Land Defense Outlook 2035: Market Overview (Ecosystem, Macroeconomics, Regulatory, Programs, Expenditure, Alliances, Dynamics), Industry Trends (Technologies, Use Cases, Maturity Curve), Market Segments (Combat Vehicles, Soldiers, Small Caliber Ammunition, Military Drones, and Land Missiles), Customer Insights (Operators, OEMs, Shifts, initiatives, Business Models, Market Position), Competitive Landscape (Competitors, Partners, Evaluation Matrix, Key Profiles) and Future Opportunities (Future Landscape, Technology Roadmap, Major Projects, Top Opportunities)

The land defense sector is evolving rapidly due to technological advancements, shifting military strategies, and geopolitical tensions. By 2035, land warfare will be dominated by artificial intelligence (AI), autonomous combat systems, directed-energy weapons, and advanced battlefield management solutions. This article provides a comprehensive outlook on the future of land defense, analyzing key market trends, industry shifts, customer insights, competitive dynamics, and emerging opportunities.

Market Overview

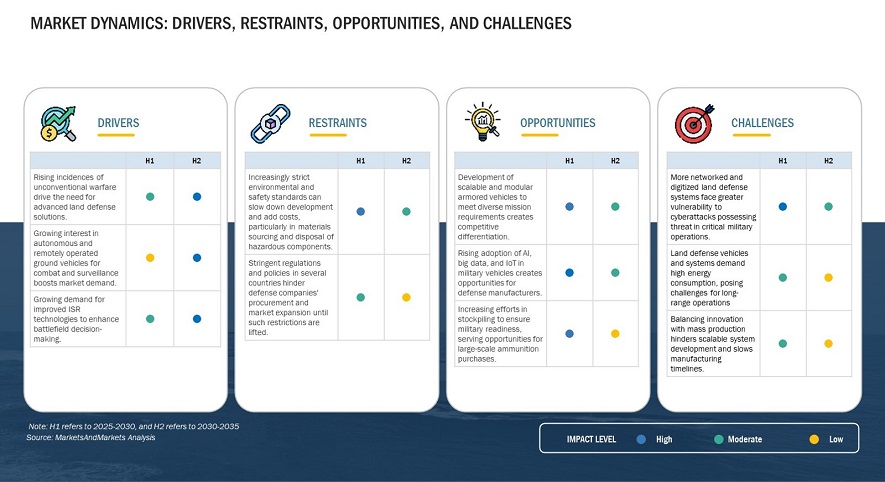

The global land defense market is projected to grow significantly, with an estimated valuation exceeding $600 billion by 2035. Key drivers of this growth include:

- Geopolitical Instability: Territorial disputes, regional conflicts, and border security challenges are fueling defense investments worldwide.

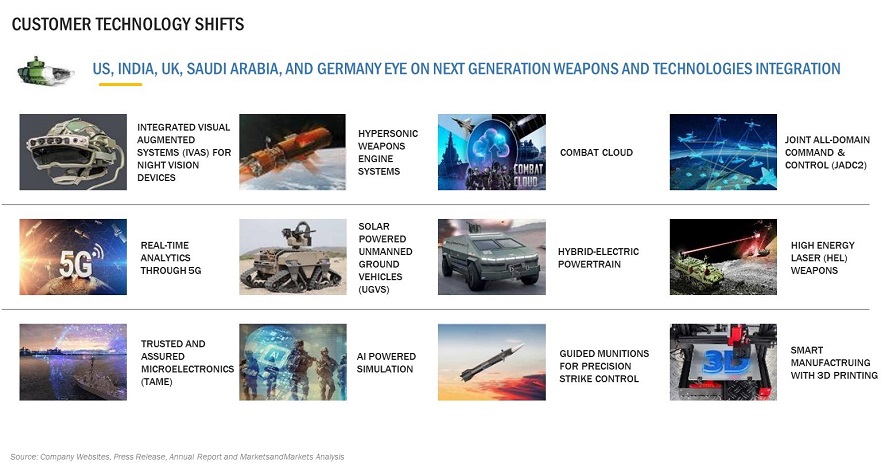

- Advancements in AI and Automation: Autonomous combat vehicles and AI-powered decision-making are redefining battlefield operations.

- Increased Defense Budgets: Governments are allocating more resources toward modernizing land-based military capabilities.

- Integration of Cyber and Electronic Warfare: The growing role of cyber threats and electronic warfare in modern conflicts is leading to increased investments in countermeasures.

