Laser Marking Market Size, Share, Statistics and Industry Growth Analysis Report by Laser Type (Fiber Laser, Diode Laser, Solid-state Laser, CO2 Laser, UV Laser), Industry (Machine Tools, Semiconductor & Electronics, Automotive), Offering, Application, Method, Material and Region - Global Forecast to 2027

Updated on : March 03, 2023

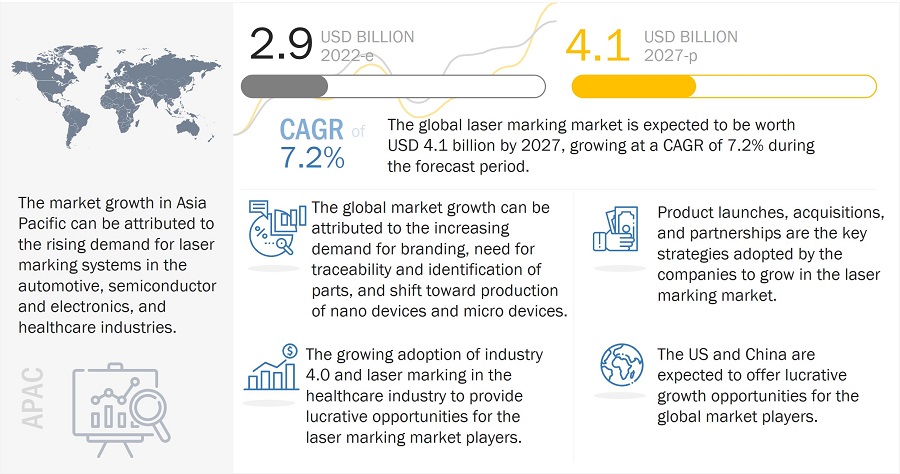

The Laser Marking Market Size is estimated to grow from USD 2.9 billion in 2022 to reach USD 4.1 billion by 2027; it is expected to grow at a CAGR of 7.2% from 2022 to 2027.

The growth of the laser marking industry can be attributed to increasing adoption of laser markers in various industries for traceability and identification of parts and growing adoption of smart manufacturing techniques.

To know about the assumptions considered for the study, Request for Free Sample Report

Laser Marking Market Dynamics

Driver: Higher performance of laser markers over traditional material marking techniques

Laser marking systems offer higher accuracy, higher readability, lower labor cost, and minimal loss than traditional material marking techniques. Laser marking systems are extremely fast compared to traditional marking systems, such as dot peen marking. They take about a second or less to create a 2D design compared to 5 seconds by dot peen marking systems, thus saving a significant amount of time in plants where many objects need to be marked or engraved. The most common applications of laser marking systems include annealing, carbon migration, foaming, and coloration.

Restraint: High deployment cost

Lasers required for processes, systems, and applications are in the range of a few hundred to thousands of watts. High-power lasers are used in large-scale laser displays, medical, military, research, laser-induced nuclear fusion, and material processing (welding, cutting, drilling, soldering, marking, and surface modification). Although laser marking helps reduce workforce and related costs in the automotive and manufacturing industries, its deployment involves a considerable investment

Opportunity: Growing adoption of advanced laser marking technologies

Recently, there has been a growing adoption of advanced laser technologies such as 3D laser marking and hybrid laser marking. A hybrid laser marker is a high-speed laser perfect for applications requiring great versatility in marking materials, from plastics to metals. The hybrid laser marker is characterized by its peak power and extremely short pulse duration. All types of permanent marking finishes are possible due to the power range of the hybrid laser marker. Companies such as KEYENCE, Gravotech, and GCC are offering hybrid laser markers.

Challenge: Technical complexities related to high-power lasers

The use of high-power lasers poses several challenges. The major challenge is the requirement of one or several powerful pump sources as diode-pumped lasers for high output power in a CW operation. Another technical challenge is the requirement for a wall plug with high efficiency for long-term CW operations. This is due to the inability to achieve efficiency at high power levels. High-power lasers also exhibit non-linear effects, such as Raman scattering, Brillouin scattering, and four-wave mixing.

The market for laser marking services is expected to grow at the highest CAGR from 2022 to 2027.

The market for laser marking services is expected to grow at the highest CAGR from 2022 to 2027. Both pre-and post-sales services are offered by companies and their channel partners to facilitate the deployment and operation of laser marking systems. There are several aspects of services during the lifecycle of laser marking systems, such as machine set-up and installation services, lifecycle services, maintenance services, spare parts supply and upgrade, and support. Additional servicing components include imparting laser safety training to operators, software training to IT professionals, and troubleshooting services.

The laser marking market for fiber laser is expected to hold the largest share from from 2022 to 2027.

The laser marking market for fiber laser is expected to hold the largest share from 2022 to 2027. The segment’s growth can be attributed to its features such as high output power, flexible fiber light, compact size, high optical quality, and availability of different systems with specific needs. Fiber lasers have a much higher output power than conventional laser markers. Fiber lasers can mark many materials, though they are optimized for metal marking applications. Their high power makes them perfect for annealing and engraving applications.

The laser marking market for the metal segment to hold the largest market share during forecast period.

The laser marking market for the metal segment to hold the largest market share during forecast period. Metals are widely used materials in different industries, such as automotive, aerospace & defense, healthcare, and machine tools, where marking is performed on them for traceability purposes. Metals require high engraving power to mark permanent or 2D codes and are done without any contact requiring no pre or post-treatment efforts. With laser machines, soft metals such as aluminum or hard metals, or alloys such as steel can be marked permanently, easily, and quickly. The applications range from labeling for traceability to the personalization of promotional items.

The laser marking market for machine tools to hold the largest share during forecast period.

The laser marking market for machine tools to hold the largest share during forecast period. Machine tool manufacturing is the major application area of laser marking and engraving systems. With increased manufacturing capacity to meet the needs of consumers, companies have deployed more machinery for faster output with increased production capacity. This requires laser marking machines to print details such as barcodes, part numbers, QR codes, and other traceability details.

