Latin American Bioinformatics Market by Sector (Agriculture, Molecular Medicine, Research & Animal), Segment (Sequencing Platforms, Knowledge Management Tools & Data Analysis Services) & Application (Genomics, Proteomics & Drug Design) - Forecasts to 2017

Bioinformatics is a scientific discipline that deals with the retrieval, storage, processing, analysis, and management of biological information through computational techniques. It uses mathematics, biology, and information technology to understand the biological importance of an extensive variety of data. Bioinformatics technologies are used in various pharmaceutical and biotechnology sectors to support their growth. The major sectors that use bioinformatics tools and services are medicine, agriculture, environment, animal, forensics, academics, and others (homeland security and defense, law-enforcement groups, bioweapon creation, and evolutionary biotechnology). The agricultural sector commanded a major share of the Latin American bioinformatics market in 2012. This can be attributed to the increasing use of bioinformatics in the study of crops (mainly sugarcane and oranges) to improve their yield and quality. However, the medical segment is the fastest-growing sector owing to increasing R&D spending by pharmaceutical companies towards the development of novel drugs.

The market was valued at $232 million in 2012 and is poised to reach $627 million by 2017, at a CAGR of 22%. The Latin American bioinformatics market displays lucrative growth potential. It is propelled by the rising number of training and development programs on usage of bioinformatics tools, which leads to an increase in the use of bioinformatics tools by industrial and academic bioinformaticians in life sciences research. In addition, the market is further driven by the high concentration of bioinformatics research institutes in Latin America that aim to facilitate the use of bioinformatics in life sciences research. However, the dearth of skilled personnel and facilities to ensure the proper use of bioinformatics products and services and the dearth of advanced and innovative bioinformatics tools and algorithms are limiting the growth of the bioinformatics market in Latin America.

Brazil was the largest market in 2012 with 40% share of the Latin American bioinformatics market, followed by Mexico with 20%. However, Chile and Peru represent the fastest-growing markets due to the initiatives taken by these nations with regards to skills development of researchers as well as the ongoing academic collaborations to facilitate the adoption of bioinformatics in life sciences research.

The dominant players in the market are Agilent Technologies, Inc. (U.S.), Affymetrix, Inc. (U.S.), Life Technologies Corporation (U.S.), Illumina, Inc. (U.S.), and CLC Bio (Denmark).

Scope of the Report

This research report categorizes and analyzes the market on the basis of sectors as well as products and services. Both these markets are further divided into segments and sub segments to provide an exhaustive value market analysis for 2010, 2011, 2012, and forecast to 2017. Furthermore, due to a wide range of bioinformatics applications in varied pharmaceutical and biotechnological areas, the market is segmented into seven categories, namely, genomics, proteomics, chemoinformatics, molecular phylogenies, metabolomics, transcriptomics, and others (glycomics, cytomics, physiomics, and interactomics). Each market is comprehensively analyzed at a granular level, by country (Brazil, Mexico, Chile, Peru, Argentina, and the Rest of Latin America), to provide in-depth information on the Latin American scenario.

