US Joint All Domain Command and Control (JADC2) Market by Platform (Land, Naval, Airborne, Cyber, Space), Application (JADC2 Specific, Command & Control (C2), Communication, SATCOM, Computers, and AI, Networks), Solution, and Region -Global Forecast to 2030

Update: 10/22/2024

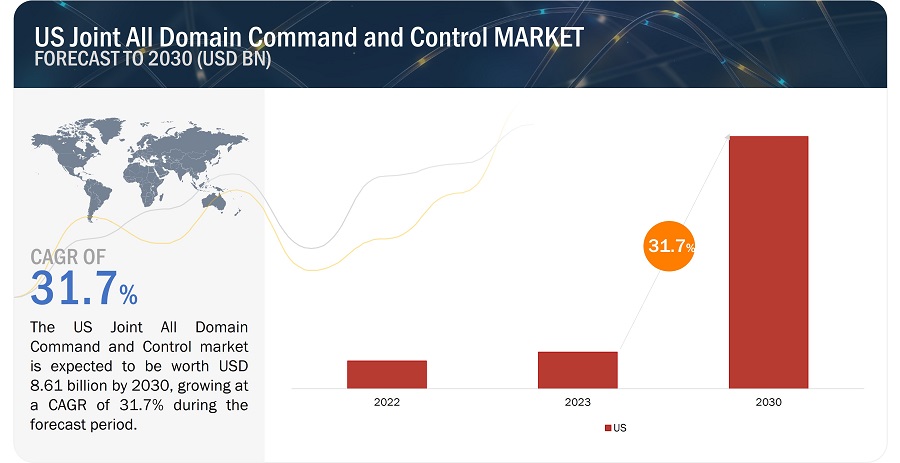

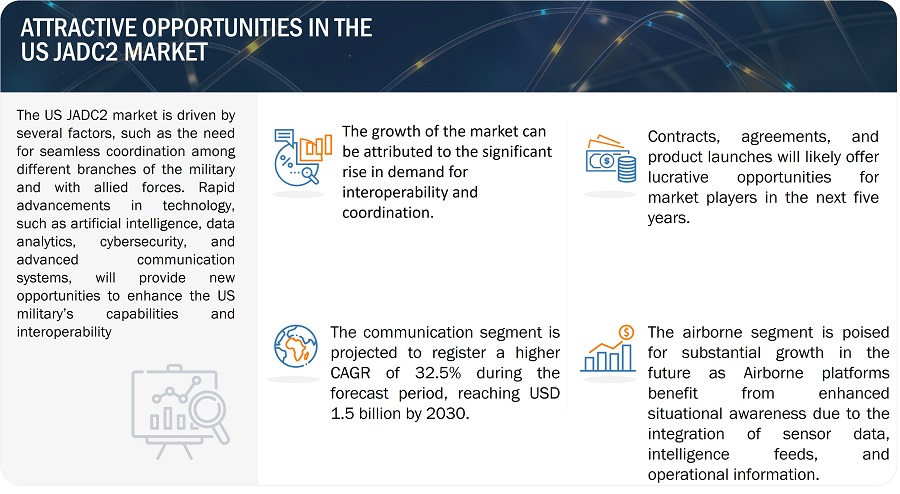

The US JADC2 Market is estimated to be USD 1.2 Billion in 2023 and is projected to reach USD 8.6 Billion by 2030, at a CAGR of 31.7% from 2023 to 2030. One key driving factor for the development and implementation of US Joint All Domain Command and Control (JADC2) Industry is the evolving nature of modern warfare and the challenges presented by highly complex and interconnected battlespaces. Modern conflicts often span multiple domains, including land, air, sea, space, and cyberspace. The ability to effectively coordinate and control operations across these domains is critical to gaining an advantage over adversaries. Rapid decision-making and agile response are essential in dynamic and fast-paced warfare scenarios. JADC2 aims to shorten the decision-making cycle by providing commanders with up-to-date, integrated, and accurate information.

US Joint All Domain Command and Control (JADC2) Market Forecast to 2030

To know about the assumptions considered for the study, Request for Free Sample Report

US JADC2 Market Dynamics:

Drivers: Rising adoption of new technologies.

Technological advancements are a key driver for the adoption and development of JADC2 systems. These advancements encompass a wide range of technologies that enhance the capabilities of military forces to operate in complex and multidomain environments. AI enables JADC2 systems to process and analyze vast amounts of data from various sources, including sensors, intelligence systems, and command and control platforms. ML algorithms can identify patterns, detect anomalies, and extract actionable insights, enhancing situational awareness and decision-making. Another technological advancement is the Internet of Things (IoT), which facilitates the connection and integration of numerous sensors, platforms, and devices, enabling seamless data exchange and better coordination across domains. With IoT, real-time information from different sources can be collected, analyzed, and shared, allowing commanders to make informed decisions and coordinate operations more effectively. Advancements in communication networks, such as the deployment of 5G and beyond, provide faster and more reliable connectivity across domains, supporting the seamless integration of various platforms, sensors, and command centers. This enables rapid and secure data sharing, collaboration, and coordination among military forces in different domains. The proliferation of autonomous systems, including unmanned aerial vehicles (UAVs), unmanned ground vehicles (UGVs), and autonomous maritime vehicles, represents a significant technological advancement in JADC2. These systems can perform reconnaissance, surveillance, logistics, and even combat operations, augmenting human capabilities and reducing risks. Autonomous systems enable enhanced operational flexibility, responsiveness, and adaptability in dynamic and contested environments.