To know about the assumptions considered for the study, download the pdf brochure

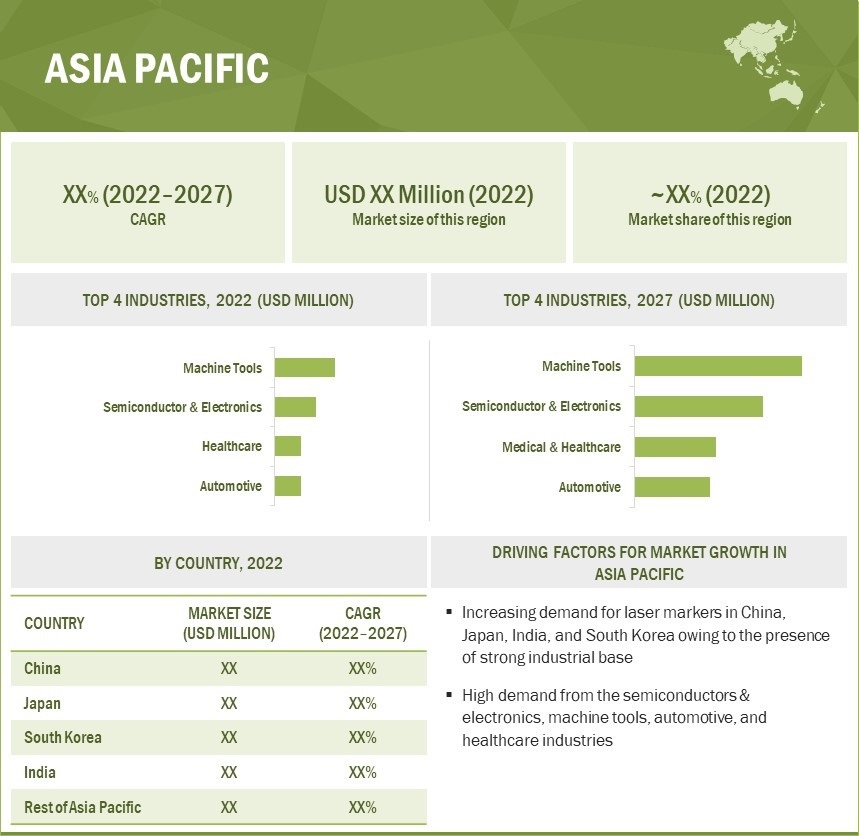

Laser marking market in APAC to grow at highest CAGR during the forecast period.

The laser marking market in APAC is projected to grow at the highest CAGR during the forecast period. Asia Pacific has been ahead in terms of adopting laser marking products and solutions compared to other regions. The region’s huge population, increasing R&D investments, and growing manufacturing and electronics sectors are expected to drive the laser marking market growth. China is one of the biggest automobile manufacturing hubs; laser marking is extensively used in automobile manufacturing. China continues to be the world’s largest vehicle market, with the Chinese government expecting that automobile output will reach 35 million units by 2025.

Key Market Players

Key players involved in the Laser Marking Companies are Coherent, Inc. (US), TRUMPF (Germany), Han’s Laser Technology Co., Ltd. (China), Gravotech Marking (France), IPG Photonics Corp. (US), 600 Group (UK), Danaher Corp. (US), Novanta Inc. (US), KEYENCE Corp. (Japan), Huagong Tech Co., Ltd. (China), Trotec Laser (Austria), Epilog Laser (US), and MECCO (US), among others.

Laser Marking Market Report Scope:

|

Report Metric |

Details |

| Estimated Market Size | USD 2.9 Billion |

| Projected Market Size | USD 4.1 Billion |

| Growth Rate | CAGR of 7.2% |

|

Market size available for years |

2022–2027 |

|

On Demand Data Available |

2030 |

|

Report Coverage |

|

|

Segments covered |

|

|

Geographies covered |

|

|

Companies covered |

|

| Key Market Driver | Higher performance of laser markers over traditional material marking techniques |

| Largest Growing Region | Asia Pacific (APAC) |

| Largest Market Share Segment | Fiber Laser Segment |

| Highest CAGR Segment | Laser Marking Services Segment |

This report categorizes the laser marking market based on Offering, Material, Laser Type, Method, Product Type, Machine Type, Application, Industry, and Region

Based on Offering, the Laser Marking Market been Segmented as follows:

- Hardware

- Software

- Services

Based on Material, the Laser Marking Market been Segmented as follows:

- Metal

- Plastic

- Glass, Paper, and Ceramics

- Others

Based on Laser Type, the Laser Marking Market been Segmented as follows:

- Fiber Laser

- Diode Laser

- Solid-state Laser

- CO2 Laser

- UV Laser

- Others

Based on Method, the Laser Marking Market been Segmented as follows:

- Annealing

- Ablation

- Engraving

- Others

Based on Product Type, the Laser Marking Market been Segmented as follows:

- Portable

- Fixed

Based on Machine Type, the Laser Marking Market been Segmented as follows:

- 2D Laser Marking

- 3D Laser Marking

Based on Application, the Laser Marking Market been Segmented as follows:

- Bar Codes

- Logos

- Date Codes

- Part Numbers

- QR Codes

- Others

Based on Industry, the Laser Marking Market been Segmented as follows:

- Machine Tools

- Automotive

- Semiconductor & Electronics

- Aerospace & Defense

- Healthcare

- Packaging

- Others

Based on Region, the Laser Marking Market been Segmented as follows:

-

North America

- US

- Canada

- Mexico

-

Europe

- Germany

- UK

- France

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

-

RoW

- Middle East & Africa

- South America

Recent Developments

- In June 2022, II-VI Inc. has successfully completed the acquisition of Coherent, Inc. The combined business will be more distributed across the value chain from materials to components, sub-systems, systems, and services. The combined company is expected to be named Coherent.

- In May 2022, Gravotech has launched its Class 1 fully secure LW2 laser station, which will meet all permanent marking and identification needs with advanced and enhanced user experience and is available in different versions based on application and needs.

- In April 2022, TRUMPF unveiled the next generation and new lines of its TruMicro ultrashort pulse lasers (USP). The two TruMicro 6000 and TruMicro 2000 product families feature new technology platforms to boost power and enhance versatility applicable for electronic manufacturing, offering high-range performance.

- In April 2022, InnovMetric launched PolyWorks 2022, the latest release of its smart 3D metrology digital ecosystem. PolyWorks 2022 offers new functionalities that significantly expand the capabilities of its ecosystem foundations. It facilitates multipiece inspection when CAD data is not available.

Frequently Asked Questions (FAQs):

Why is there an increasing need of laser markings?

The growth of the laser marking market can be attributed to higher performance of laser markers over traditional material marking techniques, increasing adoption of laser markers in various industries for traceability and identification of parts, and growing adoption of smart manufacturing techniques.

What are the recent trends in the laser marking market?

The recent trends in laser markings include 3D laser marking, hybrid lasers, cold marking, laser marking on textiles, and robotics in laser marking.

Which regions are expected to pose significant demand for laser markings from 2022 to 2027?

Asia Pacific and North America are expected to pose significant demand from 2022 to 2027.

Which are the major applications of the laser marking market?