Latin American Bioinformatics Market, by Sector

- Agriculture Biotechnology

- Crop yield improvement

- Pest resistance

- Improvement of plant resistance against abiotic stresses

- Nutritional quality improvement

- Others

- Animal Biotechnology

- Medical Biotechnology

- Molecular medicine

- Personalized medicine

- Preventive medicine

- Clinical diagnostics

- Drug development

- Gene therapy

- Reproductive biotechnology

- Molecular medicine

- Academics

- Environmental Biotechnology

- Waste cleanup

- Alternative energy sources

- Climate change studies

- Forensic biotechnology

- Others

Latin American Bioinformatics Market, by Product and Service

- Bioinformatics Knowledge Management Tools

- Generalized tools

- Specialized tools

- Bioinformatics Platforms

- Sequence analysis platforms

- Sequence alignment platforms

- Sequence manipulation platforms

- Structural and functional analysis platforms

- Others

- Bioinformatics Services

- Sequencing services

- Database management

- Data analysis

- Others

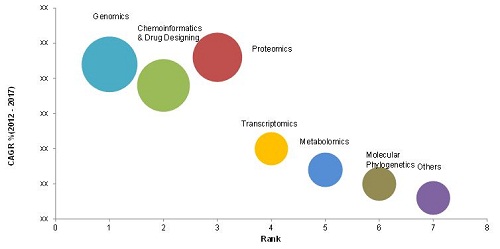

Latin American Bioinformatics Market, by Application

- Genomics

- Chemoinformatics and Drug Design

- Proteomics

- Transcriptomics

- Metabolomics

- Molecular Phylogenetics

- Others

Latin American Bioinformatics Market, by Country

- Brazil

- Mexico

- Chile

- Argentina

- Peru

- Rest of Latin America

Customer Interested in this report can also view:

-

Bioinformatics Market By Sector (Molecular Medicine, Agriculture, Research & Forensic), Segment (Sequencing Platforms, Knowledge Management Tools & Data Analysis Services) & Application (Genomics, Proteomics & Drug Design) Global Forecasts to 2017

In Latin America, bioinformatics is now widely recognized as a crucial field for research and development in agricultural, veterinary, and human health sciences. The Latin American bioinformatics market displays a lucrative growth potential. It is estimated to grow at a CAGR of 22% from 2012 to 2017 to reach $627 million by 2017. The growth of the bioinformatics market is driven by factors such as the decreasing cost of DNA sequencing, the increasing number of training and development programs on the usage of bioinformatics tools/platforms, the high concentration of bioinformatics research institutes, ongoing partnerships of academic institutions, and the formation of regional bioinformatics networks. However, the dearth of adequate infrastructural facilities and skilled professionals, presence of obsolete bioinformatics solutions, lack of government funding and investments, and less focus of global bioinformatics players on Latin American countries are factors that are restraining the growth of the market.

Based on the use of bioinformatics in various industries, the bioinformatics market is segmented into agriculture, medical, environment, forensic, academics, and others (including homeland security and defense, law-enforcement groups, bioweapon creation, antibiotic resistance, and evolutionary biotechnology). The medical biotechnology market is segmented into molecular medicine, clinical diagnostics, drug development, gene therapy, and reproductive biotechnology. On the other hand, agriculture biotechnology is segmented into crop yield improvement, insect and disease resistance, nutritional quality improvement, soil quality improvement, improvement of plant resistance against abiotic stress, and others. Furthermore, the environmental biotechnology market includes waste cleanup, alternative energy sources, climate change studies, forensics biotechnology, and others.

Based on the type of products and services, the bioinformatics market is classified into knowledge management tools, platforms, and services. The bioinformatics knowledge management tools market includes generalized and specialized knowledge management tools. The bioinformatics platforms market is segmented into sequence analysis platforms, sequence alignment platforms, sequence manipulation platforms, structural and functional analysis platforms, and others. The bioinformatics services market comprises sequencing services, database management, data analysis, and others.

The Latin American bioinformatics market has several practical applications in fields that generate large data sets. In this report, the various applications of bioinformatics include genomics, proteomics, chemoinformatics, molecular phylogenies, metabolomics, transcriptomics, and others.

Brazil was the largest market in 2012 with 40% share of the Latin American bioinformatics market, followed by Mexico. However, Chile and Peru represent the fastest-growing markets due to the initiatives taken by these nations with regards to skills development of researchers as well as the ongoing academic collaborations to facilitate the adoption of bioinformatics in life sciences research.

The major players in the bioinformatics industry include Agilent Technologies, Inc. (U.S.), Affymetrix, Inc. (U.S.), Life Technologies Corporation (U.S.), Illumina, Inc. (U.S.), and CLC Bio (Denmark).

