Liquid Crystal (LC) Antenna Market by Type (Electronically Steered Phase Array Antenna, Metasurface-based Antenna)- Global Forecast to 2028

Updated on : October 23, 2024

Liquid Crystal (LC) Antenna Market Size & Share

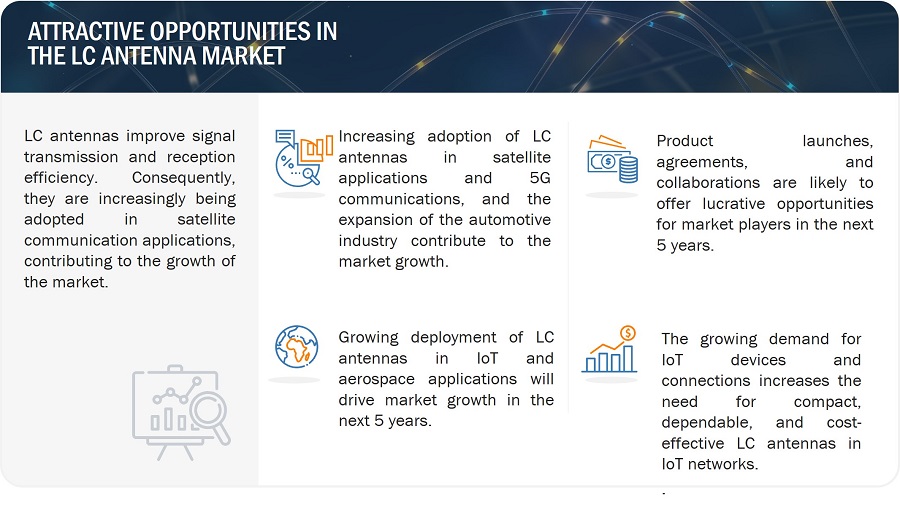

The Liquid Crystal (LC) Antenna Market size is estimated to be worth USD 9.1 million in 2023 and is projected to reach USD 12.3 million by 2028, growing at a CAGR of 6.2% during the forecast period 2023 to 2028. Rising adoption of LC antennas in satellite applications, the growing utilization of LC antennas in 5G communications and the expanding applications of LC antennas in automotive sector are some of the major factors driving the Liquid Crystal (LC) Antenna Industry growth globally.

Liquid Crystal (LC) Antenna Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

LC Antenna Market Trends & Dynamics

Driver: Growing utilization of LC antennas in 5G communications

The deployment of 5G technology networks is a significant trend in the telecommunications industry, and many telecom companies and service providers around the worldworldwide are actively working on expanding and upgrading their networks to support 5G capabilities which increases, increasing the need for LC antennas. The increasing need for reliable cost- and energy energy-efficient solutions for electronic beam-steering antennas for 5G communication drives the market growth of LC antennas.

Restraint: Ristricted frequency range of LC antennas

Unlike conventional antennas such as tunable antennas, switched-beam antennas and reconfigurable antennas, LC antennas provides limited frequency range. Therefore, the increasing need for various frequency range that cater to different applications impedes the market growth of LC antenna. The limited frequency range of LC antennas has prompted end users to use alternatives such as various types of conventional antennas.

Opportunity: Growing popularity of LC antennas in aerospace applications

LC antennas can also be integrated into aerospace-based radar systems for weather monitoring, earth mapping, and remote sensing. The ability to electronically control the radar beam's direction and shape is particularly useful in aerospace-based radar applications. Therefore, the increasing demand for LC antennas in aerospace applications drives the market growth. Additionally, LC antennas can be used on spacecraft for wireless communication during planetary exploration missions, facilitating wireless communication between Earth and other spacecraft. Therefore, the growing demand for effective wireless communication and flexibility in data collection and transmission has led to an increase in the adoption of LC antennas in aerospace applications.