Restraints: Technical complexity

JADC2 systems integrate diverse technologies, platforms, sensors, communication networks, and data sources across multiple domains, which require overcoming various technical challenges. The integration of various platforms, such as land-based vehicles, naval vessels, aircraft, and satellites, poses technical challenges due to their different communication capabilities, sensor suites, and operational requirements. Ensuring compatibility and effective communication between these platforms requires extensive integration efforts to standardize interfaces, protocols, and data exchange formats. The implementation of JADC2 systems involves addressing technical challenges related to network infrastructure and connectivity. Seamless and secure communication across domains and platforms requires robust and resilient communication networks, including wired and wireless networks., It can be technically demanding to ensure reliable connectivity in complex operational environments, including austere and contested areas. This may require advanced networking technologies and infrastructure investments.

Another aspect of technical complexity is the integration of data from diverse sensors and intelligence systems. JADC2 systems aim to provide a comprehensive and real-time understanding of the battlespace by collecting and analyzing data from various sources. However, different sensors may have different data formats, sampling rates, and quality levels, which must be reconciled and fused to generate a coherent and accurate situational picture.

Opportunities: Usage beyond military applications

While JADC2 systems are primarily developed for military purposes, the technologies and concepts employed in these systems have broader applications beyond the defense domain. Applying JADC2 capabilities to civilian contexts can contribute to overall societal resilience and address various challenges faced by civil authorities in managing complex operational environments.

• Disaster management: One area of civilian application for JADC2 is disaster response and emergency management. During natural disasters or large-scale emergencies, JADC2 systems can facilitate the coordination of various response agencies, such as emergency services, law enforcement, medical teams, and logistical support organizations. The integration of data from different sources, real-time information sharing, and coordinated decision-making enabled by JADC2 can enhance the efficiency and effectiveness of disaster response efforts, leading to better situational awareness and faster response times.

• Law Enforcement: Law enforcement is another area where JADC2 systems can find civilian applications. JADC2 can coordinate operations among law enforcement agencies, enable real-time information exchange, track suspect movements, and facilitate coordinated responses to criminal activities. The integration of data from surveillance systems, sensors, and intelligence sources can enhance the ability of law enforcement to prevent and respond to security threats effectively.

The JADC2 market can expand its reach and provide solutions in the civilian sector that enhance overall societal resilience and security. It opens up opportunities for collaboration between defense organizations, industry partners, and civilian authorities to develop tailored solutions and leverage the advancements made in JADC2 systems to benefit the wider society.

Challenges: Training and skill development

Implementing JADC2 systems requires a well-trained and skilled workforce to effectively operate, manage, and utilize these complex command and control systems. However, developing the necessary expertise and providing comprehensive training programs for personnel can be resource-intensive and time-consuming.

One of the challenges is the need to train military personnel on the operation, utilization, and management of JADC2 systems. These systems involve advanced technologies, complex data analytics, and decision support tools, which require specialized training. Comprehensive training programs that cover the technical aspects, concepts, and principles of JADC2 are crucial. Training personnel on interoperability, data fusion, real-time decision-making, and collaborative command and control processes is essential for the successful adoption and utilization of JADC2 systems.

Another challenge is the continuous skill development required to keep up with the evolving nature of JADC2 technologies and concepts. As JADC2 systems advance and new technologies emerge, personnel need to stay updated with the latest developments. Ongoing training and skill development programs should be in place to ensure that operators, commanders, and supporting staff are equipped with the necessary knowledge and skills to effectively utilize the capabilities of JADC2 systems. This requires investment in training facilities, simulation tools, and educational programs that provide hands-on experience and promote a continuous learning culture within military organizations.

The scalability of training programs is a challenge in the US JADC2 market. With the growth of the JADC2 market, the demand for trained personnel increases. Developing and delivering training programs at scale to meet the growing demand requires effective coordination, sufficient training resources, and access to qualified trainers. Maintenance of consistency and quality across different training locations and organizations is also a challenge that needs to be addressed.

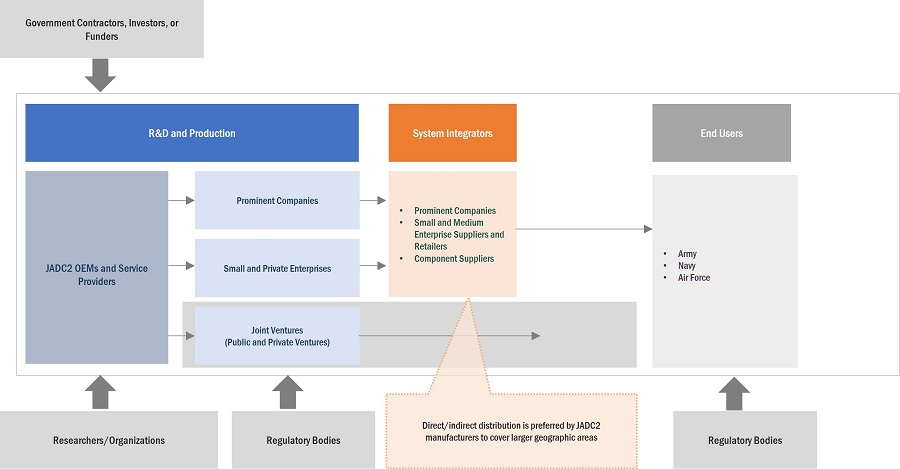

Us Jadc2 Market Ecosystem

Lockheed Martin Corporation (US), Northrop Grumman Corporation (US), Raytheon Technologies Corporation (US), Elbit Systems Ltd. (Israel), and General Dynamics Corporation(US) are some of the leading companies in the US JADC2 market.

