LED Light Engine Market by Product Type (Lamps and Luminaires), Installation Type (New Installation and Retrofit Installation), End-Use Application (Indoor Lighting and Outdoor Lighting), and Geography - Forecast to 2036

The global LED light engine market was valued at USD 63.41 billion in 2025 and is estimated to reach USD 139.31 billion by 2036, at a CAGR of 7.4% between 2025 and 2036.

The LED light engine market is expected to witness significant growth during the forecast period. Accelerated adoption of energy-efficient solutions, fueled by stringent government mandates and sustainability agendas, is a key factor driving the demand across residential, commercial, and industrial applications. Furthermore, reducing LED unit costs, along with advancements in smart and connected lighting systems, are enabling improved operational efficiency and user experience. Furthermore, urbanization, infrastructure modernization, and rising consumer preference for long-lasting, low-maintenance lighting solutions are significantly contributing to the growth of the LED light engine market.

An LED light engine is a fully integrated lighting module that combines one or more LED chips or arrays with the required electronic, optical, thermal, and mechanical components to deliver a defined light output. Unlike a bare LED, a light engine includes the driver, heat sink, and optical components such as lenses or reflectors, enabling it to function as a ready-to-use light source within luminaires or fixtures.

Market by Application

Indoor Lighting

Transition toward energy-efficient and digitally controllable illumination systems across residential, commercial, and industrial spaces is a major factor driving the market growth for LED light engines for indoor lighting applications. In residential environments, rising awareness of energy savings, longer lifespan, and aesthetic flexibility is driving the replacement of conventional light sources with integrated LED engines. Commercial and industrial facilities are increasingly adopting modular, smart-ready light engines to reduce operating costs, meet ESG compliance targets, and enable sensor-based automation.

Outdoor Lighting

The outdoor lighting segment is witnessing strong momentum driven by infrastructure modernization, smart city development, and public safety imperatives. Municipal authorities and transportation agencies are deploying LED light engines across highways, roadways, and public spaces to enhance visibility, reduce energy consumption, and reduce maintenance expenditure. Furthermore, compact, high-lumen LED engines that enable dynamic color control and creative urban aesthetics are being extensively used for architectural lighting applications. Additionally, advancements in weather-resistant designs and adaptive lighting controls are expanding the usability of LED engines across harsh outdoor environments. These developments, combined with supportive government policies for sustainable infrastructure and urban energy optimization, are driving the widespread adoption of LED light engines in outdoor lighting applications.

Market by Product Type

Lamps

The demand for LED light engines in lamps is being driven by the rapid replacement of conventional lighting technologies, such as incandescent, halogen, and compact fluorescent lamps, with energy-efficient LEDs. Consumers and businesses are increasingly opting for retrofit LED lamp solutions integrated with light engines that offer superior lumen efficacy, consistent color quality, and extended operational life. Moreover, the declining cost of LED components, combined with government incentives and energy-efficiency initiatives, is further accelerating the adoption of LED light engines in lamps across residential and commercial environments. Additionally, the shift toward smart home ecosystems and connected lighting platforms is creating a strong pull for LED lamps embedded with controllable light engines, enhancing customization and overall user experience.

Luminaires

LED light engines for luminaires are witnessing strong demand owing to rising investments in new construction, infrastructure upgrades, and smart building projects. Luminaires equipped with integrated light engines offer enhanced design flexibility, thermal stability, and optical precision. Manufacturers are increasingly developing modular and tunable white light engines that align with human-centric lighting trends and adaptive control systems. Furthermore, corporate sustainability mandates and large-scale deployment of networked lighting in offices, factories, and public infrastructure are further driving the demand for LED luminaires.

Market by Geography

Asia Pacific is expected to dominate the LED light engine market. The major factors driving the market growth in the region are rapid urbanization, large-scale infrastructure development, and strong government initiatives promoting energy-efficient lighting. Massive investments in smart cities across China, India, South Korea, and Southeast Asia, along with expanding manufacturing ecosystems and cost-competitive production of LED components, are driving the dominance of the region. North America is experiencing growth through accelerated adoption of smart lighting systems, stringent energy efficiency standards, and large-scale commercial retrofitting programs, while Europe continues to benefit from robust regulatory frameworks under EU energy directives and sustainability mandates. Furthermore, rising public-private investments in urban and roadway lighting and increasing adoption of energy-efficient lighting solutions are driving the market growth in the Middle East, Africa, and South America.

