Larvicides Market by Control Method (Biocontrol Agents, Chemical Agents, Insect Growth Regulators), Target (Mosquitoes, Flies), End-use Sector (Public Health, Agricultural, Commercial, Residential, Livestock), and Region - Global Forecast to 2023

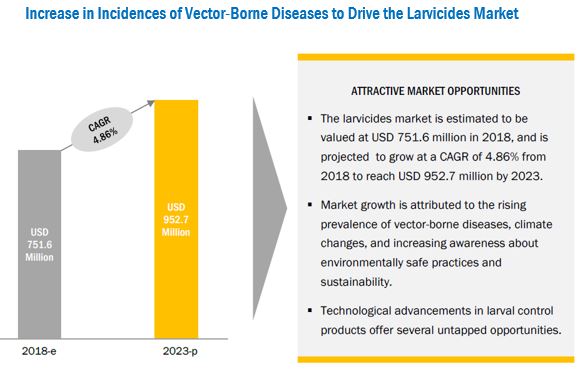

[143 Pages Report] The larvicides market was valued at USD 719.7 Million in 2017 and is projected to reach USD 952.7 Million by 2023, at a CAGR of 4.86% by 2023. Factors such as an increase in the prevalence of vectorborne diseases, epidemics or outbreaks, climatic changes, rise in the pest population, and growth in awareness about IPM practices and environmental sustainability are some of the drivers for the growth of the larvicides market. The rise in the adoption of biological and physical control methods and technological advancements in mosquito control products will increase the demand for the larvicides market.

For more details on this research, Request Free Sample Report

Various methods such as chemical, biological, insect growth regulators (IGRs), surface oils & films, and mechanical control are used for larvae elimination. Based on their sustainability, efficacy, and cost-effectiveness, these control methods are used appropriately. However, non-chemical options are gaining popularity over chemical larvicides due to their environmentally safe profile. Larvicides in the form of insect growth regulators and microbial organisms are being increasingly used to control larvae due to their relative target specificity, safety, and eco-friendly properties.

The years and their periodization considered for the study are as follows:

- Base year: 2017

- Forecast period: 20182023

The objectives of the report

- Determining and projecting the size of the global market, with respect to control method, end use, and target over a five-year period ranging from 2018 to 2023

- Identifying attractive opportunities in the market by determining the largest and fastest-growing segments across regions

- Analyzing the demand-side factors based on the impact of macro and microeconomic factors on the market and shifts in demand patterns across different subsegments and regions

Research Methodology:

- Major regions were identified, along with countries contributing the maximum share.

- Secondary research was conducted to obtain the value of larvicides market for regions such as North America, Europe, Asia Pacific, South America, and Rest of the World (RoW).

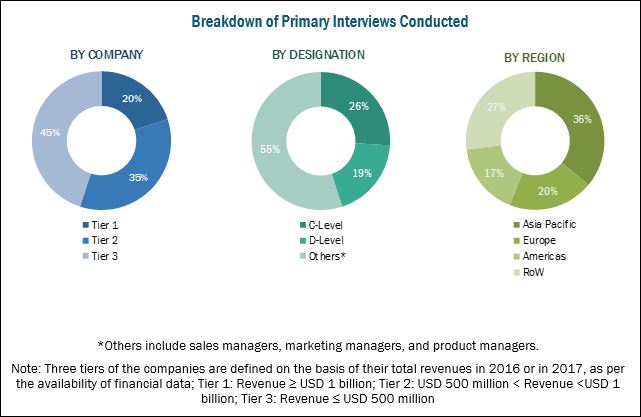

- The key players were identified through secondary sources such as the Bloomberg, Businessweek, Factiva, agricultural magazines, and companies annual reports, while their global ranking was determined through both, primary and secondary research. The research methodology includes the study of annual and financial reports of top market players, as well as interviews with industry experts (such as CEOs, VPs, directors, and marketing executives) for key insights (both quantitative and qualitative) for the larvicides market.

To know about the assumptions considered for the study, download the pdf brochure

The various contributors involved in the value chain of the larvicides market include raw material suppliers, R&D institutes, larvicides manufacturing companies such as BASF (Germany), Bayer (Germany), Sumitomo Chemical (Japan), Adama (US), and Certis (US) and government bodies & regulatory associations such as the US Department of Agriculture (USDA).