Latin American Bioinformatics Market, by Application,20122017

Source: Annual Reports, SEC Filings, Press Releases, Investor Presentations, Oxford Journals, National Human Genome Research Institute (NHGRI), Brazilian Association for Bioinformatics and Computational Biology (AB3C), Argentina Association for Bioinformatics and Computational Biology (A2B2C), Expert Interviews, and MarketsandMarkets Analysis

Table Of Contents

1 Introduction (Page No. - 22)

1.1 Key Take-Aways

1.2 Report Description

1.3 Markets Covered

1.4 Stakeholders

1.5 Research Methodology

1.5.1 Market Size

1.5.2 Key Data Points From Secondary Sources

1.5.3 Key Data Points From Primary Sources

1.5.4 Assumptions

2 Executive Summary (Page No. - 28)

3 Premium Insights (Page No. - 31)

3.1 Market Scenario in 2012

3.1.1 By Country

3.1.1.1 Brazil the Largest Bioinformatics Market

3.1.1.2 Chile and Peru- Best Markets to Invest

3.1.2 By Sector

3.1.2.1 Agriculture Sector Commands the Major Share

3.1.2.2 Medical is the Fastest-Growing Sector

4 Market Overview (Page No. - 34)

4.1 Introduction

4.2 Market Segmentation

4.2.1 Latin American Bioinformatics Market, By Sector

4.2.2 Latin American Bioinformatics Market, By Products & Services

4.2.3 Latin American Bioinformatics Market, By Application

4.2.4 Market Dynamics

4.2.4.1 Drivers

4.2.4.1.1 Rising Number of Training and Development Programs on Usage of Bioinformatics tools

4.2.4.1.2 High Concentration of Bioinformatics Research Institutes in Latin America

4.2.4.1.3 Decreasing Cost of Dna Sequencing

4.2.4.1.4 Formation of Regional Bioinformatics Networks

4.2.4.1.5 ongoing Mega Partnerships of Academic Institutions

4.2.4.1.6 Establishment of New Bioinformatics Research Centers and Laboratories

4.2.4.2 Restraints

4.2.4.2.1 Dearth of Adequate Infrastructural Facilities and Skilled Professionals

4.2.4.2.2 Obsolete Bioinformatics Solutions

4.2.4.2.3 Lack of Government Funding and Investments

4.2.4.2.4 Less Focus of Global Bioinformatics Players on Latin American Countries

4.2.4.3 Opportunities

4.2.4.4 Challenges

4.3 Market Share Analysis

4.3.1 Bioinformatics Market, By Sector

4.3.2 Bioinformatics Market, By Products & Services

4.3.3 Bioinformatics Market, By Application

4.3.4 Bioinformatics Market, By Country

4.4 Porters Five Forces Analysis

4.4.1 Threat From New Entrants

4.4.2 Threat From Substitutes

4.4.3 Bargaining Power of Buyers

4.4.4 Bargaining Power of Suppliers

4.4.5 Intensity of Competitive Rivalry

4.5 End-User Analysis

4.5.1 Introduction

4.5.2 Research Centers, Academic Institutions, & Government Institutes

4.5.3 Pharmaceutical and Biotechnology Companies

4.5.4 Hospitals and Clinics

4.5.5 Others

5 Latin American Bioinformatics Market, By Sectors (Page No. - 58)

5.1 Introduction

5.1.1 Mega Academic Partnerships Driving the Bioinformatics Market

5.1.2 Increasing R&D Activities in the Field of Drug Development (Especially Personalized Medicine) to Spur the Market in the Medical Field

5.2 Agricultural Biotechnology

5.2.1 Initiatives to Support the Use of Bioinformatics in Agricultural Biotechnology Are on A Rise in Latin America

5.2.2 Crop Imrpovement

5.2.2.1 Ongoing R&D Activities to Improve Yield of Various Crops is A Key Factor Driving the Market

5.2.3 Pest Resistance

5.2.4 Improvement of Plant-Resistance Against Abiotic Stresses

5.2.5 Nutritional Quality Improvement

5.2.6 Others

5.3 Animal Biotechnology

5.3.1 Growing Initiatives to Support the Use of Genomic Technologies in Livestock Improvement is Driving the Growth of Market

