), OSRAM Licht AG (Germany), II-VI incorporated (U.S.), and AkzoNobel (Netherlands) and other manufacturers.

Major Market Developments

- In March 2017, Cree launched XLamp XHP70.2 LED, a new generation of LED which produced 9% more lumen and 18% higher lumens-per-watt than the previous generation XHP70 LED. This also helped in making luminaires smaller and increase optical control for lighting applications.

- In October 2016, Epistar Corporation and Super Trend Lighting (Group) Ltd. (Hong Kong) signed a license agreement. This agreement allowed Super Trend Lighting to use Epistar's filament patents in its products. The patents used were limited to areas of Europe, the U.S., China, and Taiwan.

- In March 2016 Nichia Corporation (Japan) entered into a partnership with Future Lighting Solutions (Canada), a leading distributor of solid-state lighting technologies. The deal focuses on areas in the Americas and Europe and is limited to general lighting applications.

Key Target Audience:

- Manufacturers of LED Materials

- Traders, Distributors, and Suppliers of LED Materials

- Building and Construction, Automotive & Transportation and all Related End User Companies

- Regional Manufacturers Associations

- Government and Research Organizations

- Investment Research Firms

This study answers several questions for the stakeholders, primarily which market segments to focus in the next two to five years for prioritizing the efforts and investments

Scope of the Report:

This research report categorizes the LED materials market on the basis of material type, end-use industry, and region.

On the Basis of Type:

- Wafer

- Substrate

- Epitaxy

- Others

On the Basis of End-use Application:

- General Lighting

- Automotive Lighting

- Backlighting

- Others

On the Basis of Region:

- North America

- Europe

- Asia-Pacific

- Middle East & Africa

- South America

- The market is further analyzed for the key countries in each of these regions.

Critical questions which the report answers

- What is the market size of LED materials across different countries?

- Which are the key players in the market and how intense is the competition?

Available Customizations:

Along with the market data, MarketsandMarkets offers customizations according to the companys specific needs. The following customization options are available for the report:

Regional Analysis:

- Country-level analysis of the LED materials market by end-use industry

Company Information:

- Detailed analysis and profiling of additional market players

The global LED materials market is projected to reach USD 12.55 billion by 2021, at a CAGR of 9.9% from 2016 to 2021. The market has witnessed significant growth in the recent years, and this growth is projected to continue in the coming years. The growth of the LED materials market is expected to be fueled by the increasing use of LEDs in various end-use industries such as automotive, backlighting, and other consumer products.

The different material types of LEDs included in the report are substrate, wafer, epitaxy, and phosphor. The wafers segment is set to dominate the LED materials market during the forecast period as companies are moving from two and four-inch wafer size to a more cost effective six and eight-inch wafer size production. As the yield of larger diameter wafer has significantly improved in recent years, companies have gradually transitioned to higher diameter wafer production.

LEDs are used in various end-use applications such as general lighting, automotive lighting, and backlighting, and others. General lighting is the largest segment and is expected to drive the LED materials market owing to the increasing demand for LEDs in residential and industrial applications. The LED materials market for automotive segment is projected to witness the highest growth, driven by the demand for LEDs for exterior automotive lighting.