Bar codes, QR codes, and part numbers are the major application areas for laser marking machines.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 31)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 INCLUSIONS AND EXCLUSIONS

1.4 STUDY SCOPE

1.4.1 MARKETS COVERED

FIGURE 1 LASER MARKING MARKET: SEGMENTATION

1.4.2 REGIONAL SCOPE

1.5 YEARS CONSIDERED

1.6 CURRENCY CONSIDERED

1.7 UNITS CONSIDERED

1.8 LIMITATIONS

1.9 STAKEHOLDERS

1.1 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 37)

2.1 RESEARCH DATA

FIGURE 2 LASER MARKING MARKET SIZE ESTIMATION AND PROCESS FLOW

FIGURE 3 LASER MARKING MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Major secondary sources

2.1.1.2 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Primary interviews with experts

2.1.2.2 Key data from primary sources

2.1.2.3 Key industry insights

2.1.2.4 Breakdown of primaries

2.1.3 SECONDARY AND PRIMARY RESEARCH

2.2 MARKET SIZE ESTIMATION

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE): REVENUE GENERATED FROM SALE OF LASER MARKING SOLUTIONS IN 2021

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 (DEMAND SIDE): ESTIMATION OF LASER MARKING MARKET SIZE, BY INDUSTRY

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for deriving market size by bottom-up analysis (demand side)

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for capturing market size by top-down analysis (supply side)

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.2.3 MARKET SHARE ESTIMATION

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 8 MARKET BREAKDOWN AND DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

TABLE 1 ASSUMPTIONS FOR RESEARCH STUDY

2.4.1 GROWTH RATE ASSUMPTIONS/FORECASTS

2.5 LIMITATIONS

2.6 RISK ASSESSMENT

3 EXECUTIVE SUMMARY (Page No. - 51)

FIGURE 9 HARDWARE SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

FIGURE 10 FIBER LASER SEGMENT TO HOLD LARGEST SHARE OF LASER MARKING MARKET DURING FORECAST PERIOD

FIGURE 11 PACKAGING INDUSTRY TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 12 ASIA PACIFIC MARKET TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 55)

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS OPERATING IN LASER MARKING MARKET

FIGURE 13 HIGH DEMAND FOR LASER MARKERS IN HEALTHCARE AND SEMICONDUCTOR & ELECTRONICS INDUSTRIES

4.2 MARKET, BY OFFERING

FIGURE 14 HARDWARE SEGMENT TO HOLD LARGEST SHARE OF MARKET DURING FORECAST PERIOD

4.3 MARKET, BY METHOD

FIGURE 15 ENGRAVING SEGMENT TO HOLD MAJORITY OF MARKET SHARE IN 2027

4.4 MARKET, BY APPLICATION

FIGURE 16 QR CODES SEGMENT TO HOLD LARGEST MARKET SHARE IN 2027

4.5 ASIA PACIFIC MARKET, BY COUNTRY AND INDUSTRY

FIGURE 17 MACHINE TOOLS INDUSTRY AND CHINA TO HOLD MAJOR SHARES OF ASIA PACIFIC MARKET IN 2022

4.6 MARKET, BY COUNTRY

FIGURE 18 INDIA TO EXHIBIT HIGHEST CAGR IN GLOBAL MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 58)

5.1 INTRODUCTION

FIGURE 19 LASER MARKING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.1.1 DRIVERS

FIGURE 20 MARKET: DRIVERS AND THEIR IMPACT

5.1.1.1 Higher performance of laser markers over traditional material marking techniques

5.1.1.2 Increasing adoption of laser markers in various industries

5.1.1.3 Growing adoption of smart manufacturing techniques

5.1.1.4 Shift toward production of nanodevices and microdevices

FIGURE 21 GLOBAL SEMICONDUCTOR SILICON MATERIAL SALES IN MILLION SQUARE INCH (MSI), 2018–2021

5.1.2 RESTRAINTS

FIGURE 22 MARKET: RESTRAINTS AND THEIR IMPACT

5.1.2.1 High deployment cost

5.1.3 OPPORTUNITIES

FIGURE 23 MARKET: OPPORTUNITIES AND THEIR IMPACT

5.1.3.1 Growing adoption of advanced laser marking technologies

5.1.3.2 Increasing trend of personalized gifts

5.1.4 CHALLENGES

FIGURE 24 MARKET: CHALLENGES AND THEIR IMPACT

5.1.4.1 Environmental concerns associated with use of rare-earth elements

5.1.4.2 Technical complexities related to high-power lasers

5.2 VALUE CHAIN ANALYSIS

FIGURE 25 VALUE CHAIN ANALYSIS: MAJOR VALUE ADDED BY ORIGINAL EQUIPMENT MANUFACTURERS (OEMS) AND LASER MARKING SYSTEM INTEGRATORS

5.3 ECOSYSTEM ANALYSIS

FIGURE 26 ECOSYSTEM OF LASER MARKING MARKET

TABLE 2 MARKET: COMPANY ROLES

5.4 TECHNOLOGY ANALYSIS

5.5 PATENT ANALYSIS

FIGURE 27 NUMBER OF PATENTS GRANTED PER YEAR, 2012–2021

FIGURE 28 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST 10 YEARS

TABLE 3 LIST OF TOP PATENT OWNERS IN LAST 10 YEARS

5.5.1 LIST OF MAJOR PATENTS RELATED TO MARKET

TABLE 4 LIST OF MAJOR PATENTS

5.6 CASE STUDY ANALYSIS

5.6.1 LEADING OEM OF ELECTRICAL COMPONENTS RELABELS CIRCUIT BREAKERS WITH MECCO’S AND ITRACE’S TECHNOLOGIES

5.6.2 JUNGHANS ACHIEVES HIGH-QUALITY MARKING ON ITS LIMITED-EDITION PLATINUM WATCHES WITH TRUMPF’S TRUMARK STATION 7000

5.6.3 FOBA HELPS CENTEX MACHINING REDUCE MARKING TIME AND ENHANCE EFFICIENCY

5.6.4 LASERAX HELPS MERIDIAN WITH BEST LASER MARKING STATION SUITABLE FOR HARSH ENVIRONMENTS

5.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

FIGURE 29 TRENDS/DISRUPTIONS IN MARKET

5.8 TRADE ANALYSIS

FIGURE 30 IMPORT DATA FOR HS CODE 845611, BY COUNTRY, 2017–2021

FIGURE 31 EXPORT DATA FOR HS CODE 845611, BY COUNTRY, 2017–2021

5.9 PORTER’S FIVE FORCES ANALYSIS

TABLE 5 LASER MARKING MARKET: PORTER’S FIVE FORCES ANALYSIS

5.9.1 INTENSITY OF COMPETITIVE RIVALRY

5.9.2 BARGAINING POWER OF SUPPLIERS

5.9.3 BARGAINING POWER OF BUYERS

5.9.4 THREAT OF SUBSTITUTES

5.9.5 THREAT OF NEW ENTRANTS

5.10 TARIFF ANALYSIS

TABLE 6 TARIFF IMPOSED ON LASER MARKING MACHINES UNDER HS CODE 845611 EXPORTED BY US

TABLE 7 TARIFF IMPOSED ON LASER MARKING MACHINES UNDER HS CODE 845611 EXPORTED BY CHINA

TABLE 8 TARIFF IMPOSED ON LASER MARKING MACHINES UNDER HS CODE 845611 EXPORTED BY GERMANY

5.11 STANDARDS AND REGULATORY LANDSCAPE

5.11.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 9 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 10 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 11 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 12 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.11.2 LASER STANDARDS, CLASSIFICATIONS, AND RELATED RATINGS