Market Dynamics

Driver: Increasing need for energy-efficient lighting systems

The growing emphasis on energy efficiency is a key factor driving the adoption of LED light engines globally. With lighting accounting for a significant share of electricity consumption, governments, enterprises, and consumers are prioritizing technologies that deliver higher lumen output per watt and lower lifecycle costs. LED light engines, offering superior energy conversion efficiency, minimal heat loss, and extended service life, align directly with these sustainability and cost-optimization goals. Their integration into smart lighting systems further enhances control and efficiency through adaptive dimming and occupancy sensing.

Restraint: High initial cost

The high initial cost of LED light engines is a major factor adversely impacting the market growth. Compared to conventional lighting technologies, LEDs require greater upfront investment for components, advanced thermal management systems, and installation. This initial expenditure can challenge the adoption, particularly among small and medium-sized enterprises and cost-sensitive applications. Although long-term energy savings and reduced maintenance costs offset this over time, the high upfront price remains a barrier, adversely affecting the adoption of LED light engines for residential and commercial applications.

Opportunity: Increasing demand from horticulture

The growing horticulture and indoor farming sector is creating a significant growth opportunity for LED light engines. Controlled-environment agriculture relies on precisely tuned light spectra to optimize plant growth, yield, and energy efficiency, making LED light engines an ideal solution due to their spectral flexibility, high efficacy, and long lifespan. Rising investments in vertical farms, greenhouses, and urban agriculture, driven by the need for sustainable food production and year-round cultivation, are accelerating the adoption of LED light engines.

Challenge: Lack of common open standards

The absence of common open standards presents a major challenge for the LED light engine market by creating interoperability and integration problems across different lighting systems and manufacturers. Without standardized protocols for drivers, control interfaces, and performance metrics, end-users face difficulties in deploying mixed-vendor solutions, limiting scalability and increasing installation complexity. This fragmentation also slows innovation, raises compliance costs, and can adversely impact the adoption in large-scale commercial, industrial, and smart city projects.

Future Outlook

Between 2025 and 2036, the LED light engine market is expected to witness high growth as energy-efficient and long-lasting lighting solutions become essential across industrial, commercial, and smart city applications. Advances in smart lighting systems, IoT integration, and connected solutions will transform LEDs from simple lighting sources into solutions that can optimize the usage of energy and improve user experience. Moreover, increasing government initiatives for energy conservation, sustainable infrastructure, and urban modernization will further drive the adoption of LED light engines.

Key Market Players

Top LED light engine market companies include Signify Holding (Netherlands), ams-OSRAM AG (Austria), Acuity Inc. (US), Panasonic Corporation (Japan), and LG Electronics (South Korea).

Key Questions addressed in this report:

- What are the global trends in demand for the market?

- What are the upcoming technologies/product areas that will have a significant impact on the market in the future?

- What will be the revenue pockets for the market players in the next 6 years?

- What are the prime strategies followed by key players in the market?

Table of Contents

1 Introduction (Page No. - 15)

1.1 Study Objectives

1.2 Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Market Segmentation, By Region

