Leak Testing Market by Offering (Hardware, Software, Services), Equipment Type (Fixed, Portable), Vertical (Medical Devices, Pharmaceuticals, Automotive, Oil & Gas, Food & beverages, Consumer Electronics) and Region – Global Forecast 2024 to 2030

Leak testing determines whether an object or system functions within a specific leak limit. Leaks occur when there is a defect — a hole, crack, or some other kind of flaw in an object, allowing whatever liquid or gas it is holding to flow out. Leak testing uses pressure to find these defects so that they can be addressed as part of regular maintenance procedures.

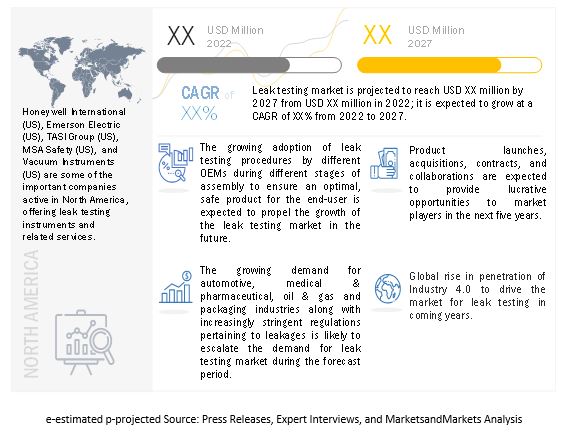

The global leak testing market size is expected to grow from USD XX million in 2024 to USD XX million by 2030, at a CAGR of XX%. The increasing requirements to inspect cracks, holes, weak seals, and other flaws & imperfections in automotive, oil and gas, medical devices, consumer goods, and packaging are the key factors boosting the market's growth.

To know about the assumptions considered for the study, Request for Free Sample Report

Drivers: Development of advanced technologies in NDT along with rising penetration of IoT and Industry 4.0

Increasing advancements in sensors, chips, valves, and other types of technology have made leak testing more necessary, sensitive, and capable of the non-destructive testing (NDT) method. Advancements in NDT have led to the development of ultrasound leak testing technology used for simple and fast leak detection on compressed air, inert gas, and vacuum systems. All of these advances have made leak testing faster and more accurate and have helped companies improve the quality of their manufacturing processes and their overall output. Another significant advance in leak testing has been the advent of the Internet of Things. Penetration of IoT has made it convenient for inspectors to collect, monitor, and share leak testing data remotely, allowing them to get the information they need on time to ensure ideal maintenance. This data can be evaluated not just by inspectors but also by manufacturing engineers, production managers, maintenance managers, and other stakeholders in the manufacturing process, allowing for improved, real-time insights into the conditions of the assets. Furthermore, in leak testing, industry 4.0 is also driving changes in many critical areas, including the rise of intelligent test connection tools. These tools allow users to safely make the necessary connections to run a proper leak test without the concern of false failures or unintended disconnections.

Substantial requirement for leak testing in several processes of the automotive industry

A large number of automotive manufacturers around the globe rely on optimal quality leak testing systems to find defects in automotive components or products. This is because numerous components need to be leak checked to secure environmental guidelines, safety, and function. Detecting fuel and air-conditioning system leakage is critical for safety and regulatory steps before the vehicle leaves the production line. Also, standard organizations define various leak testing procedures for the automotive industry, including the American Society for Testing and Materials and the Society of Automotive Engineers. Thus, the automotive sector is expected to drive the market for leak testing in the coming years due to stricter regulations regarding emissions, fuel components leaks, HVAC system leaks, and other higher sensitivities concerning leakages.

Challenges: Excessive purchasing, installation, and maintenance costs associated with leak testing methods and equipment

One of the most critical challenges with leak testing equipment is the high cost of purchasing, installation, and maintenance. The maintenance activity also includes complexities in adding leak testing machines to the existing plant infrastructure. Furthermore, there are different leak testing methods, such as air decay, helium leak, etc. Many industries rely on helium leak testing methods, as helium is a prevalent tracer gas in leak testing production. As a result, the quantity of helium has become significant when testing large volumes at higher pressures and high speeds. This has been raising the cost of helium in recent years.

Key players in the market

ATEQ Corporation (France), INFICON (Switzerland), Drägerwerk (Germany), Honeywell International (US), Emerson Electric (US), TASI Group (US), MSA Safety (US), SGS SA (Switzerland), Uson (US), Testo (Germany), Vacuum Instruments (US), CETA TESTSYSTEME (Germany), Helium Leak Testing, (US), Pfeiffer Vacuum (Germany) and LACO Technologies (US) are some of the key players operating in the global leak testing market.

Recent Developments

- In June 2022, Innomatec announced the launch of the LTC-802 M-Performance system, a new product for leak testing that enables direct and highly precise measurement of the leak rate without a reference volume. The product with an optimized design using high-precision measurement technology will allow companies to carry out flexible testing with small test specimens starting at 10 milliliters and components with large volumes of up to 200 liters for leak rates starting at two milliliters/minute.

- In May 2021, a Manchester-based engineering company VES announced the launch of its OptVol TechnologyTM, a recent innovation in helium leak testing. The company introduced a helium leak testing system that incorporates OptVol Technology benefits from a small footprint, easily interchangeable tooling for different product variants, and a lightweight design for ease of movement between production lines as production demands change.