Challenge: Performance constraints of LC antennas

As a standard criteria, many wireless applications require high performance, compact size, and affordability. The performance of an LC antenna can be influenced by several factors, such as its placement on the printed circuit board (PCB), and its proximity to neighboring components and ground planes. An LC antenna's performance also varies depending on its distance from the ground plane. Therefore, the lack of consideration regarding the placement of LC antenna can limit the performance efficiency of LC antenna, which will restrain the market growth of LC antennas.

LC Antenna Market Ecosystem

The prominent players in the LC Antenna market are Merck KGaA (Germany), Kymeta Corporation (US), ALCAN Systems GmbH i.L. (Germany), and Spatialite Antenna Systems (Latvia). These companies perform organic and inorganic growth strategies to expand themselves globally by providing advanced products of LC antennas.

To know about the assumptions considered for the study, download the pdf brochure

Electronically steered phased array antenna to register largest market size in the LC antenna market during forecast period

Electronically steered phased array antennas have high gain , making them suitable for long-range communication such as satellite communications. They are also highly preferred in adaptive communication systems as they can respond well to environmental changes, interference, or network conditions in real time while maintaining optimal usage. Therefore, factors such as performance efficiency, cost efficiency, and reliability increase the deployment of electronically steered phased array antennas in applications such as radar systems, satellite communications, and 5G networks, which is expected to drive the market.

Liquid Crystal (LC) Antenna Companies : Top Key Players

The major players in the LC antenna companies include:

- Merck KGaA (Germany),

- Kymeta Corporation (US),

- ALCAN Systems GmbH i.L. (Germany), and

- Spatialite Antenna Systems (Latvia).

These companies have used both organic and inorganic growth strategies such as product launches, agreements, and collaborations to strengthen their position in the market.

Liquid Crystal (LC) Antenna Market Report Scope

|

Report Metric |

Details |

|

Estimated Market Size |

USD 9.1 million in 2023 |

|

Projected Market Size |

USD 12.3 million by 2028 |

|

Growth Rate |

CAGR of 6.2% |

|

Market size available for years |

2019–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD Million/Billion) |

|

Segments covered |

By Type |

|

Companies covered |

The major players in the LC antenna market are Merck KGaA (Germany), Kymeta Corporation (US), ALCAN Systems GmbH i.L. (Germany), and Spatialite Antenna Systems (Latvia). |

Liquid Crystal (LC) Antenna Market Highlights

The study segments the LC antenna market based on type at the regional and global level.

|

Segment |

Subsegment |

|

By Type |

|

Recent Developments in Liquid Crystal (LC) Antenna Industry

- In March 2021, Merck KGaA launched its LC antenna technology, licriOn, an electronically beam-steered smart antenna. These antennas will then be able to connect with stationary and moving satellites.

- In December 2020, Kymeta Corporation and Hanwha Systems signed an agreement in which Hanwha Systems invested USD 30 million to develop metamaterial-based antenna technology.

- In March 2022, ALCAN collaborated with AGC to develop transparent LC antennas suitable for indoor mmWave Fixed Wireless Access (FWA).

Frequently Asked Questions (FAQs):

What is the current size of the global LC antenna market?

The LC antenna market is estimated to be worth USD 9.1 billion in 2023 and is projected to reach USD 12.3 billion by 2028, at a CAGR of 6.2% during the forecast period. Rising adoption of LC antennas in satellite applications, the growing utilization of LC antennas in 5G communications and the expanding applications of LC antennas in automotive sector are some of the major factors driving the market growth globally.

Who are the winners in the global LC antenna market?

Companies such as Merck KGaA (Germany), Kymeta Corporation (US), ALCAN Systems GmbH i.L. (Germany), and Spatialite Antenna Systems (Latvia), fall under the winners category.

What are the major drivers and opportunities related to LC antenna market?

Rising adoption of LC antennas in satellite applications, the growing utilization of LC antennas in 5G communications, the expanding applications of LC antennas in automotive sector and the increasing utilization of LC antennas in IoT networks are some of the major drivers and opportunities for LC antenna market.

What are the major strategies adopted by market players?

The key players have adopted product launches, agreements and collaborations to strengthen their position in the LC antenna market.

What are the major technological advancements related to LC antennas?