Target Audience

The stakeholders for the report are as follows:

- Larvicide manufacturers, suppliers, and formulators

- Professional pest control service providers

- Pesticide traders, distributors, importers, exporters, and suppliers

- Public health contractors

- Agricultural warehouse owners and animal & dairy cooperative societies

- Commercial research & development (R&D) organizations and financial institutions

- Pest control associations and industry bodies

- Government health authorities and regulatory bodies such as the World Health Organization (WHO), Environmental Protection Agency (EPA), and the Pest Management Regulatory Agency (PMRA)

Scope of the Report:

This research report categorizes the global market based on control method, end-use, and target, and region.

Based on Control Method, the market has been segmented as follows:

- Biocontrol agents

- Chemical agents

- Insect growth regulators

- Other control methods (surface oils & films and mechanical control)

Based on End-use, the market has been segmented as follows:

- Public health

- Agricultural

- Commercial

- Residential

- Livestock

Based on Target, the market has been segmented as follows:

- Mosquitoes

- Flies

- Others (ants, fleas, thrips, fungus gnats, nematodes, and beetles)

Based on Region, the market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- South America

- RoW (The Middle East and Africa)

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the companys specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of product portfolio of each company

Geographic Analysis

- Further breakdown of the Rest of Europe market for larvicides

- Further breakdown of the Rest of Asia Pacific market for larvicides

- Further breakdown of the Others in RoW market for larvicides

Company Information

- Detailed analyses and profiling of additional market players (up to five)

The larvicides market is estimated at USD 751.6 Million in 2018, and is projected to reach USD 952.7 Million by 2023, at a CAGR of 4.86% during the forecast period. The market is primarily driven by factors such as vector-based epidemics or outbreaks, climatic changes, the rise in pest population, worldwide, and growth in awareness about IPM practices and environmental sustainability.

The public health segment is estimated to dominate the global market in 2018. The usage of larvicides is much higher for public health compared to other sectors, both in urban and rural areas. According to the WHO, the threat to public health due to urban pests has been rising due to climatic changes and population mobility, which favor their development. Mosquitoes and mosquito-transmitted diseases are among the principal public health concerns challenging governments globally, particularly in tropical and subtropical regions. Thus, this segment is also projected to grow at the highest in the next five years.

The larvicides market, based on control methods, has been segmented into insect growth regulators, biocontrol agents, chemical agents, and other control methods (surface oils & films and mechanical control). The chemical agents segment is estimated to account for the largest share in 2018. In developing regions, chemical agents such as organophosphates are extensively used for the treatment of waters infested with mosquitoes. Larvicides, in the form of insect growth regulators and microbial organisms, are being increasingly used to control larvae worldwide, due to their relative target specificity, safety, and eco-friendly properties.

The larvicides market, by target insect, is estimated to be dominated by the mosquitoes segment, in 2018. It is also projected to grow at the highest CAGR from 2018 to 2023. Globally, mosquito larviciding is an important public health practice, since mosquitoes are vectors of diseases such as malaria and Zika fever, which pose a significant risk to public health. Larviciding has gained prominence because of its implementation as an area-wide malaria control technique. By reducing the population of adult vectors, larvicides reduce the transmission of Plasmodium spp. by adult mosquitoes, and thus reduce mortality and morbidity from malaria.

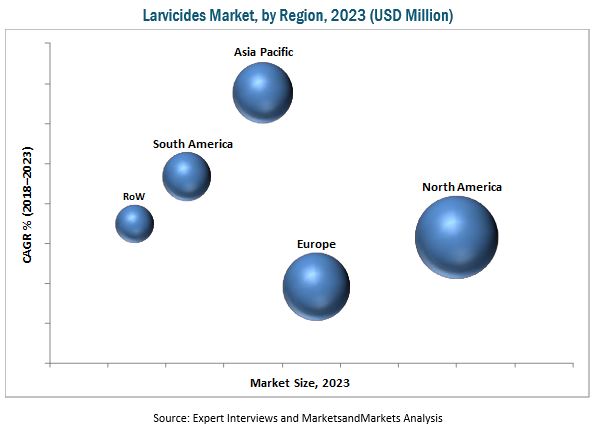

North America accounted for the largest market share in 2017, followed by Europe. North America is estimated to be the worlds largest market for pest control products, with the presence of many multinational and national companies in the region. Regions such as Asia Pacific, South America, and Africa and the Middle East are also witnessing an increase in demand for larvicides due to an increase in incidences of diseases, the prevalence of stringent hygiene & food safety legislation, IPM practices, and the growing middle-class population.

