Isothermal Nucleic Acid Amplification Technology Market by Product (Assay, System), Technology (LAMP, SDA, NASBA, NEAR, HDA), Application (Diagnostics (Influenza, Hepatitis, CT/NG, COVID-19), blood screening), End User & Region - Global Forecast to 2028

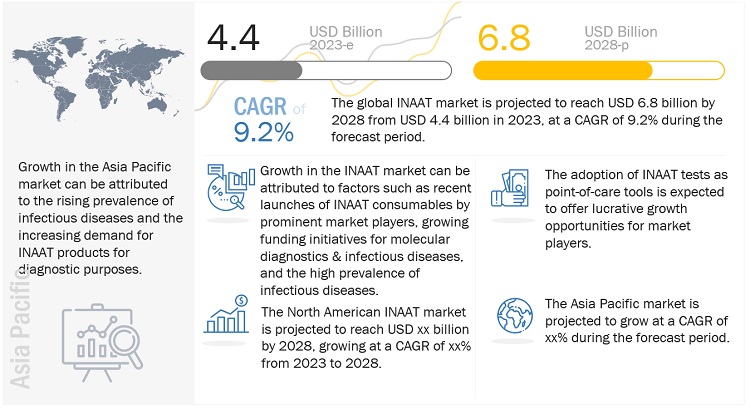

The global isothermal nucleic acid amplification technology market, stood at US$4.4 billion in 2023 and is projected to advance at a resilient CAGR of 9.2% from 2023 to 2028, culminating in a forecasted valuation of US$6.8 billion by the end of the period. The growth of the market is attributed to the cost-benefits of INAAT, rising prevalence of infectious diseases, and increasing number of blood transfusions and donations.

Attractive Opportunities in the Isothermal Nucleic Acid Amplification Technology Market

To know about the assumptions considered for the study, Request for Free Sample Report

Isothermal Nucleic Acid Amplification Technology Market Dynamics

Driver: Recent launches of INAAT consumables by prominent market players

Prominent market players have launched new kits, reagents, and systems based on INAAT in the last three years. Market players are now focusing on the increasing their R&D efforts in development of new product. For instance, in June 2022, Grifols (Spain) obtained the CE Mark for the Procleix Plasmodium Assay, a nucleic acid test (NAT) specifically validated for screening blood donors for malaria. In May 2022, Hologic, Inc. (US) received US Food and Drug Administration (FDA) approval for the Aptima CMV Quant Assay. This assay will quantify the viral load of cytomegalovirus (CMV) in patients who have had an organ or stem cell transplant.

Restraint: Unfavorable reimbursement scenario for in vitro diagnostic tests

The Centers for Medicare & Medicaid Services (CMS) reduced the Medicare reimbursement rate for COVID-19 tests based on high-throughput technology to USD 75 unless labs can process results in under two days. Medicare does not currently provide genetic testing coverage for individuals without a history of cancer. Similarly, according to MedPAC (Medicare Payment Advisory Commission), medical testing has seen a 40% decline in reimbursement over the last 40 years. This decline and additional budgetary concerns among healthcare systems will be a major obstacle to implementing novel diagnostic techniques in clinical laboratories.

Opportunity: INAAT tests as point-of-care tools

LAMP is the most used INAAT method for the development of POC tools. LAMP technology offers major advantages, such as high specificity provided by the primer design, use of a single enzyme, relatively low reaction time (<1 h), and high efficiency. The Detect COVID-19 Test (Detect Inc.) is a molecular in vitro diagnostic test for the qualitative detection of nucleic acid from the novel coronavirus SARS-CoV-2 that causes COVID-19.

Assay, kits and reagents segment accounted for the largest share of the isothermal nucleic acid amplification technology industry

Based on the product, the isothermal nucleic acid amplification technology market is segmented into assay, kits, and reagents, and systems. The assay, kits, and reagents segment accounted for the largest share in 2022. The largest share of this segment is attributed to increasing approvals of CLIA-waived tests, repeated purchase of reagents, and continuous launch of newer, faster, and more reliable POC products.