1.3.3 Years Considered

1.4 Currency

1.5 Package Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 List of Major Secondary Sources

2.1.1.2 Key Data From Secondary Sources

2.1.2 Primary Data

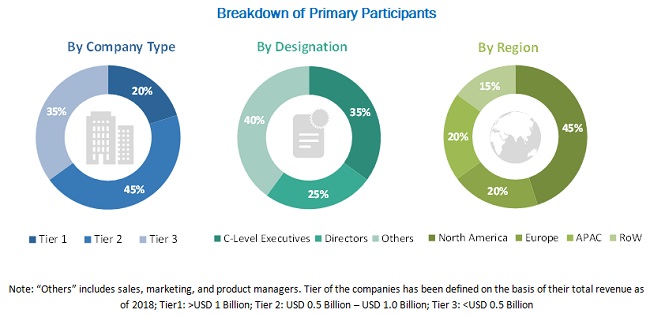

2.1.2.1 Breakdown of Primaries

2.1.2.2 Key Data From Primary Sources

2.1.3 Secondary Research and Primary Research

2.1.3.1 Key Industry Insights

2.1.4 Market Size Estimation

2.1.5 Bottom-Up Approach

2.1.5.1 Approach to Capture Market Size of Applications By Bottom-Up Analysis (Demand Side)

2.1.6 Top-Down Approach

2.1.6.1 Approach to Capture Market Size of Applications By Top-Down Analysis (Supply Side)

2.2 Market Breakdown and Data Triangulation

2.3 Research Assumptions

3 Executive Summary (Page No. - 29)

4 Premium Insights (Page No. - 33)

4.1 Attractive Opportunities in Market

4.2 Market, By Product Type

4.3 Market, By Installation Type

4.4 Market, By End-Use Application

4.5 Market, By Product Type and Region

4.6 Market, By Region

5 Market Overview (Page No. - 37)

5.1 Introduction

5.2 Market Evolution

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Modernization and Development of Infrastructure

5.3.1.2 Need for Energy-Efficient Lighting Systems

5.3.1.3 Reduction in LED Price

5.3.1.4 Government Initiatives and Regulations to Adopt Energy-Efficient LEDs

5.3.2 Restraints

5.3.2.1 Lack of Awareness Regarding Installation Cost

5.3.2.2 Development of Alternate Technologies

5.3.3 Opportunities

5.3.3.1 Development of Wireless Technology in LED Lighting Systems

5.3.3.2 Growing Demand From Horticulture Market

5.3.4 Challenges

5.3.4.1 Lack of Common Open Standards

6 LED Light Engine Market, By Product Type (Page No. - 44)

6.1 Introduction

6.2 Lamp

6.2.1 Market for Lamp to Showcase Steady Growth Rate During the Forecast Period

6.3 Luminaire

6.3.1 Market for Luminaire to Hold Largest Share and Grow at Highest Rate During the Forecast Period

7 LED Light Engine Market, By Installation Type (Page No. - 49)

7.1 Introduction

7.2 New Installation

7.2.1 New Installation Type to Hold Larger Share in the Market

7.3 Retrofit Installation

7.3.1 Retrofit Installation Market to Grow With Highest CAGR During the Forecast Period

8 LED Light Engine Market, By End-Use Application (Page No. - 56)

8.1 Introduction

8.2 Indoor Lighting

8.2.1 Residential

8.2.1.1 Residential Subsegment to Hold Largest Market Share in the Indoor Lighting Market During Forecast

8.2.2 Commercial

8.2.2.1 Commercial Subsegment to Contribute Among Major Share in the Overall Indoor Lighting Market During the Forecast Period