The major factors restraining the growth of larvicides are the increased resistance to commonly used insecticides, the high costs associated with larval control methods, and limited R&D efforts for development of new chemical classes that can be used as larvicides.

The global market for larvicides is dominated by large players such as Bayer (Germany), BASF (Germany), Gowan Company (US), Sumitomo Chemical (Japan), Nufarm (Australia), Certis (US), Summit Chemical (US), Syngenta (Switzerland), Adama (Israel), Eli Lily and Company (US), Russell IPM (UK), and Central Garden & Pet Co. (US).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.4 Periodization Considered

1.5 Currency Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Key Industry Insights

2.1.2.2 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Research Assumptions & Limitations

2.4.1 Assumptions

2.4.2 Limitations

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 32)

4.1 Attractive Opportunities in the Larvicides Market

4.2 Larvicides Market, By End-Use Sector

4.3 North America: Larvicides Market

4.4 Larvicides Market, By Target & Region

4.5 Market Share: Key Countries

5 Market Overview (Page No. - 37)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increase in Prevalence of Vector-Borne Diseases

5.2.1.1.1 Outbreaks and Existing Endemic Situations

5.2.1.1.2 Climatic Changes and Rise in Pest Population Worldwide

5.2.1.2 Growth in Awareness About IPM Practices and Environmental Sustainability

5.2.2 Restraints

5.2.2.1 Larval Resistance to Commonly Used Insecticides

5.2.2.2 High Costs Associated With Larval Control Methods

5.2.3 Opportunities

5.2.3.1 Rise in Adoption of Biological & Physical Control Methods

5.2.3.2 Technological Advancements in Mosquito Control Products

5.2.4 Challenges

5.2.4.1 Lack of Awareness About Optimal Usage Levels of Larvicides

6 Larvicides Market, By End-Use Sector (Page No. - 46)

6.1 Introduction

6.2 Public Health

6.3 Agricultural

6.4 Commercial

6.5 Residential

6.6 Livestock

7 Larvicides Market, By Target (Page No. - 53)

7.1 Introduction

7.2 Mosquitoes

7.3 Flies

7.4 Others

8 Larvicides Market, By Control Method (Page No. - 57)

8.1 Introduction

8.2 Biocontrol Agents

8.2.1 Bacillus Spp.

8.2.2 Others

8.3 Chemical Agents

8.3.1 Organophosphates

8.3.2 Others

8.4 Insect Growth Regulators

8.4.1 Methoprene

8.4.2 Pyriproxyfen

8.4.3 Diflubenzuron

8.4.4 Others

8.5 Other Control Methods

8.5.1 Surface Oils & Films

8.5.2 Mechanical Control

9 Larvicides Market, By Region (Page No. - 67)

9.1 Introduction

9.2 North America

9.2.1 US

9.2.2 Canada

9.2.3 Mexico

9.3 Europe

9.3.1 France

9.3.2 Italy

9.3.3 Spain

9.3.4 Germany

9.3.5 UK

9.3.6 Rest of Europe

9.4 Asia Pacific

9.4.1 China

9.4.2 India

9.4.3 Japan

9.4.4 Australia

9.4.5 Rest of Asia Pacific

9.5 South America

9.5.1 Brazil

9.5.2 Argentina

9.5.3 Rest of South America

9.6 Rest of the World

9.6.1 Africa

9.6.2 The Middle East

10 Competitive Landscape (Page No. - 99)

10.1 Overview

10.2 Company Ranking

10.3 Competitive Scenario

10.3.1 Mergers & Acquisitions

10.3.2 Expansions

10.3.3 Agreements & Collaborations

10.3.4 New Product Launches

11 Company Profiles (Page No. - 107)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

11.1 Bayer AG

11.2 Syngenta

11.3 BASF SE

11.4 Sumitomo Chemical Co., Ltd.

11.5 ADAMA Agricultural Solutions Ltd.

11.6 Certis USA LLC

11.7 Central Garden & Pet Company

11.8 Nufarm Limited

11.9 Russell Ipm Ltd

11.10 Eli Lilly and Company

11.11 Summit Chemical

11.12 Gowan Company

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 135)