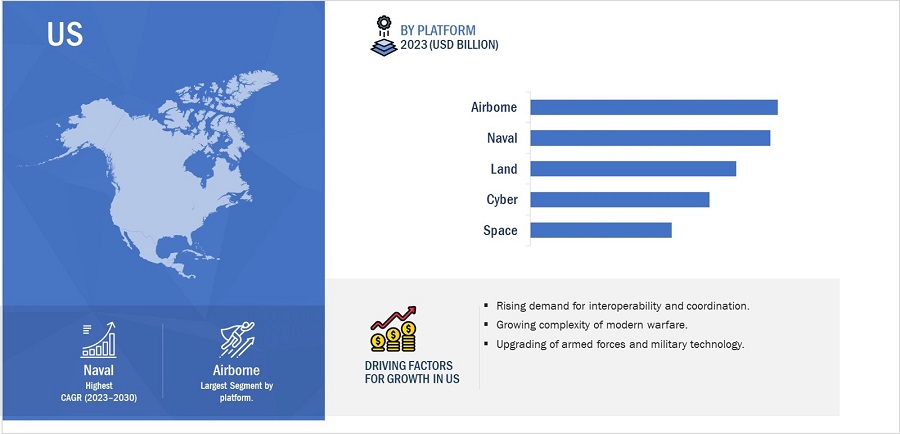

Based on Platform, the Naval Segment will record the highest market share of the US JADC2 market during the forecast period

The US JADC2 market, based on platform, has been segmented into land, naval, airborne, space, and cyber. The naval segment is projected to acquire the largest market share during the forecast period. JADC2 Naval Segment provides naval commanders with a comprehensive and up-to-date operational picture, enabling informed decision-making and swift responses to dynamic threats and opportunities. JADC2 empowers naval forces to operate collaboratively with other branches of the military and allied partners in maritime security, force projection, or multi-domain operations. This ensures a synchronized execution of missions and a decisive advantage in modern warfare scenarios.

Based on Application, the SATCOM segment will record the highest market share of the US JADC2 market during the forecast period.

The US Joint All Domain Command and Control market, based on application, has been segmented into JADC2 Specific, Command & Control (C2), communication, SATCOM, Computer and AI, and Networks. The SATCOM segment is expected to lead the market during the forecast period. The utilization of SATCOM technology within JADC2 provides a resilient communication infrastructure that is less susceptible to physical disruptions, allowing for reliable data transmission even in remote environments. JADC2 SATCOM ensures that essential information can be shared promptly between geographically dispersed forces, facilitating joint operations, situational awareness, and mission coordination.

Based on the Solution, the software segment will record the highest market share of the US JADC2 market during the forecast period.

The software segment is anticipated to have the highest growth potential in JADC2. The market has been segmented into hardware, software, and services. The software segment is projected to grow at a CAGR of 32.9% during the forecast period. JADC2 software facilitates the aggregation and analysis of data from various sources, such as sensors, satellites, intelligence feeds, and communication networks, presenting commanders with precise operational clarity. This empowers military leaders to make agile and informed choices, optimize resource allocation, and enhance joint operations.

US Joint All Domain Command and Control (JADC2) Market by Region

To know about the assumptions considered for the study, download the pdf brochure

US Joint All-Domain Command and Control (JADC2) Technology Industry Companies: Top Key Market Players

Scope of the Report

|

Report Metric |

Details |

|

Estimated Market Size

|

USD 1.2 Billion in 2023

|

|

Projected Market Size

|

USD 8.6 Billion by 2030

|

|

Growth Rate

|

CAGR of 31.7%

|

|

Market Size Available for Years |

2019–2030 |

|

Base Year Considered |

2022 |

|

Forecast Period |

2023–2030 |

|

Forecast Units |

Value (USD billion) |

|

Segments Covered |

Solution, Application, and Platform |

|

Companies Covered |

Lockheed Martin Corporation (US), General Dynamics Corporation (US), Raytheon Technologies Corporation (US), L3Harris Technologies, Inc (US), General Dynamics Corporation (US), The Boeing Company (US), Amazon (US), BAE Systems (UK), Elbit Systems Ltd (Israel), Leidos (US), SAIC (US), Kratos Defense & Security Solutions (US), Microsoft Corporation (US), Leonardo SpA (Italy), IBM (US), General Atomics (US), Viasat Inc (US), CACI (US), Improbable (UK), Sigma Defense (US), Systematic Inc (US), Draper Laboratory (US), Radiance Technologies (US), Agile Defense (US), ARC, Inc (Sweden). |

US Joint All Domain Command and Control (JADC2) Market Highlights

This research report categorizes the JADC2 market based on Platform, Application, and solution.

|

Segment |

Subsegment |

|

By Platform: |

|

|

By Application: |

|

|

By Solution: |

|

Recent Developments

- In March 2023, Northrop Grumman Corporation (US) was awarded a contract from the US Air Force. The contract was aimed to provide network communications and processing services to connect sensors and platforms across all domains for the US Air Force.

- In July 2022, L3Harris Technologies, Inc. (US) won a contract from the US Navy worth USD 380 million to produce a Cooperative Engagement Capability (CEC) System, which will enable situational awareness and integrated fire control capability and will enhance the anti-air warfare capability of the US Navy.

- In June 2020, General Dynamics Corporation (US) was awarded a contract from Space Development Agency (US) to develop, equip, and operate National Defense Space Architecture (NDSA) centers and assist in ground-to-space integration for low earth orbit satellites.

Frequently Asked Questions (FAQ):

What is the current size of the US JADC2 market?

The artillery systems market is estimated to be USD 1.2 Billion in 2023 and is projected to reach USD 8.6 Billion by 2030, at a CAGR of 31.7 % from 2023 to 2030

What are the key sustainability strategies adopted by leading players operating in the US JADC2 market?