TABLE 13 CLASSIFICATION CRITERIA OF DIFFERENT LASER STANDARDS

5.11.3 INGRESS PROTECTION (IP) RATINGS

TABLE 14 INGRESS PROTECTION (IP) RATINGS

5.11.4 RESTRICTION OF HAZARDOUS SUBSTANCES (ROHS) AND WASTE ELECTRICAL AND ELECTRONIC EQUIPMENT (WEEE)

5.11.5 REGISTRATION, EVALUATION, AUTHORIZATION, AND RESTRICTION OF CHEMICALS (REACH)

5.11.6 GENERAL DATA PROTECTION REGULATION (GDPR)

5.11.7 IMPORT–EXPORT LAWS

5.12 KEY STAKEHOLDERS AND BUYING CRITERIA

5.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 32 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS, BY TOP 3 INDUSTRIES

TABLE 15 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS, BY TOP 3 INDUSTRIES (%)

5.12.2 BUYING CRITERIA

FIGURE 33 KEY BUYING CRITERIA FOR TOP 3 INDUSTRIES

TABLE 16 KEY BUYING CRITERIA FOR TOP 3 INDUSTRIES

5.13 PRICING ANALYSIS

5.13.1 AVERAGE SELLING PRICE OF LASER MARKING SYSTEMS OFFERED BY MARKET PLAYERS TO TOP 3 INDUSTRIES

FIGURE 34 AVERAGE SELLING PRICE OF LASER MARKING SYSTEMS OFFERED BY MARKET PLAYERS TO TOP 3 INDUSTRIES

TABLE 17 AVERAGE SELLING PRICE OF LASER MARKING SYSTEMS OFFERED BY MARKET PLAYERS TO TOP 3 INDUSTRIES

5.14 KEY CONFERENCES AND EVENTS, 2022–2023

TABLE 18 MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

6 LASER MARKING MARKET, BY OFFERING (Page No. - 91)

6.1 INTRODUCTION

FIGURE 35 SERVICES SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 19 MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 20 MARKET, BY OFFERING, 2022–2027 (USD MILLION)

6.2 HARDWARE

TABLE 21 HARDWARE: MARKET, BY LASER TYPE, 2018–2021 (USD MILLION)

TABLE 22 HARDWARE: MARKET, BY LASER TYPE, 2022–2027 (USD MILLION)

TABLE 23 HARDWARE: MARKET, BY LASER TYPE, 2018–2021 (UNITS)

TABLE 24 HARDWARE: MARKET, BY LASER TYPE, 2022–2027 (UNITS)

6.2.1 LASER

6.2.1.1 Active laser medium

6.2.1.1.1 Acts as source of optical gain to produce population inversion

6.2.1.2 External energy source

6.2.1.2.1 Laser markers supported via pump source that transfers energy from external source

6.2.1.3 Optical resonator

6.2.1.3.1 Used in guiding stimulated emission processes to generate laser beam

6.2.2 CONTROLLER

6.2.2.1 Used to control laser beam emitted from laser source

6.2.3 FILTER

6.2.3.1 Used to filter range of wavelengths to transmit desired wavelengths and filter unwanted wavelengths

6.2.4 ROTARY DEVICE

6.2.4.1 Laser marking machines supported by rotary devices to work on rounded items

6.2.5 GALVANOMETER

6.2.5.1 Used to guide beam within limited area through lens onto object surface

6.2.6 POWER SUPPLY

6.2.6.1 Provides energy to all devices installed in laser marking system

6.3 SOFTWARE

6.3.1 ENABLES LASER MARKERS TO PERFORM 3D MARKING AND LASER MARKING OF TEXTS, LOGOS, AND GRAPHICS

TABLE 25 SOFTWARE: MARKET, BY LASER TYPE, 2018–2021 (USD MILLION)

TABLE 26 SOFTWARE: MARKET, BY LASER TYPE, 2022–2027 (USD MILLION)

6.4 SERVICES

6.4.1 LASER MARKING SERVICES FACILITATE DEPLOYMENT AND OPERATION OF LASER MARKING SYSTEMS

TABLE 27 SERVICES: MARKET, BY LASER TYPE, 2018–2021 (USD MILLION)

TABLE 28 SERVICES: MARKET, BY LASER TYPE, 2022–2027 (USD MILLION)

7 LASER MARKING MARKET, BY LASER TYPE (Page No. - 100)

7.1 INTRODUCTION

FIGURE 36 UV LASER SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

TABLE 29 MARKET, BY LASER TYPE, 2018–2021 (USD MILLION)

TABLE 30 MARKET, BY LASER TYPE, 2022–2027 (USD MILLION)

7.2 FIBER LASER

7.2.1 GROWING DEMAND FOR FIBER LASER MARKING SYSTEMS ATTRIBUTED TO HIGH VERSATILITY

TABLE 31 FIBER LASER: MARKET, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 32 FIBER LASER: MARKET, BY INDUSTRY, 2022–2027 (USD MILLION)

TABLE 33 FIBER LASER: MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 34 FIBER LASER: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

7.3 DIODE LASER

7.3.1 HIGH USE OF DIODE LASERS FOR ABLATION AND DAY/NIGHT MARKINGS

TABLE 35 DIODE LASER: MARKET, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 36 DIODE LASER: MARKET, BY INDUSTRY, 2022–2027 (USD MILLION)

TABLE 37 DIODE LASER: MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 38 DIODE LASER: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

7.4 SOLID-STATE LASER

TABLE 39 SOLID-STATE LASER: MARKET, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 40 SOLID-STATE LASER: MARKET, BY INDUSTRY, 2022–2027 (USD MILLION)

TABLE 41 SOLID-STATE LASER: MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 42 SOLID-STATE LASER: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