12.1 Knowledge Store: Marketsandmarkets Subscription Portal

12.2 Introducing RT: Real-Time Market Intelligence

12.3 Available Customizations

12.4 Related Reports

12.5 Author Details

List of Tables (64 Tables)

Table 1 USD Exchange Rate, 20152017

Table 2 Larvicides Market Size, By End-Use Sector, 20162023 (USD Million)

Table 3 Public Health: Larvicides Market Size, By Region, 20162023 (USD Million)

Table 4 Agricultural: Larvicides Market Size, By Region, 20162023 (USD Million)

Table 5 Commercial: Larvicides Market Size, By Region, 20162023 (USD Million)

Table 6 Residential: Larvicides Market Size, By Region, 20162023 (USD Million)

Table 7 Livestock: Larvicides Market Size, By Region, 20162023 (USD Million)

Table 8 Larvicides Market Size, By Target, 20162023 (USD Million)

Table 9 Market Size for Mosquitoes, By Region, 20162023 (USD Million)

Table 10 Market Size for Flies, By Region, 20162023 (USD Million)

Table 11 Market Size for Other Targets, By Region, 20162023 (USD Million)

Table 12 Market Size, By Control Method, 20162023 (USD Million)

Table 13 Biocontrol Larvicides Market Size, By Control Method, 20162023 (USD Million)

Table 14 Biocontrol Larvicides Market Size, By Region, 20162023 (USD Million)

Table 15 Chemical Larvicides Market Size, By Control Method, 20162023 (USD Million)

Table 16 Chemical Larvicides Market Size, By Region, 20162023 (USD Million)

Table 17 Insect Growth Regulators Market Size, By Control Method, 20162023 (USD Million)

Table 18 Insect Growth Regulators Market Size, By Region, 20162023 (USD Million)

Table 19 Other Larvicidal Control Methods Market Size, By Type, 20162023 (USD Million)

Table 20 Other Larvicidal Control Methods Market Size, By Region, 20162023 (USD Million)

Table 21 Larvicides Market Size, By Region, 20162023 (USD Million)

Table 22 North America: Larvicides Market Size, By Country, 20162023 (USD Million)

Table 23 North America: Market Size, By End-Use Sector, 20162023 (USD Million)

Table 24 North America: Market Size, By Control Method, 20162023 (USD Million)

Table 25 North America: Market Size, By Target, 20162023 (USD Million)

Table 26 US: Larvicides Market Size, By End-Use Sector, 20162023 (USD Million)

Table 27 Canada: Larvicides Market Size, By End-Use Sector, 20162023 (USD Million)

Table 28 Mexico: Larvicides Market Size, By End-Use Sector, 20162023 (USD Million)

Table 29 Europe: Larvicides Market Size, By Country, 20162023 (USD Million)

Table 30 Europe: Market Size, By End-Use Sector, 20162023 (USD Million)

Table 31 Europe: Market Size, By Control Method, 20162023 (USD Million)

Table 32 Europe: Market Size, By Target, 20162023 (USD Million)

Table 33 France: Larvicides Market Size, By End-Use Sector, 20162023 (USD Million)

Table 34 Italy: Larvicides Market Size, By End-Use Sector, 20162023 (USD Million)

Table 35 Spain: Larvicides Market Size, By End-Use Sector, 20162023 (USD Million)

Table 36 Germany: Larvicides Market Size, By End-Use Sector, 20162023 (USD Million)

Table 37 UK: Larvicides Market Size, By End-Use Sector, 20162023 (USD Million)

Table 38 Rest of Europe: Larvicides Market Size, By End-Use Sector, 20162023 (USD Million)

Table 39 Asia Pacific: Larvicides Market Size, By Country, 20162023 (USD Million)

Table 40 Asia Pacific: Market Size, By End-Use Sector, 20162023 (USD Million)

Table 41 Asia Pacific: Market Size, By Control Method, 20162023 (USD Million)

Table 42 Asia Pacific: Market Size, By Target, 20162023 (USD Million)

Table 43 China: Larvicides Market Size, By End-Use Sector, 20162023 (USD Million)

Table 44 India: Larvicides Market Size, By End-Use Sector, 20162023 (USD Million)