Response: Key players have adopted various organic and inorganic strategies to strengthen their position in the US JADC2 market Lockheed Martin Corporation (US), Bae Systems (UK), General Dynamics Corporation (US), Raytheon Technologies Corporation (US), Northrop Grumman Corporation (US), Elbit Systems Ltd (Israel) are some of the leading companies in the JADC2 market.

Who are the key players and innovators in the ecosystem of the JADC2 market?

Response. Lockheed Martin Corporation (US), Bae Systems (UK), General Dynamics Corporation (US), Raytheon Technologies Corporation (US), The Boeing Company (US), Elbit Systems Ltd (Israel), SAIC (US), Leidos (US).

What are the technological trends in the US JADC2 market?

Response: Artificial Intelligence and Machine Learning, 5G, Data Fusion, and Satellite Integration, among others, are a few of the technological trends in the JADC2 market.

What new emerging technologies and use cases disrupt the US JADC2 market?

Response: Decentralized Blockchain Networks: Distributed ledger technology might enhance data integrity and security, potentially challenging the central command structure of JADC2 systems.

Disruptive Cyber Technologies: Advanced cyberattack methods and countermeasures could challenge the security and robustness of JADC2 networks, potentially impacting their reliability.

Advanced Sensor Networks: Highly sophisticated sensor networks and remote sensing technologies might allow for more accurate and real-time data collection, altering the nature of data-driven decision-making in JADC2.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Rising adoption of new technologies- Increasing complexity of modern warfare- Growing demand for interoperability and coordination- Increased demand for situational awarenessRESTRAINTS- Technical complexities- Security concerns and cyber threatsOPPORTUNITIES- Usage beyond military applications- International collaborationsCHALLENGES- Training and skill development- Resistance to change

-

5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER’S BUSINESSREVENUE SHIFT AND NEW REVENUE POCKETS FOR US JOINT ALL-DOMAIN COMMAND AND CONTROL MANUFACTURERS

-

5.4 US JOINT ALL-DOMAIN COMMAND AND CONTROL MARKET ECOSYSTEMPROMINENT COMPANIESPRIVATE AND SMALL ENTERPRISESEND USERS

- 5.5 VALUE CHAIN ANALYSIS

-

5.6 USE CASE ANALYSISINTEGRATED DATA SHARING AND ANALYSISDYNAMIC TASKING AND RESOURCE ALLOCATION

- 5.7 KEY CONFERENCES AND EVENTS, 2023–2024

- 5.8 TARIFF AND REGULATORY LANDSCAPE

- 6.1 INTRODUCTION

-

6.2 KEY TECHNOLOGY TRENDSARTIFICIAL INTELLIGENCEINTERNET OF THINGSEDGE COMPUTING5GAR/VR TECHNOLOGY

- 7.1 INTRODUCTION

-

7.2 LANDENHANCED SITUATIONAL AWARENESS AND COORDINATION TO DRIVE MARKET

-

7.3 NAVALMARITIME SECURITY AND STRATEGIC COMPETITION TO DRIVE MARKET

-

7.4 AIRBORNEAIR SUPERIORITY AND ANTI-ACCESS/AREA DENIAL (A2/AD) THREATS TO DRIVE MARKET

-

7.5 SPACERISING IMPORTANCE IN MILITARY OPERATIONS TO DRIVE MARKET

-

7.6 CYBERINCREASING CYBER THREAT TO DRIVE MARKET

- 8.1 INTRODUCTION

-

8.2 JADC2 SPECIFICRISING COMPLEXITY IN MODERN WARFARE TO DRIVE MARKET

-

8.3 COMMAND AND CONTROL (C2)NEED FOR IMPROVED DECISION-MAKING TO DRIVE MARKET

-

8.4 COMMUNICATIONNEED FOR RAPID INFORMATION EXCHANGE ACROSS DOMAINS TO DRIVE MARKET

-

8.5 SATCOMNEED FOR ENHANCED CONNECTIVITY AND DATA TRANSMISSION TO DRIVE MARKET

-

8.6 COMPUTERS AND AIDEMAND FOR SITUATIONAL AWARENESS AND DATA PROCESSING TO DRIVE MARKET

-

8.7 NETWORKSINCREASING COMPLEXITY AND CONNECTIVITY IN MILITARY APPLICATIONS TO DRIVE MARKET

- 9.1 INTRODUCTION

-

9.2 HARDWAREMILITARY SENSORS- Need for ISR capabilities to drive marketCOMMUNICATION AND NETWORKING EQUIPMENT- Utilization across multiple domains to drive marketHIGH-PERFORMANCE COMPUTING- Incorporation of high-end technologies to drive market

-

9.3 SOFTWAREDATA FUSION AND INTEGRATION- Demand for standardized data formats and communication protocols to drive marketARTIFICIAL INTELLIGENCE AND MACHINE LEARNING- Command and control capabilities in joint operations to drive marketCYBERSECURITY AND SOFTWARE- Need for secured and effective operations to drive marketINTELLIGENCE AND RECONNAISSANCE SOFTWARE- Need for real-time information gathering from various sources to drive marketDATA ANALYTICS AND VISUALIZATION- Increased use by decision makers to drive marketMISSION PLANNING AND EXECUTION SOFTWARE- Need to optimize deployment of resources to drive market

-

9.4 SERVICESDATA AS A SERVICE (DAAS)- Flexibility and cost-effectiveness to drive marketPLATFORM AS A SERVICE (PAAS)- Increased use in dynamic operational environment to drive marketCOMMUNICATION AS A SERVICE (CAAS)- Integration of information from different platforms to drive marketTRAINING AND SIMULATION AS A SERVICE (TSAAS)- Training and simulation capabilities to drive market