- In November 2020, gas technology manufacturer Witt announced its new LEAK-MASTER® PRO 2 to detect the smallest leaks in protective gas packaging. Leak testing with the LEAK-MASTER® PRO 2 is carried out with CO2 as the tracer gas, already contained in most inert gas packaging.

TABLE OF CONTENTS

1 Introduction

1.1. Study Objectives

1.2. Market Definition

1.2.1. Inclusions and Exclusions

1.3. Market Scope

1.3.1. Markets Covered

1.3.2. Geographic Scope

1.3.3. Years considered for the study

1.4. Currency

1.5. Market Stakeholders

2 Research Methodology

2.1. Research Data

2.1.1. Secondary and Primary Research

2.1.2. Secondar Data

2.1.3. Primary Data

2.2. Market Size Estimation

2.2.1. Bottom-up Approach

2.2.2. Top-down Approach

2.3. Data Triangulation

2.4. Research Assumptions

2.5. Risk Assessment

3 Executive Summary

4 Premium Insights

5 Market Overview

5.1. Introduction

5.2. Market Dynamics

5.2.1. Drivers

5.2.2. Restraints

5.2.3. Opportunities

5.2.4. Challenges

5.3. Value Chain Analysis

5.4. Ecosystem Analysis

5.5. Trends/Disruptions impacting customer’s business

5.6. Porter’s Five Forces Analysis

5.7. Case Study Analysis

5.8. Technology Analysis

5.9. Pricing Analysis

5.9.1. ASP Analysis of Key Players

5.9.2. ASP Trend

5.10. Trade Analysis

5.11. Key Conferences & Events in 2022-2023

5.12. Patent Analysis

5.13. Regulatory Landscape

5.13.1. Regulatory Bodies, Government Agencies & Other Organizations

5.13.2. Major Standards

5.14. Key Stakeholders and Buying Criteria

6 Sales Channels used for Leak Test Equipment (Qualitative)

6.1. Introduction

6.2. Manufacturers and Distributors

6.3. Aftermarket

7 Leak Testing Market, By Offering

7.1. Introduction

7.2. Hardware

7.2.1. Detectors

7.2.1.1. Pressure Decay Leak Testing System

7.2.1.2. Tracer Gas Leak Testing System

7.2.1.3. Mass Flow Leak Test System

7.2.1.4. Vacuum Decay Leak Testing System

7.2.2. Sensors

7.2.2.1. Pressure Sensor

7.2.2.2. Liquid Leak Sensor

7.2.2.3. Micro-Flow Sensor

7.2.3. Accessories

7.2.3.1. Digital Vacuum Gauge

7.2.3.2. Portable Leak Finder

7.2.4. Others

7.3. Software

7.4. Services

7.4.1. Training

7.4.2. Maintenance & Repair

7.4.3. Rental

7.4.4. Others

8 Leak Testing Market, By Equipment Type

8.1. Introduction

8.2. Fixed

8.3. Portable

9 Leak Testing Market, By Vertical

9.1. Introduction

9.2. Medical Devices

9.3. Pharmaceuticals

9.4. Automotive

9.5. Consumer Electronics

9.6. Transportation/Agriculture

9.7. Consumer/White Goods

9.8. Industrial

9.9. HVAC

9.10. Oil & Gas

9.11. Food & Beverages

10 Leak Testing Market, By Region

10.1. Introduction

10.2. North America

10.2.1. US

10.2.2. Canada

10.2.3. Mexico

10.3. Europe

10.3.1. France

10.3.2. UK

10.3.3. Germany

10.3.4. Rest of Europe

10.4. Asia Pacific

10.4.1. China

10.4.2. Japan

10.4.3. South Korea

10.4.4. Rest of Asia Pacific

10.5. Rest of the World (RoW)

10.5.1. Middle East

10.5.1. Africa

10.5.2. South America

11 Competitive Landscape

11.1. Introduction

11.2. Top 5 Company Revenue Analysis

11.3. Market Share Analysis (2021)

11.4. Company Evaluation Quadrant, 2021

11.4.1. Star

11.4.2. Emerging Leader

11.4.3. Pervasive

11.4.4. Participants

11.5. Small and Medium Enterprises (SMEs) Evaluation Quadrant, 2021

11.5.1. Progressive Companies

11.5.2. Responsive Companies

11.5.3. Dynamic Companies

11.5.4. Starting Blocks

11.6. Company Footprint

11.7. Competitive Benchmarking

11.8. Competitive Scenario

11 Company Profiles

11.1. Key Players

11.8.1. Vacuum Instruments

11.8.2. Uson LP

11.8.3. CETA Testsysteme

11.8.4. LACO Technologies

11.8.5. Pfeiffer Vacuum

11.8.6. ATEQ

11.8.7. InterTech Development Company

11.8.8. INFICON

11.8.9. TASI Group

11.8.10. COSMO

11.2. Other Players

11.2.1. JW Froelich

11.2.2. Marposs

11.2.3. Zeltwanger

11.2.4. PTI

11.2.5. USON

11.2.6. Fakuda

11.2.7. Z-axis

11.2.8. VES

12 Appendix

*This is a tentative table of contents, and there might be few changes during the course of the study

Growth opportunities and latent adjacency in Leak Testing Market