8.2.3 Industrial

8.2.3.1 Industrial Subsegment to Grow With Highest CAGR in the Indoor Lighting Market

8.2.4 Others

8.2.4.1 Other (Indoor) Subsegment to Showcase Considerable Growth in the Indoor Lighting Market

8.3 Outdoor Lighting

8.3.1 Highways & Roadways Lighting

8.3.1.1 Highway & Roadways Lighting to Hold Larger Share in the Outdoor Lighting Market

8.3.2 Architectural Lighting

8.3.2.1 Architectural Subsegment to Contribute Considerable Share in the Outdoor Lighting Market

8.3.3 Lighting for Public Places

8.3.3.1 Lighting for Public Places Subsegment to Grow With the Highest CAGR During the Forecast Period

8.3.4 Others

8.3.4.1 Others (Outdoor) Subsegment to Hold Potential for Growth in the Outdoor Lighting Market

9 Geographic Analysis (Page No. - 73)

9.1 Introduction

9.2 North America

9.2.1 US

9.2.1.1 Building Codes Boosting Adoption of New Lighting Technologies

9.2.2 Canada

9.2.2.1 Growing Adoption of LED Lighting Systems

9.3 Europe

9.3.1 UK

9.3.1.1 Rising Demand for Energy-Efficient and Long-Lasting Lighting Systems Drive Market Growth in UK

9.3.2 Germany

9.3.2.1 Increasing Preference for Smart Homes Fuel LED Lighting Market Growth in Germany

9.3.3 France

9.3.3.1 Growing Requirement for Energy Conservation Propel Market Growth in France

9.3.4 Italy

9.3.4.1 Escalating Demand for LED Light Engine From Rebounding Construction Sector Boosts Italian Market Growth

9.3.5 Rest of Europe

9.4 APAC

9.4.1 China

9.4.1.1 Increasing Government Expenditure on Public Infrastructure to Boost LED Lighting Demand in China

9.4.2 Japan

9.4.2.1 Rising Focus on Energy Management Solutions Leads to Increased Adoption of LED Light Engines

9.4.3 Rest of APAC

9.5 RoW

9.5.1 Growing Focus on Real Estate and Urbanization Fuels LED Light Engine Market Growth in Middle East and Africa

10 Competitive Landscape (Page No. - 89)

10.1 Introduction

10.2 Market Player Ranking Analysis

10.3 Competitive Leadership Mapping

10.3.1 Visionary Leaders

10.3.2 Dynamic Differentiators

10.3.3 Innovators

10.3.4 Emerging Companies

10.4 Strength of Product Portfolio (25 Companies)

10.5 Business Strategy Excellence (25 Companies)

11 Company Profiles (Page No. - 96)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View)*

11.1 Introduction

11.2 Key Players

11.2.1 Signify Lighting NV

11.2.2 OSRAM Licht Ag

11.2.3 GE Lighting (GE Lighting + Current)

11.2.4 Cree, Inc.

11.2.5 Hubbell Incorporated

11.2.6 Zumtobel Group Ag

11.2.7 Samsung Electronics

11.2.8 Wipro Enterprises (P) Limited

11.2.9 Glamox AS

11.2.10 Lutron Electronics

11.2.11 Acuity Brands, Inc.

11.3 Other Companies

11.3.1 Lumitech LLC

11.3.2 SDA Lighting

11.3.3 Trilux GmbH & Co. Kg

11.3.4 Helvar OY AB

11.3.5 LEDrabrands, Inc.

11.3.6 Ab Fagerhult

11.3.7 Gerard Lighting

11.3.8 Halla, A.S.

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View might not be captured in case of unlisted companies.

12 Appendix (Page No. - 134)

12.1 Insights of Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.4 Available Customizations

12.5 Related Reports

12.6 Author Details

List of Tables (68 Tables)

Table 1 Market, By Product Type, 2016–2024 (USD Million)

Table 2 Market, By Product Type, 2016–2024 (Million Units)

Table 3 Market for Lamp, By Installation Type, 2016–2024 (USD Million)

Table 4 Market for Lamp, By Installation Type, 2016–2024 (Million Units)

Table 5 Market for Luminaire, By Installation Type, 2016–2024 (USD Million)

Table 6 Market for Luminaire, By Installation Type, 2016–2024 (Million Units)

Table 7 Market, By Installation Type, 2016–2024 (USD Million)

Table 8 Market, By Installation Type, 2016–2024 (Million Units)

Table 9 Market for New Installation, By Product Type, 2016–2024 (USD Million)

Table 10 Market for New Installation, By Product Type, 2016–2024 (Million Units)

Table 11 Indoor LED Light Engine for New Installation, By Type, 2016–2024 (USD Million)

Table 12 Outdoor LED Light Engine for New Installation, By Type, 2016–2024 (USD Million)

Table 13 Market for New Installation, By Region, 2016–2024 (USD Million)

Table 14 Market for Retrofit Installation, By Product Type, 2016–2024 (USD Million)

Table 15 Market for Retrofit Installation, By Product Type, 2016–2024 (Million Units)

Table 16 Indoor LED Light Engine for Retrofit Installation, By Type, 2016–2024 (USD Million)

Table 17 Outdoor LED Light Engine for Retrofit Installation, By Type, 2016–2024 (USD Million)

Table 18 Market for Retrofit Installation, By Region, 2016–2024 (USD Million)

Table 19 Market, By End-Use Application, 2016–2024 (USD Million)

Table 20 Market, By End-Use Application, 2016–2024 (Million Units)

Table 21 Market for Indoor Lighting, By Type, 2016–2024 (USD Million)

Table 22 Market for Indoor Lighting, By Type, 2016–2024 (Million Units)

Table 23 Market for Indoor Lighting, By Region, 2016–2024 (USD Million)

Table 24 Market for Indoor Lighting, By Region, 2016–2024 (Million Units)

Table 25 Indoor LED Light Engine for Residential Application, By Region, 2016–2024 (USD Million)

Table 26 Indoor LED Light Engine for Commercial Application, By Region, 2016–2024 (USD Million)

Table 27 Indoor LED Light Engine for Industrial Application, By Region, 2016–2024 (USD Million)

Table 28 Indoor LED Light Engine for Other Applications, By Region, 2016–2024 (USD Million)

Table 29 Market for Indoor Lighting, By Installation Type, 2016–2024 (USD Million)