5.4 Medical Biotechnology

5.4.1 Molecular Medicine

5.4.1.1 Growing Focus on Endemic Disease Researches is Expected to Spur the Growth of Market

5.4.1.2 Personalized Medicine

5.4.1.3 Preventive Medicine

5.4.2 Clinical Diagnostics

5.4.3 Drug Development

5.4.4 Gene therapy

5.4.4.1 Growing Cancer Research Studies Are Propelling the Growth of Market

5.4.5 Reproductive Biotechnology

5.5 Academics

5.5.1 Bioinformatics Holds Great Potential in Academics

5.6 Environmental Biotechnology

5.6.1 Waste Clean-Up/Bioremediation

5.6.2 Alternative Energy Sources

5.6.3 Climate Change Studies

5.7 Forensic Biotechnology

5.8 Others

6 Latin American Bioinformatics Market, By Products & Services (Page No. - 100)

6.1 introduction

6.2 Bioinformatics Content/Knowledge Management tools

6.2.1 Increasing Number of Clinical Trials and Life Science Researchactivities Are Expected to Fuel the Market Growth

6.3 Generalized Knowledge Management tools

6.3.1 Specialized Knowledge Management tools

6.4 Bioinformatics Platforms

6.5 High Cost of Bioinformatics Platforms is Hindering the Growth of Market

6.5.1 Sequence Analysis Platforms

6.5.2 Sequence Alignment Platforms

6.5.3 Sequence Manipulation Platforms

6.5.4 Structural & Functional Analysis Platforms

6.5.5 Other Platforms

6.6 Bioinformatics Services

6.6.1 Sequencing Services

6.6.2 Database Management

6.6.3 Data Analysis

6.6.4 Other Services

7 Latin American Bioinformatics Market, By Applications (Page No. - 127)

7.1 Introduction

7.1.1 Upsurge in Genomics and Proteomics Research Projects is Expected to Boost Bioinformatics Applications in Latin America

7.2 Genomics

7.3 Chemoinformatics & Drug Design

7.4 Proteomics

7.5 Transcriptomics

7.6 Metabolomics

7.7 Molecular Phylogenetics

7.8 Others

8 Geographic Analysis (Page No. - 144)

8.1 introduction

8.2 Increasing Focus towards Genomic Projects is Significantly Driving the Market Growth

8.3 Brazil

8.3.1 Sao Paulo Commands ~60% of the Brazilian Bioinformatics Market

8.3.2 Complicated and Time-Consuming Tax System in Brazil Hinders Market Growth

8.4 Mexico

8.4.1 Growing Multidisciplinary Approaches is Propelling the Growth of Market

8.5 Chile

8.5.1 Strategic Academic Collaborations of Bioinformatics Organizations is Driving the Growth of Market

8.6 Argentina

8.6.1 Lack of Bioinformatics Infrastructural Facilities and Skilled Professionals is Limiting the Growth of Market

8.7 Peru

8.8 Rest of Latin America

9 Company Profiles(Overview, Financials, Products & Services, & Strategy)* (Page No. - 209)

9.1 Accelrys, Inc.

9.2 Active Motif, Inc.

9.3 Affymetrix, Inc.

9.4 Agilent Technologies, Inc.

9.5 CLC Bio

9.6 Geneva Bioinfromatics (Genebio) Sa

9.7 Illumina, Inc.

9.8 Life Technologies Corporation

9.9 Partek, Incorporated

9.10 Perkinelmer, Inc.

*Details on Financials, Product & Services, & Strategy Might Not Be Captured in Case of Unlisted Companies.