In recent years the emergence of new technologies such as electronically steered phased array antennas and metasurface-based antennas has provided new opportunities in the LC antenna market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing adoption of LC antennas in satellite applications- Growing use of LC antennas in 5G communications- Increasing applications of LC antennas in automotive sectorRESTRAINTS- Limited frequency range of LC antennasOPPORTUNITIES- Growing deployment of LC antennas in IoT networks- Increasing popularity of LC antennas in aerospace applicationsCHALLENGES- Performance limitations of LC antennas

- 5.3 SUPPLY CHAIN ANALYSIS

-

5.4 ECOSYSTEM MAPPING

-

5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

-

5.6 TECHNOLOGY TRENDSELECTRONICALLY STEERED PHASED ARRAY ANTENNASMETASURFACE-BASED ANTENNAS

-

5.7 PATENT ANALYSIS

-

5.8 CASE STUDY ANALYSISAGC INC. OVERCAME IN-BUILDING PENETRATION CHALLENGES OF 5G WITH WAVETHRU TECHNOLOGYSES NETWORKS COLLABORATED WITH ALCAN SYSTEMS GMBH TO DEVELOP FLAT PANEL ANTENNAS FOR CUSTOMER EDGE TERMINALSKYMETA CORPORATION HELPED SKY PERFECT JSAT DEVELOP HIGH-CAPACITY SATELLITE COMMUNICATIONS FOR CARS AND EMERGENCY VEHICLESKYMETA’S LC ANTENNA HELPED TOYOTA DEVELOP 4G LTE CONNECTION FOR IN-CAR ENTERTAINMENT AND NAVIGATION SYSTEMS

-

5.9 REGULATORY LANDSCAPEGLOBALEUROPEASIA PACIFICNORTH AMERICAREGULATIONS- Asia Pacific- North America- Europe

- 6.1 INTRODUCTION

-

6.2 ELECTRONICALLY STEERED PHASED ARRAY ANTENNADEPLOYMENT OF ELECTRONICALLY STEERED PHASED ARRAY ANTENNAS IN 5G NETWORKS TO DRIVE MARKET

-

6.3 METASURFACE-BASED ANTENNASUITABILITY OF METASURFACE-BASED ANTENNAS IN BEAM SCANNING AND SYNTHETIC-APERTURE RADAR IMAGING TO FUEL SEGMENTAL GROWTH

- 7.1 INTRODUCTION

-

7.2 COMPETITIVE SCENARIO AND TRENDSPRODUCT LAUNCHESDEALS

- 8.1 INTRODUCTION

-

8.2 KEY PLAYERSMERCK KGAA- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewKYMETA CORPORATION- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewALCAN SYSTEMS GMBH I.L.- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewSPATIALITE ANTENNA SYSTEMS- Business overview- Products/Services/Solutions offered- MnM view

- 9.1 INSIGHTS FROM INDUSTRY EXPERTS

- 9.2 DISCUSSION GUIDE

- 9.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 9.4 RELATED REPORTS

- 9.5 AUTHOR DETAILS

- TABLE 1 MARKET GROWTH ASSUMPTIONS

- TABLE 2 LC ANTENNA MARKET: RISK ASSESSMENT

- TABLE 3 LC ANTENNA MARKET: ROLE OF KEY PLAYERS IN ECOSYSTEM

- TABLE 4 PATENTS RELATED TO LC ANTENNAS, JANUARY 2012–DECEMBER 2022

- TABLE 5 TOP 20 COMPANIES WITH SIGNIFICANT NUMBER OF GRANTED PATENTS, 2012–2022

- TABLE 6 KEY PATENTS RELATED TO LC ANTENNAS

- TABLE 7 LC ANTENNA MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 8 LC ANTENNA MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 9 PRODUCT LAUNCHES, 2020–2021