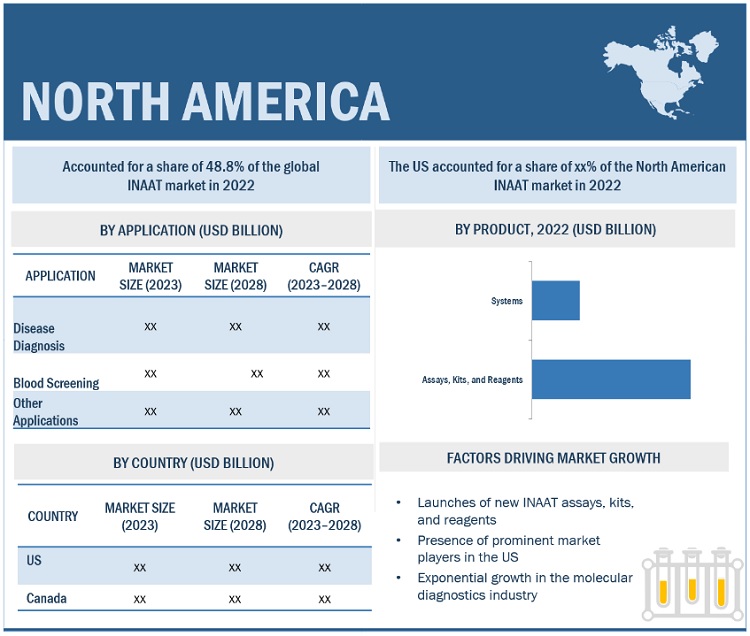

North America was the largest regional market for isothermal nucleic acid amplification technology industry in 2022.

The isothermal nucleic acid amplification technology market is segmented into five major regions—North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa. In 2022, North America accounted for the largest share of the market. Increasing number of research project on infectious disease diagnosis, rising demand for new INAAT systems and kits, and growing use of INAAT consumables are various factors projected to drive the growth of the market.

To know about the assumptions considered for the study, download the pdf brochure

Key players in the market include Grifols, S.A. (Spain), Hologic, Inc. (US), Abbott Laboratories (US), Becton, Dickinson and Company (US), Meridian Bioscience (US), Eiken Chemical Co., Ltd. (Japan), bioMérieux SA (France), Tecan Trading AG (Switzerland), New England Biolabs (US), QIAGEN N.V. (Germany), DiaSorin S.p.A. (Italy), General Electric (US), OptiGene Limited (UK), Quidel Corporation (US), Thermo Fisher Scientific (US), Genomtec (Poland), Mast Group Ltd. (UK), Ustar Biotechnologies (China), Jena Bioscience GmbH (Germany), Atila BioSystems (US), TwistDx Limited (UK), LGC Limited (UK), Life Sciences Advanced Technologies (US), GenoSensor Corporation (US), and PCR Biosystems (UK).

Scope of the Isothermal Nucleic Acid Amplification Technology Industry

|

Report Metric |

Details |

|

Market Revenue in 2023 |

$4.4 billion |

|

Projected Revenue in 2028 |

$6.8 billion |

|

Revenue Rate |

Poised to Grow at a CAGR of 9.2% |

|

Market Driver |

Recent launches of INAAT consumables by prominent market players |

|

Market Opportunity |

INAAT tests as point-of-care tools |

The study categorizes the isothermal nucleic acid amplification technology market to forecast revenue and analyze trends in each of the following submarkets:

By Product

- Assays, Kits, & Reagents

- Systems

By Technology

- Transcription Mediated Amplification (TMA)

- Loop-mediated Isothermal Amplification (LAMP)

- Strand Displacement Amplification (SDA)

- Helicase-dependent Amplification (HDA)

- Nucleic Acid Sequence-based Amplification (NASBA)

- Nicking Enzyme Amplification Reaction (NEAR)

- Single Primer Isothermal Amplification (SPIA)

- Other Technologies

By Application

-

Disease Diagnosis

- Hepatitis

- Chlamydia trachomatis (CT) and Neisseria gonorrhoeae (NG)

- Influenza

- Covid-19

- Other Disease Diagnosis

- Blood Screening

- Other Applications

By End User

- Hospitals

- Reference Laboratories

- Academic & Research Institutes

- Other End Users

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- China

- Japan

- Indias

- Rest of Asia Pacific

- Latin America

- Middle East and Africa

Recent Developments of Isothermal Nucleic Acid Amplification Technology Industry

- In May 2022, Hologic, Inc. (US) received CE marking for two new molecular assays, Panther Fusion EBV Quant Assay and Panther Fusion BKV Quant Assay, expanding its transplant pathogen monitoring menu on the Panther Fusion system.

- In December 2021, Hologic, Inc. (US) launched Panther Trax, which offers full automation to meet high-volume testing demands and will be commercially available in the US, Europe, Canada, Australia, and New Zealand.

- In September 2020, Abbott (US) received approval from Health Canada for the ID NOW rapid COVID-19 testing device for use in Canada.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global isothermal nucleic acid amplification technology market?

The global isothermal nucleic acid amplification technology market boasts a total revenue value of $6.8 billion by 2028.

What is the estimated growth rate (CAGR) of the global isothermal nucleic acid amplification technology market?