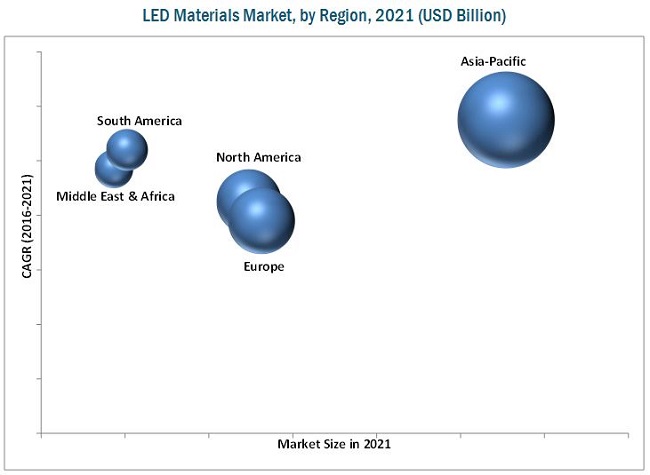

The LED materials market report covers the market in North America, Europe, Asia-Pacific, Middle East & Africa, and South America. Asia-Pacific region is dominant in the LED materials market. The rising demand for LEDs in this region is mainly driven by the increased adoption rate and government incentives. Europe is the second-largest LED materials markets, globally. The market in this region is mainly driven by the growing opportunities from automotive industries.

However, few factors, such as volatility in raw material prices and variable lifespan hinder the growth of the market, globally.

In this report, the LED materials market has been segmented into general lighting, automotive lighting, and backlighting

General Lighting

General lighting encompasses both residential, outdoor, and industrial lighting used as lighting source during the night. LEDs in the industrial setting are involved in challenging environments such as industrial bay areas, cold storage areas, and other functional areas. LEDs are ideal for outdoor lighting and are used for street lighting for many reasons, which mainly include longer lifespan and better efficiency. In addition, they have low power consumption and better color rendering compared to traditional lighting sources. As LEDs can be switched on in instant, they are ideal for street lighting applications. Conventional lighting sources such as incandescent bulbs are not very efficient at converting electricity to visible light, with only a fraction of the electricity consumed converted into useable light and the rest wasted as heat. Although Compact Fluorescent Lights (CFLs) are more energy-efficient compared to incandescent bulbs, CFLs have shorter Life spans and are less energy efficient than LEDs.

Automotive Lighting

LEDs are used in different applications such as cabin illumination, display backlighting, and indication lights in automobiles. Optimally designed interior lighting can not only increase the overall appeal of the car but also reduce the drivers fatigue especially during nighttime driving. It can also improve the perception of cabin space. LEDs have found widespread use in exterior lighting in automobiles. As the life of LEDs used in exterior applications has increased, it has garnered greater share of the automotive lighting market.

Backlighting

Backlighting can be used in a variety of applications such as handheld devices and mobile devices. These can also be used in televisions and computer monitors. Backlighting is expected to grow at a slower pace compared to general lighting and automotive lighting, as this market is expected to saturate sooner compared to others. LEDs are used in mobile phones in order to produce a flash light. These tend to be much more versatile and can run at lower voltages compared to other sources. In addition, the LED flash can be switched on immediately, making it one of the preferred sources of flash light. LEDs are used in monitors for a variety of reasons. Typically, they are less expensive and have a broader dimming range.

Nichia Corporation (Japan), Epistar Corporation (Taiwan), Koninklijke Philips N.V. (Netherlands), OSRAM Licht AG (Germany), II-VI incorporated (U.S.), and AkzoNobel (Netherlands) are the leading companies operating in this market. These companies are expected to account for a significant market share in the near future. Entering related industries and targeting new applications will enable LED materials manufacturers to overcome the effects of the volatile economy, leading to a diversified business portfolio and increased revenue. The other main manufacturers of LED materials are Sumitomo Electric (Japan), Hitachi Metals (Japan), Cree, Inc. (U.S.), and Seoul Semiconductors (South Korea).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Breakdown of Primary Interviews

2.1.2.3 Key Industry Insights

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Research Assumption

2.5 Limitation

3 Executive Summary (Page No. - 24)

4 Premium Insights (Page No. - 28)

4.1 Attractive Opportunities in the LED Materials Market

4.2 LED Materials Market Growth, By Application

4.3 LED Materials Market, By Type

4.4 LED Materials Market, By Region

5 Market Overview (Page No. - 31)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Ban on the Use of Incandescent Bulbs in Many Countries