- Urban and Hybrid Warfare Preparedness: The shift from conventional warfare to urban and asymmetric warfare is shaping military procurement strategies.

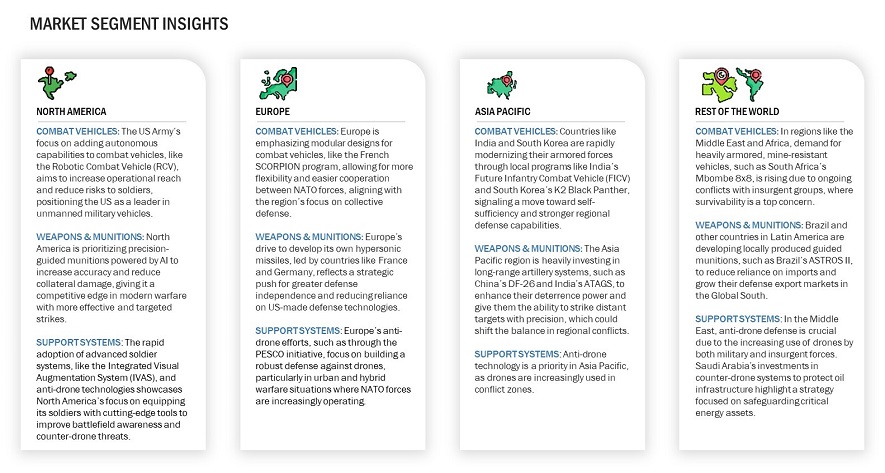

North America and Europe are expected to remain dominant in the market, while Asia-Pacific and the Middle East will witness accelerated growth due to rising military expenditures and regional security threats.

Industry Trends

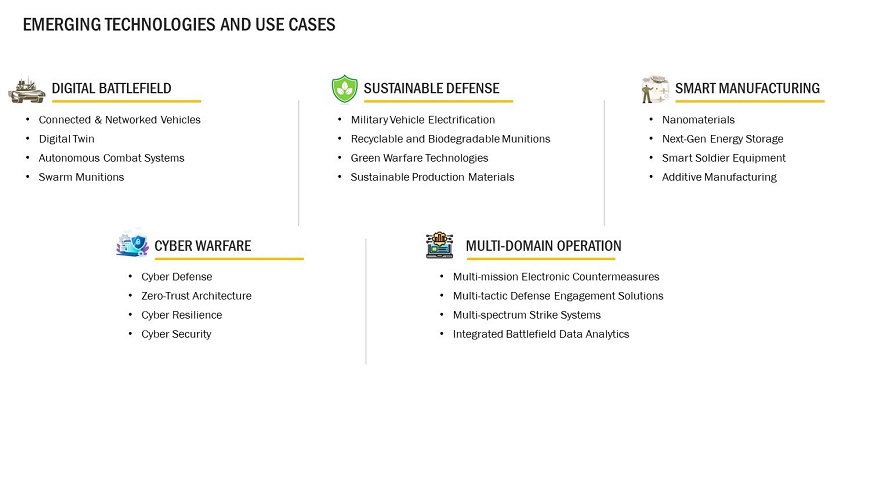

1. Rise of Autonomous Combat Systems

Unmanned ground vehicles (UGVs) and robotic combat platforms are becoming integral to military operations. These systems enhance reconnaissance, logistics, and direct combat roles while minimizing risks to soldiers.

2. AI-Powered Warfare and Battlefield Analytics

AI-driven predictive analytics, autonomous target acquisition, and real-time data processing are revolutionizing command and control structures on the battlefield.

3. Directed-Energy and Hypersonic Weapons

Laser-based weapons and hypersonic projectiles are being developed to provide rapid, high-precision strikes against enemy assets, reducing reliance on traditional artillery and missiles.

4. Cyber and Electronic Warfare Expansion

As cyber threats increase, land forces are investing in electronic warfare (EW) capabilities, jamming systems, and cybersecurity solutions to protect critical infrastructure and military networks.

5. Next-Generation Main Battle Tanks and Armored Vehicles

Modern battle tanks and armored vehicles are being equipped with AI, active protection systems, and enhanced mobility features to adapt to future combat environments.

6. Sustainable and Modular Military Technologies

The push for sustainability has led to the development of hybrid-electric armored vehicles, improved logistics efficiency, and modular weapon platforms that can be rapidly upgraded or adapted to different mission needs.

Customer Insights

Defense procurement agencies and military forces are prioritizing the following key factors in land defense acquisitions:

- Interoperability Across Military Branches: Armies are seeking systems that seamlessly integrate with air, naval, cyber, and space domains for multi-domain operations.