The global isothermal nucleic acid amplification technology market has an estimated compound annual growth rate (CAGR) of 9.2% and a revenue size in the region of $4.4 billion in 2023.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Recent launches of INAAT consumables by prominent market players- Growing funding initiatives for molecular diagnostics & infectious disease diagnostics- High prevalence of infectious diseasesRESTRAINTS- Unfavorable reimbursement scenario for in vitro diagnostic testsOPPORTUNITIES- INAAT tests as point-of-care tools- Start-ups focusing on INAATCHALLENGES- Dominance of PCR

- 5.3 PRICING ANALYSIS

- 5.4 VALUE CHAIN ANALYSIS

-

5.5 ECOSYSTEM ANALYSIS

- 5.6 KEY CONFERENCES & EVENTS IN 2023–2024

-

5.7 PORTER’S FIVE FORCES ANALYSISTHREAT FROM NEW ENTRANTSTHREAT FROM SUBSTITUTESBARGAINING POWER OF BUYERSBARGAINING POWER OF SUPPLIERSDEGREE OF COMPETITION

- 5.8 KEY STAKEHOLDERS & BUYING CRITERIA

-

5.9 PATENT ANALYSIS

-

5.10 REGULATORY ANALYSISNORTH AMERICA- US- CanadaEUROPEASIA PACIFIC- China- Japan- IndiaLATIN AMERICA- Brazil- MexicoMIDDLE EAST

-

5.11 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

- 6.1 INTRODUCTION

-

6.2 ASSAYS, KITS, AND REAGENTSGROWING AWARENESS OF INAAT TO DRIVE DEMAND FOR ASSAYS, KITS, AND REAGENTS

-

6.3 SYSTEMSGROWING POPULARITY OF INAAT SYSTEMS TO SUPPORT MARKET GROWTH

- 7.1 INTRODUCTION

-

7.2 LOOP-MEDIATED ISOTHERMAL AMPLIFICATION (LAMP)LAUNCH OF NEW LAMP DIAGNOSTIC KITS TO SUPPORT MARKET GROWTH

-

7.3 TRANSCRIPTION-MEDIATED AMPLIFICATION (TMA)GROWING EFFORTS TO DEVELOP TMA KITS TO BOOST GROWTH

-

7.4 NICKING ENZYME AMPLIFICATION REACTION (NEAR)RAPID IDENTIFICATION OF SMALL DNA OR RNA FRAGMENTS TO BOOST ADOPTION OF NEAR

-

7.5 STRAND DISPLACEMENT AMPLIFICATION (SDA)GROWING USE OF SDA IN RNA AMPLIFICATION TO PROPEL MARKET GROWTH

-

7.6 HELICASE-DEPENDENT AMPLIFICATION (HDA)USE OF THERMOSTABLE HELICASE ENZYMES INSTEAD OF HEAT TO BOOST DEMAND FOR HDA

-

7.7 NUCLEIC ACID SEQUENCE-BASED AMPLIFICATION (NASBA)ADVANTAGES OF NASBA OVER PCR TO BOOST ADOPTION IN CLINICAL SETTINGS

-

7.8 SINGLE-PRIMER ISOTHERMAL AMPLIFICATION (SPIA)USE OF RNA/DNA-3′ PRIMER FOR FIRST-STRAND CDNA SYNTHESIS TO DRIVE MARKET

- 7.9 OTHER TECHNOLOGIES

- 8.1 INTRODUCTION

-

8.2 DISEASE DIAGNOSISCOVID-19- Extensive use of INAAT kits for COVID-19 diagnosis to support market growthHEPATITIS- Growing adoption of advanced technologies for diagnosis of hepatitis B to drive growthCT/NG- Growing prevalence of CT/NG infections worldwide to boost marketINFLUENZA- Growing focus on containing spread of influenza to propel growthHIV- High global incidence of HIV to support market growthOTHER DISEASES

-

8.3 BLOOD SCREENINGINCREASING NUMBER OF BLOOD DONATIONS AND TRANSFUSIONS TO INCREASE USE OF INAAT IN BLOOD SCREENING APPLICATIONS

- 8.4 OTHER APPLICATIONS

- 9.1 INTRODUCTION

-

9.2 HOSPITALSHOSPITALS TO DOMINATE INAAT MARKET DURING FORECAST PERIOD

-

9.3 REFERENCE LABORATORIESAVAILABILITY OF WIDE RANGE OF TEST PANELS FOR INFECTIOUS DISEASE TESTING TO SUPPORT MARKET

-

9.4 ACADEMIC & RESEARCH INSTITUTESGROWING USE OF INAAT ASSAYS BY ACADEMIC & RESEARCH INSTITUTES TO BOOST MARKET

- 9.5 OTHER END USERS

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICAUS- Increasing approvals of INAAT products to drive market growthCANADA- Growing demand for molecular diagnostic kits to boost adoption of INAATNORTH AMERICA: RECESSION IMPACT

-

10.3 EUROPEGERMANY- Germany to dominate European isothermal nucleic acid amplification technology market during forecast periodUK- Growing adoption of INAAT products to support market growth in UKFRANCE- Established blood screening regulations to boost growthITALY- Favorable government initiatives for blood transfusion to support growthSPAIN- Growing demand for diagnostic testing in Spain to favor market growthREST OF EUROPEEUROPE: RECESSION IMPACT