Table 30 Indoor LED Light Engine for Residential Application, By Installation Type (2016–2024) (USD Million)

Table 31 Indoor LED Light Engine for Commercial Application, By Installation Type, 2016–2024 (USD Million)

Table 32 Indoor LED Light Engine for Industrial Application, By Installation Type, 2016–2024 (USD Million)

Table 33 Indoor LED Light Engine for Other Applications, By Installation Type, 2016–2024 (USD Million)

Table 34 Market for Outdoor Lighting, By Type, 2016–2024 (USD Million)

Table 35 Market for Outdoor Lighting, By Type, 2016–2024 (Million Units)

Table 36 Market for Outdoor Lighting, By Region, 2016–2024 (USD Million)

Table 37 Market for Outdoor Lighting, By Region, 2016–2024 (Million Units)

Table 38 Outdoor LED Light Engine for Highways and Roadways, By Region, 2016–2024 (USD Million)

Table 39 Outdoor LED Light Engine for Architectural Application, By Region, 2016–2024 (USD Million)

Table 40 Outdoor LED Light Engine for Public Places, By Region, 2016–2024 (USD Million)

Table 41 Outdoor LED Light Engine for Other Applications, By Region, 2016–2024 (USD Million)

Table 42 LED Light Engine for Outdoor Lighting, By Installation Type, 2016–2024 (USD Million)

Table 43 Outdoor LED Light Engine for Highways and Roadways, By Installation Type,2016–2024 (USD Million)

Table 44 Outdoor LED Light Engine for Architectural Application, By Installation Type, 2016–2024 (USD Million)

Table 45 Outdoor LED Light Engine for Public Places, By Installation Type,2016–2024 (USD Million)

Table 46 Outdoor LED Light Engine for Other Applications, By Installation Type, 2016–2024 (USD Million)

Table 47 Market, By Region, 2016–2024 (USD Million)

Table 48 Market, By Region, 2016–2024 (Million Units)

Table 49 Market in North America, By End-Use Application, 2016–2024 (USD Million)

Table 50 Indoor LED Light Engine in North America, By Type, 2016–2024 (USD Million)

Table 51 Outdoor LED Light Engine in North America, By Type, 2016–2024 (USD Million)

Table 52 Market in North America, By Installation Type, 2016–2024 (USD Million)

Table 53 Market in North America, By Country, 2016–2024 (USD Million)

Table 54 Market in Europe, By End-Use Application, 2016–2024 (USD Million)

Table 55 Indoor LED Light Engine in Europe, By Type, 2016–2024 (USD Million)

Table 56 Outdoor LED Light Engine in Europe, By Type, 2016–2024 (USD Million)

Table 57 Market in Europe, By Installation Type, 2016–2024 (USD Million)

Table 58 Market in Europe, By Country, 2016–2024 (USD Million)

Table 59 Market in APAC, By End-Use Application, 2016–2024 (USD Million)

Table 60 Indoor LED Light Engine in APAC, By Type, 2016–2024 (USD Million)

Table 61 Outdoor LED Light Engine in APAC, By Type, 2016–2024 (USD Million)

Table 62 Market in APAC, By Installation Type, 2016–2024 (USD Million)

Table 63 Market in APAC, By Country, 2016–2024 (USD Million)

Table 64 Market in RoW, By End-Use Application, 2016–2024 (USD Million)

Table 65 Indoor LED Light Engine in RoW, By Type, 2016–2024 (USD Million)

Table 66 Outdoor LED Light Engine in RoW, By Type, 2016–2024 (USD Million)

Table 67 Market in RoW, By Installation Type, 2016–2024 (USD Million)

Table 68 Market in RoW, By Region, 2016–2024 (USD Million)

List of Figures (40 Figures)

Figure 1 Market Segmentation

Figure 2 Market: Research Design

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Data Triangulation

Figure 6 Market in Terms of Value and Volume, 2019–2024

Figure 7 Indoor Lighting Application Expected to Hold Larger Size of Market By 2024

Figure 8 New Installation Expected to Hold Larger Size of Market During Forecast Period

Figure 9 Market for Luminaires Expected to Hold Larger Market Size By 2024

Figure 10 APAC Accounted for Largest Share of Market in 2018

Figure 11 Rising Need for Energy-Efficient LED Lighting Systems Provide Lucrative Opportunity to Market