- 10.1 INTRODUCTION

- 10.2 COMPETITIVE OVERVIEW

- 10.3 MARKET RANKING ANALYSIS OF KEY PLAYERS, 2022

- 10.4 MARKET SHARE OF KEY PLAYERS, 2022

- 10.5 REVENUE ANALYSIS OF TOP 5 MARKET PLAYERS, 2022 (USD MILLION)

- 10.6 COMPANY PRODUCT FOOTPRINT ANALYSIS

-

10.7 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

10.8 STARTUP/SME EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESSTARTING BLOCKSDYNAMIC COMPANIES

-

10.9 COMPETITIVE SCENARIOMARKET EVALUATION FRAMEWORKDEALS

-

11.1 KEY PLAYERSLOCKHEED MARTIN CORPORATION- Business overview- Products/Solutions/Services offered- MnM viewNORTHROP GRUMMAN CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewRAYTHEON TECHNOLOGIES CORPORATION- Business overview- Products/Solutions/Services offered- Deals- MnM viewL3HARRIS TECHNOLOGIES, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewGENERAL DYNAMICS CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewBAE SYSTEMS PLC- Business overview- Products/Solutions/Services offeredELBIT SYSTEMS LTD.- Business overview- Products/Solutions/Services offered- Recent developmentsLEONARDO SPA- Business overview- Products/Solutions/Services offeredKRATOS DEFENSE & SECURITY SOLUTIONS, INC.- Business overview- Products/Solutions/Services offered- Recent developmentsSAIC- Business overview- Products/Solutions/Services offered- Recent developmentsMICROSOFT CORPORATION- Business overview- Products/Solutions/Services offered- Recent developmentsIBM CORPORATION- Business overview- Products/Solutions/Services offeredTHE BOEING COMPANY- Business overview- Products/Solutions/Services offeredAMAZON- Business overview- Products/Solutions/Services offered- Recent developmentsLEIDOS- Business overview- Products/Solutions/Services offered- Recent developments

-

11.2 OTHER PLAYERSGENERAL ATOMICSCACI INTERNATIONAL INC.SYSTEMATIC INC.VIASAT INC.IMPROBABLEARC, INC.DRAPER LABORATORYRADIANCE TECHNOLOGIESAGILE DEFENSESIGMA DEFENSE

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS

- TABLE 1 INCLUSIONS AND EXCLUSIONS

- TABLE 2 USD EXCHANGE RATES

- TABLE 3 US JOINT ALL-DOMAIN COMMAND AND CONTROL MARKET ECOSYSTEM

- TABLE 4 KEY CONFERENCES AND EVENTS, 2023−2024

- TABLE 5 US: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER AGENCIES

- TABLE 6 US JOINT ALL-DOMAIN COMMAND AND CONTROL MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 7 US JOINT ALL-DOMAIN COMMAND AND CONTROL MARKET, BY PLATFORM, 2023–2030 (USD MILLION)

- TABLE 8 US JOINT ALL-DOMAIN COMMAND AND CONTROL MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 9 US JOINT ALL-DOMAIN COMMAND AND CONTROL MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 10 US JOINT ALL-DOMAIN COMMAND AND CONTROL MARKET, BY SOLUTION, 2019–2022 (USD MILLION)

- TABLE 11 US JOINT ALL-DOMAIN COMMAND AND CONTROL MARKET, BY SOLUTION, 2023–2030 (USD MILLION)

- TABLE 12 KEY DEVELOPMENTS BY LEADING PLAYERS IN US JOINT ALL-DOMAIN COMMAND AND CONTROL MARKET BETWEEN 2020 AND 2023

- TABLE 13 US JOINT ALL-DOMAIN COMMAND AND CONTROL MARKET: DEGREE OF COMPETITION

- TABLE 14 COMPANY PRODUCT FOOTPRINT

- TABLE 15 US JOINT ALL-DOMAIN COMMAND AND CONTROL MARKET: DEALS, NOVEMBER 2020–MARCH 2023

- TABLE 16 LOCKHEED MARTIN CORPORATION: BUSINESS OVERVIEW

- TABLE 17 LOCKHEED MARTIN CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 18 NORTHROP GRUMMAN CORPORATION: BUSINESS OVERVIEW

- TABLE 19 NORTHROP GRUMMAN CORPORATION: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 20 NORTHROP GRUMMAN CORPORATION: DEALS

- TABLE 21 RAYTHEON TECHNOLOGIES CORPORATION: BUSINESS OVERVIEW

- TABLE 22 RAYTHEON TECHNOLOGIES CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 23 RAYTHEON TECHNOLOGIES CORPORATION: DEALS

- TABLE 24 L3HARRIS TECHNOLOGIES, INC.: BUSINESS OVERVIEW

- TABLE 25 L3HARRIS TECHNOLOGIES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 26 L3HARRIS TECHNOLOGIES, INC.: DEALS

- TABLE 27 GENERAL DYNAMICS CORPORATION: BUSINESS OVERVIEW

- TABLE 28 GENERAL DYNAMICS CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 29 GENERAL DYNAMICS CORPORATION: DEALS

- TABLE 30 BAE SYSTEMS PLC: BUSINESS OVERVIEW

- TABLE 31 BAE SYSTEMS PLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 32 ELBIT SYSTEMS LTD.: BUSINESS OVERVIEW

- TABLE 33 ELBIT SYSTEMS LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 34 ELBIT SYSTEMS LTD.: DEALS

- TABLE 35 LEONARDO SPA: BUSINESS OVERVIEW

- TABLE 36 LEONARDO SPA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 37 KRATOS DEFENSE & SECURITY SOLUTIONS, INC.: BUSINESS OVERVIEW

- TABLE 38 KRATOS DEFENSE & SECURITY SOLUTIONS, INC.: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 39 KRATOS DEFENSE & SECURITY SOLUTIONS, INC.: DEALS