5.2.1.2 Government Subsidies in Emerging Economies Can Increase LED Consumption

5.2.2 Restraints

5.2.2.1 Lifespan

5.2.3 Opportunities

5.2.3.1 Growing Demand From Horticulture Markets

5.2.3.2 Development of Li-Fi

5.3 Porters Five Forces Analysis

5.3.1 Bargaining Power of Suppliers

5.3.2 Bargaining Power of Buyers

5.3.3 Threat of Substitutes

5.3.4 Threat of New Entrants

5.3.5 Intensity of Competitive Rivalry

6 LED Materials Market, By Type (Page No. - 36)

6.1 Introduction

6.2 Substrate Materials

6.2.1 Silicon Carbide

6.2.2 Silicon

6.2.3 Sapphire

6.3 Wafer

6.3.1 Gallium Arsenide

6.3.2 Gallium Nitride

6.4 Epitaxy Materials

6.4.1 Trimethylgallium

6.4.2 Trimethylaluminum

6.5 Phosphor

7 LED Materials Market, By Application (Page No. - 40)

7.1 Introduction

7.2 General Lighting

7.2.1 Residential Lighting

7.2.2 Industrial Lighting

7.2.3 Outdoor Lighting

7.2.4 Other General Lighting Applications

7.3 Automotive Lighting

7.3.1 Interior Lighting

7.3.2 Exterior Lighting

7.3.3 Backlighting

7.3.4 Televisions

7.3.5 Monitors

7.3.6 Handheld Devices

7.4 Other Applications

8 LED Materials Market, By Region (Page No. - 50)

8.1 Introduction

8.2 Asia-Pacific

8.2.1 China

8.2.2 Japan

8.2.3 Taiwan

8.2.4 South Korea

8.2.5 India

8.2.6 Vietnam

8.2.7 Malaysia

8.2.8 Singapore

8.2.9 Philippines

8.2.10 Rest of Asia-Pacific

8.3 Europe

8.3.1 Germany

8.3.2 France

8.3.3 Italy

8.3.4 U.K.

8.3.5 Spain

8.3.6 Rest of Europe

8.4 North America

8.4.1 U.S.

8.4.2 Canada

8.4.3 Mexico

8.5 South America

8.5.1 Brazil

8.5.2 Argentina

8.5.3 Rest of South America

8.6 Middle East & Africa

8.6.1 UAE

8.6.2 Qatar

8.6.3 Rest of Middle East & Africa

9 Dive Matrix (Page No. - 77)

9.1 Introduction

9.1.1 Dynamic

9.1.2 Innovators

9.1.3 Vanguards

9.1.4 Emerging

9.2 Overview

9.3 Product Offerings (For All 25 Players)

9.4 Business Strategy

10 Company Profiles (Page No. - 81)

(Overview, Financial*, Products & Services, Strategy, and Developments)

10.1 Akzonobel N.V

10.2 Cree, Inc.

10.3 Epistar Corporation

10.4 Hitachi Metals, Ltd.

10.5 II-VI Incorporated

10.6 Koninklijke Philips N.V.

10.7 Nichia Corporation

10.8 Osram Licht AG

10.9 Sumitomo Electric Industries

10.10 UBE Industries, Ltd.

10.11 Other Players

10.11.1 Addison Engineering, Inc.

10.11.2 China Crystal Technologies Co., Ltd

10.11.3 Dowa Electronic Materials Co Ltd

10.11.4 Epigan NV

10.11.5 Everlight Electronics Co., Ltd

10.11.6 Freiberger Compound Materials GmbH

10.11.7 Lake LED Materials Co., Ltd

10.11.8 LG Innotek

10.11.9 Macom Technology Solutions

10.11.10 MTI Corporation

10.11.11 Seoul Semiconductors Co, Ltd

10.11.12 Sino Nitride Semiconductor Co, Ltd

10.11.13 Six Point Materials, Inc.

10.11.14 Soraa

10.11.15 Xinxiang Shenzhou Crystal Technology Co., Ltd

*Details Might Not Be Captured in Case of Unlisted Companies.