7.4.1 YTTRIUM ALUMINUM GARNET (YAG) LASER

7.4.1.1 Use of yttrium aluminum garnet (YAG) lasers for several applications attributed to high thermal conductivity

7.4.2 NEODYMIUM GLASS LASER

7.4.2.1 Use of neodymium glass lasers in high-energy-pulsed operations

7.4.3 THIN DISK LASER

7.4.3.1 Ability to generate high peak power in picosecond pulses

7.5 CO2 LASER

7.5.1 HIGH USE OF CO2 LASERS FOR COMMERCIAL, INDUSTRIAL, AND MILITARY APPLICATIONS

TABLE 43 CO2 LASER: LASER MARKING MARKET, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 44 CO2 LASER: MARKET, BY INDUSTRY, 2022–2027 (USD MILLION)

TABLE 45 CO2 LASER: MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 46 CO2 LASER: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

7.6 ULTRAVIOLET (UV) LASER

7.6.1 GROWING ADOPTION OF ULTRAVIOLET (UV) LASERS TO MARK HIGHLY REFLECTIVE MATERIALS

TABLE 47 UV LASER: MARKET, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 48 UV LASER: MARKET, BY INDUSTRY, 2022–2027 (USD MILLION)

TABLE 49 UV LASER: MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 50 UV LASER: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

7.7 OTHERS

TABLE 51 OTHERS: MARKET, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 52 OTHERS: MARKET, BY INDUSTRY, 2022–2027 (USD MILLION)

TABLE 53 OTHERS: MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 54 OTHERS: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

8 LASER MARKING MARKET, BY PRODUCT TYPE (Page No. - 114)

8.1 INTRODUCTION

FIGURE 37 FIXED SEGMENT TO HOLD LARGER SHARE OF LASER MARKING MARKET DURING FORECAST PERIOD

TABLE 55 LASER MARKING MARKET, BY PRODUCT TYPE, 2018–2021 (USD MILLION)

TABLE 56 LASER MARKING MARKET, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

8.2 FIXED

8.2.1 WIDELY USED FOR 3D MARKING OF LOGOS, 2D MATRIX CODES, AND BARCODES

8.3 PORTABLE

8.3.1 HIGHLY USED ATTRIBUTED TO COMPACT SIZE, MINIMAL MAINTENANCE COST, HIGH STABILIZATION, AND LESS POWER CONSUMPTION FEATURES

9 LASER MARKING MARKET, BY MACHINE TYPE (Page No. - 117)

9.1 INTRODUCTION

FIGURE 38 3D LASER MARKING SEGMENT TO RECORD HIGHER CAGR DURING FORECAST PERIOD

TABLE 57 MARKET, BY MACHINE TYPE, 2018–2021 (USD MILLION)

TABLE 58 MARKET, BY MACHINE TYPE, 2022–2027 (USD MILLION)

9.2 2D LASER MARKING

9.2.1 USED FOR MARKING FLAT SURFACES IN VARIOUS INDUSTRIES

9.3 3D LASER MARKING

9.3.1 USED TO PERFORM ETCHINGS, ENGRAVINGS, AND MARKINGS ON NON-FLAT SURFACES

10 LASER MARKING MARKET, BY METHOD (Page No. - 120)

10.1 INTRODUCTION

FIGURE 39 ANNEALING SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 59 MARKET, BY METHOD, 2018–2021 (USD MILLION)

TABLE 60 MARKET, BY METHOD, 2022–2027 (USD MILLION)

10.2 ANNEALING

10.2.1 ANNEALING PROVIDES PERMANENT MARKING ON MACHINE TOOLS AND MEDICAL EQUIPMENT FOR TRACING AND IDENTIFICATION OF TOOLS

10.3 ABLATION

10.3.1 ABLATION IS WELL-SUITED FOR PASSIVATED, OXIDIZED, OR COATED METALS

10.4 ENGRAVING

10.4.1 LASER ENGRAVING CAN BE ACHIEVED ON DIFFERENT MATERIALS

10.5 OTHERS

11 LASER MARKING MARKET, BY MATERIAL (Page No. - 124)

11.1 INTRODUCTION

FIGURE 40 METAL SEGMENT TO HOLD LARGEST SHARE DURING FORECAST PERIOD

TABLE 61 MARKET, BY MATERIAL TYPE, 2018–2021 (USD MILLION)

TABLE 62 MARKET, BY MATERIAL TYPE, 2022–2027 (USD MILLION)

11.2 METAL

11.2.1 GROWING USE OF FIBER AND CO2 LASER MARKING MACHINES TO MARK AND ENGRAVE METALS

11.3 PLASTIC

11.3.1 RISING LASER MARKING ON PLASTIC MATERIALS

11.4 GLASS, PAPER, AND CERAMICS

11.4.1 RISING ADOPTION OF LASER ENGRAVING MACHINES TO MARK GLASS, PAPER, AND CERAMICS

11.5 OTHERS

12 LASER MARKING MARKET, BY APPLICATION (Page No. - 128)

12.1 INTRODUCTION

FIGURE 41 QR CODES SEGMENT TO HOLD LARGEST SHARE OF MARKET DURING FORECAST PERIOD

TABLE 63 MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 64 MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

12.2 BARCODES

12.2.1 RISING DEMAND FOR LASER MARKING MACHINES ATTRIBUTED TO ABILITY TO MARK PERMANENT ALPHANUMERIC DETAILS ON OBJECTS

12.3 LOGOS

12.3.1 GROWING ADOPTION OF LASER MARKING AS PERMANENT LOGO MARKING METHOD FOR SEVERAL MATERIALS

12.4 DATE CODES

12.4.1 INCREASING USE OF HIGH-PRECISION LASERS IN HEALTHCARE INDUSTRY FOR MARKING DATE CODES ON MEDICINES AND SUPPLEMENTS

12.5 PART NUMBERS

12.5.1 INCREASING APPLICATION OF LASER MARKING SYSTEMS TO MARK PART NUMBERS IN MACHINE TOOLS AND AUTOMOTIVE INDUSTRIES

12.6 QUICK RESPONSE (QR) CODES

12.6.1 RISING ADOPTION OF QUICK RESPONSE (QR) CODES IN VARIOUS INDUSTRIES

12.7 OTHERS

13 LASER MARKING MARKET, BY INDUSTRY (Page No. - 134)

13.1 INTRODUCTION

FIGURE 42 PACKAGING SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

TABLE 65 MARKET, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 66 MARKET, BY INDUSTRY, 2022–2027 (USD MILLION)

13.2 MACHINE TOOLS

13.2.1 RISING DEMAND FOR LASER MARKING AND ENGRAVING SYSTEMS IN MACHINE TOOL MANUFACTURING

TABLE 67 MACHINE TOOLS: MARKET, BY LASER TYPE, 2018–2021 (USD MILLION)