Figure 12 Market for Luminaire to Witness Larger Market Size During 2019–2024

Figure 13 New Installation to Hold Larger Market Size During Forecast Period

Figure 14 Outdoor Lighting Expected to Exhibit Higher CAGR in Market During Forecast Period

Figure 15 APAC to Hold Largest Share of Market By 2019

Figure 16 APAC to Hold Largest Market Share of Market During Forecast Period

Figure 17 Evolution of Light and LED Lighting

Figure 18 Market: DROC

Figure 19 US Annual Energy Consumption in Commercial Buildings, 2018

Figure 20 Reduction in LED Price

Figure 21 Market, By Product Type

Figure 22 Market, By Installation Type

Figure 23 Market, By End-Use Application

Figure 24 APAC to Lead the Market for LED Light Engine During Forecast Period

Figure 25 North America: Market Snapshot

Figure 26 Europe: Market Snapshot

Figure 27 APAC: Market Snapshot

Figure 28 Companies Adopted Product Launches/Developments as Key Growth Strategies During 2016–2018

Figure 29 Signify Lighting NV (Netherlands) Dominated Market in 2018

Figure 30 Market (Global) Competitive Leadership Mapping, 2018

Figure 31 Signify Lighting NV: Company Snapshot

Figure 32 OSRAM Licht AG: Company Snapshot

Figure 33 GE Lighting (GE + Current): Company Snapshot

Figure 34 Cree, Inc.: Company Snapshot

Figure 35 Hubbell Incorporated: Company Snapshot

Figure 36 Zumtobel Group AG: Company Snapshot

Figure 37 Samsung Electronics: Company Snapshot

Figure 38 Wipro Enterprises (P) Limited: Company Snapshot

Figure 39 Glamox AS: Company Snapshot

Figure 40 Acuity Brands, Inc.: Company Snapshot

The study involved 4 major activities in estimating the current size of the LED light engine market. Exhaustive secondary research was done to collect information on the LED light engine market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

The research methodology used to estimate and forecast the LED light engine market begins with capturing data on revenue of key vendors in the market through secondary research. This study incorporates the use of extensive secondary sources, directories, and databases, such as Hoovers, Bloomberg Businessweek, Factiva, and OneSource to identify and collect information useful for technical, market-oriented, and commercial study of the LED light engine market. The vendor offerings have also been taken into consideration to determine the market segmentation. This entire research methodology, includes the study of annual and financial reports of top players, presentations, press releases, journals, paid databases, trade directories, regulatory bodies, and safety standard organizations.

Primary Research

The LED light engine market comprises several stakeholders, such as suppliers, suppliers of standard components, original equipment manufacturers (OEMs), integrators, and solutions providers, in the supply chain. The supply side is characterized by advancements in types of LED light engines and their diverse end–use applications. Various primary sources from supply and demand sides of the market have been interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the total size of the LED light engine market. These methods have also been used extensively to estimate the size of various market subsegments. The research methodology used to estimate the market size includes the following:

- Key players in major applications and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures have been employed, wherever applicable. The data have been triangulated by studying various factors and trends from both the demand and supply sides in the areas of indoor lighting and outdoor lighting.

Research Objective

- To describe and forecast the global LED light engine market by product type, installation type, end–use application, and geography in terms of value

- To describe and forecast the global LED light engine market by product type, installation type, end–use application, and geography in terms of shipment

- To forecast the market size, in terms of value, for various segments with regard to 4 main regions, namely, North America, Europe, APAC, and RoW

- To forecast the market size, in terms of shipment, for various segments with regard to 4 main regions, namely, North America, Europe, APAC, and RoW

- To provide detailed information regarding (drivers, restraints, opportunities, and challenges) pertaining to the LED light engine market

- To strategically analyze micromarkets1 with respect to the individual growth trends, future prospects, and contribution to the total market

- To analyze the opportunities in the market for various stakeholders by identifying high-growth segments in the overall LED light engine market

- To strategically profile the key players and comprehensively analyze their market ranking in terms of revenue and core competencies2

- To analyze competitive developments, such as joint ventures, mergers & acquisitions, new product launches & developments, and research & development in the LED light engine market

Available Customizations

Along with the market data, MarketsandMarkets offers customizations according to a company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

Critical Questions

- What are the new application areas explored by LED light engine products/solutions providers?

- Which are the key players in the market and how intense is the competition?

Growth opportunities and latent adjacency in LED Light Engine Market