11 Appendix (Page No. - 114)

11.1 Insights From Industry Experts

11.2 Discussion Guide

11.3 Knowledge Store: Marketsandmarkets Subscription Portal

11.4 Introducing RT: Real-Time Market Intelligence

11.5 Related Reports

11.6 Author Details

List of Tables (61 Tables)

Table 1 LED Materials Market Size, By Type, 20142021 (USD Million)

Table 2 LED Materials Market Size, By Application, 20142021 (USD Million)

Table 3 LED Materials Market Size in General Lighting, By Region, 20142021 (USD Million)

Table 4 LED Materials Market Size in Residential Lighting, By Region, 20142021 (USD Million)

Table 5 LED Materials Market Size in Residential Lighting, By Country, 20142021 (USD Million)

Table 6 LED Materials Market Size in Industrial Lighting, By Region, 20142021 (USD Million)

Table 7 LED Materials Market Size in Industrial Lighting, By Country, 20142021 (USD Million)

Table 8 LED Materials Market Size in Outdoor Lighting, By Region, 20142021 (USD Million)

Table 9 LED Materials Market Size in Outdoor Lighting, By Country, 20142021 (USD Million)

Table 10 LED Materials Market Size in Other Lighting, By Region, 20142021 (USD Million)

Table 11 LED Materials Market Size in Others, By Country, 20142021 (USD Million)

Table 12 LED Materials Market Size in Automotive Lighting, By Region, 20142021 (USD Million)

Table 13 LED Materials Market Size in Automotive Lighting, By Application 20142021 (USD Million)

Table 14 LED Materials Market Size in Interior Automotive Lighting, By Region, 20142021 (USD Million)

Table 15 LED Materials Market Size in Exterior Automotive Lighting, By Region, 20142021 (USD Million)

Table 16 LED Materials Market Size in Backlighting, By Region, 20142021 (USD Million)

Table 17 LED Materials Market Size in Other Applications, By Region, 20142021 (USD Million)

Table 18 LED Materials Market Size, By Region, 20142021 (USD Million)

Table 19 Asia-Pacific: LED Materials Market Size, By Country, 20142021 (USD Million)

Table 20 Asia-Pacific: LED Materials Market Size, By Application, 20142021 (USD Million)

Table 21 Asia-Pacific: LED Materials Market Size in General Lighting, By Sub-Application, 20142021 (USD Million)

Table 22 China: Market Size, By Application, 20142021 (USD Million)

Table 23 China: Market Size in General Lighting, By Sub-Application, 20142021 (USD Million)

Table 24 Japan: Market Size, By Application, 20142021 (USD Million)

Table 25 Taiwan: Market Size, By Application, 20142021 (USD Million)

Table 26 South Korea: Market Size, By Application, 20142021 (USD Million)

Table 27 India: Market, By Application, 20142021 (USD Million)

Table 28 India: Market Size in General Lighting, By Sub-Application, 20142021 (USD Million)

Table 29 Vietnam: Market Size, By Application, 20142021 (USD Million)

Table 30 Malaysia: Market Size, By Application, 20142021 (USD Million)

Table 31 Singapore: Market Size, By Application, 20142021 (USD Million)

Table 32 Philippines: Market Size, By Application, 20142021 (USD Million)

Table 33 Rest of Asia-Pacific: LED Materials Market Size, By Application, 20142021 (USD Million)

Table 34 Europe: LED Materials Market Size, By Country, 20142021 (USD Million)

Table 35 Europe: LED Materials Market Size, Application, 20142021 (USD Million)

Table 36 Europe: LED Materials Market Size in General Lighting, By Sub-Application, 20142021 (USD Million)

Table 37 Germany: Market Size, By Application, 20142021 (USD Million)

Table 38 France: Market Size, By Application, 20142021 (USD Million)

Table 39 Italy: Market Size, By Application, 20142021 (USD Million)

Table 40 U.K.: Market Size, By Application, 20142021 (USD Million)

Table 41 Spain: Market Size, By Application, 20142021 (USD Million)