List of Tables (133 Tables)

Table 1 Bioinformatics Market, By Country, 2010 2017 ($Million)

Table 2 Latin American Bioinformatics Market, By Sector, 2010 2017 ($Million)

Table 3 the R&D Spending By Various Countries in Latin America (2011)

Table 4 Latin America Bioinformatics Market for Agriculture Biotechnology, By Application, 2010 2017 ($Million)

Table 5 Bioinformatics Market for Agriculture Biotechnology, By Country, 2010 2017 ($Million)

Table 6 Bioinformatics Market for Crop Yield Improvement, By Country, 2010 2017 ($Million)

Table 7 Bioinformatics Market for Pest Resistance, By Country, 2010 2017 ($Million)

Table 8 Bioinformatics Market for Improvement of Plant Resistance Against Abiotic Stresses, By Country, 2010 2017 ($Million)

Table 9 Bioinformatics Market for Nutritional Quality Improvement, By Country, 2010 2017 ($Million)

Table 10 Bioinformatics Market for Other Agricultural Applications, By Country, 2010 2017 ($Million)

Table 11 Bioinformatics Market for Animal Biotechnology, By Country, 2010 2017 ($Million)

Table 12 Latin American Bioinformatics Market for Medical Biotechnology, By Application, 2010 2017 ($Million)

Table 13 Bioinformatics Market for Medical Biotechnology, By Country, 2010 2017 ($Million)

Table 14 Latin American Bioinformatics Market for Molecular Medicine,By Application, 2010 2017 ($Million)

Table 15 Bioinformatics Market for Molecular Medicine, By Country, 2010 2017 ($Million)

Table 16 Latin American Bioinformatics Market for Personalized Medicine,By Country, 2010 2017 ($Million)

Table 17 Bioinformatics Market for Preventive Medicine, By Country, 2010 2017 ($Million)

Table 18 Bioinformatics Market for Clinical Diagnostics, By Country, 2010 2017 ($Million)

Table 19 Bioinformatics Market for Drug Development, By Country,2010 2017 ($Million)

Table 20 Bioinformatics Market for Gene therapy, By Country, 2010 2017 ($Million)

Table 21 Bioinformatics Market for Reproduction Biotechnology, By Country, 2010 2017 ($Million)

Table 22 Bioinformatics Market for Academics, By Country, 2010 2017 ($Million)

Table 23 Latin America Bioinformatics Market for Environmental Biotechnology, By Application, 2010 2017 ($Million)

Table 24 Bioinformatics Market for Environmental Biotechnology, By Country, 2010 2017 ($Million)

Table 25 Bioinformatics Market for Waste Clean-Up, By Country, 2010 2017 ($Million)

Table 26 Bioinformatics Market for Alternative Energy Sources, By Country, 2010 2017 ($Million)

Table 27 Bioinformatics Market for Climate Change Studies, By Country, 2010 2017 ($Million)

Table 28 Bioinformatics Market for forensic Biotechnology, By Country, 2010 2017 ($Million)

Table 29 Bioinformatics Market for Other Sectors, By Country, 2010 2017 ($Million)

Table 30 Latin America Bioinformatics Market, By Product & Service, 2010 2017 ($Million)

Table 31 Latin American Bioinformatics Content/Knowledge Management tools Market, By Product, 2010 2017 ($Million)

Table 32 Bioinformatics Content/Knowledge Management tools Market, By Country, 2010 2017 ($Million)

Table 33 Generalized Knowledge Management Tools Market, By Country, 2010 2017 ($Million)

Table 34 Specialized Knowledge Management Tools Market, By Country, 2010 2017 ($Million)

Table 35 Latin American Bioinformatics Platforms Market, By Product, 2010 2017 ($Million)

Table 36 Bioinformatics Platforms Market, By Country, 2010 2017 ($Million)

Table 37 Sequence Analysis Platforms Market, By Country, 2010 2017 ($Million)

Table 38 Sequence Alignment Platforms Market, By Country, 2010 2017 ($Million)

Table 39 Sequence Manipulation Platforms Market, By Country, 2010 2017 ($Million)