Table 45 Japan: Larvicides Market Size, By End-Use Sector, 20162023 (USD Million)

Table 46 Australia: Larvicides Market Size, By End-Use Sector, 20162023 (USD Million)

Table 47 Rest of Asia Pacific: Larvicides Market Size, By End-Use Sector, 20162023 (USD Million)

Table 48 South America: Larvicides Market Size, By Country, 20162023 (USD Million)

Table 49 South America: Market Size, By End-Use Sector, 20162023 (USD Million)

Table 50 South America: Market Size, By Control Method, 20162023 (USD Million)

Table 51 South America: Market Size, By Target, 20162023 (USD Million)

Table 52 Brazil: Larvicides Market Size, By End-Use Sector, 20162023 (USD Million)

Table 53 Argentina: Larvicides Market Size, By End-Use Sector, 20162023 (USD Million)

Table 54 Rest of South America: Larvicides Market Size, By End-Use Sector, 20162023(USD Million)

Table 55 RoW: Larvicides Market Size, By Region, 20162023 (USD Million)

Table 56 RoW: Market Size, By End-Use Sector, 20162023 (USD Million)

Table 57 RoW: Market Size, By Control Method, 20162023 (USD Million)

Table 58 RoW: Market Size, By Target, 20162023 (USD Million)

Table 59 Africa: Larvicides Market Size, By End-Use Sector, 20162023 (USD Million)

Table 60 Middle East: Larvicides Market Size, By End-Use Sector, 20162023 (USD Million)

Table 61 Mergers & Acquisitions, 20172018

Table 62 Expansions, 20142016

Table 63 Agreements & Collaborations, 20152018

Table 64 New Product Launches, 20132015

List of Figures (39 Figures)

Figure 1 Larvicides Market Segmentation

Figure 2 Regional Segmentation

Figure 3 Research Design: Larvicides Market

Figure 4 Breakdown of Primaries: By Company Type, Designation, and Region

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Data Triangulation

Figure 8 Larvicides Market, By End-Use Sector, 2018 vs 2023

Figure 9 Market, By Control Method, 2018 vs 2023

Figure 10 Market, By Target, 2018 vs 2023

Figure 11 Larvicides Market: Regional Snapshot

Figure 12 Increase in Incidences of Vector-Borne Diseases to Drive the Larvicides Market

Figure 13 Public Health Segment Recorded Largest Share in 2017

Figure 14 North American Larvicides Market Share, By Control Method & Country, 2017

Figure 15 Mosquitoes Recorded Largest Share in Larvicides Market in 2017

Figure 16 US Dominated the Market for Larvicides in 2017

Figure 17 Larvicides Market Dynamics: Drivers, Restraints, Opportunities, and Challenges

Figure 18 Number of Global Deaths Due to Malaria

Figure 19 Larvicides Market Size, By End-Use Sector, 2018 vs 2023

Figure 20 Market Size, By Target, 2018 vs 2023 (USD Million)

Figure 21 Market Size, By Control Method, 2018 vs 2023 (USD Million)

Figure 22 Regional Snapshot: India is Projected to Be the Fastest-Growing Country-Level Market for Larvicides Between 2018 and 2023

Figure 23 North America: Larvicides Market Snapshot

Figure 24 Europe: Larvicides Market Snapshot

Figure 25 Key Developments By Leading Players in the Larvicides Market, 20122017

Figure 26 Market Evaluation Framework

Figure 27 Bayer AG : Company Snapshot

Figure 28 Bayer AG : SWOT Analysis

Figure 29 Syngenta: Company Snapshot

Figure 30 Syngenta: SWOT Analysis

Figure 31 BASF SE: Company Snapshot

Figure 32 BASF SE: SWOT Analysis

Figure 33 Sumitomo Chemical Co., Ltd.: Company Snapshot

Figure 34 Sumitomo Chemical Co., Ltd.: SWOT Analysis

Figure 35 ADAMA Agricultural Solutions Ltd.: Company Snapshot

Figure 36 ADAMA Agricultural Solutions Ltd.: SWOT Analysis

Figure 37 Central Garden & Pet Co.: Company Snapshot

Figure 38 Nufarm Limited: Company Snapshot

Figure 39 Eli Lilly and Company: Business Snapshot

Growth opportunities and latent adjacency in Larvicides Market