TABLE 68 MACHINE TOOLS: MARKET, BY LASER TYPE, 2022–2027 (USD MILLION)

TABLE 69 MACHINE TOOLS: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 70 MACHINE TOOLS: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 71 MACHINE TOOLS: ASIA PACIFIC MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 72 MACHINE TOOLS: ASIA PACIFIC MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 73 MACHINE TOOLS: EUROPE MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 74 MACHINE TOOLS: EUROPE MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 75 MACHINE TOOLS: NORTH AMERICA MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 76 MACHINE TOOLS: NORTH AMERICA MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 77 MACHINE TOOLS: ROW MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 78 MACHINE TOOLS: ROW MARKET, BY REGION, 2022–2027 (USD MILLION)

13.3 SEMICONDUCTOR & ELECTRONICS

13.3.1 RISING GLOBAL INVESTMENTS IN SEMICONDUCTOR FABRICATION EXPANSION

TABLE 79 SEMICONDUCTOR & ELECTRONICS: LASER MARKING MARKET, BY LASER TYPE, 2018–2021 (USD MILLION)

TABLE 80 SEMICONDUCTOR & ELECTRONICS: MARKET, BY LASER TYPE, 2022–2027 (USD MILLION)

TABLE 81 SEMICONDUCTOR & ELECTRONICS: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 82 SEMICONDUCTOR & ELECTRONICS: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 83 SEMICONDUCTOR & ELECTRONICS: ASIA PACIFIC MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 84 SEMICONDUCTOR & ELECTRONICS: ASIA PACIFIC MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 85 SEMICONDUCTOR & ELECTRONICS: EUROPE MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 86 SEMICONDUCTOR & ELECTRONICS: EUROPE MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 87 SEMICONDUCTOR & ELECTRONICS: NORTH AMERICA MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 88 SEMICONDUCTOR & ELECTRONICS: NORTH AMERICA MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 89 SEMICONDUCTOR & ELECTRONICS: ROW MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 90 SEMICONDUCTOR & ELECTRONICS: ROW MARKET, BY REGION, 2022–2027 (USD MILLION)

13.4 AUTOMOTIVE

13.4.1 HIGH USE OF LASER MARKING SYSTEMS TO MARK AUTOMOBILE PARTS

TABLE 91 AUTOMOTIVE: LASER MARKING MARKET, BY LASER TYPE, 2018–2021 (USD MILLION)

TABLE 92 AUTOMOTIVE: MARKET, BY LASER TYPE, 2022–2027 (USD MILLION)

TABLE 93 AUTOMOTIVE: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 94 AUTOMOTIVE: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 95 AUTOMOTIVE: ASIA PACIFIC MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 96 AUTOMOTIVE: ASIA PACIFIC MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 97 AUTOMOTIVE: EUROPE MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 98 AUTOMOTIVE: EUROPE MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 99 AUTOMOTIVE: NORTH AMERICA MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 100 AUTOMOTIVE: NORTH AMERICA MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 101 AUTOMOTIVE: ROW MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 102 AUTOMOTIVE: ROW MARKET, BY REGION, 2022–2027 (USD MILLION)

13.5 HEALTHCARE

13.5.1 RISING DEMAND FOR HIGH-PRECISION LASERS TO MEET STRINGENT IDENTIFICATION AND TRACEABILITY GUIDELINES

TABLE 103 HEALTHCARE: LASER MARKING MARKET, BY LASER TYPE, 2018–2021 (USD MILLION)

TABLE 104 HEALTHCARE: MARKET, BY LASER TYPE, 2022–2027 (USD MILLION)

TABLE 105 HEALTHCARE: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 106 HEALTHCARE: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 107 HEALTHCARE: ASIA PACIFIC MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 108 HEALTHCARE: ASIA PACIFIC MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 109 HEALTHCARE: EUROPE MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 110 HEALTHCARE: EUROPE MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 111 HEALTHCARE: NORTH AMERICA MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 112 HEALTHCARE: NORTH AMERICA MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 113 HEALTHCARE: ROW MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 114 HEALTHCARE: ROW MARKET, BY REGION, 2022–2027 (USD MILLION)

13.6 AEROSPACE & DEFENSE

13.6.1 GROWING DEMAND FOR LASER MARKERS IN AEROSPACE & DEFENSE INDUSTRY ATTRIBUTED TO ABILITY TO WORK WITH SEVERAL METALS

TABLE 115 AEROSPACE & DEFENSE: LASER MARKING MARKET, BY LASER TYPE, 2018–2021 (USD MILLION)

TABLE 116 AEROSPACE & DEFENSE: MARKET, BY LASER TYPE, 2022–2027 (USD MILLION)

TABLE 117 AEROSPACE & DEFENSE: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 118 AEROSPACE & DEFENSE: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 119 AEROSPACE & DEFENSE: ASIA PACIFIC MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 120 AEROSPACE & DEFENSE: ASIA PACIFIC MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 121 AEROSPACE & DEFENSE: EUROPE MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 122 AEROSPACE & DEFENSE: EUROPE MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 123 AEROSPACE & DEFENSE: NORTH AMERICA MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 124 AEROSPACE & DEFENSE: NORTH AMERICA MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 125 AEROSPACE & DEFENSE: ROW MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 126 AEROSPACE & DEFENSE: ROW MARKET, BY REGION, 2022–2027 (USD MILLION)

13.7 PACKAGING

13.7.1 HIGH USE OF CO2 LASERS IN PACKAGING VERTICAL

TABLE 127 PACKAGING: LASER MARKING MARKET, BY LASER TYPE, 2018–2021 (USD MILLION)

TABLE 128 PACKAGING: MARKET, BY LASER TYPE, 2022–2027 (USD MILLION)

TABLE 129 PACKAGING: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 130 PACKAGING: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 131 PACKAGING: ASIA PACIFIC MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 132 PACKAGING: ASIA PACIFIC MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 133 PACKAGING: EUROPE MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 134 PACKAGING: EUROPE MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 135 PACKAGING: NORTH AMERICA MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 136 PACKAGING: NORTH AMERICA MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 137 PACKAGING: ROW MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 138 PACKAGING: ROW MARKET, BY REGION, 2022–2027 (USD MILLION)

13.8 OTHERS

13.8.1 TEXTILE

13.8.1.1 Engraving of natural and synthetic fabrics to achieve required design

13.8.2 ARCHITECTURE

13.8.2.1 Rising marking and engraving of wood and plywood

13.8.3 GEMOLOGY & JEWELRY

13.8.3.1 Ability of laser marking machines to perform customized markings quickly and easily

TABLE 139 OTHERS: LASER MARKING MARKET, BY LASER TYPE, 2018–2021 (USD MILLION)