Table 42 Rest of Europe: LED Materials Market Size, By Application, 20142021 (USD Million)

Table 43 North America: Market Size, By Country, 20142021 (USD Million)

Table 44 North America: Market Size, By Application, 20142021 (USD Million)

Table 45 North America: Market Size in General Lighting, By Sub-Application, 20142021 (USD Million)

Table 46 U.S.: Market Size, By Application, 2014-2021 (USD Million)

Table 47 Canada: Market Size, By Application, 20142021 (USD Million)

Table 48 Mexico: Market Size, By Application, 20142021 (USD Million)

Table 49 South America: Market Size, By Country, 20142021 (USD Million)

Table 50 South America: Market Size, Application, 20142021 (USD Million)

Table 51 South America: Market Size in General Lighting, By Sub-Application, 20142021 (USD Million)

Table 52 Brazil: Market Size, By Application, 20142021 (USD Million)

Table 53 Brazil: Market Size in General Lighting, By Sub-Application, 20142021 (USD Million)

Table 54 Argentina: Market Size, By Application, 20142021 (USD Million)

Table 55 Rest of South America:Market Size, By Application, 20142021 (USD Million)

Table 56 Middle East & Africa: Market Size, By Country, 20142021 (USD Million)

Table 57 Middle East & Africa: Market Size, By Application, 2014-2021 (USD Millions)

Table 58 Middle East & Africa: Market Size in General Lighting, By Sub-Application, 20142021 (USD Million)

Table 59 UAE: Market Size, By Application, 2014-2021 (USD Millions)

Table 60 Qatar: Market Size, By Application, 2014-2021 (USD Millions)

Table 61 Rest of Middle East & Africa: LED Materials Market Size, By Application, 20142021 (USD Million)

List of Figures (30 Figures)

Figure 1 LED Materials: Market Segmentation

Figure 2 LED Materials Market: Research Design

Figure 3 Market Size Estimation: Bottom-Up Approach

Figure 4 Market Size Estimation: Top-Down Approach

Figure 5 LED Materials Market: Data Triangulation

Figure 6 Assumptions

Figure 7 Wafer Material Type Dominates the LED Materials Market

Figure 8 General Lighting to Gain the Largest Demand During the Projection Period

Figure 9 Asia-Pacific to Be the Most Promising Region for LED Materials

Figure 10 Emerging Economies Offer Attractive Opportunities in the LED Materials Market

Figure 11 General Lighting is Projected to Be the Most Promising Application Through 2021

Figure 12 Wafer is Projected to Be the Largest Segment Through 2021

Figure 13 Asia-Pacific Accounted for the Largest Share in 2015

Figure 14 Impact Analysis of Short, Medium, and Long-Term Drivers & Restraints

Figure 15 Porters Five Forces Analysis

Figure 16 Wafer Segment to Dominate the LED Materials Market Through 2021

Figure 17 Regional Snapshot: Rapid Growth Markets are Emerging as New Hot Spots

Figure 18 Asia-Pacific LED Materials Market Snapshot: Vietnam, Malaysia, and India are the Most Lucrative Markets

Figure 19 U.S. is the Key Market for General Lighting Application for LED Materials in North America

Figure 20 Rising Economy to Drive the LED Materials Market

Figure 21 Dive Chart

Figure 22 Akzonobel: Company Snapshot (2016)

Figure 23 Cree, Inc.: Company Snapshot (2016)

Figure 24 Epistar Corporation: Company Snapshot (2016)

Figure 25 Hitachi Metals, Ltd.: Company Snapshot (2015)

Figure 26 II-VI Incorporated: Company Snapshot (2016)

Figure 27 Koninklijke Philips N.V. : Company Snapshot (2016)

Figure 28 Osram Licht AG: Company Snapshot (2016)

Figure 29 Sumitomo Electric: Company Snapshot (2016)

Figure 30 UBE Industries, Ltd.: Company Snapshot (2016)

Growth opportunities and latent adjacency in LED Materials Market