Latin America Pharmaceutical Excipients Market by Functionality (Fillers, Coating, Disintegrants, Binders, Lubricants, Preservatives, Emulsifying Agents, Lubricants, Glidants, Diluents), Country (Mexico, Argentina, Columbia, Peru) - Forecast to 2024

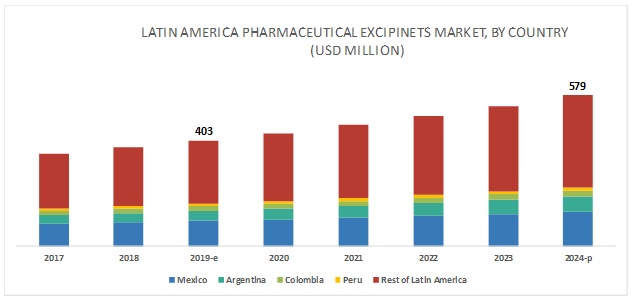

[281 Pages Report] The Latin America pharmaceutical excipients market is projected to reach USD 579 million by 2024 from USD 403 million in 2019, at a CAGR of 7.5%. Growth in this region is driven by the growing pharmaceutical industry in Latin American countries such as Brazil, Mexico, and Argentina; increasing focus of MNCs on investing in the pharmaceutical and healthcare sectors in Latin America; rapid growth in aging population & the subsequent increase in the prevalence of related diseases; and the availability of local and government funding for R&D activities.

In 2018, the fillers & diluents segment accounted for the largest share of the LATAM pharmaceutical excipients market

By functionality, the LATAM pharmaceutical excipients market is categorized into fillers & diluents, binders, suspending & viscosity agents, flavoring agents & sweeteners, coating agents, colorants, disintegrants, lubricants & glidants, preservatives, emulsifiers & solubilizers, and other functionalities. The fillers & diluents segment accounted for the largest share of the market in 2018. The large share of this segment can be attributed to the increasing use of fillers & diluents in the development & production of solid dosage form and the wide applications of diluents in the wet granulation & direct compression process for tablet formulation.

Argentina is expected to grow at the highest CAGR during the forecast period

The pharmaceutical excipients market in Argentina is expected to grow at the highest CAGR during the forecast period. The pharmaceutical excipients market in Argentina is mainly driven by the rising production & consumption of pharmaceutical products, large pool of domestic pharmaceutical manufacturers, rising pharmaceutical expenditure, growing investments by multinational market players in Argentina, growing production of biosimilar products, and rising burden of diseases.

Key Market Players

Prominent players in the global Latin America pharmaceutical excipients industry are DowDuPont (US), Roquette (France), Ashland (US), BASF (Germany), and Kerry Group (Ireland).

DowDuPont brings together the complementary portfolios of Dow and DuPont, making it one of the world’s largest chemical corporation. The acquisition of FMC’s Health & Nutrition business in November 2017 alleviated the company’s position in the global pharmaceutical excipients market bringing an extensive range of products under one roof. The company offers a comprehensive portfolio of excipients ranging from rheology modifiers, tablet coatings, controlled release, stabilizers, solubilizers, binding agents, and masking agents to name a few. The company is largely known for its diversified cellulose compound offerings for the pharmaceutical industry. Its position among the top five pharmaceutical excipient manufacturers is attributed to its global footprint through distributors and agents. The company is highly focused on conducting strategic agreements and expansions of its functional units. The company also pursues the strategy of agreements and partnerships with well-known science and technology universities to enhance its presence in the pharmaceutical excipients market. The company intends to strengthen its presence in the market by delivering superior solutions and choices to customers. The firm strongly believes that investments in R&D offer great potential for short and long-term growth.