TABLE 140 OTHERS: MARKET, BY LASER TYPE, 2022–2027 (USD MILLION)

TABLE 141 OTHERS: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 142 OTHERS: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 143 OTHERS: ASIA PACIFIC MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 144 OTHERS: ASIA PACIFIC MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 145 OTHERS: EUROPE MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 146 OTHERS: EUROPE MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 147 OTHERS: NORTH AMERICA MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 148 OTHERS: NORTH AMERICA MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 149 OTHERS: ROW MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 150 OTHERS: ROW MARKET, BY REGION, 2022–2027 (USD MILLION)

14 LASER MARKING MARKET, BY REGION (Page No. - 167)

14.1 INTRODUCTION

FIGURE 43 REGIONAL SNAPSHOT: INDIA LASER MARKING MARKET TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 151 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 152 MARKET, BY REGION, 2022–2027 (USD MILLION)

14.2 NORTH AMERICA

FIGURE 44 NORTH AMERICA: SNAPSHOT OF LASER MARKING MARKET

TABLE 153 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 154 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 155 NORTH AMERICA: MARKET, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 156 NORTH AMERICA: MARKET, BY INDUSTRY, 2022–2027 (USD MILLION)

14.2.1 US

14.2.1.1 Increasing demand for warranty traceability and regulatory requirements from manufacturing companies

14.2.2 CANADA

14.2.2.1 Growing label engraving on manufactured products

14.2.3 MEXICO

14.2.3.1 Expanding automotive industry

14.3 EUROPE

FIGURE 45 EUROPE: SNAPSHOT OF LASER MARKING MARKET

TABLE 157 EUROPE: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 158 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 159 EUROPE: MARKET, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 160 EUROPE: MARKET, BY INDUSTRY, 2022–2027 (USD MILLION)

14.3.1 GERMANY

14.3.1.1 Growing use of laser markers and engravers in foaming, frothing, annealing, and other micromachining applications

14.3.2 FRANCE

14.3.2.1 Rising government-led investments in automotive and semiconductor industries

14.3.3 UK

14.3.3.1 Growing aerospace industry

14.3.4 REST OF EUROPE

14.4 ASIA PACIFIC

FIGURE 46 ASIA PACIFIC: SNAPSHOT OF LASER MARKING MARKET

TABLE 161 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 162 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 163 ASIA PACIFIC: MARKET, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 164 ASIA PACIFIC: MARKET, BY INDUSTRY, 2022–2027 (USD MILLION)

14.4.1 CHINA

14.4.1.1 Growing adoption of enhanced manufacturing techniques in machine tools industry

14.4.2 JAPAN

14.4.2.1 Rapid industrialization and modernization

14.4.3 INDIA

14.4.3.1 Government-led initiatives to boost domestic manufacturing sector

14.4.4 SOUTH KOREA

14.4.4.1 High investments in semiconductor industry

14.4.5 REST OF ASIA PACIFIC

14.5 REST OF THE WORLD (ROW)

TABLE 165 ROW: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 166 ROW: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 167 ROW: MARKET, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 168 ROW: MARKET, BY INDUSTRY, 2022–2027 (USD MILLION)

14.5.1 MIDDLE EAST & AFRICA

14.5.1.1 Expansion of automotive vertical

14.5.2 SOUTH AMERICA

14.5.2.1 Rising demand for laser marking systems in aerospace industry

15 COMPETITIVE LANDSCAPE (Page No. - 187)

15.1 OVERVIEW

15.2 STRATEGIES ADOPTED BY KEY PLAYERS/RIGHT TO WIN

TABLE 169 OVERVIEW OF STRATEGIES ADOPTED BY KEY COMPANIES IN LASER MARKING MARKET

15.3 FIVE-YEAR COMPANY REVENUE ANALYSIS

FIGURE 47 FIVE-YEAR REVENUE ANALYSIS OF TOP PLAYERS IN MARKET

15.4 MARKET SHARE ANALYSIS, 2021

TABLE 170 MARKET: DEGREE OF COMPETITION

15.5 COMPANY EVALUATION QUADRANT

15.5.1 STARS

15.5.2 EMERGING LEADERS

15.5.3 PERVASIVE PLAYERS

15.5.4 PARTICIPANTS

FIGURE 48 MARKET (GLOBAL): COMPANY EVALUATION QUADRANT, 2021

15.6 STARTUP/SME EVALUATION QUADRANT, 2021

15.6.1 PROGRESSIVE COMPANIES

15.6.2 RESPONSIVE COMPANIES

15.6.3 DYNAMIC COMPANIES

15.6.4 STARTING BLOCKS

FIGURE 49 MARKET: STARTUP/SME EVALUATION QUADRANT, 2021

15.7 LASER MARKING MARKET: COMPANY PRODUCT FOOTPRINT

TABLE 171 PRODUCT FOOTPRINT OF COMPANIES

TABLE 172 INDUSTRY FOOTPRINT OF COMPANIES

TABLE 173 PRODUCT TYPE FOOTPRINT OF COMPANIES

TABLE 174 REGIONAL FOOTPRINT OF COMPANIES

15.8 LASER MARKING MARKET: COMPETITIVE BENCHMARKING

TABLE 175 MARKET: DETAILED LIST OF KEY STARTUPS/SMES

TABLE 176 MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, BY INDUSTRY

TABLE 177 MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, BY PRODUCT TYPE