-

10.4 ASIA PACIFICCHINA- China to dominate APAC INAAT market during forecast periodJAPAN- Universal healthcare reimbursement policy to drive market growth in JapanINDIA- Government initiatives for blood donation to contribute to growthREST OF ASIA PACIFICASIA PACIFIC: RECESSION IMPACT

-

10.5 LATIN AMERICAGROWING AWARENESS ABOUT INAAT TO PROPEL GROWTHLATIN AMERICA: RECESSION IMPACT

-

10.6 MIDDLE EAST & AFRICAIMPROVING HEALTHCARE INFRASTRUCTURE TO DRIVE MARKETMIDDLE EAST & AFRICA: RECESSION IMPACT

- 11.1 INTRODUCTION

- 11.2 RIGHT-TO-WIN APPROACHES ADOPTED BY KEY PLAYERS

- 11.3 REVENUE SHARE ANALYSIS

- 11.4 MARKET SHARE ANALYSIS

-

11.5 COMPANY EVALUATION MATRIX FOR KEY PLAYERSSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

11.6 COMPETITIVE BENCHMARKING OF TOP 25 PLAYERSOVERALL COMPANY FOOTPRINT (25 COMPANIES)PRODUCT FOOTPRINT OF COMPANIES (25 COMPANIES)REGIONAL FOOTPRINT OF COMPANIES (25 COMPANIES)

-

11.7 COMPANY EVALUATION MATRIX FOR START-UPS/SMESPROGRESSIVE COMPANIESSTARTING BLOCKSRESPONSIVE COMPANIESDYNAMIC COMPANIES

- 11.8 COMPETITIVE BENCHMARKING OF START-UPS/SMES

-

11.9 COMPETITIVE SCENARIO AND TRENDSPRODUCT LAUNCHESDEALSOTHER DEVELOPMENTS

-

12.1 KEY PLAYERSHOLOGIC, INC.- Business overview- Products offered- Recent developments- MnM viewABBOTT LABORATORIES- Business overview- Products offered- Recent developments- MnM viewGRIFOLS, S.A.- Business overview- Products offered- Recent developments- MnM viewBECTON, DICKINSON AND COMPANY- Business overview- Products offeredMERIDIAN BIOSCIENCE- Business overview- Products offered- Recent developmentsEIKEN CHEMICAL CO., LTD.- Business overview- Products offered- Recent developmentsQUIDEL CORPORATION- Business overview- Products offered- Recent developmentsQIAGEN N.V.- Business overview- Products offeredNEW ENGLAND BIOLABS- Business overview- Products offered- Recent developmentsDIASORIN S.P.A.- Business overview- Products offeredBIOMÉRIEUX SA- Business overview- Products offeredTECAN TRADING GROUP- Business overview- Products offeredGENERAL ELECTRIC COMPANY- Business overview- Products offeredTHERMO FISHER SCIENTIFIC- Business overview- Products offered- Recent developmentsOPTIGENE LIMITED- Business overview- Products offered

-

12.2 OTHER COMPANIESLGC LIMITEDUSTAR BIOTECHNOLOGIESTWISTDX LIMITEDMAST GROUP LTD.GENOMTECGENOSENSOR CORPORATIONJENA BIOSCIENCE GMBHLIFE SCIENCES ADVANCED TECHNOLOGIESPCR BIOSYSTEMSATILA BIOSYSTEMS

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET: IMPACT ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- TABLE 2 AVERAGE SELLING PRICE OF INAAT PRODUCTS, 2022

- TABLE 3 SUPPLY CHAIN ECOSYSTEM

- TABLE 4 ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET: DETAILED LIST OF CONFERENCES & EVENTS

- TABLE 5 ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 6 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 EUROPE: CLASSIFICATION OF DEVICES

- TABLE 11 ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 12 ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY ASSAYS, KITS, AND REAGENTS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 13 NORTH AMERICA: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY ASSAYS, KITS, AND REAGENTS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 14 EUROPE: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY ASSAYS, KITS, AND REAGENTS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 15 ASIA PACIFIC: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY ASSAYS, KITS, AND REAGENTS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 16 ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY SYSTEMS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 17 NORTH AMERICA: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY SYSTEMS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 18 EUROPE: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY SYSTEMS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 19 ASIA PACIFIC: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY SYSTEMS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 20 ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGIES

- TABLE 21 ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 22 LOOP-MEDIATED ISOTHERMAL AMPLIFICATION (LAMP) MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 23 NORTH AMERICA: LOOP-MEDIATED ISOTHERMAL AMPLIFICATION (LAMP) MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 24 EUROPE: LOOP-MEDIATED ISOTHERMAL AMPLIFICATION (LAMP) MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 25 ASIA PACIFIC: LOOP-MEDIATED ISOTHERMAL AMPLIFICATION (LAMP) MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 26 TRANSCRIPTION-MEDIATED AMPLIFICATION (TMA) MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 27 NORTH AMERICA: TRANSCRIPTION-MEDIATED AMPLIFICATION (TMA) MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 28 EUROPE: TRANSCRIPTION-MEDIATED AMPLIFICATION (TMA) MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 29 ASIA PACIFIC: TRANSCRIPTION-MEDIATED AMPLIFICATION (TMA) MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 30 NICKING ENZYME AMPLIFICATION REACTION (NEAR) MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 31 NORTH AMERICA: NICKING ENZYME AMPLIFICATION REACTION (NEAR) MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 32 EUROPE: NICKING ENZYME AMPLIFICATION REACTION (NEAR) MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 33 ASIA PACIFIC: NICKING ENZYME AMPLIFICATION REACTION (NEAR) MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 34 STRAND DISPLACEMENT AMPLIFICATION (SDA) MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 35 NORTH AMERICA: STRAND DISPLACEMENT AMPLIFICATION (SDA) MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 36 EUROPE: STRAND DISPLACEMENT AMPLIFICATION (SDA) MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 37 ASIA PACIFIC: STRAND DISPLACEMENT AMPLIFICATION (SDA) MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 38 HELICASE-DEPENDENT AMPLIFICATION (HDA) MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 39 NORTH AMERICA: HELICASE-DEPENDENT AMPLIFICATION (HDA) MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 40 EUROPE: HELICASE-DEPENDENT AMPLIFICATION (HDA) MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 41 ASIA PACIFIC: HELICASE-DEPENDENT AMPLIFICATION (HDA) MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 42 NUCLEIC ACID SEQUENCE-BASED AMPLIFICATION (NASBA) MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 43 NORTH AMERICA: NUCLEIC ACID SEQUENCE-BASED AMPLIFICATION (NASBA) MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 44 EUROPE: NUCLEIC ACID SEQUENCE-BASED AMPLIFICATION (NASBA) MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 45 ASIA PACIFIC: NUCLEIC ACID SEQUENCE-BASED AMPLIFICATION (NASBA) MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 46 SINGLE-PRIMER ISOTHERMAL AMPLIFICATION (SPIA) MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 47 NORTH AMERICA: SINGLE-PRIMER ISOTHERMAL AMPLIFICATION (SPIA) MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 48 EUROPE: SINGLE-PRIMER ISOTHERMAL AMPLIFICATION (SPIA) MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 49 ASIA PACIFIC: SINGLE-PRIMER ISOTHERMAL AMPLIFICATION (SPIA) MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 50 OTHER INAAT TECHNOLOGIES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 51 NORTH AMERICA: OTHER INAAT TECHNOLOGIES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 52 EUROPE: OTHER INAAT TECHNOLOGIES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 53 ASIA PACIFIC: OTHER INAAT TECHNOLOGIES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 54 ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 55 ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET FOR DISEASE DIAGNOSIS APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 56 ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET FOR DISEASE DIAGNOSIS APPLICATIONS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 57 NORTH AMERICA: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET FOR DISEASE DIAGNOSIS APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 58 EUROPE: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET FOR DISEASE DIAGNOSIS APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 59 ASIA PACIFIC: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET FOR DISEASE DIAGNOSIS APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 60 ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET FOR COVID-19 TESTING, BY REGION, 2021–2028 (USD MILLION)

- TABLE 61 NORTH AMERICA: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET FOR COVID-19 TESTING, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 62 EUROPE: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET FOR COVID-19 TESTING, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 63 ASIA PACIFIC: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET FOR COVID-19 TESTING, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 64 ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET FOR HEPATITIS TESTING, BY REGION, 2021–2028 (USD MILLION)

- TABLE 65 NORTH AMERICA: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET FOR HEPATITIS TESTING, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 66 EUROPE: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET FOR HEPATITIS TESTING, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 67 ASIA PACIFIC: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET FOR HEPATITIS TESTING, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 68 ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET FOR CT/NG TESTING, BY REGION, 2021–2028 (USD MILLION)

- TABLE 69 NORTH AMERICA: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET FOR CT/NG TESTING, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 70 EUROPE: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET FOR CT/NG TESTING, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 71 ASIA PACIFIC: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET FOR CT/NG TESTING, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 72 ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET FOR INFLUENZA TESTING, BY REGION, 2021–2028 (USD MILLION)

- TABLE 73 NORTH AMERICA: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET FOR INFLUENZA TESTING, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 74 EUROPE: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET FOR INFLUENZA TESTING, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 75 ASIA PACIFIC: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET FOR INFLUENZA TESTING, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 76 GLOBAL HIV CASES, 2021