Scope of the Report:

|

Report Metric |

Details |

|

Market size available for years |

2017–2024 |

|

Base year considered |

2018 |

|

Forecast period |

2019–2024 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Functionality and Country |

|

Geography covered |

Latin America |

|

Companies covered |

Ashland (US), DowDuPont (US), BASF SE (Germany), Roquette (France), and Kerry Group (Ireland) |

The research report categorizes the market into the following segments and subsegments:

LATAM Pharmaceutical Excipients Market, by Functionality

- Fillers & Diluents

- Binders

- Suspending & Viscosity Agents

- Coating Agents

- Disintegrants

- Flavouring Agents and Sweetners

- Lubricants & Glidants

- Colorants

- Preservatives

- Emulsifying Agents

- Other Functionalities

LATAM Pharmaceutical Excipients Market, by Country

- Mexico

- Argentina

- Columbia

- Peru

Recent Developments

- In 2018, Roquette launched the carbohydrate-based excipients—Maize Starch IP/BP and Mannitol IP.

- In 2017, DuPont acquired FMC Corporation’s Health & Nutrition business except for the Omega-3 business. With this acquisition, FMC’s Health & Nutrition segment will be integrated into the DuPont Nutrition & Health segment. It extends DuPont’s capabilities into the fast-growing pharma excipients space.

- In 2016, BASF signed an agreement with Colorcon (US) to sell its Kollicoat IR Coating Systems product line to Colorcon. This enabled the company to focus on its core competencies. However, the company will continue to develop and promote innovative film coating polymers including Kollicoat IR.

Critical questions answered in the report:

- How will the current technological trends affect the pharmaceutical excipients market in the long term?

- How is the market in the Latin American region progressing?

- The high growing functionality areas that can be tapped in the Latin America pharmaceutical excipients market?

- What are the growth strategies being implemented by major market players?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

2 Research Methodology

2.1 Research Design

2.2 Research Methodology

2.3 Market Breakdown and Data Triangulation

2.4 Market Sizing Approach for the Latin American Pharmaceutical Excipients Market

3 Pharmaceutical Excipients Market

3.1 Global Pharmaceutical Excipients Market

3.2 Latin American Pharmaceutical Excipients Market

4 Latin America Pharmaceutical Excipients Market, By Functionality

4.1 Introduction

4.2 Fillers & Diluents

4.3 Suspending & Viscosity Agents

4.4 Coating Agents

4.5 Binders

4.6 Flavouring Agents & Sweeteners

4.7 Disintegrants

4.8 Colorants

4.9 Lubricants & Glidants

4.1 Preservatives

4.11 Emulsifiers & Solubilizers

4.12 Other Functionalities

5 Latin America Pharmaceutical Excipients Market, By Country

5.1 Introduction

5.2 Mexico Pharmaceutical Excipients Market

5.3 Argentina Pharmaceutical Excipients Market

5.4 Colombia Pharmaceutical Excipients Market

5.5 Peru Pharmaceutical Excipients Market

6 Competitive Landscape

7 Company Profile

7.1 Ashland

7.2 BASF SE

7.3 Dowdupont

7.4 Roquette

7.5 Kerry Group

List of Table (28 Tables)

Table 1 Latin American Pharmaceutical Excipients Market, By Country, 2017-2024 (USD Million)

Table 2 Latin American Pharmaceutical Excipients Market, By Functionality, 2017–2024 (USD Million)

Table 3 Some of the Major Brands of Fillers & Diluents

Table 4 Latin American Fillers & Diluents Market, By Country, 2017-2024 (USD Million)

Table 5 Some of the Major Brands of Suspending & Viscosity Agents

Table 6 Latin American Suspending & Viscosity Agents Market, By Country, 2017-2024 (USD Million)

Table 7 Some of the Major Brands of Coating Agents

Table 8 Latin American Coating Agents Market, By Country, 2017-2024 (USD Million)

Table 9 Some of the Major Brands of Binders

Table 10 Latin American Binders Market, By Country, 2017-2024 (USD Million)

Table 11 Some of the Major Brands of Flavoring Agents & Sweeteners

Table 12 Latin American Flavoring Agents & Sweeteners Market, By Country, 2017-2024 (USD Million)

Table 13 Some of the Major Brands of Disintegrants

Table 14 Latin American Disintegrants Market, By Country, 2017-2024 (USD Million)