Table 40 Structural and Functional Analysis Platforms Market, By Country, 2010 2017 ($Million)

Table 41 Other Platforms Market, By Country, 2010 2017 ($Million)

Table 42 Latin America Bioinformatics Services Market, By Product,2010 2017 ($Million)

Table 43 Bioinformatics Services Market, By Country, 2010 2017 ($Million)

Table 44 Sequencing Services Market, By Country, 2010 2017 ($Million)

Table 45 Database Management Market, By Country, 2010 2017 ($Million)

Table 46 Data Analysis Market, By Country, 2010 2017 ($Million)

Table 47 Others Bioinformatics Services Market, By Country, 2010 2017 ($Million)

Table 48 Latin America Bioinformatics Market, By Application, 2010 2017 ($Million)

Table 49 Bioinformatics Market for Genomics, By Country, 2010 2017 ($Million)

Table 50 Bioinformatics Market for Chemoinformatics & Drug Design, By Country, 2010 2017 ($Million)

Table 51 Bioinformatics Market for Proteomics, By Country, 2010 2017 ($Million)

Table 52 Bioinformatics Market for Transcriptomics, By Country, 2010 2017 ($Million)

Table 53 Bioinformatics Market for Metabolomics, By Country, 2010 2017 ($Million)

Table 54 Bioinformatics Market for Molecular Phylogenetics, By Country, 2010 2017 ($Million)

Table 55 Bioinformatics Market for Other Applications, By Country, 2010 2017 ($Million)

Table 56 Brazil: Bioinformatics Market, By Sector, 2010 2017 ($Million)

Table 57 Brazil: Bioinformatics Market for Agriculture Biotechnology, By Application, 2010 2017 ($Million)

Table 58 Brazil: Bioinformatics Market for Medical Biotechnology, By Application, 2010 2017 ($Million)

Table 59 Brazil: Bioinformatics Market for Molecular Medicine, By Application, 2010 2017 ($Million)

Table 60 Brazil: Bioinformatics Market for Environmental Biotechnology, By Application, 2010 2017 ($Million)

Table 61 Brazil: Bioinformatics Market, By Products& Services, 2010 2017 ($Million)

Table 62 Brazil: Bioinformatics Knowledge Management Tools Market, By Product, 2010 2017 ($Million)

Table 63 Brazil: Bioinformatics Platforms Market, By Product, 2010 2017 ($Million)

Table 64 Brazil: Bioinformatics Services Market,By Application, 2010 2017 ($Million)

Table 65 Brazil: Bioinformatics Market, By Application, 2010 2017 ($Million)

Table 66 Mexico: Bioinformatics Market, By Sector, 2010 2017 ($Million)

Table 67 Mexico: Bioinformatics Market for Agriculture Biotechnology, By Application, 2010 2017 ($Million)

Table 68 Mexico: Bioinformatics Market for Medical Biotechnology, By Application, 2010 2017 ($Million)

Table 69 Mexico: Bioinformatics Market for Molecular Medicine, By Application, 2010 2017 ($Million)

Table 70 Mexico: Bioinformatics Market for Environmental Biotechnology, By Application, 2010 2017 ($Million)

Table 71 Mexico: Bioinformatics Market, By Products& Services, 2010 2017 ($Million)

Table 72 Mexico: Bioinformatics Knowledge Management Tools Market, By Product, 2010 2017 ($Million)

Table 73 Mexico: Bioinformatics Platforms Market, By Product, 2010 2017 ($Million)

Table 74 Mexico: Bioinformatics Services Market,By Application, 2010 2017 ($Million)

Table 75 Mexico: Bioinformatics Market, By Application, 2010 2017 ($Million)

Table 76 Chile: Bioinformatics Market, By Sector, 2010 2017 ($Million)

Table 77 Chile: Bioinformatics Market for Agriculture Biotechnology, By Application, 2010 2017 ($Million)

Table 78 Chile: Bioinformatics Market for Medical Biotechnology, By Application, 2010 2017 ($Million)