- TABLE 40 SAIC: BUSINESS OVERVIEW

- TABLE 41 SAIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 42 SAIC: DEALS

- TABLE 43 MICROSOFT CORPORATION: BUSINESS OVERVIEW

- TABLE 44 MICROSOFT CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 45 MICROSOFT CORPORATION: DEALS

- TABLE 46 IBM CORPORATION: BUSINESS OVERVIEW

- TABLE 47 IBM CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 48 THE BOEING COMPANY: BUSINESS OVERVIEW

- TABLE 49 THE BOEING COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 50 AMAZON: BUSINESS OVERVIEW

- TABLE 51 AMAZON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 52 AMAZON: DEALS

- TABLE 53 LEIDOS: BUSINESS OVERVIEW

- TABLE 54 LEIDOS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 55 LEIDOS: DEALS

- TABLE 56 GENERAL ATOMICS: COMPANY OVERVIEW

- TABLE 57 CACI INTERNATIONAL INC.: COMPANY OVERVIEW

- TABLE 58 SYSTEMATIC INC.: COMPANY OVERVIEW

- TABLE 59 VIASAT INC.: COMPANY OVERVIEW

- TABLE 60 IMPROBABLE: COMPANY OVERVIEW

- TABLE 61 ARC, INC.: COMPANY OVERVIEW

- TABLE 62 DRAPER LABORATORY: COMPANY OVERVIEW

- TABLE 63 RADIANCE TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 64 AGILE DEFENSE: COMPANY OVERVIEW

- TABLE 65 SIGMA DEFENSE: COMPANY OVERVIEW

- FIGURE 1 US JOINT ALL-DOMAIN COMMAND AND CONTROL (JADC2) MARKET SEGMENTATION

- FIGURE 2 RESEARCH PROCESS FLOW

- FIGURE 3 US JOINT ALL-DOMAIN COMMAND AND CONTROL MARKET: RESEARCH DESIGN

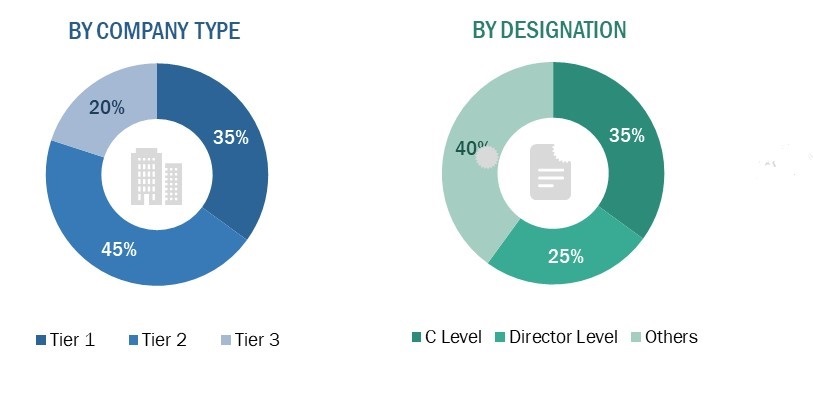

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE AND DESIGNATION

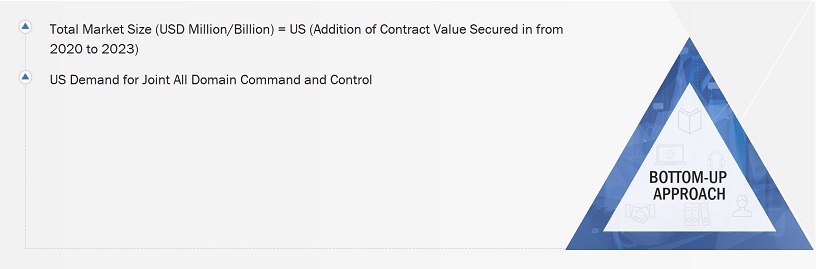

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

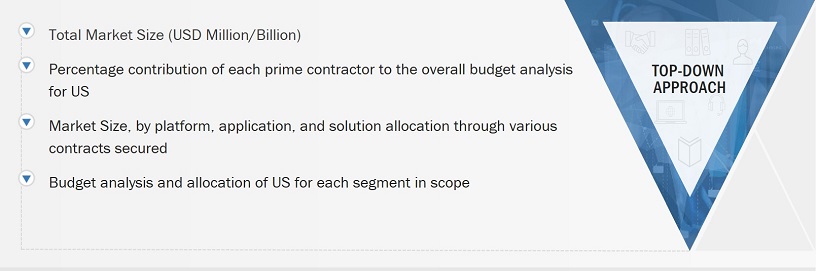

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

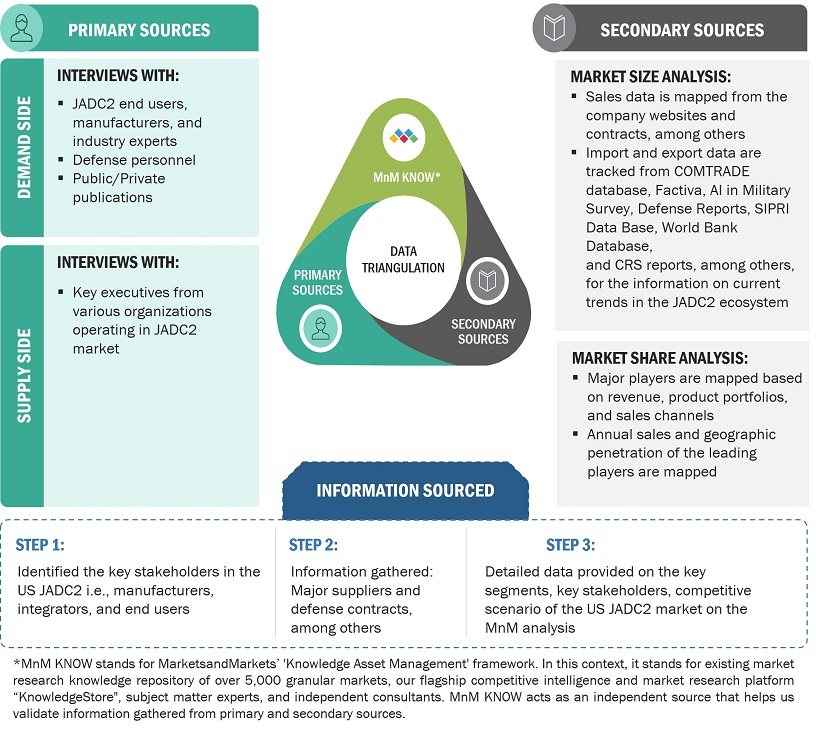

- FIGURE 7 DATA TRIANGULATION

- FIGURE 8 RESEARCH ASSUMPTIONS

- FIGURE 9 SOFTWARE SEGMENT TO REGISTER HIGHEST MARKET GROWTH FROM 2023 TO 2030

- FIGURE 10 SATCOM SEGMENT ANTICIPATED TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 11 NAVAL SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 12 INCREASED ADOPTION OF JOINT ALL-DOMAIN COMMAND AND CONTROL SYSTEMS TO DRIVE MARKET

- FIGURE 13 COMMUNICATION SEGMENT TO REGISTER HIGHEST GROWTH IN US JADC2 MARKET

- FIGURE 14 LAND SEGMENT TO HAVE HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 15 SOFTWARE SEGMENT TO LEAD MARKET BY 2030

- FIGURE 16 US JOINT ALL-DOMAIN COMMAND AND CONTROL MARKET DYNAMICS

- FIGURE 17 REVENUE SHIFT IN US JOINT ALL-DOMAIN COMMAND AND CONTROL MARKET

- FIGURE 18 US JOINT ALL-DOMAIN COMMAND AND CONTROL MARKET ECOSYSTEM

- FIGURE 19 VALUE CHAIN ANALYSIS

- FIGURE 20 US JOINT ALL-DOMAIN COMMAND AND CONTROL MARKET, BY PLATFORM, 2023–2030

- FIGURE 21 US JOINT ALL-DOMAIN COMMAND AND CONTROL MARKET, BY APPLICATION, 2023–2030