- TABLE 10 DEALS, 2020–2022

- TABLE 11 MERCK KGAA: COMPANY OVERVIEW

- TABLE 12 MERCK KGAA: PRODUCT LAUNCHES

- TABLE 13 KYMETA CORPORATION: COMPANY OVERVIEW

- TABLE 14 KYMETA CORPORATION: DEALS

- TABLE 15 ALCAN SYSTEMS GMBH I.L.: COMPANY OVERVIEW

- TABLE 16 ALCAN SYSTEMS GMBH I.L.: PRODUCT LAUNCHES

- TABLE 17 ALCAN SYSTEMS GMBH I.L.: DEALS

- TABLE 18 SPATIALITE ANTENNA SYSTEMS: COMPANY OVERVIEW

- FIGURE 1 LC ANTENNA MARKET: SEGMENTATION

- FIGURE 2 LC ANTENNA MARKET: RESEARCH DESIGN

- FIGURE 3 BOTTOM-UP APPROACH

- FIGURE 4 TOP-DOWN APPROACH

- FIGURE 5 DATA TRIANGULATION

- FIGURE 6 GLOBAL LC ANTENNA MARKET SIZE, 2019–2028

- FIGURE 7 METASURFACE-BASED ANTENNA SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 8 GROWING ADOPTION OF LC ANTENNAS IN SATELLITE APPLICATIONS TO DRIVE MARKET

- FIGURE 9 ELECTRONICALLY STEERED PHASED ARRAY ANTENNA SEGMENT TO ACCOUNT FOR LARGER SHARE OF LC ANTENNA MARKET IN 2023

- FIGURE 10 LC ANTENNA MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 11 VEHICLE PRODUCTION IN ASIA PACIFIC, 2019–2022

- FIGURE 12 ANALYSIS OF IMPACT OF DRIVERS ON LC ANTENNA MARKET

- FIGURE 13 ANALYSIS OF IMPACT OF RESTRAINTS ON LC ANTENNA MARKET

- FIGURE 14 ANALYSIS OF IMPACT OF OPPORTUNITIES ON LC ANTENNA MARKET

- FIGURE 15 ANALYSIS OF IMPACT OF CHALLENGES ON LC ANTENNA MARKET

- FIGURE 16 LC ANTENNA MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 17 LC ANTENNA ECOSYSTEM

- FIGURE 18 DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 19 NUMBER OF PATENTS GRANTED FOR LC ANTENNAS, 2012–2022

- FIGURE 20 TOP 10 COMPANIES WITH SIGNIFICANT NUMBER OF PATENTS FROM 2012 TO 2022

- FIGURE 21 METASURFACE-BASED ANTENNA SEGMENT TO EXHIBIT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 22 MERCK KGAA: COMPANY SNAPSHOT

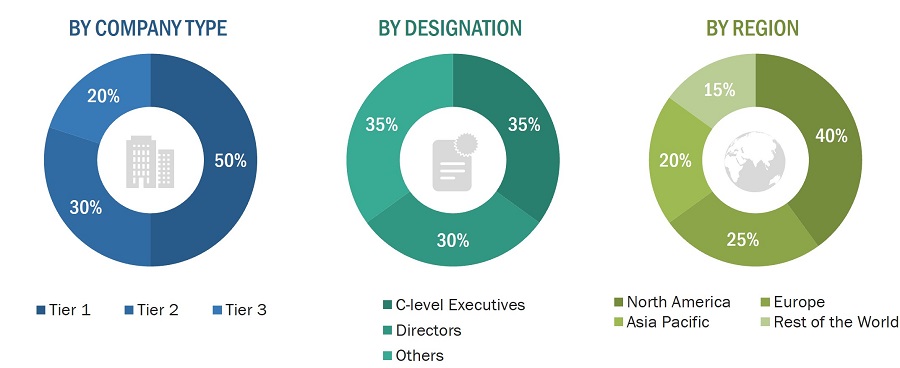

Exhaustive secondary research has been done to collect important information about the market and peer markets. The validation of these findings, assumptions, and sizing with the help of primary research with industry experts across the supply chain has been the next step. Both top-down and bottom-up approaches have been used to estimate the market size. Post which the market breakdown and data triangulation have been adopted to estimate the market sizes of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information required for this study. The secondary sources include annual reports, press releases, and investor presentations of companies, white papers, articles from recognized authors, and databases. Secondary research has been mainly done to obtain key information about the market’s supply chain, the key market players, market segmentation according to industry trends, and developments from both market and technology perspectives.