Table 79 Chile: Bioinformatics Market for Molecular Medicine, By Application, 2010 2017 ($Million)

Table 80 Chile: Bioinformatics Market for Environmental Biotechnology, By Application, 2010 2017 ($Million)

Table 81 Chile: Bioinformatics Market, By Products& Services, 2010 2017 ($Million)

Table 82 Chile: Bioinformatics Knowledge Management Tools Market, By Product, 2010 2017 ($Million)

Table 83 Chile: Bioinformatics Platforms Market, By Product, 2010 2017 ($Million)

Table 84 Chile: Bioinformatics Services Market, By Application, 2010 2017 ($Million)

Table 85 Chile: Bioinformatics Market, By Application, 2010 2017 ($Million)

Table 86 Argentina: Bioinformatics Market, By Sector, 2010 2017 ($Million)

Table 87 Argentina: Bioinformatics Market for Agriculture Biotechnology, By Application, 2010 2017 ($Million)

Table 88 Argentina: Bioinformatics Market for Medical Biotechnology, By Application, 2010 2017 ($Million)

Table 89 Argentina: Bioinformatics Market for Molecular Medicine, By Application, 2010 2017 ($Million)

Table 90 Argentina: Bioinformatics Market for Environmental Biotechnology, By Application, 2010 2017 ($Million)

Table 91 Argentina: Bioinformatics Market, By Products& Services, 2010 2017 ($Million)

Table 92 Argentina: Bioinformatics Knowledge Management Tools Market, By Product, 2010 2017 ($Million)

Table 93 Argentina: Bioinformatics Platforms Market, By Product, 2010 2017 ($Million)

Table 94 Argentina: Bioinformatics Services Market, By Application, 2010 2017 ($Million)

Table 95 Argentina: Bioinformatics Market, By Application, 2010 2017 ($Million)

Table 96 Peru: Bioinformatics Market, By Sector, 2010 2017 ($Million)

Table 97 Peru: Bioinformatics Market for Agriculture Biotechnology, By Application, 2010 2017 ($Million)

Table 98 Peru: Bioinformatics Market for Medical Biotechnology, By Application, 2010 2017 ($Million)

Table 99 Peru: Bioinformatics Market for Molecular Medicine, By Application, 2010 2017 ($Million)

Table 100 Peru: Bioinformatics Market for Environmental Biotechnology, By Application, 2010 2017 ($Million)

Table 101 Peru: Bioinformatics Market, By Products& Services, 2010 2017 ($Million)

Table 102 Peru: Bioinformatics Knowledge Management Tools Market, By Product, 2010 2017 ($Million)

Table 103 Peru: Bioinformatics Platforms Market, By Product, 2010 2017 ($Million)

Table 104 Peru: Bioinformatics Services Market, By Application, 2010 2017 ($Million)

Table 105 Peru: Bioinformatics Market, By Application, 2010 2017 ($Million)

Table 106 Rola: Bioinformatics Market, By Sector, 2010 2017 ($Million)

Table 107 Rola: Bioinformatics Market for Agriculture Biotechnology, By Application, 2010 2017 ($Million)

Table 108 Rola: Bioinformatics Market for Medical Biotechnology, By Application, 2010 2017 ($Million)

Table 109 Rola: Bioinformatics Market for Molecular Medicine, By Application, 2010 2017 ($Million)

Table 110 Rola: Bioinformatics Market for Environmental Biotechnology, By Application, 2010 2017 ($Million)

Table 111 Rola: Bioinformatics Market, By Products& Services, 2010 2017 ($Million)

Table 112 Rola: Bioinformatics Knowledge Management Tools Market, By Product, 2010 2017 ($Million)

Table 113 Rola: Bioinformatics Platforms Market, By Product, 2010 2017 ($Million)

Table 114 Rola: Bioinformatics Services Market, By Application, 2010 2017 ($Million)

Table 115 Rola: Bioinformatics Market, By Application, 2010 2017 ($Million)