- FIGURE 22 US JOINT ALL-DOMAIN COMMAND AND CONTROL MARKET, BY SOLUTION, 2023–2030

- FIGURE 23 US JOINT ALL-DOMAIN COMMAND AND CONTROL MARKET: RANKING ANALYSIS OF TOP 5 PLAYERS, 2022

- FIGURE 24 REVENUE OF TOP 5 PLAYERS 2022

- FIGURE 25 US JOINT ALL-DOMAIN COMMAND AND CONTROL MARKET: COMPANY EVALUATION MATRIX, 2023

- FIGURE 26 US JOINT ALL-DOMAIN COMMAND AND CONTROL MARKET: STARTUP/SME EVALUATION MATRIX, 2023

- FIGURE 27 LOCKHEED MARTIN CORPORATION: COMPANY SNAPSHOT

- FIGURE 28 NORTHROP GRUMMAN CORPORATION: COMPANY SNAPSHOT

- FIGURE 29 RAYTHEON TECHNOLOGIES CORPORATION: COMPANY SNAPSHOT

- FIGURE 30 L3HARRIS TECHNOLOGIES, INC.: COMPANY SNAPSHOT

- FIGURE 31 GENERAL DYNAMICS CORPORATION: COMPANY SNAPSHOT

- FIGURE 32 BAE SYSTEMS PLC: COMPANY SNAPSHOT

- FIGURE 33 ELBIT SYSTEMS LTD.: COMPANY SNAPSHOT

- FIGURE 34 LEONARDO SPA: COMPANY SNAPSHOT

- FIGURE 35 KRATOS DEFENSE & SECURITY SOLUTIONS, INC.: COMPANY SNAPSHOT

- FIGURE 36 MICROSOFT CORPORATION: COMPANY SNAPSHOT

- FIGURE 37 IBM CORPORATION: COMPANY SNAPSHOT

- FIGURE 38 THE BOEING COMPANY: COMPANY SNAPSHOT

- FIGURE 39 AMAZON: COMPANY SNAPSHOT

- FIGURE 40 LEIDOS: COMPANY SNAPSHOT

This research study involved the extensive use of secondary sources, directories, and databases [such as Stockholm International Peace Research Institute (SIPRI), DoD database, UN Comtrade, Organization for Economic Cooperation and Development (OECD), and Factiva] to identify and collect relevant information on the US Joint All Domain Command and Control (JADC2) market. The primary sources included industry experts from the concerned market, preferred suppliers, manufacturers, solution providers, technology developers, alliances, and organizations related to all segments of the industry's value chain. All primary sources were interviewed to obtain and verify critical qualitative and quantitative information as well as to assess the prospects of the market.

In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, among others, to obtain and verify critical qualitative and quantitative information and to assess the prospects of the market.

Secondary Research

The market share of the companies offering JADC2 military application solutions was procured based on the secondary data available through paid and unpaid sources and by analyzing the product portfolios of major companies and rating them based on their performance and quality. In the secondary research process, sources such as government databases: SIPRI; corporate filings: annual reports, press releases, and investor presentations of the companies; white papers, journals, and certified publications; articles by recognized authors; and directories and databases were used to identify and collect the information for this study.