Table 15 Some of the Major Brands of Colorants

Table 16 Latin American Colorants Market, By Country, 2017-2024 (USD Million)

Table 17 Some of the Major Brands of Lubricants & Glidants

Table 18 Latin American Lubricants & Glidants Market, By Country, 2017-2024 (USD Million)

Table 19 Some of the Major Brands of Preservatives

Table 20 Latin American Preservatives Market, By Country, 2017-2024 (USD Million)

Table 21 Some of the Major Brands of Emulsifiers & Solubilizers

Table 22 Latin American Emulsifiers & Solubilizers Market, By Country, 2017-2024 (USD Million)

Table 23 Some of the Major Brands of Other Functionalities

Table 24 Latin American Other Functionalities Market, By Country, 2017-2024 (USD Million)

Table 25 Mexico: Pharmaceutical Excipients Market, By Functionality, 2017–2024 (USD Million)

Table 26 Argentina: Pharmaceutical Excipients Market, By Functionality, 2017–2024 (USD Million)

Table 27 Colombia: Pharmaceutical Excipients Market, By Functionality, 2017–2024 (USD Million)

Table 28 Peru: Pharmaceutical Excipients Market, By Functionality, 2017–2024 (USD Million)

List of Figure (11 Figures)

Figure 1 Global Pharmaceutical Excipients Market, 2017-2024 (USD Million)

Figure 2 Ashland: Company Snapshot (2017)

Figure 3 Ashland: SWOT Analysis

Figure 4 BASF SE: Company Snapshot (2017)

Figure 5 BASF SE: SWOT Analysis

Figure 6 Dowdupont: Company Snapshot (2017)

Figure 7 Dowdupont: SWOT Analysis

Figure 8 Roquette: Company Snapshot (2017)

Figure 9 Roquette: SWOT Analysis

Figure 10 Kerry Group: Company Snapshot (2017)

Figure 11 Latin America Pharmaceutical Excipients Market Share (2018)

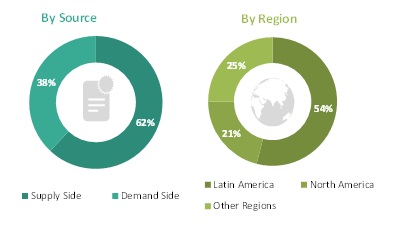

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, key market dynamics, and key player strategies.

Secondary Research

The secondary research process involves the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, companies house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the LATAM pharmaceutical excipients market. It was also used to obtain important information about the key players and market classification & segmentation according to industry trends to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and related key executives from various key companies and organizations operating in the pharmaceutical excipients market. The primary sources from the demand side include experts from drugs manufacturing companies and contract manufacturing organizations. Primary research was conducted to validate the market segmentation, identify key players in the market, and gather insights on key industry trends & key market dynamics.

A breakdown of the primary respondents is provided below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The market size estimates and forecasts provided in this study are derived through a mix of the bottom-up approach (segmental analysis of major segments) and top-down approach (assessment of utilization/adoption/penetration trends, by functionality and LATAM countries).

Data Triangulation

After arriving at the market size, the LATAM pharmaceutical excipients market was divided into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments & subsegments, the data triangulation and market breakdown procedures were employed, wherever applicable.

Objectives of the Study

- To define, and describe the Latin America pharmaceutical excipients market with respect to functionality and Latin American countries

- To strategically analyze the micromarkets with respect to individual growth trends, future prospects, and contributions to the overall market

- To forecast the size of the Latin America pharmaceutical excipients market, by functionality with respect to countries in Latin America – Mexico, Argentina, Columbia, and Peru

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players

Geographic Analysis

- A further breakdown of the Rest of Asia Pacific pharmaceutical excipients market into South Korea, New Zealand, and other South East Asian countries

- A further breakdown of the European pharmaceutical excipients market into Belgium, Netherlands, and Rest of Europe.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Latin America Pharmaceutical Excipients Market