TABLE 178 MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, BY REGION

15.9 COMPETITIVE SCENARIO AND TRENDS

TABLE 179 MARKET: PRODUCT LAUNCHES, JANUARY 2020–AUGUST 2022

TABLE 180 MARKET: DEALS, JANUARY 2020–AUGUST 2022

16 COMPANY PROFILES (Page No. - 203)

(Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)*

16.1 KEY PLAYERS

16.1.1 COHERENT, INC.

TABLE 181 COHERENT, INC.: COMPANY OVERVIEW

FIGURE 50 COHERENT, INC.: COMPANY SNAPSHOT

16.1.2 TRUMPF

TABLE 182 TRUMPF: COMPANY OVERVIEW

FIGURE 51 TRUMPF: COMPANY SNAPSHOT

16.1.3 HAN’S LASER TECHNOLOGY CO., LTD.

TABLE 183 HAN’S LASER: COMPANY OVERVIEW

FIGURE 52 HAN’S LASER: COMPANY SNAPSHOT

16.1.4 IPG PHOTONICS CORP.

TABLE 184 IPG PHOTONICS CORP.: COMPANY OVERVIEW

FIGURE 53 IPG PHOTONICS CORP.: COMPANY SNAPSHOT

16.1.5 DANAHER CORP.

TABLE 185 DANAHER CORP.: COMPANY OVERVIEW

FIGURE 54 DANAHER CORP: COMPANY SNAPSHOT

16.1.6 NOVANTA INC.

TABLE 186 NOVANTA INC.: COMPANY OVERVIEW

FIGURE 55 NOVANTA INC.: COMPANY SNAPSHOT

16.1.7 KEYENCE CORP.

TABLE 187 KEYENCE CORP.: COMPANY OVERVIEW

FIGURE 56 KEYENCE CORP.: COMPANY SNAPSHOT

16.1.8 GRAVOTECH MARKING

TABLE 188 GRAVOTECH MARKING: COMPANY OVERVIEW

16.1.9 JENOPTIK

TABLE 189 JENOPTIK: COMPANY OVERVIEW

FIGURE 57 JENOPTIK: COMPANY SNAPSHOT

16.1.10 600 GROUP

TABLE 190 600 GROUP: COMPANY OVERVIEW

FIGURE 58 600 GROUP: COMPANY SNAPSHOT

*Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)* might not be captured in case of unlisted companies.

16.2 OTHER PLAYERS

16.2.1 DATALOGIC S.P.A.

16.2.2 PANASONIC CORP.

16.2.3 HUAGONG TECH CO., LTD.

16.2.4 OMRON CORP.

16.2.5 TROTEC LASER GMBH

16.2.6 EPILOG LASER

16.2.7 MECCO

16.2.8 LASERSTAR TECHNOLOGIES CORP.

16.2.9 TELESIS TECHNOLOGIES, INC.

16.2.10 GCC WORLD

16.2.11 ACI LASER

16.2.12 RADIAN LASER SYSTEMS

16.2.13 LNA LASER

16.2.14 ACSYS LASERTECHNIK GMBH

16.2.15 LASERAX

16.2.16 HEATSIGN

16.2.17 RMI LASER

16.2.18 LASEA

17 APPENDIX (Page No. - 255)

17.1 DISCUSSION GUIDE

17.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

17.3 CUSTOMIZATION OPTIONS

17.4 RELATED REPORTS

17.5 AUTHOR DETAILS

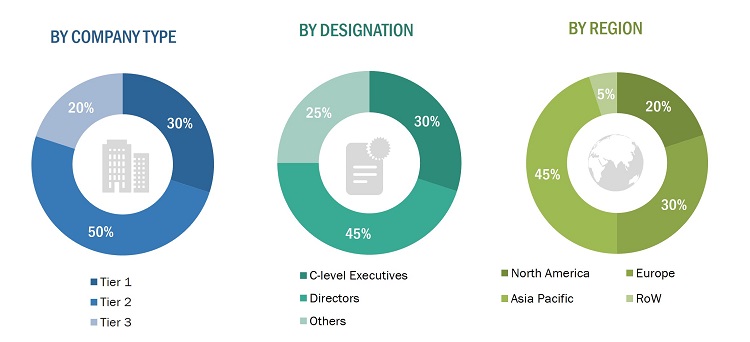

The study involved 4 major activities to estimate the size of the laser marking market. Exhaustive secondary research has been conducted to collect information on the laser marking market. Validation of these findings, assumptions, and sizing with industry experts across value chain through primary research has been the next step. Both, top-down and bottom-up approaches have been employed to estimate the complete market size. After that, market breakdown and data triangulation have been used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research, various secondary sources have been referred to for identifying and collecting information important for this study. Secondary sources include corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers, machine condition monitoring related journals, and certified publications; articles from recognized authors; gold and silver standard websites; directories; and databases. European Laser Association, Laser Industry Association, Indian Laser Association, Association of Industrial Laser Users, IEEE Photonics Society, Laser Focus World, and IEEE Spectrum are a few examples of secondary sources.

Primary Research

In the primary research, various primary sources from both the supply and demand sides have been interviewed with to obtain the qualitative and quantitative information for this report. Primary sources from the supply side include industry experts such as CEOs, VPs, marketing directors, technology and innovation directors, and related key executives from major companies and organizations operating in the laser marking market. Following is the breakdown of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both, top-down and bottom-up approaches have been used to estimate and validate the size of the overall laser marking market and the market based on subsegments. The research methodology used to estimate the market size has been given below:

- Analyzing the presence of major companies in each country and identifying hardware, software, and service providers in the laser marking market

- Identifying major industries adopting laser markings in different countries and regions

- Analyzing each industry, along with major related companies and laser marking machine providers, as well as identifying service providers for laser marking machines

- Estimating the market for industries that use laser marking machines

- Understanding the demand generated by companies for different applications

- Tracking the ongoing and upcoming installation of laser marking machines by industries and forecasting the market based on these developments and other critical parameters

- Carrying out multiple discussions with key opinion leaders to understand the type of connectivity technology products, services, and software designed and developed by industries for analyzing the breakdown of the scope of work carried out by each major company in the laser marking market

- Arriving at the market estimates by analyzing the laser marking industries according to their country; thereafter, combining this data to arrive at the market estimates based on region

- Verifying and crosschecking the estimates at every level through discussions with key opinion leaders, including CXOs, directors, and operation managers; and, finally, with the domain expert at MarketsandMarkets

- Studying various paid and unpaid sources of information, such as annual reports, press releases, white papers, and databases, for this process

Data Triangulation

After arriving at the overall size of the laser marking market from the estimation process explained above, the total market was split into several segments and subsegments. Market breakdown and data triangulation procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from demand and supply sides. Along with this, the market size was validated using the top-down and bottom-up approaches

Report Objectives

- To define and forecast the laser marking market based on offering, laser type, product type, machine type, method, material, application, industry, and region in terms of value

- To describe and forecast the laser marking market for laser type hardware in terms of volume

- To forecast the market size for various segments with respect to four main regions: North America, Europe, Asia Pacific, and Rest of the World (RoW)

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the laser marking market

- To provide an ecosystem analysis, case study analysis, patent analysis, technology analysis, pricing analysis, Porter’s five forces analysis, and regulations pertaining to the market

- To provide a detailed overview of the value chain of the laser marking ecosystem

- To strategically analyze micromarkets1 with regard to individual growth trends, prospects, and contributions to the total market

- To analyze opportunities for stakeholders by identifying high-growth segments of the market

- To strategically profile the key players, comprehensively analyze their market positions in terms of ranking and core competencies2, and provide information about the competitive landscape of the market

- To analyze strategic approaches such as product launches, acquisitions, agreements, and partnerships in the laser marking market

Available customizations

Along with the market data, MarketsandMarkets offers customizations according to a company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Laser Marking Market