Secondary research was mainly used to obtain key information about the value and supply chain of the industry. The method was also used to identify the essential players by various products, market classifications, and segmentations according to their offerings. Secondary information helped to understand the industry trends related to the application, platform, solution, and critical developments from the market and technology-oriented perspectives.

Primary Research

Extensive primary research was conducted after obtaining information about the current scenario of the US JADC2 market through secondary research. In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. Primary sources from the supply side included industry experts such as vice presidents (VPs); directors from business development, marketing, and product development/innovation teams; related key executives from cloud solution providers; military sensor manufacturers; memory and graphics processing unit manufacturers, military AI service providers; integrators; and key opinion leaders. The primary sources from the demand side included defense agencies and departments, armed forces, defense contractors, and military research institutions.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the size of the US JADC2 market. The figure in the below section is a representation of the overall market size estimation process employed for the purpose of this study.

The research methodology used to estimate the market size includes the following details.

- Key players in the markets were identified through secondary research, and their market shares were determined through primary and secondary research. This included an extensive study of annual and financial reports of top market players and interviews with CEOs, directors, and marketing executives.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

- Market growth trends were defined based on approaches such as the product revenues of the major 10–15 companies from 2019 to 2022, military expenditure, exports/imports of military sensors and hardware parts and equipment by different countries from 2019 to 2022, historic procurement patterns between 2019 to 2022, among others.

Market size estimation methodology: Bottom-up Approach

The bottom-up approach was employed to arrive at the overall size of the JADC2 market from the revenues of key players and their shares in the market. Calculations based on the revenues of key players identified in the market led to the overall market size. The bottom-up approach was also implemented for data extracted from secondary research to validate the market segment revenues obtained. The market shares were then estimated for each company to verify the revenue shares used earlier in the bottom-up approach. With the data triangulation procedure and data validation through primaries, the overall parent market size and each individual market size were determined and confirmed in this study.

Market size estimation methodology: Top-Down Approach

In the top-down approach, JADC2 hardware manufacturers and service providers were identified. The revenues of leading players operating in the JADC2 market were identified. Prime contractors for the US military were identified. Each contractor’s base allocation number was determined by assigning a weightage to different defense contracts secured by these contractors.

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the total market was split into several segments and subsegments. Data triangulation and market breakdown procedures were implemented to complete the overall market engineering process and arrive at the exact statistics for market segments and subsegments wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

The following figure indicates the market breakdown structure and the data triangulation procedure implemented in the market engineering process used in this report.

Market Definition

Joint All Domain Command and Control (JADC2) aims to enhance military operations by integrating various domains, such as land, sea, air, space, and cyberspace, into a unified command & control system. It recognizes the increasing interconnectedness and complexity of modern warfare and seeks to leverage emerging technologies and data to enable rapid decision-making and synchronized actions across all domains. It is built upon the principles of connectivity, interoperability, and information sharing. It involves the integration of sensors, platforms, and data sources to create a comprehensive and real-time situational awareness picture for commanders, which enables them to make timely and informed decisions in dynamic operational environments. One of the key elements of JADC2 is the use of advanced technologies such as artificial intelligence, machine learning, and automation. These technologies assist in processing vast amounts of data from diverse sources, such as satellites, drones, ground sensors, and cyber systems. This data enables commanders to have a holistic understanding of the battlefield and the ability to respond rapidly to emerging threats. It also emphasizes the importance of networked communication and collaboration. It aims to establish a seamless and secure communication infrastructure that enables rapid information sharing and coordination among different units and services. This includes the use of secure data links, advanced networking protocols, and standardized data formats to ensure seamless interoperability.

JADC2 aims to achieve decision superiority and operational agility. It seeks to enable commanders to understand the battlespace in real time, make informed decisions, and rapidly employ forces across all domains to achieve mission objectives. JADC2 integrates diverse capabilities and leverages emerging technologies to enhance the ability of the military to deter adversaries, project power, and effectively respond to threats in a rapidly evolving and complex security environment.

JADC2 is a concept and capability that aims to integrate and synchronize military operations across all domains, including land, air, sea, space, and cyberspace. It seeks to enable seamless communication, data sharing, and decision-making among different branches of the military and various domains to achieve superior situational awareness and operational effectiveness. It is designed to overcome the challenges posed by the complexity and diversity of modern warfare, where multiple services and domains must work together to address rapidly evolving threats. JADC2 integrates sensors, platforms, and decision-makers to create a networked environment that enables real-time information sharing and collaboration.

Key Stakeholders

- Department of Defense (DoD)

- Regulatory Bodies

- R&D Companies

- Cybersecurity Firms

- Software Development Companies

- Cloud Service Providers

- Sensor and Surveillance System Manufacturers

- Satellite Operating Companies

- Training and Simulation Providers

- Armed Forces

Report Objectives

- To define, describe, and forecast the size of the US Joint All Domain Command and Control (JADC2) market based on platform, application, and solution from 2023 to 2030.

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the US JADC2 market.

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and their contribution to the JADC2 market

- To analyze opportunities for stakeholders in the JADC2 market by identifying key market trends

- To analyze competitive developments such as contracts, acquisitions and expansions, agreements, joint ventures and partnerships, product launches, and R&D activities in the JADC2 market

- To provide a detailed competitive landscape of the JADC2 market, in addition to an analysis of business and corporate strategies adopted by leading market players

- To strategically profile key market players and comprehensively analyze their core competencies2

1. Micro markets refer to further segments and subsegments of the artillery systems market included in the report.

2. Core competencies of the companies were captured in terms of their key developments and strategies adopted by them to sustain their position in the market.

Available customizations

Along with the market data, MarketsandMarkets offers customizations as per the specific needs of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the market segments at country-level

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in US Joint All Domain Command and Control (JADC2) Market