- TABLE 77 ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET FOR HIV TESTING, BY REGION, 2021–2028 (USD MILLION)

- TABLE 78 NORTH AMERICA: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET FOR HIV TESTING, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 79 EUROPE: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET FOR HIV TESTING, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 80 ASIA PACIFIC: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET FOR HIV TESTING, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 81 ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET FOR OTHER DISEASES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 82 NORTH AMERICA: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET FOR OTHER DISEASES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 83 EUROPE: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET FOR OTHER DISEASES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 84 ASIA PACIFIC: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET FOR OTHER DISEASES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 85 ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET FOR BLOOD SCREENING APPLICATIONS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 86 NORTH AMERICA: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET FOR BLOOD SCREENING APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 87 EUROPE: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET FOR BLOOD SCREENING APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 88 ASIA PACIFIC: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET FOR BLOOD SCREENING APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 89 ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET FOR OTHER APPLICATIONS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 90 NORTH AMERICA: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 91 EUROPE: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 92 ASIA PACIFIC: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 93 ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 94 ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET FOR HOSPITALS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 95 NORTH AMERICA: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET FOR HOSPITALS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 96 EUROPE: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET FOR HOSPITALS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 97 ASIA PACIFIC: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET FOR HOSPITALS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 98 ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET FOR REFERENCE LABORATORIES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 99 NORTH AMERICA: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET FOR REFERENCE LABORATORIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 100 EUROPE: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET FOR REFERENCE LABORATORIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 101 ASIA PACIFIC: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET FOR REFERENCE LABORATORIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 102 ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET FOR ACADEMIC & RESEARCH INSTITUTES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 103 NORTH AMERICA: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET FOR ACADEMIC & RESEARCH INSTITUTES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 104 EUROPE: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET FOR ACADEMIC & RESEARCH INSTITUTES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 105 ASIA PACIFIC: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET FOR ACADEMIC & RESEARCH INSTITUTES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 106 ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET FOR OTHER END USERS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 107 NORTH AMERICA: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET FOR OTHER END USERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 108 EUROPE: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET FOR OTHER END USERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 109 ASIA PACIFIC: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET FOR OTHER END USERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 110 ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 111 NORTH AMERICA: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 112 NORTH AMERICA: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 113 NORTH AMERICA: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 114 NORTH AMERICA: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 115 NORTH AMERICA: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET FOR DISEASE DIAGNOSIS APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 116 NORTH AMERICA: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 117 US: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 118 US: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 119 US: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 120 US: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET FOR DISEASE DIAGNOSIS APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 121 US: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 122 CANADA: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 123 CANADA: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 124 CANADA: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 125 CANADA: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET FOR DISEASE DIAGNOSIS APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 126 CANADA: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 127 EUROPE: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 128 EUROPE: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 129 EUROPE: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 130 EUROPE: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 131 EUROPE: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET FOR DISEASE DIAGNOSIS APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 132 EUROPE: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 133 GERMANY: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 134 GERMANY: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 135 GERMANY: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 136 GERMANY: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET FOR DISEASE DIAGNOSIS APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 137 GERMANY: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 138 NUMBER OF BLOOD DONATIONS IN UK, 2016–2020

- TABLE 139 UK: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 140 UK: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 141 UK: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 142 UK: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET FOR DISEASE DIAGNOSIS APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 143 UK: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 144 HIV DATA FOR FRANCE, 2021

- TABLE 145 FRANCE: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 146 FRANCE: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 147 FRANCE: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 148 FRANCE: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET FOR DISEASE DIAGNOSIS APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 149 FRANCE: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 150 HIV DATA FOR ITALY, 2021

- TABLE 151 ITALY: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 152 ITALY: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 153 ITALY: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 154 ITALY: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET FOR DISEASE DIAGNOSIS APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 155 ITALY: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 156 HIV DATA FOR SPAIN, 2021