- Autonomy and Reduced Human Risk: Governments are investing in autonomous platforms to reduce human exposure to battlefield dangers.

- Cost-Effective and Scalable Solutions: Military planners prefer modular systems that can be upgraded over time to extend operational life and minimize costs.

- Urban Warfare and Counterinsurgency Capabilities: Future land defense systems must be adaptable to densely populated environments and irregular warfare scenarios.

- Cyber Resilience and Network Security: Defense organizations are ensuring that military networks are resilient against cyberattacks and electronic warfare threats.

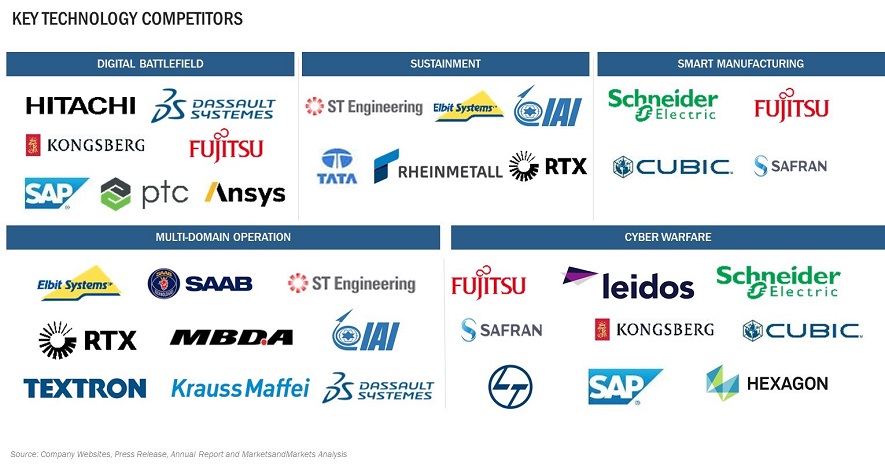

Competitive Landscape

The land defense sector is highly competitive, with major defense contractors investing heavily in research and development to maintain their edge. Key players include:

- Lockheed Martin: Develops AI-driven combat vehicles, missile defense systems, and advanced sensor networks.

- BAE Systems: A leader in armored vehicle manufacturing, active protection systems, and battlefield management software.

- General Dynamics: Specializes in main battle tanks, autonomous combat vehicles, and cyber defense solutions.

- Rheinmetall: Focuses on next-generation infantry fighting vehicles, artillery systems, and smart ammunition.

- Northrop Grumman: Invests in AI-powered battlefield intelligence, electronic warfare, and drone swarms.

- Chinese and Russian Defense Firms: Companies like Norinco (China) and Uralvagonzavod (Russia) are advancing their tank, artillery, and drone warfare capabilities to challenge Western dominance.

Future Opportunities

1. Expansion of Unmanned Ground Vehicles (UGVs)

The increasing adoption of robotic systems in reconnaissance, logistics, and combat roles presents significant investment opportunities.

2. AI-Enabled Warfare Solutions

The development of AI-powered command and control systems, autonomous targeting, and predictive maintenance will shape future military operations.

3. Growth in Cyber and Electronic Warfare Defense

As electronic and cyber threats become more sophisticated, the demand for cybersecurity solutions, network hardening, and countermeasures will surge.

4. Modular and Upgradeable Defense Systems

Defense firms are focusing on modular tank designs, adaptable infantry weapons, and scalable communication networks to enhance battlefield flexibility.

5. Green Military Technologies

Hybrid-electric propulsion for armored vehicles, renewable energy solutions for bases, and sustainable logistics strategies are becoming key investment areas.

6. Strategic Defense Partnerships and Alliances

Joint military programs, cross-border technology sharing, and multinational defense collaborations are opening new avenues for market expansion.

The land defense industry is on a trajectory of rapid transformation, driven by advancements in AI, automation, cyber warfare, and directed-energy weapons. By 2035, next-generation armored vehicles, unmanned ground systems, and AI-driven battlefield management will define modern warfare. Companies that invest in scalable, cost-effective, and technologically advanced solutions will gain a competitive edge in this evolving landscape. As defense budgets rise and geopolitical tensions persist, the demand for cutting-edge land defense capabilities will continue to grow, offering substantial opportunities for governments, defense contractors, and investors alike.

Growth opportunities and latent adjacency in Land Defense Outlook 2035: Market