Table 116 Accelrys, Inc.: Total Revenue and R&D Expenditure, 2011 2012 ($Million)

Table 117 Accelrys, Inc.: Total Revenue, By Segment, 2011 2012 ($Million)

Table 118 Accelrys, Inc.: Total Revenue, By Geography, 2011 2012 ($Million)

Table 119 Affymetrix, Inc.: Total Revenue and R&D Expenditure, 2011 2012 ($Million)

Table 120 Affymetrix, Inc.: Total Revenue, By Segment, 2011 2012 ($Million)

Table 121 Affymetrix, Inc.: Total Revenue, By Geography, 2011 2012 ($Million)

Table 122 Agilent Technologies, Inc.: Total Revenue and R&D Expenditure,2010 2012 ($Million)

Table 123 Agilent Technologies, Inc.: Total Revenue, By Segment, 2010 2012 ($Million)

Table 124 Agilent Technologies, Inc.: Total Revenue, By Geography, 2010 2012 ($Million)

Table 125 Illumina, Inc.: Total Revenue and R&D Expenditure, 2010 2012 ($Million)

Table 126 Illumina, Inc.: Total Revenue, By Segment, 2010 2012 ($Million)

Table 127 Illumina, Inc.: Total Revenue, By Geography, 2010 2012 ($Million)

Table 128 Life Technologies Corporation: Total Revenue and R&D Expenditure, 2010 2012 ($Million)

Table 129 Life Technologies Corporation: Total Revenue, By Segment, 2010 2012 ($Million)

Table 130 Life Technologies Corporation: Total Revenue, By Geography, 2010 2012 ($Million)

Table 131 Perkinelmer, Inc.: Total Revenue and R&D Expenditure, 2010 2012 ($Million)

Table 132 Perkinelmer, Inc.: Total Revenue, By Segment, 2010 2012 ($Million)

Table 133 Perkinelmer, Inc.: Total Revenue, By Geography, 2010 2012 ($Million)

List of Figures (23 Figures)

Figure 1 Bioinformatics Market, By Country, 2012

Figure 2 Latin America Bioinformatics Market, By Geography, 2012 Vs 2017

Figure 3 Latin America Bioinformatics Market, By Sector, 2012 Vs 2017

Figure 4 Bioinformatics Application Data Flow Chart

Figure 5 Bioinformatics Market:Overall Segmentation

Figure 6 Bioinformatics Market Segmentation, By Products & Services

Figure 7 Bioinformatics Market Segmentation, By Application

Figure 8 Market Dynamics

Figure 9 Latin American Bioinformatics Market Share, By Sector,2012 Vs. 2017

Figure 10 Latin American Bioinformatics Market Share, By Products & Services, 2012 Vs. 2017

Figure 11 Latin American Bioinformatics Market Share, By Application, 2012 Vs. 2017

Figure 12 Latin American Bioinformatics Market, By Country, 2012 Vs. 2017 ($Million)

Figure 13 Porters Five forces Analysis: Latin American Bioinformatics Market, 2012

Figure 14 End-User Analysis: Latin American Bioinformatics Market, 2012

Figure 15 Latin American Bioinformatics Market, End-User Analysis, 2012 & 2017

Figure 16 Latin America Bioinformatics Market, By Sector, 2012 2017

Figure 17 Latin Americabioinformatics Market for Agriculture Biotechnology, By Application, 2010 2017

Figure 18 Latin American Bioinformatics Market for Medical Biotechnology,By Application, 2012 2017

Figure 19 Market Segmentation of Molecular Medicine

Figure 20 Latin America Bioinformatics Market, By Product & Service, 2012 2017

Figure 21 Bioinformatics Platforms Market Share, By Product, 2012 Vs. 2017

Figure 22 Latin Americabioinformatics Market, By Application, 2012 2017

Figure 23 Latin American Bioinformatics Market, By Geography, 2012 2017 ($Million)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Latin American Bioinformatics Market