- TABLE 157 SPAIN: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 158 SPAIN: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 159 SPAIN: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 160 SPAIN: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET FOR DISEASE DIAGNOSIS APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 161 SPAIN: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 162 REST OF EUROPE: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 163 REST OF EUROPE: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 164 REST OF EUROPE: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 165 REST OF EUROPE: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET FOR DISEASE DIAGNOSIS APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 166 REST OF EUROPE: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 167 ASIA PACIFIC: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 168 ASIA PACIFIC: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 169 ASIA PACIFIC: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 170 ASIA PACIFIC: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 171 ASIA PACIFIC: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET FOR DISEASE DIAGNOSIS APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 172 ASIA PACIFIC: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 173 CHINA: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 174 CHINA: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 175 CHINA: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 176 CHINA: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET FOR DISEASE DIAGNOSIS APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 177 CHINA: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 178 JAPAN: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 179 JAPAN: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 180 JAPAN: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 181 JAPAN: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET FOR DISEASE DIAGNOSIS APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 182 JAPAN: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 183 INDIA: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 184 INDIA: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 185 INDIA: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 186 INDIA: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET FOR DISEASE DIAGNOSIS APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 187 INDIA: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 188 REST OF ASIA PACIFIC: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 189 REST OF ASIA PACIFIC: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 190 REST OF ASIA PACIFIC: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 191 REST OF ASIA PACIFIC: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET FOR DISEASE DIAGNOSIS APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 192 REST OF ASIA PACIFIC: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 193 LATIN AMERICA: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 194 LATIN AMERICA: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 195 LATIN AMERICA: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 196 LATIN AMERICA: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET FOR DISEASE DIAGNOSIS APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 197 LATIN AMERICA: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 198 MIDDLE EAST & AFRICA: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 199 MIDDLE EAST & AFRICA: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 200 MIDDLE EAST & AFRICA: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 201 MIDDLE EAST & AFRICA: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET FOR DISEASE DIAGNOSIS APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 202 MIDDLE EAST & AFRICA: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 203 INAAT MARKET: DEGREE OF COMPETITION

- TABLE 204 PRODUCT AND REGIONAL FOOTPRINT ANALYSIS OF KEY PLAYERS

- TABLE 205 PRODUCT FOOTPRINT ANALYSIS OF KEY PLAYERS

- TABLE 206 REGIONAL FOOTPRINT ANALYSIS OF KEY PLAYERS

- TABLE 207 ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET: DETAILED LIST OF KEY START-UPS/SMES

- TABLE 208 ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

- TABLE 209 ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET: KEY PRODUCT LAUNCHES, JANUARY 2020– JANUARY 2023

- TABLE 210 ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET: KEY DEALS, JANUARY 2020–JANUARY 2023

- TABLE 211 ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET: OTHER KEY DEVELOPMENTS, JANUARY 2020–JANUARY 2023

- TABLE 212 HOLOGIC, INC.: BUSINESS OVERVIEW

- TABLE 213 ABBOTT LABORATORIES: BUSINESS OVERVIEW

- TABLE 214 GRIFOLS, S.A.: BUSINESS OVERVIEW

- TABLE 215 BECTON, DICKINSON AND COMPANY: BUSINESS OVERVIEW

- TABLE 216 MERIDIAN BIOSCIENCE: BUSINESS OVERVIEW

- TABLE 217 EIKEN CHEMICAL CO., LTD.: BUSINESS OVERVIEW

- TABLE 218 QUIDEL CORPORATION: BUSINESS OVERVIEW

- TABLE 219 QIAGEN N.V.: BUSINESS OVERVIEW

- TABLE 220 NEW ENGLAND BIOLABS: BUSINESS OVERVIEW

- TABLE 221 DIASORIN S.P.A.: BUSINESS OVERVIEW

- TABLE 222 BIOMÉRIEUX SA: BUSINESS OVERVIEW

- TABLE 223 TECAN TRADING GROUP: BUSINESS OVERVIEW

- TABLE 224 GENERAL ELECTRIC COMPANY: BUSINESS OVERVIEW

- TABLE 225 THERMO FISHER SCIENTIFIC: BUSINESS OVERVIEW

- TABLE 226 OPTIGENE LIMITED: BUSINESS OVERVIEW

- FIGURE 1 ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET SEGMENTATION

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET: PRIMARY RESPONDENTS

- FIGURE 4 ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET SIZE ESTIMATION: SUPPLY-SIDE ANALYSIS, 2022

- FIGURE 5 MARKET SIZE ESTIMATION: APPROACH 1 (COMPANY REVENUE ANALYSIS-BASED ESTIMATION), 2022

- FIGURE 6 MARKET SIZE VALIDATION FROM PRIMARY RESOURCES

- FIGURE 7 ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET: CAGR PROJECTIONS, 2023–2028

- FIGURE 8 ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET (DEMAND SIDE): GROWTH ANALYSIS OF DEMAND-SIDE FACTORS

- FIGURE 9 DATA TRIANGULATION METHODOLOGY

- FIGURE 10 ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET, BY PRODUCT, 2023 VS. 2028 (USD MILLION)

- FIGURE 11 ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET, BY TECHNOLOGY, 2023 VS. 2028 (USD MILLION)

- FIGURE 12 ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 13 ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET, BY END USER, 2023 VS. 2028 (USD MILLION)

- FIGURE 14 GEOGRAPHICAL SNAPSHOT OF ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET

- FIGURE 15 INCREASING PREVALENCE OF INFECTIOUS DISEASES TO DRIVE MARKET GROWTH

- FIGURE 16 ASSAYS, KITS, AND REAGENTS ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