Primary Research

In primary research, various primary sources from both supply and demand sides have been interviewed to obtain qualitative and quantitative insights required for this report. Primary sources from the supply side include experts such as CEOs, vice presidents, marketing directors, equipment manufacturers, technology and innovation directors, end users, and related executives from multiple key companies and organizations operating in the LC antenna market ecosystem.

To know about the assumptions considered for the study, download the pdf brochure

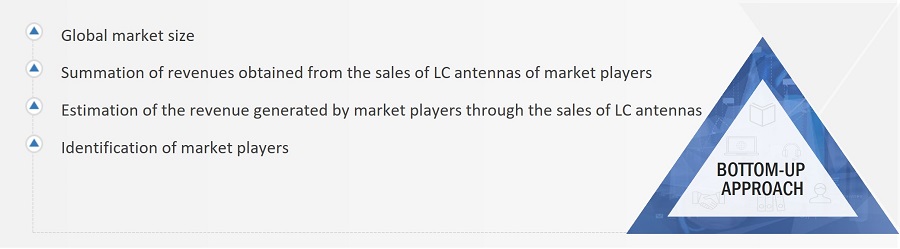

Market Size Estimation

In the market engineering process, both top-down and bottom-up approaches have been used along with data triangulation methods to estimate and validate the size of the LC antenna market and other dependent submarkets. The research methodology used to estimate the market sizes includes the following:

- Identifying different stakeholders in the LC antenna market that influence the entire market, along with participants across the supply chain

- Analyzing major manufacturers of LC antennas as well as studying their product portfolios

- Analyzing trends related to the adoption of LC antennas

- Tracking the recent and upcoming developments in the market that include investments, R&D activities, product launches, collaborations, and agreements, as well as forecasting the market size based on these developments and other critical parameters

- Carrying out multiple discussions with key opinion leaders to identify the adoption trends of LC antennas

- Segmenting the overall market into relevant segments

- Validating the estimates at every level through discussions with key opinion leaders, such as chief executives (CXOs), directors, and operation managers, and finally with the domain experts at MarketsandMarkets

Market Size Estimation Methodology-Bottom-up Approach

Market Size Estimation Methodology-Top-Down Approach

Data Triangulation

After arriving at the overall market size by the market size estimation process explained in the earlier section, the overall LC antenna market has been divided into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments, the data triangulation and market breakdown procedures have been used, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply side perspectives. Along with data triangulation and market breakdown, the market has been validated by top-down and bottom-up approaches.

Market Definition

LC antennas are a category of antennas that can be adjusted or tuned using liquid crystal materials to modify their electromagnetic characteristics, including factors like frequency, polarization, or beam direction. They find applications across a range of wireless communication systems and have gained attention because of their capacity to respond to shifting communication requirements and environmental conditions. Due to their cost efficiency LC antennas are highly preferred over their substitutes for large projects such as satellite programs and transportation.

Stakeholders

- Raw material suppliers

- Liquid crystal manufacturers

- Antenna system providers

- Technology/IP Developers

- Other Electronic Component Suppliers

- Manufacturing Equipment Suppliers

- Distributors and Resellers

- End Users

The main objectives of this study are as follows:

- To define, analyze and forecast the LC antenna market size, and by type, in terms of value.

- To provide detailed information regarding the major drivers, restraints, opportunities, and challenges influencing the growth of the LC antenna market

- To study the supply chain and related industry segments for the LC antenna market

- To strategically analyze the micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To analyze the market ecosystem; trends/disruptions impacting customer’s business; key technology trends; patent analysis; case studies; and regulatory environment related to the LC antenna market.

- To analyze competitive developments such as product launches, agreements, collaborations, and research and development (R&D) activities carried out by players in the LC antenna market.

Growth opportunities and latent adjacency in Liquid Crystal (LC) Antenna Market