- FIGURE 17 DISEASE DIAGNOSIS APPLICATION SEGMENT TO CONTINUE TO DOMINATE MARKET IN 2028

- FIGURE 18 CHINA TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 19 ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 20 VALUE CHAIN OF INAAT MARKET: MAXIMUM VALUE ADDED DURING MANUFACTURING AND ASSEMBLY PHASES

- FIGURE 21 ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET: ECOSYSTEM ANALYSIS

- FIGURE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF INAAT PRODUCTS

- FIGURE 23 BUYING CRITERIA FOR INAAT PRODUCTS

- FIGURE 24 PATENT APPLICATIONS RELATED TO ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET, JANUARY 2012–DECEMBER 2022

- FIGURE 25 REVENUE SHIFT AND NEW REVENUE POCKETS

- FIGURE 26 NEW CASES OF HEPATITIS B AND HEPATITIS C WORLDWIDE, BY GENDER, 2020

- FIGURE 27 NORTH AMERICA: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET SNAPSHOT

- FIGURE 28 ASIA PACIFIC: ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET SNAPSHOT

- FIGURE 29 ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET: STRATEGIES ADOPTED

- FIGURE 30 REVENUE ANALYSIS OF KEY COMPANIES (2020–2022)

- FIGURE 31 MARKET SHARE ANALYSIS OF KEY COMPANIES (2022)

- FIGURE 32 ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET: COMPANY EVALUATION MATRIX, 2022

- FIGURE 33 ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY MARKET: COMPANY EVALUATION MATRIX FOR START-UPS/SMES, 2022

- FIGURE 34 HOLOGIC, INC.: COMPANY SNAPSHOT (2022)

- FIGURE 35 ABBOTT LABORATORIES: COMPANY SNAPSHOT (2022)

- FIGURE 36 GRIFOLS, S.A.: COMPANY SNAPSHOT (2021)

- FIGURE 37 BECTON, DICKINSON AND COMPANY: COMPANY SNAPSHOT (2022)

- FIGURE 38 MERIDIAN BIOSCIENCE: COMPANY SNAPSHOT (2022)

- FIGURE 39 EIKEN CHEMICAL CO., LTD.: COMPANY SNAPSHOT (2021)

- FIGURE 40 QUIDEL CORPORATION: COMPANY SNAPSHOT (2021)

- FIGURE 41 QIAGEN N.V.: COMPANY SNAPSHOT (2021)

- FIGURE 42 DIASORIN S.P.A.: COMPANY SNAPSHOT (2021)

- FIGURE 43 BIOMÉRIEUX SA: COMPANY SNAPSHOT (2021)

- FIGURE 44 TECAN TRADING GROUP: COMPANY SNAPSHOT (2021)

- FIGURE 45 GENERAL ELECTRIC COMPANY: COMPANY SNAPSHOT (2021)

- FIGURE 46 THERMO FISHER SCIENTIFIC: COMPANY SNAPSHOT (2021)

This study involved four major activities in estimating the current size of the isothermal nucleic acid amplification technology market. Exhaustive secondary research was carried out to collect information on the market, its peer markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation procedures were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary research was used mainly to identify and collect information for the extensive technical, market-oriented, and commercial study of the isothermal nucleic acid amplification technology market. The secondary sources used for this study include Press Releases, Annual Reports, White Papers, Certified Publications, Articles form authorized authors, Directories and Databases, SEC Filings, Investor Presentations, Expert Interviews, and MarketsandMarkets Analysis. These sources were also used to obtain key information about major players, market classification, and segmentation according to industry trends, regional/country-level markets, market developments, and technology perspectives.

Primary Research

In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify the critical qualitative and quantitative information as well as assess future prospects of the market. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The following is a breakdown of the primary respondents:

*Others include sales managers, marketing managers, and product managers.

Note: Tiers are defined based on a company’s total revenue. As of 2021, Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 <USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the isothermal nucleic acid amplification technology market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research

- The revenues generated from the INAAT products business of leading players have been determined through primary and secondary research

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Data Triangulation

After arriving at the overall market size from the market size estimation process, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the global isothermal nucleic acid amplification technology market based on the product, application, technology, end user, and region.

- To provide detailed information regarding the major factors influencing the growth of the market (such as drivers, restraints, challenges, and opportunities).

- To strategically analyse micromarkets with respect to individual growth trends, future prospects, and contributions to the overall market.

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders.

- To forecast the size of the market segments with respect to five main regions, namely, North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

- To strategically profile the key players and comprehensively analyse their product portfolios, market positions, and core competencies.

- To track and analyse competitive developments such as product launches and approvals in the market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for this report:

Geographical Analysis

- Further breakdown of the Rest of Europe market, by country

- Further breakdown of the Rest of Asia Pacific market, by country

- Further breakdown of the market in Latin America and the Middle East & Africa, by country

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Isothermal Nucleic Acid Amplification Technology Market